Key Insights

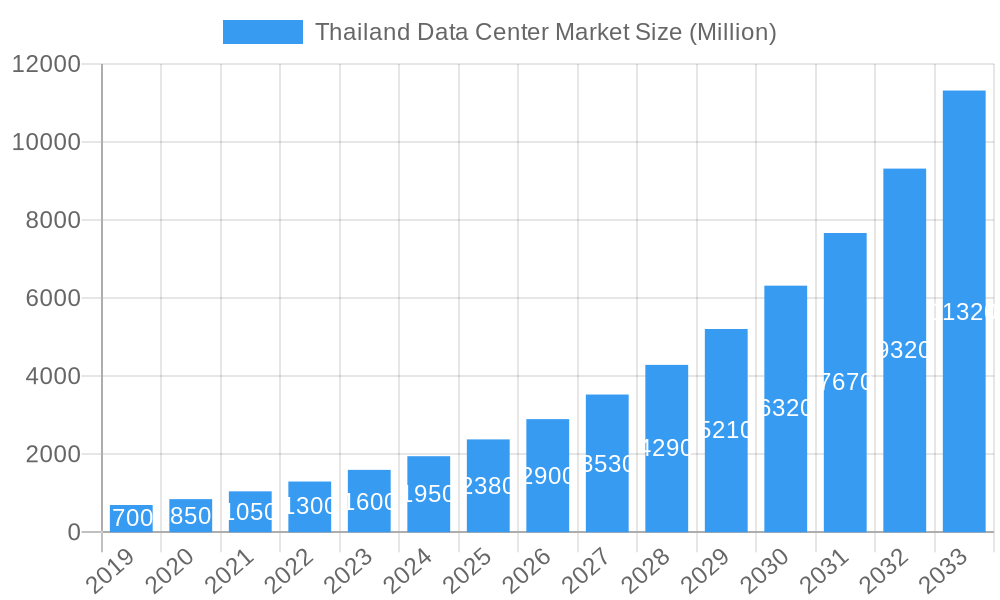

The Thailand data center market is poised for exceptional growth, projected to reach an estimated USD 3,500 million by 2025, fueled by a robust Compound Annual Growth Rate (CAGR) of 21.06% through 2033. This dynamic expansion is primarily driven by the escalating demand for digital services, cloud adoption across various industries, and the burgeoning e-commerce sector. The increasing digitalization efforts by the government and the expansion of the BFSI and manufacturing sectors are further augmenting the need for sophisticated data infrastructure. Trends such as the rise of hyperscale and colocation facilities, the increasing adoption of edge computing, and the growing focus on sustainability within data center operations are shaping the market landscape. The ongoing digital transformation initiatives within Thailand are creating a fertile ground for data center investments and expansions, positioning the country as a significant hub for digital infrastructure in Southeast Asia.

Thailand Data Center Market Market Size (In Million)

While the market exhibits strong growth, certain restraints such as the high initial capital investment for developing advanced data centers and the increasing power consumption demands need careful consideration. The market is segmented by data center size, with "Large" and "Massive" segments likely to witness the most significant expansion due to the requirements of hyperscale providers and large enterprises. Tier 3 and Tier 4 data centers are also gaining prominence, reflecting the increasing need for high availability and resilience. Bangkok, as the primary economic and technological hub, leads the regional demand, but "Rest of Thailand" is expected to witness substantial growth as digital penetration increases across the nation. Key end-users like Cloud, BFSI, and E-Commerce are the primary consumers of data center services, driving the demand for colocation and hyperscale solutions.

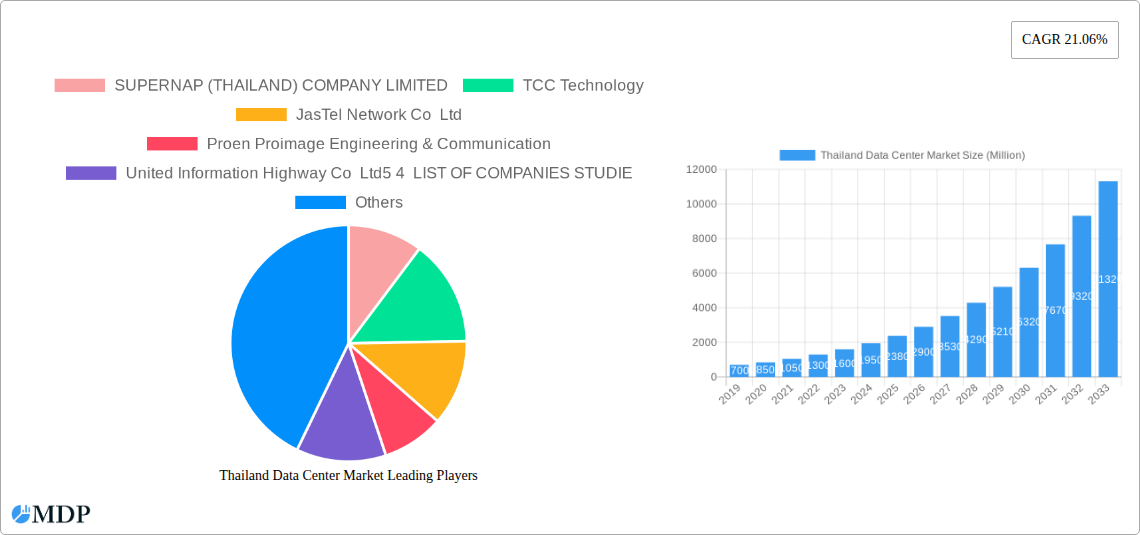

Thailand Data Center Market Company Market Share

Dive deep into the burgeoning Thailand data center market with this indispensable report. Covering the historical period (2019-2024) and projecting growth through 2033, this analysis offers critical insights into market dynamics, industry trends, leading segments, and key players. We forecast a robust CAGR of XX% for the Thailand data center market, driven by surging demand for cloud services, e-commerce expansion, and digital transformation initiatives across various end-user industries. With a projected market size of over $XX million by 2025, Thailand is emerging as a pivotal hub for digital infrastructure in Southeast Asia. This report is essential for data center investors, telecom operators, cloud providers, and enterprise IT decision-makers seeking to capitalize on this dynamic market.

Thailand Data Center Market Market Dynamics & Concentration

The Thailand data center market exhibits a moderately concentrated landscape, with a few prominent players holding significant market share. Innovation is primarily driven by the relentless demand for higher densities, improved power efficiency, and enhanced security measures, fueled by the rapid adoption of advanced technologies like AI and IoT. Regulatory frameworks, while evolving, are generally supportive of foreign investment and data infrastructure development. Product substitutes are limited, with the core offering of data center services remaining paramount. End-user trends showcase a strong inclination towards hyperscale and wholesale colocation to support the explosive growth of cloud, e-commerce, and BFSI sectors. Mergers and acquisitions (M&A) are anticipated to play a crucial role in consolidating the market, with an estimated XX M&A deals projected during the forecast period, aiming to expand capacity and service offerings.

- Market Concentration: Dominated by a few key players, with increasing competition from new entrants.

- Innovation Drivers: Demand for hyperscale capacity, energy efficiency, and advanced cooling technologies.

- Regulatory Framework: Generally favorable, with initiatives to boost digital economy.

- Product Substitutes: Limited, with focus on core colocation and managed services.

- End-User Trends: Strong demand from Cloud, E-Commerce, BFSI, and Telecom.

- M&A Activities: Expected to increase for capacity expansion and market consolidation.

Thailand Data Center Market Industry Trends & Analysis

The Thailand data center industry is experiencing an unprecedented surge, propelled by Thailand's strategic location, government initiatives promoting digitalization, and a rapidly expanding digital economy. The country's focus on becoming a regional digital hub is a significant market growth driver, attracting substantial investments from both domestic and international players. Technological disruptions, particularly the widespread adoption of 5G networks, AI, and IoT, are creating a substantial demand for high-performance, low-latency data processing capabilities. Consumer preferences are shifting towards more reliable, scalable, and secure data storage and processing solutions, driving the adoption of advanced data center infrastructure. Competitive dynamics are intensifying, with existing operators expanding their facilities and new hyperscale providers entering the market, leading to a vibrant and dynamic ecosystem. The market penetration of advanced data center solutions is projected to reach XX% by 2033.

- Market Growth Drivers: Government digital economy initiatives, increasing internet penetration, and rising adoption of cloud computing.

- Technological Disruptions: Impact of 5G, AI, IoT, and edge computing on data center infrastructure demands.

- Consumer Preferences: Growing demand for high availability, scalability, and robust security features.

- Competitive Dynamics: Intensifying competition from hyperscale providers and local players, leading to innovation and price optimization.

- Market Penetration: Increasing adoption of hyperscale and advanced colocation services.

Leading Markets & Segments in Thailand Data Center Market

Bangkok stands out as the dominant hotspot in the Thailand data center market, driven by its robust economic activity, concentration of businesses, and advanced telecommunications infrastructure. Within data center sizes, Massive and Large facilities are expected to witness the most significant growth to cater to the demands of hyperscalers and large enterprises. Tier 3 and Tier 4 data centers are increasingly preferred, reflecting the growing emphasis on reliability, uptime, and disaster recovery capabilities, especially from sectors like BFSI and Government. In terms of absorption, while non-utilized capacity exists, the rapid pace of new deployments indicates a healthy balance with demand. Hyperscale colocation is a leading segment, followed by wholesale colocation, to accommodate the massive infrastructure needs of cloud providers and large digital businesses. The Cloud, E-Commerce, and BFSI sectors are the primary end-users, accounting for a significant portion of the market's revenue.

- Dominant Hotspot: Bangkok, due to its economic significance and infrastructure.

- Leading Data Center Sizes: Massive and Large, catering to hyperscale and enterprise needs.

- Preferred Tier Types: Tier 3 and Tier 4, emphasizing high availability and reliability.

- Absorption Trends: Healthy growth in utilization driven by increasing deployments.

- Dominant Colocation Types: Hyperscale and Wholesale, supporting large-scale cloud and enterprise deployments.

- Key End-Users: Cloud, E-Commerce, BFSI, Telecom, and Government sectors are major drivers of demand.

- Economic Policies: Government incentives and digital transformation agendas.

- Infrastructure Development: Expansion of fiber optic networks and power grids.

Thailand Data Center Market Product Developments

Product developments in the Thailand data center market are focused on enhancing efficiency, scalability, and sustainability. Innovations include advancements in cooling technologies such as liquid cooling to support higher power densities, modular data center designs for faster deployment, and the integration of AI for predictive maintenance and operational optimization. Applications are expanding to support edge computing deployments and specialized workloads like AI/ML processing. Competitive advantages are being gained through the development of carrier-neutral facilities, offering greater connectivity options, and providing highly secure, compliant environments for sensitive data. Technological trends are pushing towards greater automation and intelligent management systems.

Key Drivers of Thailand Data Center Market Growth

The Thailand data center market is propelled by a confluence of powerful drivers. The Thai government's "Thailand 4.0" initiative and its commitment to fostering a digital economy are creating a fertile ground for data center investments. The burgeoning e-commerce sector, coupled with the rapid adoption of cloud services by businesses of all sizes, is a primary demand generator. Furthermore, the expansion of 5G networks and the increasing proliferation of IoT devices are creating a significant need for localized data processing and storage. The country's strategic location within ASEAN also positions it as an attractive hub for regional data operations.

Challenges in the Thailand Data Center Market Market

Despite its promising growth, the Thailand data center market faces several challenges. Obtaining necessary permits and navigating regulatory frameworks can be complex and time-consuming. Supply chain disruptions for critical equipment and skilled labor shortages can impact project timelines and operational efficiency. Intensifying competition, particularly from international hyperscalers, puts pressure on pricing and profit margins for local operators. Furthermore, ensuring a stable and cost-effective power supply, along with addressing environmental concerns related to energy consumption, remains a significant ongoing challenge.

Emerging Opportunities in Thailand Data Center Market

Emerging opportunities in the Thailand data center market lie in catering to the growing demand for specialized data center services. The expansion of edge computing, driven by the rollout of 5G and the increasing need for real-time data processing, presents a significant growth avenue. Strategic partnerships between data center operators and telecommunications providers can unlock new revenue streams and enhance connectivity. Furthermore, the development of green data centers, utilizing renewable energy sources and adopting sustainable practices, will be crucial for attracting environmentally conscious clients and gaining a competitive edge. The untapped potential in secondary cities outside of Bangkok also offers significant expansion opportunities.

Leading Players in the Thailand Data Center Market Sector

- SUPERNAP (THAILAND) COMPANY LIMITED

- TCC Technology

- JasTel Network Co Ltd

- Proen Proimage Engineering & Communication

- United Information Highway Co Ltd

- AIMS DATA CENTRE (THAILAND) LTD

- ISPIO (NIPA Technology Co Ltd)

- CS LOXINFO PUBLIC COMPANY LIMITED

- True Internet Data Center Co Ltd

- STT GDC Pte Ltd

- NTT Ltd

- Internet Thailand Public Company Limited

Key Milestones in Thailand Data Center Market Industry

- April 2022: SUPERNAP (Thailand) signs PPA with WHA Utilities & Power to power its hyperscale data center, aiming to offset 18,250 tons of CO2 emission and reduce electricity costs significantly.

- November 2021: True Internet Data Center Co., Ltd. announces expansion plans for its East Bangna facility, with a total investment of THB 3,000 million, targeting completion of four buildings.

- September 2021: ST Telemedia Global Data Centres officially opens STT Bangkok 1, the first carrier-neutral hyperscale data centre in Bangkok built to global standards.

Strategic Outlook for Thailand Data Center Market Market

The strategic outlook for the Thailand data center market is exceptionally positive. Continued government support for digitalization, coupled with increasing enterprise adoption of cloud technologies and the expansion of digital services, will fuel sustained demand. Investments in infrastructure, particularly in expanding network connectivity and renewable energy sources, will be critical growth accelerators. Strategic partnerships and potential consolidation through M&A will shape the competitive landscape, leading to more robust and sophisticated offerings. The market is poised for significant growth, driven by its role as a key digital hub in Southeast Asia.

Thailand Data Center Market Segmentation

-

1. Hotspot

- 1.1. Bangkok

- 1.2. Rest of Thailand

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End User

Thailand Data Center Market Segmentation By Geography

- 1. Thailand

Thailand Data Center Market Regional Market Share

Geographic Coverage of Thailand Data Center Market

Thailand Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of E-Commerce; Flourishing Startup Culture

- 3.3. Market Restrains

- 3.3.1. Slow Penetration Rate in Developing Countries

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Data Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Bangkok

- 5.1.2. Rest of Thailand

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SUPERNAP (THAILAND) COMPANY LIMITED

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TCC Technology

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JasTel Network Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Proen Proimage Engineering & Communication

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 United Information Highway Co Ltd5 4 LIST OF COMPANIES STUDIE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AIMS DATA CENTRE (THAILAND) LTD

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ISPIO (NIPA Technology Co Ltd)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CS LOXINFO PUBLIC COMPANY LIMITED

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 True Internet Data Center Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 STT GDC Pte Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 NTT Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Internet Thailand Public Company Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 SUPERNAP (THAILAND) COMPANY LIMITED

List of Figures

- Figure 1: Thailand Data Center Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Thailand Data Center Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Data Center Market Revenue undefined Forecast, by Hotspot 2020 & 2033

- Table 2: Thailand Data Center Market Volume K Unit Forecast, by Hotspot 2020 & 2033

- Table 3: Thailand Data Center Market Revenue undefined Forecast, by Data Center Size 2020 & 2033

- Table 4: Thailand Data Center Market Volume K Unit Forecast, by Data Center Size 2020 & 2033

- Table 5: Thailand Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 6: Thailand Data Center Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 7: Thailand Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 8: Thailand Data Center Market Volume K Unit Forecast, by Absorption 2020 & 2033

- Table 9: Thailand Data Center Market Revenue undefined Forecast, by Colocation Type 2020 & 2033

- Table 10: Thailand Data Center Market Volume K Unit Forecast, by Colocation Type 2020 & 2033

- Table 11: Thailand Data Center Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: Thailand Data Center Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 13: Thailand Data Center Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 14: Thailand Data Center Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 15: Thailand Data Center Market Revenue undefined Forecast, by Hotspot 2020 & 2033

- Table 16: Thailand Data Center Market Volume K Unit Forecast, by Hotspot 2020 & 2033

- Table 17: Thailand Data Center Market Revenue undefined Forecast, by Data Center Size 2020 & 2033

- Table 18: Thailand Data Center Market Volume K Unit Forecast, by Data Center Size 2020 & 2033

- Table 19: Thailand Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 20: Thailand Data Center Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 21: Thailand Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 22: Thailand Data Center Market Volume K Unit Forecast, by Absorption 2020 & 2033

- Table 23: Thailand Data Center Market Revenue undefined Forecast, by Colocation Type 2020 & 2033

- Table 24: Thailand Data Center Market Volume K Unit Forecast, by Colocation Type 2020 & 2033

- Table 25: Thailand Data Center Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 26: Thailand Data Center Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 27: Thailand Data Center Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Thailand Data Center Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Data Center Market?

The projected CAGR is approximately 17.48%.

2. Which companies are prominent players in the Thailand Data Center Market?

Key companies in the market include SUPERNAP (THAILAND) COMPANY LIMITED, TCC Technology, JasTel Network Co Ltd, Proen Proimage Engineering & Communication, United Information Highway Co Ltd5 4 LIST OF COMPANIES STUDIE, AIMS DATA CENTRE (THAILAND) LTD, ISPIO (NIPA Technology Co Ltd), CS LOXINFO PUBLIC COMPANY LIMITED, True Internet Data Center Co Ltd, STT GDC Pte Ltd, NTT Ltd, Internet Thailand Public Company Limited.

3. What are the main segments of the Thailand Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise of E-Commerce; Flourishing Startup Culture.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Slow Penetration Rate in Developing Countries.

8. Can you provide examples of recent developments in the market?

April 2022: SUPERNAP (Thailand) signs PPA with WHA Utilities & Power to power its hyperscale data center.In line with the company’s policy to help save the planet, reduce global warming and greenhouse effect, the project will also help SUPERNAP (Thailand), and its clients, to reduce electricity costs significantly throughout the system’s life, while offsetting 18,250 tons of CO2 emission to the environment.November 2021: True Internet Data Center Co., Ltd. announced to expand its services both in Thailand and overseas countries. True IDC-East Bangna expansion will be the second building of the total of 4 planned buildings. It will also be equipped with a data center system. With the first phase being completed in 2019, the second phase will be ready for service in 2022. The rest of the expansion will be continued until all of the 4 phases are completed through the total investment of THB 3,000 million.September 2021: ST Telemedia Global Data Centres announced the official opening of STT Bangkok 1, the first carrier-neutral hyperscale data centre in Bangkok built to global standards. It is both hyperscale-ready and carrier-neutral.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Data Center Market?

To stay informed about further developments, trends, and reports in the Thailand Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence