Key Insights

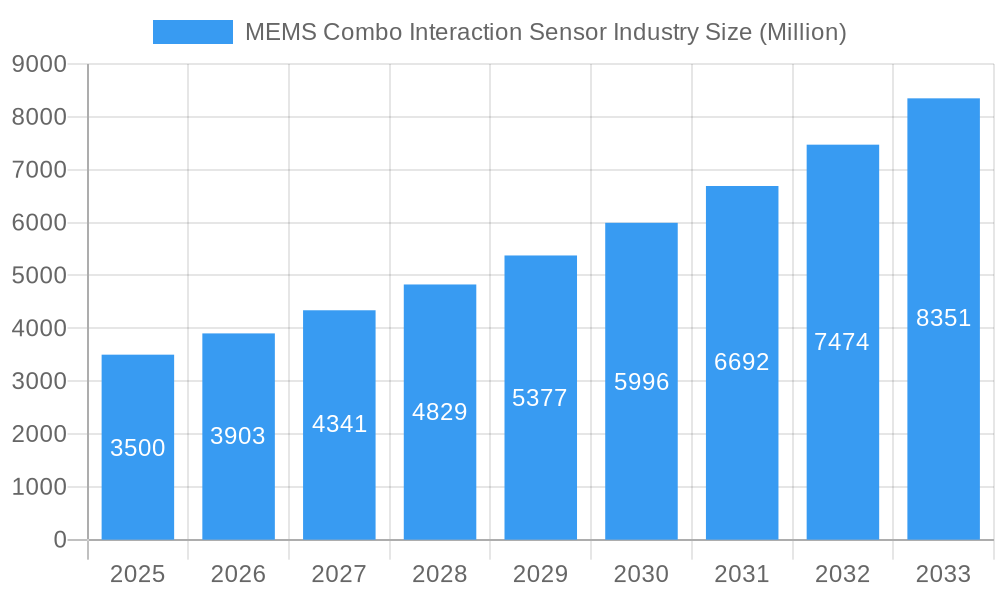

The MEMS Combo Interaction Sensor market is projected for significant expansion, expected to reach a substantial market size by 2033. Driven by a robust Compound Annual Growth Rate (CAGR) of 4.6%, this dynamic sector is rapidly evolving. Key growth catalysts include escalating demand for advanced sensing capabilities across aerospace, defense, automotive, and consumer electronics. The integration of multiple sensing functions into compact MEMS devices offers substantial benefits in cost reduction, power efficiency, and miniaturization, vital for next-generation product development. Emerging applications in the Internet of Things (IoT), wearable technology, and advanced robotics, alongside continuous innovation in sensor design and manufacturing, are fueling this upward trajectory.

MEMS Combo Interaction Sensor Industry Market Size (In Billion)

Market growth is further shaped by trends such as ultra-low-power sensors for battery-operated devices and the increasing adoption of artificial intelligence and machine learning for advanced data analysis within sensor systems. Environmental monitoring, industrial automation, and smart city initiatives are also significant contributors. However, high initial R&D investment and the complexity of integrating multiple sensor types accurately pose challenges. Despite these hurdles, the inherent advantages of MEMS combo interaction sensors, coupled with ongoing technological advancements and expanding application frontiers, ensure a promising future. Significant opportunities exist in regions like Asia Pacific due to its strong manufacturing base and burgeoning technological adoption.

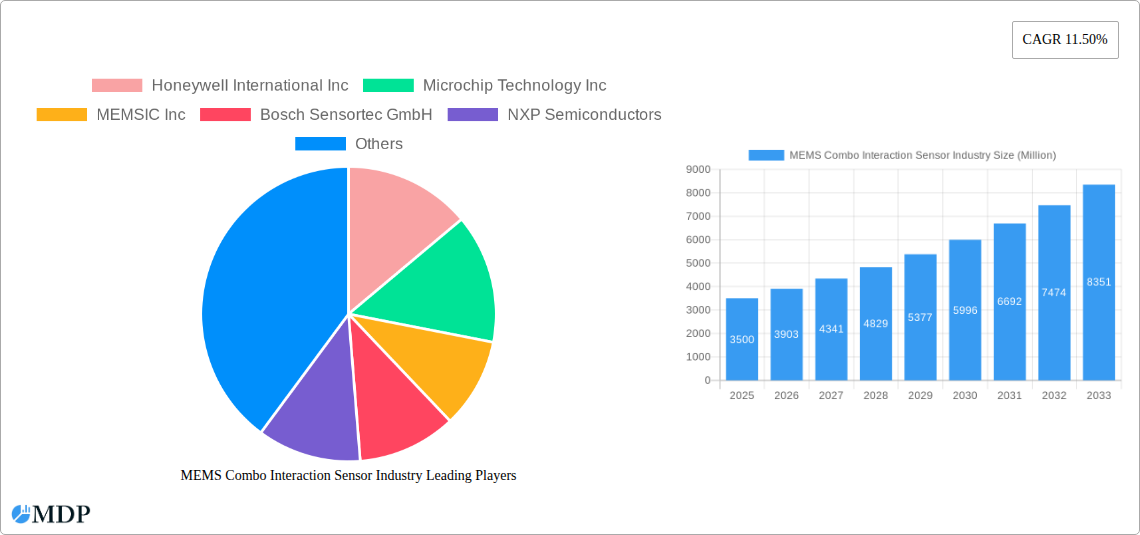

MEMS Combo Interaction Sensor Industry Company Market Share

This comprehensive report analyzes the MEMS Combo Interaction Sensor Industry, offering actionable insights for stakeholders. The study covers the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033. We examine market dynamics, key trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, leading players, critical milestones, and strategic outlooks. This report provides the knowledge to capitalize on the burgeoning demand for sophisticated interaction sensing solutions.

The MEMS Combo Interaction Sensor market is estimated at 17.61 billion in 2025 and is expected to grow at a CAGR of 4.6% by 2033.

MEMS Combo Interaction Sensor Industry Market Dynamics & Concentration

The MEMS Combo Interaction Sensor Industry is characterized by moderate to high market concentration, with a significant portion of the market share held by a few key players. Innovation drivers are primarily fueled by advancements in miniaturization, power efficiency, and enhanced sensing capabilities of Micro-Electro-Mechanical Systems (MEMS) technology. Regulatory frameworks, particularly concerning data privacy and device certification, are evolving and influencing product development. Product substitutes exist in the form of discrete sensors, but the integration and cost-effectiveness of combo sensors offer a competitive advantage. End-user trends are heavily influenced by the increasing demand for smart, intuitive, and responsive devices across consumer electronics, automotive, and industrial automation. Mergers and acquisitions (M&A) activities are expected to continue as companies seek to expand their product portfolios, gain technological expertise, and consolidate market positions. For instance, a notable trend in M&A activities indicates a CAGR of approximately xx% in deal counts over the historical period. The market share distribution among the top five players is estimated to be around xx% in the base year of 2025.

- Market Concentration: Dominated by established semiconductor and sensor manufacturers.

- Innovation Drivers: Miniaturization, low power consumption, high precision, integration of multiple sensor modalities.

- Regulatory Frameworks: Focus on data security, device safety, and interoperability standards.

- Product Substitutes: Discrete sensors (accelerometers, gyroscopes, pressure sensors), camera-based sensing.

- End-User Trends: Growing adoption of IoT devices, wearables, advanced driver-assistance systems (ADAS), and smart home technologies.

- M&A Activities: Driven by the need for technological convergence and market expansion.

MEMS Combo Interaction Sensor Industry Industry Trends & Analysis

The MEMS Combo Interaction Sensor Industry is experiencing robust growth, driven by an insatiable demand for intelligent and interactive devices across a multitude of sectors. The market penetration of MEMS combo sensors is rapidly expanding due to their ability to provide nuanced environmental and motion data, enabling richer user experiences and more sophisticated functionalities. Technological disruptions, including advancements in materials science for MEMS fabrication, the integration of artificial intelligence (AI) and machine learning (ML) algorithms for sensor fusion and data interpretation, and the development of ultra-low-power consumption designs, are propelling the industry forward. Consumer preferences are increasingly shifting towards devices that offer seamless and intuitive interactions, such as gesture control, context-aware computing, and enhanced virtual or augmented reality experiences, all of which rely heavily on sophisticated combo sensor technology.

The automotive sector, particularly with the proliferation of ADAS and the eventual advent of autonomous driving, represents a significant growth driver. MEMS combo sensors are critical for detecting vehicle motion, environmental conditions, and driver behavior. Similarly, the consumer electronics market is a major beneficiary, with smartwatches, gaming consoles, drones, and smart home devices leveraging these sensors for motion tracking, environmental monitoring, and user interaction. The industrial sector is also witnessing an increased adoption for applications such as predictive maintenance, robotics, and worker safety monitoring. The convergence of these trends points towards a sustained high Compound Annual Growth Rate (CAGR) of approximately xx% over the forecast period. Market penetration, currently at xx% in the base year of 2025, is projected to reach xx% by 2033, indicating substantial room for expansion. Furthermore, the continuous miniaturization and cost reduction of MEMS fabrication processes are making these advanced sensing capabilities accessible to a broader range of applications and price points, further accelerating market adoption. The integration of multiple sensing modalities into a single package not only reduces form factor and power consumption but also simplifies system design and reduces overall bill of materials, making them highly attractive for product developers.

Leading Markets & Segments in MEMS Combo Interaction Sensor Industry

The Automotive sector stands as a dominant region and end-user segment within the MEMS Combo Interaction Sensor Industry. This dominance is fueled by the escalating integration of Advanced Driver-Assistance Systems (ADAS) and the anticipated widespread adoption of autonomous driving technologies. Governments worldwide are mandating increased safety features in vehicles, directly translating into a higher demand for sophisticated sensors capable of environmental perception and precise motion detection. Economic policies promoting vehicle electrification and smart city initiatives further bolster this trend.

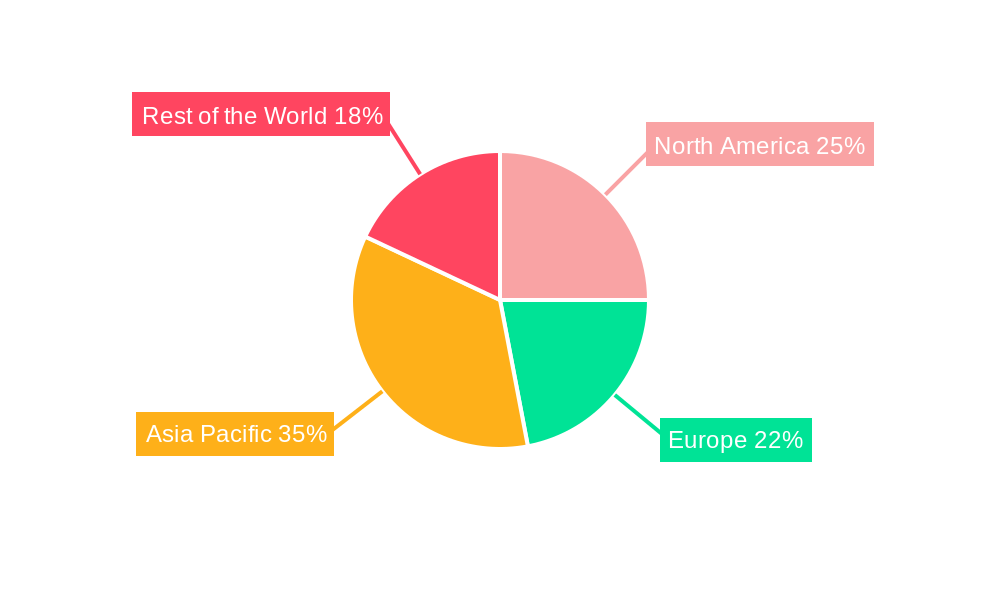

- Dominant Region: North America and Europe currently lead due to stringent automotive safety regulations and a high concentration of R&D in autonomous driving. However, Asia-Pacific is rapidly emerging as a key growth market due to the burgeoning automotive manufacturing sector and increasing consumer adoption of advanced vehicle features.

- Dominant End User Segment: Automotive.

- Key Drivers:

- ADAS Integration: Features like adaptive cruise control, lane-keeping assist, automatic emergency braking, and blind-spot detection rely heavily on the accurate and simultaneous sensing of vehicle dynamics and surrounding environment.

- Autonomous Driving: The ultimate goal of self-driving vehicles necessitates an even more robust and redundant sensing suite, where MEMS combo sensors play a crucial role in fusing data from various sources for safe navigation.

- In-cabin Monitoring: Sensors are increasingly used to monitor driver alertness, passenger presence, and internal environmental conditions.

- Regulatory Mandates: Increasing government regulations and safety standards worldwide are compelling automakers to equip vehicles with advanced safety systems.

- Electrification and Connectivity: The rise of electric vehicles (EVs) and connected car technologies further drives the need for integrated sensing solutions to manage battery performance, optimize charging, and enhance user experience.

- Key Drivers:

The Movement Combo Sensor type is also a leading segment, with its primary applications deeply embedded within the automotive and consumer electronics industries. The ability to accurately capture acceleration, rotation, and inclination is fundamental for a vast array of interactive functionalities.

- Dominant Sensor Type: Movement Combo Sensor.

- Key Drivers:

- Motion Tracking and Navigation: Essential for inertial navigation systems, dead reckoning, and activity recognition in wearables and gaming.

- Gesture Recognition: Enables intuitive control of devices through hand and body movements.

- Vehicle Dynamics Sensing: Crucial for electronic stability control, rollover detection, and other safety-critical automotive applications.

- Robotics and Automation: Provides the necessary motion data for precise control and navigation of robots in industrial and service applications.

- Key Drivers:

MEMS Combo Interaction Sensor Industry Product Developments

Product developments in the MEMS Combo Interaction Sensor Industry are characterized by increased integration, enhanced accuracy, and reduced power consumption. Companies are focusing on developing multi-axis inertial measurement units (IMUs) that combine accelerometers and gyroscopes with other sensing modalities like magnetometers, barometers, or even optical sensors. These advancements enable more sophisticated applications such as gesture recognition, advanced navigation, and context-aware sensing in devices like smart remotes, gaming peripherals, and wearable technology. The drive towards miniaturization allows for seamless integration into increasingly compact devices, while improved signal processing and sensor fusion algorithms provide more reliable and nuanced data, significantly enhancing user interaction and device performance.

Key Drivers of MEMS Combo Interaction Sensor Industry Growth

The MEMS Combo Interaction Sensor Industry is propelled by several key drivers. The relentless advancement in MEMS technology, leading to smaller, more accurate, and energy-efficient sensors, is a primary catalyst. The burgeoning adoption of the Internet of Things (IoT) ecosystem, demanding interconnected and intelligent devices, is significantly boosting demand. Furthermore, the continuous evolution of consumer electronics, particularly in areas like wearables, augmented reality (AR), and virtual reality (VR), necessitates advanced interaction sensing capabilities. Growing investments in autonomous systems, including vehicles and robotics, also contribute substantially to market expansion by requiring precise and reliable motion and environmental data. Finally, supportive government initiatives and funding for smart city projects and technological innovation further fuel the growth trajectory of this dynamic industry.

Challenges in the MEMS Combo Interaction Sensor Industry Market

Despite its promising outlook, the MEMS Combo Interaction Sensor Industry faces several challenges. The complexity of integrating multiple sensing elements into a single, cost-effective package remains a significant hurdle. Intense competition among a growing number of players can lead to price erosion, impacting profit margins. Supply chain disruptions, particularly for specialized raw materials and manufacturing equipment, can affect production volumes and lead times. Furthermore, evolving regulatory landscapes and standardization efforts can create compliance challenges for manufacturers. Lastly, the need for sophisticated software and algorithms to effectively interpret and fuse data from multiple sensors adds another layer of complexity and requires significant R&D investment, potentially limiting market entry for smaller players.

Emerging Opportunities in MEMS Combo Interaction Sensor Industry

Emerging opportunities in the MEMS Combo Interaction Sensor Industry are abundant and driven by technological breakthroughs and expanding application frontiers. The integration of AI and machine learning at the edge, directly within the sensor itself, presents a significant opportunity for enhanced on-device processing and reduced data transmission needs. The growth of the Industrial Internet of Things (IIoT) offers vast potential for predictive maintenance, asset tracking, and intelligent automation solutions. The expanding market for personalized healthcare and remote patient monitoring will drive demand for advanced wearable sensors. Furthermore, developments in haptic feedback and human-machine interfaces (HMIs) are creating new avenues for sophisticated interaction sensing. Strategic partnerships between sensor manufacturers, software developers, and end-product companies will be crucial for unlocking these emerging opportunities and driving innovation.

Leading Players in the MEMS Combo Interaction Sensor Industry Sector

- Honeywell International Inc

- Microchip Technology Inc

- MEMSIC Inc

- Bosch Sensortec GmbH

- NXP Semiconductors

- KIONIX Inc

- Safran Colibrys SA

- Murata Manufacturing Co Ltd

- STMicroelectronics NV

- Analog Devices Inc

- InvenSense Inc

- Panasonic Corporation

Key Milestones in MEMS Combo Interaction Sensor Industry Industry

- August 2022: MEMS, a primary global provider of inertial MEMS sensors, launched the MIC6100AL, its first MEMS 6-axis inertial sensor (IMU), which blends a 3-axis gyroscope and 3-axis accelerometer to enable physical interactive devices, including gamepads and smart remotes with accurate sensing, considerably improving the user experience.

Strategic Outlook for MEMS Combo Interaction Sensor Industry Market

The strategic outlook for the MEMS Combo Interaction Sensor Industry is exceptionally positive, driven by sustained demand for intelligent and interactive devices. Future growth will be accelerated by a focus on further miniaturization, enhanced power efficiency, and the seamless integration of advanced sensing modalities. Strategic opportunities lie in developing application-specific sensor solutions tailored for emerging markets like advanced robotics, immersive AR/VR experiences, and next-generation smart home ecosystems. Collaboration between industry leaders to establish interoperability standards and foster an open innovation environment will also be crucial. The continuous advancement in semiconductor manufacturing processes and novel materials will pave the way for even more sophisticated and cost-effective combo sensors, ensuring their widespread adoption across an ever-expanding range of applications and solidifying their pivotal role in shaping future technological landscapes.

MEMS Combo Interaction Sensor Industry Segmentation

-

1. Type

- 1.1. Movement Combo Sensor

- 1.2. Environment Combo Sensor

- 1.3. Optical Combo Sensor

- 1.4. Other Sensor Type

-

2. End User

- 2.1. Aerospace & Defense

- 2.2. Automotive

- 2.3. Consumer Electronics

- 2.4. Water and Wastewater Management

- 2.5. Oil and Gas

- 2.6. Food and Beverage

- 2.7. Other End Users

MEMS Combo Interaction Sensor Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

MEMS Combo Interaction Sensor Industry Regional Market Share

Geographic Coverage of MEMS Combo Interaction Sensor Industry

MEMS Combo Interaction Sensor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Handheld & Wearable Devices; Adoption of ADAS and Self Driving Solutions in Automotive Industry; Growth in Interactive Gaming

- 3.3. Market Restrains

- 3.3.1. Increase in Overall Cost of MEMS

- 3.4. Market Trends

- 3.4.1. Growing Demand for Connected Handheld and Wearable Devices to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEMS Combo Interaction Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Movement Combo Sensor

- 5.1.2. Environment Combo Sensor

- 5.1.3. Optical Combo Sensor

- 5.1.4. Other Sensor Type

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Aerospace & Defense

- 5.2.2. Automotive

- 5.2.3. Consumer Electronics

- 5.2.4. Water and Wastewater Management

- 5.2.5. Oil and Gas

- 5.2.6. Food and Beverage

- 5.2.7. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America MEMS Combo Interaction Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Movement Combo Sensor

- 6.1.2. Environment Combo Sensor

- 6.1.3. Optical Combo Sensor

- 6.1.4. Other Sensor Type

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Aerospace & Defense

- 6.2.2. Automotive

- 6.2.3. Consumer Electronics

- 6.2.4. Water and Wastewater Management

- 6.2.5. Oil and Gas

- 6.2.6. Food and Beverage

- 6.2.7. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe MEMS Combo Interaction Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Movement Combo Sensor

- 7.1.2. Environment Combo Sensor

- 7.1.3. Optical Combo Sensor

- 7.1.4. Other Sensor Type

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Aerospace & Defense

- 7.2.2. Automotive

- 7.2.3. Consumer Electronics

- 7.2.4. Water and Wastewater Management

- 7.2.5. Oil and Gas

- 7.2.6. Food and Beverage

- 7.2.7. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific MEMS Combo Interaction Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Movement Combo Sensor

- 8.1.2. Environment Combo Sensor

- 8.1.3. Optical Combo Sensor

- 8.1.4. Other Sensor Type

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Aerospace & Defense

- 8.2.2. Automotive

- 8.2.3. Consumer Electronics

- 8.2.4. Water and Wastewater Management

- 8.2.5. Oil and Gas

- 8.2.6. Food and Beverage

- 8.2.7. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World MEMS Combo Interaction Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Movement Combo Sensor

- 9.1.2. Environment Combo Sensor

- 9.1.3. Optical Combo Sensor

- 9.1.4. Other Sensor Type

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Aerospace & Defense

- 9.2.2. Automotive

- 9.2.3. Consumer Electronics

- 9.2.4. Water and Wastewater Management

- 9.2.5. Oil and Gas

- 9.2.6. Food and Beverage

- 9.2.7. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Microchip Technology Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 MEMSIC Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Bosch Sensortec GmbH

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 NXP Semiconductors

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 KIONIX Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Safran Colibrys SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Murata Manufacturing Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 STMicroelectronics NV*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Analog Devices Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 InvenSense Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Panasonic Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global MEMS Combo Interaction Sensor Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America MEMS Combo Interaction Sensor Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America MEMS Combo Interaction Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America MEMS Combo Interaction Sensor Industry Revenue (billion), by End User 2025 & 2033

- Figure 5: North America MEMS Combo Interaction Sensor Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America MEMS Combo Interaction Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America MEMS Combo Interaction Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe MEMS Combo Interaction Sensor Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe MEMS Combo Interaction Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe MEMS Combo Interaction Sensor Industry Revenue (billion), by End User 2025 & 2033

- Figure 11: Europe MEMS Combo Interaction Sensor Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe MEMS Combo Interaction Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe MEMS Combo Interaction Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific MEMS Combo Interaction Sensor Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific MEMS Combo Interaction Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific MEMS Combo Interaction Sensor Industry Revenue (billion), by End User 2025 & 2033

- Figure 17: Asia Pacific MEMS Combo Interaction Sensor Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific MEMS Combo Interaction Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific MEMS Combo Interaction Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World MEMS Combo Interaction Sensor Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Rest of the World MEMS Combo Interaction Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World MEMS Combo Interaction Sensor Industry Revenue (billion), by End User 2025 & 2033

- Figure 23: Rest of the World MEMS Combo Interaction Sensor Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Rest of the World MEMS Combo Interaction Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World MEMS Combo Interaction Sensor Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEMS Combo Interaction Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global MEMS Combo Interaction Sensor Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Global MEMS Combo Interaction Sensor Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global MEMS Combo Interaction Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global MEMS Combo Interaction Sensor Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global MEMS Combo Interaction Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global MEMS Combo Interaction Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global MEMS Combo Interaction Sensor Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 9: Global MEMS Combo Interaction Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global MEMS Combo Interaction Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global MEMS Combo Interaction Sensor Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global MEMS Combo Interaction Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global MEMS Combo Interaction Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global MEMS Combo Interaction Sensor Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Global MEMS Combo Interaction Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEMS Combo Interaction Sensor Industry?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the MEMS Combo Interaction Sensor Industry?

Key companies in the market include Honeywell International Inc, Microchip Technology Inc, MEMSIC Inc, Bosch Sensortec GmbH, NXP Semiconductors, KIONIX Inc, Safran Colibrys SA, Murata Manufacturing Co Ltd, STMicroelectronics NV*List Not Exhaustive, Analog Devices Inc, InvenSense Inc, Panasonic Corporation.

3. What are the main segments of the MEMS Combo Interaction Sensor Industry?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.61 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Handheld & Wearable Devices; Adoption of ADAS and Self Driving Solutions in Automotive Industry; Growth in Interactive Gaming.

6. What are the notable trends driving market growth?

Growing Demand for Connected Handheld and Wearable Devices to Drive the Market.

7. Are there any restraints impacting market growth?

Increase in Overall Cost of MEMS.

8. Can you provide examples of recent developments in the market?

August 2022 - MEMS, a primary global provider of inertial MEMS sensors, launched the MIC6100AL, its first MEMS 6-axis inertial sensor (IMU), which blends a 3-axis gyroscope and 3-axis accelerometer to enable physical interactive devices, including gamepads and smart remotes with accurate sensing, considerably improving the user experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEMS Combo Interaction Sensor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEMS Combo Interaction Sensor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEMS Combo Interaction Sensor Industry?

To stay informed about further developments, trends, and reports in the MEMS Combo Interaction Sensor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence