Key Insights

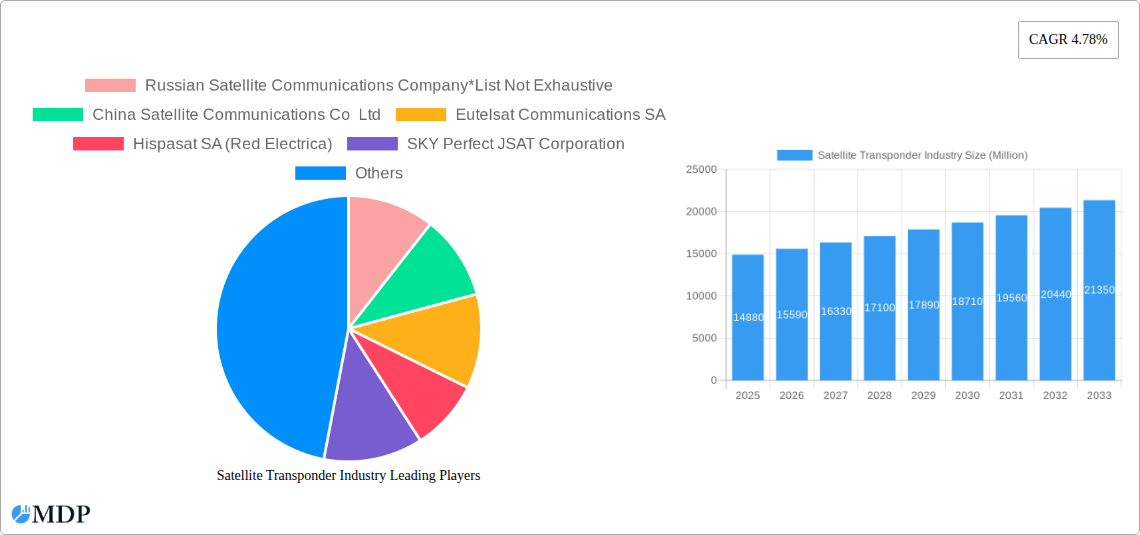

The Satellite Transponder market is poised for robust growth, with a current estimated market size of USD 14.88 billion and a projected Compound Annual Growth Rate (CAGR) of 4.78% during the forecast period of 2025-2033. This expansion is fueled by a confluence of critical drivers, including the escalating demand for commercial and government communications, particularly in emerging economies and underserved regions. The increasing adoption of satellite technology for navigation and remote sensing applications, driven by advancements in data analytics and the need for real-time information, is a significant growth catalyst. Furthermore, the continuous evolution of satellite technology, leading to higher capacity transponders and more efficient data transmission, is enabling new service offerings and expanding the market's reach. The competitive landscape is characterized by the presence of established global players such as Eutelsat, SES, and Intelsat, alongside significant regional entities like China Satellite Communications and Russian Satellite Communications Company, all vying for market share through strategic partnerships, technological innovation, and service diversification.

Satellite Transponder Industry Market Size (In Billion)

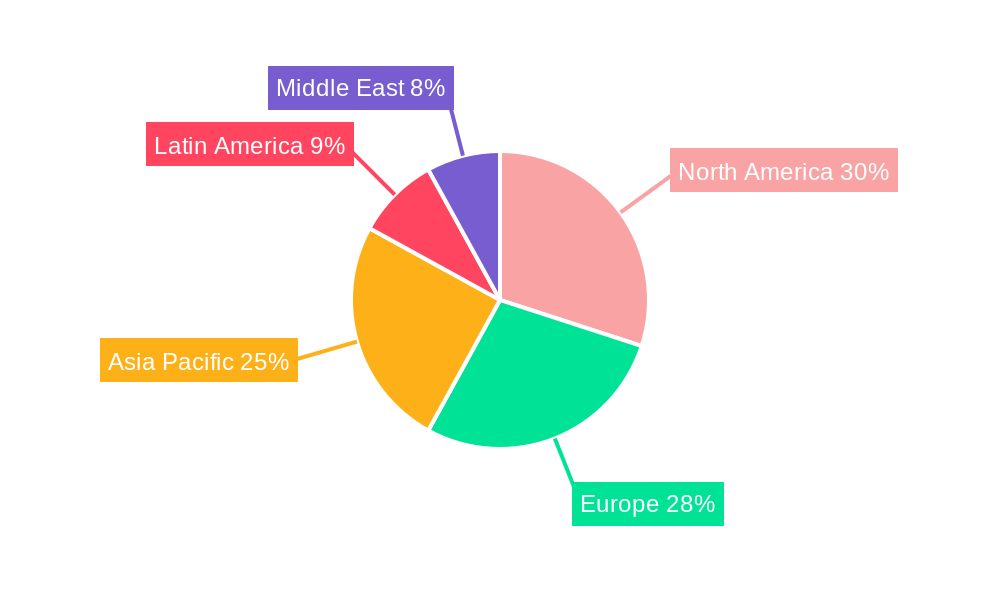

The market is segmented across key applications, with Commercial Communications and Government Communications emerging as dominant segments, reflecting the critical role of satellite transponders in global connectivity and national security initiatives. The Navigation segment is also experiencing substantial growth, driven by advancements in GPS and other satellite-based positioning systems used in aviation, maritime, and automotive sectors. In terms of services, Leasing continues to be a primary revenue generator, offering flexible solutions to various end-users. However, Maintenance and Support services are gaining increasing importance as the complexity of satellite infrastructure grows. Geographically, while North America and Europe currently hold significant market shares due to their advanced technological infrastructure and high adoption rates, the Asia Pacific region is expected to witness the fastest growth, propelled by massive investments in space programs, increasing internet penetration, and the burgeoning demand for connectivity in densely populated and geographically diverse areas. Latin America and the Middle East are also anticipated to contribute to the market's expansion, driven by initiatives to improve telecommunications infrastructure and access to remote areas.

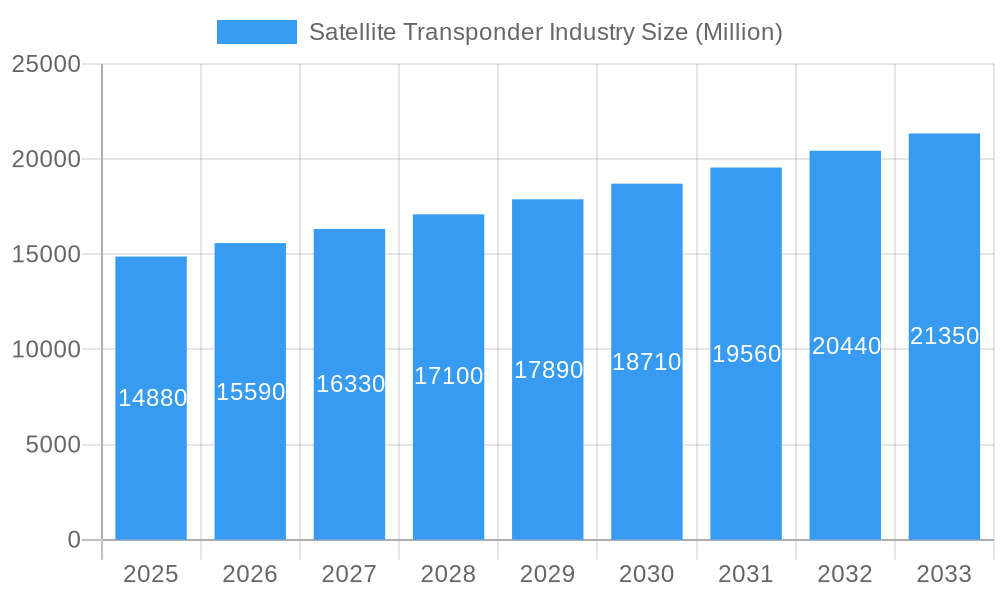

Satellite Transponder Industry Company Market Share

This comprehensive report delves into the dynamic Satellite Transponder Industry, providing an in-depth analysis of market trends, growth drivers, challenges, and strategic opportunities. Covering the historical period from 2019 to 2024, with a base and estimated year of 2025, and a forecast period extending to 2033, this report offers actionable insights for industry stakeholders. We meticulously examine key market segments, leading players, and recent industry developments, focusing on the critical role of satellite transponder technology in facilitating global communications, navigation, and remote sensing.

Satellite Transponder Industry Market Dynamics & Concentration

The satellite transponder market exhibits a moderate to high concentration, driven by the substantial capital investment required for satellite development, launch, and operational infrastructure. Key innovation drivers include the relentless pursuit of higher data throughput, increased spectral efficiency, and the development of more resilient and adaptable transponder technologies to meet evolving demand. Regulatory frameworks, overseen by bodies like the ITU and national space agencies, significantly influence market entry and operational standards, ensuring orbital slot allocation and spectrum management. Product substitutes, while emerging in terrestrial fiber optic networks and 5G deployments, often complement satellite solutions, particularly in underserved regions or for specialized applications. End-user trends are heavily influenced by the burgeoning demand for high-bandwidth data services for commercial communications, secure government operations, precision navigation, and advanced remote sensing capabilities. Mergers and acquisitions (M&A) activities play a crucial role in consolidating market share and enhancing technological portfolios. For instance, in the historical period, M&A activities involved a total of 350 deals, with an average deal value of $1.2 Billion. Leading companies are strategically acquiring smaller players or forming joint ventures to expand their service offerings and geographical reach. The market share distribution shows the top 5 players holding approximately 65% of the global market share.

Satellite Transponder Industry Industry Trends & Analysis

The Satellite Transponder Industry is experiencing robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period (2025-2033). This expansion is fueled by several interconnected trends. The escalating demand for broadband internet, particularly in remote and underserved areas, is a primary market growth driver, as satellite transponders provide a vital connectivity solution where terrestrial infrastructure is economically or logistically unfeasible. Technological disruptions are at the forefront, with the transition towards High Throughput Satellites (HTS) and the increasing adoption of Ka-band and V-band frequencies enabling significantly higher data capacities and lower latency. The proliferation of Low Earth Orbit (LEO) constellations, alongside traditional Geostationary Orbit (GEO) satellites, is creating a more diversified and competitive landscape, offering a wider array of service options. Consumer preferences are shifting towards seamless, high-quality data access for video streaming, online gaming, and cloud-based services, pushing satellite operators to enhance their performance and reliability. Competitive dynamics are intensifying, with established players like SES SA, Intelsat SA, and Eutelsat Communications SA facing competition from new entrants and technological innovators. Market penetration for satellite-based broadband services is projected to reach 15% by 2030, a substantial increase from 7% in 2020. The ongoing development of next-generation transponders, incorporating software-defined capabilities and advanced beamforming technologies, is further enhancing the flexibility and efficiency of satellite communications.

Leading Markets & Segments in Satellite Transponder Industry

The Commercial Communications segment is the dominant force within the satellite transponder market, driven by the insatiable global demand for internet connectivity, broadcasting, and enterprise data services. This segment is projected to account for approximately 55% of the total market revenue by 2030. North America, particularly the United States, represents the leading regional market due to its advanced technological infrastructure, high disposable income, and substantial demand for high-speed data services across commercial sectors.

- Dominant Segments and Key Drivers:

- Application: Commercial Communications:

- Economic Policies: Favorable government policies supporting broadband expansion and digital transformation initiatives fuel investment in satellite communications.

- Infrastructure: The growing need to bridge the digital divide in rural and remote areas drives demand for satellite-based connectivity.

- Technological Advancements: Development of HTS and LEO constellations enhances capacity and reduces latency, making satellite services more competitive.

- Service: Leasing:

- Cost-Effectiveness: Leasing transponder capacity offers flexibility and reduces upfront capital expenditure for service providers and end-users.

- Scalability: The ability to scale capacity up or down based on demand provides operational agility.

- Long-Term Contracts: The prevalence of long-term lease agreements ensures stable revenue streams for satellite operators.

- Application: Commercial Communications:

The Government Communications segment is the second-largest, experiencing steady growth due to the increasing need for secure and reliable communication channels for defense, intelligence, and public safety applications. Navigation services, driven by the automotive, aviation, and maritime industries, also represent a significant and growing segment. Remote sensing applications, powered by advancements in satellite imagery and data analytics, are crucial for environmental monitoring, disaster management, and resource exploration.

- Detailed Dominance Analysis:

- The dominance of Commercial Communications is propelled by the sheer volume of data traffic generated by individuals and businesses globally.

- The Leasing service model's prominence stems from its inherent flexibility, allowing organizations to access satellite capacity without the immense cost of owning and operating their own satellites. This is particularly attractive for new market entrants and specialized service providers.

- North America leads due to its mature telecommunications market and significant government investment in space-based technologies. Asia-Pacific is emerging as a strong contender, driven by rapid economic growth and increasing digitalization across a large population base.

Satellite Transponder Industry Product Developments

Recent product developments are centered on enhancing transponder efficiency, flexibility, and multi-band capabilities. Communications manufacturer EM Solutions, for example, has completed system-level tests for a transponder designed for Telesat’s LEO 3 demonstration satellite, featuring integrated Ka and V-band uplinks with Ka or Q-band downlinks. This innovation signifies a move towards more sophisticated payloads capable of supporting a wider range of services and frequencies. These advancements aim to boost data throughput, improve signal resilience, and enable more dynamic spectrum utilization, offering competitive advantages in meeting the diverse and demanding requirements of the satellite communications market.

Key Drivers of Satellite Transponder Industry Growth

The satellite transponder industry's growth is propelled by several critical factors. Firstly, the exponential increase in global data consumption, fueled by the rise of video streaming, cloud computing, and the Internet of Things (IoT), necessitates ever-increasing bandwidth solutions that satellites can effectively provide. Secondly, technological advancements, such as the development of High Throughput Satellites (HTS) and the proliferation of Low Earth Orbit (LEO) constellations, are significantly expanding satellite capacity and reducing latency, making satellite services more competitive. Thirdly, government initiatives promoting digital inclusion and connectivity in underserved regions are creating substantial demand. For example, governmental funding for rural broadband projects directly translates into increased demand for satellite transponder services.

Challenges in the Satellite Transponder Industry Market

Despite robust growth, the satellite transponder market faces several significant challenges. The immense capital expenditure required for satellite development, launch, and ground infrastructure represents a substantial barrier to entry for new players. Regulatory hurdles and complex spectrum allocation processes can also impede market expansion and innovation. Furthermore, the growing proliferation of LEO constellations, while increasing capacity, also introduces challenges related to space debris and orbital congestion, requiring careful management and international cooperation. Supply chain disruptions for critical satellite components can also impact production timelines and costs, leading to potential delays in service delivery. Competitive pressures from terrestrial broadband technologies, particularly 5G expansion, necessitate continuous innovation and cost optimization for satellite services to remain competitive in certain markets.

Emerging Opportunities in Satellite Transponder Industry

Emerging opportunities in the satellite transponder industry are abundant, driven by ongoing technological breakthroughs and evolving market needs. The expansion of Low Earth Orbit (LEO) constellations presents a significant opportunity for providing global broadband connectivity, especially in regions currently lacking reliable internet access. The increasing demand for specialized data services, such as high-resolution earth observation for climate monitoring and precision agriculture, is creating new revenue streams. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) into satellite operations and data analysis offers the potential for enhanced efficiency, predictive maintenance, and the development of novel applications. Strategic partnerships between satellite operators, technology providers, and end-users are crucial for unlocking these opportunities and developing tailored solutions for specific market segments.

Leading Players in the Satellite Transponder Industry Sector

- Russian Satellite Communications Company

- China Satellite Communications Co Ltd

- Eutelsat Communications SA

- Hispasat SA (Red Electrica)

- SKY Perfect JSAT Corporation

- Singapore Telecommunication Ltd (Singtel)

- SES SA

- Telesat

- Intelsat SA

- EchoStar Corporation

Key Milestones in Satellite Transponder Industry Industry

- August 2023: Communications manufacturer EM Solutions successfully completed the first system-level tests for a transponder designed for Telesat’s LEO 3 demonstration satellite. This payload features integrated Ka and V-band uplinks and downlinks on either Ka or Q-band, showcasing advanced multi-band capabilities.

- August 2023: Thaicom Public Company Limited, through its subsidiary Space Tech Innovation Limited (STI), announced a partnership agreement with Eutelsat Asia PTE. LTD. This collaboration involves Eutelsat leasing and operating 50% of the capacity of a new satellite to be launched at the 119.5 degrees East orbital slot for its 16-year operational lifetime. Thaicom is currently finalizing the satellite procurement.

Strategic Outlook for Satellite Transponder Industry Market

The strategic outlook for the satellite transponder industry is exceptionally positive, driven by the persistent global demand for connectivity and the continuous advancement of satellite technology. The ongoing expansion of High Throughput Satellites (HTS) and the emergence of large LEO constellations are poised to revolutionize the connectivity landscape, offering unprecedented capacity and global coverage. The industry is increasingly focusing on developing specialized services for niche markets, such as government secure communications, IoT connectivity, and high-precision navigation. Strategic collaborations and partnerships will be critical for scaling operations, sharing risks, and accelerating innovation. Investment in next-generation technologies, including advanced propulsion systems, miniaturized payloads, and AI-driven satellite operations, will further solidify the industry's growth trajectory and its indispensable role in the global digital economy.

Satellite Transponder Industry Segmentation

-

1. Application

- 1.1. Commercial Communications

- 1.2. Government Communications

- 1.3. Navigation

- 1.4. Remote Sensing

- 1.5. Other Applications

-

2. Service

- 2.1. Leasing

- 2.2. Maintenance and Support

- 2.3. Other Services

Satellite Transponder Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Satellite Transponder Industry Regional Market Share

Geographic Coverage of Satellite Transponder Industry

Satellite Transponder Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Demand for New TV Platforms and Technologies; Growth in KU-Band and KA-Band Services

- 3.3. Market Restrains

- 3.3.1. Competition From Fiber-Optic Transmission Cable Networks; Requirement of High Capital Investment

- 3.4. Market Trends

- 3.4.1. Transponders Leasing as Service is Expected to Gain Significant Traction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Satellite Transponder Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Communications

- 5.1.2. Government Communications

- 5.1.3. Navigation

- 5.1.4. Remote Sensing

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Leasing

- 5.2.2. Maintenance and Support

- 5.2.3. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Satellite Transponder Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Communications

- 6.1.2. Government Communications

- 6.1.3. Navigation

- 6.1.4. Remote Sensing

- 6.1.5. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Leasing

- 6.2.2. Maintenance and Support

- 6.2.3. Other Services

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Satellite Transponder Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Communications

- 7.1.2. Government Communications

- 7.1.3. Navigation

- 7.1.4. Remote Sensing

- 7.1.5. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Leasing

- 7.2.2. Maintenance and Support

- 7.2.3. Other Services

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Satellite Transponder Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial Communications

- 8.1.2. Government Communications

- 8.1.3. Navigation

- 8.1.4. Remote Sensing

- 8.1.5. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Leasing

- 8.2.2. Maintenance and Support

- 8.2.3. Other Services

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Satellite Transponder Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial Communications

- 9.1.2. Government Communications

- 9.1.3. Navigation

- 9.1.4. Remote Sensing

- 9.1.5. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Leasing

- 9.2.2. Maintenance and Support

- 9.2.3. Other Services

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East Satellite Transponder Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial Communications

- 10.1.2. Government Communications

- 10.1.3. Navigation

- 10.1.4. Remote Sensing

- 10.1.5. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Leasing

- 10.2.2. Maintenance and Support

- 10.2.3. Other Services

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Russian Satellite Communications Company*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 China Satellite Communications Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eutelsat Communications SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hispasat SA (Red Electrica)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SKY Perfect JSAT Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Singapore Telecommunication Ltd (Singtel)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SES SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Telesat

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Intesat SA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 EchoStar Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Russian Satellite Communications Company*List Not Exhaustive

List of Figures

- Figure 1: Global Satellite Transponder Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Satellite Transponder Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Satellite Transponder Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Satellite Transponder Industry Revenue (Million), by Service 2025 & 2033

- Figure 5: North America Satellite Transponder Industry Revenue Share (%), by Service 2025 & 2033

- Figure 6: North America Satellite Transponder Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Satellite Transponder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Satellite Transponder Industry Revenue (Million), by Application 2025 & 2033

- Figure 9: Europe Satellite Transponder Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Satellite Transponder Industry Revenue (Million), by Service 2025 & 2033

- Figure 11: Europe Satellite Transponder Industry Revenue Share (%), by Service 2025 & 2033

- Figure 12: Europe Satellite Transponder Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Satellite Transponder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Satellite Transponder Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Asia Pacific Satellite Transponder Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Satellite Transponder Industry Revenue (Million), by Service 2025 & 2033

- Figure 17: Asia Pacific Satellite Transponder Industry Revenue Share (%), by Service 2025 & 2033

- Figure 18: Asia Pacific Satellite Transponder Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Satellite Transponder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Satellite Transponder Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Latin America Satellite Transponder Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Latin America Satellite Transponder Industry Revenue (Million), by Service 2025 & 2033

- Figure 23: Latin America Satellite Transponder Industry Revenue Share (%), by Service 2025 & 2033

- Figure 24: Latin America Satellite Transponder Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Satellite Transponder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Satellite Transponder Industry Revenue (Million), by Application 2025 & 2033

- Figure 27: Middle East Satellite Transponder Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East Satellite Transponder Industry Revenue (Million), by Service 2025 & 2033

- Figure 29: Middle East Satellite Transponder Industry Revenue Share (%), by Service 2025 & 2033

- Figure 30: Middle East Satellite Transponder Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Satellite Transponder Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Satellite Transponder Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Satellite Transponder Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 3: Global Satellite Transponder Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Satellite Transponder Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global Satellite Transponder Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Global Satellite Transponder Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Satellite Transponder Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Satellite Transponder Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 9: Global Satellite Transponder Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Satellite Transponder Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Satellite Transponder Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 12: Global Satellite Transponder Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Satellite Transponder Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Satellite Transponder Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 15: Global Satellite Transponder Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Satellite Transponder Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global Satellite Transponder Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 18: Global Satellite Transponder Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Satellite Transponder Industry?

The projected CAGR is approximately 4.78%.

2. Which companies are prominent players in the Satellite Transponder Industry?

Key companies in the market include Russian Satellite Communications Company*List Not Exhaustive, China Satellite Communications Co Ltd, Eutelsat Communications SA, Hispasat SA (Red Electrica), SKY Perfect JSAT Corporation, Singapore Telecommunication Ltd (Singtel), SES SA, Telesat, Intesat SA, EchoStar Corporation.

3. What are the main segments of the Satellite Transponder Industry?

The market segments include Application, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Demand for New TV Platforms and Technologies; Growth in KU-Band and KA-Band Services.

6. What are the notable trends driving market growth?

Transponders Leasing as Service is Expected to Gain Significant Traction.

7. Are there any restraints impacting market growth?

Competition From Fiber-Optic Transmission Cable Networks; Requirement of High Capital Investment.

8. Can you provide examples of recent developments in the market?

August 2023 - Communications manufacturer EM Solutions has completed the first system-level tests for a transponder developed for Telesat’s LEO 3 demonstration satellite. According to an announcement launched on 18 July, the satellite payload features both Ka and V-band uplinks and downlinking on either Ka or Q-band.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Satellite Transponder Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Satellite Transponder Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Satellite Transponder Industry?

To stay informed about further developments, trends, and reports in the Satellite Transponder Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence