Key Insights

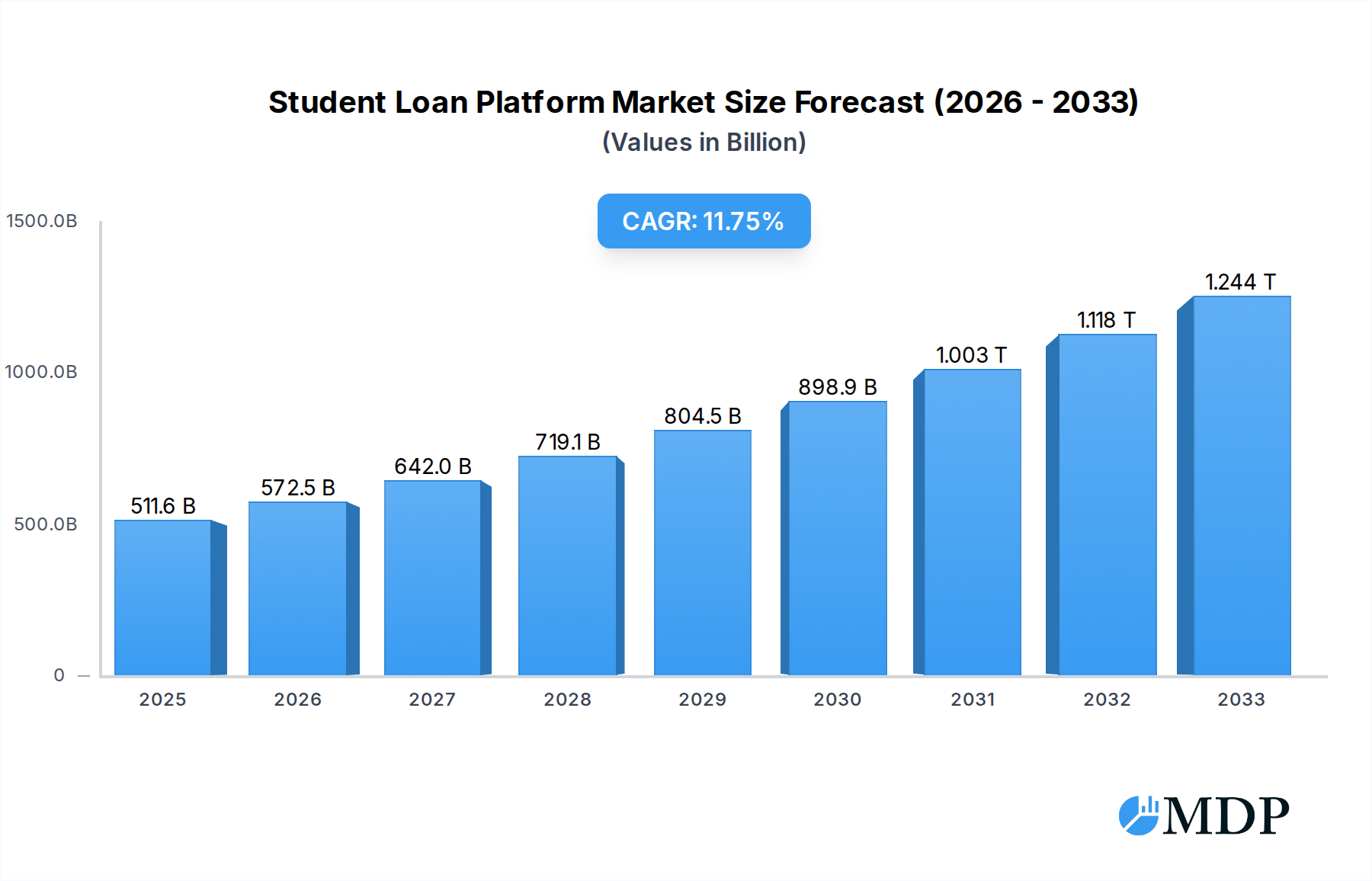

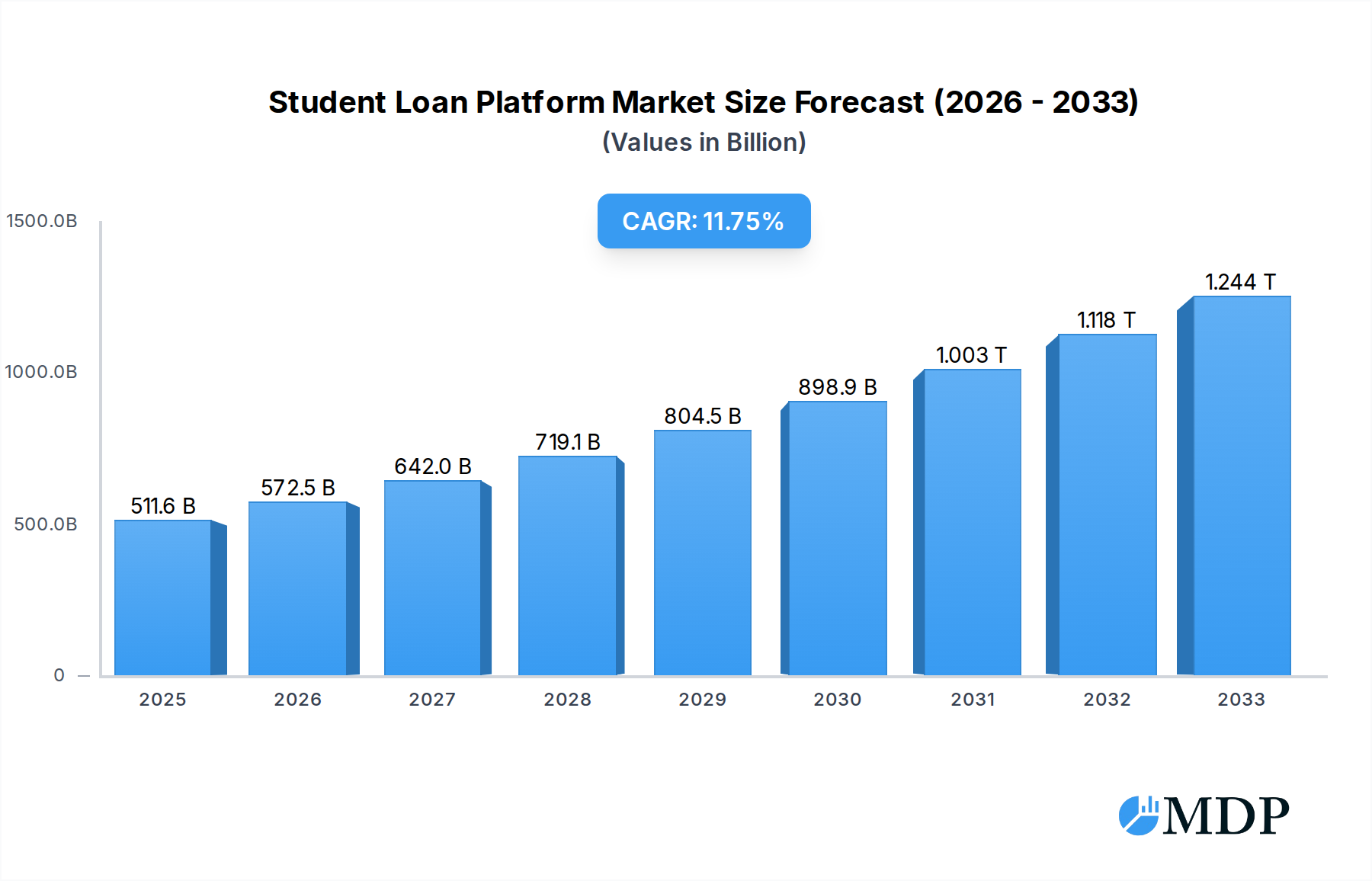

The global Student Loan Platform market is poised for substantial expansion, projected to reach $511.57 billion in 2025 and exhibit a robust CAGR of 11.87% through 2033. This significant growth is fueled by increasing demand for higher education worldwide, coupled with a rising need for accessible and streamlined student financing solutions. The market encompasses a broad spectrum of applications, including undergraduate and graduate loans, alongside other specialized educational financing. On the supply side, the landscape is characterized by innovative offerings such as interest-free loans and general commercial loans, catering to diverse borrower needs. Key drivers include government initiatives promoting access to education, evolving lending models, and the increasing reliance on digital platforms for loan origination and management. The surge in the number of students pursuing advanced degrees and specialized vocational training further bolsters the demand for comprehensive student loan platforms.

Student Loan Platform Market Size (In Billion)

The trajectory of the Student Loan Platform market is significantly influenced by evolving lending technologies and a growing preference for digital-first financial services. Trends like the integration of AI for credit assessment, personalized loan offerings, and seamless online application processes are reshaping the competitive landscape. Furthermore, the emphasis on financial literacy and borrower support services is becoming a crucial differentiator for platform providers. However, the market also faces certain restraints, including evolving regulatory frameworks, concerns around student debt accumulation, and the potential impact of economic downturns on repayment capacities. Despite these challenges, the expanding global student population, coupled with a persistent gap in traditional financing, ensures a sustained upward trend for student loan platforms. Prominent players like Finastra, Prodigy Finance, and MPOWER Financing are actively innovating to capture market share, while emerging companies and regional banks are also increasing their presence.

Student Loan Platform Company Market Share

Here's an SEO-optimized, engaging report description for the Student Loan Platform market, designed for maximum visibility and stakeholder interest, without any placeholders.

Student Loan Platform Market Dynamics & Concentration

The global Student Loan Platform market, projected to reach several billion by 2033, is characterized by dynamic shifts and a moderate concentration of leading entities. Innovation drivers, such as the increasing demand for flexible repayment options and the integration of AI for personalized financial advice, are reshaping the competitive landscape. Regulatory frameworks, including evolving government policies on student debt and lending practices, significantly influence market entry and operational strategies. Product substitutes, such as scholarships, grants, and employer-sponsored educational assistance programs, pose a constant challenge, compelling platform providers to offer compelling value propositions. End-user trends reveal a growing preference for digital-first, seamless application processes and transparent fee structures, particularly among Gen Z and millennial borrowers. Mergers & Acquisitions (M&A) activities are a key indicator of market consolidation, with recent deals indicating a strategic push towards expanding service offerings and geographic reach. For instance, the acquisition of LendKey by Finastra in the historical period underscored a trend towards platform integration. M&A deal counts have been steadily increasing, indicating strategic realignments to capture greater market share. The market share of top players is estimated to be around 60% as of the base year 2025, with a projected growth in market share for innovative fintech solutions.

Student Loan Platform Industry Trends & Analysis

The Student Loan Platform industry is experiencing robust growth, driven by a confluence of technological advancements, evolving consumer preferences, and supportive economic policies. The compound annual growth rate (CAGR) for the student loan platform market is estimated to be approximately 7.5% during the forecast period 2025–2033. This expansion is fueled by the ever-increasing cost of higher education globally, necessitating accessible and efficient financing solutions. Technological disruptions, including the adoption of blockchain for secure loan processing, AI-powered underwriting for faster approvals, and advanced data analytics for personalized product recommendations, are revolutionizing how students access and manage their educational finances. Mobile-first platforms are gaining significant traction, catering to the digital native generation's preference for on-the-go access and streamlined user experiences. Consumer preferences are shifting towards flexible repayment schemes, income-share agreements (ISAs), and loan consolidation options that offer greater control and reduced financial burden. Competitive dynamics are intensifying, with established financial institutions, fintech startups, and specialized student lending companies vying for market dominance. Companies like Sallie Mae, SoFi, and Prodigy Finance are at the forefront, leveraging their technological capabilities and customer-centric approaches to capture market share. The market penetration of digital student loan platforms is expected to reach over 70% by 2033, indicating a significant shift away from traditional lending methods. Industry developments such as the increasing prevalence of "buy now, pay later" (BNPL) options for educational expenses are also contributing to market diversification and growth. The trend towards personalized financial education integrated within loan platforms is another significant factor enhancing user engagement and retention. Furthermore, the growing emphasis on mental wellness and financial literacy among student borrowers is prompting platforms to incorporate resources and tools that support holistic financial well-being.

Leading Markets & Segments in Student Loan Platform

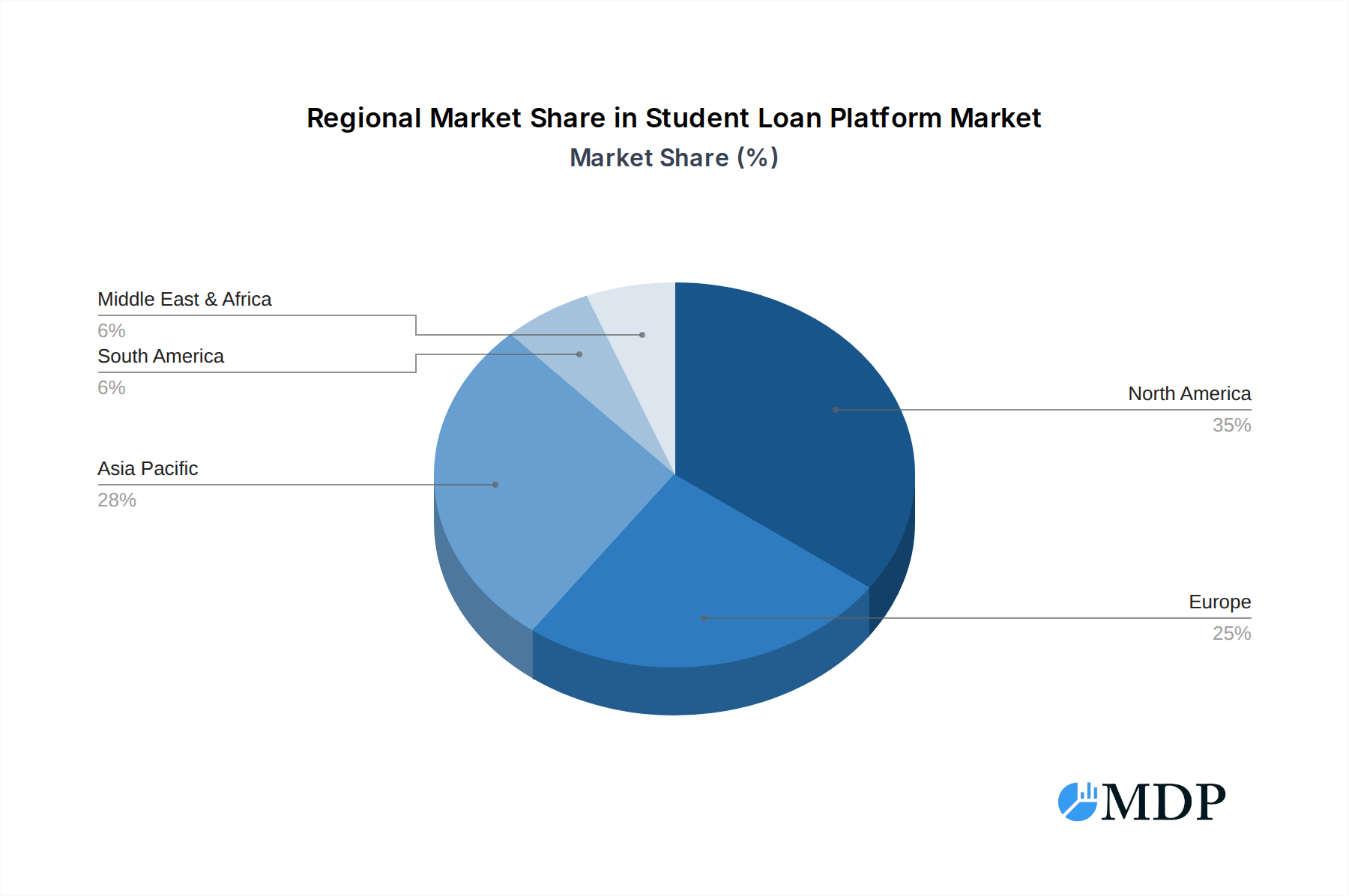

The global Student Loan Platform market exhibits distinct leadership across various regions and segments, driven by a combination of economic policies, educational infrastructure, and demographic trends.

Dominant Region and Country Analysis

North America, particularly the United States, continues to be a leading market for student loan platforms. This dominance is attributed to a well-established higher education system, a high proportion of students requiring financial aid, and a mature fintech ecosystem. Government policies, such as federal student loan programs and tax incentives for education, have historically supported a robust student lending environment. The robust infrastructure of universities and colleges, coupled with a strong demand for advanced degrees, further solidifies the region's leadership.

Application Segment Dominance

- Undergraduate Loans: This segment represents the largest portion of the student loan platform market. The sheer volume of students pursuing undergraduate degrees globally, coupled with rising tuition fees, makes this segment a primary focus for lenders. Economic policies aimed at increasing college accessibility and affordability, such as Pell Grants and subsidized loan programs, indirectly bolster the demand for undergraduate loan platforms.

- Graduate Loans: While smaller in volume compared to undergraduate loans, the graduate loan segment is characterized by higher loan amounts and a borrower base with potentially greater earning capacity. Countries with strong postgraduate research and development sectors, and a growing demand for specialized skills, exhibit significant growth in this segment.

- Others: This segment encompasses loans for vocational training, professional certifications, and continuing education. As the global economy emphasizes lifelong learning and skill development, this segment is poised for substantial growth.

Type Segment Dynamics

- General Commercial Loan: This remains the most prevalent type of student loan financing, offered by both traditional banks and newer fintech lenders. The availability of competitive interest rates and various repayment structures drives demand.

- Interest-Free Loan: While less common, interest-free loan options are emerging as a niche but highly attractive offering, particularly for specific educational programs or for borrowers demonstrating exceptional academic merit. This type of financing can significantly reduce the long-term cost of education.

- Others: This category includes innovative financing models like income-share agreements (ISAs), where repayment is a percentage of future income, and customized loan products catering to specific borrower needs or educational institutions.

Student Loan Platform Product Developments

Product innovations in the student loan platform sector are rapidly advancing, focusing on enhancing user experience and accessibility. Key developments include the integration of AI-powered personalized financial advisory tools that guide students through loan options and repayment strategies. Mobile-first applications with streamlined, paperless onboarding processes are becoming standard. Competitive advantages are being built around offering flexible repayment plans, including income-driven repayment options and early repayment incentives, alongside robust fraud detection and security measures. Technological trends like blockchain are being explored for enhanced transparency and efficiency in loan origination and servicing.

Key Drivers of Student Loan Platform Growth

Several key factors are propelling the growth of the student loan platform market. Technological advancements, including the widespread adoption of AI and machine learning for personalized financial advice and automated loan processing, are significantly improving efficiency and customer satisfaction. Economic factors, such as the rising cost of higher education globally, create a consistent demand for student financing solutions. Supportive regulatory frameworks, which aim to increase access to education and provide borrower protections, further stimulate market expansion. The increasing emphasis on digital transformation across the financial services sector is also a major driver, pushing traditional lenders and fintechs to innovate their student loan offerings.

Challenges in the Student Loan Platform Market

Despite robust growth, the student loan platform market faces significant challenges. Regulatory hurdles, including evolving compliance requirements and potential changes in government lending policies, can create uncertainty and impact operational costs. Intense competitive pressures from both established financial institutions and agile fintech startups necessitate continuous innovation and aggressive pricing strategies. Supply chain issues, particularly in the technology sector impacting platform development and maintenance, can lead to delays. Furthermore, the perceived risk associated with student lending, especially in the face of economic downturns, can influence lender appetite and impact loan availability.

Emerging Opportunities in Student Loan Platform

The student loan platform market is ripe with emerging opportunities for long-term growth. Technological breakthroughs in areas like predictive analytics for early identification of at-risk borrowers and personalized financial wellness tools are creating enhanced value propositions. Strategic partnerships between fintech platforms and educational institutions, as well as employers offering tuition assistance programs, are expanding market reach and customer acquisition channels. Market expansion into underserved demographics and emerging economies presents significant growth potential. The increasing demand for specialized postgraduate education and vocational training also opens new avenues for tailored loan products.

Leading Players in the Student Loan Platform Sector

- Finastra

- Prodigy Finance

- MPOWER Financing

- ZeeFi

- LendKey

- ELM Resources

- Goodly

- Navient Solutions, LLC

- College Ave

- Sallie Mae

- SoFi

- Earnest

- ZuntaFi

- Tuition.io

- Eduvanz

- Meritize

- TurnKey Lender

- Lendwise

- Future Finance Loan Corporation Limited

- Avanse Financial Services

- Ascent Funding

- China Development Bank

- China Merchants Bank

Key Milestones in Student Loan Platform Industry

- 2019: Launch of enhanced AI-driven loan recommendation engines by several fintech platforms, improving personalization.

- 2020: Significant increase in the adoption of fully digital loan application processes due to the global pandemic.

- 2021: Rise of Income Share Agreements (ISAs) as a viable alternative financing model, gaining traction among specific borrower groups.

- 2022: Major M&A activity as larger financial institutions acquire agile fintech startups to expand their student loan offerings.

- 2023: Increased focus on financial literacy tools and mental wellness support integrated within student loan platforms.

- 2024: Emergence of blockchain technology pilots for enhanced transparency and security in student loan servicing.

- 2025 (Estimated): Widespread integration of conversational AI for customer support and application assistance, significantly reducing response times.

Strategic Outlook for Student Loan Platform Market

The strategic outlook for the Student Loan Platform market is exceptionally positive, driven by sustained demand for higher education and continuous technological innovation. Growth accelerators include the ongoing digital transformation of financial services, leading to more efficient and user-friendly platforms. The increasing exploration of alternative financing models like ISAs and micro-loans for specialized training will broaden market appeal. Furthermore, strategic partnerships between technology providers, educational institutions, and employers are expected to create synergistic growth opportunities. The focus on personalized financial guidance and borrower success will differentiate leading platforms and drive long-term customer loyalty.

Student Loan Platform Segmentation

-

1. Application

- 1.1. Undergraduate Loans

- 1.2. Graduate Loans

- 1.3. Others

-

2. Types

- 2.1. Interest Free Loan

- 2.2. General Commercial Loan

- 2.3. Others

Student Loan Platform Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Student Loan Platform Regional Market Share

Geographic Coverage of Student Loan Platform

Student Loan Platform REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Student Loan Platform Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Undergraduate Loans

- 5.1.2. Graduate Loans

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Interest Free Loan

- 5.2.2. General Commercial Loan

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Student Loan Platform Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Undergraduate Loans

- 6.1.2. Graduate Loans

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Interest Free Loan

- 6.2.2. General Commercial Loan

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Student Loan Platform Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Undergraduate Loans

- 7.1.2. Graduate Loans

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Interest Free Loan

- 7.2.2. General Commercial Loan

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Student Loan Platform Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Undergraduate Loans

- 8.1.2. Graduate Loans

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Interest Free Loan

- 8.2.2. General Commercial Loan

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Student Loan Platform Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Undergraduate Loans

- 9.1.2. Graduate Loans

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Interest Free Loan

- 9.2.2. General Commercial Loan

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Student Loan Platform Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Undergraduate Loans

- 10.1.2. Graduate Loans

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Interest Free Loan

- 10.2.2. General Commercial Loan

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Finastra

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Prodigy Finance

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MPOWER Financing

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ZeeFi

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LendKey

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ELM Resources

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Goodly

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Navient Solutions

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 College Ave

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sallie Mae

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SoFi

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Earnest

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ZuntaFi

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Tuition.io

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Eduvanz

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Meritize

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 TurnKey Lender

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Lendwise

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Future Finance Loan Corporation Limited

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Avanse Financial Services

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Ascent Funding

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 China Development Bank

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 China Merchants Bank

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.1 Finastra

List of Figures

- Figure 1: Global Student Loan Platform Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Student Loan Platform Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Student Loan Platform Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Student Loan Platform Revenue (billion), by Types 2025 & 2033

- Figure 5: North America Student Loan Platform Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Student Loan Platform Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Student Loan Platform Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Student Loan Platform Revenue (billion), by Application 2025 & 2033

- Figure 9: South America Student Loan Platform Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Student Loan Platform Revenue (billion), by Types 2025 & 2033

- Figure 11: South America Student Loan Platform Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Student Loan Platform Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Student Loan Platform Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Student Loan Platform Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Student Loan Platform Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Student Loan Platform Revenue (billion), by Types 2025 & 2033

- Figure 17: Europe Student Loan Platform Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Student Loan Platform Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Student Loan Platform Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Student Loan Platform Revenue (billion), by Application 2025 & 2033

- Figure 21: Middle East & Africa Student Loan Platform Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Student Loan Platform Revenue (billion), by Types 2025 & 2033

- Figure 23: Middle East & Africa Student Loan Platform Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Student Loan Platform Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Student Loan Platform Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Student Loan Platform Revenue (billion), by Application 2025 & 2033

- Figure 27: Asia Pacific Student Loan Platform Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Student Loan Platform Revenue (billion), by Types 2025 & 2033

- Figure 29: Asia Pacific Student Loan Platform Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Student Loan Platform Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Student Loan Platform Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Student Loan Platform Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Student Loan Platform Revenue billion Forecast, by Types 2020 & 2033

- Table 3: Global Student Loan Platform Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Student Loan Platform Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Student Loan Platform Revenue billion Forecast, by Types 2020 & 2033

- Table 6: Global Student Loan Platform Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Student Loan Platform Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Student Loan Platform Revenue billion Forecast, by Types 2020 & 2033

- Table 12: Global Student Loan Platform Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Student Loan Platform Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Student Loan Platform Revenue billion Forecast, by Types 2020 & 2033

- Table 18: Global Student Loan Platform Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Student Loan Platform Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Student Loan Platform Revenue billion Forecast, by Types 2020 & 2033

- Table 30: Global Student Loan Platform Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Student Loan Platform Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Global Student Loan Platform Revenue billion Forecast, by Types 2020 & 2033

- Table 39: Global Student Loan Platform Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Student Loan Platform Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Student Loan Platform?

The projected CAGR is approximately 11.87%.

2. Which companies are prominent players in the Student Loan Platform?

Key companies in the market include Finastra, Prodigy Finance, MPOWER Financing, ZeeFi, LendKey, ELM Resources, Goodly, Navient Solutions, LLC, College Ave, Sallie Mae, SoFi, Earnest, ZuntaFi, Tuition.io, Eduvanz, Meritize, TurnKey Lender, Lendwise, Future Finance Loan Corporation Limited, Avanse Financial Services, Ascent Funding, China Development Bank, China Merchants Bank.

3. What are the main segments of the Student Loan Platform?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 511.57 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Student Loan Platform," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Student Loan Platform report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Student Loan Platform?

To stay informed about further developments, trends, and reports in the Student Loan Platform, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence