Key Insights

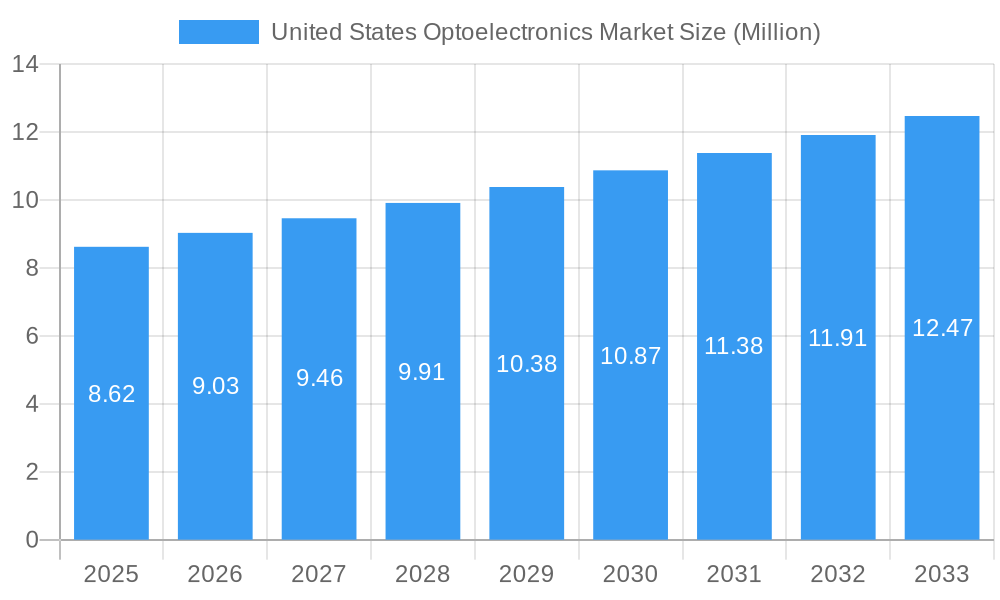

The United States optoelectronics market is poised for substantial growth, driven by escalating demand across diverse sectors. With a current market size estimated at $8.62 million (as of the base year 2025) and a projected Compound Annual Growth Rate (CAGR) of 4.70% from 2025 to 2033, the industry is set to expand significantly. Key growth drivers include the accelerating adoption of advanced technologies in automotive, such as sophisticated lighting systems and sensor technologies for autonomous driving. The consumer electronics sector continues to be a major contributor, fueled by the demand for high-resolution displays, advanced smartphone cameras, and innovative wearable devices. Furthermore, the increasing integration of optoelectronic components in healthcare for diagnostic imaging, surgical equipment, and patient monitoring systems is a critical factor propelling market expansion. The aerospace and defense industries are also investing heavily in optoelectronics for advanced surveillance, communication, and targeting systems, further bolstering market opportunities.

United States Optoelectronics Market Market Size (In Million)

The market is segmented by device type, with LED, Laser Diodes, and Image Sensors emerging as leading contributors due to their widespread applications. LED technology is transforming lighting solutions across residential, commercial, and industrial spaces, offering energy efficiency and enhanced performance. Laser diodes are crucial for applications ranging from telecommunications and data storage to industrial cutting and medical procedures. Image sensors are indispensable for digital cameras, security systems, and increasingly, for AI-driven applications. The growth trajectory is further supported by significant investments in research and development, leading to the introduction of novel optoelectronic devices with superior capabilities. Despite this robust growth, potential restraints such as high manufacturing costs and the need for specialized expertise could pose challenges, although strategic collaborations and technological advancements are expected to mitigate these. The United States, with its strong technological infrastructure and robust innovation ecosystem, is well-positioned to capitalize on these emerging opportunities in the global optoelectronics landscape.

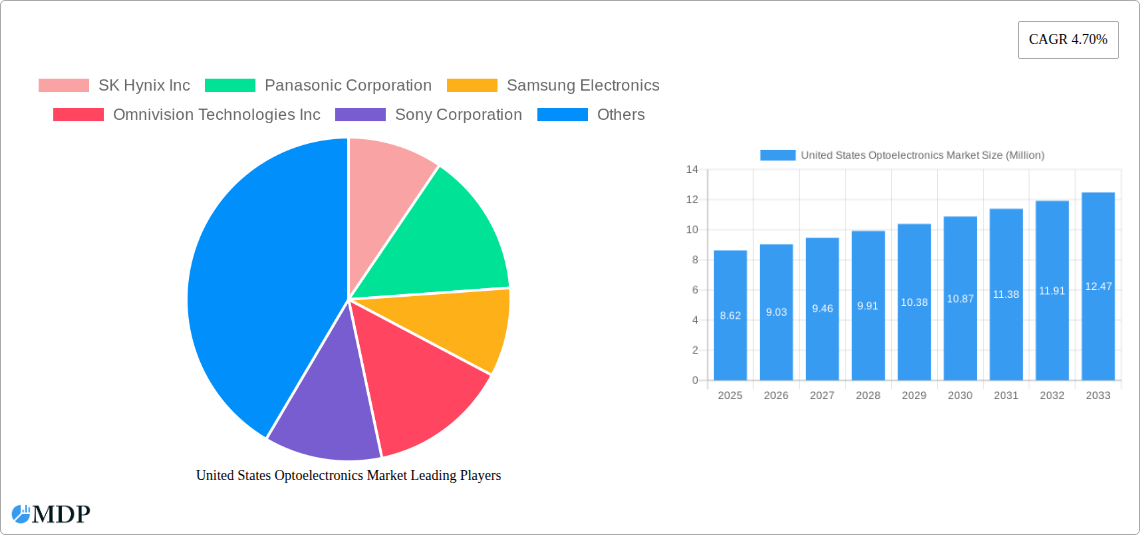

United States Optoelectronics Market Company Market Share

Unveiling the Future of Light: The United States Optoelectronics Market Report (2019-2033)

Dive deep into the dynamic landscape of the United States Optoelectronics Market with this comprehensive report. Spanning the historical period of 2019-2024, the base year of 2025, and a robust forecast period from 2025 to 2033, this analysis provides unparalleled insights into market size, growth trajectories, and competitive strategies. Explore the impact of pivotal industry developments, identify leading players, and understand the key drivers and challenges shaping this multi-billion dollar sector. This report is your essential guide to understanding the innovations in LEDs, laser diodes, image sensors, and more, across critical end-user industries like automotive, consumer electronics, and healthcare. Discover actionable intelligence on market concentration, innovation drivers, regulatory frameworks, and emerging opportunities, empowering stakeholders to make informed decisions and capitalize on the evolving optoelectronics revolution.

United States Optoelectronics Market Market Dynamics & Concentration

The United States optoelectronics market exhibits a moderate to high concentration, with a few dominant players holding significant market share. However, the presence of numerous specialized manufacturers and ongoing innovation from both established giants and agile startups prevents extreme consolidation. Innovation drivers are paramount, fueled by advancements in semiconductor technology, materials science, and miniaturization. The relentless pursuit of higher efficiency, greater brightness, smaller form factors, and enhanced functionalities in devices like LEDs and image sensors propels market growth. Regulatory frameworks, while generally supportive of technological advancement, focus on safety standards, energy efficiency mandates (especially for lighting applications), and data privacy concerns for imaging technologies, indirectly influencing product development and market access. Product substitutes exist, particularly in lighting and display technologies, where alternatives like OLEDs or advanced filament bulbs offer competing solutions. However, optoelectronic components often provide superior performance in terms of energy efficiency, lifespan, and specific optical characteristics, maintaining their competitive edge. End-user trends are a major influence; the burgeoning demand for sophisticated automotive lighting, advanced display technologies in consumer electronics, and high-resolution sensors in IT and healthcare applications are key growth catalysts. Mergers & Acquisitions (M&A) activity within the sector, while not consistently high in volume, often involves strategic acquisitions aimed at acquiring novel technologies, expanding market reach, or consolidating market share in specific niches. For instance, in the historical period, there were an estimated 5-10 significant M&A deals annually, impacting market concentration and the competitive landscape.

United States Optoelectronics Market Industry Trends & Analysis

The United States optoelectronics market is experiencing robust growth, driven by a confluence of technological advancements, expanding applications, and increasing consumer and industrial demand. The Compound Annual Growth Rate (CAGR) for the market is projected to be approximately 8.5% during the forecast period (2025-2033), indicating a healthy expansion trajectory. Market penetration is deepening across various sectors, with optoelectronic components becoming increasingly integral to everyday devices and industrial processes.

A primary growth driver is the continuous evolution of LED technology. The demand for energy-efficient, long-lasting, and versatile lighting solutions is fueling widespread adoption in residential, commercial, and industrial settings. In the automotive sector, advanced LED lighting systems, including adaptive headlights and interior ambient lighting, are becoming standard features, driven by both aesthetic appeal and enhanced safety. The display industry also relies heavily on LEDs for backlighting in televisions, smartphones, and other electronic devices.

Image sensors represent another significant growth segment. The proliferation of smart devices, the rise of autonomous driving technologies requiring advanced perception systems, and the increasing sophistication of medical imaging equipment are creating substantial demand for high-resolution, high-speed, and low-power image sensors. The miniaturization and improved performance of these sensors are enabling new applications in areas like augmented reality (AR) and virtual reality (VR).

Laser diodes are also witnessing steady growth, propelled by their applications in telecommunications (fiber optics), industrial manufacturing (cutting, welding), medical devices (surgery, diagnostics), and consumer electronics (barcode scanners, optical drives). The development of more efficient and powerful laser diodes is expanding their utility in emerging fields.

Technological disruptions such as the development of micro-LED displays, advancements in quantum dot technology for enhanced display colors, and the integration of optoelectronics with AI for intelligent sensing systems are further shaping the market. The increasing emphasis on energy efficiency and sustainability is also a key trend, pushing manufacturers to develop more power-conscious optoelectronic solutions.

Consumer preferences are leaning towards devices with enhanced visual experiences, intuitive interfaces, and greater connectivity, all of which rely on advanced optoelectronic components. The demand for personalized and immersive entertainment experiences, coupled with the growing adoption of smart home technologies, further fuels this trend.

Competitive dynamics are characterized by intense research and development efforts, strategic partnerships, and a focus on product differentiation. Companies are investing heavily in next-generation technologies to gain a competitive advantage. The market is witnessing a trend towards vertical integration, with some companies controlling various stages of the supply chain to ensure quality and cost-effectiveness. The overall outlook for the United States optoelectronics market remains exceptionally positive, driven by sustained innovation and the expanding applications of light-based technologies.

Leading Markets & Segments in United States Optoelectronics Market

The United States optoelectronics market is characterized by strong performance across several key segments and end-user industries, with distinct growth drivers influencing their dominance.

Dominant Device Type Segments:

- LEDs: This segment is a powerhouse within the United States optoelectronics market, projected to hold a significant market share exceeding 35% in 2025.

- Key Drivers:

- Energy Efficiency Mandates: Government regulations and growing environmental consciousness are driving the adoption of LED lighting in residential, commercial, and industrial applications, significantly reducing energy consumption.

- Automotive Innovation: The automotive sector's demand for advanced headlight systems, interior lighting, and signaling applications, coupled with the shift towards electric vehicles where energy efficiency is paramount, is a major growth catalyst.

- Consumer Electronics Integration: The ubiquitous use of LEDs in displays for smartphones, televisions, and wearables ensures consistent demand.

- Smart Lighting Solutions: The integration of LEDs with smart home systems and IoT devices is creating new avenues for growth.

- Key Drivers:

- Image Sensors: This segment is experiencing rapid growth, with a projected market share of over 25% in 2025, driven by the insatiable demand for visual data capture.

- Key Drivers:

- Automotive Advanced Driver-Assistance Systems (ADAS) & Autonomous Driving: High-resolution cameras are critical for perception, object detection, and navigation, making this a primary growth area.

- Consumer Electronics Sophistication: The demand for higher quality smartphone cameras, VR/AR headsets, and advanced security cameras fuels continuous innovation and adoption.

- Healthcare Imaging: Advancements in medical diagnostics, endoscopy, and minimally invasive surgical procedures rely on sophisticated image sensors.

- Industrial Automation & Quality Control: Machine vision systems powered by image sensors are crucial for automated manufacturing processes and product inspection.

- Key Drivers:

- Laser Diodes: While a smaller segment, it demonstrates strong growth potential, with an estimated market share of around 15% in 2025.

- Key Drivers:

- Telecommunications Infrastructure: The expansion of 5G networks and data centers relies heavily on laser diodes for high-speed data transmission.

- Industrial Applications: Laser cutting, welding, and marking technologies continue to evolve, driving demand for robust laser diode solutions.

- Medical Advancements: Sophisticated laser-based surgical and therapeutic devices are creating new market opportunities.

- Key Drivers:

Dominant End-User Industry Segments:

- Consumer Electronics: This is the largest end-user industry, expected to command a market share of over 30% in 2025. The continuous release of new devices, including smartphones, smart TVs, gaming consoles, and wearable technology, creates a perpetual demand for optoelectronic components. The ongoing trend of miniaturization and enhanced visual experiences further solidifies its dominance.

- Automotive: This sector is rapidly emerging as a critical growth engine, projected to account for over 25% of the market in 2025. The increasing integration of advanced lighting, infotainment systems, ADAS, and autonomous driving technologies is transforming vehicle design and functionality, making optoelectronics indispensable.

- Information Technology (IT): This segment, with a projected market share of approximately 15% in 2025, is driven by data centers, networking equipment, and the growing adoption of display technologies in professional settings. The demand for high-speed optical communication components and advanced display solutions for servers and computing infrastructure remains strong.

Other segments like Healthcare (driven by medical imaging and diagnostics), Industrial (automation, sensors, and inspection), and Aerospace & Defense (surveillance, communication, and guidance systems) also contribute significantly to market diversification and growth.

United States Optoelectronics Market Product Developments

Recent product innovations in the United States optoelectronics market are focused on enhancing efficiency, miniaturization, and specialized functionalities. AMS Osram AG's introduction of the SYNIOS P1515 side looker LEDs in January 2024 exemplifies a targeted development for the automotive sector, enabling more streamlined design and uniform lighting in rear and light bar applications. This innovation addresses the industry's need for aesthetically pleasing and functionally superior lighting solutions. Concurrently, Marktech Optoelectronics, Inc.'s December 2023 release of enhanced sharpness green dot point source LEDs (MTSP-1358 and MTSP-1360) highlights advancements in precision optics for aiming applications in optics and defense. The expansion of their red dot LED offerings with additional micron sizes and package types underscores a commitment to providing versatile and customizable solutions. These developments showcase a trend towards application-specific optoelectronic components that offer tangible benefits like improved design flexibility, enhanced performance, and broader integration possibilities across diverse industries.

Key Drivers of United States Optoelectronics Market Growth

The United States optoelectronics market is propelled by several key growth drivers. The relentless pace of technological innovation, particularly in semiconductor fabrication and materials science, enables the development of more efficient, smaller, and higher-performing optoelectronic devices like LEDs, image sensors, and laser diodes. The increasing demand for energy-efficient solutions across all sectors, from general lighting to automotive systems, is a significant catalyst, as optoelectronics offer substantial energy savings. Furthermore, the rapid expansion of the Internet of Things (IoT) ecosystem necessitates advanced sensing and communication capabilities, driving the adoption of image sensors, LiDAR, and optical communication components. The automotive industry's transformation towards electrification and autonomous driving, requiring sophisticated ADAS and interior/exterior lighting systems, provides another powerful growth avenue. Finally, government initiatives supporting research and development in advanced manufacturing and high-tech industries, alongside favorable regulatory environments for energy-efficient technologies, further underpin market expansion.

Challenges in the United States Optoelectronics Market Market

Despite its robust growth, the United States optoelectronics market faces several challenges. Intensifying global competition, particularly from Asian manufacturers, exerts downward pressure on pricing and necessitates continuous innovation to maintain market share. Supply chain disruptions, as highlighted by recent global events, can impact the availability of raw materials and critical components, leading to production delays and increased costs. High research and development expenditure required to stay at the forefront of technological advancements can be a barrier for smaller companies. Evolving regulatory landscapes, especially concerning data privacy for image sensor applications and environmental standards for manufacturing, can necessitate costly compliance measures. Furthermore, the short product life cycles in consumer electronics demand rapid adaptation and continuous product updates, creating pressure on manufacturers to innovate quickly and efficiently.

Emerging Opportunities in United States Optoelectronics Market

The United States optoelectronics market is ripe with emerging opportunities. The accelerating adoption of 5G and beyond wireless technologies is creating substantial demand for high-speed optical communication components, including laser diodes and photodetectors, for fiber optic infrastructure and data centers. The ongoing development of autonomous vehicles and advanced driver-assistance systems (ADAS) presents a massive opportunity for image sensors, LiDAR, and other optical sensing technologies. The burgeoning field of augmented reality (AR) and virtual reality (VR) requires sophisticated display technologies and optical components for immersive experiences. Furthermore, the increasing focus on sustainable technologies and green initiatives opens doors for advanced LED lighting solutions and energy-harvesting optoelectronic devices. The healthcare sector's continuous drive for innovation in diagnostics, minimally invasive surgery, and personalized medicine also presents significant opportunities for specialized optoelectronic applications.

Leading Players in the United States Optoelectronics Market Sector

- SK Hynix Inc

- Panasonic Corporation

- Samsung Electronics

- Omnivision Technologies Inc

- Sony Corporation

- Osram Licht AG

- Koninklijke Philips N V

- Vishay Intertechnology Inc

- Texas Instruments Inc

- LITE-ON Technology Corporation

- Rohm Co Ltd (ROHM SEMICONDUCTOR)

- Mitsubishi Electric Corporation

- Broadcom Inc

- Sharp Corporation

Key Milestones in United States Optoelectronics Market Industry

- January 2024: AMS Osram AG introduced a line of low-power LEDs, named SYNIOS P1515 side lookers, designed to streamline design processes, enhance implementation, and facilitate the creation of uniform lighting in extended automotive light bars and rear lighting applications. As per the company, by opting for these side-looker LEDs over traditional top-looker ones, automakers can achieve a consistent appearance spanning the vehicle's width. Furthermore, utilizing the same LED count as a top looker setup, these side lookers allow for significantly slimmer and more straightforward optical assemblies in rear combination lamps and turn indicators.

- December 2023: Marktech Optoelectronics, Inc., a privately-held designer and manufacturer of standard and custom optoelectronics, including visible, UV, near-infrared, and short-wavelength infrared emitters, detectors, InPepi wafers, and other compound semiconductors, announced the release of their enhanced sharpness 25 and 50 microngreen dot point source LEDs (MTSP-1358 and MTSP-1360) for reflex sights, riflescopes, camera viewfinders, sports optics, and other aiming applications. In addition, Marktech expanded its offering of red dot LEDs with additional micron sizes and package types. Marktech claimed that it can assemble the red dot or reticle die into several standard & custom packages, and chip-on-board (COB), rigid PCB, and flexible circuit assemblies.

Strategic Outlook for United States Optoelectronics Market Market

The strategic outlook for the United States optoelectronics market is highly positive, with a focus on capitalizing on emerging technologies and expanding market reach. Companies are expected to continue investing heavily in research and development to drive innovation in areas such as micro-LEDs, advanced sensors for autonomous systems, and next-generation optical communication technologies. Strategic partnerships and collaborations will be crucial for addressing complex technological challenges and accelerating market entry for new products. The increasing integration of optoelectronics with artificial intelligence and machine learning will unlock new application potentials. Furthermore, a continued emphasis on sustainability and energy efficiency will drive demand for innovative solutions across various industries. Expansion into high-growth sectors like electric vehicles, advanced medical devices, and the expanding AR/VR ecosystem will be key strategic imperatives.

United States Optoelectronics Market Segmentation

-

1. Device Type

- 1.1. LED

- 1.2. Laser Diode

- 1.3. Image Sensors

- 1.4. Optocouplers

- 1.5. Photovoltaic cells

- 1.6. Others

-

2. End-User Industry

- 2.1. Automotive

- 2.2. Aerospace & Defense

- 2.3. Consumer Electronics

- 2.4. Information Technology

- 2.5. Healthcare

- 2.6. Residential and Commercial

- 2.7. Industrial

- 2.8. Others

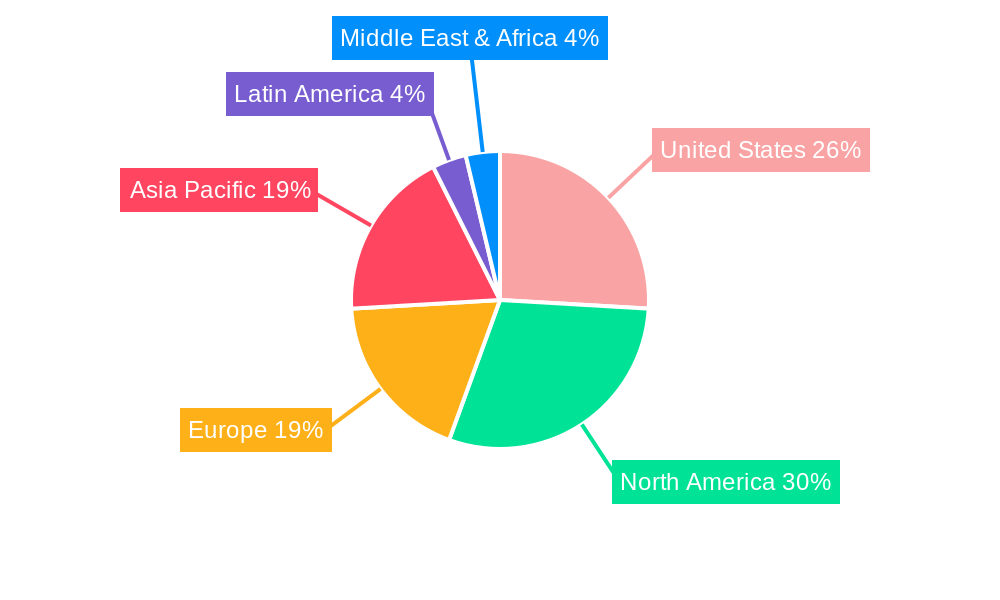

United States Optoelectronics Market Segmentation By Geography

- 1. United States

United States Optoelectronics Market Regional Market Share

Geographic Coverage of United States Optoelectronics Market

United States Optoelectronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Smart Consumer Electronics and Next-Generation Technologies; Increasing Industrial Applications of the Technology; Expansion of the Li-Fi Market

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Smart Consumer Electronics and Next-Generation Technologies; Increasing Industrial Applications of the Technology; Expansion of the Li-Fi Market

- 3.4. Market Trends

- 3.4.1. The Image Sensors Segment Anticipated to Drive Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. LED

- 5.1.2. Laser Diode

- 5.1.3. Image Sensors

- 5.1.4. Optocouplers

- 5.1.5. Photovoltaic cells

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Automotive

- 5.2.2. Aerospace & Defense

- 5.2.3. Consumer Electronics

- 5.2.4. Information Technology

- 5.2.5. Healthcare

- 5.2.6. Residential and Commercial

- 5.2.7. Industrial

- 5.2.8. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SK Hynix Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Panasonic Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samsung Electronics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Omnivision Technologies Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sony Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Osram Licht AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Koninklijke Philips N V

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vishay Intertechnology Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Texas Instruments Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LITE-ON Technology Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rohm Co Ltd (ROHM SEMICONDUCTOR)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mitsubishi Electric Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Broadcom Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Sharp Corporatio

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 SK Hynix Inc

List of Figures

- Figure 1: United States Optoelectronics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Optoelectronics Market Share (%) by Company 2025

List of Tables

- Table 1: United States Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: United States Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 3: United States Optoelectronics Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: United States Optoelectronics Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 5: United States Optoelectronics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United States Optoelectronics Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: United States Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 8: United States Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 9: United States Optoelectronics Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 10: United States Optoelectronics Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 11: United States Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Optoelectronics Market?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the United States Optoelectronics Market?

Key companies in the market include SK Hynix Inc, Panasonic Corporation, Samsung Electronics, Omnivision Technologies Inc, Sony Corporation, Osram Licht AG, Koninklijke Philips N V, Vishay Intertechnology Inc, Texas Instruments Inc, LITE-ON Technology Corporation, Rohm Co Ltd (ROHM SEMICONDUCTOR), Mitsubishi Electric Corporation, Broadcom Inc, Sharp Corporatio.

3. What are the main segments of the United States Optoelectronics Market?

The market segments include Device Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Smart Consumer Electronics and Next-Generation Technologies; Increasing Industrial Applications of the Technology; Expansion of the Li-Fi Market.

6. What are the notable trends driving market growth?

The Image Sensors Segment Anticipated to Drive Demand.

7. Are there any restraints impacting market growth?

Growing Demand for Smart Consumer Electronics and Next-Generation Technologies; Increasing Industrial Applications of the Technology; Expansion of the Li-Fi Market.

8. Can you provide examples of recent developments in the market?

January 2024 - AMS Osram AG introduced a line of low-power LEDs, named SYNIOS P1515 side lookers, designed to streamline design processes, enhance implementation, and facilitate the creation of uniform lighting in extended automotive light bars and rear lighting applications. As per the company, by opting for these side-looker LEDs over traditional top-looker ones, automakers can achieve a consistent appearance spanning the vehicle's width. Furthermore, utilizing the same LED count as a top looker setup, these side lookers allow for significantly slimmer and more straightforward optical assemblies in rear combination lamps and turn indicators.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Optoelectronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Optoelectronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Optoelectronics Market?

To stay informed about further developments, trends, and reports in the United States Optoelectronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence