Key Insights

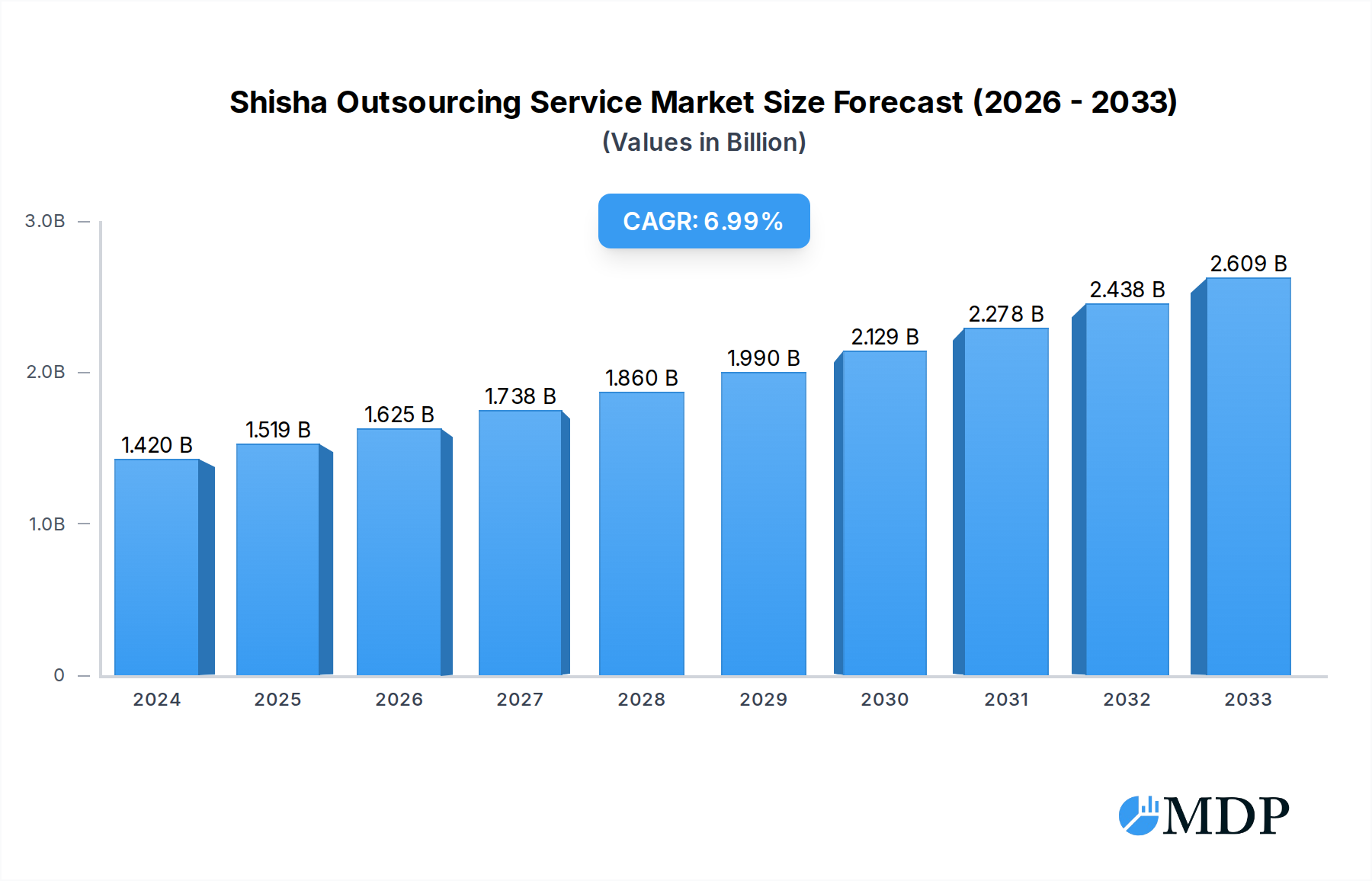

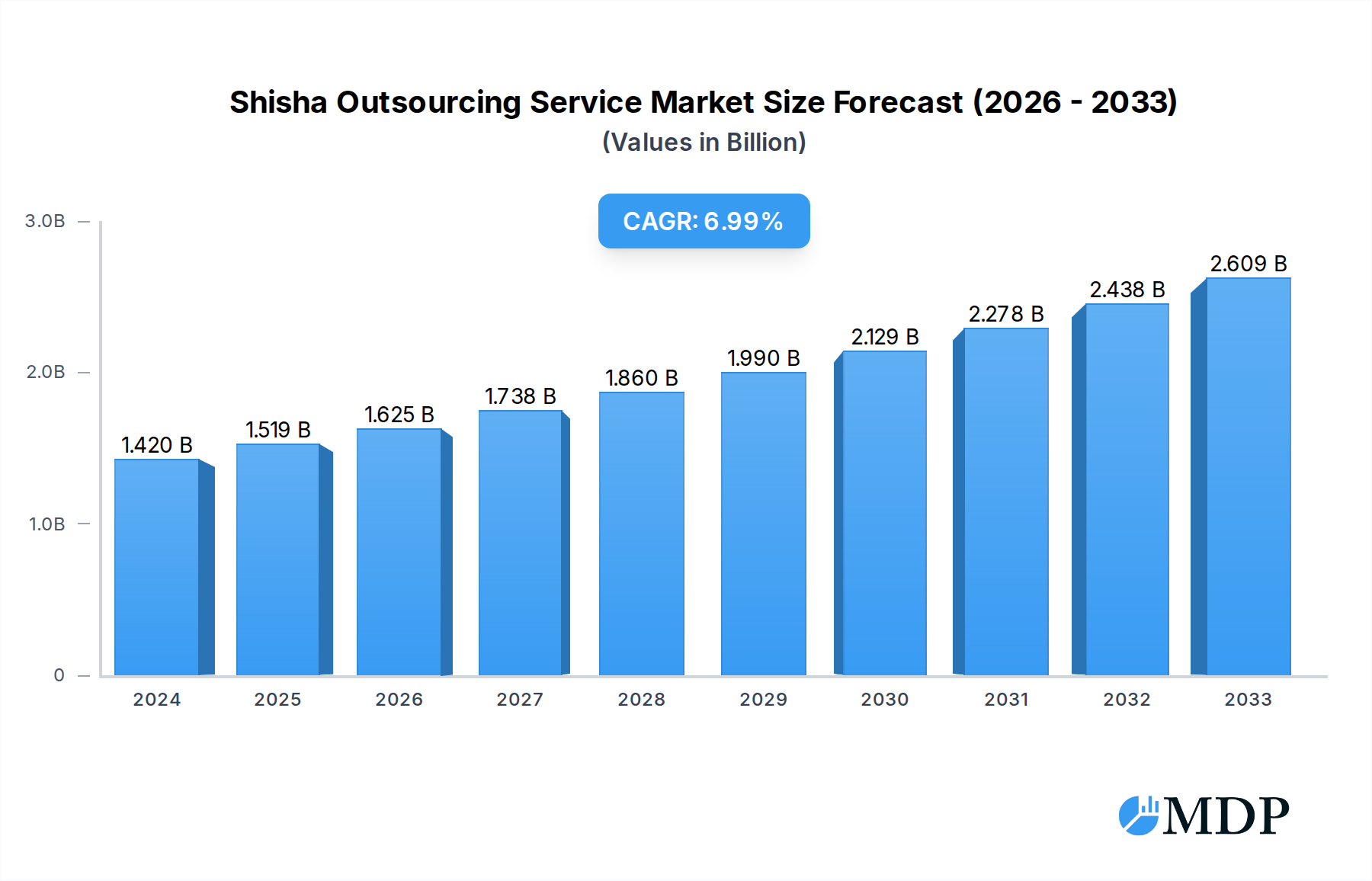

The global Shisha Outsourcing Service market is poised for significant expansion, projected to reach an estimated $1.42 billion in 2024. This growth is fueled by a robust CAGR of 6.8%, indicating a dynamic and expanding sector. Key drivers underpinning this upward trajectory include the increasing popularity of shisha lounges and cafes as social hubs, particularly among younger demographics. The rising disposable incomes in emerging economies and the growing trend of experiential dining and entertainment further bolster demand for shisha-related services. Furthermore, the convenience and quality assurance offered by outsourcing specialized shisha operations, from sourcing premium tobacco and equipment to managing the overall customer experience, are becoming increasingly attractive to businesses looking to optimize their operations and focus on core competencies. The market is segmented by application into Bar, Dining Room, and Other, with Applications in Bars and Dining Rooms expected to lead due to the integrated nature of shisha services in hospitality settings.

Shisha Outsourcing Service Market Size (In Billion)

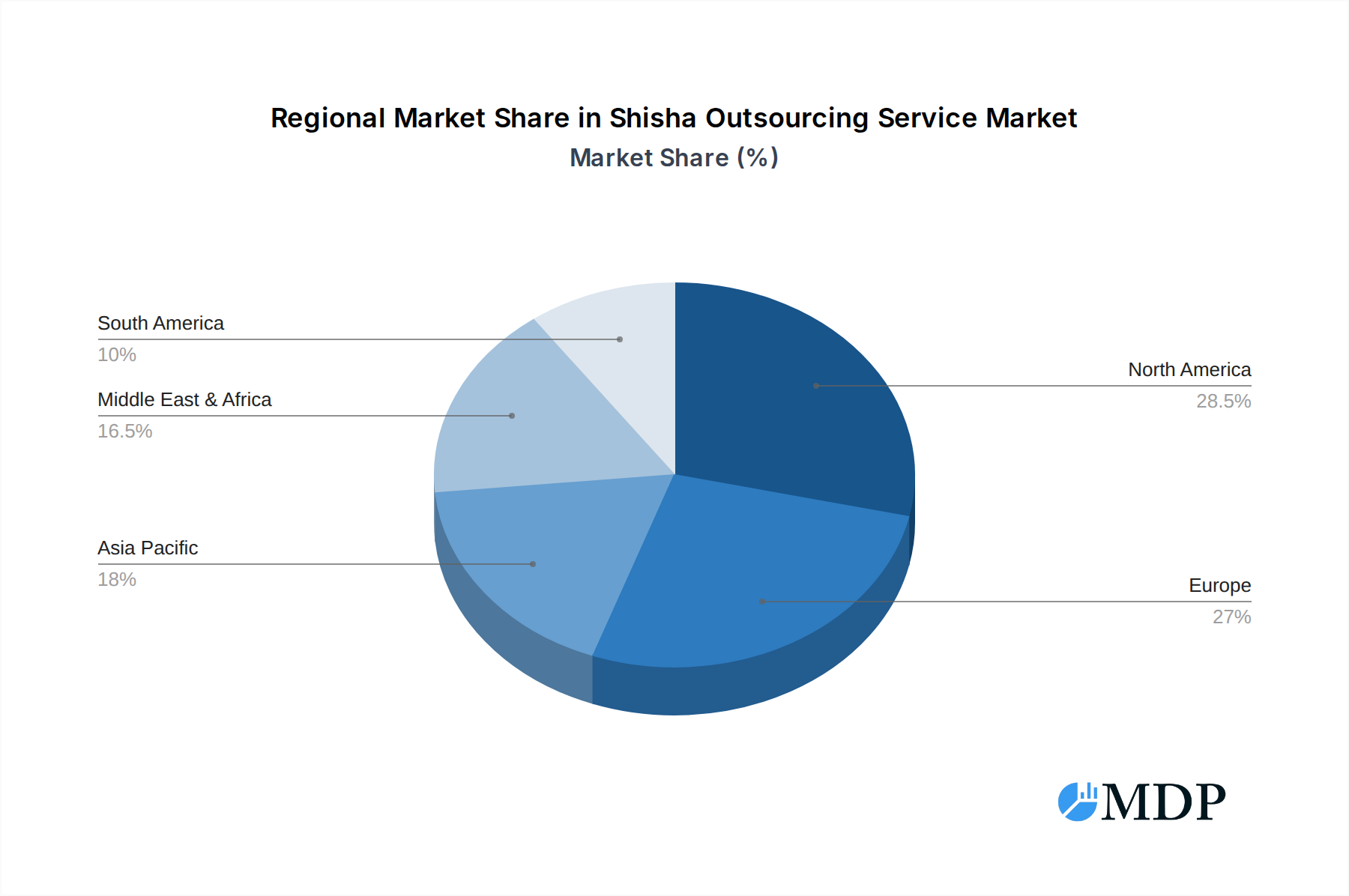

The market's evolution is also shaped by distinct trends, such as the introduction of innovative shisha flavors and equipment, the growing demand for premium and artisanal shisha experiences, and the rise of online platforms facilitating shisha rentals and delivery services. While the market presents substantial opportunities, restraints such as evolving regulatory landscapes concerning shisha consumption in public places and potential health concerns associated with smoking can pose challenges. However, the industry is actively adapting through the development of cleaner smoking alternatives and enhanced product safety standards. The market's growth is expected to be geographically diverse, with North America and Europe leading in adoption, while Asia Pacific and the Middle East & Africa show strong potential for rapid expansion due to cultural affinities and burgeoning hospitality sectors. The "Tobacco," "Equipment," and "Accessories" types represent core offerings within this outsourcing landscape.

Shisha Outsourcing Service Company Market Share

Shisha Outsourcing Service Market Dynamics & Concentration

The Shisha Outsourcing Service market is experiencing dynamic shifts, characterized by moderate concentration. Key innovation drivers include the development of novel shisha flavors, advanced heating technologies, and user-friendly electronic shisha devices. Regulatory frameworks, particularly concerning health and safety standards, play a significant role in shaping market entry and operational compliance. Product substitutes, such as traditional cigarettes and other smoking alternatives, exert a constant competitive pressure. End-user trends are leaning towards premium experiences, customized flavors, and the convenience offered by outsourcing operational aspects of shisha lounges and bars. Mergers and acquisitions (M&A) activity is observed, with an estimated xx M&A deals valued at over $XX billion in the historical period. Market share for leading players is estimated to be between 10-15%, indicating room for further consolidation.

Shisha Outsourcing Service Industry Trends & Analysis

The Shisha Outsourcing Service industry is projected for robust growth, driven by evolving consumer preferences and the increasing demand for specialized services in the hospitality sector. The Compound Annual Growth Rate (CAGR) is estimated to be XX% during the forecast period. Market penetration is steadily increasing as businesses recognize the cost-effectiveness and efficiency gains associated with outsourcing shisha operations. Technological disruptions, such as the integration of AI for inventory management and personalized customer recommendations, are transforming the landscape. Consumer preferences are shifting towards more diverse and high-quality shisha experiences, demanding a wider array of premium tobaccos and innovative accessories. Competitive dynamics are intensifying, with both established players and emerging startups vying for market share through service differentiation and strategic alliances. The increasing popularity of shisha lounges as social hubs, particularly among younger demographics, is a significant growth catalyst. The focus on creating unique ambiance and offering curated shisha selections further fuels the demand for expert outsourcing solutions.

Leading Markets & Segments in Shisha Outsourcing Service

The Bar segment is currently the dominant market within the Shisha Outsourcing Service industry, driven by its widespread adoption as a primary revenue-generating channel. In this segment, Tobacco represents the most significant type, accounting for an estimated XX% of market value. Key drivers for the dominance of the Bar segment include:

- Economic Policies: Favorable tourism and hospitality policies in various regions encourage the establishment and expansion of bars offering shisha services.

- Infrastructure: The availability of suitable commercial spaces and robust supply chains for shisha products contribute to the growth of bars.

- Consumer Behavior: The perception of bars as social gathering spots where shisha is an integral part of the experience is a major influence.

The Dining Room segment is also a significant contributor, with Equipment outsourcing playing a crucial role in maintaining operational efficiency and offering diverse shisha options. Key drivers for this segment include:

- Lifestyle Trends: The growing trend of experiential dining where shisha enhances the overall meal experience.

- Restaurant Diversification: Restaurants looking to offer unique value propositions often integrate shisha services, requiring specialized outsourcing.

The Other segment, encompassing lounges and dedicated shisha cafes, shows promising growth, particularly driven by the demand for Accessories. This segment benefits from:

- Niche Market Appeal: Catering to enthusiasts who seek specialized knowledge and a refined shisha experience.

- Product Innovation: The demand for premium accessories and customizable shisha setups fuels growth in this segment.

Geographically, North America and Europe are leading markets, with countries like the United States, United Kingdom, and Germany showing substantial market penetration. The increasing disposable income and acceptance of shisha culture in these regions are significant contributing factors.

Shisha Outsourcing Service Product Developments

Product developments in the Shisha Outsourcing Service market are centered on enhancing user experience and operational efficiency. Innovations include the creation of low-nicotine and organic shisha tobaccos, catering to health-conscious consumers. Advanced electronic shisha devices offering precise temperature control and digital flavor profiles are gaining traction. Furthermore, smart accessories, such as self-heating coals and automated cleaning systems, are being developed to simplify operations for service providers. These advancements aim to provide a competitive edge by offering superior quality, convenience, and a personalized shisha experience, aligning with evolving market demands and technological trends.

Key Drivers of Shisha Outsourcing Service Growth

Several key drivers are fueling the growth of the Shisha Outsourcing Service market. Economically, the increasing disposable income and a growing demand for premium leisure experiences are paramount. Technologically, advancements in shisha device design, flavor innovation, and online ordering platforms enhance accessibility and appeal. Regulatory frameworks, when supportive of regulated shisha services, can also act as a growth catalyst. The rising popularity of shisha lounges as social hubs, particularly among millennials and Gen Z, further propels market expansion. Outsourcing providers are capitalizing on these trends by offering specialized expertise in flavor curation, operational management, and compliance.

Challenges in the Shisha Outsourcing Service Market

Despite robust growth, the Shisha Outsourcing Service market faces significant challenges. Regulatory hurdles remain a primary concern, with varying and sometimes stringent health and safety regulations across different jurisdictions potentially increasing operational costs and limiting market entry. Supply chain disruptions, particularly in sourcing premium tobaccos and specialized equipment, can impact service reliability and profitability. Intense competitive pressures from both established players and new entrants necessitate continuous innovation and cost-effective solutions. Furthermore, the perception of shisha as a health risk in some segments of the population poses a challenge to broader market acceptance.

Emerging Opportunities in Shisha Outsourcing Service

Emerging opportunities in the Shisha Outsourcing Service market are ripe for exploration. Technological breakthroughs in creating healthier shisha alternatives, such as nicotine-free or herbal blends, present a significant growth avenue. Strategic partnerships between outsourcing providers and hospitality groups, or even e-commerce platforms, can unlock new customer bases and service offerings. The expansion into emerging markets with a nascent but growing shisha culture, supported by localized service adaptations, offers considerable untapped potential. Furthermore, the development of subscription-based models for shisha supplies and maintenance services can foster customer loyalty and recurring revenue streams.

Leading Players in the Shisha Outsourcing Service Sector

- Shisha Art

- Fuma

- Keif

- ShishaSol

- Puff Hookah

- One Shishas

- Ashlabs

- Hookah Zone

- Fumaro

- LSS

- El Patron

- Al Sukariyah

- Wolk Shisha

- RunaShisha

- SoBe Hookah

- Laikalounge

- AficionadoShisha

- Shisha Les Noms

- APRIDE Hookah

- Gustoy Dim

- Shisha Pro

- ALLO SHISHA

Key Milestones in Shisha Outsourcing Service Industry

- 2019: Increased adoption of online ordering platforms for shisha delivery services.

- 2020: Emergence of novel, premium shisha tobacco blends catering to sophisticated palates.

- 2021: Introduction of advanced electronic shisha devices with enhanced features and safety.

- 2022: Growing trend of shisha lounges focusing on unique ambiance and curated experiences.

- 2023: Increased M&A activity with consolidation among smaller outsourcing providers.

- 2024: Development of eco-friendly shisha accessories and sustainable sourcing practices.

- 2025: Predicted surge in AI-driven inventory and customer management solutions for shisha businesses.

Strategic Outlook for Shisha Outsourcing Service Market

The strategic outlook for the Shisha Outsourcing Service market is characterized by a focus on innovation, customization, and sustainable growth. Companies will continue to invest in research and development to introduce healthier shisha alternatives and advanced electronic devices. Expanding service portfolios to include end-to-end management solutions, from procurement to customer service, will be crucial. Strategic alliances and geographical expansion into underserved markets will drive revenue growth. Emphasizing exceptional customer experiences and adapting to evolving consumer preferences for convenience and premium offerings will be key to sustained market leadership. The integration of digital technologies for operational efficiency and enhanced customer engagement will remain a pivotal strategy.

Shisha Outsourcing Service Segmentation

-

1. Application

- 1.1. Bar

- 1.2. Dining Room

- 1.3. Other

-

2. Types

- 2.1. Tobacco

- 2.2. Equipment

- 2.3. Accessories

Shisha Outsourcing Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Shisha Outsourcing Service Regional Market Share

Geographic Coverage of Shisha Outsourcing Service

Shisha Outsourcing Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Shisha Outsourcing Service Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Bar

- 5.1.2. Dining Room

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Tobacco

- 5.2.2. Equipment

- 5.2.3. Accessories

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Shisha Outsourcing Service Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Bar

- 6.1.2. Dining Room

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Tobacco

- 6.2.2. Equipment

- 6.2.3. Accessories

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Shisha Outsourcing Service Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Bar

- 7.1.2. Dining Room

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Tobacco

- 7.2.2. Equipment

- 7.2.3. Accessories

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Shisha Outsourcing Service Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Bar

- 8.1.2. Dining Room

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Tobacco

- 8.2.2. Equipment

- 8.2.3. Accessories

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Shisha Outsourcing Service Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Bar

- 9.1.2. Dining Room

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Tobacco

- 9.2.2. Equipment

- 9.2.3. Accessories

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Shisha Outsourcing Service Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Bar

- 10.1.2. Dining Room

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Tobacco

- 10.2.2. Equipment

- 10.2.3. Accessories

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Shisha Art

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Fuma

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Keif

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ShishaSol

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Puff Hookah

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 One Shishas

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ashlabs

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hookah Zone

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fumaro

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 LSS

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 El Patron

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Al Sukariyah

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Wolk Shisha

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 RunaShisha

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 SoBe Hookah

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Laikalounge

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 AficionadoShisha

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Shisha Les Noms

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 APRIDE Hookah

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Gustoy Dim

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Shisha Pro

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 ALLO SHISHA

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 Shisha Art

List of Figures

- Figure 1: Global Shisha Outsourcing Service Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Shisha Outsourcing Service Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Shisha Outsourcing Service Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Shisha Outsourcing Service Revenue (billion), by Types 2025 & 2033

- Figure 5: North America Shisha Outsourcing Service Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Shisha Outsourcing Service Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Shisha Outsourcing Service Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Shisha Outsourcing Service Revenue (billion), by Application 2025 & 2033

- Figure 9: South America Shisha Outsourcing Service Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Shisha Outsourcing Service Revenue (billion), by Types 2025 & 2033

- Figure 11: South America Shisha Outsourcing Service Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Shisha Outsourcing Service Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Shisha Outsourcing Service Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Shisha Outsourcing Service Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Shisha Outsourcing Service Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Shisha Outsourcing Service Revenue (billion), by Types 2025 & 2033

- Figure 17: Europe Shisha Outsourcing Service Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Shisha Outsourcing Service Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Shisha Outsourcing Service Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Shisha Outsourcing Service Revenue (billion), by Application 2025 & 2033

- Figure 21: Middle East & Africa Shisha Outsourcing Service Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Shisha Outsourcing Service Revenue (billion), by Types 2025 & 2033

- Figure 23: Middle East & Africa Shisha Outsourcing Service Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Shisha Outsourcing Service Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Shisha Outsourcing Service Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Shisha Outsourcing Service Revenue (billion), by Application 2025 & 2033

- Figure 27: Asia Pacific Shisha Outsourcing Service Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Shisha Outsourcing Service Revenue (billion), by Types 2025 & 2033

- Figure 29: Asia Pacific Shisha Outsourcing Service Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Shisha Outsourcing Service Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Shisha Outsourcing Service Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Shisha Outsourcing Service Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Shisha Outsourcing Service Revenue billion Forecast, by Types 2020 & 2033

- Table 3: Global Shisha Outsourcing Service Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Shisha Outsourcing Service Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Shisha Outsourcing Service Revenue billion Forecast, by Types 2020 & 2033

- Table 6: Global Shisha Outsourcing Service Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Shisha Outsourcing Service Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Shisha Outsourcing Service Revenue billion Forecast, by Types 2020 & 2033

- Table 12: Global Shisha Outsourcing Service Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Shisha Outsourcing Service Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Shisha Outsourcing Service Revenue billion Forecast, by Types 2020 & 2033

- Table 18: Global Shisha Outsourcing Service Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Shisha Outsourcing Service Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Shisha Outsourcing Service Revenue billion Forecast, by Types 2020 & 2033

- Table 30: Global Shisha Outsourcing Service Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Shisha Outsourcing Service Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Global Shisha Outsourcing Service Revenue billion Forecast, by Types 2020 & 2033

- Table 39: Global Shisha Outsourcing Service Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Shisha Outsourcing Service Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Shisha Outsourcing Service?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Shisha Outsourcing Service?

Key companies in the market include Shisha Art, Fuma, Keif, ShishaSol, Puff Hookah, One Shishas, Ashlabs, Hookah Zone, Fumaro, LSS, El Patron, Al Sukariyah, Wolk Shisha, RunaShisha, SoBe Hookah, Laikalounge, AficionadoShisha, Shisha Les Noms, APRIDE Hookah, Gustoy Dim, Shisha Pro, ALLO SHISHA.

3. What are the main segments of the Shisha Outsourcing Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.42 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Shisha Outsourcing Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Shisha Outsourcing Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Shisha Outsourcing Service?

To stay informed about further developments, trends, and reports in the Shisha Outsourcing Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence