Key Insights

The United States power transformer market is poised for significant expansion, driven by escalating electricity demand from industrial growth and population increase. Essential for maintaining a robust power transmission infrastructure, transformers are vital for the ongoing modernization of the nation's power grid, including smart grid deployments and the seamless integration of renewable energy sources like solar and wind. This advanced infrastructure necessitates substantial investment in power transformers to efficiently manage voltage levels for reliable energy delivery. While specific US segmentation data is pending, global trends indicate oil-insulated and air-insulated transformers, alongside single-phase and three-phase variations, will continue to dominate. Key industry leaders such as ABB, Siemens, and Eaton are expected to maintain their market leadership through technological innovation and established distribution channels. Potential market challenges include volatile raw material costs and significant capital expenditure for infrastructure upgrades.

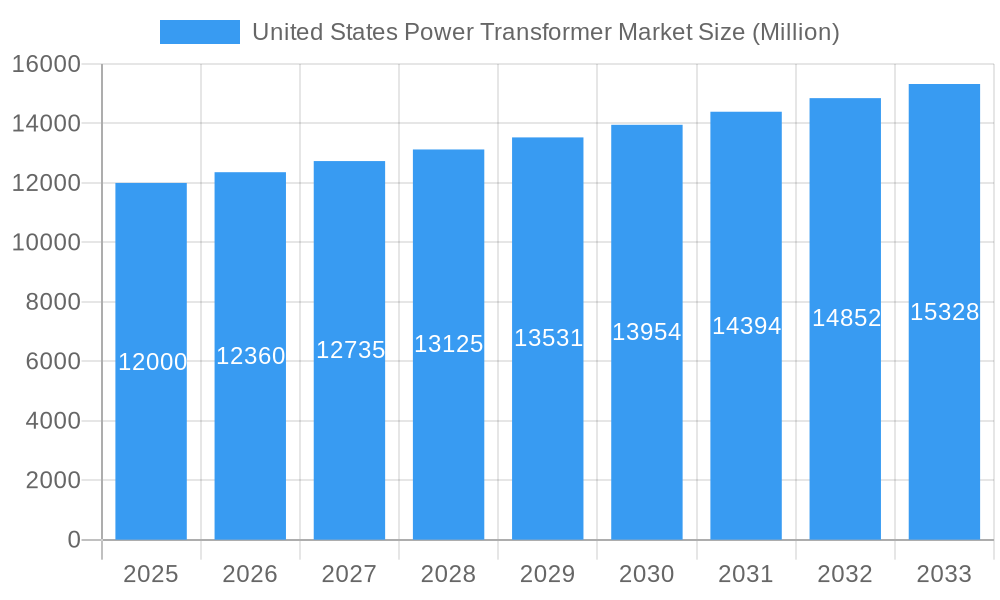

United States Power Transformer Market Market Size (In Billion)

Projected to grow at a Compound Annual Growth Rate (CAGR) of 10.67%, the US power transformer market is estimated to reach a market size of $11.94 billion by 2025. This forecast reflects the substantial investments in grid modernization and renewable energy integration within the US, surpassing growth rates observed in broader African contexts. The estimated market size considers the extensive scale of the US power grid and its high per capita energy consumption.

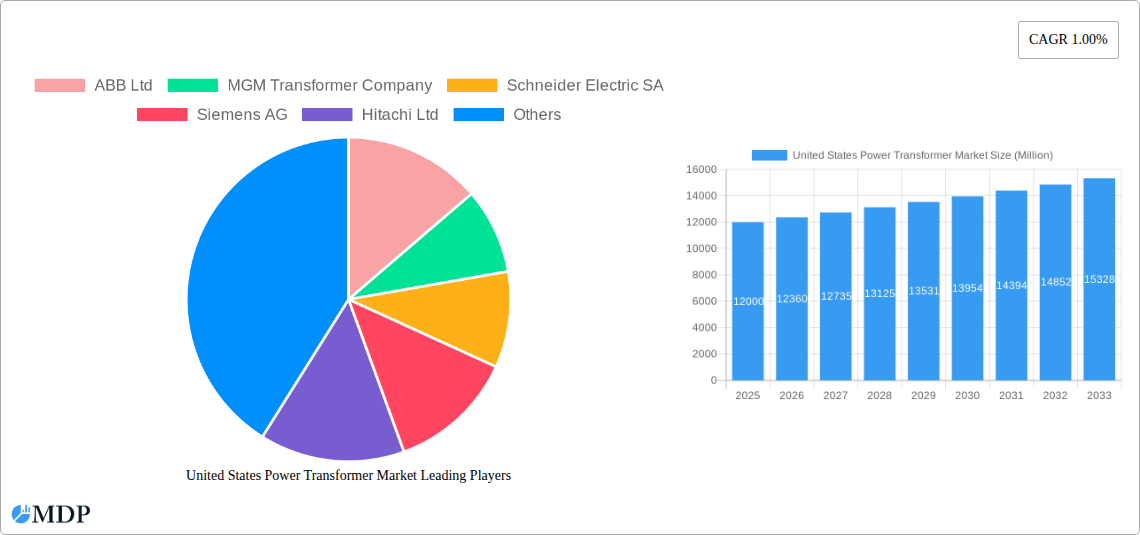

United States Power Transformer Market Company Market Share

United States Power Transformer Market Analysis (2025-2033)

This report delivers a comprehensive analysis of the US power transformer market, offering critical insights for stakeholders. Covering the forecast period 2025-2033, with a base year of 2025, the analysis includes key segments such as phase (single-phase, three-phase) and type (oil-insulated, air-insulated). The competitive landscape features leading companies including ABB Ltd, MGM Transformer Company, Schneider Electric SA, Siemens AG, Hitachi Ltd, Eaton Corporation PLC, Hyundai Heavy Industries Co Ltd, Kirloskar Electric Co Ltd, and Emerson Electric Company. This report is indispensable for businesses aiming to understand market dynamics, capitalize on growth opportunities, and navigate industry challenges.

United States Power Transformer Market Market Dynamics & Concentration

The US power transformer market is characterized by a moderately concentrated landscape, with several major players holding significant market share. Market concentration is influenced by factors such as economies of scale, technological advancements, and regulatory compliance. Innovation in materials science, such as the adoption of amorphous steel cores (as highlighted by the DOE's January 2023 proposal), is a key driver. Regulatory frameworks, including energy efficiency standards, significantly impact market dynamics, pushing manufacturers to develop more energy-efficient transformers. Product substitutes, such as advanced switching technologies, pose a competitive threat, though their market penetration remains limited. End-user trends, particularly in the renewable energy sector, are fueling demand for larger and more robust transformers. M&A activity in the sector has been moderate, with a recorded xx number of deals in the past five years, influencing market consolidation and technological transfer.

- Market Share: ABB Ltd holds an estimated xx% market share, followed by Siemens AG at xx%, and Schneider Electric SA at xx%. The remaining market share is distributed among other key players and smaller niche participants.

- M&A Activity: Recent deals such as the May 2022 acquisition of VRT Power Ltd. by Northern Transformer Corporation illustrate the strategic importance of mergers and acquisitions in enhancing technological capabilities and expanding market reach.

United States Power Transformer Market Industry Trends & Analysis

The US power transformer market is witnessing robust growth, driven by several factors. The increasing demand for electricity from both residential and industrial sectors, coupled with aging infrastructure, necessitates significant upgrades and replacements of existing power transformers. The energy transition towards renewable energy sources, like solar and wind, is a key driver, creating opportunities for manufacturers specializing in grid-integration technologies. Technological advancements in materials science and design are leading to higher efficiency, compact designs, and improved reliability. The market's CAGR during the historical period (2019-2024) was approximately xx%, and is projected to reach xx% during the forecast period (2025-2033). The market penetration of advanced technologies like amorphous steel cores is gradually increasing, driven by regulatory mandates and cost-effectiveness in the long run. Competitive dynamics are shaping market pricing and technological innovation, fostering a more efficient and sustainable power transformer market.

Leading Markets & Segments in United States Power Transformer Market

The three-phase segment dominates the US power transformer market, accounting for approximately xx% of the total market value in 2024. Within the type segment, oil-insulated transformers hold a larger market share than air-insulated transformers due to established infrastructure and cost advantages. This dominance is expected to continue over the forecast period, albeit with increasing adoption of air-insulated transformers in specific niche applications due to their enhanced environmental friendliness.

Key Drivers for Three-Phase Segment Dominance:

- Widespread use in industrial and utility applications.

- Established infrastructure supporting three-phase power distribution.

- High efficiency compared to single-phase transformers.

Key Drivers for Oil-Insulated Segment Dominance:

- Mature technology and proven reliability.

- Cost-effectiveness compared to air-insulated options.

- Established supply chains and manufacturing expertise.

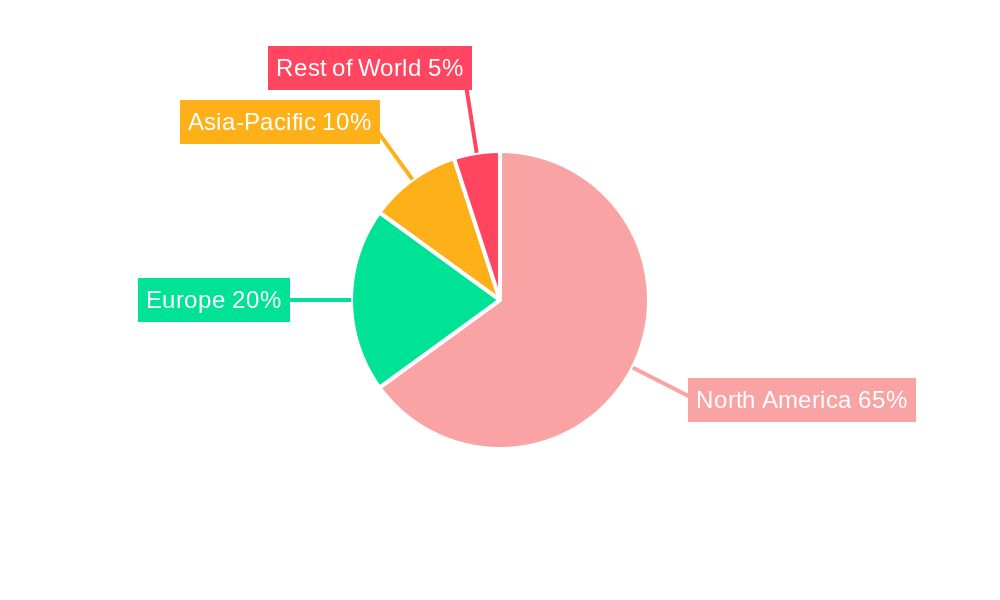

Regional Dominance: The South and West regions of the United States showcase robust growth, driven primarily by increasing energy consumption and expanding renewable energy projects. The Northeast and Midwest regions show comparatively slower growth but maintain steady demand due to established industrial activities.

United States Power Transformer Market Product Developments

Recent product innovations focus on enhancing efficiency, reducing environmental impact, and improving reliability. The incorporation of amorphous steel cores, as mandated by the DOE's proposed regulations, is a significant development. Furthermore, advancements in insulation materials and cooling systems are contributing to improved performance and extended lifespans. These innovations cater to market demands for increased energy efficiency, reduced operational costs, and environmentally friendly solutions. The competitive advantage lies in offering a combination of high efficiency, compact design, and reduced lifecycle costs.

Key Drivers of United States Power Transformer Market Growth

Several factors are propelling the growth of the US power transformer market. Firstly, the rising electricity demand across various sectors, particularly from residential and industrial customers, demands significant infrastructure upgrades and expansions. Secondly, the increased adoption of renewable energy sources, such as wind and solar, is boosting demand for advanced power transformers capable of integrating variable renewable energy sources into the existing power grid. Thirdly, supportive government policies and regulations, including incentives for renewable energy and energy efficiency standards, further bolster market expansion.

Challenges in the United States Power Transformer Market Market

The US power transformer market faces certain challenges. The rising cost of raw materials and supply chain disruptions impact production costs and timelines. Stringent regulatory compliance requirements and energy efficiency standards necessitate continuous product innovation, increasing development costs. Intense competition from established and emerging players necessitates differentiation through technological advancements and cost optimization. These challenges collectively influence market pricing, availability, and profit margins.

Emerging Opportunities in United States Power Transformer Market

Significant opportunities exist for long-term growth. The growing focus on smart grids and grid modernization opens doors for smart transformers with advanced monitoring and control capabilities. Strategic partnerships between transformer manufacturers and energy companies facilitate the development of optimized solutions for grid integration and renewable energy projects. Expanding into emerging markets and focusing on niche applications, such as microgrids and distributed generation systems, provides further potential for market expansion.

Leading Players in the United States Power Transformer Market Sector

- ABB Ltd

- MGM Transformer Company

- Schneider Electric SA

- Siemens AG

- Hitachi Ltd

- Eaton Corporation PLC

- Hyundai Heavy Industries Co Ltd

- Kirloskar Electric Co Ltd

- Emerson Electric Company

Key Milestones in United States Power Transformer Market Industry

- January 2023: The U.S. Department of Energy (DOE) proposed new energy efficiency standards requiring almost all new distribution transformers to add amorphous steel cores. This is expected to significantly impact market dynamics by driving the adoption of more efficient technologies.

- May 2022: Northern Transformer Corporation announced the acquisition of VRT Power Ltd.'s North American operations. This acquisition brought advanced technologies in low-noise, compact transformers to the North American market, benefiting utility clients with customized and reliable solutions.

Strategic Outlook for United States Power Transformer Market Market

The US power transformer market is poised for continued growth, driven by increasing electricity demand, renewable energy integration, and supportive government policies. Strategic investments in research and development, focusing on efficiency, reliability, and smart grid integration, will be crucial for success. Companies should prioritize strategic partnerships, acquisitions, and market expansion into niche segments to capitalize on emerging opportunities and maintain competitiveness in this dynamic market.

United States Power Transformer Market Segmentation

-

1. Type

- 1.1. Oil-Insulated

- 1.2. Air-Insulated

-

2. Phase

- 2.1. Single Phase

- 2.2. Three Phase

United States Power Transformer Market Segmentation By Geography

- 1. United States

United States Power Transformer Market Regional Market Share

Geographic Coverage of United States Power Transformer Market

United States Power Transformer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rapid urbanization

- 3.2.2 industrial expansion

- 3.2.3 and population growth in the U.S. are driving electricity consumption.

- 3.3. Market Restrains

- 3.3.1 The installation and maintenance of power transformers involve significant capital

- 3.3.2 which can deter small-scale utilities and industries.

- 3.4. Market Trends

- 3.4.1 Modular transformer designs offer flexibility

- 3.4.2 scalability

- 3.4.3 and ease of installation

- 3.4.4 making them a preferred choice for utilities.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Power Transformer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Oil-Insulated

- 5.1.2. Air-Insulated

- 5.2. Market Analysis, Insights and Forecast - by Phase

- 5.2.1. Single Phase

- 5.2.2. Three Phase

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MGM Transformer Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Schneider Electric SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Siemens AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hitachi Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eaton Corporation PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hyundai Heavy Industries Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kirloskar Electric Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Emerson Electric Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: United States Power Transformer Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Power Transformer Market Share (%) by Company 2025

List of Tables

- Table 1: United States Power Transformer Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: United States Power Transformer Market Revenue billion Forecast, by Phase 2020 & 2033

- Table 3: United States Power Transformer Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United States Power Transformer Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: United States Power Transformer Market Revenue billion Forecast, by Phase 2020 & 2033

- Table 6: United States Power Transformer Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Power Transformer Market?

The projected CAGR is approximately 10.67%.

2. Which companies are prominent players in the United States Power Transformer Market?

Key companies in the market include ABB Ltd, MGM Transformer Company, Schneider Electric SA, Siemens AG, Hitachi Ltd, Eaton Corporation PLC, Hyundai Heavy Industries Co Ltd, Kirloskar Electric Co Ltd, Emerson Electric Company.

3. What are the main segments of the United States Power Transformer Market?

The market segments include Type, Phase.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.94 billion as of 2022.

5. What are some drivers contributing to market growth?

Rapid urbanization. industrial expansion. and population growth in the U.S. are driving electricity consumption..

6. What are the notable trends driving market growth?

Modular transformer designs offer flexibility. scalability. and ease of installation. making them a preferred choice for utilities..

7. Are there any restraints impacting market growth?

The installation and maintenance of power transformers involve significant capital. which can deter small-scale utilities and industries..

8. Can you provide examples of recent developments in the market?

In January 2023, the U.S. Department of Energy (DOE) proposed new energy efficiency standards requiring almost all new distribution transformers to add amorphous steel cores, which are more efficient than conventional grain-oriented electrical steel.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Power Transformer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Power Transformer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Power Transformer Market?

To stay informed about further developments, trends, and reports in the United States Power Transformer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence