Key Insights

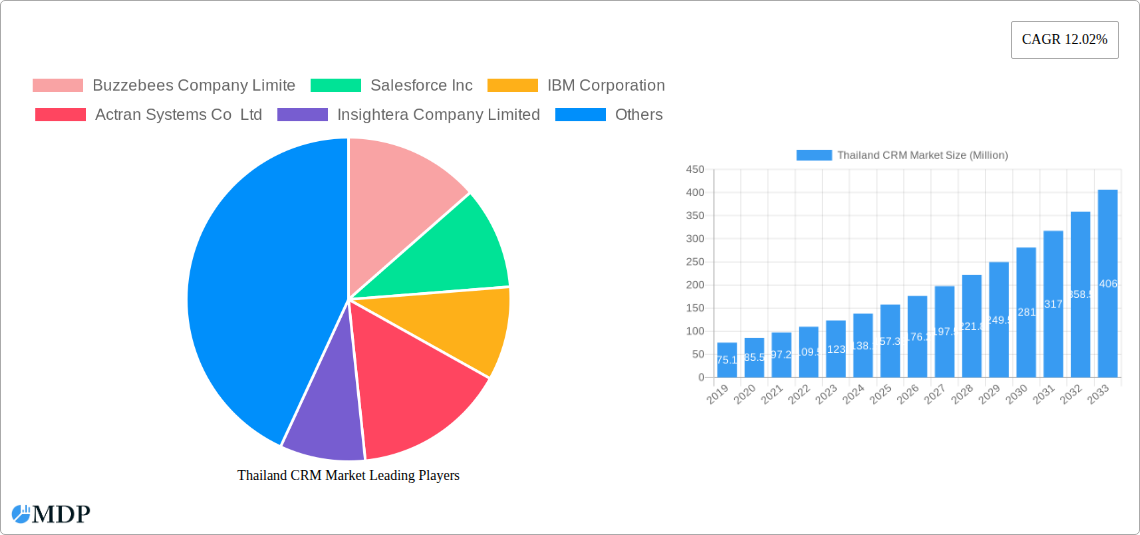

The Thailand Customer Relationship Management (CRM) market is poised for significant expansion, projected to reach USD 157.38 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12.02% expected throughout the forecast period of 2025-2033. This substantial growth is being propelled by several key drivers. The increasing adoption of digital transformation initiatives across various industries in Thailand is a primary catalyst, pushing businesses to leverage CRM solutions for enhanced customer engagement, streamlined sales processes, and improved marketing effectiveness. Furthermore, the growing emphasis on personalized customer experiences and the need for data-driven decision-making are compelling organizations of all sizes to invest in sophisticated CRM platforms. Small and medium-sized enterprises (SMEs), in particular, are increasingly recognizing the value of affordable and scalable cloud-based CRM solutions to compete effectively with larger players. The manufacturing and services sectors, along with the burgeoning retail and logistics industries, are anticipated to be major contributors to this market expansion, driven by the need to manage complex customer interactions and supply chains efficiently.

Thailand CRM Market Market Size (In Million)

The market landscape is characterized by a dynamic interplay of trends and strategic initiatives by leading companies. The shift towards cloud-based CRM deployments continues to dominate, offering flexibility, cost-efficiency, and easier scalability, which are particularly attractive to Thai businesses. Hybrid deployment models are also gaining traction, catering to organizations with specific data security or legacy system integration requirements. In terms of end-user verticals, the services sector, including hospitality and professional services, is showing strong demand for CRM solutions that can manage customer loyalty programs and personalized service delivery. The retail and logistics sectors are actively seeking CRM functionalities that can optimize inventory management, enhance customer service, and streamline last-mile delivery operations. Key players such as Salesforce Inc., IBM Corporation, Microsoft Corporation, and Oracle are actively introducing innovative features and tailored solutions to meet the evolving needs of the Thai market, fostering a competitive yet collaborative environment that ultimately benefits businesses seeking to deepen customer relationships and drive revenue growth.

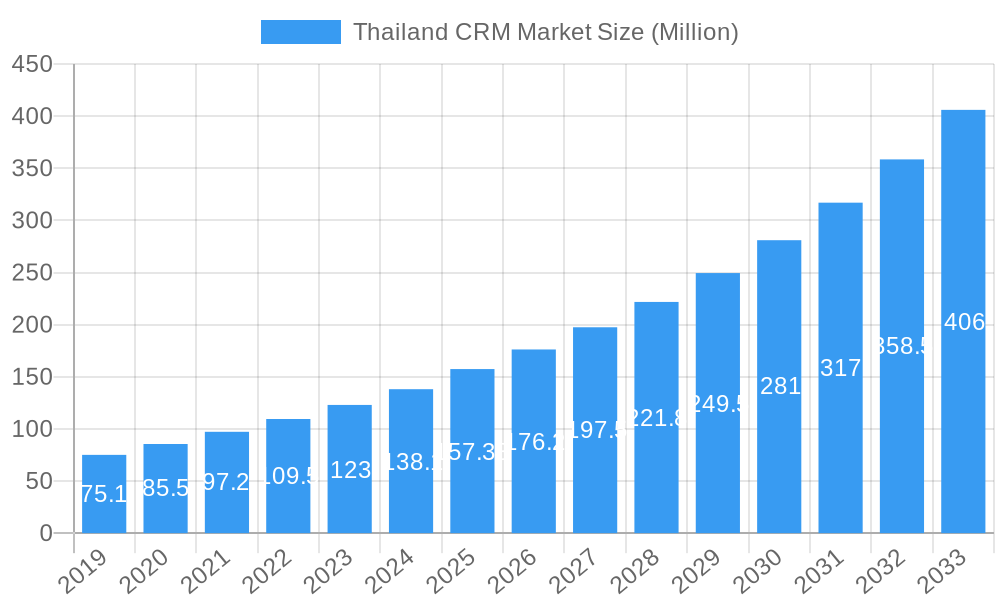

Thailand CRM Market Company Market Share

Thailand CRM Market: Unlocking Growth and Digital Transformation in Southeast Asia

Gain unparalleled insights into the dynamic Thailand CRM market with this comprehensive report. Analyzing the period from 2019–2033, with a base year of 2025, this report delves into the evolving landscape of Customer Relationship Management solutions in Thailand. Discover key market drivers, emerging trends, and the competitive strategies of leading players. This report is essential for IT decision-makers, CRM vendors, investors, and business leaders seeking to understand and capitalize on the digital transformation and customer-centric initiatives reshaping the Thai economy.

Thailand CRM Market Market Dynamics & Concentration

The Thailand CRM market is characterized by a growing concentration driven by the increasing adoption of digital technologies and a strong emphasis on customer experience across various industries. Innovation is a key driver, with vendors continuously enhancing their offerings with AI, machine learning, and advanced analytics to provide deeper customer insights and personalized engagement. Regulatory frameworks, while evolving, are generally supportive of digital transformation, encouraging businesses to invest in robust CRM systems. Product substitutes, such as standalone marketing automation tools or basic contact management software, exist but often lack the comprehensive capabilities of integrated CRM solutions. End-user trends show a clear shift towards cloud-based solutions for their scalability and cost-effectiveness. Mergers and acquisitions (M&A) activity is a significant indicator of market concentration. While specific M&A deal counts are not readily available for the entire market, strategic alliances and acquisitions by major technology players indicate consolidation and a drive for market share. Companies like Salesforce, Microsoft, and Oracle are actively expanding their presence, acquiring smaller local players or forming strategic partnerships to bolster their market position. The market share distribution is influenced by the presence of global giants and the emergence of local specialized CRM providers. The increasing demand for sophisticated customer engagement tools fuels this dynamic.

Thailand CRM Market Industry Trends & Analysis

The Thailand CRM market is poised for substantial growth, fueled by the nation's rapid digitalization and a burgeoning focus on enhancing customer relationships across all sectors. The estimated market size for CRM solutions in Thailand is projected to reach USD X Million by 2025, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This robust growth is underpinned by several critical trends. Firstly, the increasing penetration of cloud-based CRM solutions is a major growth driver. Businesses of all sizes are embracing cloud deployments for their agility, scalability, and reduced upfront investment, allowing for easier access to advanced functionalities. Secondly, the demand for AI-powered CRM capabilities, including predictive analytics, sentiment analysis, and intelligent automation, is on the rise. These technologies empower businesses to understand customer behavior more deeply, personalize interactions, and optimize sales and marketing efforts. The COVID-19 pandemic further accelerated the adoption of digital tools, highlighting the importance of robust CRM systems for remote workforces and online customer engagement. End-user verticals such as BFSI (Banking, Financial Services, and Insurance), Retail, and Manufacturing are leading the charge, investing heavily in CRM to improve customer acquisition, retention, and loyalty. The Services sector is also a significant contributor, leveraging CRM to manage client relationships and streamline service delivery. The competitive landscape is a blend of global technology giants and agile local players, each vying for market share through product innovation, strategic partnerships, and targeted go-to-market strategies. The increasing emphasis on data privacy and security is also influencing CRM development, with vendors prioritizing compliance and robust data protection features. Overall, the Thailand CRM market is on a strong upward trajectory, driven by technological advancements, evolving customer expectations, and a supportive business environment for digital transformation.

Leading Markets & Segments in Thailand CRM Market

The Thailand CRM market exhibits distinct patterns of dominance across various segments, reflecting the diverse economic landscape and adoption rates of digital solutions.

Organization Size:

- Small and Medium Enterprises (SMEs): This segment represents a significant growth opportunity. SMEs are increasingly recognizing the value of CRM in streamlining operations, improving customer outreach, and competing effectively. The availability of affordable, cloud-based CRM solutions tailored for SMEs is a key driver. Factors like government initiatives supporting SME digitalization and the need for efficient customer management with limited resources contribute to their growing adoption.

- Large Scale Enterprises: Large enterprises are sophisticated users of CRM, often deploying comprehensive suites for complex sales, marketing, and service operations. They are early adopters of advanced features like AI integration, sophisticated analytics, and multi-channel customer engagement. Their investment capacity and the critical need for managing vast customer bases and intricate business processes make them a dominant segment in terms of overall market value.

Deployment Mode:

- Cloud: This is the overwhelmingly dominant deployment mode. The flexibility, scalability, cost-effectiveness, and ease of access offered by cloud-based CRM solutions align perfectly with the needs of businesses in Thailand. Reduced IT infrastructure burden and faster deployment times are significant advantages, particularly for SMEs. The widespread availability of reliable internet connectivity further bolsters cloud adoption.

- On-premise: While still present, on-premise deployments are gradually declining, primarily adopted by large organizations with specific security or regulatory requirements that necessitate localized data control. The upfront investment and ongoing maintenance costs make it less attractive for many businesses.

- Hybrid: A growing number of organizations are opting for hybrid models, leveraging the benefits of both cloud and on-premise solutions. This approach allows for sensitive data to be managed on-premise while utilizing cloud capabilities for scalability and broader accessibility.

End-user Vertical:

- BFSI: This sector is a powerhouse in CRM adoption. The highly competitive nature of banking, financial services, and insurance necessitates robust customer relationship management for client acquisition, personalized service, risk management, and compliance. The need for secure and efficient customer data handling makes advanced CRM solutions indispensable.

- Retail and Logistics: These industries are rapidly embracing CRM to manage customer loyalty, personalize offers, optimize supply chains, and enhance e-commerce experiences. The rise of online retail and the need for efficient delivery networks have significantly boosted CRM adoption. Understanding customer purchasing patterns and streamlining logistics for better customer satisfaction are key drivers.

- Services: The Services sector, encompassing IT, consulting, and professional services, relies heavily on CRM for client management, project tracking, and lead generation. Building and maintaining strong client relationships are paramount for success in this segment.

- Manufacturing: Manufacturers are increasingly using CRM to manage sales pipelines, improve post-sales service, and gain insights into customer demand for product development. The integration of CRM with ERP systems is a growing trend in this vertical.

- Government: Government agencies are also exploring CRM solutions to improve citizen engagement, streamline service delivery, and enhance operational efficiency. The focus is often on improving transparency and accessibility of public services.

- Other: This broad category includes various other sectors adopting CRM to enhance their customer interactions and operational effectiveness.

Thailand CRM Market Product Developments

Product development in the Thailand CRM market is characterized by a strong emphasis on integrating advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and Big Data analytics. Vendors are focusing on creating more intelligent, intuitive, and personalized customer experiences. Innovations include AI-powered chatbots for instant customer support, predictive analytics for sales forecasting and lead scoring, and sentiment analysis tools to gauge customer satisfaction. The development of omnichannel capabilities is also a key trend, allowing businesses to seamlessly engage with customers across various touchpoints, including social media, email, and mobile applications. Furthermore, there is a growing focus on vertical-specific CRM solutions, offering tailored functionalities for industries such as BFSI, Retail, and Manufacturing, providing a competitive advantage and better market fit.

Key Drivers of Thailand CRM Market Growth

The Thailand CRM market's growth is propelled by a confluence of factors. The accelerating digital transformation across all business sectors necessitates more sophisticated customer management tools. A rising emphasis on customer-centricity and personalized experiences compels businesses to invest in CRM to understand and cater to individual customer needs. The proliferation of mobile devices and the increasing adoption of cloud technologies have made CRM solutions more accessible and scalable. Furthermore, government initiatives promoting digitalization and economic development create a fertile ground for technology adoption, including CRM. The competitive landscape also drives adoption, as businesses seek to gain a competitive edge through enhanced customer relationships and operational efficiency.

Challenges in the Thailand CRM Market Market

Despite its promising growth, the Thailand CRM market faces several challenges. A primary concern is the relatively high cost of advanced CRM solutions, which can be a barrier for smaller businesses. Limited IT infrastructure and technical expertise in some regions can also hinder widespread adoption and effective utilization. Data privacy and security concerns, coupled with evolving regulations, require significant investment in compliance and robust security measures. Furthermore, the availability of skilled CRM professionals for implementation and ongoing management can be a bottleneck. Intense competition among global and local vendors also presents challenges in differentiating offerings and acquiring market share.

Emerging Opportunities in Thailand CRM Market

Emerging opportunities in the Thailand CRM market lie in the increasing demand for AI-driven CRM functionalities, such as predictive analytics and intelligent automation, which offer businesses deeper insights and improved efficiency. The growing adoption of cloud-based solutions, particularly among SMEs, presents a significant expansion avenue. The burgeoning e-commerce sector and the increasing focus on customer experience in retail and logistics create a strong demand for integrated CRM and marketing automation tools. Strategic partnerships between CRM vendors and local technology integrators can unlock new market segments and provide localized support. Furthermore, the development of specialized CRM solutions tailored for niche industries and emerging sectors offers unique growth potential.

Leading Players in the Thailand CRM Market Sector

- Buzzebees Company Limite

- Salesforce Inc

- IBM Corporation

- Actran Systems Co Ltd

- Insightera Company Limited

- Microsoft Corporation

- Zoho Corporation Pvt Ltd

- Choco CRM

- Pega Systems

- Oracle Siebel

- SAP SE

Key Milestones in Thailand CRM Market Industry

- February 2024: Thailand-based full-service electric vehicle (EV) lifestyle platform EVme announced a new strategic alliance with Salesforce. With this collaboration, EVme plans to leverage Salesforce's Customer 360 and Automotive Cloud Intelligence, which utilizes Salesforce's CRM Analytics to generate real-time insights.

- November 2023: DA Consortium Inc. announced that DAC group company I-DAC Co. Ltd and Tangible Solutions Company Ltd have jointly established Audience IQ Asia Co. Ltd. With this new company, DAC will be able to enhance its CRM (Customer Relationship Management) capabilities and contribute to corporate DX in Thailand.

Strategic Outlook for Thailand CRM Market Market

The strategic outlook for the Thailand CRM market is highly positive, driven by the continued digital transformation agenda and the escalating importance of customer experience as a key differentiator. Growth accelerators include the pervasive adoption of cloud technologies, offering scalable and cost-effective CRM solutions for businesses of all sizes. The increasing integration of Artificial Intelligence and Machine Learning into CRM platforms will further enhance predictive capabilities, personalization, and automation, providing a significant competitive edge. Strategic partnerships between global CRM providers and local implementation specialists will be crucial for expanding reach and offering tailored solutions. The focus on data analytics and business intelligence embedded within CRM systems will empower organizations to make more informed decisions and optimize their customer engagement strategies, solidifying the market's growth trajectory.

Thailand CRM Market Segmentation

-

1. Organization Size

- 1.1. Small and Medium

- 1.2. Large Scale

-

2. Deployment Mode

- 2.1. Cloud

- 2.2. On-premise

- 2.3. Hybrid

-

3. End-user Vertical

- 3.1. Services

- 3.2. Manufacturing

- 3.3. BFSI

- 3.4. Retail and Logistics

- 3.5. Government

- 3.6. Other En

Thailand CRM Market Segmentation By Geography

- 1. Thailand

Thailand CRM Market Regional Market Share

Geographic Coverage of Thailand CRM Market

Thailand CRM Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Global Cues

- 3.2.2 Such as BYOD and Use of it Tools For Driving Decision Making Expected to Provide Ample Scope For Future Growth; Emergence of Several Pure-play CRM Solutions at a Local And Regional-level to Compete With the Top 5 Incumbents; Increasing Adoption From SMEs Aided By Flexible Pricing Strategies Provided By the Vendors

- 3.3. Market Restrains

- 3.3.1. Operational and Implementational Challenges; Cost and Lack of Resources and Skilled Professionals

- 3.4. Market Trends

- 3.4.1. SMEs to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand CRM Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 5.1.1. Small and Medium

- 5.1.2. Large Scale

- 5.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.2.3. Hybrid

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Services

- 5.3.2. Manufacturing

- 5.3.3. BFSI

- 5.3.4. Retail and Logistics

- 5.3.5. Government

- 5.3.6. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Buzzebees Company Limite

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Salesforce Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IBM Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Actran Systems Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Insightera Company Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Microsoft Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zoho Corporation Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Choco CRM

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pega Systems

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Oracle Siebel

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SAP SE

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Buzzebees Company Limite

List of Figures

- Figure 1: Thailand CRM Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Thailand CRM Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand CRM Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 2: Thailand CRM Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 3: Thailand CRM Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Thailand CRM Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Thailand CRM Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 6: Thailand CRM Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 7: Thailand CRM Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Thailand CRM Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand CRM Market?

The projected CAGR is approximately 12.02%.

2. Which companies are prominent players in the Thailand CRM Market?

Key companies in the market include Buzzebees Company Limite, Salesforce Inc, IBM Corporation, Actran Systems Co Ltd, Insightera Company Limited, Microsoft Corporation, Zoho Corporation Pvt Ltd, Choco CRM, Pega Systems, Oracle Siebel, SAP SE.

3. What are the main segments of the Thailand CRM Market?

The market segments include Organization Size, Deployment Mode, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 157.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Global Cues. Such as BYOD and Use of it Tools For Driving Decision Making Expected to Provide Ample Scope For Future Growth; Emergence of Several Pure-play CRM Solutions at a Local And Regional-level to Compete With the Top 5 Incumbents; Increasing Adoption From SMEs Aided By Flexible Pricing Strategies Provided By the Vendors.

6. What are the notable trends driving market growth?

SMEs to Witness Major Growth.

7. Are there any restraints impacting market growth?

Operational and Implementational Challenges; Cost and Lack of Resources and Skilled Professionals.

8. Can you provide examples of recent developments in the market?

February 2024 - Thailand-based full-service electric vehicle (EV) lifestyle platform EVme has announced a new strategic alliance with Salesforce. With this collaboration, EVme plans to leverage Salesforce's Customer 360 and Automotive Cloud Intelligence, which utilizes Salesforce's CRM Analytics to generate real-time insights.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand CRM Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand CRM Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand CRM Market?

To stay informed about further developments, trends, and reports in the Thailand CRM Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence