Key Insights

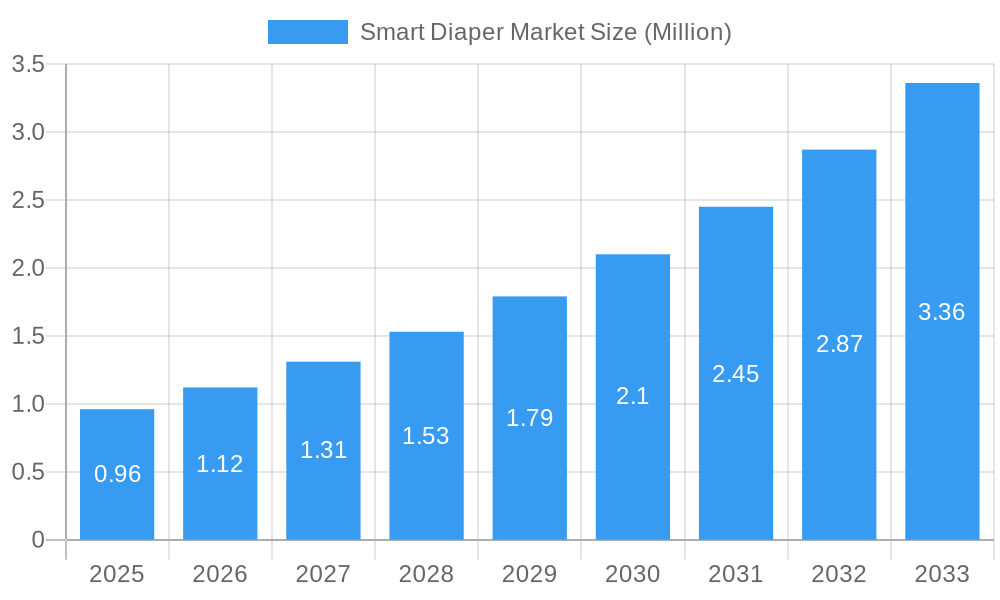

The global Smart Diaper Market is poised for significant expansion, projected to grow from an estimated $0.96 million in the base year 2025 to reach substantial figures by 2033. This impressive growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 16.98%, indicating a rapidly evolving and increasingly adopted segment within the larger healthcare and personal care industries. The primary drivers fueling this surge include the escalating demand for advanced infant care solutions that offer enhanced monitoring and convenience for parents, alongside a growing need for intelligent incontinence management for adults, particularly among aging populations. Technological advancements in sensor technology, connectivity, and data analytics are making smart diapers more accurate, user-friendly, and affordable, further accelerating market penetration. The ability of these smart diapers to provide real-time alerts for wetness, temperature, and even potential health indicators is revolutionizing how caregivers monitor health and hygiene.

Smart Diaper Market Market Size (In Million)

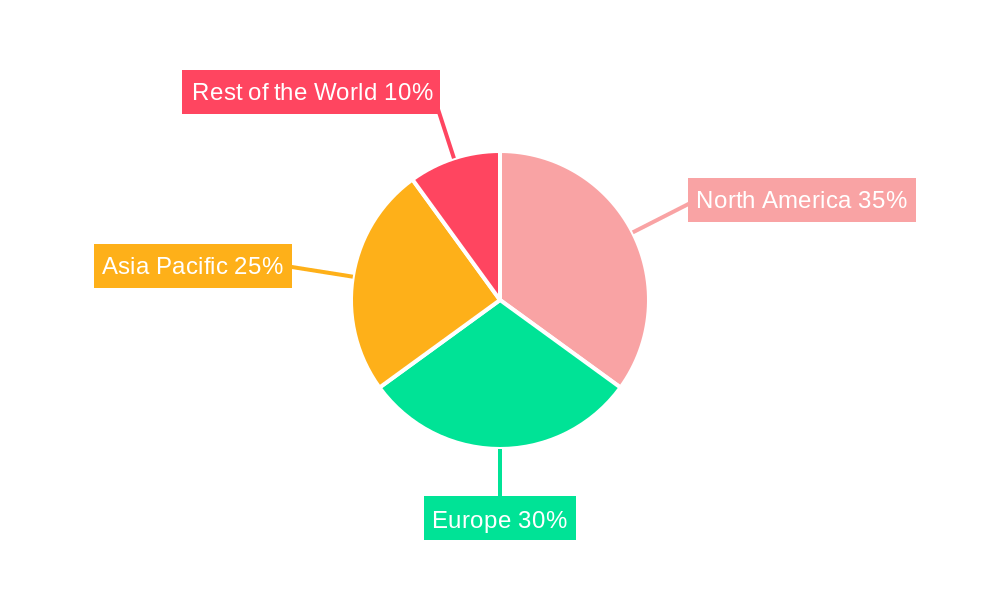

The market's trajectory is further shaped by distinct trends, such as the integration of AI and machine learning for predictive health insights derived from diaper usage, and the development of eco-friendly and sustainable smart diaper options. While the market enjoys strong growth, certain restraints may emerge, including the initial cost of smart diaper systems, potential data privacy concerns associated with connected devices, and the need for widespread consumer education regarding the benefits and usage of these innovative products. The market is segmented by end-user industry, with both Baby and Adult segments demonstrating considerable potential. Key players like Abena Holding A/S, Verily Life Sciences (Alphabet Inc.), and Smardii are at the forefront of innovation, driving the market forward with their diverse product portfolios and strategic investments in research and development. Regional analysis indicates robust demand in North America and Europe, with the Asia Pacific region expected to witness rapid growth due to increasing disposable incomes and a rising awareness of advanced healthcare technologies.

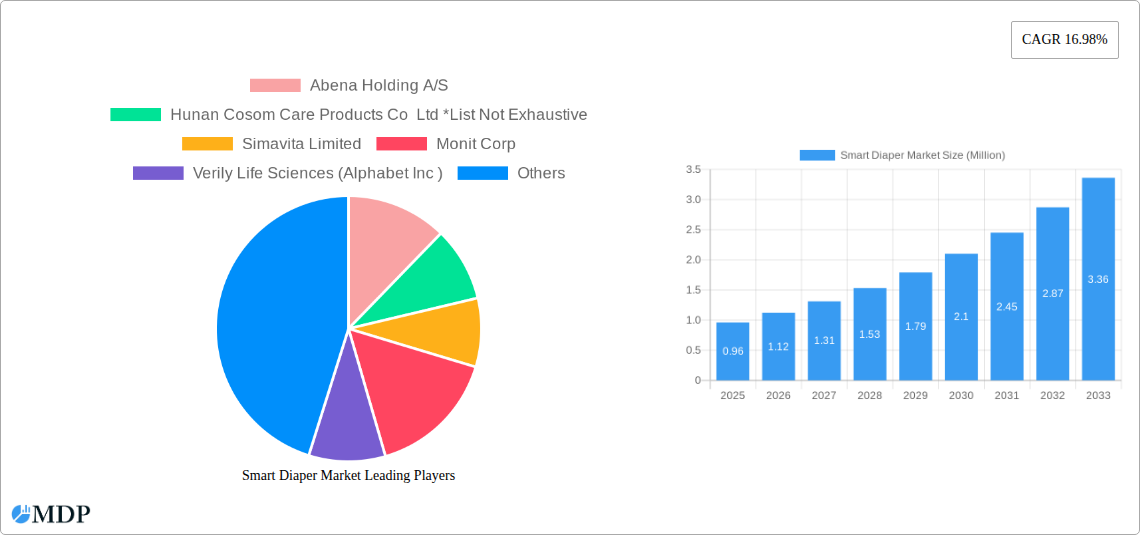

Smart Diaper Market Company Market Share

Smart Diaper Market Report: Unveiling the Future of Connected Childcare and Adult Incontinence Monitoring

This comprehensive Smart Diaper Market report delves into the burgeoning landscape of connected baby monitors and adult incontinence solutions. With a study period from 2019 to 2033, and a base year of 2025, this analysis provides deep insights into market dynamics, industry trends, leading segments, and key players driving innovation. Explore the projected CAGR of xx% for the forecast period 2025-2033, and understand the strategic imperatives for stakeholders in this rapidly evolving sector. This report is essential for investors, manufacturers, and healthcare providers seeking to capitalize on the global smart diaper market, encompassing both the baby and adult end-user industries.

Smart Diaper Market Market Dynamics & Concentration

The smart diaper market is characterized by moderate concentration, with a few key players holding significant market share, particularly in the niche baby monitoring segment. Innovation remains the primary driver, fueled by advancements in sensor technology, AI, and connectivity. Regulatory frameworks are still nascent but are expected to mature as the technology gains wider adoption, especially concerning data privacy and medical device classification for certain advanced functionalities. Product substitutes include traditional diapers augmented with external monitoring devices, but the integrated nature of smart diapers offers a distinct advantage. End-user trends are leaning towards convenience, early detection of health issues, and remote monitoring capabilities. Mergers and acquisitions (M&A) activity is anticipated to increase as larger technology and healthcare companies seek to enter this promising market, with an estimated xx M&A deal count expected in the forecast period.

- Market Concentration: Moderate, with key players like Verily Life Sciences and Monit Corp leading in certain sub-segments.

- Innovation Drivers: Miniaturization of sensors, AI-powered analytics, battery efficiency, and improved user interfaces.

- Regulatory Frameworks: Emerging, with focus on data security and accuracy of health monitoring.

- Product Substitutes: Traditional diapers with external sensors, wearable health trackers.

- End-User Trends: Demand for proactive health management, reduced caregiver burden, and enhanced baby safety.

- M&A Activities: Expected to rise as the market matures and consolidates.

Smart Diaper Market Industry Trends & Analysis

The smart diaper market is experiencing robust growth driven by increasing parental awareness of infant health and the rising prevalence of adult incontinence. Technological disruptions, particularly in the realm of the Internet of Things (IoT) and artificial intelligence (AI), are revolutionizing product capabilities. Smart diapers are no longer just about detecting wetness; they are evolving into sophisticated health monitoring devices capable of tracking vital signs, sleep patterns, and even predicting potential health anomalies. Consumer preferences are shifting towards integrated solutions that offer peace of mind and proactive health management. This transition is fostering a competitive landscape where companies are differentiating themselves through advanced analytics, user-friendly applications, and seamless integration with other smart home devices. Market penetration is still in its early stages, but the estimated market penetration rate is projected to reach xx% by 2033, indicating significant untapped potential. The global smart diaper market size is projected to reach $xx Million by 2033.

- Market Growth Drivers: Increasing disposable incomes, growing adoption of smart home technology, and a rising focus on preventative healthcare.

- Technological Disruptions: Integration of AI for predictive health alerts, miniaturization of flexible electronics, and development of eco-friendly sensor materials.

- Consumer Preferences: Demand for non-intrusive monitoring, real-time data, and actionable health insights.

- Competitive Dynamics: Intensifying competition between established baby monitor brands and emerging tech startups, with a focus on data analytics and personalized user experiences.

Leading Markets & Segments in Smart Diaper Market

The baby segment currently dominates the smart diaper market, driven by heightened parental concerns for infant well-being and the widespread adoption of smart baby monitoring devices. North America leads in market penetration, owing to high disposable incomes, advanced technological infrastructure, and a strong consumer appetite for innovative childcare solutions. Within North America, the United States represents a significant market due to early adoption rates and the presence of key research and development hubs. Economic policies supporting technological innovation and a robust healthcare system further bolster the region's dominance.

- Dominant End-User Industry: Baby

- Key Drivers:

- Heightened parental anxiety regarding infant health and safety.

- Growing trend of "connected parenting" and smart nursery setups.

- Technological advancements making smart diapers more affordable and feature-rich.

- Increased awareness of potential health issues like diaper rash and infections, necessitating timely detection.

- Dominance Analysis: The baby segment benefits from a more established ecosystem of connected devices and a strong emotional appeal for parents investing in their child's health. The development of AI-powered baby monitors that integrate with smart diaper data further solidifies this segment's lead.

- Key Drivers:

The adult segment is poised for substantial growth, driven by an aging global population, increasing prevalence of chronic diseases leading to incontinence, and a growing desire for independent living among the elderly. Europe is a key region for the adult segment, influenced by supportive healthcare policies and a high proportion of elderly individuals. The demand for discreet, reliable, and user-friendly incontinence management solutions is a significant catalyst for this segment's expansion.

- Emerging End-User Industry: Adult

- Key Drivers:

- Global aging population and the associated rise in incontinence issues.

- Advancements in sensor technology enabling more accurate and comfortable adult monitoring.

- Focus on enabling independent living and reducing the burden on caregivers.

- Integration with telehealth platforms for remote patient monitoring.

- Dominance Analysis: While currently smaller than the baby segment, the adult incontinence market presents a vast and growing opportunity. The development of smart diapers for adults offers a significant improvement over traditional methods, promoting dignity and better health outcomes.

- Key Drivers:

Smart Diaper Market Product Developments

Product innovations in the smart diaper market are rapidly advancing beyond simple wetness detection. Companies are integrating advanced sensors to monitor body temperature, track activity levels, and even detect early signs of urinary tract infections (UTIs) or dehydration. The use of AI and machine learning algorithms allows these smart diapers to provide personalized insights and predictive alerts to caregivers and healthcare professionals. This technological evolution offers significant competitive advantages by enhancing user experience, improving health outcomes, and creating a more proactive approach to infant and adult care. The market is seeing the emergence of self-powered and wirelessly connected smart diapers, further streamlining their integration into daily life.

Key Drivers of Smart Diaper Market Growth

The smart diaper market is propelled by several key drivers. Technological advancements, including the miniaturization of sensors, development of flexible electronics, and sophisticated AI algorithms for data analysis, are central. Economic factors such as increasing disposable incomes and a growing demand for convenience and preventative healthcare solutions play a crucial role. Furthermore, regulatory support for digital health technologies and an aging global population leading to a higher demand for incontinence management solutions are significant growth catalysts. The increasing adoption of smart home ecosystems also fosters the integration of smart diapers.

Challenges in the Smart Diaper Market Market

Despite its promising growth, the smart diaper market faces several challenges. High initial product cost can be a barrier for widespread adoption, particularly in price-sensitive markets. Concerns regarding data privacy and security are paramount, requiring robust encryption and compliance with regulations. The need for standardization in data protocols and device interoperability is crucial for seamless integration. Furthermore, challenges in battery life and disposal of electronic components within diapers present environmental and practical hurdles. Consumer education on the benefits and proper usage of smart diapers is also essential.

Emerging Opportunities in Smart Diaper Market

Emerging opportunities in the smart diaper market are numerous. The integration with telehealth platforms for remote patient monitoring presents a significant avenue for growth, particularly in the adult segment. Partnerships with healthcare providers and insurance companies can drive adoption and reimbursement. Further miniaturization and cost reduction of sensor technology will make smart diapers more accessible. The development of biodegradable smart diapers addresses environmental concerns and can attract eco-conscious consumers. Expansion into emerging markets with growing middle classes and increasing awareness of advanced healthcare solutions offers substantial long-term growth potential.

Leading Players in the Smart Diaper Market Sector

- Abena Holding A/S

- Hunan Cosom Care Products Co Ltd

- Simavita Limited

- Monit Corp

- Verily Life Sciences (Alphabet Inc)

- Smardii

- Sinopulsar Technology Inc

- Pixie Scientific

Key Milestones in Smart Diaper Market Industry

- March 2023: An innovative smart diaper utilizing a basic pencil-on-paper electrode sensor array treated with a sodium chloride solution was developed by an international team of scientists funded by the NIH and NSF. This technology, developed at Penn State, can detect urine dampness and has the potential for wearable, self-powered health monitors to predict serious health issues.

- January 2023: Chillax introduced its latest solutions at CES, including Giraffe AI, an advanced AI-powered baby monitor for danger notifications, and Thermo AI, a multispectral imaging baby monitor that detects body core temperature and alerts for substantial temperature changes in the diaper area.

Strategic Outlook for Smart Diaper Market Market

The smart diaper market is set for exponential growth, driven by continuous innovation and increasing demand for connected health solutions. The strategic outlook involves focusing on developing more affordable, user-friendly, and multi-functional smart diapers. Strategic partnerships with healthcare institutions and technology providers will be crucial for expanding market reach and integrating smart diaper data into broader health management ecosystems. Companies that prioritize data security, privacy, and the development of sustainable products will likely gain a significant competitive advantage. The future of the smart diaper market lies in its evolution from a simple monitoring device to an integral part of comprehensive preventative and proactive healthcare for all age groups.

Smart Diaper Market Segmentation

-

1. End-User Industry

- 1.1. Baby

- 1.2. Adult

Smart Diaper Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Smart Diaper Market Regional Market Share

Geographic Coverage of Smart Diaper Market

Smart Diaper Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Large Geriatric Population in Developed Countries; High Birth Rates and Rise in Disposable Incomes in Emerging Markets

- 3.3. Market Restrains

- 3.3.1. Infections and Kidney Problems Associated with their Prolonged Use might Act as a Restraint for Market Growth

- 3.4. Market Trends

- 3.4.1. The Rising Baby Care Will Act as a Major Driver of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Diaper Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Baby

- 5.1.2. Adult

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. North America Smart Diaper Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6.1.1. Baby

- 6.1.2. Adult

- 6.1. Market Analysis, Insights and Forecast - by End-User Industry

- 7. Europe Smart Diaper Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-User Industry

- 7.1.1. Baby

- 7.1.2. Adult

- 7.1. Market Analysis, Insights and Forecast - by End-User Industry

- 8. Asia Pacific Smart Diaper Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-User Industry

- 8.1.1. Baby

- 8.1.2. Adult

- 8.1. Market Analysis, Insights and Forecast - by End-User Industry

- 9. Rest of the World Smart Diaper Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-User Industry

- 9.1.1. Baby

- 9.1.2. Adult

- 9.1. Market Analysis, Insights and Forecast - by End-User Industry

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Abena Holding A/S

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Hunan Cosom Care Products Co Ltd *List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Simavita Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Monit Corp

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Verily Life Sciences (Alphabet Inc )

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Smardii

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Sinopulsar Technology Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Pixie Scientific

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Abena Holding A/S

List of Figures

- Figure 1: Global Smart Diaper Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Smart Diaper Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 3: North America Smart Diaper Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 4: North America Smart Diaper Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Smart Diaper Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Smart Diaper Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 7: Europe Smart Diaper Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 8: Europe Smart Diaper Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Smart Diaper Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Smart Diaper Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 11: Asia Pacific Smart Diaper Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 12: Asia Pacific Smart Diaper Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Smart Diaper Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Smart Diaper Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 15: Rest of the World Smart Diaper Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 16: Rest of the World Smart Diaper Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Smart Diaper Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smart Diaper Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 2: Global Smart Diaper Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Smart Diaper Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: Global Smart Diaper Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Smart Diaper Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Global Smart Diaper Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Smart Diaper Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: Global Smart Diaper Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Smart Diaper Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 10: Global Smart Diaper Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Diaper Market?

The projected CAGR is approximately 16.98%.

2. Which companies are prominent players in the Smart Diaper Market?

Key companies in the market include Abena Holding A/S, Hunan Cosom Care Products Co Ltd *List Not Exhaustive, Simavita Limited, Monit Corp, Verily Life Sciences (Alphabet Inc ), Smardii, Sinopulsar Technology Inc, Pixie Scientific.

3. What are the main segments of the Smart Diaper Market?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Large Geriatric Population in Developed Countries; High Birth Rates and Rise in Disposable Incomes in Emerging Markets.

6. What are the notable trends driving market growth?

The Rising Baby Care Will Act as a Major Driver of the Market.

7. Are there any restraints impacting market growth?

Infections and Kidney Problems Associated with their Prolonged Use might Act as a Restraint for Market Growth.

8. Can you provide examples of recent developments in the market?

March 2023 - An innovative smart diaper has been created by an international team of scientists, with funding from the National Institutes of Health (NIH) and the National Science Foundation (NSF). Developed at Penn State, this diaper utilizes a basic pencil-on-paper design, incorporating an electrode sensor array treated with a sodium chloride solution. This array can detect dampness caused by urine. The simplicity and affordability of this sensor array could potentially pave the way for wearable, self-powered health monitors. These monitors could be used not only in smart diapers but also to predict serious health issues such as cardiac arrest and pneumonia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Diaper Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Diaper Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Diaper Market?

To stay informed about further developments, trends, and reports in the Smart Diaper Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence