Key Insights

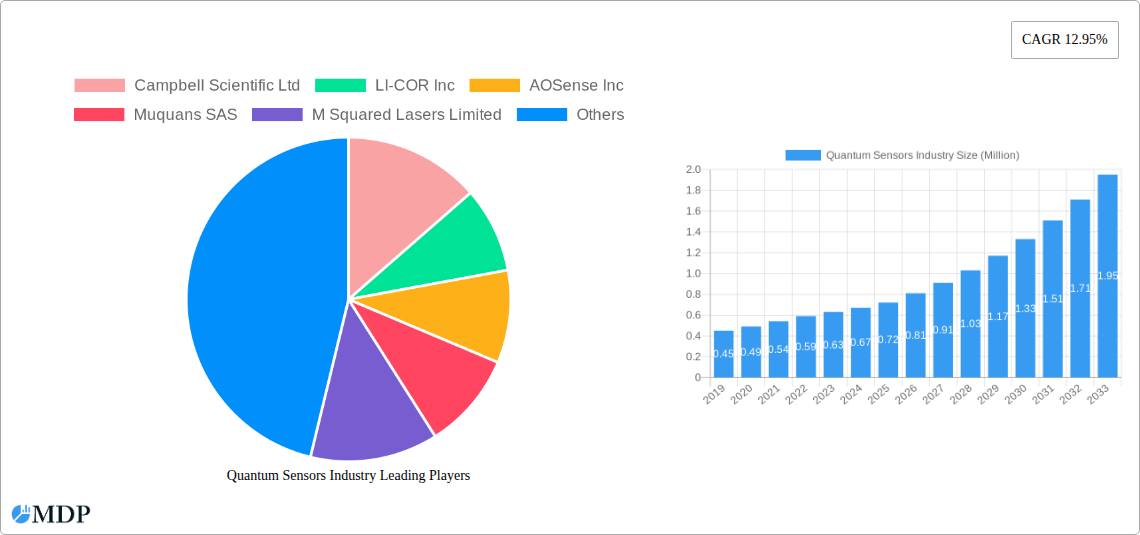

The global Quantum Sensors market is poised for substantial growth, projected to expand from an estimated USD 0.67 million in the base year of 2025 to significantly higher figures by 2033. This robust expansion is fueled by a remarkable Compound Annual Growth Rate (CAGR) of 12.95% over the forecast period of 2025-2033. Driving this growth are key factors such as the increasing demand for highly precise measurement solutions across various sectors and the ongoing advancements in quantum technology research and development. The strategic importance of quantum sensing in applications demanding unparalleled accuracy, such as navigation, resource exploration, and advanced scientific research, further underpins this upward trajectory.

Quantum Sensors Industry Market Size (In Million)

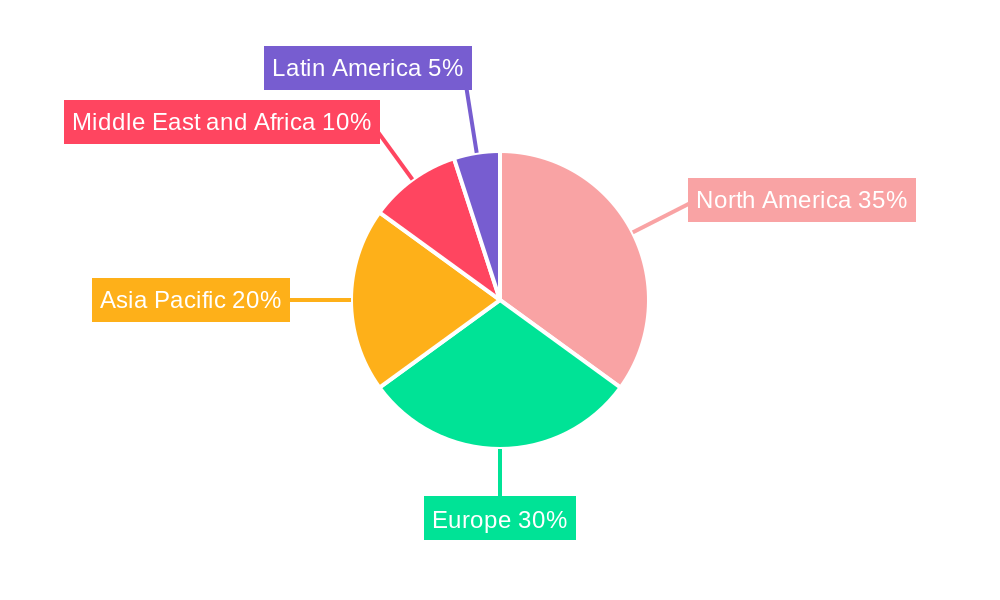

The market is segmented into various product types, including Atomic Clocks, Magnetic Sensors, PAR Quantum Sensors, and Gravity Sensors, each catering to distinct industrial needs. Application areas are equally diverse, with Military and Defense, Automotive, Oil and Gas, and Healthcare leading the charge in adoption. North America and Europe are expected to remain dominant regions, driven by significant investment in R&D and early adoption of cutting-edge technologies. However, the Asia Pacific region is anticipated to witness rapid growth, propelled by increasing industrialization and government initiatives supporting technological innovation. Restraints, though present, such as the high cost of initial investment and the need for specialized expertise, are being steadily overcome by technological maturation and market demand.

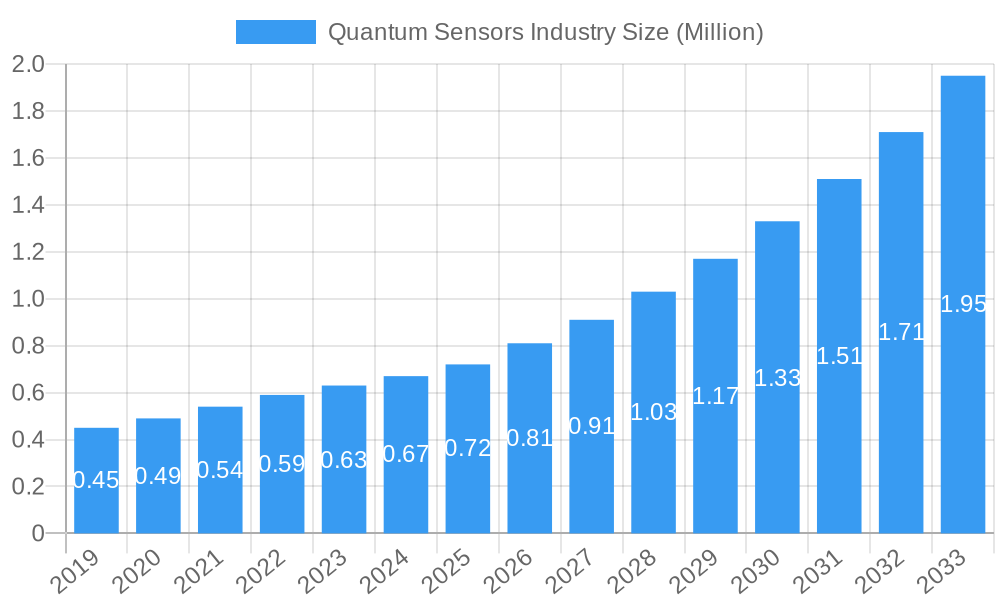

Quantum Sensors Industry Company Market Share

Dive into the groundbreaking Quantum Sensors Industry with this comprehensive report, exploring its trajectory from a niche technology to a transformative force across diverse sectors. This in-depth analysis covers the period from 2019 to 2033, with a base year of 2025, offering unparalleled insights into market dynamics, key players, and future growth opportunities. Discover how advancements in atomic clocks, magnetic sensors, PAR quantum sensors, and gravity sensors are reshaping military and defense, automotive, oil and gas, and healthcare applications. Understand the pivotal role of innovation, regulatory shifts, and strategic investments, such as the US National Science Foundation's USD 29 million investment in April 2024, in driving the adoption of quantum sensing technologies.

Quantum Sensors Industry Market Dynamics & Concentration

The Quantum Sensors Industry is characterized by a moderate to high level of concentration, with a few key players dominating specialized segments. Innovation is the primary driver, fueled by ongoing research into quantum phenomena like entanglement and superposition. While no extensive regulatory frameworks are universally in place, the potential for disruptive applications is prompting increased government attention and investment. Product substitutes are currently limited due to the unique precision and sensitivity offered by quantum sensors, although advancements in classical sensing technologies are continuously being made. End-user trends indicate a growing demand for enhanced accuracy and novel detection capabilities across all major applications. Merger and acquisition (M&A) activities, while not yet at an extreme level, are expected to increase as larger technology conglomerates recognize the strategic importance of quantum sensing. The market share distribution is dynamic, with specialized companies holding significant sway in their respective niche areas. Key M&A deal counts are projected to rise as the technology matures and its commercial viability becomes more apparent.

Quantum Sensors Industry Industry Trends & Analysis

The Quantum Sensors Industry is experiencing robust growth driven by a confluence of technological breakthroughs, increasing investment, and expanding application horizons. The compound annual growth rate (CAGR) for this sector is projected to be substantial, reflecting its disruptive potential. Market penetration is rapidly accelerating as the unique advantages of quantum sensing, such as unparalleled precision, sensitivity, and resolution, become increasingly recognized and valued by industries. Technological disruptions are at the forefront, with continuous advancements in quantum materials, miniaturization, and improved signal processing enabling more accessible and cost-effective quantum sensor solutions. Consumer preferences, though indirectly influenced, are shifting towards products and services that leverage enhanced precision and data accuracy, such as advanced navigation systems, sophisticated medical diagnostics, and more efficient resource exploration. The competitive dynamics are evolving, with established players investing heavily in R&D and new ventures emerging with innovative approaches. This environment fosters a rapid pace of innovation and a constant push for performance improvements. The increasing demand for highly accurate measurements in scientific research, industrial automation, and critical infrastructure monitoring further solidifies the growth trajectory of the quantum sensors market.

Leading Markets & Segments in Quantum Sensors Industry

The Quantum Sensors Industry is witnessing significant growth across multiple regions and applications, with specific segments poised for exceptional expansion.

Dominant Product Segments:

- Atomic Clocks: These remain a cornerstone, driving advancements in navigation, telecommunications, and scientific research due to their unparalleled timekeeping accuracy. Their dominance is fueled by the need for precise synchronization in critical infrastructure and advanced scientific experiments.

- Magnetic Sensors: Experiencing rapid adoption in healthcare for non-invasive imaging (e.g., magnetoencephalography), automotive for enhanced navigation and driver assistance systems, and oil and gas for improved subsurface exploration. The demand for higher sensitivity and spatial resolution is a key driver.

- PAR Quantum Sensors: These are finding increasing application in agriculture and environmental monitoring, offering precise measurements of light for plant growth and ecosystem analysis. Their growth is linked to precision agriculture initiatives and climate change research.

- Gravity Sensors: Crucial for geological surveys, resource exploration (oil, gas, minerals), and infrastructure monitoring, gravity sensors are benefiting from advancements that reduce size, weight, and power consumption, making them more deployable in challenging environments.

- Other Product Types: This category encompasses emerging technologies like quantum accelerometers and quantum imagers, which are rapidly gaining traction in specialized defense applications and scientific discovery.

Dominant Application Segments:

- Military and Defense: This sector is a major early adopter, leveraging quantum sensors for enhanced navigation, stealth detection, secure communications, and advanced reconnaissance. The inherent precision and ability to operate in GPS-denied environments make them invaluable.

- Automotive: The rise of autonomous driving necessitates highly accurate sensors for localization, environmental perception, and object detection. Quantum magnetic and gravity sensors are expected to play a significant role in future vehicle systems, offering superior performance compared to conventional sensors.

- Oil and Gas: Quantum gravity and magnetic sensors are revolutionizing subsurface exploration by enabling more precise identification of mineral deposits and hydrocarbon reserves, leading to more efficient and cost-effective extraction.

- Healthcare: Beyond magnetic sensors for imaging, quantum technologies are being explored for highly sensitive disease detection, drug discovery, and personalized medicine, promising a new era of diagnostic capabilities.

Quantum Sensors Industry Product Developments

Product developments in the Quantum Sensors Industry are marked by significant strides in miniaturization, increased sensitivity, and expanded operational capabilities. Innovations in atomic clocks are leading to smaller, more robust devices for portable navigation and secure communication systems. Magnetic sensors are benefiting from improved coherence times and reduced noise, enabling novel medical imaging techniques and highly precise geophysical surveys. PAR quantum sensors are becoming more integrated and user-friendly for a wider range of environmental and agricultural monitoring. The competitive advantage lies in achieving higher signal-to-noise ratios, lower power consumption, and greater robustness in diverse operating conditions. These developments are critical for accelerating market adoption and unlocking new application frontiers.

Key Drivers of Quantum Sensors Industry Growth

The Quantum Sensors Industry is propelled by several critical growth drivers. Technological advancements, particularly in atomic physics and quantum materials, are enabling the creation of sensors with unprecedented sensitivity and precision, unlocking applications previously thought impossible. Increased government and private sector investment, exemplified by the US National Science Foundation's USD 29 million initiative, is fueling research and development, accelerating commercialization. The growing demand for high-precision measurement and detection across sectors like defense, healthcare, and automotive for enhanced navigation, diagnostics, and resource exploration is a significant catalyst. Furthermore, the potential for quantum sensors to overcome limitations of classical technologies in areas like GPS-denied navigation and non-invasive medical imaging is creating substantial market opportunities.

Challenges in the Quantum Sensors Industry Market

Despite its immense potential, the Quantum Sensors Industry faces several challenges. High development and manufacturing costs associated with complex quantum technologies remain a significant barrier to widespread adoption, particularly for smaller enterprises. The need for specialized expertise in quantum physics and engineering to design, operate, and maintain these sophisticated systems creates a talent gap. Furthermore, integrating quantum sensors into existing infrastructure and ensuring interoperability with current systems requires substantial effort and investment. While specific regulations are still evolving, the potential for misuse of highly sensitive detection capabilities may lead to future regulatory hurdles. Supply chain complexities for specialized quantum components can also lead to production delays and cost escalations, impacting market accessibility.

Emerging Opportunities in Quantum Sensors Industry

Emerging opportunities in the Quantum Sensors Industry are vast and transformative. The ongoing miniaturization and cost reduction of quantum sensing components are paving the way for integration into a broader range of consumer electronics and portable devices, expanding market reach significantly. Strategic partnerships between quantum technology developers and established industry leaders, particularly in the automotive and healthcare sectors, are creating new product development pathways and market access. The exploration of novel applications in areas such as advanced materials science, fundamental physics research, and climate monitoring presents long-term growth catalysts. Furthermore, the development of quantum sensor networks for enhanced environmental monitoring and disaster prediction holds immense potential for societal benefit and commercial ventures.

Leading Players in the Quantum Sensors Industry Sector

- Campbell Scientific Ltd

- LI-COR Inc

- AOSense Inc

- Muquans SAS

- M Squared Lasers Limited

- Skye Instruments Ltd

- Robert Bosch GmbH

- Apogee Instrument Inc

Key Milestones in Quantum Sensors Industry Industry

- April 2024: The US National Science Foundation invested USD 29 million to assist 18 teams of researchers at universities across the United States to explore quantum sensing. Each research team will receive around USD 2 million over four years to research quantum phenomena, such as entanglement, to create sensors to assist in things that would otherwise be impossible. Quantum sensors can enable experts to pinpoint infections inside individual cells and find subterranean mineral deposits.

- January 2024: The Brazilian government announced a new industrial policy with development goals and measures up to 2033. The new policies are expected to directly improve people's daily lives, stimulate production and technology development, increase the competitiveness of the Brazilian industry, provide investment guidance, promote better jobs, and enhance the country's qualified presence in the international market.

Strategic Outlook for Quantum Sensors Industry Market

The strategic outlook for the Quantum Sensors Industry is exceptionally positive, driven by continued technological innovation and increasing market demand for unparalleled precision. Key growth accelerators include the ongoing maturation of quantum computing and AI, which will further enhance the capabilities and applications of quantum sensors. Strategic opportunities lie in the development of quantum sensor networks for real-time environmental monitoring and the creation of highly accurate, non-invasive diagnostic tools for personalized healthcare. Market expansion will also be driven by the integration of quantum sensors into existing technological ecosystems, such as advanced driver-assistance systems and secure communication infrastructures. The potential for quantum sensors to address critical global challenges, from climate change to disease detection, positions this industry for sustained and significant growth.

Quantum Sensors Industry Segmentation

-

1. Product Type

- 1.1. Atomic Clocks

- 1.2. Magnetic Sensors

- 1.3. PAR Quantum Sensors

- 1.4. Gravity Sensors

- 1.5. Other Product Types

-

2. Application

- 2.1. Military and Defense

- 2.2. Automotive

- 2.3. Oil and Gas

- 2.4. Healthcare

- 2.5. Other Applications

Quantum Sensors Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. UAE

- 4.2. South Africa

- 4.3. Saudi Arabia

- 4.4. Rest Of MEA

-

5. Latin America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Quantum Sensors Industry Regional Market Share

Geographic Coverage of Quantum Sensors Industry

Quantum Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Research Activities in the Quantum Field; Increasing Investment in Space Communication

- 3.3. Market Restrains

- 3.3.1. High Deployment and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Oil and Gas Industry to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Quantum Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Atomic Clocks

- 5.1.2. Magnetic Sensors

- 5.1.3. PAR Quantum Sensors

- 5.1.4. Gravity Sensors

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Military and Defense

- 5.2.2. Automotive

- 5.2.3. Oil and Gas

- 5.2.4. Healthcare

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Middle East and Africa

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Quantum Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Atomic Clocks

- 6.1.2. Magnetic Sensors

- 6.1.3. PAR Quantum Sensors

- 6.1.4. Gravity Sensors

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Military and Defense

- 6.2.2. Automotive

- 6.2.3. Oil and Gas

- 6.2.4. Healthcare

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Quantum Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Atomic Clocks

- 7.1.2. Magnetic Sensors

- 7.1.3. PAR Quantum Sensors

- 7.1.4. Gravity Sensors

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Military and Defense

- 7.2.2. Automotive

- 7.2.3. Oil and Gas

- 7.2.4. Healthcare

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Quantum Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Atomic Clocks

- 8.1.2. Magnetic Sensors

- 8.1.3. PAR Quantum Sensors

- 8.1.4. Gravity Sensors

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Military and Defense

- 8.2.2. Automotive

- 8.2.3. Oil and Gas

- 8.2.4. Healthcare

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Quantum Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Atomic Clocks

- 9.1.2. Magnetic Sensors

- 9.1.3. PAR Quantum Sensors

- 9.1.4. Gravity Sensors

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Military and Defense

- 9.2.2. Automotive

- 9.2.3. Oil and Gas

- 9.2.4. Healthcare

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Latin America Quantum Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Atomic Clocks

- 10.1.2. Magnetic Sensors

- 10.1.3. PAR Quantum Sensors

- 10.1.4. Gravity Sensors

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Military and Defense

- 10.2.2. Automotive

- 10.2.3. Oil and Gas

- 10.2.4. Healthcare

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Campbell Scientific Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LI-COR Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AOSense Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Muquans SAS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 M Squared Lasers Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Skye Instruments Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Robert Bosch GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Apogee Instrument Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Campbell Scientific Ltd

List of Figures

- Figure 1: Global Quantum Sensors Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Quantum Sensors Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Quantum Sensors Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 4: North America Quantum Sensors Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: North America Quantum Sensors Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Quantum Sensors Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Quantum Sensors Industry Revenue (Million), by Application 2025 & 2033

- Figure 8: North America Quantum Sensors Industry Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Quantum Sensors Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Quantum Sensors Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Quantum Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Quantum Sensors Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Quantum Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Quantum Sensors Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Quantum Sensors Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 16: Europe Quantum Sensors Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 17: Europe Quantum Sensors Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Quantum Sensors Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 19: Europe Quantum Sensors Industry Revenue (Million), by Application 2025 & 2033

- Figure 20: Europe Quantum Sensors Industry Volume (K Unit), by Application 2025 & 2033

- Figure 21: Europe Quantum Sensors Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Quantum Sensors Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Quantum Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Quantum Sensors Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Quantum Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Quantum Sensors Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Quantum Sensors Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 28: Asia Quantum Sensors Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 29: Asia Quantum Sensors Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Quantum Sensors Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Asia Quantum Sensors Industry Revenue (Million), by Application 2025 & 2033

- Figure 32: Asia Quantum Sensors Industry Volume (K Unit), by Application 2025 & 2033

- Figure 33: Asia Quantum Sensors Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Quantum Sensors Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Quantum Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Quantum Sensors Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Quantum Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Quantum Sensors Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Quantum Sensors Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 40: Middle East and Africa Quantum Sensors Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 41: Middle East and Africa Quantum Sensors Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: Middle East and Africa Quantum Sensors Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 43: Middle East and Africa Quantum Sensors Industry Revenue (Million), by Application 2025 & 2033

- Figure 44: Middle East and Africa Quantum Sensors Industry Volume (K Unit), by Application 2025 & 2033

- Figure 45: Middle East and Africa Quantum Sensors Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Middle East and Africa Quantum Sensors Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: Middle East and Africa Quantum Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Quantum Sensors Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Quantum Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Quantum Sensors Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Quantum Sensors Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 52: Latin America Quantum Sensors Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 53: Latin America Quantum Sensors Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Latin America Quantum Sensors Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Latin America Quantum Sensors Industry Revenue (Million), by Application 2025 & 2033

- Figure 56: Latin America Quantum Sensors Industry Volume (K Unit), by Application 2025 & 2033

- Figure 57: Latin America Quantum Sensors Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: Latin America Quantum Sensors Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: Latin America Quantum Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Latin America Quantum Sensors Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: Latin America Quantum Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America Quantum Sensors Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Quantum Sensors Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Quantum Sensors Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Quantum Sensors Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Quantum Sensors Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Quantum Sensors Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Quantum Sensors Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Quantum Sensors Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Quantum Sensors Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 9: Global Quantum Sensors Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Quantum Sensors Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Quantum Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Quantum Sensors Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Quantum Sensors Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global Quantum Sensors Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 21: Global Quantum Sensors Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Quantum Sensors Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Quantum Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Quantum Sensors Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: France Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Italy Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Spain Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Quantum Sensors Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Global Quantum Sensors Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 39: Global Quantum Sensors Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global Quantum Sensors Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 41: Global Quantum Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Quantum Sensors Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: China Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Japan Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: India Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Australia Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: South Korea Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Quantum Sensors Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 56: Global Quantum Sensors Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 57: Global Quantum Sensors Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 58: Global Quantum Sensors Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 59: Global Quantum Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Quantum Sensors Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: UAE Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: UAE Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: South Africa Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Saudi Arabia Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Saudi Arabia Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Rest Of MEA Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Rest Of MEA Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 69: Global Quantum Sensors Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 70: Global Quantum Sensors Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 71: Global Quantum Sensors Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 72: Global Quantum Sensors Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 73: Global Quantum Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 74: Global Quantum Sensors Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 75: Brazil Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Brazil Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Argentina Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Argentina Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: Rest of South America Quantum Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Rest of South America Quantum Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Quantum Sensors Industry?

The projected CAGR is approximately 12.95%.

2. Which companies are prominent players in the Quantum Sensors Industry?

Key companies in the market include Campbell Scientific Ltd, LI-COR Inc, AOSense Inc, Muquans SAS, M Squared Lasers Limited, Skye Instruments Ltd, Robert Bosch GmbH, Apogee Instrument Inc.

3. What are the main segments of the Quantum Sensors Industry?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Research Activities in the Quantum Field; Increasing Investment in Space Communication.

6. What are the notable trends driving market growth?

Oil and Gas Industry to Grow Significantly.

7. Are there any restraints impacting market growth?

High Deployment and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

April 2024: The US National Science Foundation invested USD 29 million to assist 18 teams of researchers at universities across the United States to explore quantum sensing. Each research team will receive around USD 2 million over four years to research quantum phenomena, such as entanglement, to create sensors to assist in things that would otherwise be impossible. Quantum sensors can enable experts to pinpoint infections inside individual cells and find subterranean mineral deposits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Quantum Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Quantum Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Quantum Sensors Industry?

To stay informed about further developments, trends, and reports in the Quantum Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence