Key Insights

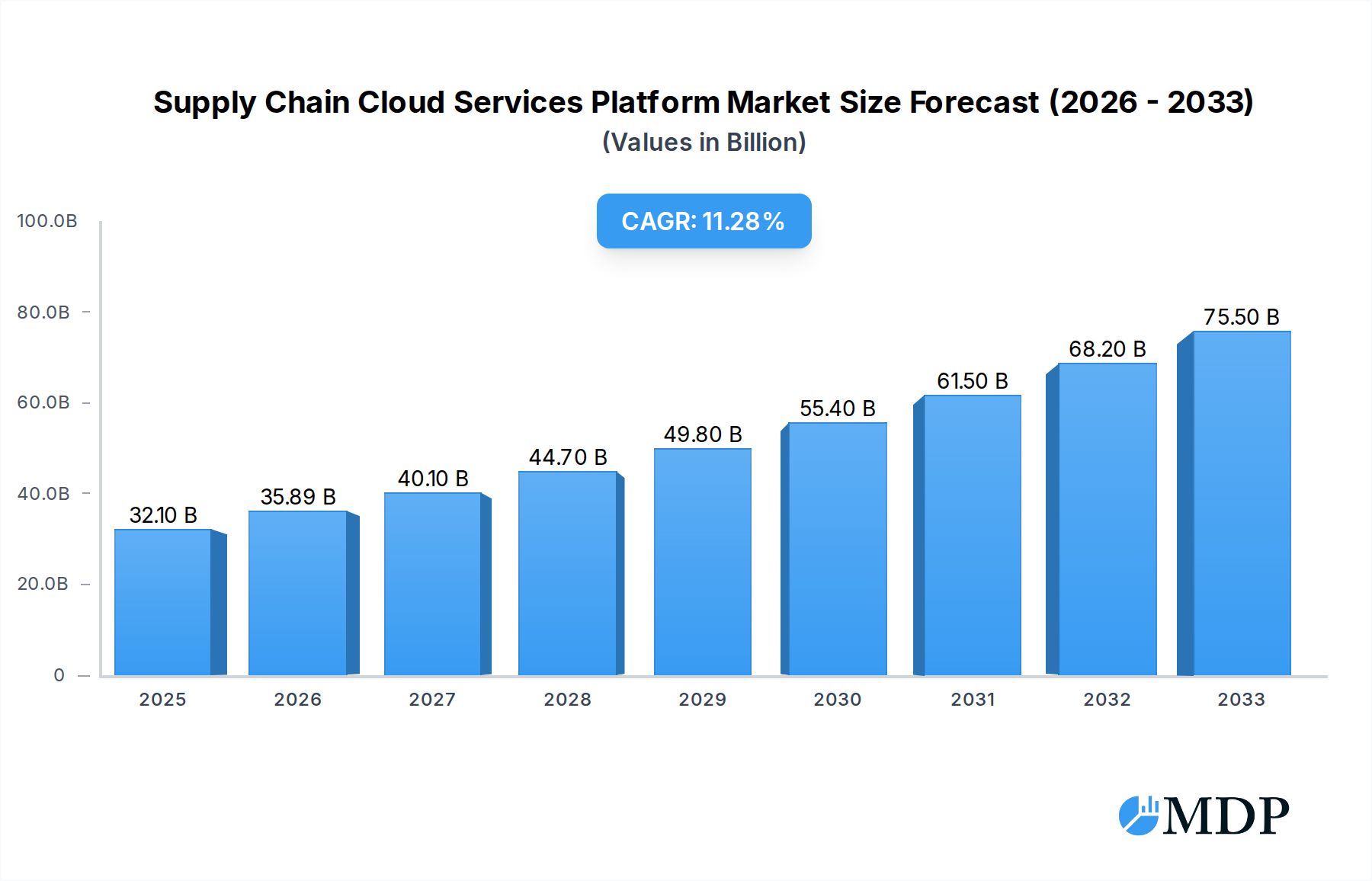

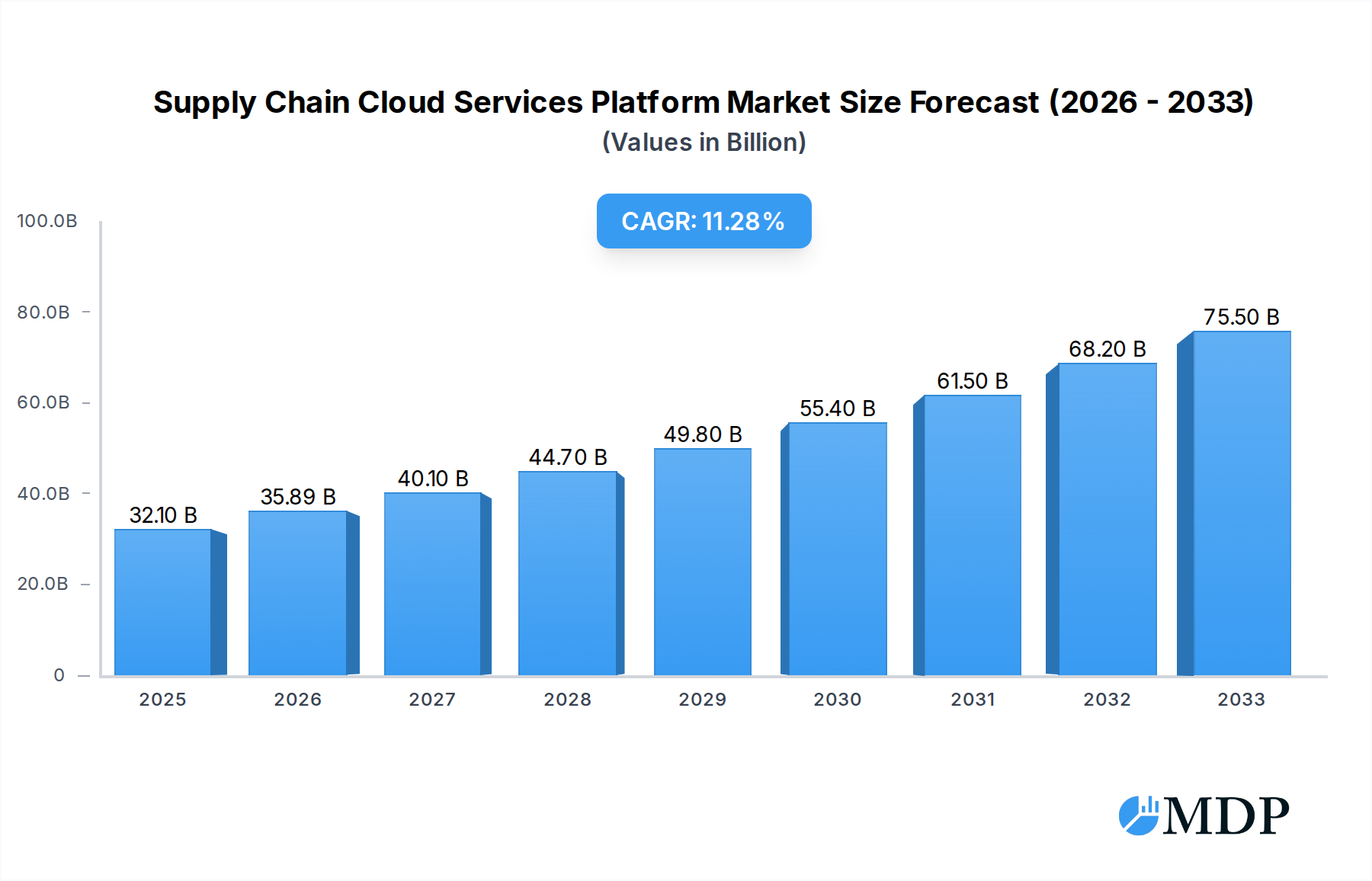

The global Supply Chain Cloud Services Platform market is poised for robust expansion, with an estimated market size of $32.1 billion in 2025, projected to grow at an impressive compound annual growth rate (CAGR) of 11.8% through 2033. This significant growth is primarily fueled by the increasing demand for enhanced supply chain visibility, agility, and resilience across industries. Businesses are actively adopting cloud-based solutions to optimize their operations, from upstream procurement and midstream warehousing to downstream sales and service networks. Key drivers include the need for real-time data analytics, improved inventory management, streamlined logistics, and the imperative to adapt to rapidly evolving market dynamics. The platform's ability to integrate disparate systems and foster collaboration among supply chain partners is a critical factor in its widespread adoption. The shift towards digital transformation and the growing complexity of global supply chains are further accelerating this market's trajectory.

Supply Chain Cloud Services Platform Market Size (In Billion)

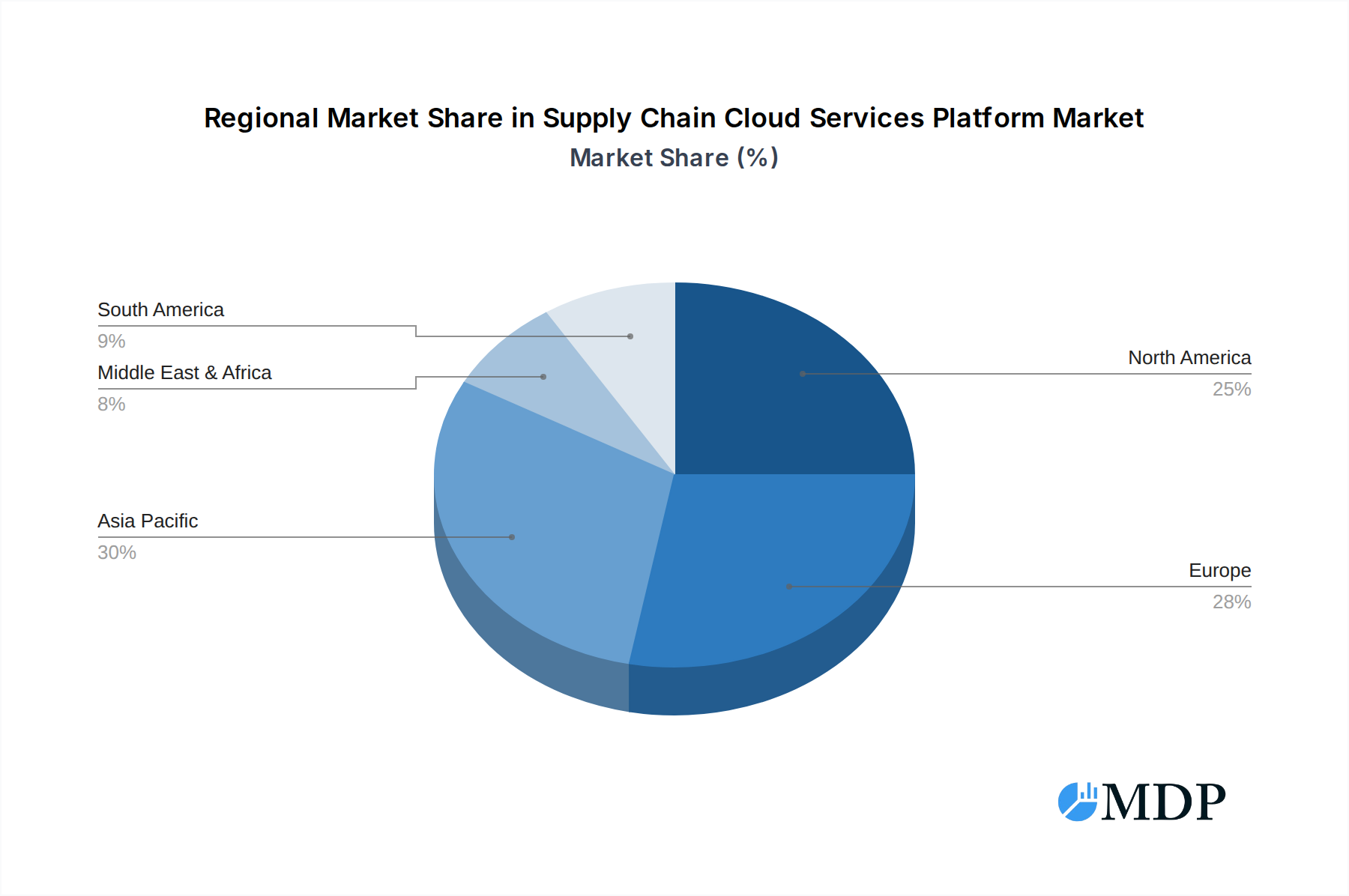

The market is segmented by application and type, catering to a diverse range of industry needs. Application segments such as Upstream Procurement Network, Midstream Warehousing and Circulation Network, and Downstream Sales and Service Network highlight the comprehensive reach of these platforms. Furthermore, the diversity in platform types, including Comprehensive, E-commerce, Collaborative Distribution, Collaborative Purchasing, and Virtual Production, allows businesses to select solutions that best align with their specific operational models and strategic objectives. Leading companies like Yonyou Network Technology, JD.COM, Accenture, and Kingdee International Software Group are at the forefront, driving innovation and offering advanced solutions. The Asia Pacific region, particularly China, is anticipated to be a significant growth engine, alongside established markets like North America and Europe, due to rapid industrialization and increasing digital adoption. While the market presents immense opportunities, challenges such as data security concerns and the need for significant initial investment can be considered as potential restraints.

Supply Chain Cloud Services Platform Company Market Share

Here is the SEO-optimized and engaging report description for the Supply Chain Cloud Services Platform market.

Unleash Supply Chain Excellence: The Global Supply Chain Cloud Services Platform Market Report (2019-2033)

Dive deep into the transformative world of Supply Chain Cloud Services Platforms with our comprehensive market analysis. This definitive report, covering the historical period of 2019–2024, base year of 2025, estimated year of 2025, and an extensive forecast period of 2025–2033, provides unparalleled insights into a market projected to reach hundreds of billions in value. We meticulously dissect the dynamics, trends, and future trajectory of cloud-based solutions revolutionizing global logistics, procurement, warehousing, and sales. Whether you're a supply chain executive, IT decision-maker, investor, or industry analyst, this report offers actionable intelligence to navigate and capitalize on the burgeoning opportunities within this critical sector. Discover how leading enterprises like JD.COM, Yonyou Network Technology, Kingdee International Software Group, Ant Group, Accenture, and Shanghai Pharmaceutical are leveraging these platforms for enhanced efficiency, resilience, and competitive advantage.

Supply Chain Cloud Services Platform Market Dynamics & Concentration

The Supply Chain Cloud Services Platform market exhibits a dynamic landscape characterized by a moderate to high level of concentration, with key players like Yonyou Network Technology, Kingdee International Software Group, and JD.COM commanding significant market share, estimated to be in the tens of billions for the leading entities. Innovation drivers are primarily fueled by the relentless demand for real-time visibility, enhanced predictive analytics, and automation across the entire supply chain lifecycle. Regulatory frameworks, though varied by region, are increasingly emphasizing data security, interoperability, and sustainability, impacting platform development and adoption. Product substitutes, while existing in the form of on-premise solutions and fragmented point solutions, are rapidly losing ground to the scalability and cost-effectiveness of cloud-based offerings. End-user trends reveal a strong preference for integrated solutions that streamline operations from Upstream Procurement Network to Downstream Sales and Service Network. Mergers and acquisitions (M&A) activities are prevalent, with an estimated XX deal counts annually, as larger players consolidate their offerings and smaller innovative companies seek strategic partnerships, contributing to market consolidation and the expansion of comprehensive service portfolios valued in the hundreds of billions.

Supply Chain Cloud Services Platform Industry Trends & Analysis

The global Supply Chain Cloud Services Platform market is on an exponential growth trajectory, driven by the imperative for digital transformation and operational resilience in an increasingly complex global economy. Market growth is significantly propelled by the need for enhanced efficiency and cost reduction in managing intricate supply chains. Technological disruptions, including the integration of Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), and blockchain, are revolutionizing how businesses manage their networks, offering unprecedented levels of automation, predictive capabilities, and transparency. Consumer preferences are shifting towards faster delivery, personalized products, and greater transparency regarding product origins and ethical sourcing, placing immense pressure on supply chain operations to adapt. Competitive dynamics are intensifying, with established technology giants, specialized cloud providers, and enterprise software vendors vying for market dominance. The market penetration of Supply Chain Cloud Services Platforms is rapidly increasing, with projections indicating a significant portion of businesses adopting comprehensive cloud solutions within the forecast period. The Compound Annual Growth Rate (CAGR) is estimated to be in the double digits, with market size projected to reach hundreds of billions by the end of the forecast period. Key segments such as E-commerce and Collaborative Distribution are experiencing particularly robust growth, fueled by the expansion of online retail and the demand for efficient last-mile delivery solutions. The adoption of Comprehensive platforms, offering end-to-end supply chain management, is also a significant trend, indicating a move towards holistic digital transformation.

Leading Markets & Segments in Supply Chain Cloud Services Platform

Within the expansive Supply Chain Cloud Services Platform market, specific segments and applications are demonstrating remarkable dominance. The Midstream Warehousing and Circulation Network segment is a primary growth engine, driven by the critical need for efficient inventory management, real-time tracking, and optimized logistics within the supply chain. Regions like North America and Asia-Pacific are leading the market in terms of adoption and investment, fueled by robust economic policies, extensive infrastructure development, and a high concentration of global manufacturing and e-commerce hubs. In Asia-Pacific, countries like China are at the forefront, with companies such as JD.COM, Yonyou Network Technology, and Kingdee International Software Group pioneering innovative cloud solutions for both domestic and international markets, contributing billions to the regional market value.

The E-commerce and Collaborative Distribution types of platforms are experiencing significant traction. The explosion of online retail has made efficient, scalable, and responsive distribution networks a paramount concern for businesses of all sizes. These platforms enable seamless integration of online sales channels with physical logistics, optimizing inventory across multiple locations and facilitating faster, more reliable deliveries. The Upstream Procurement Network is also gaining prominence as companies seek to gain greater control and visibility over their raw material sourcing, supplier relationships, and inventory levels, aiming to mitigate risks and improve cost-efficiency, with early investments in this area already in the billions.

Key drivers for this segment dominance include:

- Economic Policies: Government initiatives promoting digitalization, e-commerce, and supply chain resilience are accelerating adoption.

- Infrastructure Development: Advanced transportation networks and widespread internet connectivity in leading regions facilitate the seamless operation of cloud-based supply chain solutions.

- Technological Advancement: The widespread availability and integration of AI, IoT, and big data analytics enhance the capabilities of these platforms, offering predictive insights and automation.

- Industry-Specific Needs: The unique demands of fast-moving consumer goods (FMCG), pharmaceuticals, and manufacturing sectors, requiring precise inventory management and rapid fulfillment, are driving the demand for specialized cloud solutions.

The Comprehensive type of platform, which integrates various functionalities across the supply chain, is becoming increasingly popular as businesses look for unified solutions to manage their end-to-end operations, representing a significant portion of the market's multi-billion dollar valuation.

Supply Chain Cloud Services Platform Product Developments

Product innovation in the Supply Chain Cloud Services Platform sector is rapidly advancing, focusing on enhanced intelligence, automation, and integration. Companies are developing platforms with advanced AI-powered forecasting, real-time risk assessment, and autonomous decision-making capabilities. Applications are expanding beyond traditional logistics to encompass areas like sustainable sourcing, ethical supply chain verification, and predictive maintenance for assets within the supply chain. Competitive advantages are being built around seamless integration with enterprise resource planning (ERP) systems, advanced data analytics for actionable insights, and robust security protocols. Emerging technologies like digital twins and the metaverse are being explored for supply chain visualization and simulation, pushing the boundaries of what these platforms can achieve in the multi-billion dollar market.

Key Drivers of Supply Chain Cloud Services Platform Growth

The Supply Chain Cloud Services Platform market is experiencing robust growth driven by several critical factors. Technological advancements, particularly the proliferation of AI, ML, and IoT, are enabling greater automation, predictive analytics, and real-time visibility across the supply chain, contributing billions in efficiency gains. Economic factors, such as the increasing globalization of trade and the need for resilient supply chains in the face of disruptions, are pushing businesses to adopt scalable cloud solutions. Regulatory pressures, including mandates for sustainability and data traceability, are also encouraging the adoption of platforms that can ensure compliance and provide transparent reporting. Furthermore, the surge in e-commerce and the demand for faster, more efficient delivery services are directly fueling the need for sophisticated cloud-based logistics and inventory management systems, representing billions in market potential.

Challenges in the Supply Chain Cloud Services Platform Market

Despite its rapid growth, the Supply Chain Cloud Services Platform market faces significant challenges. Regulatory hurdles, particularly concerning data privacy and cross-border data transfer, can impede international adoption and create compliance complexities, impacting billions in potential revenue. Integration complexities with legacy IT systems remain a persistent barrier, requiring substantial investment and technical expertise, thus limiting rapid scalability. Fierce competitive pressures from established players and emerging startups can lead to price erosion and the need for continuous innovation, influencing profit margins across the billions-dollar market. Moreover, the ongoing threat of cyberattacks and data breaches necessitates robust security measures, adding to operational costs and impacting user trust. Supply chain disruptions, though a driver for adoption, can also create operational challenges for platform providers if not managed effectively.

Emerging Opportunities in Supply Chain Cloud Services Platform

The Supply Chain Cloud Services Platform market is ripe with emerging opportunities, primarily driven by technological breakthroughs and evolving business needs. The growing emphasis on sustainability and environmental, social, and governance (ESG) factors presents a significant opportunity for platforms that can offer enhanced traceability, carbon footprint analysis, and ethical sourcing verification, opening up billions in new market segments. Strategic partnerships between cloud providers, logistics companies, and technology firms are fostering the development of more specialized and integrated solutions. The expansion of emerging markets and the increasing digitalization of small and medium-sized enterprises (SMEs) offer vast untapped potential for cloud adoption, driving future market growth in the hundreds of billions. Furthermore, the application of AI and ML for hyper-personalization of supply chain services and predictive disruption management promises to unlock new levels of efficiency and resilience.

Leading Players in the Supply Chain Cloud Services Platform Sector

- Guangzhou Digital Commerce Cloud Network Technology

- Yonyou Network Technology

- JD.COM

- Shanghai Pharmaceutical

- Accenture

- Ant Group

- Chengdu Renwoxing Technology

- Treelab

- Kingdee International Software Group

- Hangzhou Thothinfo Information Technology

- Baizhuo Network Technology

- Beijing Pactera Jinxin Technology

- Sichuan Chuantou Cloud Chain Technology

- Entroyi

- Guangzhou Yunzhong Information Technology

Key Milestones in Supply Chain Cloud Services Platform Industry

- 2019: Significant growth in cloud adoption for supply chain visibility solutions.

- 2020: Accelerated adoption of cloud-based collaboration tools due to global supply chain disruptions.

- 2021: Increased investment in AI and ML for predictive analytics in supply chain platforms, with market values in the billions.

- 2022: Expansion of blockchain integration for enhanced supply chain transparency and security.

- 2023: Major cloud providers launch specialized supply chain solutions, further intensifying competition and innovation.

- 2024: Growing focus on sustainability features and ESG reporting capabilities within cloud platforms.

- 2025: Estimated market value expected to reach hundreds of billions.

Strategic Outlook for Supply Chain Cloud Services Platform Market

The strategic outlook for the Supply Chain Cloud Services Platform market remains exceptionally positive, fueled by the ongoing digital transformation across industries. Future growth will be accelerated by the deeper integration of AI, ML, and IoT, enabling hyper-automation and predictive intelligence. The increasing demand for resilient, agile, and sustainable supply chains will drive the adoption of comprehensive cloud solutions. Strategic opportunities lie in expanding into emerging markets, developing industry-specific platforms, and fostering stronger ecosystems through partnerships. As businesses continue to prioritize operational efficiency and risk mitigation, cloud-based supply chain services will become an indispensable component of successful global commerce, contributing hundreds of billions to the global economy.

Supply Chain Cloud Services Platform Segmentation

-

1. Application

- 1.1. Upstream Procurement Network

- 1.2. Midstream Warehousing and Circulation Network

- 1.3. Downstream Sales and Service Network

-

2. Types

- 2.1. Comprehensive

- 2.2. E-commerce

- 2.3. Collaborative Distribution

- 2.4. Collaborative Purchasing

- 2.5. Virtual Production

- 2.6. Other

Supply Chain Cloud Services Platform Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Supply Chain Cloud Services Platform Regional Market Share

Geographic Coverage of Supply Chain Cloud Services Platform

Supply Chain Cloud Services Platform REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Supply Chain Cloud Services Platform Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Upstream Procurement Network

- 5.1.2. Midstream Warehousing and Circulation Network

- 5.1.3. Downstream Sales and Service Network

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Comprehensive

- 5.2.2. E-commerce

- 5.2.3. Collaborative Distribution

- 5.2.4. Collaborative Purchasing

- 5.2.5. Virtual Production

- 5.2.6. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Supply Chain Cloud Services Platform Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Upstream Procurement Network

- 6.1.2. Midstream Warehousing and Circulation Network

- 6.1.3. Downstream Sales and Service Network

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Comprehensive

- 6.2.2. E-commerce

- 6.2.3. Collaborative Distribution

- 6.2.4. Collaborative Purchasing

- 6.2.5. Virtual Production

- 6.2.6. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Supply Chain Cloud Services Platform Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Upstream Procurement Network

- 7.1.2. Midstream Warehousing and Circulation Network

- 7.1.3. Downstream Sales and Service Network

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Comprehensive

- 7.2.2. E-commerce

- 7.2.3. Collaborative Distribution

- 7.2.4. Collaborative Purchasing

- 7.2.5. Virtual Production

- 7.2.6. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Supply Chain Cloud Services Platform Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Upstream Procurement Network

- 8.1.2. Midstream Warehousing and Circulation Network

- 8.1.3. Downstream Sales and Service Network

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Comprehensive

- 8.2.2. E-commerce

- 8.2.3. Collaborative Distribution

- 8.2.4. Collaborative Purchasing

- 8.2.5. Virtual Production

- 8.2.6. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Supply Chain Cloud Services Platform Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Upstream Procurement Network

- 9.1.2. Midstream Warehousing and Circulation Network

- 9.1.3. Downstream Sales and Service Network

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Comprehensive

- 9.2.2. E-commerce

- 9.2.3. Collaborative Distribution

- 9.2.4. Collaborative Purchasing

- 9.2.5. Virtual Production

- 9.2.6. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Supply Chain Cloud Services Platform Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Upstream Procurement Network

- 10.1.2. Midstream Warehousing and Circulation Network

- 10.1.3. Downstream Sales and Service Network

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Comprehensive

- 10.2.2. E-commerce

- 10.2.3. Collaborative Distribution

- 10.2.4. Collaborative Purchasing

- 10.2.5. Virtual Production

- 10.2.6. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Guangzhou Digital Commerce Cloud Network Technology

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Yonyou Network Technology

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 JD.COM

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Shanghai Pharmaceutical

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Accenture

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ant Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Chengdu Renwoxing Technology

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Treelab

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kingdee International Software Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hangzhou Thothinfo Information Technology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Baizhuo Network Technology

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Beijing Pactera Jinxin Technology

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sichuan Chuantou Cloud Chain Technology

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Entroyi

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Guangzhou Yunzhong Information Technology

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Guangzhou Digital Commerce Cloud Network Technology

List of Figures

- Figure 1: Global Supply Chain Cloud Services Platform Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Supply Chain Cloud Services Platform Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Supply Chain Cloud Services Platform Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Supply Chain Cloud Services Platform Revenue (billion), by Types 2025 & 2033

- Figure 5: North America Supply Chain Cloud Services Platform Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Supply Chain Cloud Services Platform Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Supply Chain Cloud Services Platform Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Supply Chain Cloud Services Platform Revenue (billion), by Application 2025 & 2033

- Figure 9: South America Supply Chain Cloud Services Platform Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Supply Chain Cloud Services Platform Revenue (billion), by Types 2025 & 2033

- Figure 11: South America Supply Chain Cloud Services Platform Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Supply Chain Cloud Services Platform Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Supply Chain Cloud Services Platform Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Supply Chain Cloud Services Platform Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Supply Chain Cloud Services Platform Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Supply Chain Cloud Services Platform Revenue (billion), by Types 2025 & 2033

- Figure 17: Europe Supply Chain Cloud Services Platform Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Supply Chain Cloud Services Platform Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Supply Chain Cloud Services Platform Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Supply Chain Cloud Services Platform Revenue (billion), by Application 2025 & 2033

- Figure 21: Middle East & Africa Supply Chain Cloud Services Platform Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Supply Chain Cloud Services Platform Revenue (billion), by Types 2025 & 2033

- Figure 23: Middle East & Africa Supply Chain Cloud Services Platform Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Supply Chain Cloud Services Platform Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Supply Chain Cloud Services Platform Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Supply Chain Cloud Services Platform Revenue (billion), by Application 2025 & 2033

- Figure 27: Asia Pacific Supply Chain Cloud Services Platform Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Supply Chain Cloud Services Platform Revenue (billion), by Types 2025 & 2033

- Figure 29: Asia Pacific Supply Chain Cloud Services Platform Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Supply Chain Cloud Services Platform Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Supply Chain Cloud Services Platform Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Supply Chain Cloud Services Platform Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Supply Chain Cloud Services Platform Revenue billion Forecast, by Types 2020 & 2033

- Table 3: Global Supply Chain Cloud Services Platform Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Supply Chain Cloud Services Platform Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Supply Chain Cloud Services Platform Revenue billion Forecast, by Types 2020 & 2033

- Table 6: Global Supply Chain Cloud Services Platform Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Supply Chain Cloud Services Platform Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Supply Chain Cloud Services Platform Revenue billion Forecast, by Types 2020 & 2033

- Table 12: Global Supply Chain Cloud Services Platform Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Supply Chain Cloud Services Platform Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Supply Chain Cloud Services Platform Revenue billion Forecast, by Types 2020 & 2033

- Table 18: Global Supply Chain Cloud Services Platform Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Supply Chain Cloud Services Platform Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Supply Chain Cloud Services Platform Revenue billion Forecast, by Types 2020 & 2033

- Table 30: Global Supply Chain Cloud Services Platform Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Supply Chain Cloud Services Platform Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Global Supply Chain Cloud Services Platform Revenue billion Forecast, by Types 2020 & 2033

- Table 39: Global Supply Chain Cloud Services Platform Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Supply Chain Cloud Services Platform Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Supply Chain Cloud Services Platform?

The projected CAGR is approximately 11.8%.

2. Which companies are prominent players in the Supply Chain Cloud Services Platform?

Key companies in the market include Guangzhou Digital Commerce Cloud Network Technology, Yonyou Network Technology, JD.COM, Shanghai Pharmaceutical, Accenture, Ant Group, Chengdu Renwoxing Technology, Treelab, Kingdee International Software Group, Hangzhou Thothinfo Information Technology, Baizhuo Network Technology, Beijing Pactera Jinxin Technology, Sichuan Chuantou Cloud Chain Technology, Entroyi, Guangzhou Yunzhong Information Technology.

3. What are the main segments of the Supply Chain Cloud Services Platform?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.1 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Supply Chain Cloud Services Platform," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Supply Chain Cloud Services Platform report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Supply Chain Cloud Services Platform?

To stay informed about further developments, trends, and reports in the Supply Chain Cloud Services Platform, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence