Key Insights

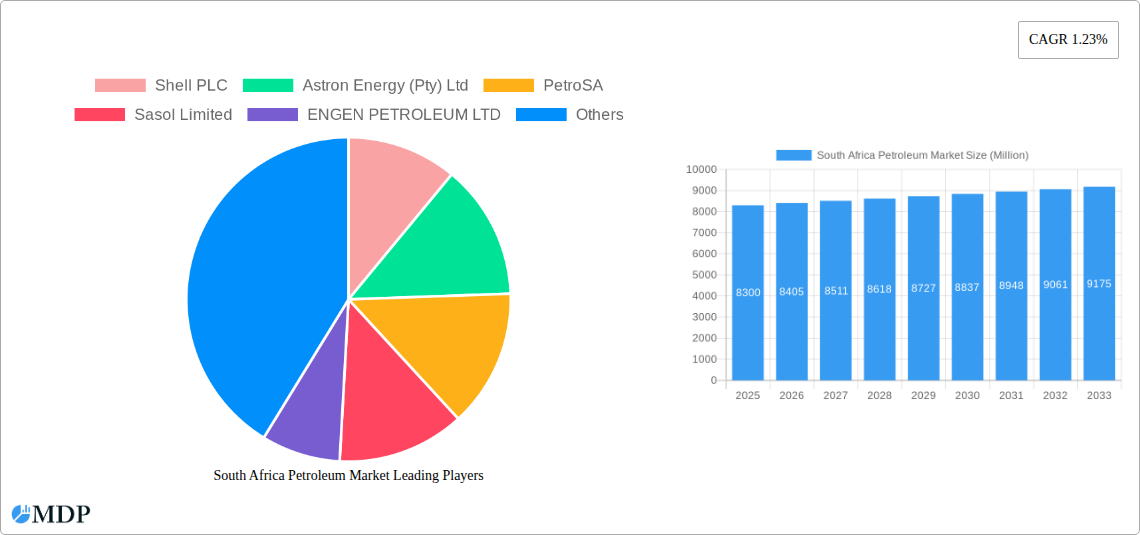

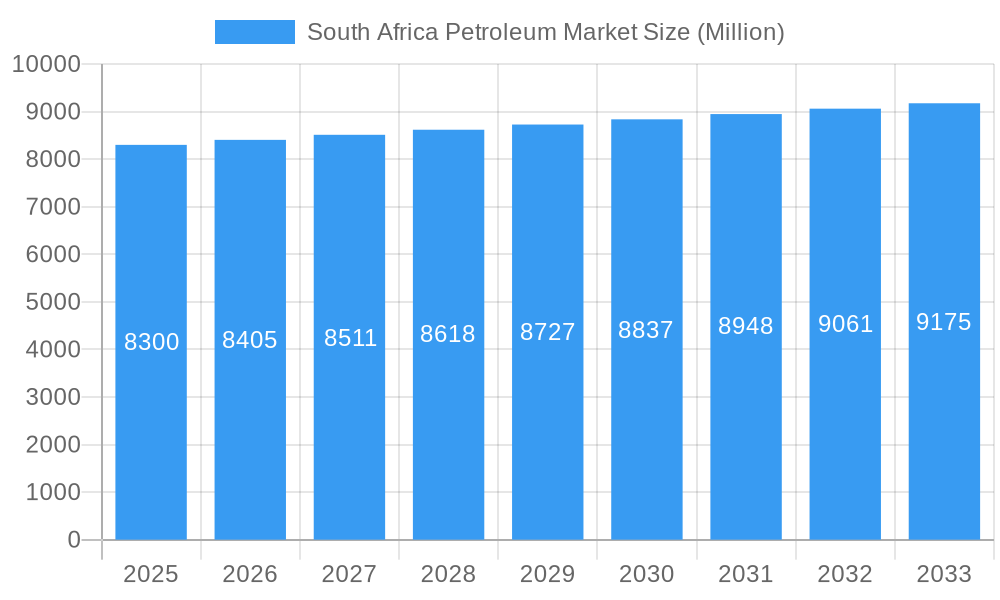

The South African petroleum market, valued at $8.30 billion in 2025, exhibits a moderate Compound Annual Growth Rate (CAGR) of 1.23%. This growth is driven by a steadily increasing vehicle population, particularly in urban areas, fueling demand for gasoline (Premium Motor Spirit – PMS) and diesel (Automotive Gas Oil – AGO). Furthermore, the expanding industrial sector contributes to the consumption of fuel oil and liquefied petroleum gas (LPG), particularly in manufacturing and power generation. However, the market faces constraints including fluctuating global crude oil prices, which impact domestic fuel costs and consumer spending, and increasing pressure to adopt cleaner energy sources to mitigate environmental concerns. Government regulations aimed at promoting renewable energy alternatives, such as biofuels and solar power, also pose a challenge to the traditional petroleum sector's growth trajectory. The market is segmented by refined products, with PMS and AGO holding significant market shares, reflecting South Africa's reliance on automobiles and transportation. Key players like Shell, Astron Energy, PetroSA, Sasol, Engen, TotalEnergies, Chevron, and BP actively compete in this market, employing various strategies including price competitiveness, brand loyalty programs, and investment in infrastructure to maintain their market positions. The growth projection for the forecast period (2025-2033) suggests a continued, albeit gradual, expansion, influenced by the interplay between economic growth, government policies, and global energy market dynamics.

South Africa Petroleum Market Market Size (In Billion)

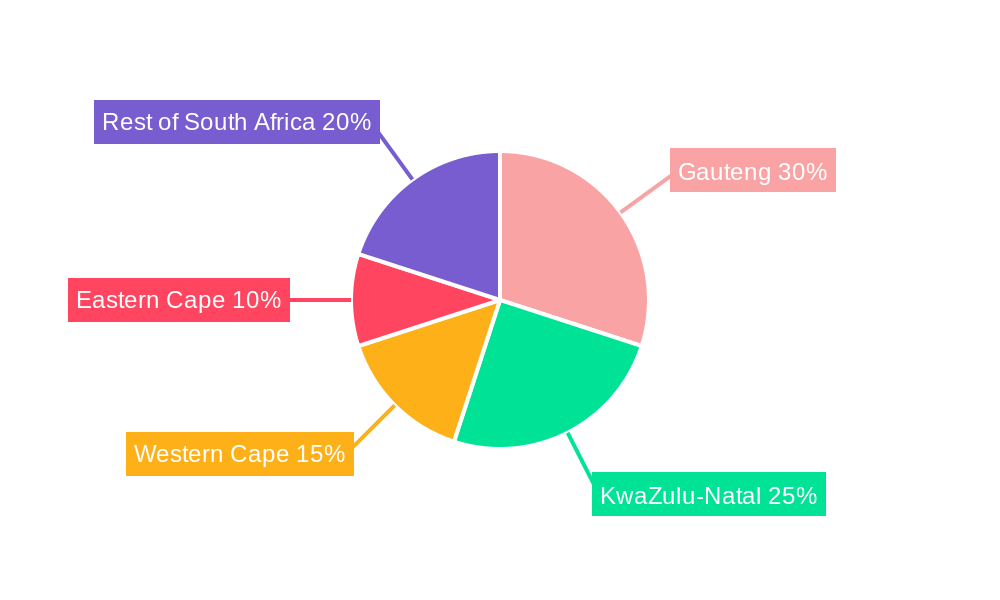

The regional analysis within South Africa reveals variations in petroleum consumption across different provinces, largely correlated with population density and economic activity. Urban centers like Gauteng and KwaZulu-Natal show higher demand, driven by concentrated industrial activity and higher vehicle ownership. Growth in other regions like the Eastern Cape and Western Cape, though slower, is still influenced by rising populations and expanding infrastructure projects. The competitive landscape is marked by both international and domestic players, each leveraging their strengths in terms of distribution networks, refining capabilities, and brand recognition. This competition fosters innovation, price optimization, and improved service offerings for consumers. Considering the influence of external factors like global oil prices and governmental regulations, strategic planning and adaptation will be crucial for market participants to navigate successfully over the forecast period.

South Africa Petroleum Market Company Market Share

Unlocking the Potential of South Africa's Dynamic Petroleum Sector: A Comprehensive Market Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the South Africa petroleum market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, industry trends, leading players, and future growth opportunities, equipping stakeholders with actionable intelligence to navigate this evolving landscape. The report leverages rigorous data analysis, incorporating historical data (2019-2024), base year (2025), and forecast data (2025-2033) to provide a holistic view of the market. Key players like Shell PLC, Astron Energy (Pty) Ltd, PetroSA, Sasol Limited, ENGEN PETROLEUM LTD, TotalEnergies SE, Chevron Corporation, and BP Southern Africa (Pty) Ltd are thoroughly examined. The analysis encompasses various refined product segments: Illuminating Paraffin, Fuel Oil, Automotive Gas Oil (AGO)/Diesel, Premium Motor Spirit (PMS), Liquefied Petroleum Gas (LPG), and Other Refined Products. Discover key market trends, growth drivers, challenges, and opportunities shaping this crucial sector of the South African economy.

South Africa Petroleum Market Market Dynamics & Concentration

The South African petroleum market exhibits a moderately concentrated structure, with a few major players controlling a significant market share. While exact figures for market share are proprietary and constantly changing, a concentration ratio analysis reveals a dominance by a handful of multinational and national companies. This concentration is further influenced by the regulatory framework governing exploration, production, refining, and distribution. The market is dynamic, with ongoing mergers and acquisitions (M&A) activity. Recent years have seen approximately xx M&A deals, though this number is subject to change upon further research. Innovation in refining technologies, particularly aimed at enhancing efficiency and reducing environmental impact, is a key driver shaping the competitive landscape. The emergence of biofuels and alternative energy sources represents a significant disruptive force, albeit one with relatively low market penetration currently (xx%). Consumer preferences are increasingly focused on fuel quality and environmental sustainability, pushing companies to adapt their offerings and operational practices.

- Market Concentration: Moderately concentrated, with major players holding significant share.

- Innovation Drivers: Refining technology advancements, biofuels, and alternative energy.

- Regulatory Framework: Significant influence on market access and operations.

- Product Substitutes: Increasing presence of biofuels and alternative energy sources.

- End-User Trends: Growing emphasis on fuel quality and environmental concerns.

- M&A Activity: Approximately xx deals in recent years (specific figures need further research).

South Africa Petroleum Market Industry Trends & Analysis

The South African petroleum market is characterized by a complex interplay of factors influencing its growth trajectory. From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of xx%, primarily driven by increasing vehicle ownership and industrial activity. However, economic fluctuations and shifts in government policy have created periods of both growth and contraction. The forecasted CAGR for 2025-2033 is estimated at xx%, reflecting projected economic growth and infrastructure development. Technological disruptions, such as the adoption of advanced refining techniques and the integration of digital technologies in supply chain management, are altering the operational landscape. Consumer preferences are evolving towards cleaner fuels and environmentally friendly solutions, influencing industry investment in refining and alternative energy solutions. The competitive dynamics remain intense, with both international and local players vying for market share. The market penetration of biofuels remains relatively low, currently estimated at xx%, but is expected to increase gradually over the forecast period.

Leading Markets & Segments in South Africa Petroleum Market

While precise regional breakdowns require further in-depth research, the Gauteng province likely remains the dominant market due to its high population density and significant industrial activity. Within the refined products segment, Premium Motor Spirit (PMS) and Automotive Gas Oil (AGO)/Diesel command the largest market shares.

Key Drivers:

- Economic Policies: Government regulations and economic growth significantly influence demand.

- Infrastructure: Adequate distribution networks are crucial for market access.

Dominance Analysis:

- PMS (Premium Motor Spirit): High demand due to widespread vehicle ownership.

- AGO/Diesel (Automotive Gas Oil): Essential fuel for the industrial and transport sectors.

Other Segments:

- Illuminating Paraffin: Continues to see demand, albeit potentially declining as electrification increases

- Fuel Oil: Relatively stable demand from various industrial applications.

- LPG (Liquefied Petroleum Gas): Consistent demand for cooking and heating.

- Other Refined Products: This category's trends will depend on the specific components it contains.

South Africa Petroleum Market Product Developments

Recent years have witnessed a focus on improving fuel quality and efficiency, driven partly by stricter emission standards. The development of improved fuel additives and the exploration of biofuel blends are key areas of innovation. The integration of digital technologies, enabling predictive maintenance and optimizing supply chain efficiency, is also becoming increasingly prominent. Technological advancements leading to cleaner and more efficient fuel production and distribution are key competitive advantages. The market fit for these newer developments depends heavily on consumer acceptance and regulatory support.

Key Drivers of South Africa Petroleum Market Growth

Several factors contribute to the South Africa petroleum market's growth. Economic expansion fuels increased industrial and transport activity, boosting demand for petroleum products. Government policies and regulations also play a crucial role, influencing investment and market access. Technological advancements in refining and distribution improve efficiency and reduce operational costs.

Challenges in the South Africa Petroleum Market Market

The South African petroleum market faces various challenges. Fluctuations in global crude oil prices significantly impact profitability. Regulatory hurdles and supply chain disruptions can create uncertainties and increase operational costs. Intense competition from both local and international players also adds to the pressure on profit margins. For example, a xx% increase in crude oil prices would directly impact the sector’s profitability.

Emerging Opportunities in South Africa Petroleum Market

Despite challenges, the South African petroleum market presents considerable opportunities. Strategic partnerships between energy companies and technology providers can unlock innovation and efficiency gains. Investments in renewable energy sources and biofuels can tap into growing environmental awareness and government support. Expanding into emerging markets and diversifying product offerings can create new avenues for growth.

Leading Players in the South Africa Petroleum Market Sector

- Shell PLC

- Astron Energy (Pty) Ltd

- PetroSA

- Sasol Limited

- ENGEN PETROLEUM LTD

- TotalEnergies SE

- Chevron Corporation

- BP Southern Africa (Pty) Ltd

Key Milestones in South Africa Petroleum Market Industry

- February 2023: Astron Energy announces plans to reopen the Cape Town oil refinery. This could significantly impact regional supply and competition.

- November 2022: South Africa's Mineral Resources and Energy Ministry explores a potential USD 10 Billion refinery project with Saudi Aramco, potentially boosting refining capacity by 300,000 barrels per day by 2028. This indicates significant potential future investment and capacity additions.

Strategic Outlook for South Africa Petroleum Market Market

The South Africa petroleum market's future potential is promising, driven by economic growth and infrastructure development. Strategic investments in refining technology, renewable energy sources, and efficient supply chains are crucial for long-term success. Companies that adapt to evolving consumer preferences and regulatory landscapes are well-positioned to capitalize on emerging opportunities. The market's trajectory will significantly depend on the successful implementation of large-scale projects like the potential Saudi Aramco refinery and further investments in refining capacity.

South Africa Petroleum Market Segmentation

-

1. Refined Products

- 1.1. Illuminating Paraffin

- 1.2. Fuel Oil

- 1.3. Automotive Gas Oil (AGO)/Diesel

- 1.4. Premium Motor Spirit (PMS)

- 1.5. Liquefied Petroleum Gas (LPG)

- 1.6. Other Refined Products

South Africa Petroleum Market Segmentation By Geography

- 1. South Africa

South Africa Petroleum Market Regional Market Share

Geographic Coverage of South Africa Petroleum Market

South Africa Petroleum Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumption Of Petroleum Products

- 3.3. Market Restrains

- 3.3.1 Fluctuating Crude Oil Prices

- 3.3.2 Adoption of Cleaner Alternatives In Transportation

- 3.4. Market Trends

- 3.4.1. Automotive Gas Oil (AGO) to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Petroleum Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Refined Products

- 5.1.1. Illuminating Paraffin

- 5.1.2. Fuel Oil

- 5.1.3. Automotive Gas Oil (AGO)/Diesel

- 5.1.4. Premium Motor Spirit (PMS)

- 5.1.5. Liquefied Petroleum Gas (LPG)

- 5.1.6. Other Refined Products

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Refined Products

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shell PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Astron Energy (Pty) Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PetroSA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sasol Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ENGEN PETROLEUM LTD

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TotalEnergies SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Chevron Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BP Southern Africa (Pty) Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Shell PLC

List of Figures

- Figure 1: South Africa Petroleum Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa Petroleum Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Petroleum Market Revenue Million Forecast, by Refined Products 2020 & 2033

- Table 2: South Africa Petroleum Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: South Africa Petroleum Market Revenue Million Forecast, by Refined Products 2020 & 2033

- Table 4: South Africa Petroleum Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Petroleum Market?

The projected CAGR is approximately 1.23%.

2. Which companies are prominent players in the South Africa Petroleum Market?

Key companies in the market include Shell PLC, Astron Energy (Pty) Ltd, PetroSA, Sasol Limited, ENGEN PETROLEUM LTD, TotalEnergies SE, Chevron Corporation, BP Southern Africa (Pty) Ltd.

3. What are the main segments of the South Africa Petroleum Market?

The market segments include Refined Products.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumption Of Petroleum Products.

6. What are the notable trends driving market growth?

Automotive Gas Oil (AGO) to Dominate the Market.

7. Are there any restraints impacting market growth?

Fluctuating Crude Oil Prices. Adoption of Cleaner Alternatives In Transportation.

8. Can you provide examples of recent developments in the market?

February 2023: Astron Energy, a subsidiary of Glencore, has announced plans to reopen the Cape Town oil refinery based on a compelling commercial rationale. The company is fully dedicated to restarting the refinery and is progressing with the required work to achieve this objective.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Petroleum Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Petroleum Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Petroleum Market?

To stay informed about further developments, trends, and reports in the South Africa Petroleum Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence