Key Insights

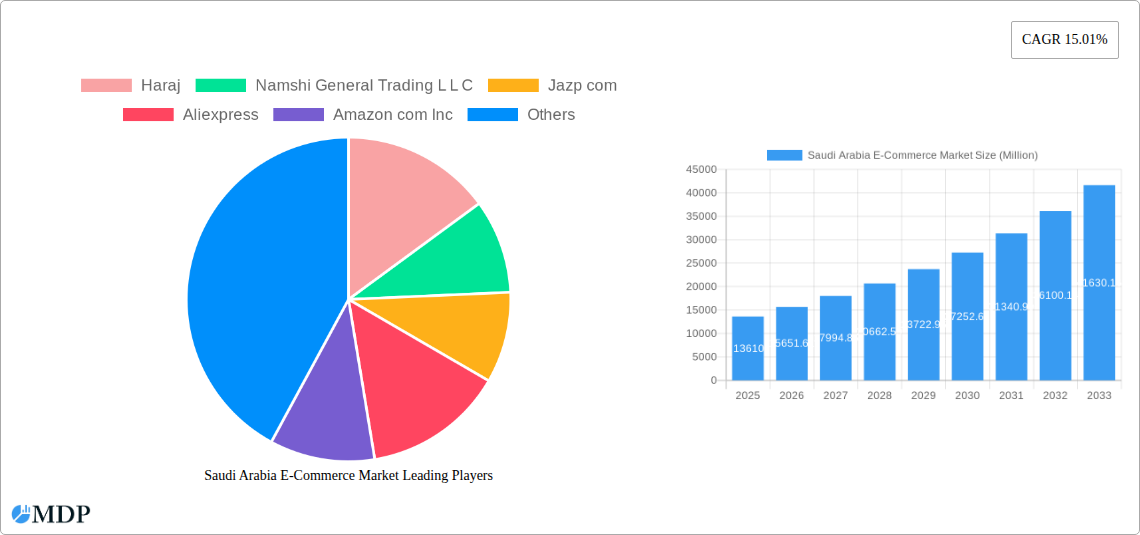

The Saudi Arabian e-commerce market exhibits robust growth, projected to reach \$13.61 billion in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 15.01% from 2025 to 2033. This surge is driven by increasing internet and smartphone penetration, a young and digitally savvy population, and government initiatives promoting digital transformation. The rising adoption of online payment methods and the expansion of logistics infrastructure further fuel this growth. Key segments include fashion & apparel, electronics, grocery, beauty & personal care, and home décor & furniture, catering to both individual consumers and businesses (B2B), with a significant portion of growth anticipated from the B2B sector as businesses increasingly integrate e-commerce into their operations. Major players like Haraj, Namshi, Amazon, Noon, and Carrefour are key competitors in this dynamic market, constantly innovating to capture market share. However, challenges remain, including the need for enhanced cybersecurity measures to protect consumer data and addressing potential concerns around delivery infrastructure in remote areas. The competitive landscape is intense, demanding strategic investments in technology and customer experience.

Saudi Arabia E-Commerce Market Market Size (In Billion)

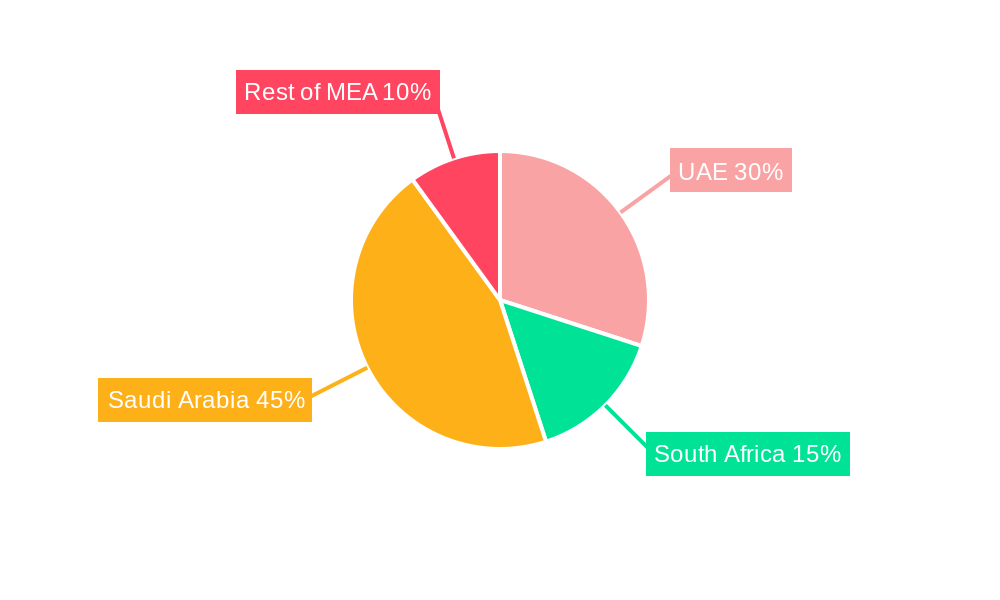

The substantial growth potential in the Saudi Arabian e-commerce market is further evidenced by its diverse segments and regional expansion. While the UAE and South Africa currently represent significant regional players, the Rest of MEA region presents considerable untapped potential. The forecast period (2025-2033) promises consistent growth, fueled by ongoing infrastructural improvements and a rising middle class with increased disposable income. Focus on improving customer trust and satisfaction, especially regarding returns and dispute resolution, will be crucial for sustained market expansion. Government initiatives aimed at fostering digital inclusion and promoting digital literacy will play a significant role in driving future growth, contributing to a flourishing and increasingly competitive e-commerce landscape.

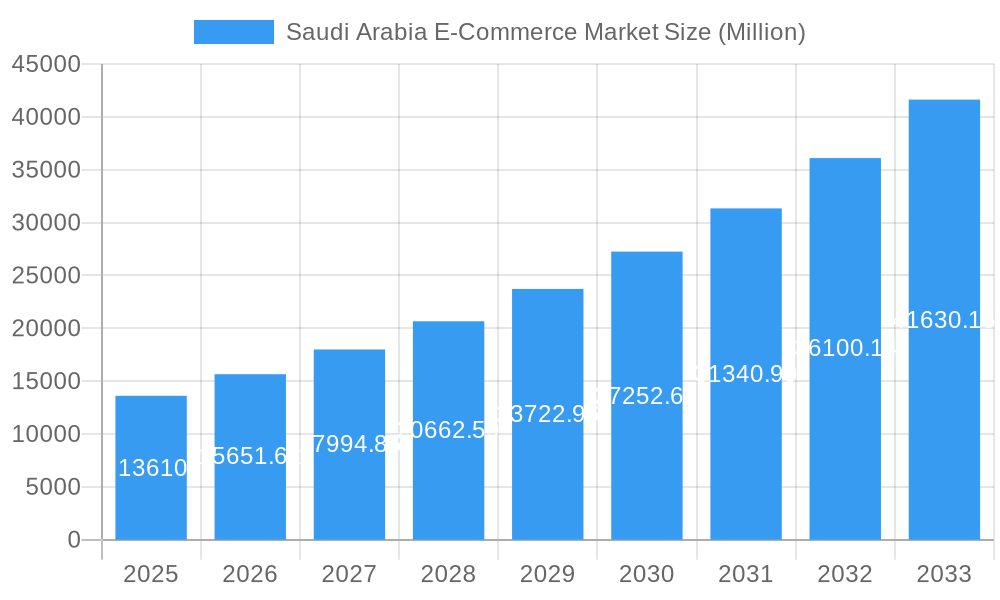

Saudi Arabia E-Commerce Market Company Market Share

Saudi Arabia E-Commerce Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the rapidly expanding Saudi Arabia e-commerce market, covering the period 2019-2033. It offers invaluable insights into market dynamics, key players, growth drivers, and challenges, equipping businesses and stakeholders with the knowledge to navigate this dynamic landscape. The report uses 2025 as its base year and projects the market's trajectory until 2033. Expect in-depth analysis across various segments, including Fashion & Apparel, Electronics, Grocery, Beauty & Personal Care, Home Décor & Furniture, and Others, catering to Individual Consumers, Businesses (B2B), and Government & Institutions.

Saudi Arabia E-Commerce Market Dynamics & Concentration

The Saudi Arabian e-commerce market is experiencing robust growth, driven by rising internet and smartphone penetration, a young and tech-savvy population, and government initiatives promoting digital transformation. Market concentration is moderate, with several key players vying for dominance. However, the market is characterized by a high level of innovation, fueled by substantial investments in technology and logistics infrastructure. The regulatory framework, while evolving, is generally supportive of e-commerce growth. Product substitutes, particularly traditional retail channels, continue to pose some competition, but the convenience and expanding selection offered by online platforms are steadily eroding their market share. End-user trends show a clear preference towards online shopping for convenience and wider product choice. M&A activity is significant, indicating market consolidation and strategic expansion by key players. For instance, Noon's acquisition of Namshi highlights the trend of larger players absorbing smaller competitors to expand market share.

- Market Share (2024 Estimate): Noon: 30%; Amazon: 15%; AliExpress: 10%; Others: 45%

- M&A Deal Count (2019-2024): xx

Saudi Arabia E-Commerce Market Industry Trends & Analysis

The Saudi Arabian e-commerce market is experiencing a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Key drivers include increasing disposable incomes, a burgeoning middle class, and government initiatives like Vision 2030, which promotes digitalization. Technological disruptions, such as the rise of mobile commerce and improved logistics networks, are further accelerating market growth. Consumer preferences are shifting towards online platforms for their convenience, broader selection, and competitive pricing. The competitive landscape is characterized by both domestic and international players, creating a dynamic and fiercely contested environment. Market penetration is steadily increasing, with a significant portion of the population now engaging in online shopping.

Leading Markets & Segments in Saudi Arabia E-Commerce Market

The Saudi Arabian e-commerce market demonstrates strong growth across all regions within the Kingdom. However, major cities like Riyadh, Jeddah, and Dammam exhibit higher market penetration due to better infrastructure and higher internet adoption rates. Among product types, Fashion & Apparel and Electronics are currently the leading segments, benefiting from high consumer demand and readily available online options. The Grocery segment is also experiencing rapid growth, fueled by convenient delivery services and increased consumer preference for online grocery shopping. Individual consumers constitute the largest end-user segment, but businesses (B2B) and government & institutions are also increasingly adopting e-commerce solutions.

- Key Drivers for Fashion & Apparel: Strong consumer demand, wide selection, competitive pricing, and influence of social media.

- Key Drivers for Electronics: High tech adoption rate, availability of latest gadgets, and competitive pricing from online retailers.

- Key Drivers for Individual Consumers: Convenience, wider product choice, competitive pricing, and ease of online payment options.

Saudi Arabia E-Commerce Market Product Developments

The Saudi Arabian e-commerce market is witnessing significant product innovations, particularly in areas such as personalized recommendations, augmented reality (AR) shopping experiences, and improved mobile app functionalities. These innovations aim to enhance customer experience and drive sales. Companies are adopting advanced technologies like AI and machine learning to optimize logistics and personalize marketing efforts. The focus is on providing seamless, user-friendly platforms that cater to the unique needs and preferences of the Saudi Arabian consumer base.

Key Drivers of Saudi Arabia E-Commerce Market Growth

Several factors contribute to the growth of the Saudi Arabian e-commerce market. Government initiatives like Vision 2030 promote digital transformation and attract foreign investment. The increasing penetration of smartphones and internet access coupled with a young, tech-savvy population fuels online shopping adoption. Furthermore, improvements in logistics infrastructure, including efficient delivery networks and payment gateways, enhance the overall customer experience. The growth of social commerce and influencer marketing also contributes significantly.

Challenges in the Saudi Arabia E-Commerce Market

Despite significant growth, the Saudi Arabian e-commerce market faces challenges. Trust and security remain concerns for some consumers hesitant to provide sensitive information online. Logistics in remote areas can be a significant hurdle, impacting delivery times and costs. Furthermore, competition is intense, requiring companies to constantly innovate and adapt to stay ahead. Regulatory hurdles and data privacy concerns also present ongoing challenges. Cybersecurity threats remain a significant risk, requiring robust security measures. The cost of internet access and digital literacy gaps also impact market penetration in certain segments.

Emerging Opportunities in Saudi Arabia E-Commerce Market

The Saudi Arabian e-commerce market presents numerous opportunities for long-term growth. The expanding adoption of mobile payments and fintech solutions can significantly improve the customer experience. Strategic partnerships between e-commerce platforms and traditional retailers can enhance market reach and accessibility. Expansion into new product categories and niche markets offers promising growth avenues. Finally, the increasing focus on sustainable and ethical practices presents opportunities for differentiation and consumer appeal.

Leading Players in the Saudi Arabia E-Commerce Market Sector

- Haraj

- Namshi General Trading L L C

- Jazp.com

- Aliexpress

- Amazon com Inc

- Carrefour

- eBay Inc

- Noon Ad Holdings Ltd (Noon E-Commerce)

Key Milestones in Saudi Arabia E-Commerce Market Industry

- December 2022: Sideup, an e-commerce platform developer, secured USD 1.2 Million in funding to expand operations in Saudi Arabia and relocate its headquarters to Riyadh. This signifies increasing investor confidence in the Saudi Arabian e-commerce sector.

- February 2023: Noon acquired Namshi for USD 335.2 Million, consolidating the market and expanding Noon's fashion and lifestyle offerings. This acquisition signals further market consolidation and the growing importance of the fashion sector in the Saudi Arabian e-commerce landscape.

Strategic Outlook for Saudi Arabia E-Commerce Market Market

The Saudi Arabian e-commerce market is poised for continued expansion, driven by strong government support, technological advancements, and rising consumer adoption. Strategic partnerships, innovative business models, and a focus on customer experience will be crucial for success. Expanding into underserved markets and focusing on niche segments offers significant growth potential. Companies that prioritize security and trust-building measures will be best positioned to capture market share and drive long-term growth. The market's future looks bright, with continued growth expected across all segments and regions.

Saudi Arabia E-Commerce Market Segmentation

-

1. Product Type

- 1.1. Fashion & Apparel

- 1.2. Electronics

- 1.3. Grocery

- 1.4. Beauty & Personal Care

- 1.5. Home Décor & Furniture

- 1.6. Others

-

2. End-User

- 2.1. Individual Consumers

- 2.2. Businesses (B2B)

- 2.3. Government & Institutions

Saudi Arabia E-Commerce Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia E-Commerce Market Regional Market Share

Geographic Coverage of Saudi Arabia E-Commerce Market

Saudi Arabia E-Commerce Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in Internet Penetration and Smartphone Usage; Promotion of E-commerce by the Government Sector

- 3.2.2 including Measures to Strengthen Last-Mile Delivery and Improvise Distribution Centers

- 3.3. Market Restrains

- 3.3.1. Privacy and security concerns

- 3.4. Market Trends

- 3.4.1. Fashion and Apparel Segment is Expected to Grow Exponentially

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia E-Commerce Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fashion & Apparel

- 5.1.2. Electronics

- 5.1.3. Grocery

- 5.1.4. Beauty & Personal Care

- 5.1.5. Home Décor & Furniture

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Individual Consumers

- 5.2.2. Businesses (B2B)

- 5.2.3. Government & Institutions

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Haraj

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Namshi General Trading L L C

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jazp com

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aliexpress

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amazon com Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Carrefou

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 eBay Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Noon Ad Holdings Ltd (Noon E-Commerce)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Haraj

List of Figures

- Figure 1: Saudi Arabia E-Commerce Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia E-Commerce Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Saudi Arabia E-Commerce Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 5: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 9: Saudi Arabia E-Commerce Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 11: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia E-Commerce Market?

The projected CAGR is approximately 15.01%.

2. Which companies are prominent players in the Saudi Arabia E-Commerce Market?

Key companies in the market include Haraj, Namshi General Trading L L C, Jazp com, Aliexpress, Amazon com Inc, Carrefou, eBay Inc, Noon Ad Holdings Ltd (Noon E-Commerce).

3. What are the main segments of the Saudi Arabia E-Commerce Market?

The market segments include Product Type , End-User .

4. Can you provide details about the market size?

The market size is estimated to be USD 13.61 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet Penetration and Smartphone Usage; Promotion of E-commerce by the Government Sector. including Measures to Strengthen Last-Mile Delivery and Improvise Distribution Centers.

6. What are the notable trends driving market growth?

Fashion and Apparel Segment is Expected to Grow Exponentially.

7. Are there any restraints impacting market growth?

Privacy and security concerns.

8. Can you provide examples of recent developments in the market?

February 2023: The online fashion retailer Namshi, which operated primarily in Saudi Arabia, was acquired by the e-commerce company Noon for a total cash consideration of USD 335.2 million, and this addition of more fashion and lifestyle brands to Noon's digital offering of goods and services in the country

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia E-Commerce Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia E-Commerce Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia E-Commerce Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia E-Commerce Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence