Key Insights

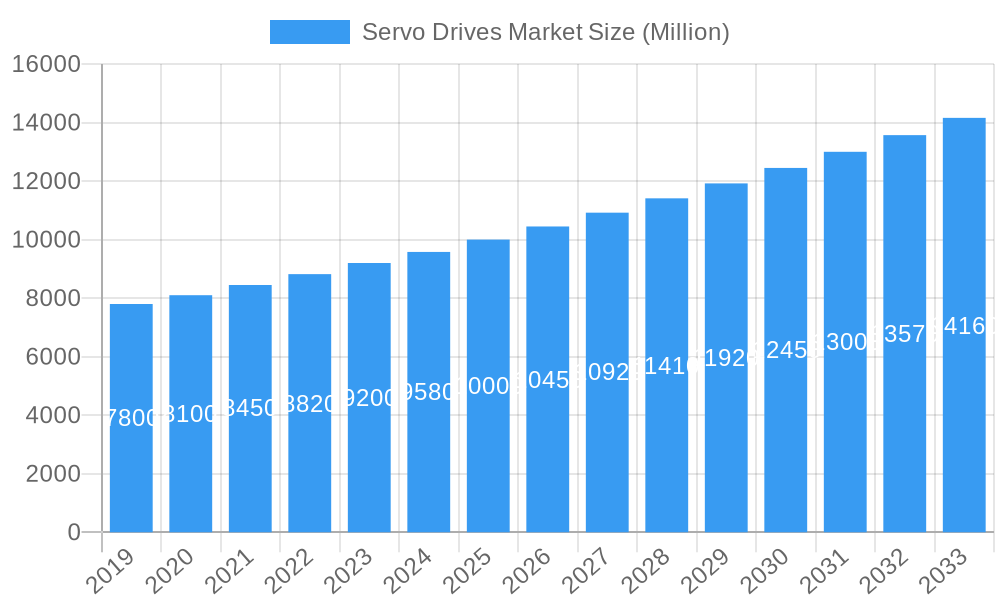

The global Servo Drives Market is poised for robust expansion, projected to reach a substantial market size of approximately $10,500 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 4.90%. This growth is predominantly fueled by the escalating adoption of industrial automation across various sectors, driven by the inherent need for enhanced precision, efficiency, and productivity. The surge in robotics, particularly in manufacturing and logistics, is a significant catalyst, as servo drives are indispensable for controlling the intricate movements and operations of robotic systems. Furthermore, the increasing integration of servo drives in advanced medical technology, exemplified by robotic surgery and diagnostic equipment, contributes to this upward trajectory. The aerospace industry's demand for high-performance and reliable motion control systems, coupled with the burgeoning renewable energy sector's reliance on precise tracking and control for solar and wind power generation, further solidifies the market's positive outlook. Key trends shaping the market include the miniaturization of servo drives, the integration of advanced features like AI and machine learning for predictive maintenance and optimized performance, and the growing emphasis on energy efficiency and sustainable manufacturing practices.

Servo Drives Market Market Size (In Billion)

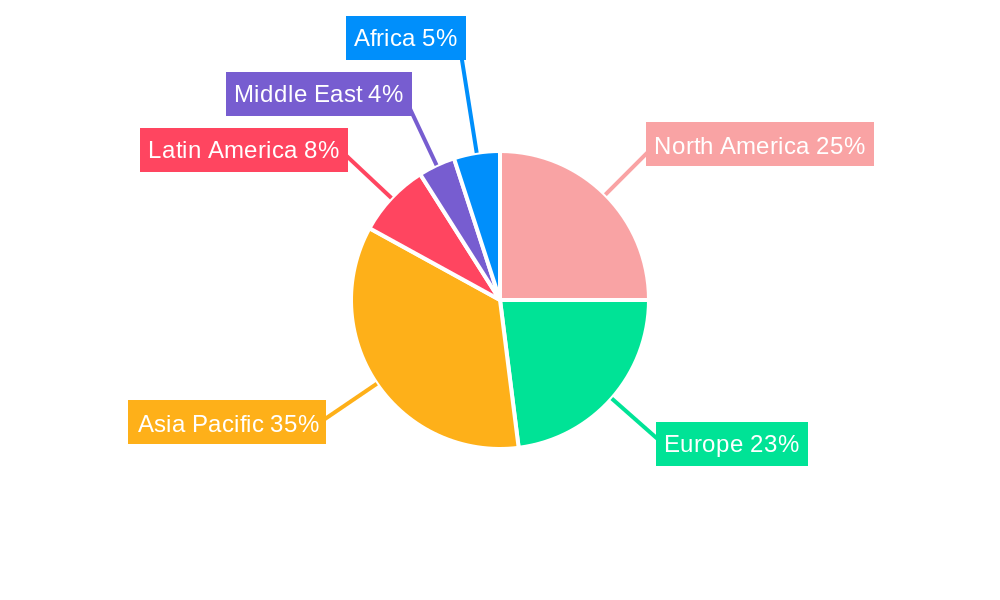

Despite the optimistic growth forecast, certain restraints could impact the market's full potential. The initial high cost of sophisticated servo drive systems can be a barrier for small and medium-sized enterprises (SMEs) looking to upgrade their automation capabilities. Additionally, the need for skilled labor to install, operate, and maintain these advanced systems presents a challenge in certain regions. The market is characterized by intense competition among established players like Rockwell Automation, ABB Ltd, Siemens, Yaskawa Electric Corporation, and Mitsubishi Electric Corporation, who are continuously innovating and expanding their product portfolios to cater to evolving industry demands. The geographical distribution of market growth is expected to be led by the Asia Pacific region, particularly China and India, owing to their strong manufacturing base and rapid industrialization. North America and Europe also represent significant markets, driven by advanced technological adoption and a focus on Industry 4.0 initiatives.

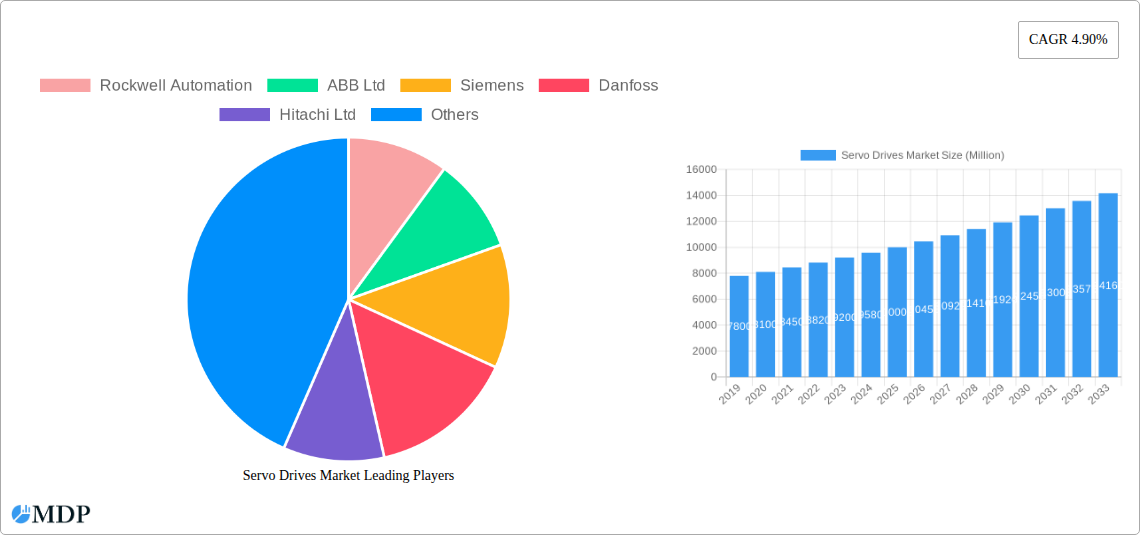

Servo Drives Market Company Market Share

Unlock the future of motion control with our comprehensive Servo Drives Market report. Delve into a rapidly evolving landscape driven by industrial automation, robotics, and the relentless pursuit of efficiency. This in-depth analysis, covering the study period of 2019–2033, with a base year of 2025, provides critical insights into market dynamics, key trends, leading players, and future growth opportunities. Discover how advancements in AC servo drives, DC servo drives, brushless servo drives, and stepper servo drives are revolutionizing applications in industrial automation, robotics, medical technology, aerospace, and renewable energy sectors. With a projected market size expected to reach USD X Million in 2025, this report is an indispensable resource for manufacturers, integrators, investors, and stakeholders seeking to capitalize on the burgeoning demand for high-performance motion control solutions.

Servo Drives Market Dynamics & Concentration

The Servo Drives Market is characterized by a moderate to high concentration, with a few dominant players like Rockwell Automation, ABB Ltd, Siemens, Danfoss, Hitachi Ltd, Emerson Electric Co, Mitsubishi Electric Corporation, Schneider Electric, WEG, and Yaskawa Electric Corporation holding significant market share. Innovation drivers are primarily centered around enhanced precision, increased speed, improved energy efficiency, and seamless integration with advanced automation systems, including Industrial Internet of Things (IIoT) and artificial intelligence (AI). Regulatory frameworks, particularly concerning safety standards and energy consumption, are increasingly influencing product development and market entry. While product substitutes exist, such as variable frequency drives (VFDs) for less demanding applications, servo drives offer superior performance for high-precision and dynamic tasks. End-user trends are strongly aligned with the adoption of Industry 4.0 principles, leading to a growing demand for sophisticated motion control solutions in sectors like industrial automation and robotics. Mergers and acquisitions (M&A) activities, though not excessively high in volume, have been strategic, focusing on acquiring niche technologies or expanding geographical reach, with a few notable deals in the past few years contributing to market consolidation.

Servo Drives Market Industry Trends & Analysis

The Servo Drives Market is poised for robust expansion, driven by the escalating adoption of industrial automation across diverse sectors. The global CAGR of xx% projected over the forecast period (2025–2033) underscores the significant growth trajectory of this market. A primary growth driver is the increasing demand for precision and speed in manufacturing processes, particularly in industries such as automotive, electronics, and packaging, where robotic systems and automated machinery are becoming indispensable. Technological disruptions, including the integration of AI and machine learning algorithms into servo drive controllers, are enabling predictive maintenance, real-time performance optimization, and enhanced collaborative robotics. Consumer preferences are shifting towards more energy-efficient and compact servo drive solutions that offer higher power density and reduced operational costs. The competitive dynamics within the market are characterized by continuous innovation, strategic partnerships, and a focus on providing integrated solutions rather than standalone products. Market penetration is deepening as servo drive technology becomes more accessible and cost-effective for small and medium-sized enterprises (SMEs), further fueling market growth. The rising complexity of modern manufacturing, coupled with the need for greater flexibility and customization, is propelling the demand for advanced servo drives capable of handling intricate motion profiles and multi-axis synchronization. Furthermore, the growing emphasis on Industry 4.0 initiatives worldwide is creating a fertile ground for the adoption of smart and connected servo drive systems that facilitate data exchange and enable enhanced control over automated production lines.

Leading Markets & Segments in Servo Drives Market

The Servo Drives Market is experiencing significant growth across various regions and segments. Geographically, North America and Europe currently lead the market, driven by advanced industrial infrastructure, high adoption rates of automation technologies, and stringent quality standards in manufacturing. Within these regions, countries like the United States, Germany, and China are pivotal due to their extensive manufacturing bases and strong emphasis on technological innovation.

Segment Breakdown:

By Type:

- AC Servo Drives: Dominating the market due to their widespread use in industrial automation, robotics, and CNC machines. Their high efficiency, reliability, and ability to handle a wide range of power requirements make them the preferred choice. Economic policies promoting industrial modernization and infrastructure development significantly boost AC servo drive adoption.

- Brushless Servo Drives: Exhibiting rapid growth, these drives offer superior performance in terms of speed, torque, and lifespan compared to brushed counterparts. Their application in high-performance robotics and aerospace is a key driver. Technological advancements in motor design and control algorithms further enhance their market penetration.

- DC Servo Drives: While historically significant, their market share is gradually declining in favor of AC and brushless variants, primarily used in niche applications and smaller-scale automation.

- Stepper Servo Drives: Increasingly integrated into applications requiring precise positioning and open-loop control, especially in areas like 3D printing and certain types of medical equipment.

By Application:

- Industrial Automation: The largest and fastest-growing application segment. This includes applications in material handling, packaging, assembly lines, and machine tools, where servo drives are crucial for precise and efficient operation. Government initiatives promoting smart manufacturing and Industry 4.0 adoption are major catalysts.

- Robotics: A key growth area, driven by the increasing deployment of industrial robots, collaborative robots (cobots), and autonomous mobile robots (AMRs) across various industries. The demand for high-precision and dynamic motion control in robotic arms and manipulators is a significant factor.

- Medical Technology: Growing demand for precision and reliability in medical devices, diagnostic equipment, and surgical robots. The development of advanced imaging systems and robotic surgery platforms relies heavily on sophisticated servo drive technology. Regulatory approvals and healthcare infrastructure investments play a crucial role.

- Aerospace: Application in aircraft manufacturing, flight simulators, and satellite deployment, where extreme precision, reliability, and performance under harsh conditions are paramount. Stringent safety standards and defense spending influence this segment.

- Renewable Energy: Increasingly used in solar panel tracking systems, wind turbine pitch control, and other renewable energy applications requiring precise motion control for optimal energy generation. Government incentives for clean energy adoption are a key driver.

Servo Drives Market Product Developments

Recent product developments in the Servo Drives Market are focused on enhancing integration, intelligence, and performance. For instance, Trio Motion Technology's launch of its DX4 servo drive and MX servo motor series offers OEMs a plug-and-play solution for faster machine development and cost-effectiveness. Similarly, Mitsubishi's MELSERVO MR-J5 series introduces TSN compatibility, enabling higher frequency response (3.5kHz) and faster communication cycle times (31.25μs), crucial for precision, dynamics, and multi-axis synchronization in demanding applications like printing and converting. These innovations underscore a trend towards more compact, energy-efficient, and intelligent servo drive systems that seamlessly integrate with higher-level control architectures.

Key Drivers of Servo Drives Market Growth

The Servo Drives Market is propelled by several key drivers. The escalating demand for automation in manufacturing, driven by the pursuit of increased productivity and reduced labor costs, is a primary catalyst. Technological advancements, particularly in motor efficiency, control algorithms, and integration with IIoT platforms, are enabling more sophisticated and cost-effective solutions. The growing adoption of robotics across industries, from automotive to healthcare, directly fuels the need for high-precision servo drives. Furthermore, government initiatives and regulations promoting energy efficiency and advanced manufacturing standards are encouraging the adoption of modern servo drive technologies. The increasing complexity of product designs and the need for greater manufacturing flexibility also contribute to the demand for versatile and precise motion control solutions.

Challenges in the Servo Drives Market Market

Despite its robust growth, the Servo Drives Market faces several challenges. Supply chain disruptions, particularly for critical electronic components, can impact production timelines and costs. Intense competition among established players and emerging manufacturers can lead to pricing pressures. Moreover, the initial investment cost for advanced servo drive systems can be a deterrent for smaller enterprises or those in less developed economies. The need for skilled personnel to install, configure, and maintain these sophisticated systems also presents a challenge. Evolving cybersecurity threats in connected industrial environments require constant vigilance and investment in secure solutions, adding to the complexity and cost.

Emerging Opportunities in Servo Drives Market

The Servo Drives Market is ripe with emerging opportunities. The rapid expansion of Industry 4.0 and the Industrial Internet of Things (IIoT) is creating a demand for smart, connected servo drives capable of real-time data exchange and predictive analytics. The growing focus on sustainability and energy efficiency presents an opportunity for the development of ultra-efficient servo drive solutions. The burgeoning electric vehicle (EV) market, with its intricate assembly processes, requires advanced motion control. Furthermore, the increasing use of collaborative robots (cobots) in diverse environments, including logistics and healthcare, opens up new avenues for specialized servo drives. Strategic partnerships and collaborations between servo drive manufacturers and automation solution providers will be crucial for leveraging these opportunities.

Leading Players in the Servo Drives Market Sector

- Rockwell Automation

- ABB Ltd

- Siemens

- Danfoss

- Hitachi Ltd

- Emerson Electric Co

- Mitsubishi Electric Corporation

- Schneider Electric

- WEG

- Yaskawa Electric Corporation

Key Milestones in Servo Drives Market Industry

- February 2021 - Motion control specialist Trio Motion Technology expanded its motion controller range with the launch of a servo drive and motor package. This plug-and-play solution enables faster machine development and optimum cost-effectiveness for OEMs, with the new DX4 servo drive and MX servo motor series enhancing Trio's machine solution offerings.

- February 2021 - Mitsubishi introduced its MELSERVO MR-J5 series of TSN-compatible servo drives. These drives enhance line and system performance with a frequency response of 3.5kHz and a communication cycle time of 31.25μs, meeting precision, dynamics, and multi-axis synchronization requirements in applications like printing/converting.

Strategic Outlook for Servo Drives Market Market

The strategic outlook for the Servo Drives Market is highly positive, fueled by the ongoing digital transformation of industries. Key growth accelerators include the continued integration of AI and machine learning for enhanced control and predictive maintenance, the development of more energy-efficient and compact servo drive designs, and the expansion of servo drive applications into emerging sectors like advanced manufacturing, renewable energy, and medical devices. Strategic partnerships and the focus on offering integrated motion control solutions will be paramount for sustained market leadership. The increasing demand for high-performance, reliable, and intelligent motion control systems will continue to drive innovation and market expansion, positioning servo drives as indispensable components in the future of automation.

Servo Drives Market Segmentation

-

1. Type

- 1.1. AC servo drives

- 1.2. DC servo drives

- 1.3. Brushless servo drives

- 1.4. stepper servo drives

-

2. Application

- 2.1. Industrial automation

- 2.2. robotics

- 2.3. medical technology

- 2.4. aerospace

- 2.5. renewable energy

Servo Drives Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Italy

- 2.4. France

- 2.5. Russia

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia

- 4. Rest of Asia Pacific

-

5. Latin America

- 5.1. Brazil

- 5.2. Mexico

- 5.3. Chile

- 5.4. Rest of Latin America

- 6. Middle East

-

7. United Arab Emirates

- 7.1. Saudi Arabia

- 7.2. Turkey

- 7.3. Rest of Middle East

Servo Drives Market Regional Market Share

Geographic Coverage of Servo Drives Market

Servo Drives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Industrial Automation; Growing Regulations Regarding Energy Efficiency

- 3.3. Market Restrains

- 3.3.1. High Cost of Microplate Systems

- 3.4. Market Trends

- 3.4.1. Discrete Manufacturing is Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Servo Drives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. AC servo drives

- 5.1.2. DC servo drives

- 5.1.3. Brushless servo drives

- 5.1.4. stepper servo drives

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Industrial automation

- 5.2.2. robotics

- 5.2.3. medical technology

- 5.2.4. aerospace

- 5.2.5. renewable energy

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of Asia Pacific

- 5.3.5. Latin America

- 5.3.6. Middle East

- 5.3.7. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Servo Drives Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. AC servo drives

- 6.1.2. DC servo drives

- 6.1.3. Brushless servo drives

- 6.1.4. stepper servo drives

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Industrial automation

- 6.2.2. robotics

- 6.2.3. medical technology

- 6.2.4. aerospace

- 6.2.5. renewable energy

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Servo Drives Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. AC servo drives

- 7.1.2. DC servo drives

- 7.1.3. Brushless servo drives

- 7.1.4. stepper servo drives

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Industrial automation

- 7.2.2. robotics

- 7.2.3. medical technology

- 7.2.4. aerospace

- 7.2.5. renewable energy

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Servo Drives Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. AC servo drives

- 8.1.2. DC servo drives

- 8.1.3. Brushless servo drives

- 8.1.4. stepper servo drives

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Industrial automation

- 8.2.2. robotics

- 8.2.3. medical technology

- 8.2.4. aerospace

- 8.2.5. renewable energy

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Asia Pacific Servo Drives Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. AC servo drives

- 9.1.2. DC servo drives

- 9.1.3. Brushless servo drives

- 9.1.4. stepper servo drives

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Industrial automation

- 9.2.2. robotics

- 9.2.3. medical technology

- 9.2.4. aerospace

- 9.2.5. renewable energy

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Servo Drives Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. AC servo drives

- 10.1.2. DC servo drives

- 10.1.3. Brushless servo drives

- 10.1.4. stepper servo drives

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Industrial automation

- 10.2.2. robotics

- 10.2.3. medical technology

- 10.2.4. aerospace

- 10.2.5. renewable energy

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East Servo Drives Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. AC servo drives

- 11.1.2. DC servo drives

- 11.1.3. Brushless servo drives

- 11.1.4. stepper servo drives

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Industrial automation

- 11.2.2. robotics

- 11.2.3. medical technology

- 11.2.4. aerospace

- 11.2.5. renewable energy

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. United Arab Emirates Servo Drives Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. AC servo drives

- 12.1.2. DC servo drives

- 12.1.3. Brushless servo drives

- 12.1.4. stepper servo drives

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Industrial automation

- 12.2.2. robotics

- 12.2.3. medical technology

- 12.2.4. aerospace

- 12.2.5. renewable energy

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Rockwell Automation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ABB Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Siemens

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Danfoss

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Hitachi Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Emerson Electric Co

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Mitsubishi Electric Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Schneider Electric

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 WEG

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Yaskawa Electric Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Rockwell Automation

List of Figures

- Figure 1: Global Servo Drives Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Servo Drives Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Servo Drives Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Servo Drives Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Servo Drives Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Servo Drives Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Servo Drives Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Servo Drives Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Servo Drives Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Servo Drives Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Servo Drives Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Servo Drives Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Servo Drives Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Servo Drives Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Servo Drives Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Servo Drives Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Servo Drives Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Servo Drives Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Servo Drives Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of Asia Pacific Servo Drives Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Rest of Asia Pacific Servo Drives Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of Asia Pacific Servo Drives Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Rest of Asia Pacific Servo Drives Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of Asia Pacific Servo Drives Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of Asia Pacific Servo Drives Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Servo Drives Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Latin America Servo Drives Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Servo Drives Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Latin America Servo Drives Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Latin America Servo Drives Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Servo Drives Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East Servo Drives Market Revenue (Million), by Type 2025 & 2033

- Figure 33: Middle East Servo Drives Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Middle East Servo Drives Market Revenue (Million), by Application 2025 & 2033

- Figure 35: Middle East Servo Drives Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: Middle East Servo Drives Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East Servo Drives Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: United Arab Emirates Servo Drives Market Revenue (Million), by Type 2025 & 2033

- Figure 39: United Arab Emirates Servo Drives Market Revenue Share (%), by Type 2025 & 2033

- Figure 40: United Arab Emirates Servo Drives Market Revenue (Million), by Application 2025 & 2033

- Figure 41: United Arab Emirates Servo Drives Market Revenue Share (%), by Application 2025 & 2033

- Figure 42: United Arab Emirates Servo Drives Market Revenue (Million), by Country 2025 & 2033

- Figure 43: United Arab Emirates Servo Drives Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Servo Drives Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Servo Drives Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Servo Drives Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Servo Drives Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Servo Drives Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Servo Drives Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Servo Drives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Servo Drives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Servo Drives Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Servo Drives Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Servo Drives Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Servo Drives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Servo Drives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Servo Drives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Servo Drives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Russia Servo Drives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Servo Drives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Servo Drives Market Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Servo Drives Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Servo Drives Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: China Servo Drives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Servo Drives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Servo Drives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Servo Drives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Servo Drives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Servo Drives Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Servo Drives Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Servo Drives Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Global Servo Drives Market Revenue Million Forecast, by Type 2020 & 2033

- Table 30: Global Servo Drives Market Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Servo Drives Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Servo Drives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Mexico Servo Drives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Chile Servo Drives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Latin America Servo Drives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Servo Drives Market Revenue Million Forecast, by Type 2020 & 2033

- Table 37: Global Servo Drives Market Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Global Servo Drives Market Revenue Million Forecast, by Country 2020 & 2033

- Table 39: Global Servo Drives Market Revenue Million Forecast, by Type 2020 & 2033

- Table 40: Global Servo Drives Market Revenue Million Forecast, by Application 2020 & 2033

- Table 41: Global Servo Drives Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Saudi Arabia Servo Drives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Turkey Servo Drives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Rest of Middle East Servo Drives Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Servo Drives Market?

The projected CAGR is approximately 4.90%.

2. Which companies are prominent players in the Servo Drives Market?

Key companies in the market include Rockwell Automation, ABB Ltd, Siemens, Danfoss, Hitachi Ltd, Emerson Electric Co, Mitsubishi Electric Corporation, Schneider Electric, WEG, Yaskawa Electric Corporation.

3. What are the main segments of the Servo Drives Market?

The market segments include Type , Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Industrial Automation; Growing Regulations Regarding Energy Efficiency.

6. What are the notable trends driving market growth?

Discrete Manufacturing is Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

High Cost of Microplate Systems.

8. Can you provide examples of recent developments in the market?

February 2021 - Motion control specialist Trio Motion Technology has expanded its motion controller range with the launch of a servo drive and motor package. With a complete plug-and-play solution, OEMs can now benefit from Trio's specialist motion control performance, enabling faster machine development and optimum cost-effectiveness. Launching the new DX4 servo drive and MX servo motor series expands Trio's machine solution and makes it faster and easier for OEMs to utilize the high-performance motion control available from Trio's range of Motion Coordinators.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Servo Drives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Servo Drives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Servo Drives Market?

To stay informed about further developments, trends, and reports in the Servo Drives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence