Key Insights

New Zealand's e-commerce sector is poised for significant expansion, offering a promising investment horizon. Fueled by increasing internet and smartphone penetration, alongside a growing consumer preference for online convenience, the market is projected to achieve a Compound Annual Growth Rate (CAGR) of 0.6%. This robust growth will see the market size reach 6.8 billion by 2025. Leading entities such as The Warehouse Group, Fishpond, Mighty Ape, and Trade Me are strategically leveraging diverse product offerings and advanced logistics to capture market share. While cybersecurity and pricing remain critical considerations, the overall market trajectory is positive. Segmentation across fashion, electronics, groceries, and home goods, coupled with supportive government initiatives and the adoption of mobile payments, further solidifies this upward trend.

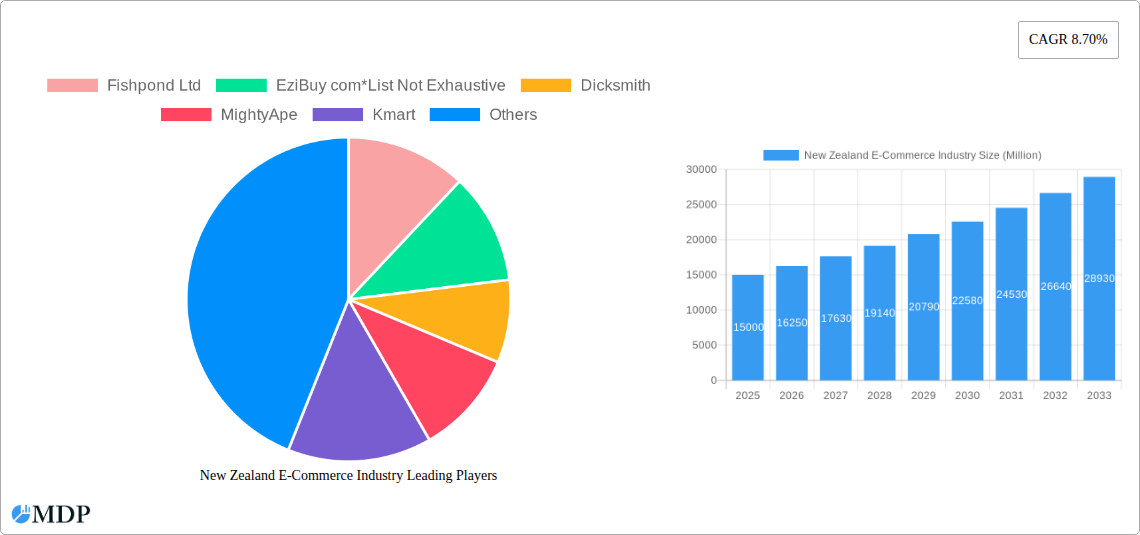

New Zealand E-Commerce Industry Market Size (In Billion)

The sustained growth of New Zealand's e-commerce market is driven by several key developments. Mobile commerce and sophisticated online marketplaces are increasingly influential. Enhanced digital infrastructure and logistics networks are facilitating faster, more reliable deliveries, boosting customer satisfaction. Intense competition compels established players to innovate continuously. Broadening e-commerce adoption across all age demographics indicates a lasting positive trend. However, businesses must prioritize data privacy and online security to mitigate potential risks. Addressing logistical challenges in remote areas will also be crucial for future expansion. Consequently, the market is anticipated to maintain a healthy growth trajectory.

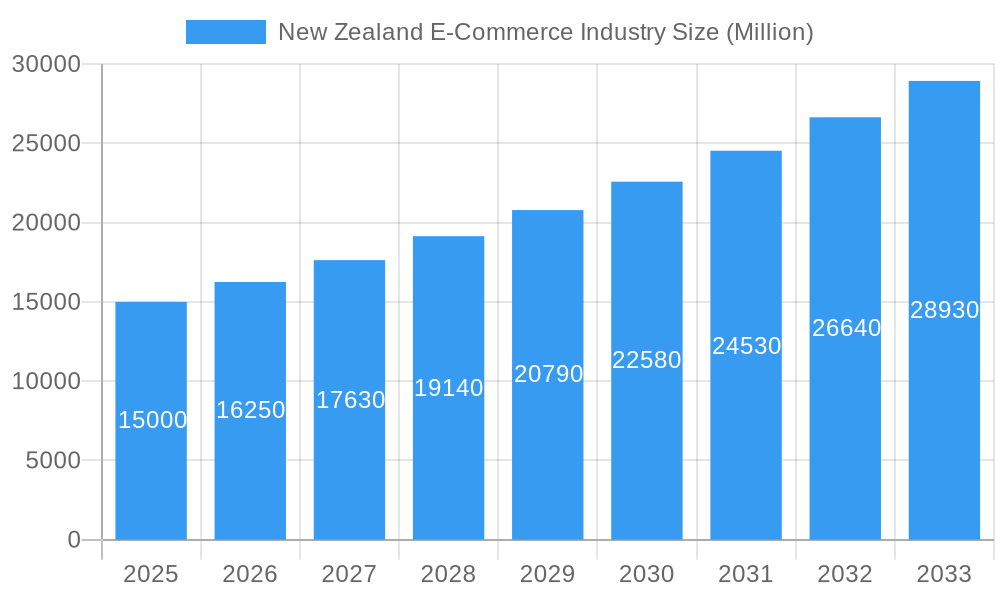

New Zealand E-Commerce Industry Company Market Share

New Zealand E-Commerce Industry: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the New Zealand e-commerce industry, offering invaluable insights for businesses, investors, and policymakers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market dynamics, growth drivers, challenges, and future opportunities within this dynamic sector. Discover key trends, leading players, and strategic recommendations to navigate the ever-evolving landscape of New Zealand's online retail market.

Keywords: New Zealand e-commerce, online retail New Zealand, NZ e-commerce market, New Zealand online shopping, e-commerce growth New Zealand, New Zealand digital commerce, e-commerce trends New Zealand, NZ e-commerce statistics, New Zealand e-commerce industry analysis, Fishpond, EziBuy, MightyApe, Trade Me, The Warehouse NZ, Countdown, Kmart, Briscoe, Priceme, Farmers, market analysis, market research, market forecast.

New Zealand E-Commerce Industry Market Dynamics & Concentration

The New Zealand e-commerce market exhibits a dynamic interplay of factors influencing its concentration and growth. From 2019-2024, the market witnessed a CAGR of xx%, driven by increasing internet penetration and smartphone usage. Market concentration is moderate, with a few dominant players like The Warehouse Group and Trade Me holding significant market share (estimated at xx% and xx% respectively in 2025), alongside other key players such as Countdown, Farmers, and MightyApe. However, the landscape remains competitive, with new entrants and innovative business models constantly emerging. Regulatory frameworks, while generally supportive, are evolving to address issues like consumer protection and data privacy. Product substitutes, primarily traditional brick-and-mortar stores, continue to exert competitive pressure, but the convenience and expanding product range offered by e-commerce platforms are progressively shifting consumer preferences. Increased adoption of mobile commerce and omnichannel strategies are significant innovation drivers. The historical period (2019-2024) saw xx M&A deals, reflecting the industry's consolidation trend. We project xx M&A deals for the forecast period (2025-2033).

- Market Concentration: Moderate, with a few dominant players.

- Innovation Drivers: Mobile commerce, omnichannel strategies.

- Regulatory Framework: Evolving to address consumer protection and data privacy.

- Product Substitutes: Traditional brick-and-mortar stores.

- End-User Trends: Increasing preference for online shopping convenience.

- M&A Activity: xx deals (2019-2024), projected xx deals (2025-2033).

New Zealand E-Commerce Industry Industry Trends & Analysis

The New Zealand e-commerce industry is experiencing robust growth fueled by several factors. The market's CAGR from 2019-2024 was xx%, exceeding global averages. This growth is primarily driven by rising internet and smartphone penetration, coupled with increasing consumer comfort in online transactions. Technological disruptions, such as the rise of mobile payments and AI-powered recommendation engines, enhance the shopping experience. Consumers increasingly value convenience, personalization, and competitive pricing, significantly influencing market dynamics. The competitive landscape is characterized by both established players and nimble startups, constantly vying for market share through innovative offerings, aggressive marketing, and strategic partnerships. This heightened competition is driving down prices and pushing innovation in customer service and delivery methods. Market penetration, while already significant, is poised to increase further as more New Zealanders embrace online shopping. The forecast period (2025-2033) anticipates a projected CAGR of xx%, indicating a continuously evolving and expanding market.

Leading Markets & Segments in New Zealand E-Commerce Industry

While precise regional data is unavailable publicly, the Auckland region and other major urban centers are believed to dominate the New Zealand e-commerce market due to higher population density, internet penetration, and disposable income. The dominance of specific segments within Market Segmentation - by Application is influenced by several factors.

Key Drivers:

- Strong infrastructure, including reliable internet and logistics networks.

- Favorable economic policies promoting digitalization.

- High consumer adoption of online shopping.

Dominance Analysis: The largest segments are likely to be apparel & fashion, electronics, and groceries, driven by high consumer demand and established online presence of key players in these sectors. More detailed segmentation data and analysis requires further research but the general trend points to a broadening of segments with increasing consumer choice and niche market development. The ongoing growth of specific segments is also driven by increased accessibility through diverse payment methods and increased promotional activities.

New Zealand E-Commerce Industry Product Developments

Technological advancements are significantly shaping product development in the New Zealand e-commerce industry. The integration of artificial intelligence (AI) for personalized recommendations, enhanced search functionalities, and improved customer service is becoming widespread. Innovative payment gateways and secure online transaction systems are enhancing consumer trust and confidence. Focus on omnichannel strategies and seamless integration between online and offline experiences are becoming crucial for competitive advantage. These factors ensure a better user experience leading to increased customer retention and market share.

Key Drivers of New Zealand E-Commerce Industry Growth

Several factors contribute to the growth of New Zealand's e-commerce sector. Firstly, rising internet and smartphone penetration provide access to online retail for a larger portion of the population. Secondly, the convenience and accessibility of online shopping appeal to time-constrained consumers. Thirdly, increasing disposable incomes enable higher spending on online purchases. Fourthly, government initiatives supporting digitalization and e-commerce create a supportive environment. Lastly, the aggressive expansion of logistics and delivery networks ensures faster and more reliable delivery services.

Challenges in the New Zealand E-Commerce Industry Market

The New Zealand e-commerce market faces several challenges. High delivery costs, particularly to rural areas, impact profitability and limit reach. Concerns around data security and online fraud can deter consumers from online shopping. Competition from international e-commerce giants creates intense pressure on local businesses. Supply chain disruptions and rising costs of goods negatively impact profit margins. The lack of skilled workforce needed for technical support and digital marketing is a growing concern. This challenge negatively impacts the industry's ability to expand its services and increase innovation.

Emerging Opportunities in New Zealand E-Commerce Industry

Significant opportunities exist for growth within the New Zealand e-commerce industry. The expansion of high-speed broadband internet access into rural areas will open new markets. The development of sophisticated logistics networks that facilitate efficient and cost-effective delivery will boost online retail sales. Strategic partnerships between local businesses and international e-commerce platforms can help expand market reach and access to a broader range of products. The increasing adoption of mobile commerce represents a significant avenue for growth.

Leading Players in the New Zealand E-Commerce Industry Sector

- Fishpond Ltd

- EziBuy

- Dicksmith

- MightyApe

- Kmart

- Countdown co nz

- Grabone

- Trade Me

- Briscoe

- The Warehouse NZ

- Priceme

- Farmers

Key Milestones in New Zealand E-Commerce Industry Industry

- March 2022: MyDeal, an Australian e-commerce company, announced plans to expand into New Zealand.

- April 2022: Andoo, a New Zealand e-commerce retailer, launched, offering next-day delivery in Auckland and Hamilton, with plans for nationwide expansion.

Strategic Outlook for New Zealand E-Commerce Industry Market

The future of the New Zealand e-commerce market appears bright, with significant growth potential driven by ongoing technological advancements, increasing consumer adoption, and supportive regulatory frameworks. Strategic opportunities lie in focusing on personalized customer experiences, enhancing logistics capabilities, and leveraging the power of data analytics to optimize operations and marketing efforts. Businesses that adapt to evolving consumer preferences, embrace innovation, and manage the challenges effectively will be best positioned to thrive in this dynamic market.

New Zealand E-Commerce Industry Segmentation

-

1. B2C E-commerce

- 1.1. Market Size (GMV) for the Period of 2017-2027

-

1.2. Market Segmentation - by Application

- 1.2.1. Beauty and Personal Care

- 1.2.2. Consumer Electronics

- 1.2.3. Fashion and Apparel

- 1.2.4. Food and Beverages

- 1.2.5. Furniture and Home

- 1.2.6. Others (Toys, DIY, Media, etc.)

- 2. Market Size (GMV) for the Period of 2017-2027

-

3. Application

- 3.1. Beauty and Personal Care

- 3.2. Consumer Electronics

- 3.3. Fashion and Apparel

- 3.4. Food and Beverages

- 3.5. Furniture and Home

- 3.6. Others (Toys, DIY, Media, etc.)

- 4. Beauty and Personal Care

- 5. Consumer Electronics

- 6. Fashion and Apparel

- 7. Food and Beverages

- 8. Furniture and Home

- 9. Others (Toys, DIY, Media, etc.)

-

10. B2B E-commerce

- 10.1. Market Size for the Period of 2017-2027

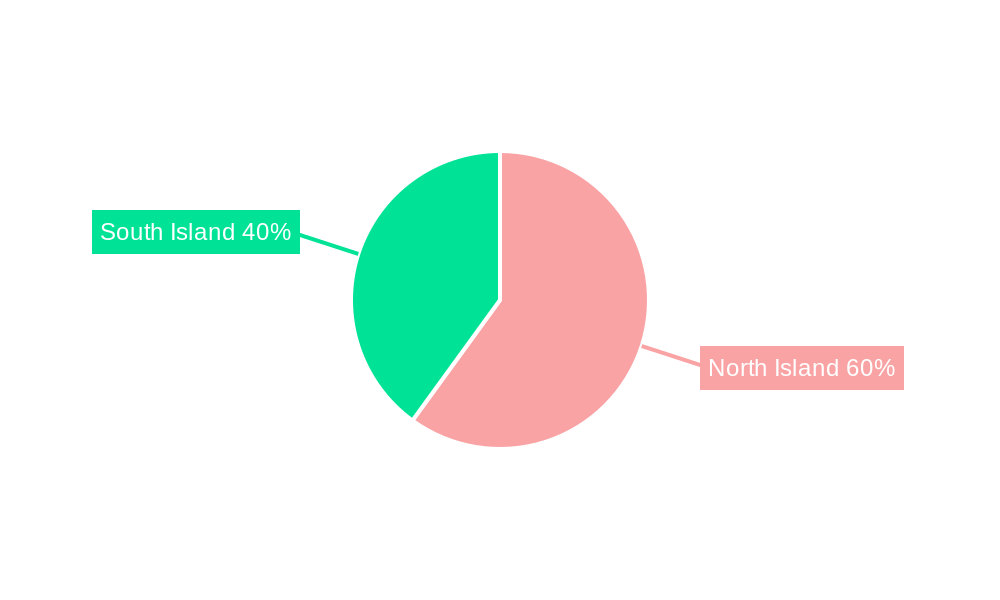

New Zealand E-Commerce Industry Segmentation By Geography

- 1. New Zealand

New Zealand E-Commerce Industry Regional Market Share

Geographic Coverage of New Zealand E-Commerce Industry

New Zealand E-Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Online Shoppers is Expected to Boost the Market; Rising Adoption of Buy Now Pay Later Services

- 3.3. Market Restrains

- 3.3.1. ; Technology is Expensive to Integrate and Comparatively Slower Charging

- 3.4. Market Trends

- 3.4.1. Increasing Online Shoppers is Expected to Boost the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. New Zealand E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 5.1.1. Market Size (GMV) for the Period of 2017-2027

- 5.1.2. Market Segmentation - by Application

- 5.1.2.1. Beauty and Personal Care

- 5.1.2.2. Consumer Electronics

- 5.1.2.3. Fashion and Apparel

- 5.1.2.4. Food and Beverages

- 5.1.2.5. Furniture and Home

- 5.1.2.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Market Size (GMV) for the Period of 2017-2027

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Beauty and Personal Care

- 5.3.2. Consumer Electronics

- 5.3.3. Fashion and Apparel

- 5.3.4. Food and Beverages

- 5.3.5. Furniture and Home

- 5.3.6. Others (Toys, DIY, Media, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Beauty and Personal Care

- 5.5. Market Analysis, Insights and Forecast - by Consumer Electronics

- 5.6. Market Analysis, Insights and Forecast - by Fashion and Apparel

- 5.7. Market Analysis, Insights and Forecast - by Food and Beverages

- 5.8. Market Analysis, Insights and Forecast - by Furniture and Home

- 5.9. Market Analysis, Insights and Forecast - by Others (Toys, DIY, Media, etc.)

- 5.10. Market Analysis, Insights and Forecast - by B2B E-commerce

- 5.10.1. Market Size for the Period of 2017-2027

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. New Zealand

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Fishpond Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EziBuy com*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dicksmith

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MightyApe

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kmart

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Countdown co nz

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Grabone

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trade Me

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Briscoe

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Warehouse NZ

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Priceme

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Farmers

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Fishpond Ltd

List of Figures

- Figure 1: New Zealand E-Commerce Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: New Zealand E-Commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: New Zealand E-Commerce Industry Revenue billion Forecast, by B2C E-commerce 2020 & 2033

- Table 2: New Zealand E-Commerce Industry Revenue billion Forecast, by Market Size (GMV) for the Period of 2017-2027 2020 & 2033

- Table 3: New Zealand E-Commerce Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: New Zealand E-Commerce Industry Revenue billion Forecast, by Beauty and Personal Care 2020 & 2033

- Table 5: New Zealand E-Commerce Industry Revenue billion Forecast, by Consumer Electronics 2020 & 2033

- Table 6: New Zealand E-Commerce Industry Revenue billion Forecast, by Fashion and Apparel 2020 & 2033

- Table 7: New Zealand E-Commerce Industry Revenue billion Forecast, by Food and Beverages 2020 & 2033

- Table 8: New Zealand E-Commerce Industry Revenue billion Forecast, by Furniture and Home 2020 & 2033

- Table 9: New Zealand E-Commerce Industry Revenue billion Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 10: New Zealand E-Commerce Industry Revenue billion Forecast, by B2B E-commerce 2020 & 2033

- Table 11: New Zealand E-Commerce Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 12: New Zealand E-Commerce Industry Revenue billion Forecast, by B2C E-commerce 2020 & 2033

- Table 13: New Zealand E-Commerce Industry Revenue billion Forecast, by Market Size (GMV) for the Period of 2017-2027 2020 & 2033

- Table 14: New Zealand E-Commerce Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: New Zealand E-Commerce Industry Revenue billion Forecast, by Beauty and Personal Care 2020 & 2033

- Table 16: New Zealand E-Commerce Industry Revenue billion Forecast, by Consumer Electronics 2020 & 2033

- Table 17: New Zealand E-Commerce Industry Revenue billion Forecast, by Fashion and Apparel 2020 & 2033

- Table 18: New Zealand E-Commerce Industry Revenue billion Forecast, by Food and Beverages 2020 & 2033

- Table 19: New Zealand E-Commerce Industry Revenue billion Forecast, by Furniture and Home 2020 & 2033

- Table 20: New Zealand E-Commerce Industry Revenue billion Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 21: New Zealand E-Commerce Industry Revenue billion Forecast, by B2B E-commerce 2020 & 2033

- Table 22: New Zealand E-Commerce Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the New Zealand E-Commerce Industry?

The projected CAGR is approximately 0.6%.

2. Which companies are prominent players in the New Zealand E-Commerce Industry?

Key companies in the market include Fishpond Ltd, EziBuy com*List Not Exhaustive, Dicksmith, MightyApe, Kmart, Countdown co nz, Grabone, Trade Me, Briscoe, The Warehouse NZ, Priceme, Farmers.

3. What are the main segments of the New Zealand E-Commerce Industry?

The market segments include B2C E-commerce, Market Size (GMV) for the Period of 2017-2027, Application, Beauty and Personal Care, Consumer Electronics, Fashion and Apparel, Food and Beverages, Furniture and Home, Others (Toys, DIY, Media, etc.), B2B E-commerce.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Online Shoppers is Expected to Boost the Market; Rising Adoption of Buy Now Pay Later Services.

6. What are the notable trends driving market growth?

Increasing Online Shoppers is Expected to Boost the Market.

7. Are there any restraints impacting market growth?

; Technology is Expensive to Integrate and Comparatively Slower Charging.

8. Can you provide examples of recent developments in the market?

March 2022 - Australian e-commerce company MyDeal announced its plans to expand into New Zealand during the first half of the calendar year. After that, the company is eyeing moving further abroad, entering the UK and the US markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "New Zealand E-Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the New Zealand E-Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the New Zealand E-Commerce Industry?

To stay informed about further developments, trends, and reports in the New Zealand E-Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence