Key Insights

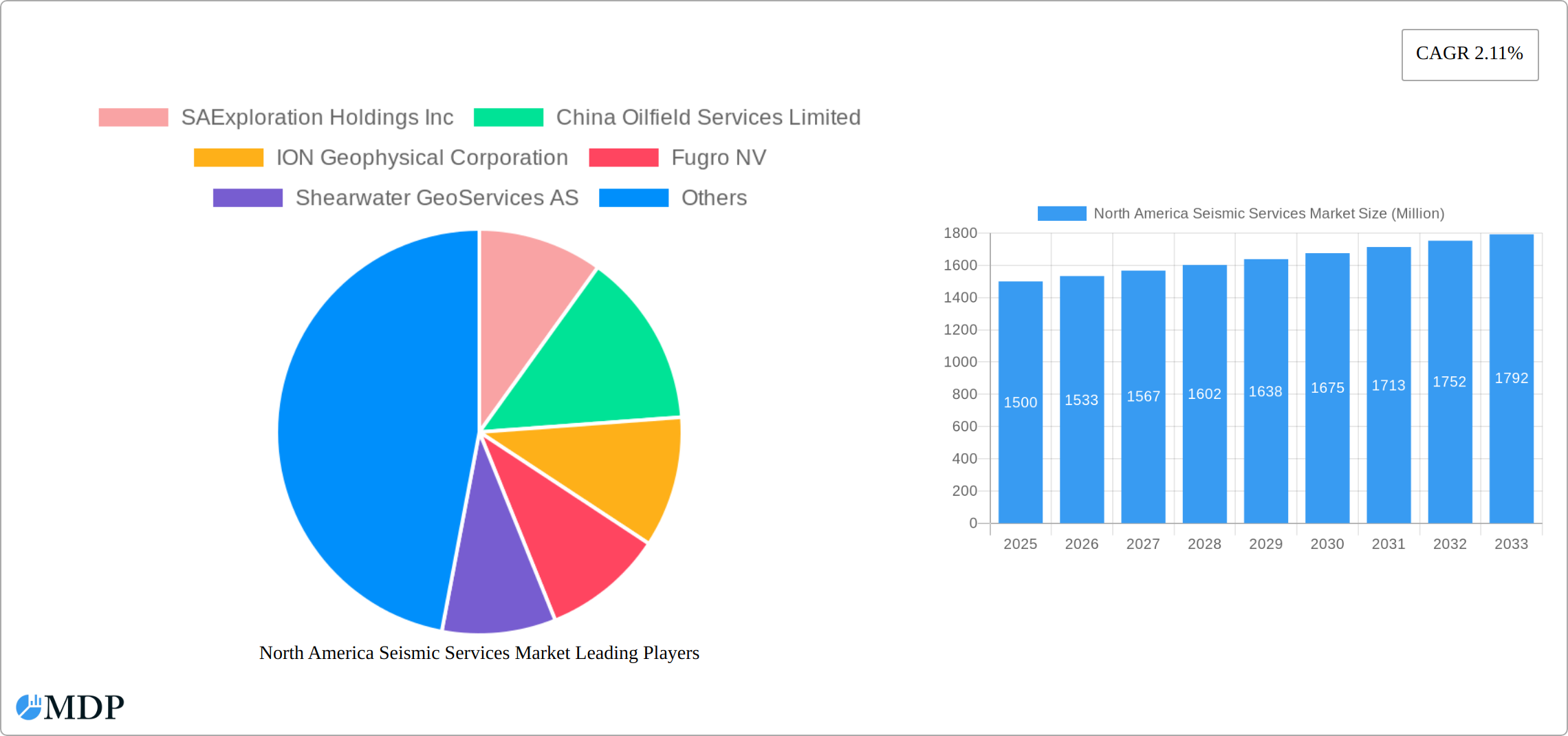

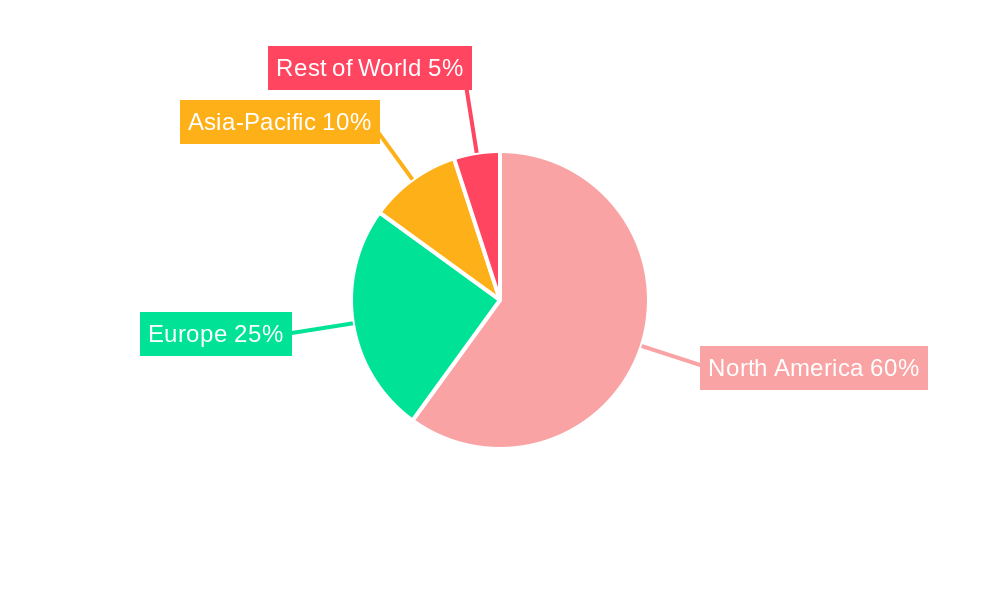

The North American seismic services market, encompassing data acquisition, processing, and interpretation, is a significant contributor to the energy sector's exploration and production activities. Driven by increasing oil and gas exploration and production activities, particularly in unconventional shale formations, the market witnessed substantial growth during the historical period (2019-2024). While precise market size figures for the historical period aren't available, a projected 2025 market size of $XX million (replace XX with a reasonable estimate based on industry reports and growth trends – for example, if a global market is $YYY million and North America holds a 25% share, a reasonable estimate for the North American market might be $YYY*0.25) and a CAGR of 2.11% indicate a relatively stable, albeit modestly growing, market. The onshore segment currently dominates, fueled by easier accessibility and established infrastructure. However, the offshore segment is poised for growth, driven by exploration in deeper waters and technological advancements enabling efficient offshore seismic surveys. Key players like Schlumberger, Halliburton, and ION Geophysical are actively shaping the market through technological innovation and strategic partnerships. The market faces restraints from fluctuating oil and gas prices, environmental regulations, and the increasing adoption of alternative energy sources.

Despite these challenges, the long-term outlook for the North American seismic services market remains positive. Continued advancements in seismic acquisition technologies, such as 3D and 4D surveys, and improved data processing and interpretation techniques will enhance the accuracy and efficiency of exploration efforts. This, coupled with growing demand for detailed subsurface imaging to optimize well placement and production, will drive market expansion during the forecast period (2025-2033). The integration of advanced technologies like artificial intelligence and machine learning into data processing and interpretation workflows will further improve operational efficiency and reduce costs, stimulating market growth. Companies are also focusing on developing environmentally friendly solutions and adhering to stringent regulatory norms to ensure sustainable operations and secure long-term market success.

North America Seismic Services Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America Seismic Services Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report leverages extensive market research and data analysis to provide a thorough understanding of current market dynamics and future growth potential. The market is segmented by service (Data Acquisition, Data Processing and Interpretation) and location of deployment (Onshore, Offshore). Key players such as SAExploration Holdings Inc, China Oilfield Services Limited, ION Geophysical Corporation, and others are analyzed for their market share and strategic initiatives. The report projects a market value of xx Million by 2033, showcasing significant growth opportunities.

North America Seismic Services Market Dynamics & Concentration

The North America Seismic Services market is characterized by moderate concentration, with a few major players holding significant market share. The market share of the top five companies is estimated at 60% in 2025. Innovation is a key driver, with continuous advancements in data acquisition technologies, processing techniques, and interpretation software pushing the boundaries of exploration efficiency. Regulatory frameworks, primarily concerning environmental regulations and safety standards, significantly influence market operations. Substitute technologies, such as electromagnetic surveys, present a competitive challenge. End-user trends reflect a growing demand for higher-resolution data and faster turnaround times. M&A activities have been relatively moderate in recent years, with approximately xx deals recorded between 2019 and 2024. However, an increasing number of strategic alliances and partnerships are observed, emphasizing collaborations for technological advancement and market expansion.

- Market Concentration: Top 5 players hold approximately 60% market share (2025).

- Innovation Drivers: Advanced data acquisition technologies, improved processing software.

- Regulatory Landscape: Stringent environmental and safety regulations.

- Substitutes: Electromagnetic surveys present a competitive alternative.

- End-User Trends: Demand for higher-resolution data and faster delivery.

- M&A Activity: Approximately xx deals between 2019 and 2024.

North America Seismic Services Market Industry Trends & Analysis

The North American Seismic Services market is experiencing robust growth, fueled by several interconnected factors. The escalating global demand for energy resources, particularly shale gas and oil, is a primary driver. This demand is further amplified by the increasing need for reliable energy infrastructure to support growing populations and economies. Technological advancements play a crucial role, with 3D and 4D seismic imaging significantly enhancing data resolution and interpretation accuracy, leading to improved exploration efficiency and reduced operational costs. The growing adoption of advanced data analytics and interpretation services by exploration companies is another key factor. The market is highly competitive, with established players continuously innovating and strategically expanding to maintain their market share. The compound annual growth rate (CAGR) for the period 2025-2033 is projected at xx%, indicating substantial market expansion, with market penetration expected to increase by xx% during the same period. Furthermore, a shift towards more comprehensive and integrated service packages is evident, reflecting a preference for end-to-end solutions from clients.

Leading Markets & Segments in North America Seismic Services Market

Within the North American Seismic Services market, the offshore segment holds a dominant position, primarily driven by the exploration of vast, untapped offshore reserves. The United States maintains a significant market share due to its extensive energy exploration activities and established infrastructure. Canada also represents a substantial market, particularly in its western provinces.

Key Drivers for Offshore Segment Dominance:

- Extensive Offshore Reserves: Significant undiscovered oil and gas reserves in offshore areas, including deepwater regions.

- Technological Advancements: Continuous improvements in offshore seismic acquisition technologies, including autonomous systems and improved sensor capabilities.

- Government Support and Regulation: Supportive government policies and regulatory frameworks encouraging offshore exploration, while also addressing environmental concerns.

- Investment in Infrastructure: Substantial investment in port facilities, specialized vessels, and related infrastructure to support offshore operations.

Key Drivers for Data Acquisition Segment Dominance:

- High Demand for Precision: The continuous demand for more precise and detailed data acquisition to improve exploration success rates.

- Technological Innovation: Ongoing development of innovative technologies, such as high-density seismic sensors and advanced data processing algorithms.

- Focus on Efficiency: The industry’s push for more efficient data acquisition methods to minimize costs and environmental impact.

Detailed Dominance Analysis: The dominance of the offshore segment and the strong performance of the US and Canadian markets are a result of factors including significant investment in exploration and production, technological advancements, supportive government policies, and the presence of established industry players.

North America Seismic Services Market Product Developments

Recent product innovations within the North American Seismic Services market are focused on enhancing data acquisition efficiency, processing speed, and interpretation accuracy. This includes advancements in autonomous underwater vehicles (AUVs), high-density seismic sensors, advanced processing algorithms for improved image resolution and noise reduction, and the integration of artificial intelligence (AI) and machine learning (ML) for improved data analysis. These developments provide significant competitive advantages by delivering higher-quality data, improving exploration success rates, and reducing operational costs. The market fit for these innovations is excellent, given the industry's continuous need for improved data quality and exploration efficiency.

Key Drivers of North America Seismic Services Market Growth

Several factors drive the growth of the North America Seismic Services market. Technological advancements in seismic acquisition, processing, and interpretation techniques are enhancing data quality and reducing exploration risks. The increasing demand for energy resources globally drives exploration activities, fueling the demand for seismic services. Favorable government policies and regulatory frameworks in some regions support the growth of the market. For instance, tax incentives and streamlining of regulatory processes accelerate exploration.

Challenges in the North America Seismic Services Market

The North America Seismic Services market faces several challenges. Fluctuations in oil and gas prices directly impact exploration spending, leading to market volatility. Environmental concerns and stringent regulations can increase operational costs and complicate project approvals. Intense competition among established players and the emergence of new entrants create pressure on pricing and margins. Supply chain disruptions and skilled labor shortages further constrain market growth. The total impact of these challenges can lead to a xx% decrease in profitability during periods of economic downturn.

Emerging Opportunities in North America Seismic Services Market

Significant opportunities exist for long-term growth. Advancements in artificial intelligence (AI) and machine learning (ML) offer potential for automating data processing and interpretation, enhancing efficiency and accuracy. Strategic partnerships between seismic service providers and technology companies can unlock innovative solutions. Expanding into new geographic markets, particularly those with untapped hydrocarbon resources, presents significant growth opportunities. These factors collectively suggest a strong potential for market expansion in the coming years.

Leading Players in the North America Seismic Services Market Sector

- SAExploration Holdings Inc

- China Oilfield Services Limited

- ION Geophysical Corporation

- Fugro NV

- Shearwater GeoServices AS

- Schlumberger Ltd

- TGS NOPEC GEOPHYSICAL COMPANY ASA

- CGG SA

- BGP Inc China National Petroleum Corporation

- Halliburton Company

- SeaBird Exploration PLC

- Magseis Fairfield ASA (WGP Group Ltd)

- Polarcus Ltd

- PGS ASA

Key Milestones in North America Seismic Services Market Industry

- 2020: Introduction of a new high-density seismic sensor technology by Schlumberger, significantly improving data acquisition capabilities.

- 2021: Merger between two smaller seismic service providers in the US, consolidating market share and resources.

- 2022: Launch of an advanced AI-powered seismic interpretation software by CGG, revolutionizing data analysis and interpretation.

- 2023: Significant investment in offshore seismic acquisition projects in the Gulf of Mexico, expanding exploration activities in deepwater areas.

- 2024: Implementation of new regulatory changes impacting the environmental aspects of seismic operations, emphasizing sustainable practices.

- 2025-Present: Increasing adoption of cloud-based seismic data processing and storage solutions, enhancing collaboration and efficiency.

Strategic Outlook for North America Seismic Services Market

The North American Seismic Services market is poised for sustained growth, driven by continuous technological innovation, rising global energy demand, strategic partnerships, and a growing focus on environmental sustainability. Successful companies will be those that can adapt to evolving market dynamics, invest in cutting-edge technologies, effectively manage operational risks, and maintain a strong commitment to responsible environmental practices. Future market potential hinges on the successful integration of AI, ML, and automation technologies into seismic workflows to further enhance efficiency and data analysis capabilities. Expansion into new areas like carbon capture and storage, where seismic technology plays a crucial role in site characterization, also presents significant opportunities for growth and diversification.

North America Seismic Services Market Segmentation

-

1. Service

- 1.1. Data Acquisition

- 1.2. Data Processing and Interpretation

-

2. Location of Deployment

- 2.1. Onshore

- 2.2. Offshore

-

3. Geography

- 3.1. United States

- 3.2. Mexico

- 3.3. Canada

- 3.4. Rest of North America

North America Seismic Services Market Segmentation By Geography

- 1. United States

- 2. Mexico

- 3. Canada

- 4. Rest of North America

North America Seismic Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Penetration of Other Energy Sources

- 3.4. Market Trends

- 3.4.1. Offshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Seismic Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Data Acquisition

- 5.1.2. Data Processing and Interpretation

- 5.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Mexico

- 5.3.3. Canada

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Mexico

- 5.4.3. Canada

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. United States North America Seismic Services Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Data Acquisition

- 6.1.2. Data Processing and Interpretation

- 6.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Mexico

- 6.3.3. Canada

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Mexico North America Seismic Services Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Data Acquisition

- 7.1.2. Data Processing and Interpretation

- 7.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Mexico

- 7.3.3. Canada

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Canada North America Seismic Services Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Data Acquisition

- 8.1.2. Data Processing and Interpretation

- 8.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Mexico

- 8.3.3. Canada

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Rest of North America North America Seismic Services Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Data Acquisition

- 9.1.2. Data Processing and Interpretation

- 9.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.2.1. Onshore

- 9.2.2. Offshore

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Mexico

- 9.3.3. Canada

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. United States North America Seismic Services Market Analysis, Insights and Forecast, 2019-2031

- 11. Canada North America Seismic Services Market Analysis, Insights and Forecast, 2019-2031

- 12. Mexico North America Seismic Services Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America North America Seismic Services Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 SAExploration Holdings Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 China Oilfield Services Limited

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 ION Geophysical Corporation

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Fugro NV

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Shearwater GeoServices AS

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Schlumberger Ltd

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 TGS NOPEC GEOPHYSICAL COMPANY ASA

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 CGG SA

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 BGP Inc China National Petroleum Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Halliburton Company

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 SeaBird Exploration PLC

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Magseis Fairfield ASA (WGP Group Ltd)

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Polarcus Ltd

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 PGS ASA

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.1 SAExploration Holdings Inc

List of Figures

- Figure 1: North America Seismic Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Seismic Services Market Share (%) by Company 2024

List of Tables

- Table 1: North America Seismic Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Seismic Services Market Revenue Million Forecast, by Service 2019 & 2032

- Table 3: North America Seismic Services Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 4: North America Seismic Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Seismic Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Seismic Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Seismic Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Seismic Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Seismic Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Seismic Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Seismic Services Market Revenue Million Forecast, by Service 2019 & 2032

- Table 12: North America Seismic Services Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 13: North America Seismic Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Seismic Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Seismic Services Market Revenue Million Forecast, by Service 2019 & 2032

- Table 16: North America Seismic Services Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 17: North America Seismic Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Seismic Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Seismic Services Market Revenue Million Forecast, by Service 2019 & 2032

- Table 20: North America Seismic Services Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 21: North America Seismic Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Seismic Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: North America Seismic Services Market Revenue Million Forecast, by Service 2019 & 2032

- Table 24: North America Seismic Services Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 25: North America Seismic Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Seismic Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Seismic Services Market?

The projected CAGR is approximately 2.11%.

2. Which companies are prominent players in the North America Seismic Services Market?

Key companies in the market include SAExploration Holdings Inc, China Oilfield Services Limited, ION Geophysical Corporation, Fugro NV, Shearwater GeoServices AS, Schlumberger Ltd, TGS NOPEC GEOPHYSICAL COMPANY ASA, CGG SA, BGP Inc China National Petroleum Corporation, Halliburton Company, SeaBird Exploration PLC, Magseis Fairfield ASA (WGP Group Ltd), Polarcus Ltd, PGS ASA.

3. What are the main segments of the North America Seismic Services Market?

The market segments include Service, Location of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy.

6. What are the notable trends driving market growth?

Offshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Penetration of Other Energy Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Seismic Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Seismic Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Seismic Services Market?

To stay informed about further developments, trends, and reports in the North America Seismic Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence