Key Insights

The global TV Set-Top Box (STB) market is projected to achieve a substantial size of USD 307.1 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 5.54% from 2025 to 2033. This expansion is primarily driven by advancements in television technology, catering to consumer demand for superior viewing experiences, including HD and Ultra-HD resolutions. The growth of IPTV and Satellite/DTH services, alongside digital terrestrial television (DTT) adoption in regions undergoing digital migration, further fuels demand for sophisticated STBs.

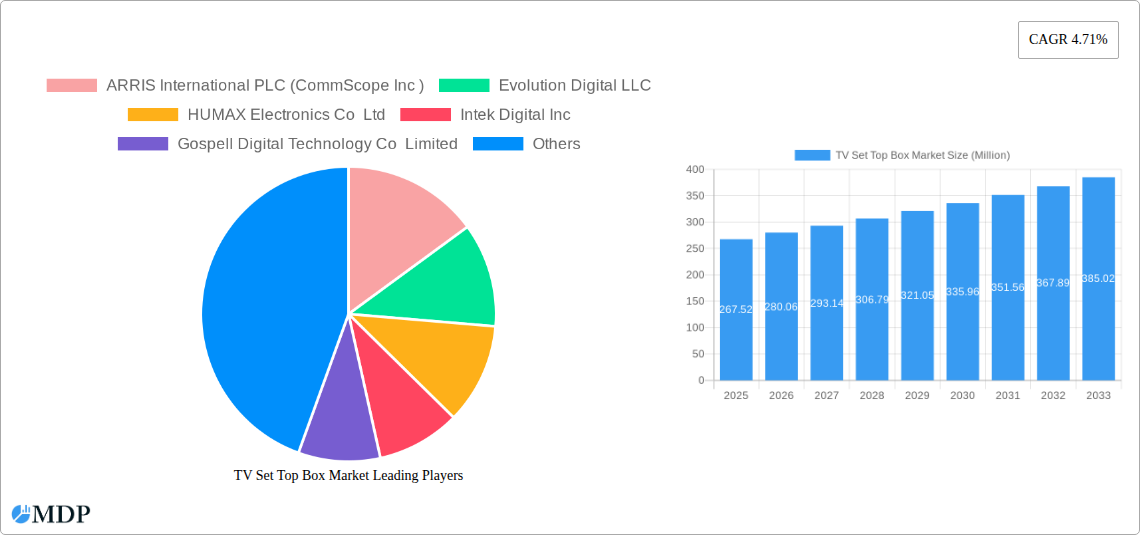

TV Set Top Box Market Market Size (In Million)

Key challenges impacting market growth include the rising adoption of Smart TVs with integrated streaming capabilities, potentially diminishing the demand for standalone STBs. Intense competition among established vendors and rapid technological obsolescence also pose hurdles, necessitating continuous R&D investment. Nevertheless, innovation in connectivity, personalized content recommendations, and voice control integration are expected to sustain STB relevance. Geographically, Asia, led by India, is anticipated to dominate the market due to its large population, increasing disposable incomes, and swift digital broadcasting deployment. North America and Europe will maintain significant shares, supported by established pay-TV infrastructure and high adoption of advanced television technologies.

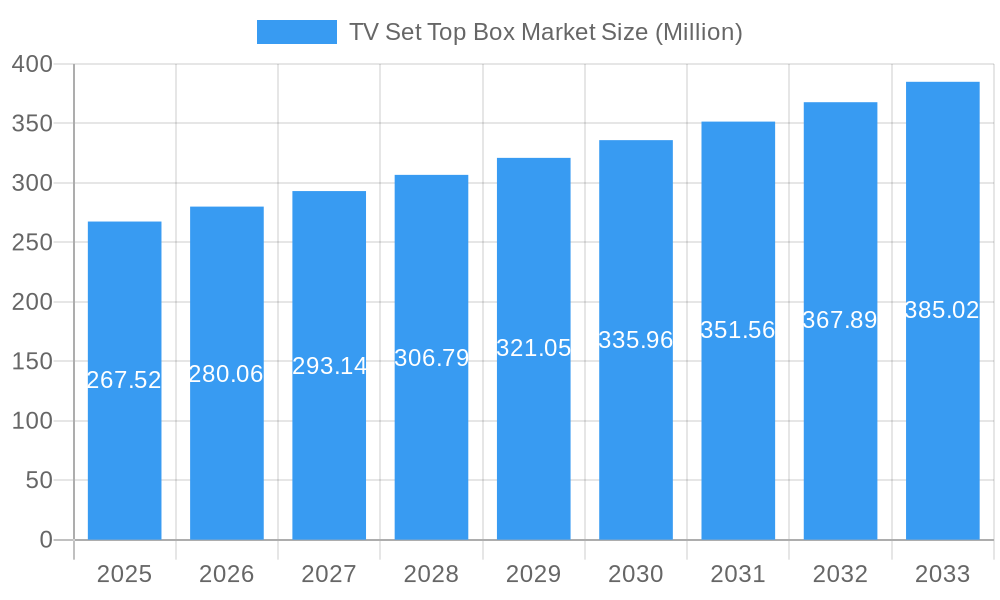

TV Set Top Box Market Company Market Share

Unlocking the Future of Home Entertainment: In-depth Report on the Global TV Set Top Box Market (2019-2033)

Dive deep into the dynamic TV Set Top Box Market with our comprehensive industry analysis. This report provides unparalleled insights into market dynamics, technological advancements, leading players, and future trajectories of the set-top box industry. Analyze the proliferation of Android TV boxes, 4K UHD set-top boxes, and 5G media gateways shaping the future of digital TV reception. Discover growth drivers for IPTV set-top boxes, satellite DTH boxes, and cable set-top boxes, understanding how these technologies are converging to offer richer entertainment experiences. With coverage spanning from the historical performance (2019-2024) to an estimated market size of $XX Million in 2025 and a robust forecast period (2025-2033), this report is essential for industry stakeholders, investors, and manufacturers seeking to capitalize on market trends in smart set-top boxes and hybrid TV solutions.

TV Set Top Box Market Market Dynamics & Concentration

The global TV Set Top Box Market exhibits a moderate to high concentration, with key players like ARRIS International PLC (CommScope Inc), ZTE Corporation, and Skyworth Digital Ltd holding significant market share. Innovation is primarily driven by the demand for enhanced viewing experiences, including higher resolutions (Ultra HD), smart features, and seamless integration with Over-The-Top (OTT) services. Regulatory frameworks primarily focus on digital switchover mandates and content delivery standards, influencing regional market penetration. Product substitutes, such as smart TVs with integrated tuners and streaming dongles, are increasingly challenging the traditional set-top box market, pushing manufacturers towards more advanced, feature-rich devices. End-user trends indicate a strong preference for user-friendly interfaces, personalized content recommendations, and access to a wider array of entertainment options, fueling the adoption of Android TV boxes and hybrid set-top boxes. Mergers and acquisitions (M&A) activities, though not at peak levels, are strategically aimed at expanding product portfolios and geographical reach. For instance, key M&A deals in the past have aimed at consolidating technological expertise in areas like middleware and content security, contributing to market consolidation and the strengthening of competitive moats. The market share distribution sees dominant players commanding substantial portions of the global revenue, while a spectrum of smaller manufacturers caters to niche segments.

TV Set Top Box Market Industry Trends & Analysis

The TV Set Top Box Market is experiencing a significant growth trajectory, propelled by several interconnected industry trends. The ongoing digital transformation in broadcasting, coupled with government initiatives for digital switchover in various developing economies, continues to be a primary growth driver. The increasing penetration of high-speed internet services is fueling the demand for IPTV set-top boxes and OTT-enabled set-top boxes, allowing consumers to access a vast library of on-demand content alongside traditional linear television. Technological advancements are at the forefront, with the rapid adoption of 4K UHD resolution and the emerging integration of HDR (High Dynamic Range) technology, promising a more immersive and visually stunning viewing experience. The proliferation of Android TV operating systems within set-top boxes is a major disruptive force, offering a unified platform for live TV, streaming apps, and gaming, thereby enhancing user engagement and creating a richer ecosystem. This trend is driving the demand for smart set-top boxes that act as central hubs for home entertainment. The competitive landscape is intensifying, with established players and new entrants vying for market dominance through product innovation and strategic partnerships. Consumer preferences are evolving towards seamless user experiences, personalized content discovery, and cost-effectiveness. The shift from standalone devices to integrated solutions, where set-top boxes offer functionalities beyond mere signal reception, is a testament to this evolution. The market penetration of advanced set-top boxes, particularly in developed regions, is nearing saturation, prompting manufacturers to focus on emerging markets and value-added services to sustain growth. The CAGR for the set-top box industry is projected to remain robust, driven by the continuous upgrade cycles and the integration of newer technologies like 5G. The increasing adoption of hybrid models, blending satellite, cable, and IPTV services, further broadens the market appeal.

Leading Markets & Segments in TV Set Top Box Market

The TV Set Top Box Market is characterized by distinct regional dominance and segment preferences.

Dominant Technology Segments:

- IPTV: This segment is experiencing substantial growth, driven by the increasing availability of high-speed internet infrastructure and the growing consumer appetite for on-demand content and streaming services. Countries with advanced broadband penetration, such as South Korea, the United States, and many Western European nations, are leading the adoption of IPTV set-top boxes. Economic policies that encourage digital infrastructure development and telco-led convergence strategies are key drivers.

- Satellite/DTH: While facing competition from IPTV, the Satellite/DTH segment remains a dominant force, particularly in regions where terrestrial broadcasting infrastructure is less developed or where direct-to-home broadcasting offers a cost-effective solution. India and many parts of Africa and Asia rely heavily on DTH for television access. Favorable regulatory environments promoting direct broadcasting services and lower infrastructure setup costs contribute to its sustained market share.

- Cable: The Cable segment continues to be a significant player, especially in established markets where cable networks are already in place. However, the transition towards digital cable and the integration of IP-based services are crucial for its future growth. Regions with strong incumbent cable operators often see continued demand for their set-top boxes.

- Other Types (DTT): Digital Terrestrial Television (DTT) is prevalent in regions undergoing digital switchover, offering a free-to-air alternative. Its dominance is often temporary, transitioning towards more advanced digital solutions.

Dominant Resolution Segments:

- Ultra-HD and Higher: This segment is the fastest-growing, driven by consumer demand for premium viewing experiences and the increasing availability of 4K content. Developed markets with higher disposable incomes and a greater willingness to invest in advanced home entertainment systems are leading this trend. The availability of 4K content on streaming platforms and broadcast channels further accelerates adoption.

- HD: High Definition (HD) resolution remains a significant segment, offering a substantial improvement over Standard Definition (SD) and serving as a widespread standard for digital broadcasting. It continues to be a strong choice for a large consumer base seeking a balance between quality and cost.

- SD: Standard Definition (SD) is gradually declining, primarily seen in legacy systems or in cost-sensitive emerging markets where upfront device cost is a primary consideration. Its market share is expected to diminish further as digital switchover progresses and affordability of HD and UHD devices improves.

The dominance of specific regions is often dictated by a combination of factors including regulatory frameworks, economic development, internet penetration, and consumer disposable income. For instance, North America and Western Europe lead in the adoption of advanced technologies like 4K UHD and integrated smart features, while Asia-Pacific, particularly countries like India and China, represents a massive volume market for both Satellite/DTH and IPTV set-top boxes, with a growing demand for HD and increasingly, Ultra-HD solutions.

TV Set Top Box Market Product Developments

Recent product developments in the TV Set Top Box Market highlight a strong trend towards convergence and enhanced user experience. Manufacturers are focusing on integrating advanced functionalities such as Android TV OS for seamless app access, voice control capabilities for intuitive navigation, and robust connectivity options like Wi-Fi 6 and Ethernet for faster streaming. The introduction of hybrid set-top boxes, capable of receiving both traditional broadcast signals (Satellite/DTH, Cable) and streaming content via IP, is a significant innovation. These devices offer users a unified platform for all their entertainment needs. The emphasis is on delivering 4K Ultra HD and higher resolutions, often coupled with HDR support, to provide a superior visual experience. Furthermore, the development of 5G-enabled set-top boxes is on the horizon, promising ultra-low latency and faster data transfer rates for next-generation video services and interactive entertainment. Competitive advantages are being built around user interface design, content recommendation algorithms, and the ability to integrate with smart home ecosystems.

Key Drivers of TV Set Top Box Market Growth

The TV Set Top Box Market is propelled by several key drivers that are reshaping the home entertainment landscape. The global push for digital switchover from analog broadcasting continues to be a fundamental driver, mandating the adoption of digital set-top boxes. The escalating demand for High-Definition (HD) and 4K Ultra HD content, coupled with the proliferation of streaming services and Over-The-Top (OTT) platforms, is a major catalyst. The increasing availability and affordability of high-speed internet connections are vital for the growth of IPTV set-top boxes. Furthermore, the growing popularity of Android TV boxes and smart functionalities, offering a converged entertainment experience, is significantly influencing consumer purchasing decisions. Government initiatives promoting digital infrastructure and content accessibility, along with competitive pricing strategies by manufacturers, also contribute to market expansion.

Challenges in the TV Set Top Box Market Market

Despite robust growth, the TV Set Top Box Market faces several challenges. The increasing integration of set-top box functionalities within smart TVs poses a direct threat of market cannibalization. Intense competition among manufacturers leads to significant price pressures, impacting profit margins. Evolving technological standards and the rapid obsolescence of older models necessitate continuous investment in research and development. Regulatory hurdles in certain regions related to content licensing and digital broadcasting standards can slow down market penetration. Furthermore, supply chain disruptions and component shortages can impact production volumes and delivery timelines, affecting market availability. The high cost of some advanced set-top boxes, particularly for emerging markets, can also act as a restraint on widespread adoption.

Emerging Opportunities in TV Set Top Box Market

The TV Set Top Box Market is ripe with emerging opportunities for growth and innovation. The burgeoning demand for personalized and interactive content viewing experiences presents a significant opportunity for set-top boxes with advanced AI-powered recommendation engines and voice control features. The continued expansion of 5G networks opens avenues for 5G set-top boxes capable of delivering ultra-high-definition streaming with minimal latency, paving the way for immersive gaming and augmented reality experiences. Strategic partnerships between set-top box manufacturers, content providers, and telecommunication companies can unlock new revenue streams through bundled service offerings and exclusive content deals. Furthermore, the increasing adoption of smart home ecosystems creates opportunities for set-top boxes to act as central control hubs, integrating with other connected devices. The untapped potential in emerging economies, with their growing middle class and increasing access to digital infrastructure, offers substantial market expansion possibilities.

Leading Players in the TV Set Top Box Market Sector

- ARRIS International PLC (CommScope Inc)

- Evolution Digital LLC

- HUMAX Electronics Co Ltd

- Intek Digital Inc

- Gospell Digital Technology Co Limited

- Shenzhen SDMC Technology Co Ltd

- Shenzhen Coship Electronics Co Ltd

- Sagemcom SAS

- ZTE Corporation

- Skyworth Digital Ltd

- Kaon Media Co Limited

- Technicolor SA

Key Milestones in TV Set Top Box Market Industry

- March 2022: GTPL Hathway Limited (GTPL) launched the GTPL Genie, a Hybrid Android TV Set Top Box. This device offers easy access to Live TV and OTT channels at an attractive bulk price, blending classic Cable TV with contemporary features and a customizable environment for a wide variety of content in OTT entertainment apps. This launch expanded their "Connection Dil Se" offer, allowing customers to watch popular OTT app material on their existing TV screen alongside traditional TV channels.

- February 2022: ZTE Corporation announced the launch of the ZXV10 B960GV1 next-generation 5G media gateway set-top box (STB), sponsored by Android TV, at Mobile World Congress (MWC) 2022. This set-top box is designed to provide home users with fast, stable, and low-latency video experiences. It integrates gigabit gateway, router, and set-top box functions, capable of delivering gigabit speed access and 4K UHD video services, along with rich video content support via the Android TV operating system.

Strategic Outlook for TV Set Top Box Market Market

The strategic outlook for the TV Set Top Box Market is characterized by a strong emphasis on innovation and convergence. Manufacturers are expected to continue investing in the development of feature-rich devices that offer seamless integration of linear TV, streaming services, and interactive applications. The continued evolution towards higher resolutions like 4K UHD and the exploration of emerging technologies such as 8K and cloud gaming will be critical for market relevance. Strategic partnerships with content providers, internet service providers, and smart home ecosystem players will be instrumental in expanding market reach and creating value-added service bundles. The focus on user experience, including intuitive interfaces and personalized content discovery, will remain a key differentiator. Furthermore, exploring opportunities in emerging markets with large untapped potential and tailoring product offerings to local needs and affordability will be crucial for sustained growth in the set-top box industry. The market will likely witness further consolidation through M&A activities as companies seek to strengthen their technological capabilities and market positioning.

TV Set Top Box Market Segmentation

-

1. Technology

- 1.1. Satellite/DTH

- 1.2. IPTV

- 1.3. Cable

- 1.4. Other Types (DTT)

-

2. Resolution

- 2.1. SD

- 2.2. HD

- 2.3. Ultra-HD and Higher

TV Set Top Box Market Segmentation By Geography

- 1. North America

- 2. Europe

-

3. Asia

- 3.1. India

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

TV Set Top Box Market Regional Market Share

Geographic Coverage of TV Set Top Box Market

TV Set Top Box Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Levels of Technological Innovations; Increasing Adoption of Set-Top Boxes in the Emerging Markets; Deployment of OS-based Devices

- 3.3. Market Restrains

- 3.3.1. Growing Online OTT Services/Platform

- 3.4. Market Trends

- 3.4.1. HD Resolution Held the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global TV Set Top Box Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Satellite/DTH

- 5.1.2. IPTV

- 5.1.3. Cable

- 5.1.4. Other Types (DTT)

- 5.2. Market Analysis, Insights and Forecast - by Resolution

- 5.2.1. SD

- 5.2.2. HD

- 5.2.3. Ultra-HD and Higher

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America TV Set Top Box Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Satellite/DTH

- 6.1.2. IPTV

- 6.1.3. Cable

- 6.1.4. Other Types (DTT)

- 6.2. Market Analysis, Insights and Forecast - by Resolution

- 6.2.1. SD

- 6.2.2. HD

- 6.2.3. Ultra-HD and Higher

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe TV Set Top Box Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Satellite/DTH

- 7.1.2. IPTV

- 7.1.3. Cable

- 7.1.4. Other Types (DTT)

- 7.2. Market Analysis, Insights and Forecast - by Resolution

- 7.2.1. SD

- 7.2.2. HD

- 7.2.3. Ultra-HD and Higher

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia TV Set Top Box Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Satellite/DTH

- 8.1.2. IPTV

- 8.1.3. Cable

- 8.1.4. Other Types (DTT)

- 8.2. Market Analysis, Insights and Forecast - by Resolution

- 8.2.1. SD

- 8.2.2. HD

- 8.2.3. Ultra-HD and Higher

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Australia and New Zealand TV Set Top Box Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Satellite/DTH

- 9.1.2. IPTV

- 9.1.3. Cable

- 9.1.4. Other Types (DTT)

- 9.2. Market Analysis, Insights and Forecast - by Resolution

- 9.2.1. SD

- 9.2.2. HD

- 9.2.3. Ultra-HD and Higher

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Latin America TV Set Top Box Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Satellite/DTH

- 10.1.2. IPTV

- 10.1.3. Cable

- 10.1.4. Other Types (DTT)

- 10.2. Market Analysis, Insights and Forecast - by Resolution

- 10.2.1. SD

- 10.2.2. HD

- 10.2.3. Ultra-HD and Higher

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Middle East and Africa TV Set Top Box Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 11.1.1. Satellite/DTH

- 11.1.2. IPTV

- 11.1.3. Cable

- 11.1.4. Other Types (DTT)

- 11.2. Market Analysis, Insights and Forecast - by Resolution

- 11.2.1. SD

- 11.2.2. HD

- 11.2.3. Ultra-HD and Higher

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 ARRIS International PLC (CommScope Inc )

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Evolution Digital LLC

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 HUMAX Electronics Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Intek Digital Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Gospell Digital Technology Co Limited

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Shenzhen SDMC Technology Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Shenzhen Coship Electronics Co Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Sagemcom SAS

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 ZTE Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Skyworth Digital Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Kaon Media Co Limited

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Technicolor SA

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 ARRIS International PLC (CommScope Inc )

List of Figures

- Figure 1: Global TV Set Top Box Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global TV Set Top Box Market Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America TV Set Top Box Market Revenue (million), by Technology 2025 & 2033

- Figure 4: North America TV Set Top Box Market Volume (K Units), by Technology 2025 & 2033

- Figure 5: North America TV Set Top Box Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America TV Set Top Box Market Volume Share (%), by Technology 2025 & 2033

- Figure 7: North America TV Set Top Box Market Revenue (million), by Resolution 2025 & 2033

- Figure 8: North America TV Set Top Box Market Volume (K Units), by Resolution 2025 & 2033

- Figure 9: North America TV Set Top Box Market Revenue Share (%), by Resolution 2025 & 2033

- Figure 10: North America TV Set Top Box Market Volume Share (%), by Resolution 2025 & 2033

- Figure 11: North America TV Set Top Box Market Revenue (million), by Country 2025 & 2033

- Figure 12: North America TV Set Top Box Market Volume (K Units), by Country 2025 & 2033

- Figure 13: North America TV Set Top Box Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America TV Set Top Box Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe TV Set Top Box Market Revenue (million), by Technology 2025 & 2033

- Figure 16: Europe TV Set Top Box Market Volume (K Units), by Technology 2025 & 2033

- Figure 17: Europe TV Set Top Box Market Revenue Share (%), by Technology 2025 & 2033

- Figure 18: Europe TV Set Top Box Market Volume Share (%), by Technology 2025 & 2033

- Figure 19: Europe TV Set Top Box Market Revenue (million), by Resolution 2025 & 2033

- Figure 20: Europe TV Set Top Box Market Volume (K Units), by Resolution 2025 & 2033

- Figure 21: Europe TV Set Top Box Market Revenue Share (%), by Resolution 2025 & 2033

- Figure 22: Europe TV Set Top Box Market Volume Share (%), by Resolution 2025 & 2033

- Figure 23: Europe TV Set Top Box Market Revenue (million), by Country 2025 & 2033

- Figure 24: Europe TV Set Top Box Market Volume (K Units), by Country 2025 & 2033

- Figure 25: Europe TV Set Top Box Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe TV Set Top Box Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia TV Set Top Box Market Revenue (million), by Technology 2025 & 2033

- Figure 28: Asia TV Set Top Box Market Volume (K Units), by Technology 2025 & 2033

- Figure 29: Asia TV Set Top Box Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Asia TV Set Top Box Market Volume Share (%), by Technology 2025 & 2033

- Figure 31: Asia TV Set Top Box Market Revenue (million), by Resolution 2025 & 2033

- Figure 32: Asia TV Set Top Box Market Volume (K Units), by Resolution 2025 & 2033

- Figure 33: Asia TV Set Top Box Market Revenue Share (%), by Resolution 2025 & 2033

- Figure 34: Asia TV Set Top Box Market Volume Share (%), by Resolution 2025 & 2033

- Figure 35: Asia TV Set Top Box Market Revenue (million), by Country 2025 & 2033

- Figure 36: Asia TV Set Top Box Market Volume (K Units), by Country 2025 & 2033

- Figure 37: Asia TV Set Top Box Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia TV Set Top Box Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Australia and New Zealand TV Set Top Box Market Revenue (million), by Technology 2025 & 2033

- Figure 40: Australia and New Zealand TV Set Top Box Market Volume (K Units), by Technology 2025 & 2033

- Figure 41: Australia and New Zealand TV Set Top Box Market Revenue Share (%), by Technology 2025 & 2033

- Figure 42: Australia and New Zealand TV Set Top Box Market Volume Share (%), by Technology 2025 & 2033

- Figure 43: Australia and New Zealand TV Set Top Box Market Revenue (million), by Resolution 2025 & 2033

- Figure 44: Australia and New Zealand TV Set Top Box Market Volume (K Units), by Resolution 2025 & 2033

- Figure 45: Australia and New Zealand TV Set Top Box Market Revenue Share (%), by Resolution 2025 & 2033

- Figure 46: Australia and New Zealand TV Set Top Box Market Volume Share (%), by Resolution 2025 & 2033

- Figure 47: Australia and New Zealand TV Set Top Box Market Revenue (million), by Country 2025 & 2033

- Figure 48: Australia and New Zealand TV Set Top Box Market Volume (K Units), by Country 2025 & 2033

- Figure 49: Australia and New Zealand TV Set Top Box Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Australia and New Zealand TV Set Top Box Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America TV Set Top Box Market Revenue (million), by Technology 2025 & 2033

- Figure 52: Latin America TV Set Top Box Market Volume (K Units), by Technology 2025 & 2033

- Figure 53: Latin America TV Set Top Box Market Revenue Share (%), by Technology 2025 & 2033

- Figure 54: Latin America TV Set Top Box Market Volume Share (%), by Technology 2025 & 2033

- Figure 55: Latin America TV Set Top Box Market Revenue (million), by Resolution 2025 & 2033

- Figure 56: Latin America TV Set Top Box Market Volume (K Units), by Resolution 2025 & 2033

- Figure 57: Latin America TV Set Top Box Market Revenue Share (%), by Resolution 2025 & 2033

- Figure 58: Latin America TV Set Top Box Market Volume Share (%), by Resolution 2025 & 2033

- Figure 59: Latin America TV Set Top Box Market Revenue (million), by Country 2025 & 2033

- Figure 60: Latin America TV Set Top Box Market Volume (K Units), by Country 2025 & 2033

- Figure 61: Latin America TV Set Top Box Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America TV Set Top Box Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa TV Set Top Box Market Revenue (million), by Technology 2025 & 2033

- Figure 64: Middle East and Africa TV Set Top Box Market Volume (K Units), by Technology 2025 & 2033

- Figure 65: Middle East and Africa TV Set Top Box Market Revenue Share (%), by Technology 2025 & 2033

- Figure 66: Middle East and Africa TV Set Top Box Market Volume Share (%), by Technology 2025 & 2033

- Figure 67: Middle East and Africa TV Set Top Box Market Revenue (million), by Resolution 2025 & 2033

- Figure 68: Middle East and Africa TV Set Top Box Market Volume (K Units), by Resolution 2025 & 2033

- Figure 69: Middle East and Africa TV Set Top Box Market Revenue Share (%), by Resolution 2025 & 2033

- Figure 70: Middle East and Africa TV Set Top Box Market Volume Share (%), by Resolution 2025 & 2033

- Figure 71: Middle East and Africa TV Set Top Box Market Revenue (million), by Country 2025 & 2033

- Figure 72: Middle East and Africa TV Set Top Box Market Volume (K Units), by Country 2025 & 2033

- Figure 73: Middle East and Africa TV Set Top Box Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Middle East and Africa TV Set Top Box Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global TV Set Top Box Market Revenue million Forecast, by Technology 2020 & 2033

- Table 2: Global TV Set Top Box Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 3: Global TV Set Top Box Market Revenue million Forecast, by Resolution 2020 & 2033

- Table 4: Global TV Set Top Box Market Volume K Units Forecast, by Resolution 2020 & 2033

- Table 5: Global TV Set Top Box Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Global TV Set Top Box Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global TV Set Top Box Market Revenue million Forecast, by Technology 2020 & 2033

- Table 8: Global TV Set Top Box Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 9: Global TV Set Top Box Market Revenue million Forecast, by Resolution 2020 & 2033

- Table 10: Global TV Set Top Box Market Volume K Units Forecast, by Resolution 2020 & 2033

- Table 11: Global TV Set Top Box Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Global TV Set Top Box Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: Global TV Set Top Box Market Revenue million Forecast, by Technology 2020 & 2033

- Table 14: Global TV Set Top Box Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 15: Global TV Set Top Box Market Revenue million Forecast, by Resolution 2020 & 2033

- Table 16: Global TV Set Top Box Market Volume K Units Forecast, by Resolution 2020 & 2033

- Table 17: Global TV Set Top Box Market Revenue million Forecast, by Country 2020 & 2033

- Table 18: Global TV Set Top Box Market Volume K Units Forecast, by Country 2020 & 2033

- Table 19: Global TV Set Top Box Market Revenue million Forecast, by Technology 2020 & 2033

- Table 20: Global TV Set Top Box Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 21: Global TV Set Top Box Market Revenue million Forecast, by Resolution 2020 & 2033

- Table 22: Global TV Set Top Box Market Volume K Units Forecast, by Resolution 2020 & 2033

- Table 23: Global TV Set Top Box Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Global TV Set Top Box Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: India TV Set Top Box Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: India TV Set Top Box Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 27: Global TV Set Top Box Market Revenue million Forecast, by Technology 2020 & 2033

- Table 28: Global TV Set Top Box Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 29: Global TV Set Top Box Market Revenue million Forecast, by Resolution 2020 & 2033

- Table 30: Global TV Set Top Box Market Volume K Units Forecast, by Resolution 2020 & 2033

- Table 31: Global TV Set Top Box Market Revenue million Forecast, by Country 2020 & 2033

- Table 32: Global TV Set Top Box Market Volume K Units Forecast, by Country 2020 & 2033

- Table 33: Global TV Set Top Box Market Revenue million Forecast, by Technology 2020 & 2033

- Table 34: Global TV Set Top Box Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 35: Global TV Set Top Box Market Revenue million Forecast, by Resolution 2020 & 2033

- Table 36: Global TV Set Top Box Market Volume K Units Forecast, by Resolution 2020 & 2033

- Table 37: Global TV Set Top Box Market Revenue million Forecast, by Country 2020 & 2033

- Table 38: Global TV Set Top Box Market Volume K Units Forecast, by Country 2020 & 2033

- Table 39: Global TV Set Top Box Market Revenue million Forecast, by Technology 2020 & 2033

- Table 40: Global TV Set Top Box Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 41: Global TV Set Top Box Market Revenue million Forecast, by Resolution 2020 & 2033

- Table 42: Global TV Set Top Box Market Volume K Units Forecast, by Resolution 2020 & 2033

- Table 43: Global TV Set Top Box Market Revenue million Forecast, by Country 2020 & 2033

- Table 44: Global TV Set Top Box Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the TV Set Top Box Market?

The projected CAGR is approximately 5.54%.

2. Which companies are prominent players in the TV Set Top Box Market?

Key companies in the market include ARRIS International PLC (CommScope Inc ), Evolution Digital LLC, HUMAX Electronics Co Ltd, Intek Digital Inc, Gospell Digital Technology Co Limited, Shenzhen SDMC Technology Co Ltd, Shenzhen Coship Electronics Co Ltd, Sagemcom SAS, ZTE Corporation, Skyworth Digital Ltd, Kaon Media Co Limited, Technicolor SA.

3. What are the main segments of the TV Set Top Box Market?

The market segments include Technology, Resolution.

4. Can you provide details about the market size?

The market size is estimated to be USD 307.1 million as of 2022.

5. What are some drivers contributing to market growth?

High Levels of Technological Innovations; Increasing Adoption of Set-Top Boxes in the Emerging Markets; Deployment of OS-based Devices.

6. What are the notable trends driving market growth?

HD Resolution Held the Largest Market Share.

7. Are there any restraints impacting market growth?

Growing Online OTT Services/Platform.

8. Can you provide examples of recent developments in the market?

March 2022 - The GTPL Genie, a Hybrid Android TV Set Top Box, which provides easy Live TV and OTT channels at an attractive bulk price, was introduced by GTPL Hathway Limited (GTPL), a leading supplier of digital cable TV and broadband service in India. GTPL Genie blends the strength of classic Cable TV with contemporary features and a customizable environment to offer a wide variety of content in OTT entertainment apps. Customers can now watch popular OTT app material on their existing TV screen in addition to line TV channels as part of GTPL Genie's expansion of its "Connection Dil Se" offer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "TV Set Top Box Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the TV Set Top Box Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the TV Set Top Box Market?

To stay informed about further developments, trends, and reports in the TV Set Top Box Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence