Key Insights

The Romanian Point-of-Sale (POS) terminal market is poised for significant expansion, projected to reach $111.05 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 11.05% from the base year 2024 to 2033. This growth is propelled by the accelerating shift towards digital and cashless transactions across key sectors including retail, hospitality, and healthcare. Growing consumer preference for convenient, secure electronic payments is driving businesses to invest in modern POS infrastructure.

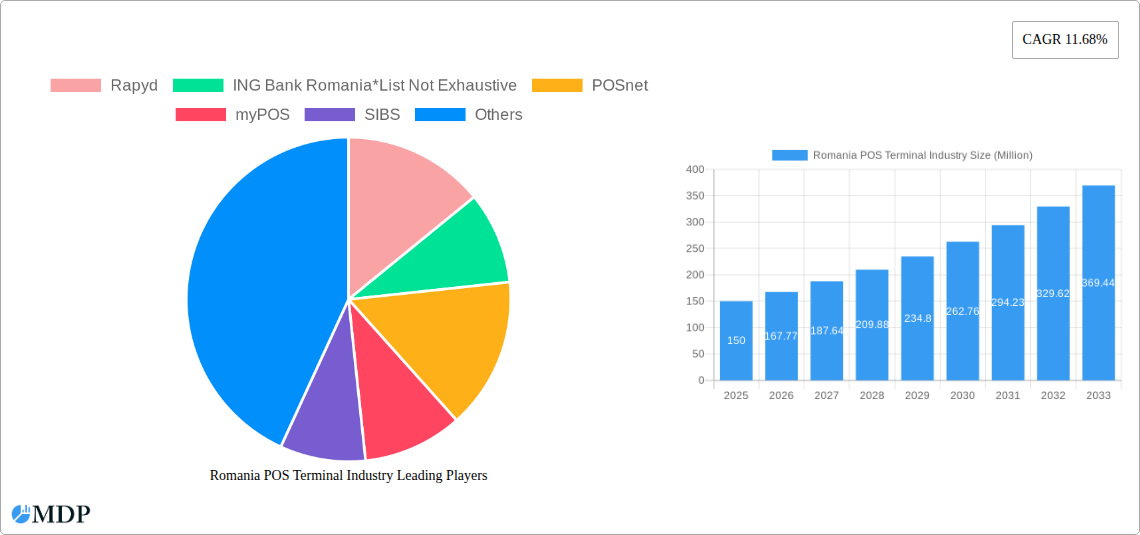

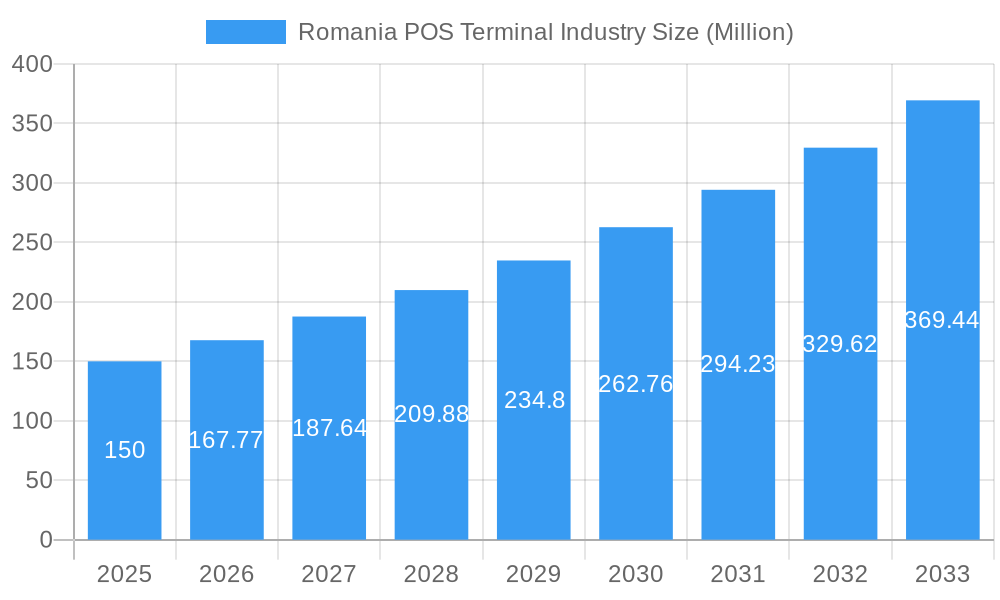

Romania POS Terminal Industry Market Size (In Billion)

Government-led digitalization initiatives and efforts to enhance financial inclusion are fostering a supportive regulatory environment for POS terminal adoption. Technological innovation, particularly the rise of mobile and portable POS solutions, offers enhanced flexibility and accessibility, catering to a broader range of business needs. Moreover, competitive pricing and innovative service packages from leading providers are further stimulating market penetration.

Romania POS Terminal Industry Company Market Share

Despite these positive trends, market growth faces certain constraints. The initial capital expenditure for POS system implementation can be a barrier, especially for small and medium-sized enterprises (SMEs). Additionally, concerns surrounding data security and the potential for cyber threats in electronic transactions require ongoing attention. Nonetheless, the market outlook remains robust, with diverse opportunities identified through segmentation by POS type (fixed vs. mobile) and end-user industry. The competitive landscape, featuring both established entities and agile fintech startups, promises continued innovation and market dynamism.

Romania POS Terminal Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Romanian POS terminal market from 2019 to 2033, offering invaluable insights for industry stakeholders, investors, and businesses seeking to enter or expand within this dynamic sector. The report leverages extensive market research, incorporating key performance indicators (KPIs), and future projections to provide a holistic understanding of the Romanian POS terminal landscape. With a focus on market size, segmentation, key players, and future trends, this report is an essential resource for navigating the complexities of this growing market. The study period covers 2019-2033, with 2025 as the base and estimated year.

Romania POS Terminal Industry Market Dynamics & Concentration

The Romanian POS terminal market exhibits a moderately concentrated landscape, with several major players vying for market share. While precise market share figures for individual companies are commercially sensitive and unavailable, we estimate that the top five players account for approximately 60% of the market in 2025. Innovation is a key driver, fueled by advancements in contactless payments, mobile POS solutions, and enhanced security features. The regulatory framework, while generally supportive of digital payments, undergoes periodic updates impacting market players. The market also faces pressure from alternative payment methods like mobile wallets and online banking. Mergers and acquisitions (M&A) activity has been relatively modest in recent years, with an estimated xx M&A deals concluded between 2019 and 2024. End-user trends point towards increasing adoption of contactless payments across various sectors, driving demand for sophisticated POS systems.

- Market Concentration: Top 5 players control ~60% (2025 estimate).

- Innovation Drivers: Contactless payments, mobile POS, enhanced security.

- Regulatory Framework: Supportive, with periodic updates.

- Product Substitutes: Mobile wallets, online banking.

- M&A Activity: Estimated xx deals (2019-2024).

- End-User Trends: Growing adoption of contactless payments.

Romania POS Terminal Industry Industry Trends & Analysis

The Romanian POS terminal market is experiencing robust growth, driven by increasing card penetration, government initiatives promoting digital payments, and the expanding e-commerce sector. We project a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, with the market size reaching xx Million by 2033. Technological disruptions, such as the adoption of EMVCo standards and the rise of cloud-based POS solutions, are reshaping the market landscape. Consumer preferences increasingly favor contactless and secure payment options, influencing the demand for advanced POS terminals. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants offering innovative solutions. Market penetration for POS terminals in the retail sector is estimated at xx% in 2025, expected to rise to xx% by 2033.

Leading Markets & Segments in Romania POS Terminal Industry

The retail sector dominates the Romanian POS terminal market, accounting for over 70% of total installations in 2025. This is followed by the hospitality sector (xx%), healthcare (xx%), and others (xx%). Within the "By Type" segment, fixed point-of-sale systems currently hold the largest market share, but mobile/portable POS systems are witnessing significant growth driven by the increasing preference for mobility and convenience in various business settings.

- Dominant Segment: Retail (70% in 2025).

- Key Drivers (Retail): Increasing consumer spending, expansion of retail chains, government initiatives promoting digital payments.

- Key Drivers (Hospitality): Growth of tourism and the restaurant industry, increasing demand for fast and convenient payment options.

- Key Drivers (Healthcare): Growing adoption of digital payment systems in hospitals and clinics.

- Fastest-Growing Segment: Mobile/Portable POS systems.

Romania POS Terminal Industry Product Developments

Recent product developments focus on enhanced security features, improved user interfaces, and seamless integration with other business systems. The introduction of cloud-based POS solutions allows for real-time data analysis and remote management, enhancing operational efficiency. Technological trends indicate a continued shift towards contactless payments and the integration of biometric authentication, driving demand for next-generation POS terminals tailored to these advancements. Manufacturers are striving to offer competitive advantages through innovative features, robust security protocols, and competitive pricing.

Key Drivers of Romania POS Terminal Industry Growth

Several factors contribute to the robust growth of the Romanian POS terminal market. The increasing adoption of digital payment methods driven by government initiatives and increasing consumer preference is a significant driver. The expansion of e-commerce and the rise of online businesses boost the demand for secure and efficient POS systems. Technological advancements, like the introduction of contactless payment technologies and EMVCo-compliant terminals, are also key growth catalysts. Furthermore, favorable economic conditions and increased investment in infrastructure support market expansion.

Challenges in the Romania POS Terminal Industry Market

The Romanian POS terminal market faces challenges, including the high initial investment costs for businesses, particularly small and medium-sized enterprises (SMEs). Competition from alternative payment methods and the potential for cybersecurity threats present ongoing concerns. Supply chain disruptions, exacerbated by global events, can impact the availability and cost of POS terminals. Regulatory changes and compliance requirements can also present hurdles for market players. These factors may hinder market growth in the short to medium term.

Emerging Opportunities in Romania POS Terminal Industry

The long-term growth of the Romanian POS terminal market is promising. Technological breakthroughs like improved biometrics and advanced analytics integrated into POS systems present significant opportunities. Strategic partnerships between POS terminal providers and fintech companies can unlock new market segments and innovative payment solutions. Expansion into underserved regions and industries, such as rural areas and specialized sectors like healthcare and transportation, creates further growth potential.

Key Milestones in Romania POS Terminal Industry Industry

- May 2020: Alpha Bank introduces Verifone Engage EFT-POS terminals, enhancing user experience and security.

- February 2022: Banca Comerciala Romana (BCR) expands contactless payment system to Bucharest public transport.

Strategic Outlook for Romania POS Terminal Industry Market

The Romanian POS terminal market is poised for continued expansion, driven by technological innovation, increasing digitalization, and supportive government policies. Strategic partnerships and investments in innovative technologies will be crucial for companies to maintain competitiveness. The market offers significant opportunities for both established players and new entrants to capitalize on the growing demand for secure, efficient, and user-friendly POS solutions. Expanding into niche markets and adopting data-driven strategies will be key to success in the years to come.

Romania POS Terminal Industry Segmentation

-

1. Type

- 1.1. Fixed Point-of-sale Systems

- 1.2. Mobile/Portable Point-of-sale Systems

-

2. End-User Industry

- 2.1. Retail

- 2.2. Hospitality

- 2.3. Healthcare

- 2.4. Others

Romania POS Terminal Industry Segmentation By Geography

- 1. Romania

Romania POS Terminal Industry Regional Market Share

Geographic Coverage of Romania POS Terminal Industry

Romania POS Terminal Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Mobile Pos Terminals; Surge In Demand For Affordable Wireless Communication Technologies; Increased Demand From The End-Use Industries

- 3.3. Market Restrains

- 3.3.1. Entry Barriers for New Players and Standardization Concerns Especially in the Case of Inter-border Transactions

- 3.4. Market Trends

- 3.4.1. Fixed Point-of -Sale to Show Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Romania POS Terminal Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed Point-of-sale Systems

- 5.1.2. Mobile/Portable Point-of-sale Systems

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Retail

- 5.2.2. Hospitality

- 5.2.3. Healthcare

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Romania

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rapyd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ING Bank Romania*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 POSnet

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 myPOS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SIBS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mellon Romania S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 OTP Bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alpha Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ingenico

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Rapyd

List of Figures

- Figure 1: Romania POS Terminal Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Romania POS Terminal Industry Share (%) by Company 2025

List of Tables

- Table 1: Romania POS Terminal Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Romania POS Terminal Industry Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 3: Romania POS Terminal Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Romania POS Terminal Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Romania POS Terminal Industry Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 6: Romania POS Terminal Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Romania POS Terminal Industry?

The projected CAGR is approximately 11.05%.

2. Which companies are prominent players in the Romania POS Terminal Industry?

Key companies in the market include Rapyd, ING Bank Romania*List Not Exhaustive, POSnet, myPOS, SIBS, Mellon Romania S A, OTP Bank, Alpha Bank, Ingenico.

3. What are the main segments of the Romania POS Terminal Industry?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 111.05 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Mobile Pos Terminals; Surge In Demand For Affordable Wireless Communication Technologies; Increased Demand From The End-Use Industries.

6. What are the notable trends driving market growth?

Fixed Point-of -Sale to Show Significant Growth.

7. Are there any restraints impacting market growth?

Entry Barriers for New Players and Standardization Concerns Especially in the Case of Inter-border Transactions.

8. Can you provide examples of recent developments in the market?

February 2022 - Banca Comerciala Romana (BCR) has signed a contract with the Bucharest Transport Company (STB), the operator of the overground public transport, to expand the smart contactless payment system to all buses, trams and trolleybuses in the city.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Romania POS Terminal Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Romania POS Terminal Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Romania POS Terminal Industry?

To stay informed about further developments, trends, and reports in the Romania POS Terminal Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence