Key Insights

The Netherlands offshore oil and gas decommissioning market is poised for significant growth, driven by aging infrastructure and stringent regulatory mandates for responsible asset retirement. The market is projected to expand considerably, with an estimated Compound Annual Growth Rate (CAGR) of 6.5% from 2025 to 2033. This growth is supported by a current market size of 11.1 billion. Key market segments include deployment location (overhead, underground, submarine) and voltage levels (high, extra-high, ultra-high voltage). Leading companies such as ABB Ltd, Neptune Energy, and Boskalis are instrumental in driving innovation and expertise in complex decommissioning projects. The Netherlands' strategic North Sea location and mature oil and gas sector provide a conducive environment. Escalating environmental concerns and stricter regulations for platform dismantling and waste management further accelerate market expansion.

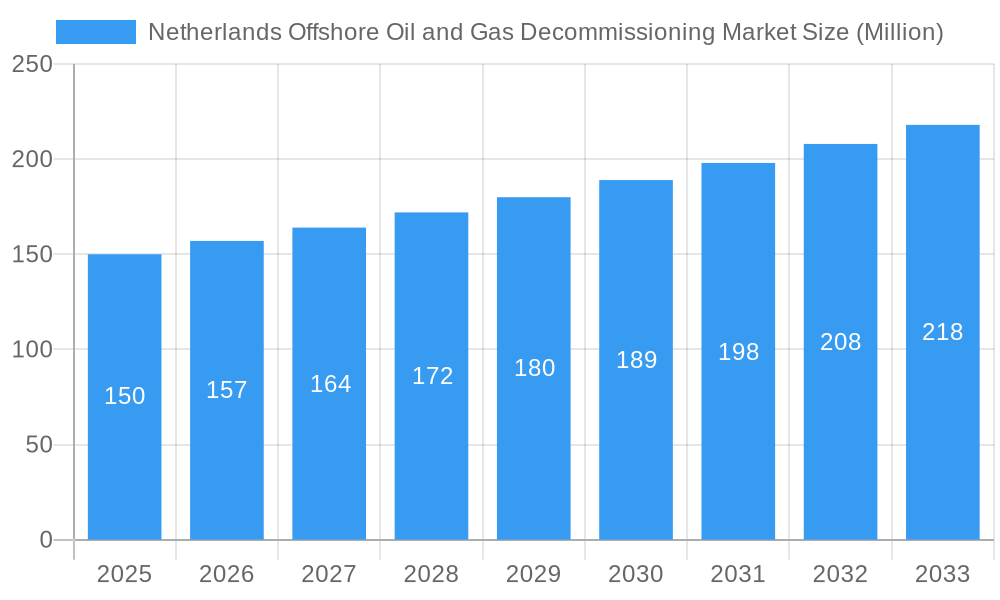

Netherlands Offshore Oil and Gas Decommissioning Market Market Size (In Billion)

Substantial investments in safe and efficient decommissioning operations are a primary market driver. While logistical complexities and specialized equipment pose challenges, they are mitigated by strong government support and a growing commitment to environmental sustainability. The robust market size, combined with consistent demand for eco-friendly decommissioning solutions, solidifies the Netherlands' position in this dynamic global sector. Anticipated market consolidation, with smaller entities seeking strategic partnerships or acquisitions, will necessitate adaptability and forward-thinking strategies for all participants.

Netherlands Offshore Oil and Gas Decommissioning Market Company Market Share

Netherlands Offshore Oil and Gas Decommissioning Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Netherlands Offshore Oil and Gas Decommissioning Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence on market dynamics, technological advancements, and future growth prospects. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Key players like ABB Ltd, Neptune Energy, Royal Boskalis Westminster N V, and others are shaping the landscape of this growing market.

Netherlands Offshore Oil and Gas Decommissioning Market Market Dynamics & Concentration

The Netherlands offshore oil and gas decommissioning market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. Market concentration is influenced by factors like technological expertise, financial capabilities, and established operational presence. The market witnesses continuous innovation driven by stricter environmental regulations, the need for efficient and cost-effective decommissioning solutions, and advancements in robotics and automation. The regulatory framework, including licensing requirements and environmental impact assessments, significantly impacts market activities. Product substitutes, such as alternative energy sources, although not directly competing, exert indirect pressure. End-user trends focus on sustainability and responsible decommissioning practices. M&A activities play a vital role in market consolidation and expansion. While precise market share figures for individual companies are proprietary data, the number of M&A deals has increased steadily in recent years (estimated at xx deals in the past 5 years). Key factors driving mergers and acquisitions include expanding operational capacity, technological synergy, and enhanced market competitiveness.

Netherlands Offshore Oil and Gas Decommissioning Market Industry Trends & Analysis

The Netherlands offshore oil and gas decommissioning market is experiencing substantial growth, driven by several key factors. Aging offshore infrastructure requires significant investment in decommissioning activities. Stringent environmental regulations mandate the responsible removal of infrastructure, fueling market demand. Technological advancements, including improved robotics, remotely operated vehicles (ROVs), and advanced recycling techniques, are enhancing efficiency and reducing decommissioning costs. Increasing industry awareness of environmental sustainability and the long-term costs of neglecting decommissioning further contribute to market expansion. Consumer preferences, mainly reflecting governmental and public pressure for environmentally friendly practices, are pushing the industry towards cleaner and more sustainable solutions. Competitive dynamics are shaping the market, with companies focusing on innovation, cost optimization, and securing contracts to maintain their market positioning. The market growth is anticipated to be driven by increasing government support and technological innovation in the foreseeable future. The market exhibits a strong potential for growth and investment.

Leading Markets & Segments in Netherlands Offshore Oil and Gas Decommissioning Market

Dominant Segment: The submarine segment currently holds the largest market share, driven by the extensive network of subsea infrastructure requiring decommissioning. The high-voltage segment also exhibits strong growth, reflecting the technical requirements for safe and efficient decommissioning of offshore platforms.

Key Drivers:

- Governmental Policies: Stringent environmental regulations and financial incentives for sustainable decommissioning practices significantly influence market growth.

- Infrastructure: The extensive network of aging offshore oil and gas infrastructure in the Netherlands directly fuels demand for decommissioning services.

- Technological Advancements: Innovation in underwater robotics, advanced recycling techniques, and improved safety protocols are key drivers.

Dominance Analysis: The submarine segment's dominance stems from the significant number of subsea installations requiring decommissioning. This segment also benefits from considerable technological advancements focused on subsea operations. The high-voltage segment’s prominence is linked to the electrical infrastructure commonly found on offshore platforms. These factors combine to contribute to the overall market growth and shape the deployment landscape within the Netherlands.

Netherlands Offshore Oil and Gas Decommissioning Market Product Developments

Recent product innovations focus on enhancing efficiency, safety, and environmental sustainability. Developments include advanced remotely operated vehicles (ROVs), improved recycling technologies, and innovative techniques for dismantling and removing complex subsea structures. These innovations offer significant competitive advantages by reducing operational costs, minimizing environmental impact, and ensuring safer decommissioning processes. Technological trends indicate a continuous push for automation and more environmentally-friendly solutions, well-aligned with market demands.

Key Drivers of Netherlands Offshore Oil and Gas Decommissioning Market Growth

The Netherlands offshore oil and gas decommissioning market's growth is primarily driven by several factors. Stricter environmental regulations mandate responsible decommissioning, fostering demand. Aging offshore infrastructure necessitates substantial decommissioning activities. Technological advancements continuously improve efficiency and cost-effectiveness. Government incentives and supportive policies further accelerate market growth.

Challenges in the Netherlands Offshore Oil and Gas Decommissioning Market Market

Significant challenges exist, including the high costs associated with decommissioning, complex regulatory hurdles delaying projects, and supply chain disruptions impacting project timelines. Competition among service providers, coupled with fluctuating oil prices, also pose challenges. These factors can collectively reduce profitability and increase project uncertainties.

Emerging Opportunities in Netherlands Offshore Oil and Gas Decommissioning Market

Emerging opportunities lie in technological innovation, strategic partnerships among industry players, and expansion into new service offerings (like complete well decommissioning and the development of advanced recycling facilities). These initiatives enhance cost-effectiveness, environmental responsibility, and market competitiveness, driving future market growth.

Leading Players in the Netherlands Offshore Oil and Gas Decommissioning Market Sector

- ABB Ltd

- Neptune Energy

- Royal Boskalis Westminster N V

- Jansen Recycling Group

- Jumbo Offshore v o f

- SALTWATER ENGINEERING B V

- Veolia Environnement SA

- Nexstep

Key Milestones in Netherlands Offshore Oil and Gas Decommissioning Market Industry

- September 2022: Neptune Energy awarded a USD 30 Million decommissioning contract to Well-Safe Solutions for over 20 wells across eight North Sea fields (Dutch and UK). This highlights increasing outsourcing trends and the growing market for specialized services.

- October 2022: TotalEnergies and AF Offshore Decom signed a contract for the EPRD (engineering, preparation, removal, transportation, dismantling, and recycling) of 10 production platforms from the L7 field. This signifies the scale of decommissioning projects and the involvement of specialized firms in large-scale operations.

Strategic Outlook for Netherlands Offshore Oil and Gas Decommissioning Market Market

The Netherlands offshore oil and gas decommissioning market holds significant potential for growth, driven by increasing government support for sustainable decommissioning, technological innovations reducing costs and risks, and a rising number of aging offshore installations needing decommissioning. Strategic opportunities exist for companies focusing on innovative technologies and environmentally conscious solutions, leading to higher market shares and greater profitability in this dynamic sector.

Netherlands Offshore Oil and Gas Decommissioning Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Netherlands Offshore Oil and Gas Decommissioning Market Segmentation By Geography

- 1. Netherlands

Netherlands Offshore Oil and Gas Decommissioning Market Regional Market Share

Geographic Coverage of Netherlands Offshore Oil and Gas Decommissioning Market

Netherlands Offshore Oil and Gas Decommissioning Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Integration Of Renewable Energy Generation4.; Aging Power Grids And Investments In Transmission And Distribution Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Raw Material Prices And Investment In Distributed Renewable Energy Generation Affect The Growth

- 3.4. Market Trends

- 3.4.1. Shallow Water Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Offshore Oil and Gas Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Neptune Energy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Royal Boskalis Westminster N V

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jansen Recycling Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jumbo Offshore v o f

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SALTWATER ENGINEERING B V

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Veolia Environnement SA*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nexstep

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: Netherlands Offshore Oil and Gas Decommissioning Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Netherlands Offshore Oil and Gas Decommissioning Market Share (%) by Company 2025

List of Tables

- Table 1: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Offshore Oil and Gas Decommissioning Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Netherlands Offshore Oil and Gas Decommissioning Market?

Key companies in the market include ABB Ltd, Neptune Energy, Royal Boskalis Westminster N V, Jansen Recycling Group, Jumbo Offshore v o f, SALTWATER ENGINEERING B V, Veolia Environnement SA*List Not Exhaustive, Nexstep.

3. What are the main segments of the Netherlands Offshore Oil and Gas Decommissioning Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.1 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Integration Of Renewable Energy Generation4.; Aging Power Grids And Investments In Transmission And Distribution Infrastructure.

6. What are the notable trends driving market growth?

Shallow Water Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Raw Material Prices And Investment In Distributed Renewable Energy Generation Affect The Growth.

8. Can you provide examples of recent developments in the market?

September 2022: Neptune Energy announced the award of a USD 30 million decommissioning contract to Well-Safe Solutions, for a campaign covering more than 20 wells located across eight Dutch and UK North Sea fields.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Offshore Oil and Gas Decommissioning Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Offshore Oil and Gas Decommissioning Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Offshore Oil and Gas Decommissioning Market?

To stay informed about further developments, trends, and reports in the Netherlands Offshore Oil and Gas Decommissioning Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence