Key Insights

The global smart fabrics market is projected for significant expansion, reaching an estimated market size of $39.51 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 28.4%. This growth is driven by technological advancements and escalating demand for innovative textile solutions. The integration of electronic functionalities allows fabrics to sense, react, and adapt, fueling the adoption of passive, active, and ultra-smart fabrics. Key application sectors include fashion & entertainment and sports & fitness, enhancing user experience and enabling personalized performance tracking. The medical industry also benefits from smart textiles for remote patient monitoring and therapeutic applications. Expansion into transportation, military, and industrial sectors is anticipated to further accelerate market growth.

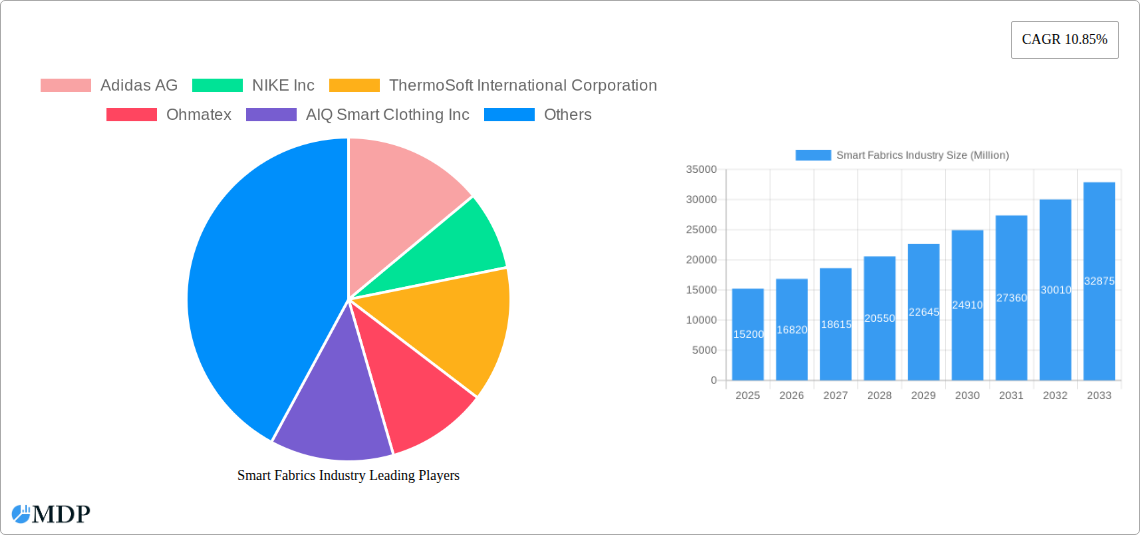

Smart Fabrics Industry Market Size (In Billion)

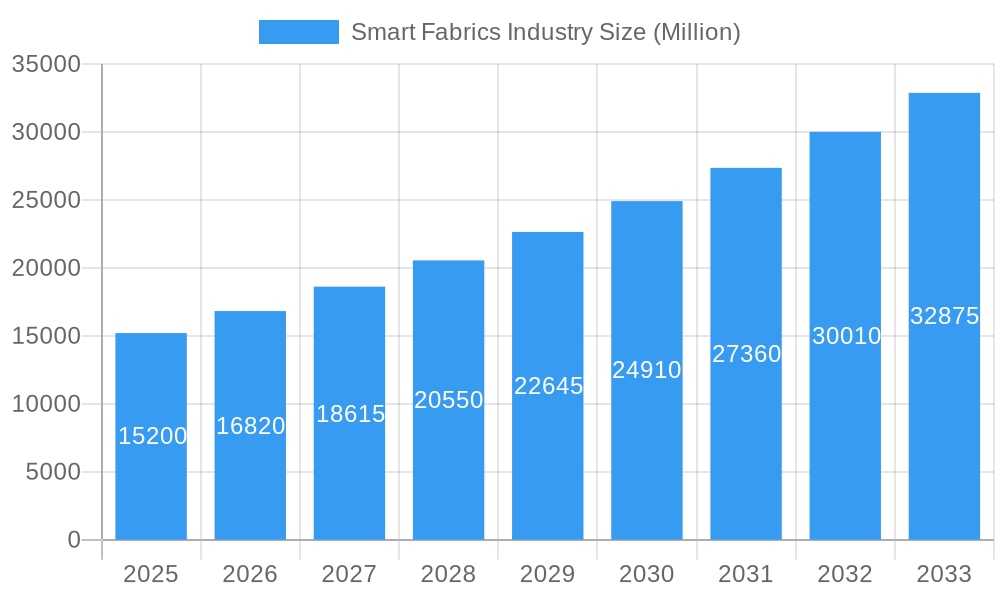

The smart fabrics industry is highly competitive, with leading players focusing on research and development for novel products. Key trends include sensor miniaturization, improved power solutions, and the development of sustainable, washable smart textiles. North America and Europe currently lead the market due to R&D investments and strong consumer adoption of wearable technology. The Asia Pacific region is poised for rapid growth, driven by manufacturing capabilities and increasing smart technology integration. Challenges include high manufacturing costs, scalability issues, and data privacy concerns. Nevertheless, continuous innovation and a widening application scope ensure a promising future for the smart fabrics industry.

Smart Fabrics Industry Company Market Share

This report provides an in-depth analysis of the global Smart Fabrics Market, examining its current status, projected growth, and future trajectory from 2019 to 2033. With a base year of 2025 and an estimated market size of $39.51 billion, the forecast period (2025–2033) offers critical insights for stakeholders. Explore market drivers, technological advancements, key player strategies, and emerging opportunities within the wearable technology, functional textiles, and connected clothing sectors.

Smart Fabrics Industry Market Dynamics & Concentration

The Smart Fabrics Industry is characterized by a dynamic and evolving market concentration. Innovation drivers such as advancements in embedded sensors, flexible electronics, and biocompatible materials are fueling growth. Regulatory frameworks are gradually taking shape, particularly concerning data privacy and device certification, influencing product development and market entry strategies. Product substitutes are emerging from traditional electronics, but the integration and seamless application of smart fabrics offer distinct advantages. End-user trends are increasingly leaning towards personalized health monitoring, enhanced athletic performance, and improved safety in various applications. Mergers and acquisitions (M&A) activities are on the rise as larger players seek to acquire innovative technologies and expand their market share. For instance, there have been xx M&A deals recorded in the historical period, with an estimated market share concentration of xx% held by the top five players. Key M&A targets often include startups with novel material science breakthroughs or unique integration capabilities.

- Innovation Drivers:

- Miniaturization of sensors and actuators

- Development of conductive yarns and inks

- Integration of energy harvesting and storage solutions

- Advancements in biocompatible and sustainable materials

- Regulatory Frameworks:

- Data security and privacy regulations (e.g., GDPR)

- Medical device certifications for health-monitoring textiles

- Safety standards for electronic components in clothing

- End-User Trends:

- Demand for real-time health data tracking

- Interest in performance enhancement through smart apparel

- Growing adoption in safety-critical industrial and military applications

- M&A Activity:

- Acquisition of specialized technology providers

- Strategic partnerships for market penetration

- Consolidation among key material suppliers and integrators

Smart Fabrics Industry Industry Trends & Analysis

The Smart Fabrics Industry is poised for substantial expansion, driven by a confluence of technological innovation, evolving consumer preferences, and a widening array of applications. The wearable technology market is a significant catalyst, with smart fabrics offering a more integrated and aesthetically pleasing alternative to traditional wearable devices. The functional textiles segment is experiencing a surge in demand, particularly in the sports and fitness and medical sectors, where real-time data collection for performance optimization and health monitoring is highly valued. Technological disruptions, such as the development of self-powered smart textiles and advanced conductive materials, are continuously pushing the boundaries of what is possible. Consumer preferences are shifting towards personalized experiences, with individuals seeking apparel that not only provides comfort and style but also offers advanced functionalities. The connected clothing market is therefore experiencing a robust Compound Annual Growth Rate (CAGR) of xx% projected over the forecast period, with an estimated market penetration of xx% by 2033. Competitive dynamics are intensifying, with established textile manufacturers collaborating with technology companies to develop next-generation products. The market's growth is further underpinned by increasing investments in research and development by key industry players, aiming to unlock new functionalities and applications. The integration of Artificial Intelligence (AI) into smart fabrics for predictive analysis and personalized feedback is a notable emerging trend.

- Market Growth Drivers:

- Increasing adoption of wearable devices for health and fitness

- Growing demand for personalized healthcare solutions

- Advancements in material science and miniaturization of electronics

- Expanding applications in industrial safety and military operations

- Rising consumer awareness and acceptance of smart textiles

- Technological Disruptions:

- Development of flexible and stretchable electronics

- Integration of advanced sensor technologies (e.g., bio-sensors, environmental sensors)

- Progress in energy harvesting and storage for self-powered textiles

- AI-driven data analysis and feedback systems

- Consumer Preferences:

- Desire for seamless integration of technology into daily life

- Emphasis on comfort, style, and performance

- Interest in proactive health management and preventative care

- Competitive Dynamics:

- Strategic collaborations between textile and tech companies

- Intensified R&D efforts for product differentiation

- Entry of new players with disruptive technologies

- Focus on sustainability and ethical production practices

Leading Markets & Segments in Smart Fabrics Industry

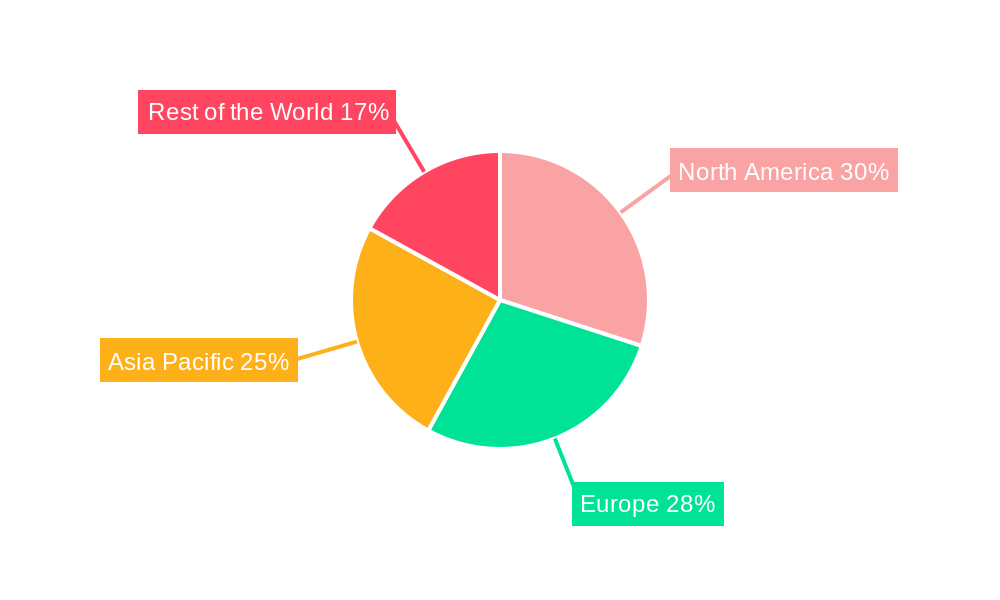

The Smart Fabrics Industry exhibits strong dominance in specific regions and segments, driven by unique market conditions and technological adoption rates. North America and Europe are currently leading markets, propelled by high disposable incomes, advanced technological infrastructure, and a strong emphasis on health and wellness. Within these regions, the Sports and Fitness segment is a major revenue contributor, with athletes and fitness enthusiasts increasingly embracing smart apparel for performance tracking and improvement. The Medical segment is another high-growth area, driven by the demand for remote patient monitoring, chronic disease management, and advanced diagnostics. Passive Smart Fabrics are currently the largest segment by revenue, owing to their widespread use in basic sensing and data collection. However, Active Fabrics, with their ability to actively respond to stimuli and perform actions, are witnessing rapid growth, particularly in areas like adaptive sportswear and haptic feedback systems. Ultra-smart Fabrics, representing the pinnacle of smart textile integration with complex functionalities like AI processing and seamless connectivity, are in their nascent stages but hold immense future potential.

- Dominant Regions:

- North America: High R&D investment, strong consumer demand for wearables, presence of key technology hubs.

- Europe: Robust healthcare infrastructure, growing awareness of preventative health, supportive government initiatives for innovation.

- Asia-Pacific: Rapidly growing manufacturing capabilities, increasing disposable incomes, rising adoption in emerging economies, particularly in the sports and industrial sectors.

- Dominant Segments by Type:

- Passive Smart Fabrics: Widely adopted for basic sensing, connectivity, and power transmission. Examples include basic fitness trackers embedded in clothing.

- Active Fabrics: Growing rapidly due to their responsive capabilities, such as temperature regulation, vibration feedback, and energy generation.

- Ultra-smart Fabrics: Emerging segment with advanced capabilities, including AI integration, complex sensor networks, and self-healing properties.

- Dominant Segments by Application:

- Sports and Fitness: Performance monitoring, injury prevention, personalized training. Driven by advanced sensor integration for heart rate, motion, and physiological data.

- Medical: Remote patient monitoring, therapeutic applications, diagnostic tools, rehabilitation. Catalyzed by the need for continuous health tracking and early disease detection.

- Industrial: Safety monitoring for workers in hazardous environments, improved efficiency through integrated sensors.

- Space and Military: Enhanced soldier performance, communication systems, environmental monitoring, advanced protective gear.

Smart Fabrics Industry Product Developments

Product innovation in the Smart Fabrics Industry is characterized by the integration of advanced electronics and functionalities directly into textiles. Companies are developing fabrics with embedded LEDs for enhanced visibility, energy harvesting capabilities to power integrated sensors, and sophisticated sensor arrays for precise data collection. These innovations aim to create seamless, comfortable, and highly functional apparel. Competitive advantages are being derived from the miniaturization of components, improved durability of electronic elements within flexible textiles, and the development of biocompatible materials suitable for prolonged skin contact. The focus is on creating a more intuitive and integrated user experience, moving beyond bulky wearable devices. The market is witnessing the emergence of textiles that can actively monitor physiological parameters, adjust to environmental conditions, and even communicate data wirelessly, paving the way for truly intelligent garments.

Key Drivers of Smart Fabrics Industry Growth

The Smart Fabrics Industry is propelled by several key drivers. Technologically, continuous advancements in sensor technology, flexible electronics, and material science are enabling more sophisticated and integrated smart textiles. Economically, the increasing disposable income and growing consumer demand for advanced wearable technology and personalized health solutions are significant factors. Regulatory environments are becoming more conducive with the development of standards for wearable electronics and healthcare devices. The expanding applications across various sectors, from sports and healthcare to industrial safety and military, further fuel growth. The burgeoning wearable technology market and the drive towards a more connected lifestyle are creating substantial opportunities.

- Technological Advancements: Miniaturization of sensors, development of conductive yarns, energy harvesting solutions.

- Economic Factors: Rising disposable incomes, increased spending on health and wellness, growing adoption of smart devices.

- Regulatory Support: Evolving standards for wearable devices and medical technologies, government initiatives promoting innovation.

- Expanding Applications: Proliferation of smart textiles in healthcare, sports, industrial safety, and military.

Challenges in the Smart Fabrics Industry Market

Despite its promising outlook, the Smart Fabrics Industry faces several significant challenges. Regulatory hurdles, particularly concerning data privacy and the certification of medical-grade smart textiles, can slow down market entry and product adoption. Supply chain complexities arise from the need to integrate disparate components, including advanced electronics and specialized textiles, which can lead to higher production costs and potential bottlenecks. Competitive pressures are intense, with a constant need for innovation and differentiation in a rapidly evolving market. Furthermore, consumer adoption is sometimes hindered by concerns about the cost, durability, and washability of smart garments. The wearable technology market also faces challenges related to battery life and power management for continuously active smart textiles, impacting user experience and product reliability.

- Regulatory Hurdles: Data privacy concerns, medical device certification complexities.

- Supply Chain Issues: Integration of electronics and textiles, cost of advanced materials.

- Competitive Pressures: Rapid technological obsolescence, need for continuous innovation.

- Consumer Adoption Barriers: High initial cost, durability and washability concerns, power management limitations.

Emerging Opportunities in Smart Fabrics Industry

Emerging opportunities in the Smart Fabrics Industry are abundant, fueled by ongoing technological breakthroughs and strategic market expansion. The development of truly self-powered smart textiles through advanced energy harvesting techniques presents a significant avenue for growth, eliminating the need for external charging. Strategic partnerships between textile manufacturers, technology companies, and healthcare providers are crucial for co-creating innovative solutions for personalized medicine and remote patient monitoring. Market expansion into emerging economies, where the demand for affordable and functional smart apparel is growing, offers substantial potential. The integration of AI and machine learning capabilities within smart fabrics will unlock predictive analytics for health and performance, creating new service-based revenue streams and enhancing the overall user experience in the connected clothing market.

Leading Players in the Smart Fabrics Industry Sector

- Adidas AG

- NIKE Inc

- ThermoSoft International Corporation

- Ohmatex

- AIQ Smart Clothing Inc

- OTEX Specialty Narrow Fabrics Inc

- Sensoria Inc

- Schoeller Textil AG

- Interactive Wear AG

- Kolon Industries Inc

Key Milestones in Smart Fabrics Industry Industry

- April 2023: A team at Cambridge University has developed a fabric that would incorporate LEDs, energy harvesting, storage capabilities, and sensors into clothing. The researchers have exhibited a method to produce next-generation smart textiles inexpensively and without changing the technology currently used for textile manufacturing. This development signifies a major step towards mass-producible, integrated smart fabrics.

- March 2023: Schoeller Textil AG Launches Re-Source, A Sustainable Textile Collection. This collection offers breathability and thermal regulation, is wind and water-resistant, and is made from bio-based, post- and pre-consumer materials, including recycled polyester and spandex. This highlights the growing importance of sustainability in the functional textiles market.

- April 2022: At the Smart Textiles Summit, Advanced Functional Fabrics of America (AFFOA) presented and set up an exhibit where the company displayed the advanced functional fiber preforms and fibers with LED chips. AFFOA is at the forefront of technological advancements for high-tech textile systems, showcasing cutting-edge materials for the wearable technology market.

Strategic Outlook for Smart Fabrics Industry Market

The strategic outlook for the Smart Fabrics Industry is exceptionally promising, marked by continuous innovation and expanding market applications. Growth accelerators include the increasing convergence of fashion and technology, leading to more aesthetically pleasing and integrated connected clothing. The growing emphasis on preventative healthcare and personalized wellness will drive demand for sophisticated smart textiles in the medical sector. Further advancements in material science, particularly in biodegradable and sustainable smart fabrics, will address growing environmental concerns. Strategic investments in research and development, coupled with collaborative efforts between industry players, will be crucial for unlocking new functionalities and market segments, solidifying the position of smart fabrics as a transformative technology across diverse industries.

Smart Fabrics Industry Segmentation

-

1. Type

- 1.1. Passive Smart Fabrics

- 1.2. Active Fabrics

- 1.3. Ultra-smart Fabrics

-

2. Application

- 2.1. Fashion and Entertainment

- 2.2. Sports and Fitness

- 2.3. Medical

- 2.4. Transportation and Others

- 2.5. Space and Military

- 2.6. Industrial

Smart Fabrics Industry Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. Rest of the World

Smart Fabrics Industry Regional Market Share

Geographic Coverage of Smart Fabrics Industry

Smart Fabrics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 28.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Wearable Electronics Industry; Miniaturization of Electronics and Developments across Flexible Electronics

- 3.3. Market Restrains

- 3.3.1. High Initial Cost

- 3.4. Market Trends

- 3.4.1. Fashion and Entertainment Industry to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Fabrics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Passive Smart Fabrics

- 5.1.2. Active Fabrics

- 5.1.3. Ultra-smart Fabrics

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Fashion and Entertainment

- 5.2.2. Sports and Fitness

- 5.2.3. Medical

- 5.2.4. Transportation and Others

- 5.2.5. Space and Military

- 5.2.6. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Asia Pacific

- 5.3.3. Europe

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Smart Fabrics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Passive Smart Fabrics

- 6.1.2. Active Fabrics

- 6.1.3. Ultra-smart Fabrics

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Fashion and Entertainment

- 6.2.2. Sports and Fitness

- 6.2.3. Medical

- 6.2.4. Transportation and Others

- 6.2.5. Space and Military

- 6.2.6. Industrial

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Asia Pacific Smart Fabrics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Passive Smart Fabrics

- 7.1.2. Active Fabrics

- 7.1.3. Ultra-smart Fabrics

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Fashion and Entertainment

- 7.2.2. Sports and Fitness

- 7.2.3. Medical

- 7.2.4. Transportation and Others

- 7.2.5. Space and Military

- 7.2.6. Industrial

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Smart Fabrics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Passive Smart Fabrics

- 8.1.2. Active Fabrics

- 8.1.3. Ultra-smart Fabrics

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Fashion and Entertainment

- 8.2.2. Sports and Fitness

- 8.2.3. Medical

- 8.2.4. Transportation and Others

- 8.2.5. Space and Military

- 8.2.6. Industrial

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Smart Fabrics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Passive Smart Fabrics

- 9.1.2. Active Fabrics

- 9.1.3. Ultra-smart Fabrics

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Fashion and Entertainment

- 9.2.2. Sports and Fitness

- 9.2.3. Medical

- 9.2.4. Transportation and Others

- 9.2.5. Space and Military

- 9.2.6. Industrial

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Adidas AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 NIKE Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 ThermoSoft International Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Ohmatex

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 AIQ Smart Clothing Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 OTEX Specialty Narrow Fabrics Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Sensoria Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Schoeller Textil AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Interactive Wear AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Kolon Industries Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Adidas AG

List of Figures

- Figure 1: Global Smart Fabrics Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Smart Fabrics Industry Volume Breakdown (Million, %) by Region 2025 & 2033

- Figure 3: North America Smart Fabrics Industry Revenue (billion), by Type 2025 & 2033

- Figure 4: North America Smart Fabrics Industry Volume (Million), by Type 2025 & 2033

- Figure 5: North America Smart Fabrics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Smart Fabrics Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Smart Fabrics Industry Revenue (billion), by Application 2025 & 2033

- Figure 8: North America Smart Fabrics Industry Volume (Million), by Application 2025 & 2033

- Figure 9: North America Smart Fabrics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Smart Fabrics Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Smart Fabrics Industry Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Smart Fabrics Industry Volume (Million), by Country 2025 & 2033

- Figure 13: North America Smart Fabrics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Smart Fabrics Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Asia Pacific Smart Fabrics Industry Revenue (billion), by Type 2025 & 2033

- Figure 16: Asia Pacific Smart Fabrics Industry Volume (Million), by Type 2025 & 2033

- Figure 17: Asia Pacific Smart Fabrics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Asia Pacific Smart Fabrics Industry Volume Share (%), by Type 2025 & 2033

- Figure 19: Asia Pacific Smart Fabrics Industry Revenue (billion), by Application 2025 & 2033

- Figure 20: Asia Pacific Smart Fabrics Industry Volume (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Smart Fabrics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Smart Fabrics Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: Asia Pacific Smart Fabrics Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Asia Pacific Smart Fabrics Industry Volume (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Smart Fabrics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Smart Fabrics Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Smart Fabrics Industry Revenue (billion), by Type 2025 & 2033

- Figure 28: Europe Smart Fabrics Industry Volume (Million), by Type 2025 & 2033

- Figure 29: Europe Smart Fabrics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Smart Fabrics Industry Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Smart Fabrics Industry Revenue (billion), by Application 2025 & 2033

- Figure 32: Europe Smart Fabrics Industry Volume (Million), by Application 2025 & 2033

- Figure 33: Europe Smart Fabrics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Europe Smart Fabrics Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: Europe Smart Fabrics Industry Revenue (billion), by Country 2025 & 2033

- Figure 36: Europe Smart Fabrics Industry Volume (Million), by Country 2025 & 2033

- Figure 37: Europe Smart Fabrics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Smart Fabrics Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Rest of the World Smart Fabrics Industry Revenue (billion), by Type 2025 & 2033

- Figure 40: Rest of the World Smart Fabrics Industry Volume (Million), by Type 2025 & 2033

- Figure 41: Rest of the World Smart Fabrics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 42: Rest of the World Smart Fabrics Industry Volume Share (%), by Type 2025 & 2033

- Figure 43: Rest of the World Smart Fabrics Industry Revenue (billion), by Application 2025 & 2033

- Figure 44: Rest of the World Smart Fabrics Industry Volume (Million), by Application 2025 & 2033

- Figure 45: Rest of the World Smart Fabrics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Rest of the World Smart Fabrics Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: Rest of the World Smart Fabrics Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Rest of the World Smart Fabrics Industry Volume (Million), by Country 2025 & 2033

- Figure 49: Rest of the World Smart Fabrics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of the World Smart Fabrics Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smart Fabrics Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Smart Fabrics Industry Volume Million Forecast, by Type 2020 & 2033

- Table 3: Global Smart Fabrics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Smart Fabrics Industry Volume Million Forecast, by Application 2020 & 2033

- Table 5: Global Smart Fabrics Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Smart Fabrics Industry Volume Million Forecast, by Region 2020 & 2033

- Table 7: Global Smart Fabrics Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Smart Fabrics Industry Volume Million Forecast, by Type 2020 & 2033

- Table 9: Global Smart Fabrics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Smart Fabrics Industry Volume Million Forecast, by Application 2020 & 2033

- Table 11: Global Smart Fabrics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Smart Fabrics Industry Volume Million Forecast, by Country 2020 & 2033

- Table 13: Global Smart Fabrics Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Smart Fabrics Industry Volume Million Forecast, by Type 2020 & 2033

- Table 15: Global Smart Fabrics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Global Smart Fabrics Industry Volume Million Forecast, by Application 2020 & 2033

- Table 17: Global Smart Fabrics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Global Smart Fabrics Industry Volume Million Forecast, by Country 2020 & 2033

- Table 19: Global Smart Fabrics Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Global Smart Fabrics Industry Volume Million Forecast, by Type 2020 & 2033

- Table 21: Global Smart Fabrics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Smart Fabrics Industry Volume Million Forecast, by Application 2020 & 2033

- Table 23: Global Smart Fabrics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Smart Fabrics Industry Volume Million Forecast, by Country 2020 & 2033

- Table 25: Global Smart Fabrics Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Global Smart Fabrics Industry Volume Million Forecast, by Type 2020 & 2033

- Table 27: Global Smart Fabrics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Global Smart Fabrics Industry Volume Million Forecast, by Application 2020 & 2033

- Table 29: Global Smart Fabrics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Smart Fabrics Industry Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Fabrics Industry?

The projected CAGR is approximately 28.4%.

2. Which companies are prominent players in the Smart Fabrics Industry?

Key companies in the market include Adidas AG, NIKE Inc, ThermoSoft International Corporation, Ohmatex, AIQ Smart Clothing Inc, OTEX Specialty Narrow Fabrics Inc , Sensoria Inc, Schoeller Textil AG, Interactive Wear AG, Kolon Industries Inc.

3. What are the main segments of the Smart Fabrics Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 39.51 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in Wearable Electronics Industry; Miniaturization of Electronics and Developments across Flexible Electronics.

6. What are the notable trends driving market growth?

Fashion and Entertainment Industry to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Initial Cost.

8. Can you provide examples of recent developments in the market?

April 2023 : A team at Cambridge University has developed a fabric that would incorporate LEDs, energy harvesting, storage capabilities, and sensors into clothing. The researchers have exhibited a method to produce next-generation smart textiles inexpensively and without changing the technology currently used for textile manufacturing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Fabrics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Fabrics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Fabrics Industry?

To stay informed about further developments, trends, and reports in the Smart Fabrics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence