Key Insights

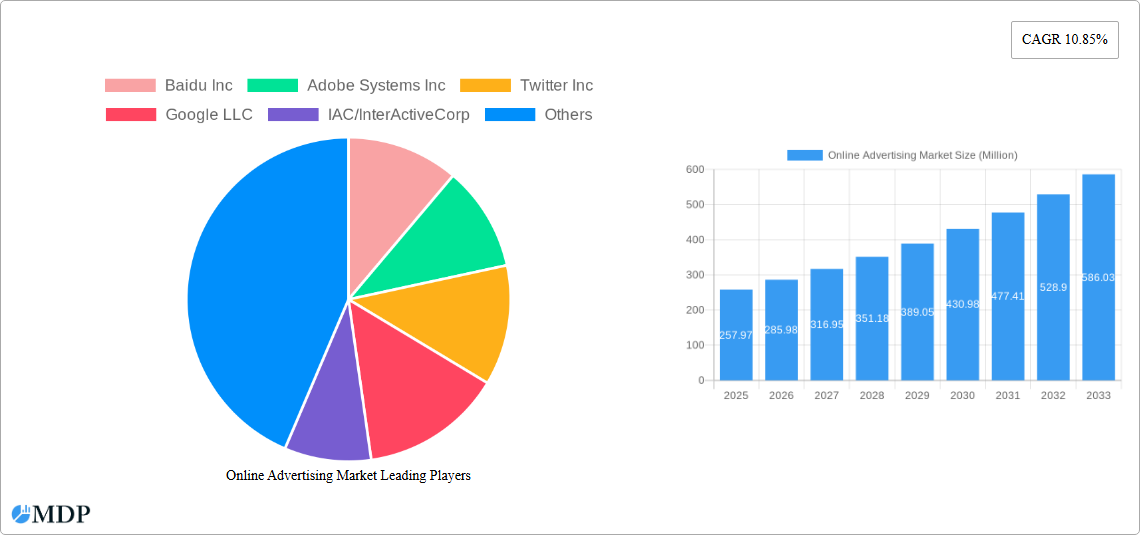

The global Online Advertising Market is poised for substantial growth, projected to reach USD 257.97 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 10.85% expected to propel it forward throughout the forecast period of 2025-2033. This robust expansion is primarily fueled by the increasing digital penetration across various end-user verticals and the continuous evolution of advertising formats. The shift towards digital channels by businesses seeking to engage a wider audience, coupled with the sophisticated targeting capabilities offered by online platforms, are key drivers. Social media advertising, search engine marketing, and video advertising are leading the charge, demonstrating remarkable adaptability to evolving consumer behaviors and technological advancements. Mobile advertising, in particular, continues to dominate, reflecting the ubiquitous nature of smartphones and their integration into daily life. As consumers spend more time online, advertisers are strategically allocating larger portions of their budgets to these digital avenues to achieve greater reach and impact.

Online Advertising Market Market Size (In Million)

The market's trajectory is further shaped by several influencing factors. Trends such as the rise of programmatic advertising, influencer marketing, and the increasing demand for personalized ad experiences are significantly contributing to market dynamism. Programmatic buying ensures efficiency and data-driven decision-making in ad placements, while influencer marketing leverages authentic connections to drive brand awareness and conversions. The ongoing innovation in artificial intelligence and machine learning is enabling more precise audience segmentation and ad optimization, leading to higher return on investment for advertisers. While the market presents immense opportunities, it also faces certain restraints. Data privacy concerns and evolving regulatory landscapes, such as GDPR and CCPA, require advertisers to adopt more transparent and ethical practices. Nevertheless, the inherent agility of the online advertising ecosystem, coupled with its ability to adapt to these challenges, ensures continued progress and innovation, making it an indispensable component of modern marketing strategies.

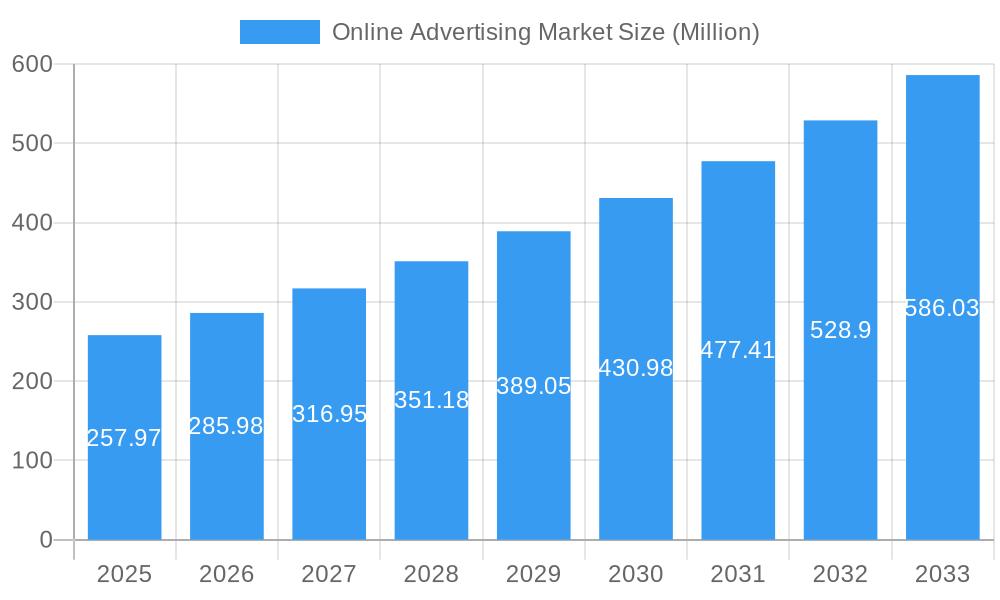

Online Advertising Market Company Market Share

Dive deep into the dynamic world of online advertising with this definitive report. Covering the study period of 2019–2033, with a base year of 2025, this analysis offers unparalleled insights into market size, segmentation, and future trajectory. Explore the intricate forces shaping digital marketing, from technological innovations and evolving consumer behavior to regulatory landscapes and competitive strategies. This report is an essential resource for marketers, advertisers, investors, and stakeholders seeking to navigate and capitalize on the rapidly expanding online advertising market, digital marketing trends, performance marketing, and programmatic advertising. With detailed breakdowns of social media advertising, search engine marketing, video advertising, and mobile advertising, you'll gain actionable intelligence to optimize your campaigns and drive superior ROI.

Online Advertising Market Market Dynamics & Concentration

The online advertising market is characterized by dynamic shifts, driven by continuous innovation and intense competition. Market concentration is relatively high, with major players like Google LLC, Facebook Inc., and Amazon com Inc. holding significant market share, estimated to be over 70% of the global digital ad spend. However, specialized platforms and emerging technologies are fostering niche growth and increasing competition in specific segments. Innovation drivers include advancements in AI and machine learning for ad targeting and personalization, the rise of immersive ad formats like augmented reality (AR) and virtual reality (VR), and the increasing demand for privacy-centric advertising solutions. Regulatory frameworks, such as GDPR and CCPA, are evolving, influencing data privacy practices and ad targeting methodologies, leading to a greater focus on consent-based marketing. Product substitutes are constantly emerging, ranging from native advertising and influencer marketing to content marketing and email campaigns, each offering unique value propositions. End-user trends highlight a growing demand for personalized, relevant, and non-intrusive advertising experiences across all devices. Mergers and acquisitions (M&A) activities are a constant feature, consolidating market power and expanding technological capabilities. For instance, an estimated 300+ M&A deals are projected within the forecast period, involving companies like Baidu Inc., Adobe Systems Inc., and Microsoft Corporation, aimed at acquiring new technologies or expanding market reach.

Online Advertising Market Industry Trends & Analysis

The online advertising market is poised for substantial growth, driven by a confluence of technological advancements, shifting consumer preferences, and increasing digital adoption globally. The digital advertising market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 15% from 2025 to 2033, reaching an estimated market size of over $1.5 Trillion by the end of the forecast period. This expansion is fueled by the pervasive integration of the internet and mobile devices into daily life, leading to unprecedented levels of consumer engagement. Technological disruptions, such as the widespread adoption of 5G networks, the continuous evolution of artificial intelligence (AI) in ad optimization and creative generation, and the increasing sophistication of programmatic advertising platforms, are revolutionizing how brands connect with their audiences. AI-powered programmatic advertising is enabling hyper-personalization at scale, allowing advertisers to deliver highly targeted messages to specific demographics and psychographics with increased efficiency. Consumer preferences are increasingly leaning towards authentic, value-driven content and seamless, personalized ad experiences. The demand for video advertising continues to surge, driven by the popularity of platforms like YouTube and TikTok, and the growing consumption of streaming services. Social media advertising remains a dominant force, leveraging the vast user bases and sophisticated targeting capabilities of platforms like Facebook Inc. and Twitter Inc. The increasing focus on data privacy, however, presents both challenges and opportunities, pushing the industry towards more transparent and privacy-compliant advertising practices, fostering innovation in areas like contextual advertising and first-party data utilization. The competitive dynamics within the online advertising market are intense, with established giants like Google LLC and Amazon com Inc. facing increasing competition from specialized ad tech providers and platforms. The growing importance of customer data platforms (CDPs) and marketing automation tools further intensifies the need for data-driven strategies. Market penetration of digital advertising continues to rise across all end-user verticals, indicating a strong and sustained demand for online promotional activities.

Leading Markets & Segments in Online Advertising Market

The online advertising market is segmented across various platforms, advertising formats, and end-user verticals, each exhibiting unique growth dynamics.

Dominant Platforms:

- Mobile: This platform is overwhelmingly dominant, accounting for an estimated 60% of the total online ad spend in 2025. The proliferation of smartphones and the increasing time spent by users on mobile devices for browsing, shopping, and entertainment solidify its leading position. Key drivers include the ubiquity of mobile internet access, the development of sophisticated mobile advertising technologies, and the strong performance of mobile-first applications.

- Desktop and Laptop: While still significant, this platform's share is gradually shifting towards mobile, estimated at 35% in 2025. It remains crucial for in-depth research, content consumption, and complex transactions, particularly in B2B advertising.

Dominant Advertising Formats:

- Social Media Advertising: This format continues to capture a substantial share, estimated at 30% of the market. Platforms like Facebook Inc., Instagram, and Twitter Inc. offer unparalleled reach and sophisticated targeting options, driven by user engagement and influencer marketing trends.

- Search Engine Advertising: Holding a significant 28% share, search engine marketing, dominated by Google LLC, remains a cornerstone for capturing high-intent users actively seeking products and services. The effectiveness of paid search in driving conversions is a key driver.

- Video Advertising: Experiencing robust growth, video advertising is projected to reach 25% of the market. The increasing consumption of video content across platforms like YouTube, streaming services, and social media fuels its expansion. Advertisers are leveraging video for brand storytelling, product demonstrations, and engaging content.

- Email Advertising: While a more traditional format, email advertising still holds a relevant 10% share, especially for customer retention and direct marketing campaigns.

- Other Advertising Formats: This includes native advertising, display advertising, and emerging formats, collectively making up the remaining 7%.

Dominant End-user Verticals:

- Retail: This vertical is a leading spender, accounting for approximately 25% of the online advertising market. The rise of e-commerce, personalized shopping experiences, and the continuous need to drive sales make online advertising indispensable.

- Automotive: With a significant 15% share, the automotive sector utilizes online advertising for brand awareness, lead generation, and promoting new models through sophisticated digital campaigns.

- BFSI (Banking, Financial Services, and Insurance): This sector represents 12% of the market, leveraging online advertising for customer acquisition, promoting financial products, and building trust.

- Telecom: Contributing 10%, the telecom industry uses online advertising for service promotions, customer retention, and new plan launches.

- Healthcare: With a 8% share, the healthcare industry is increasingly adopting online advertising for patient education, service promotion, and physician outreach.

- Other End-user Verticals: This category encompasses a wide range of industries, collectively contributing the remaining 30%, demonstrating the pervasive reach of online advertising across the economy.

Online Advertising Market Product Developments

Product developments in the online advertising market are characterized by an intense focus on enhancing targeting precision, improving creative efficacy, and ensuring user privacy. Innovations in AI and machine learning are driving the creation of more sophisticated algorithms for predictive analytics, allowing advertisers to anticipate consumer behavior and optimize campaign delivery in real-time. The rise of AI-powered creative tools is enabling the automated generation of ad variants tailored to specific audience segments, increasing engagement rates. Furthermore, the industry is witnessing a surge in the development of privacy-preserving advertising technologies, such as contextual targeting and on-device processing, as well as advancements in measurement and attribution solutions that provide greater transparency and accountability. These developments are crucial for maintaining advertiser trust and adapting to evolving regulatory landscapes, thereby strengthening the market fit and competitive advantage of innovative solutions.

Key Drivers of Online Advertising Market Growth

The online advertising market is propelled by several key drivers that are reshaping the digital landscape. Technological advancements, particularly the widespread adoption of AI, machine learning, and 5G technology, are enhancing ad targeting, personalization, and delivery capabilities, leading to more effective campaigns. The escalating penetration of the internet and smartphones globally, especially in emerging economies, expands the addressable audience for online advertising. Evolving consumer preferences for personalized and relevant digital experiences, coupled with the increasing demand for video content, further fuels market expansion. Government initiatives promoting digital transformation and e-commerce, along with a growing number of businesses recognizing the ROI of online advertising, also contribute significantly to sustained growth.

Challenges in the Online Advertising Market Market

Despite its robust growth, the online advertising market faces several significant challenges. The increasing stringency of data privacy regulations worldwide, such as GDPR and CCPA, poses compliance hurdles and restricts data collection and usage for some targeting strategies. Ad fraud, including click fraud and impression fraud, continues to plague the industry, leading to wasted ad spend and impacting advertiser ROI, estimated to cost the industry over $100 Billion annually. Growing ad fatigue among consumers, who are increasingly exposed to a high volume of advertisements, necessitates more creative and engaging ad formats to capture attention. Intense competition among a multitude of platforms and ad tech providers can lead to pricing pressures and make it challenging for new entrants to gain market share.

Emerging Opportunities in Online Advertising Market

The online advertising market presents a wealth of emerging opportunities for forward-thinking stakeholders. The continued growth of connected TV (CTV) advertising offers a significant avenue for reaching audiences with highly engaging video content, bridging the gap between linear TV and digital. The expansion of programmatic advertising into new channels, such as audio and out-of-home (OOH) advertising, opens up innovative ways to engage consumers. The increasing adoption of AI-driven personalization and predictive analytics allows for hyper-targeted campaigns that deliver exceptional value to both advertisers and consumers. Furthermore, the growing demand for sustainable and ethical advertising practices presents an opportunity for companies that prioritize transparency, privacy, and social responsibility in their operations. Strategic partnerships between ad tech providers, publishers, and brands are also crucial for creating integrated and effective advertising ecosystems.

Leading Players in the Online Advertising Market Sector

- Google LLC

- Facebook Inc.

- Amazon com Inc.

- Microsoft Corporation

- Baidu Inc.

- Adobe Systems Inc.

- IAC/InterActiveCorp

- Twitter Inc.

- Yahoo Inc.

Key Milestones in Online Advertising Market Industry

- June 2022: InMobi, a leader in content, marketing, and monetization technologies, expanded its partnership with Microsoft Advertising. This collaboration aims to provide enterprise and strategic advertisers in Southeast Asia, the Middle East, and Africa with an integrated solution combining Microsoft Advertising's search and native display capabilities with InMobi's mobile ad tech. This move signifies a strategic push to enhance cross-platform advertising solutions in key growth regions.

- May 2022: Skai, an intelligent marketing platform, achieved advanced partner status within the Amazon Ads Partner Network. This recognition highlights Skai's consistent delivery of strong growth for its advertising clients, its expertise with Amazon Ads products, and its deep engagement with the Amazon advertising ecosystem. This milestone underscores the growing importance of specialized platforms in optimizing performance on major e-commerce advertising networks.

Strategic Outlook for Online Advertising Market Market

The strategic outlook for the online advertising market is one of sustained and transformative growth. The continuous evolution of AI and machine learning will unlock new levels of personalization and efficiency, enabling advertisers to connect with consumers on a more profound level. The burgeoning adoption of connected TV (CTV) and the expansion of programmatic advertising into new frontiers like audio and metaverse environments present significant growth accelerators. As privacy concerns remain paramount, innovations in privacy-centric advertising technologies and a greater reliance on first-party data will become critical success factors. Strategic partnerships and collaborations, such as the one between InMobi and Microsoft Advertising, will be instrumental in developing integrated solutions that cater to the complex needs of a global market. The market will likely witness increased consolidation as larger players acquire innovative technologies and niche expertise, further shaping the competitive landscape and driving the overall expansion of the digital advertising ecosystem.

Online Advertising Market Segmentation

-

1. Advertising Format

- 1.1. Social Media

- 1.2. Search Engine

- 1.3. Video

- 1.4. Email

- 1.5. Other Advertising Formats

-

2. Platform

- 2.1. Mobile

- 2.2. Desktop and Laptop

- 2.3. Other Platforms

-

3. End-user Vertical

- 3.1. Automotive

- 3.2. Retail

- 3.3. Healthcare

- 3.4. BFSI

- 3.5. Telecom

- 3.6. Other End-user Verticals

Online Advertising Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Italy

- 2.6. Netherlands

- 2.7. Poland

- 2.8. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. India

- 3.5. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

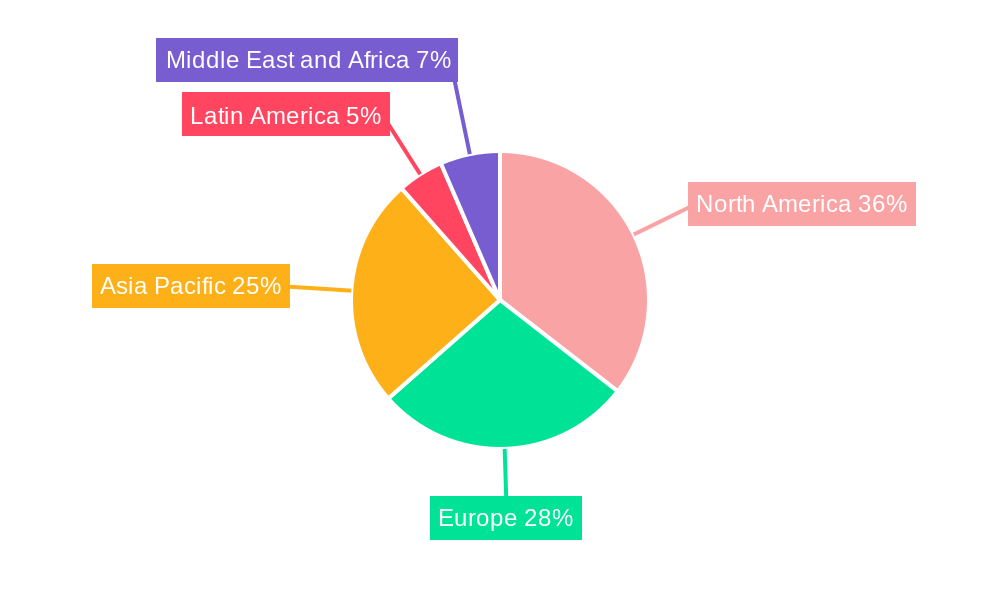

Online Advertising Market Regional Market Share

Geographic Coverage of Online Advertising Market

Online Advertising Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing shift from Traditional to Online Advertising; Increasing Use of Mobile Devices and Consumption of Digital Content; Emergence of Novel Advertising Techniques Coupled with Growing Trend of Mobile Apps-based Advertising

- 3.3. Market Restrains

- 3.3.1. Operational Complexities and Concerns over Effectiveness of Communication in Mature End-user Industries due to Presence of Incumbents

- 3.4. Market Trends

- 3.4.1. Increasing Use of Mobile Devices and Consumption of Digital Content is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Advertising Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Advertising Format

- 5.1.1. Social Media

- 5.1.2. Search Engine

- 5.1.3. Video

- 5.1.4. Email

- 5.1.5. Other Advertising Formats

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Mobile

- 5.2.2. Desktop and Laptop

- 5.2.3. Other Platforms

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Automotive

- 5.3.2. Retail

- 5.3.3. Healthcare

- 5.3.4. BFSI

- 5.3.5. Telecom

- 5.3.6. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Advertising Format

- 6. North America Online Advertising Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Advertising Format

- 6.1.1. Social Media

- 6.1.2. Search Engine

- 6.1.3. Video

- 6.1.4. Email

- 6.1.5. Other Advertising Formats

- 6.2. Market Analysis, Insights and Forecast - by Platform

- 6.2.1. Mobile

- 6.2.2. Desktop and Laptop

- 6.2.3. Other Platforms

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. Automotive

- 6.3.2. Retail

- 6.3.3. Healthcare

- 6.3.4. BFSI

- 6.3.5. Telecom

- 6.3.6. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Advertising Format

- 7. Europe Online Advertising Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Advertising Format

- 7.1.1. Social Media

- 7.1.2. Search Engine

- 7.1.3. Video

- 7.1.4. Email

- 7.1.5. Other Advertising Formats

- 7.2. Market Analysis, Insights and Forecast - by Platform

- 7.2.1. Mobile

- 7.2.2. Desktop and Laptop

- 7.2.3. Other Platforms

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. Automotive

- 7.3.2. Retail

- 7.3.3. Healthcare

- 7.3.4. BFSI

- 7.3.5. Telecom

- 7.3.6. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Advertising Format

- 8. Asia Pacific Online Advertising Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Advertising Format

- 8.1.1. Social Media

- 8.1.2. Search Engine

- 8.1.3. Video

- 8.1.4. Email

- 8.1.5. Other Advertising Formats

- 8.2. Market Analysis, Insights and Forecast - by Platform

- 8.2.1. Mobile

- 8.2.2. Desktop and Laptop

- 8.2.3. Other Platforms

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. Automotive

- 8.3.2. Retail

- 8.3.3. Healthcare

- 8.3.4. BFSI

- 8.3.5. Telecom

- 8.3.6. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Advertising Format

- 9. Latin America Online Advertising Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Advertising Format

- 9.1.1. Social Media

- 9.1.2. Search Engine

- 9.1.3. Video

- 9.1.4. Email

- 9.1.5. Other Advertising Formats

- 9.2. Market Analysis, Insights and Forecast - by Platform

- 9.2.1. Mobile

- 9.2.2. Desktop and Laptop

- 9.2.3. Other Platforms

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. Automotive

- 9.3.2. Retail

- 9.3.3. Healthcare

- 9.3.4. BFSI

- 9.3.5. Telecom

- 9.3.6. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Advertising Format

- 10. Middle East and Africa Online Advertising Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Advertising Format

- 10.1.1. Social Media

- 10.1.2. Search Engine

- 10.1.3. Video

- 10.1.4. Email

- 10.1.5. Other Advertising Formats

- 10.2. Market Analysis, Insights and Forecast - by Platform

- 10.2.1. Mobile

- 10.2.2. Desktop and Laptop

- 10.2.3. Other Platforms

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. Automotive

- 10.3.2. Retail

- 10.3.3. Healthcare

- 10.3.4. BFSI

- 10.3.5. Telecom

- 10.3.6. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Advertising Format

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Baidu Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Adobe Systems Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Twitter Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Google LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IAC/InterActiveCorp

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Microsoft Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Yahoo Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Amazon com Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Facebook Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Baidu Inc

List of Figures

- Figure 1: Global Online Advertising Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Online Advertising Market Revenue (Million), by Advertising Format 2025 & 2033

- Figure 3: North America Online Advertising Market Revenue Share (%), by Advertising Format 2025 & 2033

- Figure 4: North America Online Advertising Market Revenue (Million), by Platform 2025 & 2033

- Figure 5: North America Online Advertising Market Revenue Share (%), by Platform 2025 & 2033

- Figure 6: North America Online Advertising Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 7: North America Online Advertising Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: North America Online Advertising Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Online Advertising Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Online Advertising Market Revenue (Million), by Advertising Format 2025 & 2033

- Figure 11: Europe Online Advertising Market Revenue Share (%), by Advertising Format 2025 & 2033

- Figure 12: Europe Online Advertising Market Revenue (Million), by Platform 2025 & 2033

- Figure 13: Europe Online Advertising Market Revenue Share (%), by Platform 2025 & 2033

- Figure 14: Europe Online Advertising Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 15: Europe Online Advertising Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Europe Online Advertising Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Online Advertising Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Online Advertising Market Revenue (Million), by Advertising Format 2025 & 2033

- Figure 19: Asia Pacific Online Advertising Market Revenue Share (%), by Advertising Format 2025 & 2033

- Figure 20: Asia Pacific Online Advertising Market Revenue (Million), by Platform 2025 & 2033

- Figure 21: Asia Pacific Online Advertising Market Revenue Share (%), by Platform 2025 & 2033

- Figure 22: Asia Pacific Online Advertising Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Asia Pacific Online Advertising Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Asia Pacific Online Advertising Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Online Advertising Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Online Advertising Market Revenue (Million), by Advertising Format 2025 & 2033

- Figure 27: Latin America Online Advertising Market Revenue Share (%), by Advertising Format 2025 & 2033

- Figure 28: Latin America Online Advertising Market Revenue (Million), by Platform 2025 & 2033

- Figure 29: Latin America Online Advertising Market Revenue Share (%), by Platform 2025 & 2033

- Figure 30: Latin America Online Advertising Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 31: Latin America Online Advertising Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 32: Latin America Online Advertising Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Online Advertising Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Online Advertising Market Revenue (Million), by Advertising Format 2025 & 2033

- Figure 35: Middle East and Africa Online Advertising Market Revenue Share (%), by Advertising Format 2025 & 2033

- Figure 36: Middle East and Africa Online Advertising Market Revenue (Million), by Platform 2025 & 2033

- Figure 37: Middle East and Africa Online Advertising Market Revenue Share (%), by Platform 2025 & 2033

- Figure 38: Middle East and Africa Online Advertising Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 39: Middle East and Africa Online Advertising Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 40: Middle East and Africa Online Advertising Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Online Advertising Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Online Advertising Market Revenue Million Forecast, by Advertising Format 2020 & 2033

- Table 2: Global Online Advertising Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 3: Global Online Advertising Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Online Advertising Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Online Advertising Market Revenue Million Forecast, by Advertising Format 2020 & 2033

- Table 6: Global Online Advertising Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 7: Global Online Advertising Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global Online Advertising Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Online Advertising Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Online Advertising Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Online Advertising Market Revenue Million Forecast, by Advertising Format 2020 & 2033

- Table 12: Global Online Advertising Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 13: Global Online Advertising Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 14: Global Online Advertising Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Online Advertising Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Online Advertising Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Online Advertising Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Online Advertising Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Online Advertising Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Netherlands Online Advertising Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Poland Online Advertising Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe Online Advertising Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Online Advertising Market Revenue Million Forecast, by Advertising Format 2020 & 2033

- Table 24: Global Online Advertising Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 25: Global Online Advertising Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 26: Global Online Advertising Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: China Online Advertising Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Japan Online Advertising Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: South Korea Online Advertising Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: India Online Advertising Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Online Advertising Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Online Advertising Market Revenue Million Forecast, by Advertising Format 2020 & 2033

- Table 33: Global Online Advertising Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 34: Global Online Advertising Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 35: Global Online Advertising Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Online Advertising Market Revenue Million Forecast, by Advertising Format 2020 & 2033

- Table 37: Global Online Advertising Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 38: Global Online Advertising Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 39: Global Online Advertising Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Advertising Market?

The projected CAGR is approximately 10.85%.

2. Which companies are prominent players in the Online Advertising Market?

Key companies in the market include Baidu Inc, Adobe Systems Inc, Twitter Inc, Google LLC, IAC/InterActiveCorp, Microsoft Corporation, Yahoo Inc, Amazon com Inc, Facebook Inc.

3. What are the main segments of the Online Advertising Market?

The market segments include Advertising Format, Platform, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 257.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing shift from Traditional to Online Advertising; Increasing Use of Mobile Devices and Consumption of Digital Content; Emergence of Novel Advertising Techniques Coupled with Growing Trend of Mobile Apps-based Advertising.

6. What are the notable trends driving market growth?

Increasing Use of Mobile Devices and Consumption of Digital Content is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Operational Complexities and Concerns over Effectiveness of Communication in Mature End-user Industries due to Presence of Incumbents.

8. Can you provide examples of recent developments in the market?

June 2022 - InMobi, a leading provider of content, marketing, and monetization technologies that help businesses fuel growth, announced an expansion of its partnership with Microsoft Advertising to support enterprise and strategic advertisers in Southeast Asia, the Middle East, and Africa. InMobi will offer marketers an integrated solution to power their campaigns built on the search and native display capabilities of Microsoft Advertising and the mobile ad tech capability of InMobi's advertising platforms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Advertising Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Advertising Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Advertising Market?

To stay informed about further developments, trends, and reports in the Online Advertising Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence