Key Insights

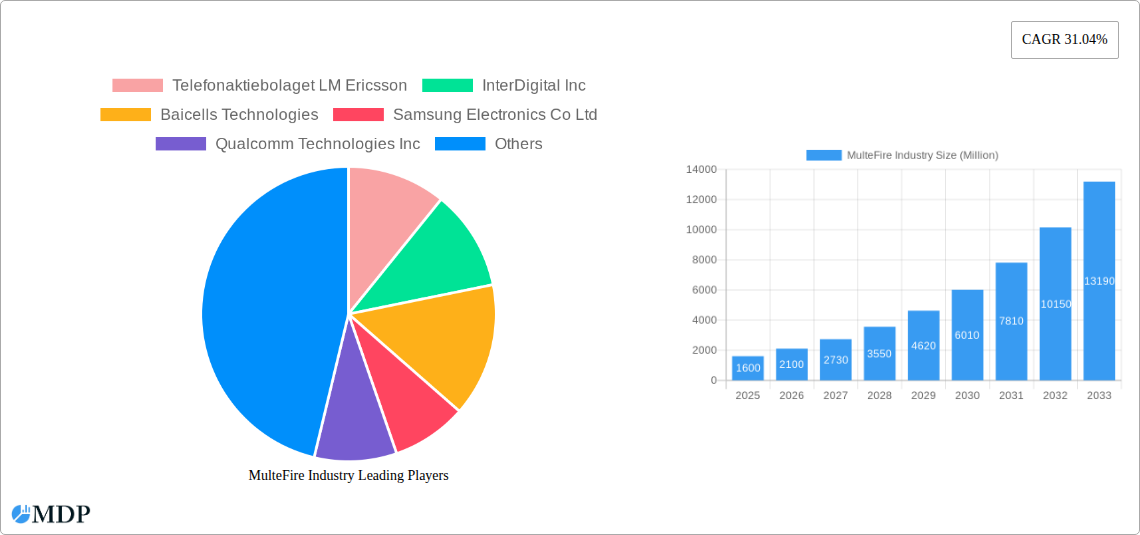

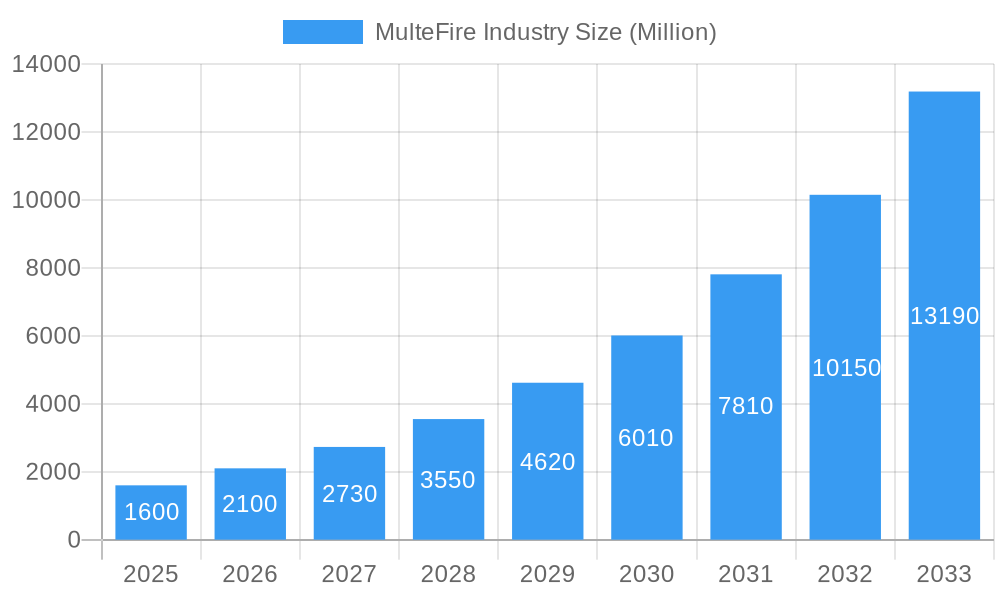

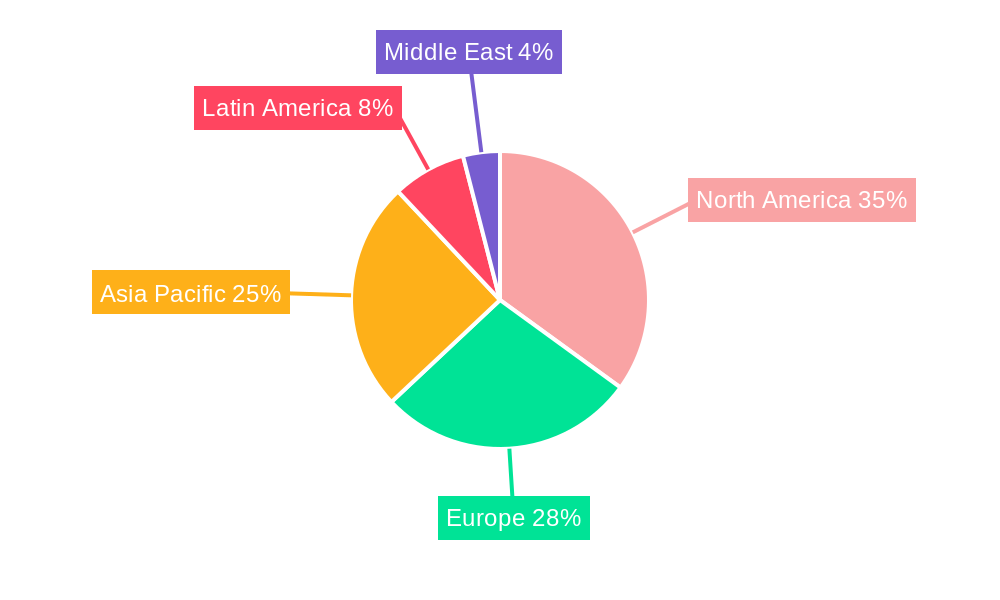

The MulteFire market, valued at $1.6 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 31.04% from 2025 to 2033. This surge is driven by the increasing demand for reliable, high-speed, and cost-effective private LTE/5G networks across various sectors. Key drivers include the need for enhanced security and control over private networks, particularly within critical infrastructure like healthcare, supply chain, and commercial buildings. The rising adoption of Internet of Things (IoT) devices and the need for low latency communication further fuel this market expansion. Growth is also being propelled by technological advancements leading to more affordable and easily deployable MulteFire solutions. The market segmentation reveals strong interest across multiple verticals. Commercial and institutional buildings, along with the supply chain and distribution sectors, are early adopters, leveraging MulteFire for improved operational efficiency and enhanced security. Retail, hospitality, and public venues are also increasingly adopting the technology to improve customer experience and operational capabilities. While the market faces restraints such as the initial investment costs and the complexity of integrating MulteFire solutions with existing infrastructure, the long-term benefits significantly outweigh these challenges. The competitive landscape is dynamic, with major players like Ericsson, Qualcomm, Huawei, and Nokia actively investing in research and development to enhance their offerings and capture market share. The geographic distribution shows strong growth potential across North America, Europe, and Asia Pacific, with North America currently leading the market due to early adoption and robust technological infrastructure.

MulteFire Industry Market Size (In Billion)

The projected market size for 2033, extrapolated from the provided CAGR, signifies substantial growth opportunities. The continued investment in 5G infrastructure globally, coupled with the increasing demand for private networks, points towards a sustained period of growth for the MulteFire market. The key to success for vendors will be focusing on delivering cost-effective, easy-to-deploy solutions that address the specific needs of various industry verticals, while simultaneously ensuring strong security features. This will require continued innovation in both hardware and software, as well as strategic partnerships to foster wider adoption. Furthermore, educating the market about the benefits and applications of MulteFire will be crucial in driving future growth.

MulteFire Industry Company Market Share

MulteFire Industry Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the MulteFire industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. From market size and concentration to leading players and emerging trends, this report covers all crucial aspects for informed decision-making. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report provides a complete historical and future perspective. The report projects a market valuation exceeding $XX Million by 2033, presenting significant growth opportunities.

MulteFire Industry Market Dynamics & Concentration

The MulteFire industry, valued at $XX Million in 2024, is characterized by [describe level of concentration: high, medium, low] market concentration. Key drivers of innovation include advancements in small cell technology, increasing demand for high-bandwidth applications, and the growing adoption of private LTE/5G networks. Regulatory frameworks, particularly concerning spectrum allocation and licensing, significantly impact market growth. Product substitutes, such as traditional Wi-Fi solutions, pose a competitive challenge, although MulteFire’s advantages in terms of security, reliability, and performance are mitigating this. End-user trends favor the adoption of private networks for enhanced security and control, driving demand.

- Market Share: While precise market share data for individual companies is confidential and varies across segments, companies like Ericsson, Nokia, and Qualcomm hold significant shares. Smaller players like Baicells are gaining traction.

- M&A Activity: The industry has witnessed [Number] major M&A deals in the last five years, indicating consolidation and increased competition. These deals primarily involved smaller companies being acquired by larger industry players to expand their product portfolios and market reach.

MulteFire Industry Industry Trends & Analysis

The MulteFire market exhibits a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). This robust growth is driven by several factors. The increasing demand for reliable, high-speed connectivity in various sectors, particularly commercial and institutional buildings, is a primary driver. Technological advancements such as improved small cell designs and more efficient spectrum usage are further accelerating market expansion. Consumer preference is shifting towards solutions that offer enhanced security, reliability, and scalability, which strongly favors MulteFire. The competitive dynamics are characterized by intense rivalry among major players, fostering innovation and driving down prices. Market penetration is expected to reach XX% by 2033, representing significant untapped potential.

Leading Markets & Segments in MulteFire Industry

The [Region/Country - e.g., North America] region currently dominates the MulteFire market, driven by factors such as strong economic growth, advanced infrastructure, and early adoption of private LTE/5G networks. Within the equipment type segment, Small Cells account for the largest market share due to their scalability and cost-effectiveness. In end-user verticals, Commercial & Institutional Buildings represent a significant market segment, followed by Retail and Hospitality.

Key Drivers in North America:

- Strong government initiatives supporting 5G infrastructure development.

- High density of commercial and institutional buildings requiring private network solutions.

- Well-established supply chains and distribution networks.

Dominance Analysis: North America’s dominance is attributed to its early adoption of advanced technologies, strong regulatory support, and the presence of key industry players. However, other regions, particularly in Asia and Europe, are demonstrating strong growth potential.

MulteFire Industry Product Developments

Recent product innovations focus on improving the efficiency, security, and scalability of MulteFire solutions. Manufacturers are developing more compact and power-efficient small cells, along with advanced network management and optimization tools. The integration of advanced features, such as AI-powered network slicing and edge computing capabilities, is enhancing the overall user experience and creating new market opportunities. This focus on improving features is driving market acceptance and adoption across various industry verticals.

Key Drivers of MulteFire Industry Growth

Several factors are fueling the growth of the MulteFire industry. Technological advancements, such as the development of more efficient small cells and improved spectrum utilization techniques, are a primary driver. Strong economic growth in several key regions is further boosting demand. Favorable regulatory environments in certain countries, which support the deployment of private LTE/5G networks, are also contributing to market expansion.

Challenges in the MulteFire Industry Market

The MulteFire industry faces several challenges, including regulatory hurdles in some regions that impede the rapid deployment of private networks. Supply chain disruptions can affect the availability and cost of components, impacting overall market growth. Intense competition among established players and the emergence of new entrants also create price pressures. The cost of implementation can be a barrier to entry for some end-users, especially small businesses. These factors collectively impact market expansion and profitability.

Emerging Opportunities in MulteFire Industry

The MulteFire market presents several lucrative opportunities for growth. Advancements in 5G technology are paving the way for increased capacity and enhanced performance, attracting new users. Strategic partnerships between MulteFire vendors and network operators can broaden market reach and accelerate adoption. Expanding into new and emerging markets, particularly in developing economies, offers significant untapped potential. The growing need for reliable and secure private networks across various sectors presents immense opportunities for growth in the coming years.

Leading Players in the MulteFire Industry Sector

Key Milestones in MulteFire Industry Industry

- February 2023: Verana Networks announced a new trial with Verizon, securing Verizon as a strategic investor. This trial focuses on mmWave small cells for Integrated Access and Backhaul, significantly boosting the credibility and market potential of this technology.

Strategic Outlook for MulteFire Industry Market

The MulteFire market is poised for significant growth, driven by the increasing demand for secure and reliable private networks across various sectors. Strategic partnerships, technological innovation, and expansion into new markets will be crucial for success. Companies focusing on providing cost-effective, scalable, and feature-rich solutions will be best positioned to capitalize on the market's immense potential. The long-term outlook remains optimistic, with substantial opportunities for market expansion and revenue generation.

MulteFire Industry Segmentation

-

1. Equipment Type

- 1.1. Small Cells

- 1.2. Switches

- 1.3. Controllers

-

2. End User Vertical

- 2.1. Commercial & Institutional Buildings

- 2.2. Supply Chain and Distribution

- 2.3. Retail

- 2.4. Hospitality

- 2.5. Public Venues

- 2.6. Healthcare

- 2.7. Others

MulteFire Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of Latin America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. Rest of Middle East

MulteFire Industry Regional Market Share

Geographic Coverage of MulteFire Industry

MulteFire Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Availability of Shared and Unlicensed Spectrum Bands; Growing Demand for Better and More Scalable Network Connectivity for Industrial Internet of Things (IIoT) Applications; Low Cost of Deployment that doesn't Require Spectrum License

- 3.3. Market Restrains

- 3.3.1. Disadvantage Compared to Wi-Fi Technologies in Accessing the Channel; Delay in Decision-Making Regarding Use of Shared Spectrum

- 3.4. Market Trends

- 3.4.1. Growing Demand for Better and More Scalable Network Connectivity for Industrial Internet of Things (IIoT) Applications

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MulteFire Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Small Cells

- 5.1.2. Switches

- 5.1.3. Controllers

- 5.2. Market Analysis, Insights and Forecast - by End User Vertical

- 5.2.1. Commercial & Institutional Buildings

- 5.2.2. Supply Chain and Distribution

- 5.2.3. Retail

- 5.2.4. Hospitality

- 5.2.5. Public Venues

- 5.2.6. Healthcare

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.3.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. North America MulteFire Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6.1.1. Small Cells

- 6.1.2. Switches

- 6.1.3. Controllers

- 6.2. Market Analysis, Insights and Forecast - by End User Vertical

- 6.2.1. Commercial & Institutional Buildings

- 6.2.2. Supply Chain and Distribution

- 6.2.3. Retail

- 6.2.4. Hospitality

- 6.2.5. Public Venues

- 6.2.6. Healthcare

- 6.2.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7. Europe MulteFire Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7.1.1. Small Cells

- 7.1.2. Switches

- 7.1.3. Controllers

- 7.2. Market Analysis, Insights and Forecast - by End User Vertical

- 7.2.1. Commercial & Institutional Buildings

- 7.2.2. Supply Chain and Distribution

- 7.2.3. Retail

- 7.2.4. Hospitality

- 7.2.5. Public Venues

- 7.2.6. Healthcare

- 7.2.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8. Asia Pacific MulteFire Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8.1.1. Small Cells

- 8.1.2. Switches

- 8.1.3. Controllers

- 8.2. Market Analysis, Insights and Forecast - by End User Vertical

- 8.2.1. Commercial & Institutional Buildings

- 8.2.2. Supply Chain and Distribution

- 8.2.3. Retail

- 8.2.4. Hospitality

- 8.2.5. Public Venues

- 8.2.6. Healthcare

- 8.2.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 9. Latin America MulteFire Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Equipment Type

- 9.1.1. Small Cells

- 9.1.2. Switches

- 9.1.3. Controllers

- 9.2. Market Analysis, Insights and Forecast - by End User Vertical

- 9.2.1. Commercial & Institutional Buildings

- 9.2.2. Supply Chain and Distribution

- 9.2.3. Retail

- 9.2.4. Hospitality

- 9.2.5. Public Venues

- 9.2.6. Healthcare

- 9.2.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Equipment Type

- 10. Middle East MulteFire Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Equipment Type

- 10.1.1. Small Cells

- 10.1.2. Switches

- 10.1.3. Controllers

- 10.2. Market Analysis, Insights and Forecast - by End User Vertical

- 10.2.1. Commercial & Institutional Buildings

- 10.2.2. Supply Chain and Distribution

- 10.2.3. Retail

- 10.2.4. Hospitality

- 10.2.5. Public Venues

- 10.2.6. Healthcare

- 10.2.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Equipment Type

- 11. United Arab Emirates MulteFire Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Equipment Type

- 11.1.1. Small Cells

- 11.1.2. Switches

- 11.1.3. Controllers

- 11.2. Market Analysis, Insights and Forecast - by End User Vertical

- 11.2.1. Commercial & Institutional Buildings

- 11.2.2. Supply Chain and Distribution

- 11.2.3. Retail

- 11.2.4. Hospitality

- 11.2.5. Public Venues

- 11.2.6. Healthcare

- 11.2.7. Others

- 11.1. Market Analysis, Insights and Forecast - by Equipment Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Telefonaktiebolaget LM Ericsson

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 InterDigital Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Baicells Technologies

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Samsung Electronics Co Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Qualcomm Technologies Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 DEKRA India Private Limited*List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Huawei Technologies Co Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Nokia Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Intel Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Sony Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Telefonaktiebolaget LM Ericsson

List of Figures

- Figure 1: Global MulteFire Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America MulteFire Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 3: North America MulteFire Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 4: North America MulteFire Industry Revenue (Million), by End User Vertical 2025 & 2033

- Figure 5: North America MulteFire Industry Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 6: North America MulteFire Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America MulteFire Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe MulteFire Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 9: Europe MulteFire Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 10: Europe MulteFire Industry Revenue (Million), by End User Vertical 2025 & 2033

- Figure 11: Europe MulteFire Industry Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 12: Europe MulteFire Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe MulteFire Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific MulteFire Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 15: Asia Pacific MulteFire Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 16: Asia Pacific MulteFire Industry Revenue (Million), by End User Vertical 2025 & 2033

- Figure 17: Asia Pacific MulteFire Industry Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 18: Asia Pacific MulteFire Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific MulteFire Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America MulteFire Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 21: Latin America MulteFire Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 22: Latin America MulteFire Industry Revenue (Million), by End User Vertical 2025 & 2033

- Figure 23: Latin America MulteFire Industry Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 24: Latin America MulteFire Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America MulteFire Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East MulteFire Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 27: Middle East MulteFire Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 28: Middle East MulteFire Industry Revenue (Million), by End User Vertical 2025 & 2033

- Figure 29: Middle East MulteFire Industry Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 30: Middle East MulteFire Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East MulteFire Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: United Arab Emirates MulteFire Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 33: United Arab Emirates MulteFire Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 34: United Arab Emirates MulteFire Industry Revenue (Million), by End User Vertical 2025 & 2033

- Figure 35: United Arab Emirates MulteFire Industry Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 36: United Arab Emirates MulteFire Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: United Arab Emirates MulteFire Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MulteFire Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 2: Global MulteFire Industry Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 3: Global MulteFire Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global MulteFire Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 5: Global MulteFire Industry Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 6: Global MulteFire Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global MulteFire Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 10: Global MulteFire Industry Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 11: Global MulteFire Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global MulteFire Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 17: Global MulteFire Industry Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 18: Global MulteFire Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: India MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: China MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global MulteFire Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 24: Global MulteFire Industry Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 25: Global MulteFire Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Brazil MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Argentina MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Latin America MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global MulteFire Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 30: Global MulteFire Industry Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 31: Global MulteFire Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global MulteFire Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 33: Global MulteFire Industry Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 34: Global MulteFire Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MulteFire Industry?

The projected CAGR is approximately 31.04%.

2. Which companies are prominent players in the MulteFire Industry?

Key companies in the market include Telefonaktiebolaget LM Ericsson, InterDigital Inc, Baicells Technologies, Samsung Electronics Co Ltd, Qualcomm Technologies Inc, DEKRA India Private Limited*List Not Exhaustive, Huawei Technologies Co Ltd, Nokia Corporation, Intel Corporation, Sony Corporation.

3. What are the main segments of the MulteFire Industry?

The market segments include Equipment Type, End User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Availability of Shared and Unlicensed Spectrum Bands; Growing Demand for Better and More Scalable Network Connectivity for Industrial Internet of Things (IIoT) Applications; Low Cost of Deployment that doesn't Require Spectrum License.

6. What are the notable trends driving market growth?

Growing Demand for Better and More Scalable Network Connectivity for Industrial Internet of Things (IIoT) Applications.

7. Are there any restraints impacting market growth?

Disadvantage Compared to Wi-Fi Technologies in Accessing the Channel; Delay in Decision-Making Regarding Use of Shared Spectrum.

8. Can you provide examples of recent developments in the market?

February 2023 - Verana Networks, a mmWave small cells startup that The Mobile Network (TMN) profiled last year, has published parameters of a new trial with Verizon and made Verizon a strategic investor in the startup public for the initial time. Verana's mmWave small cells, installed to enable Integrated Access and Backhaul, will be put through field tests.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MulteFire Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MulteFire Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MulteFire Industry?

To stay informed about further developments, trends, and reports in the MulteFire Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence