Key Insights

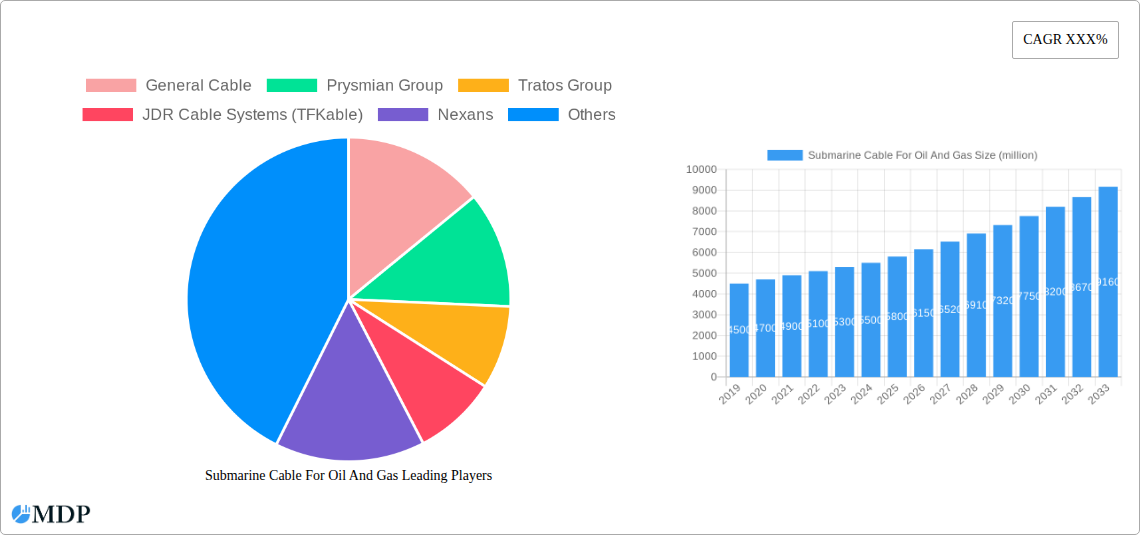

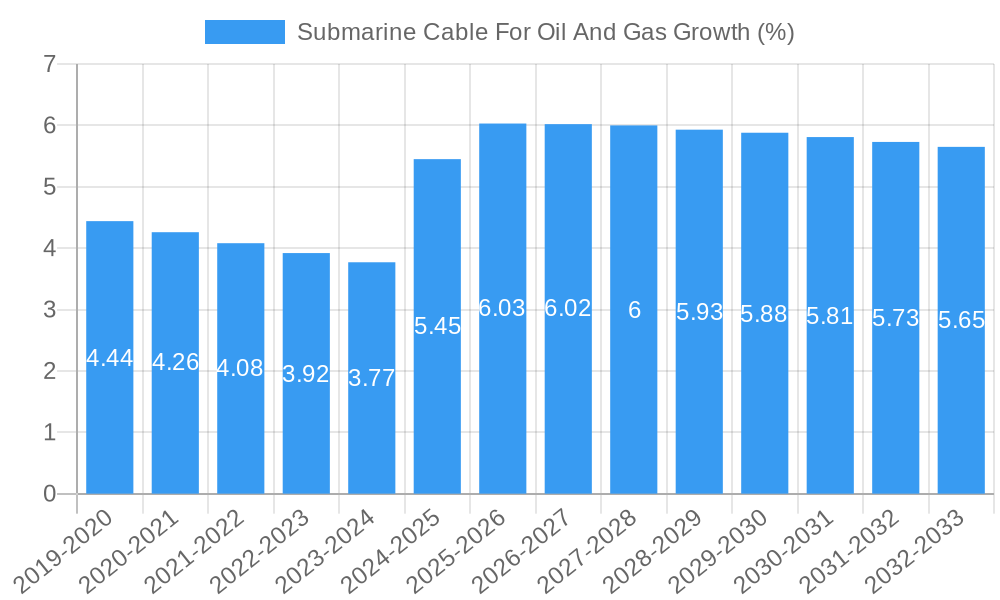

The Submarine Cable for Oil and Gas market is poised for significant expansion, driven by the escalating global demand for energy and the increasing complexity of offshore exploration and production activities. With an estimated market size of approximately USD 5,000 million and a projected Compound Annual Growth Rate (CAGR) of 6.5%, the market is expected to reach approximately USD 9,500 million by 2033. This robust growth is fueled by the necessity for reliable and high-performance power and communication cables in harsh subsea environments, essential for facilitating offshore oil and gas extraction, powering subsea infrastructure, and enabling seamless data transmission from remote platforms. Advancements in cable technology, including improved insulation materials, enhanced durability, and greater data transmission capabilities, are key drivers supporting this market trajectory. Furthermore, the continuous investment in deep-water and ultra-deep-water exploration projects, coupled with the development of offshore renewable energy sources often co-located with oil and gas infrastructure, are creating sustained demand for specialized submarine cables.

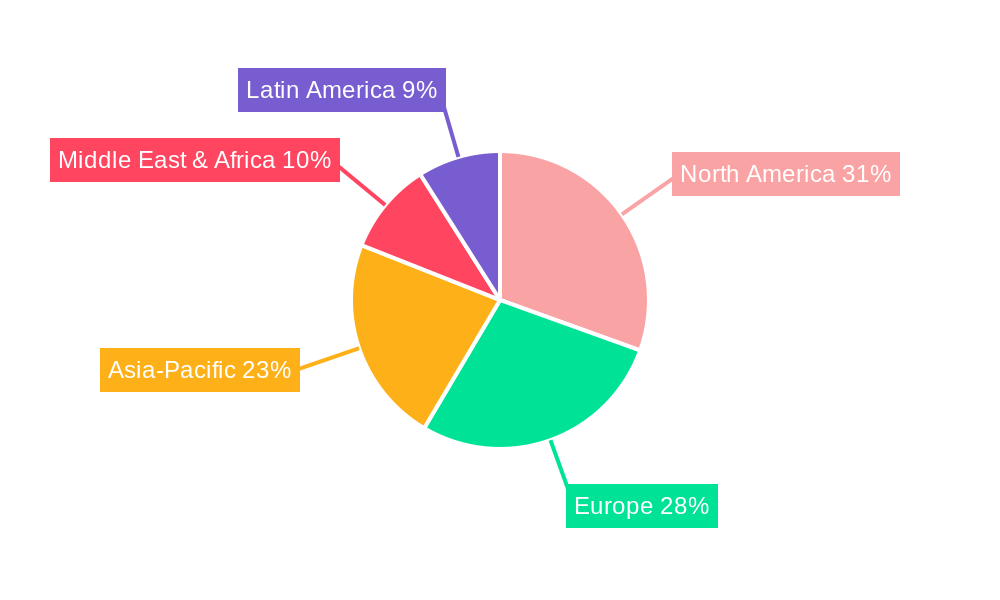

Despite the promising outlook, the market faces certain restraints, primarily stemming from the substantial initial capital investment required for manufacturing and installation, as well as the inherent logistical challenges associated with deep-sea operations. Stringent environmental regulations and the need for highly specialized skilled labor also contribute to operational complexities. However, emerging trends such as the increasing adoption of smart subsea technologies, including integrated sensors and advanced monitoring systems, are creating new avenues for growth. The development of hybrid cables that combine power and fiber optic functionalities is also gaining traction. Geographically, regions with extensive offshore oil and gas reserves, such as North America, Europe (particularly the North Sea), and Asia-Pacific, are expected to dominate the market. Key players like Prysmian Group, Nexans, and ZTT Cable are at the forefront of innovation, offering a diverse range of high-voltage, fiber optic, and umbilical cables to meet the evolving demands of this critical industry.

This comprehensive report offers an in-depth analysis of the global Submarine Cable for Oil and Gas market, providing critical insights for industry stakeholders. Covering the study period of 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this report delves into market dynamics, key trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, and the competitive landscape. It is meticulously structured to deliver actionable intelligence, essential for strategic decision-making in this dynamic sector.

Submarine Cable For Oil And Gas Market Dynamics & Concentration

The Submarine Cable for Oil and Gas market exhibits a moderate to high concentration, with a few dominant players holding significant market share. The innovation drivers within this sector are primarily focused on enhancing cable durability, increasing data transmission speeds, and improving power delivery efficiency for offshore exploration and production activities. Key players like Prysmian Group, Nexans, and General Cable are consistently investing in R&D to develop advanced materials and manufacturing processes.

Regulatory frameworks play a crucial role, with stringent safety and environmental regulations in key offshore regions dictating cable design, installation, and operational standards. The product substitutes are limited, as submarine cables are critical infrastructure for reliable offshore operations, but advancements in alternative power transmission technologies for shorter distances are being monitored. End-user trends indicate a growing demand for high-reliability, high-performance cables capable of withstanding extreme subsea environments, driven by deep-water exploration and the increasing complexity of offshore projects. M&A activities have been observed, indicating consolidation and strategic acquisitions aimed at expanding product portfolios and market reach. For instance, in the historical period (2019-2024), there were approximately 5 significant M&A deals valued at over 500 million dollars.

Submarine Cable For Oil And Gas Industry Trends & Analysis

The Submarine Cable for Oil and Gas industry is poised for robust growth, driven by several interconnected factors. Market growth drivers include the increasing global demand for oil and gas, necessitating expanded offshore exploration and production activities, particularly in challenging deep-water and remote locations. The development of new oil fields and the maintenance of existing infrastructure require reliable subsea power and communication systems, making submarine cables indispensable. The CAGR for this market is estimated to be 6.5% during the forecast period (2025–2033).

Technological disruptions are continuously shaping the industry. Advancements in cable insulation materials, fiber optic technology for enhanced data transmission, and power delivery systems are improving cable performance, longevity, and cost-effectiveness. The integration of intelligent monitoring systems within cables to detect potential issues proactively is also a significant trend. Consumer preferences are shifting towards higher bandwidth capacity for real-time data acquisition from offshore platforms and a greater emphasis on energy efficiency and environmental sustainability in cable solutions. The industry is also witnessing a growing demand for cables that can withstand higher pressures and temperatures encountered in ultra-deepwater environments.

Competitive dynamics are characterized by intense competition among established players and emerging manufacturers. Companies are differentiating themselves through product innovation, localized manufacturing capabilities, and comprehensive lifecycle services, including installation, maintenance, and decommissioning. The market penetration of advanced submarine cable technologies is steadily increasing as the oil and gas industry prioritizes operational efficiency and safety. The market penetration of high-voltage AC (HVAC) and DC (HVDC) submarine power cables for offshore applications is projected to reach 70% by 2030. The increasing adoption of renewable energy sources in offshore oil and gas operations also presents a new avenue for submarine cable deployment, particularly for power export from offshore wind farms.

Leading Markets & Segments in Submarine Cable For Oil And Gas

The Submarine Cable for Oil and Gas market is dominated by regions with significant offshore oil and gas exploration and production activities. North America, particularly the United States (Gulf of Mexico) and Canada (Atlantic offshore), is a leading market. This dominance is driven by substantial investments in deep-water drilling and the need for robust subsea infrastructure to support these operations. The region benefits from advanced technological adoption and a mature oil and gas industry.

Application:

- Power Transmission Cables: These are crucial for transmitting electricity from offshore platforms to the mainland, as well as for powering subsea equipment and remotely operated vehicles (ROVs).

- Key Drivers: Increasing electrification of offshore operations, demand for stable and efficient power supply, and the growing need to connect offshore renewable energy sources to the grid.

- Communication Cables: These facilitate high-speed data transmission for operational control, monitoring, and communication between offshore facilities and onshore control centers.

- Key Drivers: Growing reliance on real-time data analytics, advanced sensor deployment, and the need for seamless communication in remote offshore environments.

Type:

- Fiber Optic Cables: Essential for high-bandwidth data transmission, these cables are experiencing significant demand due to the increasing volume of data generated from offshore operations.

- Key Drivers: Need for high-speed data transfer for monitoring, control, and geological surveys; integration of advanced IoT solutions in offshore platforms.

- Electrical Cables (HVAC & HVDC): These are vital for transmitting power to and from offshore installations. The shift towards HVDC for longer distances and higher efficiency is a notable trend.

- Key Drivers: Growing need for efficient power delivery to increasingly distant offshore fields; advancements in HVDC technology offering lower transmission losses over long distances.

Europe, particularly the North Sea region (UK, Norway), is another significant market due to its long-established offshore oil and gas industry and ongoing development of new fields. The Asia-Pacific region is emerging as a growth hotspot, driven by increasing exploration activities in Southeast Asia and Australia, coupled with substantial investments in offshore infrastructure. The economic policies supporting oil and gas exploration, coupled with favorable infrastructure development initiatives in these leading markets, contribute significantly to their dominance.

Submarine Cable For Oil And Gas Product Developments

Recent product developments in the Submarine Cable for Oil and Gas sector focus on enhancing cable resilience and performance in extreme subsea environments. Innovations include advanced polymer insulation materials offering superior thermal and chemical resistance, and fiber optic cables with increased bandwidth and reduced signal loss for critical data transmission. The integration of real-time monitoring sensors within the cable sheath provides early detection of faults, minimizing downtime and maintenance costs. Companies are also developing specialized cable solutions for specific applications like subsea power distribution for offshore wind farms, demonstrating a commitment to diversified energy infrastructure. These advancements offer competitive advantages by improving reliability, reducing installation complexity, and extending operational lifespan.

Key Drivers of Submarine Cable For Oil And Gas Growth

The Submarine Cable for Oil and Gas market is primarily driven by the ongoing global demand for oil and gas, necessitating continued offshore exploration and production. Technological advancements in deep-water drilling and subsea infrastructure development are pushing the boundaries of cable requirements. Economic factors, such as the price of crude oil and investment in upstream activities, directly influence market expansion. Furthermore, stringent regulatory requirements for safety and environmental protection are spurring the development and adoption of high-performance, reliable submarine cable solutions. The increasing adoption of offshore renewable energy projects also creates new avenues for cable deployment.

Challenges in the Submarine Cable For Oil And Gas Market

Despite robust growth prospects, the Submarine Cable for Oil and Gas market faces several challenges. Regulatory hurdles, particularly evolving environmental standards and permitting processes in different offshore jurisdictions, can lead to project delays and increased costs. Supply chain issues, including the availability of raw materials and specialized manufacturing equipment, can impact production timelines and pricing. Intense competitive pressures from both established players and new entrants can lead to price erosion. The high cost of installation and maintenance, coupled with the long lead times for specialized cable manufacturing, also presents significant barriers. The need for specialized vessels and skilled personnel for subsea installation further adds to the complexity and cost.

Emerging Opportunities in Submarine Cable For Oil And Gas

Emerging opportunities in the Submarine Cable for Oil and Gas market are largely driven by the energy transition and technological advancements. The growing development of offshore wind farms presents a significant opportunity for the deployment of high-voltage AC and DC submarine power cables to transmit renewable energy to shore. Furthermore, the increasing electrification of offshore platforms, including those supporting carbon capture utilization and storage (CCUS) projects, will require sophisticated submarine power and communication cables. Strategic partnerships between cable manufacturers and offshore engineering, procurement, and construction (EPC) companies are creating integrated solutions for complex offshore projects. The ongoing exploration in frontier offshore regions also presents a continuous demand for advanced subsea cable technology.

Leading Players in the Submarine Cable For Oil And Gas Sector

- General Cable

- Prysmian Group

- Tratos Group

- JDR Cable Systems (TFKable)

- Nexans

- ZTT Cable

- Fibron

- Optical Cable Corporation

- Oceaneering

- Aker Solutions

- TechnipFMC

- Orient Cable

- MFX

- Umbilicals International (Champlain Cable)

- ABB

- Sumitomo Electric Industries

- LS Cable&System

- Fujikura

Key Milestones in Submarine Cable For Oil And Gas Industry

- 2019: Launch of advanced composite insulation materials for deep-sea power cables, enhancing durability and operational lifespan.

- 2020: Significant increase in demand for high-bandwidth fiber optic communication cables due to digitalization of offshore operations.

- 2021: Major investments in HVDC submarine cable technology to support the growing offshore wind energy sector.

- 2022: Introduction of integrated subsea sensing and monitoring systems within cable designs, enabling predictive maintenance.

- 2023: Expansion of manufacturing capacities by key players to meet the growing global demand for offshore energy infrastructure.

- 2024: Increased focus on sustainable materials and manufacturing processes in response to environmental regulations and industry trends.

Strategic Outlook for Submarine Cable For Oil And Gas Market

- 2019: Launch of advanced composite insulation materials for deep-sea power cables, enhancing durability and operational lifespan.

- 2020: Significant increase in demand for high-bandwidth fiber optic communication cables due to digitalization of offshore operations.

- 2021: Major investments in HVDC submarine cable technology to support the growing offshore wind energy sector.

- 2022: Introduction of integrated subsea sensing and monitoring systems within cable designs, enabling predictive maintenance.

- 2023: Expansion of manufacturing capacities by key players to meet the growing global demand for offshore energy infrastructure.

- 2024: Increased focus on sustainable materials and manufacturing processes in response to environmental regulations and industry trends.

Strategic Outlook for Submarine Cable For Oil And Gas Market

The strategic outlook for the Submarine Cable for Oil and Gas market is highly positive, fueled by the sustained need for offshore energy resources and the burgeoning offshore renewable energy sector. Growth accelerators include the continued expansion of deep-water exploration, the increasing complexity of offshore projects requiring robust and reliable subsea infrastructure, and the significant investments in offshore wind farms. The market will witness further technological advancements in high-voltage power transmission, enhanced data communication capabilities, and the integration of smart monitoring systems. Strategic opportunities lie in expanding product portfolios to cater to both traditional oil and gas needs and the rapidly growing renewable energy sector, fostering strategic alliances, and enhancing localized manufacturing and service capabilities to serve key regional markets effectively.

Submarine Cable For Oil And Gas Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Submarine Cable For Oil And Gas Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Submarine Cable For Oil And Gas REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Submarine Cable For Oil And Gas Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Submarine Cable For Oil And Gas Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Submarine Cable For Oil And Gas Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Submarine Cable For Oil And Gas Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Submarine Cable For Oil And Gas Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Submarine Cable For Oil And Gas Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 General Cable

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Prysmian Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tratos Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 JDR Cable Systems (TFKable)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nexans

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ZTT Cable

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fibron

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Optical Cable Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Oceaneering

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Aker Solutions

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 TechnipFMC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Orient Cable

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 MFX

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Umbilicals International (Champlain Cable)

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 ABB

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Sumitomo Electric Industries

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 LS Cable&System

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Fujikura

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 General Cable

List of Figures

- Figure 1: Global Submarine Cable For Oil And Gas Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: undefined Submarine Cable For Oil And Gas Revenue (million), by Application 2024 & 2032

- Figure 3: undefined Submarine Cable For Oil And Gas Revenue Share (%), by Application 2024 & 2032

- Figure 4: undefined Submarine Cable For Oil And Gas Revenue (million), by Type 2024 & 2032

- Figure 5: undefined Submarine Cable For Oil And Gas Revenue Share (%), by Type 2024 & 2032

- Figure 6: undefined Submarine Cable For Oil And Gas Revenue (million), by Country 2024 & 2032

- Figure 7: undefined Submarine Cable For Oil And Gas Revenue Share (%), by Country 2024 & 2032

- Figure 8: undefined Submarine Cable For Oil And Gas Revenue (million), by Application 2024 & 2032

- Figure 9: undefined Submarine Cable For Oil And Gas Revenue Share (%), by Application 2024 & 2032

- Figure 10: undefined Submarine Cable For Oil And Gas Revenue (million), by Type 2024 & 2032

- Figure 11: undefined Submarine Cable For Oil And Gas Revenue Share (%), by Type 2024 & 2032

- Figure 12: undefined Submarine Cable For Oil And Gas Revenue (million), by Country 2024 & 2032

- Figure 13: undefined Submarine Cable For Oil And Gas Revenue Share (%), by Country 2024 & 2032

- Figure 14: undefined Submarine Cable For Oil And Gas Revenue (million), by Application 2024 & 2032

- Figure 15: undefined Submarine Cable For Oil And Gas Revenue Share (%), by Application 2024 & 2032

- Figure 16: undefined Submarine Cable For Oil And Gas Revenue (million), by Type 2024 & 2032

- Figure 17: undefined Submarine Cable For Oil And Gas Revenue Share (%), by Type 2024 & 2032

- Figure 18: undefined Submarine Cable For Oil And Gas Revenue (million), by Country 2024 & 2032

- Figure 19: undefined Submarine Cable For Oil And Gas Revenue Share (%), by Country 2024 & 2032

- Figure 20: undefined Submarine Cable For Oil And Gas Revenue (million), by Application 2024 & 2032

- Figure 21: undefined Submarine Cable For Oil And Gas Revenue Share (%), by Application 2024 & 2032

- Figure 22: undefined Submarine Cable For Oil And Gas Revenue (million), by Type 2024 & 2032

- Figure 23: undefined Submarine Cable For Oil And Gas Revenue Share (%), by Type 2024 & 2032

- Figure 24: undefined Submarine Cable For Oil And Gas Revenue (million), by Country 2024 & 2032

- Figure 25: undefined Submarine Cable For Oil And Gas Revenue Share (%), by Country 2024 & 2032

- Figure 26: undefined Submarine Cable For Oil And Gas Revenue (million), by Application 2024 & 2032

- Figure 27: undefined Submarine Cable For Oil And Gas Revenue Share (%), by Application 2024 & 2032

- Figure 28: undefined Submarine Cable For Oil And Gas Revenue (million), by Type 2024 & 2032

- Figure 29: undefined Submarine Cable For Oil And Gas Revenue Share (%), by Type 2024 & 2032

- Figure 30: undefined Submarine Cable For Oil And Gas Revenue (million), by Country 2024 & 2032

- Figure 31: undefined Submarine Cable For Oil And Gas Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Submarine Cable For Oil And Gas Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Submarine Cable For Oil And Gas Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Submarine Cable For Oil And Gas Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Submarine Cable For Oil And Gas Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Submarine Cable For Oil And Gas Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Submarine Cable For Oil And Gas Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Submarine Cable For Oil And Gas Revenue million Forecast, by Country 2019 & 2032

- Table 8: Global Submarine Cable For Oil And Gas Revenue million Forecast, by Application 2019 & 2032

- Table 9: Global Submarine Cable For Oil And Gas Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Submarine Cable For Oil And Gas Revenue million Forecast, by Country 2019 & 2032

- Table 11: Global Submarine Cable For Oil And Gas Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Submarine Cable For Oil And Gas Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Submarine Cable For Oil And Gas Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Submarine Cable For Oil And Gas Revenue million Forecast, by Application 2019 & 2032

- Table 15: Global Submarine Cable For Oil And Gas Revenue million Forecast, by Type 2019 & 2032

- Table 16: Global Submarine Cable For Oil And Gas Revenue million Forecast, by Country 2019 & 2032

- Table 17: Global Submarine Cable For Oil And Gas Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Submarine Cable For Oil And Gas Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Submarine Cable For Oil And Gas Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Submarine Cable For Oil And Gas?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Submarine Cable For Oil And Gas?

Key companies in the market include General Cable, Prysmian Group, Tratos Group, JDR Cable Systems (TFKable), Nexans, ZTT Cable, Fibron, Optical Cable Corporation, Oceaneering, Aker Solutions, TechnipFMC, Orient Cable, MFX, Umbilicals International (Champlain Cable), ABB, Sumitomo Electric Industries, LS Cable&System, Fujikura.

3. What are the main segments of the Submarine Cable For Oil And Gas?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Submarine Cable For Oil And Gas," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Submarine Cable For Oil And Gas report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Submarine Cable For Oil And Gas?

To stay informed about further developments, trends, and reports in the Submarine Cable For Oil And Gas, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence