Key Insights

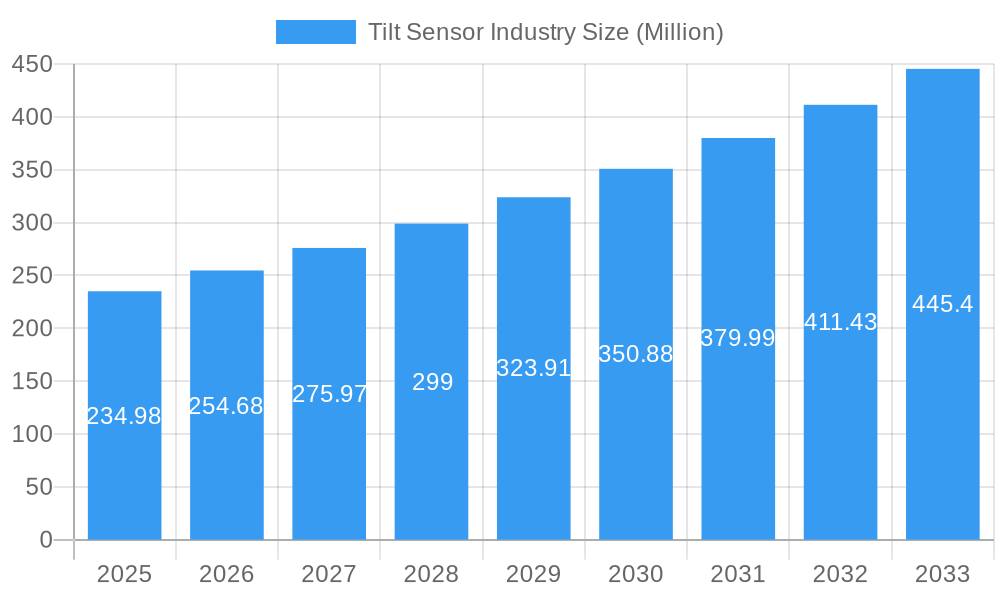

The global tilt sensor market is experiencing robust growth, projected to reach an estimated USD 234.98 million in 2025, with a significant Compound Annual Growth Rate (CAGR) of 8.52% expected from 2025 to 2033. This expansion is fueled by increasing demand across various end-user verticals, including the burgeoning mining and construction sectors, where precise angle measurement is critical for heavy machinery operation and safety. The automotive industry, with its rapid adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies, is another major contributor, necessitating reliable tilt sensing for vehicle stability control and navigation. Furthermore, the aerospace and defense sector continues to drive demand for high-accuracy tilt sensors in applications ranging from aircraft stabilization to missile guidance. The telecommunications sector also plays a role, utilizing these sensors in antenna alignment and infrastructure monitoring.

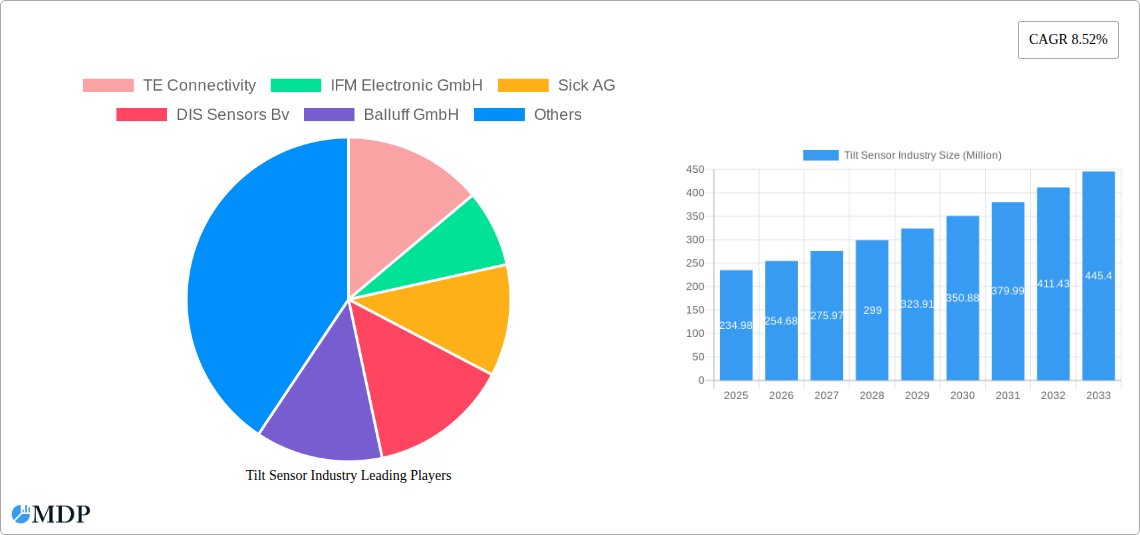

Tilt Sensor Industry Market Size (In Million)

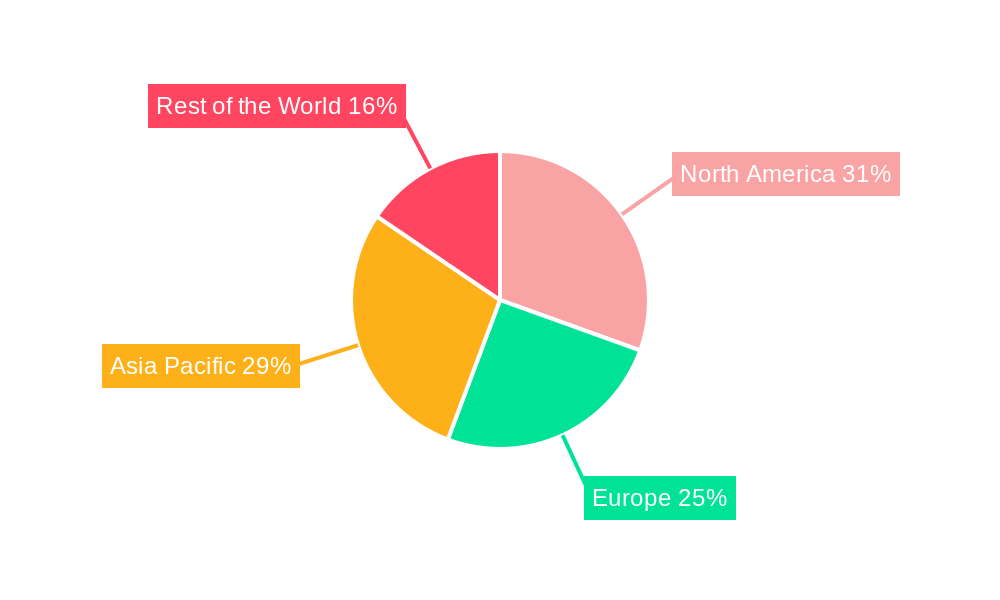

Technological advancements are shaping the market landscape, with MEMS (Micro-Electro-Mechanical Systems) technology leading the way due to its miniaturization, cost-effectiveness, and superior performance compared to traditional fluid-filled and force-balance sensors. The dominance of non-metal housing materials is also evident, offering better resistance to environmental factors and improved design flexibility. Geographically, North America, particularly the United States, is anticipated to be a leading market, owing to its strong industrial base and early adoption of advanced technologies. Asia Pacific, driven by the rapid industrialization and smart city initiatives in countries like China and India, presents substantial growth opportunities. However, challenges such as fluctuating raw material prices and the high cost of specialized, high-precision sensors for niche applications could potentially temper the market's growth trajectory.

Tilt Sensor Industry Company Market Share

Tilt Sensor Industry Market: Comprehensive Analysis and Future Outlook (2019–2033)

Dive deep into the dynamic Tilt Sensor Industry with this in-depth market research report. Covering the period from 2019 to 2033, with a base year of 2025, this report provides a granular analysis of market dynamics, emerging trends, leading segments, and future projections. Explore the critical role of tilt sensors in automotive and transportation, aerospace and defense, mining and construction, and telecommunication sectors. Understand the impact of technologies like MEMS, Force Balance, and Fluid Filled sensors, and the influence of metal and non-metal housing materials. This report is an indispensable resource for stakeholders seeking to understand the global tilt sensor market, inertial sensor market, and positioning sensor market.

Tilt Sensor Industry Market Dynamics & Concentration

The Tilt Sensor Industry exhibits a moderate level of market concentration, with key players like TE Connectivity, IFM Electronic GmbH, and Sick AG holding significant market share. The market is driven by continuous innovation, fueled by the demand for higher accuracy, miniaturization, and enhanced durability in tilt sensing solutions. Regulatory frameworks, particularly in the aerospace and defense and automotive sectors, are increasingly stringent, pushing manufacturers to adhere to rigorous quality and performance standards. While product substitutes exist, such as accelerometers and gyroscopes for certain applications, dedicated tilt sensors offer superior precision and stability for specific orientation and leveling tasks. End-user trends are heavily influenced by the rise of automation, autonomous systems, and the Internet of Things (IoT), necessitating reliable and precise tilt measurement capabilities across diverse industries. Mergers and acquisition (M&A) activities are moderately present, indicating a trend towards consolidation and strategic partnerships aimed at expanding product portfolios and market reach. For instance, the acquisition of MEMSENSE by Inertial Labs in December 2021 highlights this trend, aiming to bolster offerings in GPS-denied navigation. The market anticipates continued growth in M&A deals as companies seek to acquire advanced technologies and establish a stronger competitive presence.

Tilt Sensor Industry Industry Trends & Analysis

The Tilt Sensor Industry is experiencing robust growth, projected to expand at a significant Compound Annual Growth Rate (CAGR) throughout the forecast period of 2025–2033. This expansion is primarily fueled by escalating demand from the automotive and transportation sector, driven by the proliferation of Advanced Driver-Assistance Systems (ADAS) and the ongoing development of autonomous vehicles. The need for precise vehicle leveling, stability control, and object detection in these applications creates a substantial market for advanced tilt sensors. Furthermore, the aerospace and defense industry continues to be a major contributor, requiring high-reliability tilt sensors for navigation, stabilization, and guidance systems in aircraft, drones, and defense equipment. The mining and construction sector also presents a growing opportunity, with tilt sensors being crucial for heavy machinery operation, site leveling, and structural monitoring, ensuring safety and operational efficiency. Technological disruptions, particularly advancements in MEMS (Micro-Electro-Mechanical Systems) technology, are a key trend. MEMS-based tilt sensors offer advantages such as smaller size, lower power consumption, and cost-effectiveness, making them increasingly viable for a wider range of applications. The emergence of sophisticated Force Balance and Fluid Filled technologies also caters to niche applications requiring extreme precision and stability. Consumer preferences are shifting towards more intelligent and interconnected devices, which indirectly boosts the demand for tilt sensors as integral components in smart devices, consumer electronics, and home automation systems. Competitive dynamics are characterized by innovation and strategic collaborations. Key players are investing heavily in research and development to enhance sensor accuracy, reduce drift, and improve resistance to environmental factors like vibration and temperature fluctuations. Market penetration is expected to deepen across various end-user verticals as awareness of the benefits of accurate tilt sensing grows and the cost-effectiveness of these solutions improves. The increasing adoption of IoT solutions across industries further amplifies the demand for reliable tilt sensors that can provide real-time orientation data for a multitude of applications. The global tilt sensor market is poised for sustained growth, driven by these multifaceted trends.

Leading Markets & Segments in Tilt Sensor Industry

The Tilt Sensor Industry is characterized by dominant regions and segments that are shaping its growth trajectory. Geographically, North America and Europe currently lead the market, driven by strong industrial bases, significant investments in R&D, and the early adoption of advanced technologies in sectors like automotive and aerospace. However, the Asia Pacific region is anticipated to witness the fastest growth due to rapid industrialization, increasing investments in infrastructure projects in countries like China and India, and a burgeoning automotive manufacturing sector.

Housing Material Type:

- Metal housing sensors are prevalent in demanding environments such as mining and construction and aerospace and defense, where robustness and durability are paramount. These sensors offer superior protection against harsh conditions, impact, and extreme temperatures.

- Non-metal housing sensors are increasingly adopted in automotive and transportation and telecommunication sectors due to their lighter weight, cost-effectiveness, and suitability for less extreme operational conditions. The growing adoption of MEMS technology also favors non-metal housing for compact and integrated solutions.

Technology:

- MEMS technology is a significant growth driver, offering miniaturization, lower power consumption, and cost efficiencies. Its widespread adoption in consumer electronics and automotive applications is pushing the demand for MEMS-based tilt sensors.

- Force Balance technology remains crucial for applications demanding exceptionally high accuracy and stability, particularly in aerospace and defense and specialized industrial equipment.

- Fluid Filled technology finds its niche in applications requiring excellent damping of vibrations and shocks, making them suitable for heavy machinery and critical industrial processes.

End-user Vertical:

- Automotive and Transportation stands out as a dominant end-user vertical, propelled by the relentless advancements in ADAS and autonomous driving. The need for precise tilt information for vehicle stability, safety systems, and advanced parking assist functionalities is immense. Market penetration is further amplified by the global push towards electric vehicles and smart mobility solutions.

- Aerospace and Defense is another significant vertical, where the inherent demand for high-precision and high-reliability sensors for navigation, flight control, and missile guidance systems ensures consistent market engagement.

- Mining and Construction exhibits strong growth potential, with tilt sensors being indispensable for ensuring the safe and efficient operation of heavy machinery, site surveying, and the structural integrity monitoring of infrastructure projects. Economic policies favoring infrastructure development in emerging economies are key drivers here.

- Telecommunication applications, though smaller in volume, are growing with the deployment of 5G infrastructure and the need for precise antenna alignment and equipment leveling.

Tilt Sensor Industry Product Developments

Recent product developments in the Tilt Sensor Industry are focused on enhancing accuracy, miniaturization, and integration capabilities. Aceinna Inc.'s introduction of the INS401 INS and GNSS/RTK, a turnkey solution for autonomous vehicle precise positioning, exemplifies the trend towards high-accuracy localization for ADAS and autonomy solutions. This innovation addresses the critical need for reliable positioning in complex driving scenarios. Furthermore, Inertial Labs' acquisition of MEMSENSE, aimed at developing new tilt sensors for GPS-denied navigation, industrial machines, and aerospace & defense, highlights a strategic move to expand technological offerings and cater to specialized market demands. These advancements underscore a competitive landscape driven by technological innovation and a commitment to meeting the evolving needs of end-user industries for robust and precise orientation sensing.

Key Drivers of Tilt Sensor Industry Growth

The Tilt Sensor Industry is propelled by a confluence of technological advancements, economic imperatives, and evolving regulatory landscapes. Technologically, the continuous innovation in MEMS sensor technology offers smaller, more cost-effective, and power-efficient solutions, expanding their applicability across diverse sectors. Economic factors such as increased global investment in infrastructure development in mining and construction, and the rapid expansion of the automotive industry, particularly in the realm of autonomous vehicles and ADAS, are significant growth catalysts. Regulatory frameworks, especially those mandating enhanced safety features in automotive and aerospace applications, further drive the demand for accurate tilt sensing solutions. The growing adoption of IoT devices and smart manufacturing processes also necessitates precise orientation data, fueling market expansion.

Challenges in the Tilt Sensor Industry Market

Despite its robust growth, the Tilt Sensor Industry faces several challenges. Intense competitive pressures from established players and emerging manufacturers can lead to price erosion and impact profit margins. Supply chain disruptions, exacerbated by geopolitical factors and component shortages, can affect production timelines and cost-effectiveness. Regulatory hurdles, particularly in highly regulated sectors like aerospace and defense, require significant investment in compliance and certification, which can be a barrier for smaller companies. The high cost of advanced MEMS sensors for highly precise applications, while decreasing, can still be a restraint for widespread adoption in cost-sensitive markets. Furthermore, the availability of product substitutes for less demanding applications requires continuous innovation to highlight the unique value proposition of dedicated tilt sensors.

Emerging Opportunities in Tilt Sensor Industry

Emerging opportunities within the Tilt Sensor Industry are primarily driven by technological breakthroughs and expanding market applications. The accelerating development of the Internet of Things (IoT) ecosystem presents a substantial opportunity, as tilt sensors are becoming integral components in smart home devices, industrial automation, and environmental monitoring systems, enabling intelligent data collection and control. The continued advancement of autonomous systems, not only in vehicles but also in robotics and drones, creates a growing demand for high-performance tilt sensors that can provide reliable attitude and orientation data in complex, GPS-denied environments. Strategic partnerships between sensor manufacturers and end-users in emerging markets, particularly in the Asia Pacific region, offer significant potential for market expansion. Furthermore, the development of multi-axis tilt sensors with integrated functionalities like temperature compensation and self-calibration will cater to more sophisticated application requirements, opening new revenue streams.

Leading Players in the Tilt Sensor Industry Sector

- TE Connectivity

- IFM Electronic GmbH

- Sick AG

- DIS Sensors Bv

- Balluff GmbH

- The Fredericks Company

- Gefran

- Level Developments Ltd

- Murata Manufacturing Co Ltd

- Jewell Instruments LLC

- Pepperl+Fuchs Vertrieb GmbH & Co Kg

Key Milestones in Tilt Sensor Industry Industry

- January 2022: Aceinna Inc. announced the INS401 INS and GNSS/RTK, a turnkey solution for autonomous vehicle precise positioning. The INS401 is part of Aceinna's new product portfolio that provides high accuracy and high integrity localization for developers and manufacturers of an advanced driver-assistance system (ADAS) and autonomy solutions for vehicles of all types.

- December 2021: Inertial Labs, a developer and supplier of orientation, inertial navigation, and optically enhanced tilt sensor modules, has acquired MEMSENSE. The combined company expects to introduce new tilt sensors for GPS-denied navigation, industrial machines, and aerospace & defense.

Strategic Outlook for Tilt Sensor Industry Market

The Tilt Sensor Industry is poised for continued, strong growth, driven by the persistent demand for accurate orientation sensing across a widening array of applications. Key growth accelerators include the accelerating adoption of autonomous and semi-autonomous systems in automotive, industrial robotics, and aerospace, where precision tilt data is fundamental for safety and functionality. The ongoing expansion of the IoT ecosystem will further integrate tilt sensors into smart devices and infrastructure, creating new markets and increasing overall volume. Strategic opportunities lie in the development of highly integrated, intelligent tilt sensing modules that combine multiple functionalities and provide advanced data processing capabilities. Collaborations between sensor manufacturers and key end-users, particularly in emerging economies undergoing significant industrial and infrastructural development, will be crucial for market penetration and sustained revenue growth. The focus will remain on innovation in MEMS technology for cost-effective, high-performance solutions and on catering to niche, high-accuracy requirements with advanced technologies like Force Balance.

Tilt Sensor Industry Segmentation

-

1. Housing Material Type

- 1.1. Metal

- 1.2. Non-metal

-

2. Technology

- 2.1. Force Balance

- 2.2. MEMS

- 2.3. Fluid Filled

-

3. End-user Vertical

- 3.1. Mining and Construction

- 3.2. Aerospace and Defense

- 3.3. Automotive and Transportation

- 3.4. Telecommunication

- 3.5. Other End-user Verticals

Tilt Sensor Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East and Africa

Tilt Sensor Industry Regional Market Share

Geographic Coverage of Tilt Sensor Industry

Tilt Sensor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Mems Technology-based Tilt Sensors; Rising Demand For Construction Equipment

- 3.3. Market Restrains

- 3.3.1. High Cost Of Tilt Sensors Based On Force Balance Technology

- 3.4. Market Trends

- 3.4.1. Demand from Automotive and Transportation Segment to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tilt Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Housing Material Type

- 5.1.1. Metal

- 5.1.2. Non-metal

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Force Balance

- 5.2.2. MEMS

- 5.2.3. Fluid Filled

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Mining and Construction

- 5.3.2. Aerospace and Defense

- 5.3.3. Automotive and Transportation

- 5.3.4. Telecommunication

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Housing Material Type

- 6. North America Tilt Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Housing Material Type

- 6.1.1. Metal

- 6.1.2. Non-metal

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Force Balance

- 6.2.2. MEMS

- 6.2.3. Fluid Filled

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. Mining and Construction

- 6.3.2. Aerospace and Defense

- 6.3.3. Automotive and Transportation

- 6.3.4. Telecommunication

- 6.3.5. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Housing Material Type

- 7. Europe Tilt Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Housing Material Type

- 7.1.1. Metal

- 7.1.2. Non-metal

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Force Balance

- 7.2.2. MEMS

- 7.2.3. Fluid Filled

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. Mining and Construction

- 7.3.2. Aerospace and Defense

- 7.3.3. Automotive and Transportation

- 7.3.4. Telecommunication

- 7.3.5. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Housing Material Type

- 8. Asia Pacific Tilt Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Housing Material Type

- 8.1.1. Metal

- 8.1.2. Non-metal

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Force Balance

- 8.2.2. MEMS

- 8.2.3. Fluid Filled

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. Mining and Construction

- 8.3.2. Aerospace and Defense

- 8.3.3. Automotive and Transportation

- 8.3.4. Telecommunication

- 8.3.5. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Housing Material Type

- 9. Rest of the World Tilt Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Housing Material Type

- 9.1.1. Metal

- 9.1.2. Non-metal

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Force Balance

- 9.2.2. MEMS

- 9.2.3. Fluid Filled

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. Mining and Construction

- 9.3.2. Aerospace and Defense

- 9.3.3. Automotive and Transportation

- 9.3.4. Telecommunication

- 9.3.5. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Housing Material Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 TE Connectivity

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 IFM Electronic GmbH

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sick AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 DIS Sensors Bv

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Balluff GmbH

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 The Fredericks Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Gefran*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Level Developments Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Murata Manufacturing Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Jewell Instruments LLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Pepperl+Fuchs Vertrieb GmbH & Co Kg

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 TE Connectivity

List of Figures

- Figure 1: Global Tilt Sensor Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Tilt Sensor Industry Revenue (Million), by Housing Material Type 2025 & 2033

- Figure 3: North America Tilt Sensor Industry Revenue Share (%), by Housing Material Type 2025 & 2033

- Figure 4: North America Tilt Sensor Industry Revenue (Million), by Technology 2025 & 2033

- Figure 5: North America Tilt Sensor Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Tilt Sensor Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 7: North America Tilt Sensor Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: North America Tilt Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Tilt Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Tilt Sensor Industry Revenue (Million), by Housing Material Type 2025 & 2033

- Figure 11: Europe Tilt Sensor Industry Revenue Share (%), by Housing Material Type 2025 & 2033

- Figure 12: Europe Tilt Sensor Industry Revenue (Million), by Technology 2025 & 2033

- Figure 13: Europe Tilt Sensor Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Europe Tilt Sensor Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 15: Europe Tilt Sensor Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Europe Tilt Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Tilt Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Tilt Sensor Industry Revenue (Million), by Housing Material Type 2025 & 2033

- Figure 19: Asia Pacific Tilt Sensor Industry Revenue Share (%), by Housing Material Type 2025 & 2033

- Figure 20: Asia Pacific Tilt Sensor Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Asia Pacific Tilt Sensor Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Asia Pacific Tilt Sensor Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Asia Pacific Tilt Sensor Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Asia Pacific Tilt Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Tilt Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Tilt Sensor Industry Revenue (Million), by Housing Material Type 2025 & 2033

- Figure 27: Rest of the World Tilt Sensor Industry Revenue Share (%), by Housing Material Type 2025 & 2033

- Figure 28: Rest of the World Tilt Sensor Industry Revenue (Million), by Technology 2025 & 2033

- Figure 29: Rest of the World Tilt Sensor Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Rest of the World Tilt Sensor Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 31: Rest of the World Tilt Sensor Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 32: Rest of the World Tilt Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Tilt Sensor Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Tilt Sensor Industry Revenue Million Forecast, by Housing Material Type 2020 & 2033

- Table 2: Global Tilt Sensor Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Global Tilt Sensor Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Tilt Sensor Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Tilt Sensor Industry Revenue Million Forecast, by Housing Material Type 2020 & 2033

- Table 6: Global Tilt Sensor Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 7: Global Tilt Sensor Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global Tilt Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Tilt Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Tilt Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Tilt Sensor Industry Revenue Million Forecast, by Housing Material Type 2020 & 2033

- Table 12: Global Tilt Sensor Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 13: Global Tilt Sensor Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 14: Global Tilt Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Tilt Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Tilt Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Tilt Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Tilt Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Tilt Sensor Industry Revenue Million Forecast, by Housing Material Type 2020 & 2033

- Table 20: Global Tilt Sensor Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 21: Global Tilt Sensor Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 22: Global Tilt Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: China Tilt Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Tilt Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Tilt Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Tilt Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Tilt Sensor Industry Revenue Million Forecast, by Housing Material Type 2020 & 2033

- Table 28: Global Tilt Sensor Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 29: Global Tilt Sensor Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 30: Global Tilt Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Latin America Tilt Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Middle East and Africa Tilt Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tilt Sensor Industry?

The projected CAGR is approximately 8.52%.

2. Which companies are prominent players in the Tilt Sensor Industry?

Key companies in the market include TE Connectivity, IFM Electronic GmbH, Sick AG, DIS Sensors Bv, Balluff GmbH, The Fredericks Company, Gefran*List Not Exhaustive, Level Developments Ltd, Murata Manufacturing Co Ltd, Jewell Instruments LLC, Pepperl+Fuchs Vertrieb GmbH & Co Kg.

3. What are the main segments of the Tilt Sensor Industry?

The market segments include Housing Material Type, Technology, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 234.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Mems Technology-based Tilt Sensors; Rising Demand For Construction Equipment.

6. What are the notable trends driving market growth?

Demand from Automotive and Transportation Segment to Grow Significantly.

7. Are there any restraints impacting market growth?

High Cost Of Tilt Sensors Based On Force Balance Technology.

8. Can you provide examples of recent developments in the market?

January 2022 - Aceinna Inc. has announced the sensors such as INS401 INS and GNSS/RTK, a turnkey solution for autonomous vehicle precise positioning. The INS401 is part of Aceinna's new product portfolio that provides high accuracy and high integrity localization for developers and manufacturers of an advanced driver-assistance system (ADAS) and autonomy solutions for vehicles of all types.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tilt Sensor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tilt Sensor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tilt Sensor Industry?

To stay informed about further developments, trends, and reports in the Tilt Sensor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence