Key Insights

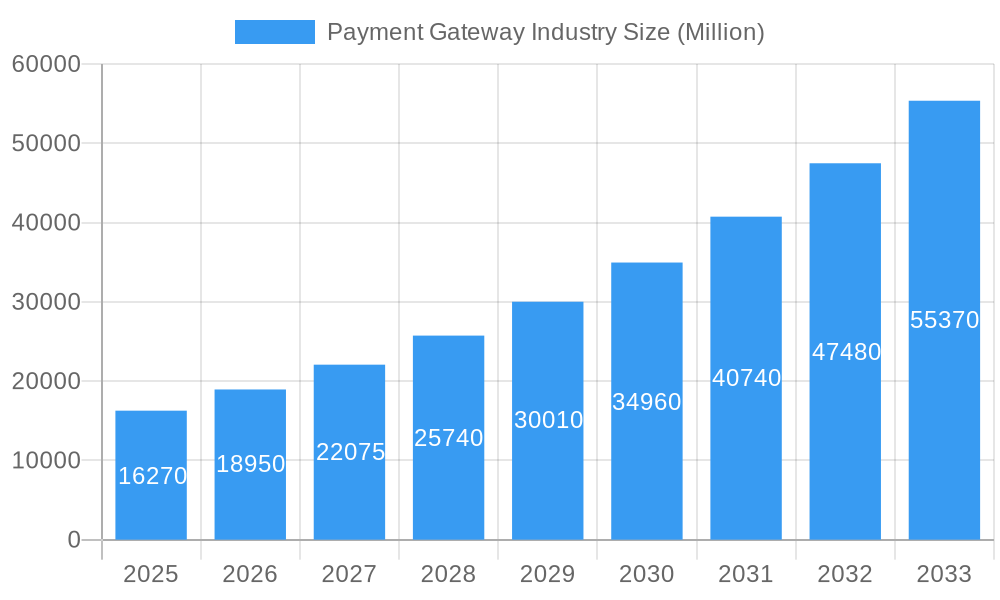

The global Payment Gateway Industry is experiencing robust growth, projected to reach a substantial market size of approximately $16.27 billion by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 16.43%. This rapid expansion is propelled by a confluence of powerful drivers, including the accelerating digital transformation across industries, the escalating adoption of e-commerce platforms, and the increasing demand for seamless, secure, and convenient online transactions. The proliferation of mobile payment solutions and the growing global acceptance of digital wallets further fuel this growth. The industry is witnessing significant trends such as the rise of API-driven payment gateways, enabling greater integration and customization for businesses, and the increasing focus on enhanced security features like tokenization and multi-factor authentication to combat fraud. Moreover, the surge in cross-border e-commerce necessitates sophisticated payment gateways capable of handling diverse currencies and regulatory landscapes.

Payment Gateway Industry Market Size (In Billion)

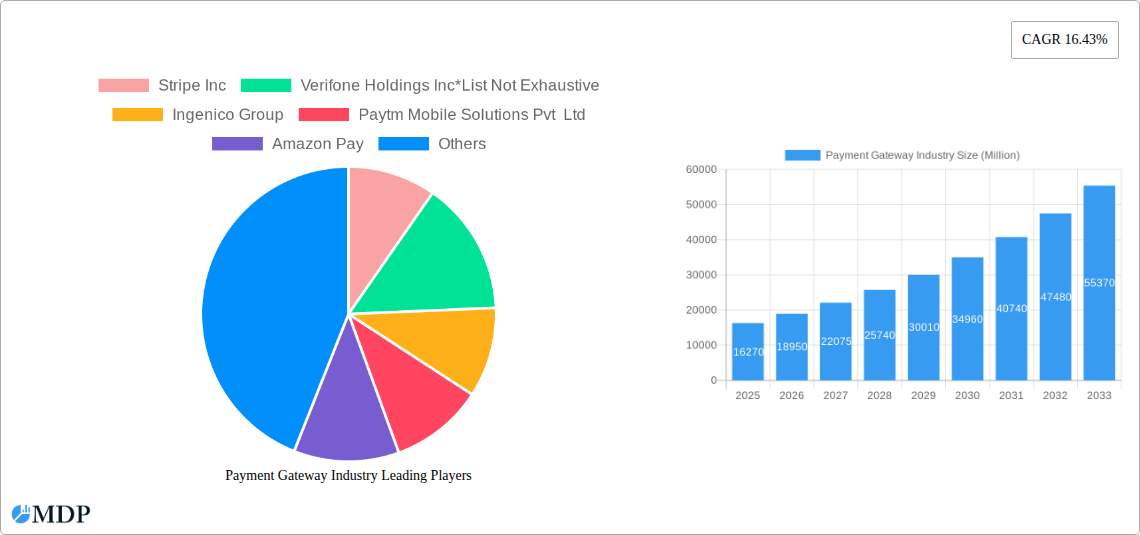

The market is segmented into Hosted and Non-Hosted types, with a significant push towards Hosted solutions due to their ease of implementation and scalability. In terms of enterprise size, Small and Medium Enterprises (SMEs) are increasingly leveraging payment gateways to compete with larger players, while Large Enterprises are focused on optimizing their payment infrastructure for global reach and enhanced customer experience. Key end-user verticals like Travel, Retail, BFSI (Banking, Financial Services, and Insurance), and Media and Entertainment are major contributors to market demand, driven by their high transaction volumes. While the market's growth trajectory is strong, certain restraints may emerge, including stringent regulatory compliance requirements across different regions and potential cybersecurity threats that could erode consumer trust. However, the continuous innovation in payment technologies and the ongoing expansion of the digital economy are expected to outweigh these challenges, ensuring sustained market expansion. Prominent players like Stripe Inc., Verifone Holdings Inc., Ingenico Group, Paytm Mobile Solutions Pvt Ltd, Amazon Pay, Alipay.com, PayPal Holdings Inc., Adyen N.V., Payoneer Inc., Skrill Limited, Payza, and PayU Group are actively shaping the competitive landscape through strategic partnerships and technological advancements.

Payment Gateway Industry Company Market Share

Unleash the Future of Digital Transactions: Comprehensive Payment Gateway Industry Report 2024-2033

Gain unparalleled insights into the global payment gateway market, a dynamic sector projected to reach trillions of dollars by 2033. This in-depth report, covering the historical period of 2019-2024 and a forecast period of 2025-2033 with 2025 as the base and estimated year, equips industry stakeholders with actionable intelligence to navigate evolving landscapes. Delve into critical market dynamics, emerging trends, leading segments, and strategic opportunities within the online payment processing industry, e-commerce payment solutions, and mobile payment gateways. Understand the impact of innovations, regulatory shifts, and competitive strategies from key players like Stripe Inc, Verifone Holdings Inc, Ingenico Group, Paytm Mobile Solutions Pvt Ltd, Amazon Pay, Alipay.com, PayPal Holdings Inc, Adyen NV, Payoneer Inc, Skrill Limited, Payza, and PayU Group.

Payment Gateway Industry Market Dynamics & Concentration

The payment gateway industry exhibits a moderate to high concentration, driven by significant technological advancements and increasing adoption of digital payment methods across various end-user verticals. Innovation remains a key differentiator, with companies continuously developing solutions for enhanced security, faster transaction processing, and improved user experience. Regulatory frameworks, while varied by region, are increasingly focused on data privacy, fraud prevention, and interoperability, influencing market access and operational strategies. Product substitutes, though present in traditional payment methods, are steadily losing ground to the convenience and efficiency of digital gateways. End-user trends highlight a growing demand for seamless, omnichannel payment experiences, particularly within the retail, travel, and BFSI sectors. Mergers and acquisitions (M&A) activity is a notable aspect of market consolidation, with numerous deals valued in the hundreds of millions to billions of dollars aimed at expanding market reach, acquiring innovative technologies, or integrating complementary services. The market share of leading players like Stripe and PayPal is substantial, often exceeding 15-20% individually, reflecting their established brand presence and extensive service portfolios. The number of significant M&A deals annually hovers around 10-25, signaling ongoing strategic realignments.

Payment Gateway Industry Industry Trends & Analysis

The global payment gateway market is experiencing robust growth, fueled by several intersecting trends that are reshaping how businesses and consumers transact. The Compound Annual Growth Rate (CAGR) for the industry is estimated to be in the range of 12-15% during the forecast period, driven by the accelerating shift towards digital commerce and mobile payments. Market penetration for digital payment solutions continues to rise, especially in emerging economies, where it is projected to surpass 70-80% by 2033.

Technological disruptions are at the forefront of this evolution. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is enhancing fraud detection capabilities, improving authorization rates, and personalizing customer experiences. The rise of Application Programming Interfaces (APIs) has enabled greater interoperability, allowing for more flexible and integrated payment solutions that can be embedded within various platforms and applications. Furthermore, the increasing adoption of contactless payments, driven by convenience and hygiene concerns, is pushing gateway providers to enhance their support for technologies like Near Field Communication (NFC).

Consumer preferences are increasingly leaning towards frictionless, secure, and diverse payment options. Customers expect to be able to pay using their preferred method, whether it be credit/debit cards, digital wallets, buy now, pay later (BNPL) services, or cryptocurrencies. This demand for choice is compelling payment gateway providers to broaden their acceptance networks and offer a wider array of payment instruments. The growing emphasis on data security and privacy regulations, such as GDPR and CCPA, also necessitates robust compliance measures from gateway providers, thus fostering trust and confidence among users.

The competitive landscape is characterized by intense innovation and strategic partnerships. Established players are continuously refining their offerings to maintain market leadership, while new entrants are disrupting the market with niche solutions and innovative business models. The ongoing expansion of e-commerce, coupled with the increasing digitalization of traditional industries, provides a fertile ground for payment gateway services to thrive. The total addressable market for payment gateways is projected to exceed $150 trillion by 2033, underscoring the immense opportunity.

Leading Markets & Segments in Payment Gateway Industry

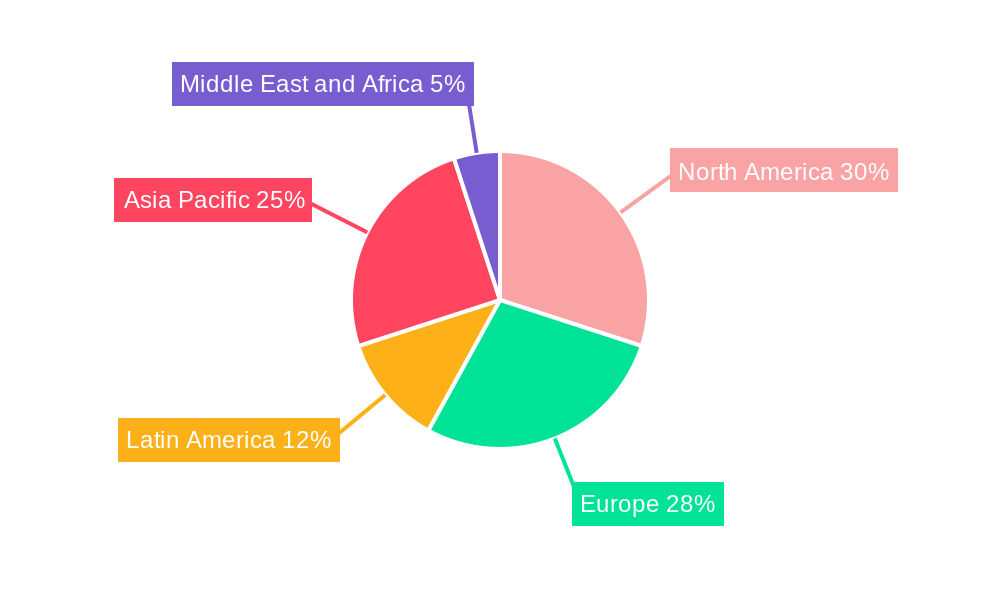

The payment gateway industry's dominance is most pronounced in regions with high internet penetration and advanced digital economies, with North America and Europe leading in market share, each accounting for approximately 25-30% of the global market. The Asia-Pacific region is witnessing the fastest growth, driven by rapid digitalization and a burgeoning middle class, and is projected to become the largest market within the next decade. Within countries, the United States and China are the pivotal markets, representing a significant portion of global transaction volumes.

In terms of Type, Hosted payment gateways hold a substantial market share, estimated to be around 60%, due to their ease of implementation and inherent security features, which are particularly appealing to small and medium-sized enterprises (SMEs). However, Non-Hosted gateways are gaining traction, especially among larger enterprises seeking greater control over the customer checkout experience and branding, with their market share projected to grow steadily to around 40%.

The Enterprise segment is bifurcated, with Large Enterprises currently dominating due to their higher transaction volumes and complex payment needs, accounting for roughly 55% of the market. However, the Small and Medium Enterprise (SME) segment is experiencing accelerated growth, with an estimated CAGR of 13-16%, as more businesses migrate online and seek cost-effective, scalable payment solutions. This segment is projected to capture a larger share, nearing 45%, by the end of the forecast period.

Across End-User Verticals, the Retail sector remains the largest consumer of payment gateway services, driven by the explosive growth of e-commerce. It accounts for approximately 30-35% of the market. The BFSI (Banking, Financial Services, and Insurance) sector is another significant segment, leveraging gateways for online account management, loan applications, and insurance premium payments, representing about 20-25%. The Travel industry, despite its cyclical nature, is a crucial segment for online bookings and payments, contributing around 15%. The Media and Entertainment sector is also expanding its reliance on digital payments for subscriptions and content purchases, estimated at 10%. The "Other End-user Verticals" category, encompassing gaming, education, and healthcare, is a rapidly growing segment, projected to collectively account for 15-20% of the market.

- Key Drivers for Regional Dominance:

- High internet and smartphone penetration.

- Mature e-commerce ecosystems.

- Favorable regulatory environments for digital payments.

- Strong consumer trust in digital financial services.

- Availability of robust financial infrastructure.

Payment Gateway Industry Product Developments

Product development in the payment gateway industry is intensely focused on enhancing security, streamlining the checkout process, and expanding functionality. Innovations include advanced fraud detection algorithms leveraging AI and ML, tokenization for secure card data handling, and one-click payment solutions for reduced friction. Companies are also developing integrated solutions that offer embedded finance options, such as Buy Now, Pay Later (BNPL) functionalities, directly within the checkout flow. The competitive advantage lies in providing a seamless, end-to-end payment experience that caters to diverse customer preferences and regulatory demands, thereby boosting conversion rates and customer loyalty. This is further amplified by the increasing demand for cross-border payment capabilities and localized payment methods to cater to a global customer base.

Key Drivers of Payment Gateway Industry Growth

Several key drivers are propelling the growth of the payment gateway industry. The relentless expansion of e-commerce, fueled by increasing internet penetration and changing consumer shopping habits, is a primary catalyst. Technological advancements, such as the proliferation of smartphones and the widespread adoption of mobile payment solutions, are making digital transactions more accessible and convenient. Furthermore, government initiatives promoting digital economies and financial inclusion in various countries are creating a more favorable ecosystem for payment gateways. The increasing demand for secure and seamless transaction experiences, coupled with the growing acceptance of alternative payment methods like digital wallets and BNPL services, are also significant growth accelerators. The ongoing digitalization of traditional businesses across all sectors is further broadening the addressable market.

Challenges in the Payment Gateway Industry Market

Despite robust growth, the payment gateway industry faces significant challenges. Evolving regulatory landscapes, particularly around data privacy and anti-money laundering (AML) compliance, can impose complex and costly obligations on businesses. Intense competition from a multitude of established and emerging players leads to price pressures and demands for continuous innovation, requiring substantial investment. The threat of sophisticated cyberattacks and data breaches necessitates constant vigilance and investment in advanced security measures, which can be a burden for smaller providers. Furthermore, the operational complexity of integrating with diverse banking systems and payment networks globally, alongside ensuring consistent service availability and managing chargebacks effectively, presents ongoing challenges. The cost of acquiring and retaining customers in a crowded market also adds to the operational burden.

Emerging Opportunities in Payment Gateway Industry

Emerging opportunities in the payment gateway industry are abundant, driven by technological breakthroughs and evolving market demands. The integration of cryptocurrencies as a payment option presents a significant untapped market, attracting both businesses and consumers seeking decentralized and borderless transactions. The burgeoning field of embedded finance, where payment solutions are seamlessly integrated into non-financial platforms, offers vast potential for expansion. Strategic partnerships between payment gateways, fintech companies, and traditional financial institutions are creating innovative ecosystems and expanding service offerings. Furthermore, the growing demand for cross-border e-commerce presents a substantial opportunity for gateways that can facilitate smooth international transactions with competitive exchange rates and localized payment methods. The expansion of payment solutions into underserved markets and developing economies also offers significant long-term growth potential.

Leading Players in the Payment Gateway Industry Sector

- Stripe Inc

- Verifone Holdings Inc

- Ingenico Group

- Paytm Mobile Solutions Pvt Ltd

- Amazon Pay

- Alipay.com

- PayPal Holdings Inc

- Adyen NV

- Payoneer Inc

- Skrill Limited

- Payza

- PayU Group

Key Milestones in Payment Gateway Industry Industry

- November 2022: Adyen, a global financial technology platform, partnered with Instacart, North America's leading grocery technology company, as an additional payments gateway processing partner. As part of the new partnership, Instacart would leverage Adyen functionality, including PINless debit enablement of transactions, to further optimize and improve authorization rates for an even more seamless customer experience.

- September 2022: Unified Payments Interface (UPI) leader PhonePe is working toward launching its own payments gateway as an extension to its QR code-based UPI Payments service and in-app payments. The gateway is expected to launch in the 1st Quarter of 2023.

Strategic Outlook for Payment Gateway Industry Market

The strategic outlook for the payment gateway industry is overwhelmingly positive, driven by continuous innovation and expanding digital adoption. The future market potential lies in the seamless integration of diverse payment methods, including cryptocurrencies and BNPL, into unified checkout experiences. Strategic opportunities revolve around expanding into emerging markets with tailored solutions, fostering deeper partnerships with e-commerce platforms, and leveraging advanced technologies like AI for enhanced security and personalization. Focusing on providing robust cross-border payment capabilities and catering to the specific needs of SMEs through scalable and affordable solutions will be crucial for sustained growth. The industry is poised for further consolidation and specialization, with players differentiating themselves through specialized services, superior customer support, and adherence to evolving global compliance standards, ultimately shaping the future of digital commerce.

Payment Gateway Industry Segmentation

-

1. Type

- 1.1. Hosted

- 1.2. Non-Hosted

-

2. Enterprise

- 2.1. Small and Medium Enterprise (SME)

- 2.2. Large Enterprise

-

3. End User

- 3.1. Travel

- 3.2. Retail

- 3.3. BFSI

- 3.4. Media and Entertainment

- 3.5. Other End-user Verticals

Payment Gateway Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Latin America

- 4. Asia Pacific

- 5. Middle East and Africa

Payment Gateway Industry Regional Market Share

Geographic Coverage of Payment Gateway Industry

Payment Gateway Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased e-commerce Sales and the High Internet Penetration Rate; Increase Demand for Mobile Based Payments; Growing adoption of payment gateway in Retail

- 3.3. Market Restrains

- 3.3.1. Security and Privacy Concerns to Restrain the Market

- 3.4. Market Trends

- 3.4.1. Growing adoption of payment gateway in Retail

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Payment Gateway Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hosted

- 5.1.2. Non-Hosted

- 5.2. Market Analysis, Insights and Forecast - by Enterprise

- 5.2.1. Small and Medium Enterprise (SME)

- 5.2.2. Large Enterprise

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Travel

- 5.3.2. Retail

- 5.3.3. BFSI

- 5.3.4. Media and Entertainment

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Latin America

- 5.4.4. Asia Pacific

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Payment Gateway Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hosted

- 6.1.2. Non-Hosted

- 6.2. Market Analysis, Insights and Forecast - by Enterprise

- 6.2.1. Small and Medium Enterprise (SME)

- 6.2.2. Large Enterprise

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Travel

- 6.3.2. Retail

- 6.3.3. BFSI

- 6.3.4. Media and Entertainment

- 6.3.5. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Payment Gateway Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hosted

- 7.1.2. Non-Hosted

- 7.2. Market Analysis, Insights and Forecast - by Enterprise

- 7.2.1. Small and Medium Enterprise (SME)

- 7.2.2. Large Enterprise

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Travel

- 7.3.2. Retail

- 7.3.3. BFSI

- 7.3.4. Media and Entertainment

- 7.3.5. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Latin America Payment Gateway Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hosted

- 8.1.2. Non-Hosted

- 8.2. Market Analysis, Insights and Forecast - by Enterprise

- 8.2.1. Small and Medium Enterprise (SME)

- 8.2.2. Large Enterprise

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Travel

- 8.3.2. Retail

- 8.3.3. BFSI

- 8.3.4. Media and Entertainment

- 8.3.5. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Asia Pacific Payment Gateway Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hosted

- 9.1.2. Non-Hosted

- 9.2. Market Analysis, Insights and Forecast - by Enterprise

- 9.2.1. Small and Medium Enterprise (SME)

- 9.2.2. Large Enterprise

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Travel

- 9.3.2. Retail

- 9.3.3. BFSI

- 9.3.4. Media and Entertainment

- 9.3.5. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Payment Gateway Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Hosted

- 10.1.2. Non-Hosted

- 10.2. Market Analysis, Insights and Forecast - by Enterprise

- 10.2.1. Small and Medium Enterprise (SME)

- 10.2.2. Large Enterprise

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Travel

- 10.3.2. Retail

- 10.3.3. BFSI

- 10.3.4. Media and Entertainment

- 10.3.5. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Stripe Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Verifone Holdings Inc*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ingenico Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Paytm Mobile Solutions Pvt Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Amazon Pay

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Alipay com

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PayPal Holdings Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Adyen NV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Payoneer Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Skrill Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Payza

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PayU Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Stripe Inc

List of Figures

- Figure 1: Global Payment Gateway Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Payment Gateway Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Payment Gateway Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Payment Gateway Industry Revenue (Million), by Enterprise 2025 & 2033

- Figure 5: North America Payment Gateway Industry Revenue Share (%), by Enterprise 2025 & 2033

- Figure 6: North America Payment Gateway Industry Revenue (Million), by End User 2025 & 2033

- Figure 7: North America Payment Gateway Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Payment Gateway Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Payment Gateway Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Payment Gateway Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Payment Gateway Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Payment Gateway Industry Revenue (Million), by Enterprise 2025 & 2033

- Figure 13: Europe Payment Gateway Industry Revenue Share (%), by Enterprise 2025 & 2033

- Figure 14: Europe Payment Gateway Industry Revenue (Million), by End User 2025 & 2033

- Figure 15: Europe Payment Gateway Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Payment Gateway Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Payment Gateway Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Latin America Payment Gateway Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Latin America Payment Gateway Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Latin America Payment Gateway Industry Revenue (Million), by Enterprise 2025 & 2033

- Figure 21: Latin America Payment Gateway Industry Revenue Share (%), by Enterprise 2025 & 2033

- Figure 22: Latin America Payment Gateway Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Latin America Payment Gateway Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America Payment Gateway Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Payment Gateway Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Payment Gateway Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific Payment Gateway Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Payment Gateway Industry Revenue (Million), by Enterprise 2025 & 2033

- Figure 29: Asia Pacific Payment Gateway Industry Revenue Share (%), by Enterprise 2025 & 2033

- Figure 30: Asia Pacific Payment Gateway Industry Revenue (Million), by End User 2025 & 2033

- Figure 31: Asia Pacific Payment Gateway Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Asia Pacific Payment Gateway Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Asia Pacific Payment Gateway Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Payment Gateway Industry Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East and Africa Payment Gateway Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Payment Gateway Industry Revenue (Million), by Enterprise 2025 & 2033

- Figure 37: Middle East and Africa Payment Gateway Industry Revenue Share (%), by Enterprise 2025 & 2033

- Figure 38: Middle East and Africa Payment Gateway Industry Revenue (Million), by End User 2025 & 2033

- Figure 39: Middle East and Africa Payment Gateway Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: Middle East and Africa Payment Gateway Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Payment Gateway Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Payment Gateway Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Payment Gateway Industry Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 3: Global Payment Gateway Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Payment Gateway Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Payment Gateway Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Payment Gateway Industry Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 7: Global Payment Gateway Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Payment Gateway Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Payment Gateway Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Payment Gateway Industry Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 11: Global Payment Gateway Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Payment Gateway Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Payment Gateway Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Payment Gateway Industry Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 15: Global Payment Gateway Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 16: Global Payment Gateway Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Payment Gateway Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Payment Gateway Industry Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 19: Global Payment Gateway Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 20: Global Payment Gateway Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Payment Gateway Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Payment Gateway Industry Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 23: Global Payment Gateway Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 24: Global Payment Gateway Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Payment Gateway Industry?

The projected CAGR is approximately 16.43%.

2. Which companies are prominent players in the Payment Gateway Industry?

Key companies in the market include Stripe Inc, Verifone Holdings Inc*List Not Exhaustive, Ingenico Group, Paytm Mobile Solutions Pvt Ltd, Amazon Pay, Alipay com, PayPal Holdings Inc, Adyen NV, Payoneer Inc, Skrill Limited, Payza, PayU Group.

3. What are the main segments of the Payment Gateway Industry?

The market segments include Type, Enterprise, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased e-commerce Sales and the High Internet Penetration Rate; Increase Demand for Mobile Based Payments; Growing adoption of payment gateway in Retail.

6. What are the notable trends driving market growth?

Growing adoption of payment gateway in Retail.

7. Are there any restraints impacting market growth?

Security and Privacy Concerns to Restrain the Market.

8. Can you provide examples of recent developments in the market?

November 2022 : Adyen, a global financial technology platform, partnered with Instacart, North America's leading grocery technology company, as an additional payments gateway processing partner. As part of the new partnership, Instacart would leverage Adyen functionality, including PINless debit enablement of transactions, to further optimize and improve authorization rates for an even more seamless customer experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Payment Gateway Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Payment Gateway Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Payment Gateway Industry?

To stay informed about further developments, trends, and reports in the Payment Gateway Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence