Key Insights

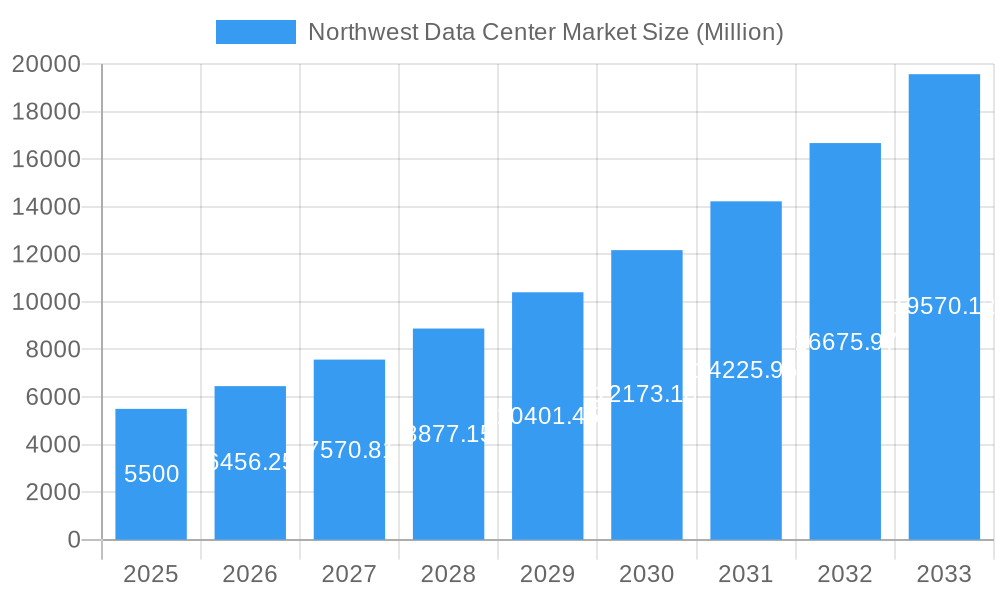

The Northwest Data Center Market is experiencing robust expansion, projected to reach a market size of $17.01 billion by 2033. This growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 17.5% from a base year of 2024. Key drivers include the surging demand for digital infrastructure, fueled by cloud computing adoption, edge computing proliferation, and the expansion of data-intensive sectors such as Media & Entertainment and BFSI. The increasing integration of Artificial Intelligence (AI) and the Internet of Things (IoT) further necessitates advanced, distributed data processing capabilities, significantly benefiting the Northwest region. Strategic investments in hyperscale and colocation facilities by industry leaders like Digital Realty Trust Inc., EdgeConneX Inc., and NTT Ltd. are expanding their footprints. The region's superior connectivity, access to renewable energy, and favorable business climate solidify its appeal for data center development.

Northwest Data Center Market Market Size (In Billion)

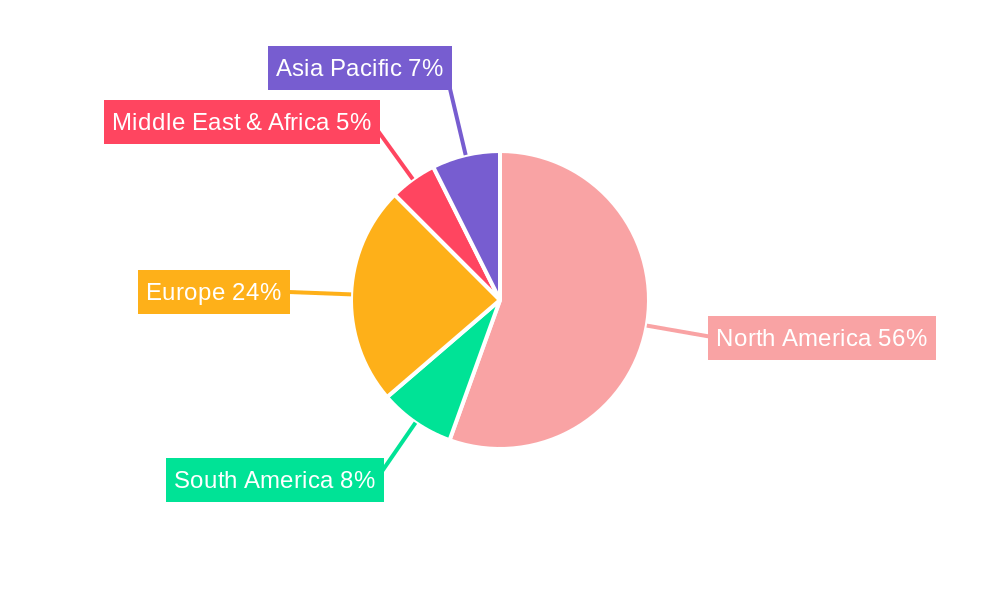

Market dynamics emphasize optimizing capacity across retail, wholesale, and hyperscale colocation, serving diverse end-users including Cloud & IT providers, Telecom operators, and Government entities. While growth prospects are strong, potential challenges may arise from rising real estate costs in prime locations and evolving data privacy and energy consumption regulations. The trend towards smaller, distributed edge data centers for low-latency applications is complementing the growth of larger hyperscale facilities. Key contributors to this landscape include Lunavi, Quality Technology Services, Fifteen Forty seven, and CoreSite, driving technological advancement and economic growth through innovation and expansion. The Northwest region is anticipated to maintain its dominant position, with Asia Pacific also presenting a significant growth avenue.

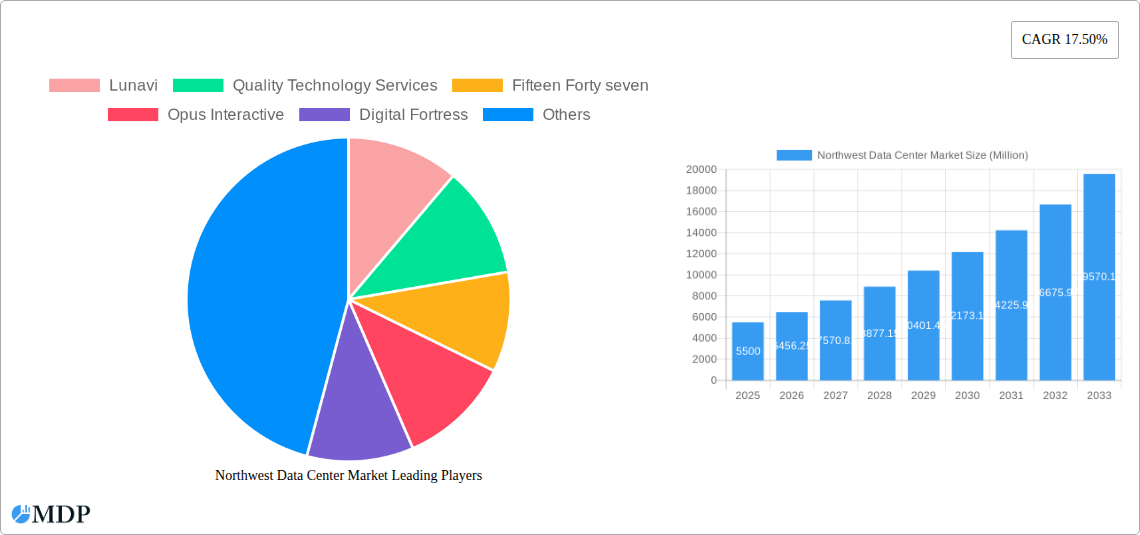

Northwest Data Center Market Company Market Share

This report offers critical insights into the thriving Northwest Data Center Market, providing an in-depth analysis of market dynamics, industry trends, leading players, and future growth opportunities from 2024 to 2033. With a base year of 2024, this research is vital for stakeholders looking to capitalize on the rapid expansion of data infrastructure in this key region.

The Northwest data center sector is characterized by substantial investment and technological innovation, driven by escalating demand for cloud computing, AI, and big data processing. This report details market concentration, innovation drivers, and the evolving regulatory environment. It analyzes product substitutes and end-user adoption patterns, offering a clear view of competitive advantages and potential M&A activities. Quantifying market share and M&A deal counts, the report provides actionable intelligence for strategic decision-making in this dynamic sector.

Northwest Data Center Market Market Dynamics & Concentration

The Northwest Data Center Market is experiencing robust growth, fueled by a confluence of technological innovation, increasing digital transformation across industries, and favorable economic conditions. Market concentration remains a key factor, with a handful of major players dominating capacity, although the influx of new entrants and niche providers is diversifying the competitive landscape. Innovation drivers are primarily centered around power efficiency, cooling technologies, and edge computing solutions, responding to the ever-growing demand for low latency and increased processing power. The regulatory framework, while generally supportive, presents specific compliance considerations related to environmental sustainability and data privacy, which influence development strategies. Product substitutes, such as on-premises solutions and private cloud, continue to exist but are increasingly overshadowed by the scalability and flexibility offered by colocation and hyperscale facilities. End-user trends are heavily skewed towards cloud and IT services, telecom, and the rapidly growing media and entertainment sectors, all demanding more sophisticated and reliable data infrastructure. Mergers and acquisitions (M&A) activities are a significant indicator of market maturation, with strategic consolidations aimed at expanding geographic reach and service portfolios. For instance, recent M&A activities have seen larger entities acquiring smaller providers to integrate their infrastructure and client bases, thereby increasing market concentration while simultaneously fostering competition through expanded offerings. This dynamic interplay of consolidation and new investment defines the current market structure, setting the stage for continued evolution.

Northwest Data Center Market Industry Trends & Analysis

The Northwest Data Center Market is projected for substantial growth, with a projected Compound Annual Growth Rate (CAGR) of 18.5% over the forecast period. This expansion is underpinned by an accelerating demand for digital services, including cloud computing, artificial intelligence (AI), and the Internet of Things (IoT), all of which require robust and scalable data processing and storage capabilities. Technological disruptions are a constant theme, with advancements in cooling technologies, such as liquid cooling, and the development of more energy-efficient hardware significantly impacting operational costs and sustainability metrics. The market's penetration is deepening across all industry verticals, with significant uptake from hyperscale cloud providers, telecommunications companies, and the media and entertainment industry, all seeking to leverage the region's connectivity and power advantages. Consumer preferences are increasingly dictating the need for lower latency and higher bandwidth, driving the development of edge data centers closer to end-users. This has led to a strategic focus on distributed infrastructure and the expansion of network connectivity. The competitive dynamics are intensifying, marked by continuous capacity build-outs, strategic partnerships, and a focus on offering differentiated services, such as specialized security measures and advanced disaster recovery solutions. The increasing adoption of AI and machine learning workloads is further augmenting demand for high-density compute environments, pushing the boundaries of existing infrastructure. Furthermore, the growing emphasis on environmental sustainability is driving investments in renewable energy sources and innovative power management solutions, shaping the future of data center operations in the region. The ongoing digital transformation initiatives globally, coupled with the inherent advantages of the Northwest region, including access to abundant renewable energy and a skilled workforce, are collectively propelling this robust market expansion.

Leading Markets & Segments in Northwest Data Center Market

The Northwest Data Center Market exhibits a strong preference for Massive and Mega DC Size segments, reflecting the substantial demand from hyperscale cloud providers and large enterprises requiring extensive capacity. Within the Tier Type segmentation, Tier 3 facilities are currently the most dominant, offering a balance of reliability, redundancy, and uptime crucial for mission-critical operations. However, there is a growing demand for Tier 4 facilities, especially from sectors like BFSI and Government, which require the highest levels of availability and fault tolerance.

Key drivers for the dominance of these segments include:

- Economic Policies: Supportive government initiatives and tax incentives for technology infrastructure development.

- Infrastructure: Access to abundant, low-cost renewable energy, particularly hydroelectric power, and well-developed fiber optic networks.

- Geographic Location: Strategic positioning for disaster recovery and proximity to major technology hubs.

In terms of Absorption, the Utilized segment is experiencing significant growth across all colocation types. Wholesale colocation is particularly strong, catering to large-scale deployments for cloud providers and enterprises. Hyperscale deployments represent a substantial portion of the utilized capacity, driven by major cloud giants expanding their regional footprints. Retail colocation is also seeing steady growth, serving a broader range of businesses with smaller space requirements.

By End-User, Cloud & IT services represent the largest share of utilization, followed closely by Telecom and Media & Entertainment. The increasing reliance on cloud services for data storage, processing, and application hosting is a primary growth catalyst. The telecommunications sector's need for distributed infrastructure to support 5G deployment and enhanced network services also contributes significantly. Media and entertainment companies are increasingly leveraging data centers for content creation, rendering, and distribution. While Government, BFSI, Manufacturing, and E-Commerce are also key consumers of data center services, their current utilization percentages are lower compared to the aforementioned sectors, indicating substantial room for future growth. The Non-Utilized capacity, while present, is shrinking as demand outpaces supply in key submarkets, indicating a tightening market and potential for new development.

Northwest Data Center Market Product Developments

Product developments in the Northwest Data Center Market are keenly focused on enhancing efficiency, sustainability, and performance. Innovations in cooling technologies, such as advanced liquid cooling solutions and free-cooling systems, are crucial for managing increasing power densities and reducing environmental impact. The development of modular and pre-fabricated data center solutions is accelerating deployment times and offering greater scalability. Advancements in power management and grid integration are enabling data centers to operate more sustainably and reliably, often leveraging renewable energy sources. The competitive advantage lies in offering highly efficient, resilient, and secure facilities that can accommodate the evolving demands of AI, machine learning, and edge computing, making these developments critical for market leadership.

Key Drivers of Northwest Data Center Market Growth

The Northwest Data Center Market's growth is propelled by several key drivers. The accelerating adoption of cloud computing and digital transformation initiatives across all industries is creating insatiable demand for data storage and processing power. The region's abundant and affordable renewable energy sources, particularly hydropower, make it an attractive location for energy-intensive data center operations, driving down operational costs and enhancing sustainability credentials. Significant investments in fiber optic infrastructure are providing the necessary high-speed connectivity required for modern digital services. Furthermore, the presence of major technology companies and a skilled workforce fosters innovation and facilitates the development of cutting-edge data center solutions.

Challenges in the Northwest Data Center Market Market

Despite robust growth, the Northwest Data Center Market faces several challenges. Securing adequate and reliable power, especially as demand escalates and grid capacity is tested, remains a paramount concern. The increasing environmental scrutiny and regulatory requirements, particularly concerning water usage and carbon emissions, necessitate substantial investments in sustainable technologies and practices. Supply chain disruptions for critical components and construction materials can lead to project delays and increased costs. Furthermore, the competitive landscape is intensifying, with a constant pressure to innovate and offer compelling pricing to attract and retain clients. Land acquisition and zoning regulations in desirable locations can also present hurdles to rapid expansion.

Emerging Opportunities in Northwest Data Center Market

Emerging opportunities in the Northwest Data Center Market are abundant. The ongoing expansion of 5G networks and the proliferation of IoT devices are creating a significant demand for edge data centers, bringing computing power closer to end-users for reduced latency and improved performance. The burgeoning fields of AI and machine learning, requiring massive computational power, present a substantial growth area for high-density compute facilities. Strategic partnerships between data center operators, renewable energy providers, and technology companies can unlock new efficiencies and sustainability models. Market expansion into underserved sub-regions within the Northwest also offers untapped potential, driven by the decentralization of data processing and the need for localized digital infrastructure.

Leading Players in the Northwest Data Center Market Sector

- Lunavi

- Quality Technology Services

- Fifteen Forty seven

- Opus Interactive

- Digital Fortress

- EdgeConneX Inc

- Involta

- Flexential

- T5 Datacenters

- Cogent

- CoreSite

- H5 Data centers

- Digital Realty Trust Inc

- OneNeckITSolutionsLLC

- NTT Ltd

Key Milestones in Northwest Data Center Market Industry

- January 2023: Crane Data Centers, in collaboration with Principal Asset Management, commenced development of a 100MW data center complex in Forest Grove, Oregon. The initial phase is slated to deliver 50MW across 35 acres, significantly boosting the region's capacity.

- May 2022: Intel began construction of a USD 700 million research center in Hillsboro, Oregon. This facility, expected to open in late 2023, focuses on pioneering technologies to enhance data center operational efficiency, with a particular emphasis on reducing heating, cooling, and water consumption. The 200,000-square-foot lab is set to drive innovation in sustainable data center practices.

Strategic Outlook for Northwest Data Center Market Market

The strategic outlook for the Northwest Data Center Market remains exceptionally positive, driven by sustained demand for digital infrastructure and ongoing technological advancements. Future growth will be accelerated by the continued expansion of cloud services, the increasing adoption of AI and machine learning, and the deployment of edge computing solutions. Investments in renewable energy integration and sustainable operational practices will be crucial for long-term success and competitive advantage. Strategic partnerships will play a vital role in expanding network reach, enhancing service offerings, and optimizing resource utilization. The market's ability to adapt to evolving regulatory landscapes and embrace innovative technologies will be key to capitalizing on its significant future potential.

Northwest Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. By Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. By End-User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End-User

-

3.1.1. By Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

Northwest Data Center Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Northwest Data Center Market Regional Market Share

Geographic Coverage of Northwest Data Center Market

Northwest Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's

- 3.3. Market Restrains

- 3.3.1. Dependence on Regulatory Landscape & Stringent Security Requirements

- 3.4. Market Trends

- 3.4.1. Rising Adoption of Hyperscale Data Centers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Northwest Data Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. By Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. By End-User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End-User

- 5.3.1.1. By Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Northwest Data Center Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 6.1.1. Small

- 6.1.2. Medium

- 6.1.3. Large

- 6.1.4. Massive

- 6.1.5. Mega

- 6.2. Market Analysis, Insights and Forecast - by Tier Type

- 6.2.1. Tier 1 & 2

- 6.2.2. Tier 3

- 6.2.3. Tier 4

- 6.3. Market Analysis, Insights and Forecast - by Absorption

- 6.3.1. Utilized

- 6.3.1.1. By Colocation Type

- 6.3.1.1.1. Retail

- 6.3.1.1.2. Wholesale

- 6.3.1.1.3. Hyperscale

- 6.3.1.2. By End-User

- 6.3.1.2.1. Cloud & IT

- 6.3.1.2.2. Telecom

- 6.3.1.2.3. Media & Entertainment

- 6.3.1.2.4. Government

- 6.3.1.2.5. BFSI

- 6.3.1.2.6. Manufacturing

- 6.3.1.2.7. E-Commerce

- 6.3.1.2.8. Other End-User

- 6.3.1.1. By Colocation Type

- 6.3.2. Non-Utilized

- 6.3.1. Utilized

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 7. South America Northwest Data Center Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 7.1.1. Small

- 7.1.2. Medium

- 7.1.3. Large

- 7.1.4. Massive

- 7.1.5. Mega

- 7.2. Market Analysis, Insights and Forecast - by Tier Type

- 7.2.1. Tier 1 & 2

- 7.2.2. Tier 3

- 7.2.3. Tier 4

- 7.3. Market Analysis, Insights and Forecast - by Absorption

- 7.3.1. Utilized

- 7.3.1.1. By Colocation Type

- 7.3.1.1.1. Retail

- 7.3.1.1.2. Wholesale

- 7.3.1.1.3. Hyperscale

- 7.3.1.2. By End-User

- 7.3.1.2.1. Cloud & IT

- 7.3.1.2.2. Telecom

- 7.3.1.2.3. Media & Entertainment

- 7.3.1.2.4. Government

- 7.3.1.2.5. BFSI

- 7.3.1.2.6. Manufacturing

- 7.3.1.2.7. E-Commerce

- 7.3.1.2.8. Other End-User

- 7.3.1.1. By Colocation Type

- 7.3.2. Non-Utilized

- 7.3.1. Utilized

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 8. Europe Northwest Data Center Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 8.1.1. Small

- 8.1.2. Medium

- 8.1.3. Large

- 8.1.4. Massive

- 8.1.5. Mega

- 8.2. Market Analysis, Insights and Forecast - by Tier Type

- 8.2.1. Tier 1 & 2

- 8.2.2. Tier 3

- 8.2.3. Tier 4

- 8.3. Market Analysis, Insights and Forecast - by Absorption

- 8.3.1. Utilized

- 8.3.1.1. By Colocation Type

- 8.3.1.1.1. Retail

- 8.3.1.1.2. Wholesale

- 8.3.1.1.3. Hyperscale

- 8.3.1.2. By End-User

- 8.3.1.2.1. Cloud & IT

- 8.3.1.2.2. Telecom

- 8.3.1.2.3. Media & Entertainment

- 8.3.1.2.4. Government

- 8.3.1.2.5. BFSI

- 8.3.1.2.6. Manufacturing

- 8.3.1.2.7. E-Commerce

- 8.3.1.2.8. Other End-User

- 8.3.1.1. By Colocation Type

- 8.3.2. Non-Utilized

- 8.3.1. Utilized

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 9. Middle East & Africa Northwest Data Center Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 9.1.1. Small

- 9.1.2. Medium

- 9.1.3. Large

- 9.1.4. Massive

- 9.1.5. Mega

- 9.2. Market Analysis, Insights and Forecast - by Tier Type

- 9.2.1. Tier 1 & 2

- 9.2.2. Tier 3

- 9.2.3. Tier 4

- 9.3. Market Analysis, Insights and Forecast - by Absorption

- 9.3.1. Utilized

- 9.3.1.1. By Colocation Type

- 9.3.1.1.1. Retail

- 9.3.1.1.2. Wholesale

- 9.3.1.1.3. Hyperscale

- 9.3.1.2. By End-User

- 9.3.1.2.1. Cloud & IT

- 9.3.1.2.2. Telecom

- 9.3.1.2.3. Media & Entertainment

- 9.3.1.2.4. Government

- 9.3.1.2.5. BFSI

- 9.3.1.2.6. Manufacturing

- 9.3.1.2.7. E-Commerce

- 9.3.1.2.8. Other End-User

- 9.3.1.1. By Colocation Type

- 9.3.2. Non-Utilized

- 9.3.1. Utilized

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 10. Asia Pacific Northwest Data Center Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 10.1.1. Small

- 10.1.2. Medium

- 10.1.3. Large

- 10.1.4. Massive

- 10.1.5. Mega

- 10.2. Market Analysis, Insights and Forecast - by Tier Type

- 10.2.1. Tier 1 & 2

- 10.2.2. Tier 3

- 10.2.3. Tier 4

- 10.3. Market Analysis, Insights and Forecast - by Absorption

- 10.3.1. Utilized

- 10.3.1.1. By Colocation Type

- 10.3.1.1.1. Retail

- 10.3.1.1.2. Wholesale

- 10.3.1.1.3. Hyperscale

- 10.3.1.2. By End-User

- 10.3.1.2.1. Cloud & IT

- 10.3.1.2.2. Telecom

- 10.3.1.2.3. Media & Entertainment

- 10.3.1.2.4. Government

- 10.3.1.2.5. BFSI

- 10.3.1.2.6. Manufacturing

- 10.3.1.2.7. E-Commerce

- 10.3.1.2.8. Other End-User

- 10.3.1.1. By Colocation Type

- 10.3.2. Non-Utilized

- 10.3.1. Utilized

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Lunavi

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Quality Technology Services

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fifteen Forty seven

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Opus Interactive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Digital Fortress

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 EdgeConneX Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Involta

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Flexential

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 T5 Datacenters

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cogent

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 CoreSite

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 H5 Data centers

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Digital Realty Trust Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 OneNeckITSolutionsLLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 NTT Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Lunavi

List of Figures

- Figure 1: Global Northwest Data Center Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Northwest Data Center Market Revenue (billion), by DC Size 2025 & 2033

- Figure 3: North America Northwest Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 4: North America Northwest Data Center Market Revenue (billion), by Tier Type 2025 & 2033

- Figure 5: North America Northwest Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 6: North America Northwest Data Center Market Revenue (billion), by Absorption 2025 & 2033

- Figure 7: North America Northwest Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 8: North America Northwest Data Center Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Northwest Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Northwest Data Center Market Revenue (billion), by DC Size 2025 & 2033

- Figure 11: South America Northwest Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 12: South America Northwest Data Center Market Revenue (billion), by Tier Type 2025 & 2033

- Figure 13: South America Northwest Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 14: South America Northwest Data Center Market Revenue (billion), by Absorption 2025 & 2033

- Figure 15: South America Northwest Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 16: South America Northwest Data Center Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Northwest Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Northwest Data Center Market Revenue (billion), by DC Size 2025 & 2033

- Figure 19: Europe Northwest Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 20: Europe Northwest Data Center Market Revenue (billion), by Tier Type 2025 & 2033

- Figure 21: Europe Northwest Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 22: Europe Northwest Data Center Market Revenue (billion), by Absorption 2025 & 2033

- Figure 23: Europe Northwest Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 24: Europe Northwest Data Center Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Northwest Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Northwest Data Center Market Revenue (billion), by DC Size 2025 & 2033

- Figure 27: Middle East & Africa Northwest Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 28: Middle East & Africa Northwest Data Center Market Revenue (billion), by Tier Type 2025 & 2033

- Figure 29: Middle East & Africa Northwest Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 30: Middle East & Africa Northwest Data Center Market Revenue (billion), by Absorption 2025 & 2033

- Figure 31: Middle East & Africa Northwest Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 32: Middle East & Africa Northwest Data Center Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa Northwest Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Northwest Data Center Market Revenue (billion), by DC Size 2025 & 2033

- Figure 35: Asia Pacific Northwest Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 36: Asia Pacific Northwest Data Center Market Revenue (billion), by Tier Type 2025 & 2033

- Figure 37: Asia Pacific Northwest Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 38: Asia Pacific Northwest Data Center Market Revenue (billion), by Absorption 2025 & 2033

- Figure 39: Asia Pacific Northwest Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 40: Asia Pacific Northwest Data Center Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific Northwest Data Center Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Northwest Data Center Market Revenue billion Forecast, by DC Size 2020 & 2033

- Table 2: Global Northwest Data Center Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 3: Global Northwest Data Center Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 4: Global Northwest Data Center Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Northwest Data Center Market Revenue billion Forecast, by DC Size 2020 & 2033

- Table 6: Global Northwest Data Center Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 7: Global Northwest Data Center Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 8: Global Northwest Data Center Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Northwest Data Center Market Revenue billion Forecast, by DC Size 2020 & 2033

- Table 13: Global Northwest Data Center Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 14: Global Northwest Data Center Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 15: Global Northwest Data Center Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Northwest Data Center Market Revenue billion Forecast, by DC Size 2020 & 2033

- Table 20: Global Northwest Data Center Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 21: Global Northwest Data Center Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 22: Global Northwest Data Center Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Northwest Data Center Market Revenue billion Forecast, by DC Size 2020 & 2033

- Table 33: Global Northwest Data Center Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 34: Global Northwest Data Center Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 35: Global Northwest Data Center Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global Northwest Data Center Market Revenue billion Forecast, by DC Size 2020 & 2033

- Table 43: Global Northwest Data Center Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 44: Global Northwest Data Center Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 45: Global Northwest Data Center Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Northwest Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Northwest Data Center Market?

The projected CAGR is approximately 17.5%.

2. Which companies are prominent players in the Northwest Data Center Market?

Key companies in the market include Lunavi, Quality Technology Services, Fifteen Forty seven, Opus Interactive, Digital Fortress, EdgeConneX Inc, Involta, Flexential, T5 Datacenters, Cogent, CoreSite, H5 Data centers, Digital Realty Trust Inc, OneNeckITSolutionsLLC, NTT Ltd.

3. What are the main segments of the Northwest Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.01 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's.

6. What are the notable trends driving market growth?

Rising Adoption of Hyperscale Data Centers.

7. Are there any restraints impacting market growth?

Dependence on Regulatory Landscape & Stringent Security Requirements.

8. Can you provide examples of recent developments in the market?

January 2023: In collaboration with Principal Asset Management, Crane Data Centers developed a 100MW data center complex in Forest Grove (a few miles from Hillsboro). The first phase is expected to deliver 50MW over 35 acres.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Northwest Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Northwest Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Northwest Data Center Market?

To stay informed about further developments, trends, and reports in the Northwest Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence