Key Insights

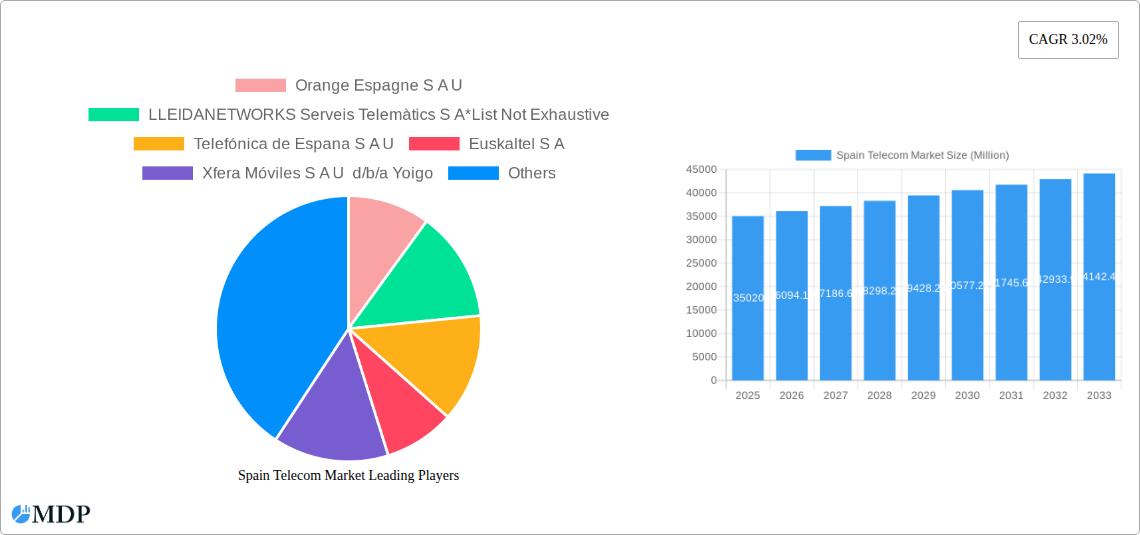

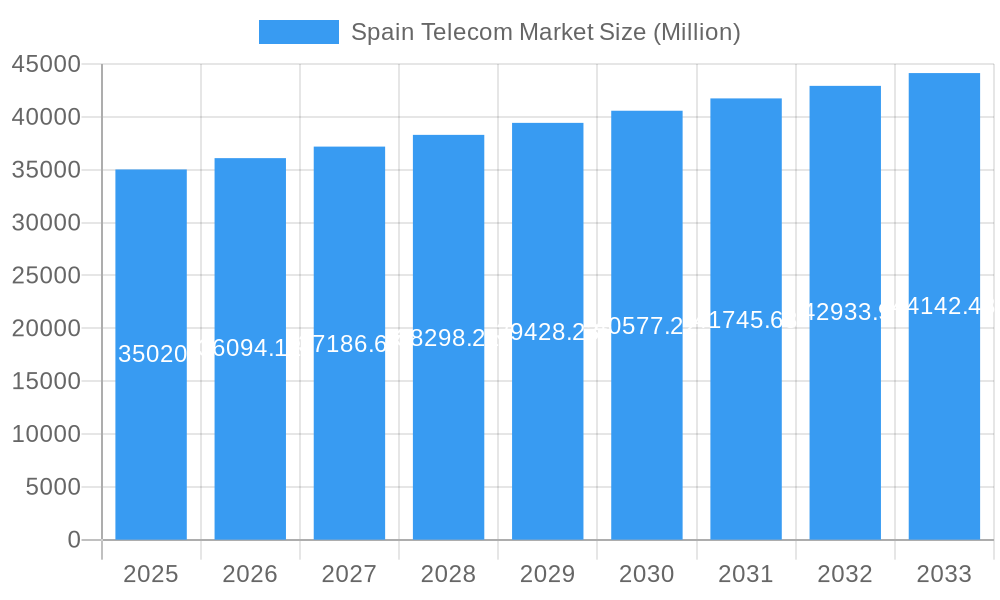

The Spain Telecom market, valued at €35.02 billion in 2025, is projected to experience steady growth, driven primarily by increasing mobile data consumption fueled by the rise of smartphones and video streaming services. The market's Compound Annual Growth Rate (CAGR) of 3.02% reflects a consistent, albeit moderate, expansion. Key growth drivers include the ongoing 5G network rollout, which is enhancing network speeds and capacity, and the increasing adoption of Internet of Things (IoT) devices. Furthermore, the growing demand for bundled services (combining mobile, internet, and television) presents significant opportunities for market players. However, price competition among established telecom operators such as Telefónica, Vodafone, and MásMóvil, and the emergence of new players offering disruptive services, exert pressure on margins. The market segmentation reveals a significant portion attributed to data and messaging services, with average revenue per user (ARPU) playing a crucial role in determining overall segment profitability. This segment is expected to continue its growth trajectory fueled by increased demand for higher data packages and increasingly attractive bundle deals. The competitive landscape is characterized by a mix of established national players and smaller regional operators, each vying for market share through innovative service offerings and competitive pricing strategies. The forecast period (2025-2033) anticipates continued growth, though the pace might moderate slightly depending on economic factors and regulatory changes.

Spain Telecom Market Market Size (In Billion)

The competitive landscape necessitates continuous innovation and investment in network infrastructure to maintain a leading position. While the market shows resilience, potential restraints include regulatory hurdles concerning network infrastructure deployment and spectrum allocation. Furthermore, economic downturns could impact consumer spending on telecom services, influencing the overall market growth. The segmentation analysis will allow for a granular understanding of individual service segment performance, identifying opportunities and challenges within voice services, data packages, and the increasingly important OTT and PayTV sectors. Analyzing ARPU within each service segment provides valuable insights into pricing strategies and customer segmentation, enabling a more nuanced understanding of market dynamics.

Spain Telecom Market Company Market Share

Spain Telecom Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Spain Telecom Market, covering market dynamics, industry trends, leading players, and future growth opportunities. With data spanning from 2019 to 2033, including a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for industry stakeholders, investors, and strategic planners. The report leverages extensive research to provide actionable insights, covering key segments like Voice Services, Wireless Data & Messaging, and OTT/PayTV services. We analyze the performance of major players including Telefónica de España S.A.U, Vodafone España S.A.U, Orange Espagne S.A.U, MasMovil Ibercom SA, and Euskaltel S.A., among others, providing crucial data on market share and strategic maneuvers. The report includes detailed market size estimations (in Millions) and forecasts for the period 2020-2027, ARPU analysis and in-depth trend analysis for each service segment.

Spain Telecom Market Dynamics & Concentration

The Spanish telecom market exhibits a high degree of concentration, with a few major players dominating the landscape. Telefónica, Vodafone, Orange, and MásMóvil collectively hold a significant market share, exceeding xx%. This concentration is influenced by factors including substantial capital investment requirements for network infrastructure, high regulatory barriers to entry, and economies of scale. Market dynamics are shaped by several key factors:

- Innovation: Continuous innovation in 5G technology, IoT applications, and cloud-based services drives market growth. The recent launch of 5G SA by Orange exemplifies this trend.

- Regulatory Framework: The regulatory environment, including spectrum allocation policies and competition rules, significantly influences market structure and competitiveness.

- Product Substitutes: The rise of OTT services (Over-the-Top) and alternative communication platforms presents competitive pressure on traditional telecom providers.

- End-User Trends: Increasing demand for high-speed data, bundled services, and personalized offerings shapes the market's evolution.

- M&A Activities: Consolidation through mergers and acquisitions (M&A) has been a prominent feature of the Spanish telecom market in recent years. The number of M&A deals has fluctuated, with xx deals recorded in 2024 and an estimated xx deals projected for 2025.

Spain Telecom Market Industry Trends & Analysis

The Spanish telecom market is characterized by consistent growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) for the overall market during the period 2019-2024 was xx%, and is projected to be xx% during the forecast period (2025-2033). This growth is fueled by:

- Increasing Smartphone Penetration: The high penetration of smartphones and other smart devices contributes significantly to data consumption.

- Growth of Fixed Broadband: Expansion of fiber optic networks and increasing demand for high-speed internet services fuels market growth in the fixed broadband segment.

- Rising Demand for Data Services: The increasing adoption of streaming services, cloud computing, and online gaming drives demand for higher data allowances.

- Technological Disruptions: The adoption of 5G technology is transforming the landscape, with opportunities in areas like IoT and enhanced mobile broadband.

- Competitive Dynamics: Intense competition among established players and the emergence of new entrants keep pricing competitive and drive innovation. Market penetration of 5G is expected to reach xx% by 2033, significantly increasing average data consumption.

Leading Markets & Segments in Spain Telecom Market

The Spanish telecom market is geographically concentrated, with major urban areas experiencing the highest demand. The leading segments by services are:

- Wireless: Data and Messaging Services: This segment holds the largest market share, fueled by the rising demand for mobile data. ARPU for the overall services segment in 2024 was €xx, projected to reach €xx in 2025. Market size for Wireless: Data and Messaging was €xx Million in 2024 and is projected to reach €xx Million in 2025. Internet and handset data packages, along with package discounts are key drivers of growth.

- OTT and PayTV Services: This segment is experiencing rapid growth due to increasing video streaming consumption. Market size was €xx Million in 2024 and is expected to grow to €xx Million in 2025.

- Voice Services: While experiencing slower growth, the Voice Services segment still holds significant revenue. Market size in 2024 was €xx Million, estimated to be €xx Million in 2025.

Key drivers include favorable economic policies promoting digital infrastructure investment and strong government support for digital transformation initiatives.

Spain Telecom Market Product Developments

The Spanish telecom market showcases ongoing innovation in service offerings and technologies. Key trends include the rollout of 5G standalone networks, the development of advanced IoT solutions, and the expansion of fiber optic broadband infrastructure to reach underserved areas. Operators are increasingly focusing on bundled services that combine mobile, fixed broadband, and Pay TV offerings to enhance customer value and loyalty. These developments cater to the growing demand for reliable, high-speed connectivity and integrated digital services.

Key Drivers of Spain Telecom Market Growth

Several factors contribute to the growth of the Spanish telecom market:

- Technological Advancements: The deployment of 5G and fiber optic infrastructure supports higher data speeds and enhanced network capacity.

- Economic Growth: Economic prosperity boosts consumer spending on telecom services.

- Favorable Regulatory Environment: Supportive government policies facilitate investment and competition in the sector.

- Increasing Mobile Penetration: High rates of mobile penetration and smartphone adoption drive demand for mobile data.

Challenges in the Spain Telecom Market Market

Despite the growth, the Spanish telecom market faces certain challenges:

- Intense Competition: Competition among major players leads to price pressures and reduced margins.

- Regulatory Hurdles: Navigating regulatory complexities and obtaining necessary permits can slow down infrastructure deployments.

- Investment Requirements: Significant capital investments are needed to upgrade and expand network infrastructure.

Emerging Opportunities in Spain Telecom Market

Significant opportunities exist for growth in the Spanish telecom market, particularly in the areas of 5G applications, IoT solutions, and cloud-based services. Strategic partnerships, focusing on 5G innovations and expansion into underserved rural areas, represent key strategic opportunities for operators. The increasing adoption of smart city initiatives also presents exciting avenues for growth and market expansion.

Leading Players in the Spain Telecom Market Sector

- Orange Espagne S.A.U

- LLEIDANETWORKS Serveis Telemàtics S.A

- Telefónica de España S.A.U

- Euskaltel S.A

- Xfera Móviles S.A.U d/b/a Yoigo

- Vodafone España S.A.U

- Focus Telecom SLU

- MasMovil Ibercom SA

- Cellnex Telecom

- Atresmedia Corporación de Medios de Comunicación S.A

Key Milestones in Spain Telecom Market Industry

- June 2023: Orange Spain launches commercial 5G SA (Standalone) technology in major cities, covering over 80% of the population in those cities. This significantly expands 5G+ access.

- September 2022: Vodafone Spain introduces a new movie pack with Filmin, offering bundled entertainment services at a competitive price. This enhanced bundling strategy aims to increase customer retention and attract new subscribers.

Strategic Outlook for Spain Telecom Market Market

The Spanish telecom market is poised for continued growth, driven by technological advancements and increasing demand for data services. Strategic investments in 5G infrastructure, coupled with innovative service offerings and strategic partnerships, will be crucial for operators to maintain a competitive edge. The market's future lies in leveraging the opportunities presented by technological innovations and addressing the challenges of intense competition to capture significant market share and drive long-term growth.

Spain Telecom Market Segmentation

-

1. Servi

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Spain Telecom Market Segmentation By Geography

- 1. Spain

Spain Telecom Market Regional Market Share

Geographic Coverage of Spain Telecom Market

Spain Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Deployment of 5G; Accelerated Digital Transformation

- 3.3. Market Restrains

- 3.3.1. Evolving Market Regulations

- 3.4. Market Trends

- 3.4.1. Speedy Rollout of 5G Network to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Telecom Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Servi

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Servi

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Orange Espagne S A U

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LLEIDANETWORKS Serveis Telemàtics S A*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Telefónica de Espana S A U

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Euskaltel S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Xfera Móviles S A U d/b/a Yoigo

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vodafone Espana S A U

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Focus Telecom SLU

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MasMovil Ibercom SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cellnex Telecom

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Atresmedia Corporación de Medios de Comunicación S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Orange Espagne S A U

List of Figures

- Figure 1: Spain Telecom Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Spain Telecom Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Telecom Market Revenue Million Forecast, by Servi 2020 & 2033

- Table 2: Spain Telecom Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Spain Telecom Market Revenue Million Forecast, by Servi 2020 & 2033

- Table 4: Spain Telecom Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Telecom Market?

The projected CAGR is approximately 3.02%.

2. Which companies are prominent players in the Spain Telecom Market?

Key companies in the market include Orange Espagne S A U, LLEIDANETWORKS Serveis Telemàtics S A*List Not Exhaustive, Telefónica de Espana S A U, Euskaltel S A, Xfera Móviles S A U d/b/a Yoigo, Vodafone Espana S A U, Focus Telecom SLU, MasMovil Ibercom SA, Cellnex Telecom, Atresmedia Corporación de Medios de Comunicación S A.

3. What are the main segments of the Spain Telecom Market?

The market segments include Servi.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Deployment of 5G; Accelerated Digital Transformation.

6. What are the notable trends driving market growth?

Speedy Rollout of 5G Network to Drive the Market.

7. Are there any restraints impacting market growth?

Evolving Market Regulations.

8. Can you provide examples of recent developments in the market?

June 2023: Orange Spain has become the first telecom operator in Spain to commercially launch 5G SA (Standalone) technology in major cities such as Barcelona, Madrid, Bilbao, Seville, and Valencia. Orange's 5G+ deployment in these cities boasts a network coverage of over 80 percent of the total population. With this expansion, it is projected that nearly 30 percent of the total population in Spain will have access to the advanced capabilities of 5G+.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Telecom Market?

To stay informed about further developments, trends, and reports in the Spain Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence