Key Insights

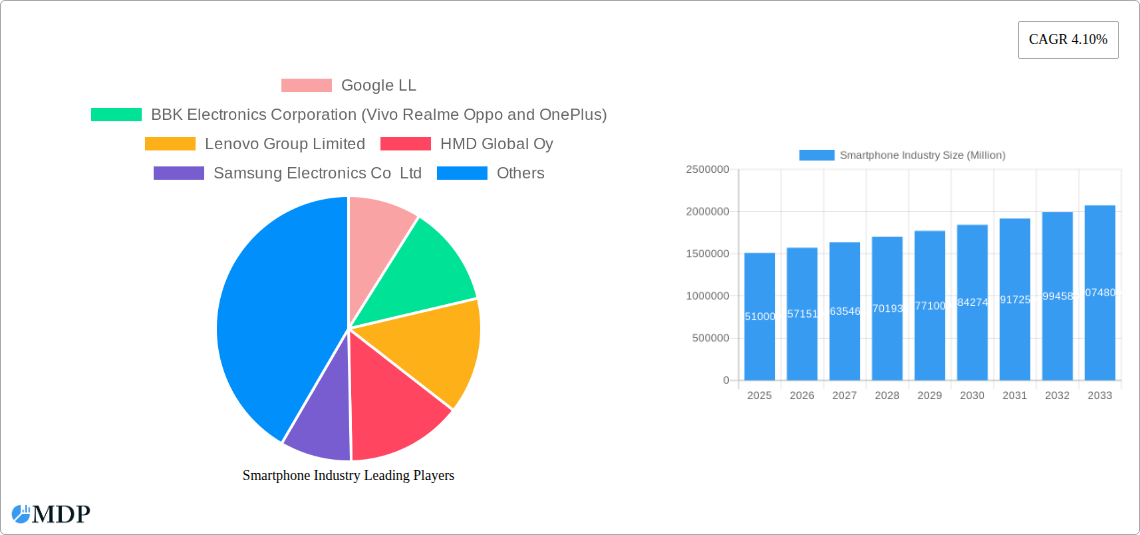

The global smartphone market, valued at $1.51 trillion in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 4.10% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the continuous innovation in smartphone technology, including advancements in processing power, camera capabilities, and display technology, consistently attracts consumers seeking upgrades. Secondly, the expanding global middle class, particularly in emerging markets, fuels increased smartphone adoption as access to mobile technology becomes more widespread. Thirdly, the rise of mobile-first applications and services further intensifies the demand for smartphones across diverse demographics. The market is segmented primarily by operating system (Android and iOS), with Android currently holding a significant market share. Key players like Samsung, Apple, Xiaomi, and BBK Electronics (Vivo, Oppo, Realme, OnePlus) dominate the landscape, engaging in intense competition through product diversification, strategic partnerships, and aggressive marketing campaigns. However, challenges remain, including the saturation of developed markets and increasing component costs that might impact affordability.

Smartphone Industry Market Size (In Million)

Despite these challenges, the long-term outlook for the smartphone market remains positive. The increasing integration of smartphones into various aspects of daily life, from communication and entertainment to financial transactions and healthcare, will continue to drive demand. The emergence of new technologies such as foldable smartphones and advancements in 5G connectivity are poised to create new growth opportunities. Regional variations in market growth are anticipated, with emerging economies in Asia and Africa likely to exhibit faster growth rates compared to mature markets in North America and Europe. The competitive landscape will continue to evolve, with existing players focusing on innovation and market expansion, while new entrants explore niche markets and specialized functionalities. Successful companies will leverage technological advancements, effectively manage supply chain complexities, and cater to the evolving consumer preferences across different regions.

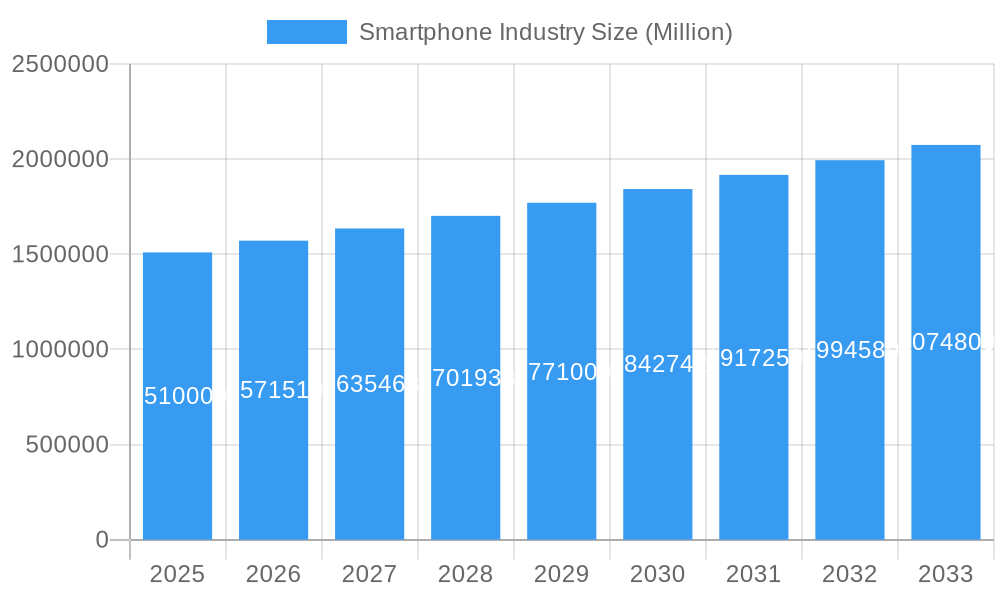

Smartphone Industry Company Market Share

Smartphone Industry Market Report: 2019-2033 - A Comprehensive Analysis

This comprehensive report provides an in-depth analysis of the global smartphone industry, covering market dynamics, leading players, technological advancements, and future growth prospects from 2019 to 2033. The study period spans 2019-2024 (historical), with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report leverages extensive data analysis and expert insights to deliver actionable intelligence for industry stakeholders, investors, and strategic decision-makers. This report is crucial for understanding the competitive landscape and navigating the evolving trends within this dynamic market. Expect detailed analysis of market share, CAGR, and M&A activities, all expressed in Millions.

Smartphone Industry Market Dynamics & Concentration

The global smartphone market, valued at xx Million in 2024, exhibits a moderately concentrated structure. A handful of major players, including Apple Inc, Samsung Electronics Co Ltd, Google LL, Xiaomi Corporation, and BBK Electronics Corporation (Vivo, Realme, Oppo, and OnePlus), control a significant portion of the market share. Market concentration is influenced by factors such as brand recognition, technological innovation, and economies of scale.

- Market Share (2024 Estimate): Samsung (xx%), Apple (xx%), Xiaomi (xx%), BBK (xx%), Others (xx%). These figures are estimates based on available data.

- Innovation Drivers: Advancements in 5G technology, artificial intelligence (AI), camera capabilities, and foldable screen technology are major drivers of innovation.

- Regulatory Frameworks: Government regulations concerning data privacy, security, and antitrust are impacting market dynamics.

- Product Substitutes: Smartwatches, smart glasses, and other wearable devices pose a partial substitution threat.

- End-User Trends: Consumers increasingly prioritize features like high-quality cameras, long battery life, and premium design.

- M&A Activities: The historical period (2019-2024) witnessed xx major M&A deals in the smartphone industry, predominantly focused on enhancing technological capabilities and expanding market reach.

Smartphone Industry Industry Trends & Analysis

The global smartphone market experienced a CAGR of xx% during the historical period (2019-2024), driven by factors such as increasing smartphone penetration in emerging markets, the adoption of 5G technology, and continuous improvements in device functionality. However, market growth is expected to moderate in the forecast period (2025-2033), with a projected CAGR of xx%. This moderation is attributable to market saturation in developed countries and a slowing pace of innovation in core smartphone features. Consumer preferences are shifting towards longer device lifecycles, impacting overall replacement cycles. Competitive pressures remain intense, with companies focusing on differentiation strategies through software, services, and innovative designs. The market penetration of 5G smartphones is rapidly increasing, exceeding xx% in key markets by 2025.

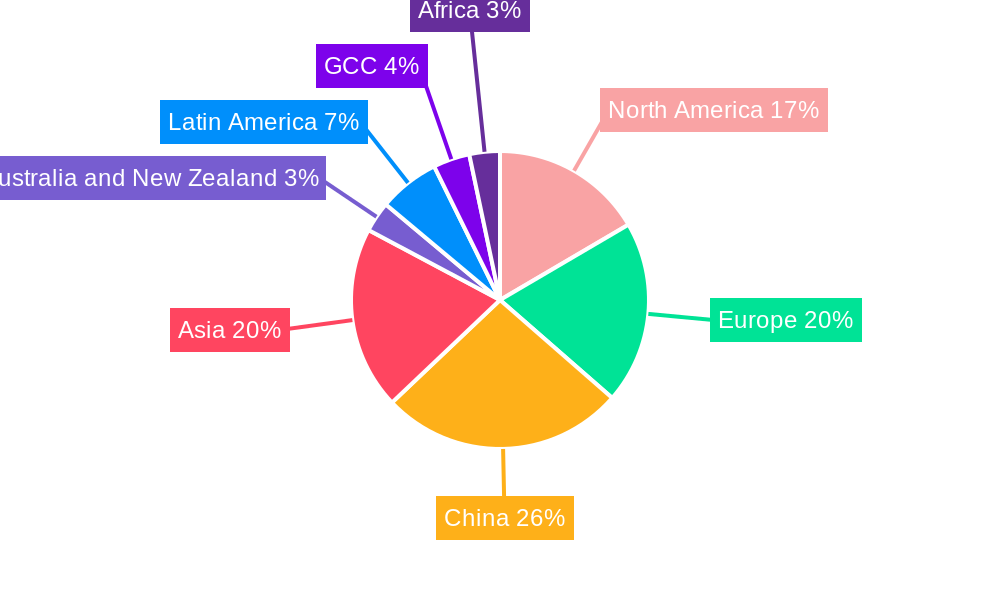

Leading Markets & Segments in Smartphone Industry

Asia, particularly China and India, are the dominant regions for smartphone sales, accounting for over xx% of the global market. These regions benefit from expanding middle classes, growing smartphone adoption rates, and supportive government policies. The Android operating system holds a significantly larger market share than iOS, driven by the wider range of price points and device choices available.

Key Drivers in Asia:

- Rapid economic growth and expanding middle class.

- Increasing disposable incomes.

- Growing internet and mobile penetration.

- Favorable government policies promoting digitalization.

Dominance Analysis: Android's dominance is reinforced by its open-source nature and the large ecosystem of supporting manufacturers. However, iOS maintains a strong premium market segment with a highly loyal customer base.

Smartphone Industry Product Developments

Recent product innovations focus on enhanced camera systems, improved battery technology, foldable screens, and integration of advanced AI features. These developments aim to cater to evolving consumer demands and offer competitive advantages. The market is seeing a shift towards premium features previously restricted to flagship models, becoming more accessible across various price points.

Key Drivers of Smartphone Industry Growth

Technological advancements, particularly in 5G and AI, are fueling growth. Expanding internet connectivity in developing countries is another crucial driver. Government initiatives supporting digital infrastructure and policies promoting smartphone usage also contribute significantly. For example, the ongoing rollout of 5G networks globally is expected to boost demand for 5G-enabled smartphones.

Challenges in the Smartphone Industry Market

The smartphone market faces significant challenges, including intensifying competition, supply chain disruptions, and increasing regulatory scrutiny regarding data privacy and security. These factors can impact profitability and market share, with an estimated xx Million potential revenue loss due to supply chain uncertainties in 2025. Furthermore, geopolitical factors can also impact manufacturing and distribution networks.

Emerging Opportunities in Smartphone Industry

The integration of AI and IoT technologies into smartphones offers significant opportunities for growth. Strategic partnerships between smartphone manufacturers and other technology companies can drive innovation and expand market reach. Expansion into untapped markets in Africa and Latin America also presents promising opportunities. The development of sustainable and environmentally friendly smartphone manufacturing processes represents another emerging opportunity, tapping into growing consumer awareness.

Key Milestones in Smartphone Industry Industry

- 2019: Launch of the first commercially available 5G smartphones.

- 2020: Increased adoption of foldable smartphones.

- 2021: Significant expansion of 5G network infrastructure.

- 2022: Growing focus on sustainable and environmentally friendly manufacturing practices.

- 2023: Advancements in AI-powered camera features.

- 2024: Increased mergers and acquisitions to consolidate the market.

Strategic Outlook for Smartphone Industry Market

The smartphone market is poised for continued growth, albeit at a more moderate pace than in previous years. Strategic opportunities lie in technological innovation, particularly in AI, foldable devices, and improved battery technology. Expanding into new markets and fostering strategic partnerships will be crucial for sustained success. The focus will shift from sheer unit sales towards higher-value devices and associated services.

Smartphone Industry Segmentation

-

1. Operating Segment

- 1.1. Android

- 1.2. iOS

Smartphone Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. China

- 4. Asia

- 5. Australia and New Zealand

- 6. Latin America

- 7. GCC

- 8. Africa

Smartphone Industry Regional Market Share

Geographic Coverage of Smartphone Industry

Smartphone Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Launch of 5G Devices

- 3.2.2 Services

- 3.2.3 and Technologies; Increasing Demand in the Emerging Markets

- 3.3. Market Restrains

- 3.3.1. Stagnating Demand

- 3.4. Market Trends

- 3.4.1. Android Operating System is Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Smartphone Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operating Segment

- 5.1.1. Android

- 5.1.2. iOS

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. China

- 5.2.4. Asia

- 5.2.5. Australia and New Zealand

- 5.2.6. Latin America

- 5.2.7. GCC

- 5.2.8. Africa

- 5.1. Market Analysis, Insights and Forecast - by Operating Segment

- 6. North America Smartphone Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Operating Segment

- 6.1.1. Android

- 6.1.2. iOS

- 6.1. Market Analysis, Insights and Forecast - by Operating Segment

- 7. Europe Smartphone Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Operating Segment

- 7.1.1. Android

- 7.1.2. iOS

- 7.1. Market Analysis, Insights and Forecast - by Operating Segment

- 8. China Smartphone Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Operating Segment

- 8.1.1. Android

- 8.1.2. iOS

- 8.1. Market Analysis, Insights and Forecast - by Operating Segment

- 9. Asia Smartphone Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Operating Segment

- 9.1.1. Android

- 9.1.2. iOS

- 9.1. Market Analysis, Insights and Forecast - by Operating Segment

- 10. Australia and New Zealand Smartphone Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Operating Segment

- 10.1.1. Android

- 10.1.2. iOS

- 10.1. Market Analysis, Insights and Forecast - by Operating Segment

- 11. Latin America Smartphone Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Operating Segment

- 11.1.1. Android

- 11.1.2. iOS

- 11.1. Market Analysis, Insights and Forecast - by Operating Segment

- 12. GCC Smartphone Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Operating Segment

- 12.1.1. Android

- 12.1.2. iOS

- 12.1. Market Analysis, Insights and Forecast - by Operating Segment

- 13. Africa Smartphone Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Operating Segment

- 13.1.1. Android

- 13.1.2. iOS

- 13.1. Market Analysis, Insights and Forecast - by Operating Segment

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Google LL

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 BBK Electronics Corporation (Vivo Realme Oppo and OnePlus)

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Lenovo Group Limited

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 HMD Global Oy

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Samsung Electronics Co Ltd

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Xiaomi Corporation

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Huawei Technologies Co Ltd

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 ZTE Corporation

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Apple Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 HTC Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Sony Corporation

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Google LL

List of Figures

- Figure 1: Smartphone Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Smartphone Industry Share (%) by Company 2025

List of Tables

- Table 1: Smartphone Industry Revenue Million Forecast, by Operating Segment 2020 & 2033

- Table 2: Smartphone Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Smartphone Industry Revenue Million Forecast, by Operating Segment 2020 & 2033

- Table 4: Smartphone Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Smartphone Industry Revenue Million Forecast, by Operating Segment 2020 & 2033

- Table 6: Smartphone Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Smartphone Industry Revenue Million Forecast, by Operating Segment 2020 & 2033

- Table 8: Smartphone Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Smartphone Industry Revenue Million Forecast, by Operating Segment 2020 & 2033

- Table 10: Smartphone Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Smartphone Industry Revenue Million Forecast, by Operating Segment 2020 & 2033

- Table 12: Smartphone Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Smartphone Industry Revenue Million Forecast, by Operating Segment 2020 & 2033

- Table 14: Smartphone Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Smartphone Industry Revenue Million Forecast, by Operating Segment 2020 & 2033

- Table 16: Smartphone Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Smartphone Industry Revenue Million Forecast, by Operating Segment 2020 & 2033

- Table 18: Smartphone Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smartphone Industry?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the Smartphone Industry?

Key companies in the market include Google LL, BBK Electronics Corporation (Vivo Realme Oppo and OnePlus), Lenovo Group Limited, HMD Global Oy, Samsung Electronics Co Ltd, Xiaomi Corporation, Huawei Technologies Co Ltd, ZTE Corporation, Apple Inc, HTC Corporation, Sony Corporation.

3. What are the main segments of the Smartphone Industry?

The market segments include Operating Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Launch of 5G Devices. Services. and Technologies; Increasing Demand in the Emerging Markets.

6. What are the notable trends driving market growth?

Android Operating System is Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

Stagnating Demand.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smartphone Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smartphone Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smartphone Industry?

To stay informed about further developments, trends, and reports in the Smartphone Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence