Key Insights

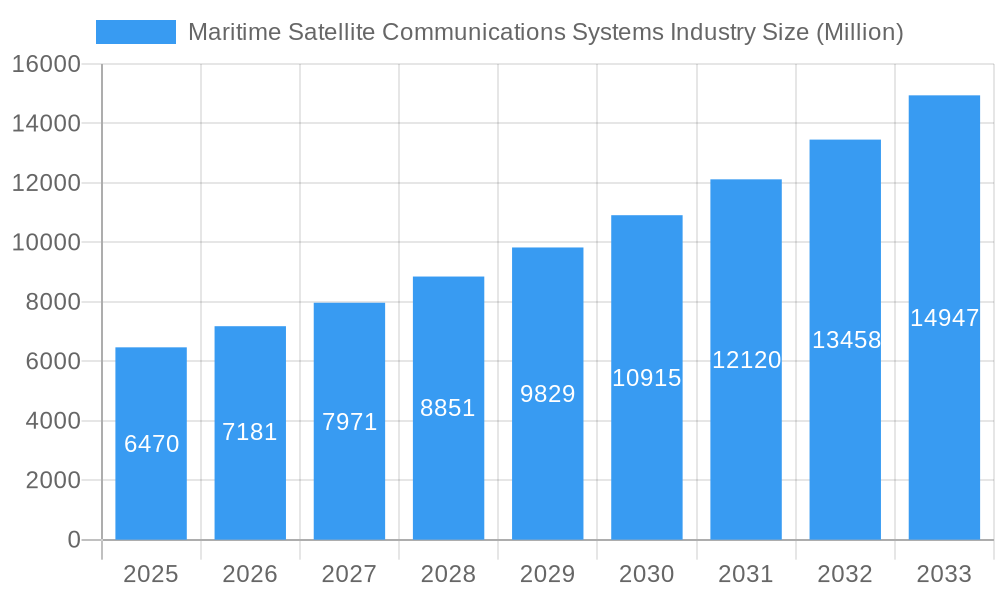

The global Maritime Satellite Communications Systems market is projected for robust expansion, driven by the increasing demand for high-speed data connectivity and enhanced operational efficiency across various maritime sectors. With an estimated market size of USD 6.47 billion in 2025, the industry is poised for significant growth, forecasted to expand at a Compound Annual Growth Rate (CAGR) of 11.00% through 2033. This surge is primarily propelled by the growing adoption of VSAT terminals, which offer superior bandwidth and reliability compared to traditional L-band solutions, meeting the evolving connectivity needs of merchant vessels, offshore operations, and the rapidly expanding cruise and ferry sector. The shift towards integrated solutions and advanced services, encompassing everything from real-time vessel tracking and crew welfare communication to sophisticated fleet management and remote monitoring, further fuels market penetration. This upward trajectory is supported by ongoing technological advancements, including the deployment of Low Earth Orbit (LEO) satellites, which promise even lower latency and higher throughput, redefining the potential for maritime connectivity.

Maritime Satellite Communications Systems Industry Market Size (In Billion)

Several key trends are shaping the maritime satellite communications landscape. The integration of smart technologies and the Internet of Things (IoT) on vessels necessitates constant, high-capacity connectivity for data transmission, analytics, and predictive maintenance, thereby driving demand for advanced satellite solutions. Furthermore, increasing regulatory emphasis on safety, security, and environmental monitoring is also a significant catalyst, requiring reliable and secure communication channels. While the market benefits from these powerful drivers, potential restraints include the high initial capital expenditure associated with terminal installation and service subscriptions, as well as the complexities of navigating diverse regulatory environments across different regions. However, the long-term outlook remains exceptionally strong, with continuous innovation and the expanding scope of applications for satellite communications in the maritime domain expected to overcome these challenges and sustain the projected impressive growth.

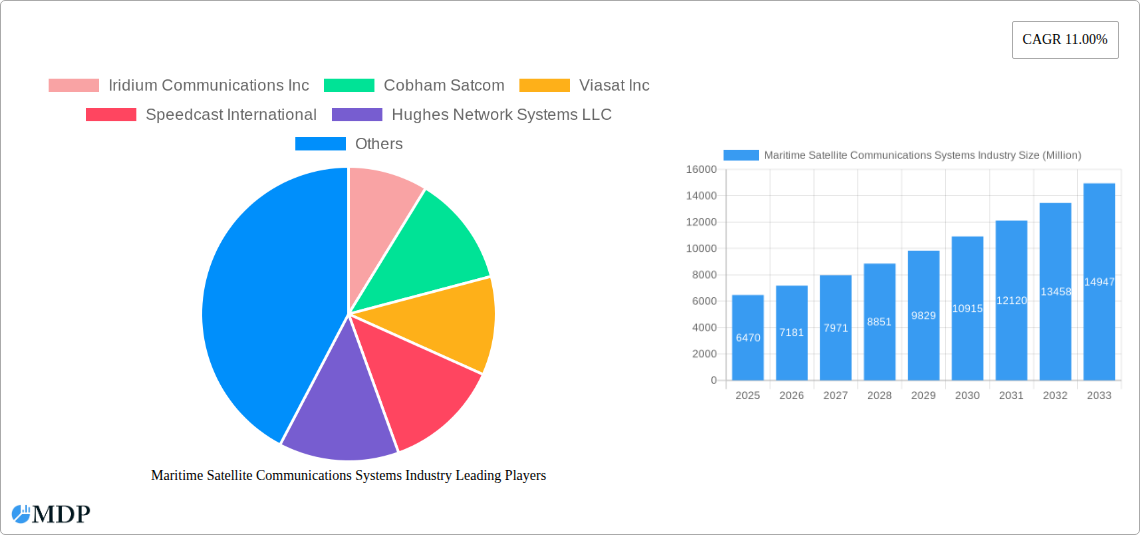

Maritime Satellite Communications Systems Industry Company Market Share

This comprehensive report delves into the dynamic maritime satellite communications systems industry, a critical sector enabling global maritime operations. Analyze market dynamics, technological advancements, leading players, and future opportunities in this essential market. The study encompasses the Study Period: 2019–2033, with a Base Year: 2025, Estimated Year: 2025, and a Forecast Period: 2025–2033, examining the Historical Period: 2019–2024. Explore market size projected at XX Million in 2025, with significant growth anticipated. Key segments include Mobile S and Very Small Aperture Terminal (VSAT). The report analyzes the Offering: Solution and Service segments, catering to diverse End-User Verticals such as Merchant, Offshore Rigs and Support Vessels, Passenger Fleet (Cruise and Ferry), Leisure (Yachts), and Finishing Vessels. Discover how innovations are shaping the future of maritime connectivity, ensuring seamless communication for vessels worldwide.

Maritime Satellite Communications Systems Industry Market Dynamics & Concentration

The maritime satellite communications systems industry exhibits a moderately concentrated market structure, characterized by a blend of established global players and specialized regional providers. Innovation is a primary driver, with companies continuously investing in next-generation satellite technology, such as Low Earth Orbit (LEO) constellations, and advanced antenna systems to offer higher bandwidth and lower latency. Regulatory frameworks, largely governed by the International Maritime Organization (IMO) and national maritime authorities, focus on safety, security, and environmental compliance, indirectly influencing technology adoption. Product substitutes, primarily terrestrial broadband networks in coastal areas, are becoming increasingly sophisticated but cannot fully replace satellite communications for true ocean-going vessels. End-user trends are heavily skewed towards increased data consumption for operational efficiency, crew welfare, and enhanced navigation. Mergers and acquisitions (M&A) activity is a notable aspect of market dynamics, as larger players seek to consolidate market share, expand service portfolios, and gain access to new technologies or geographical markets. The M&A deal count has seen a steady increase in recent years. Market share is distributed among key providers, with top players holding significant portions of the global market.

Maritime Satellite Communications Systems Industry Industry Trends & Analysis

The maritime satellite communications systems industry is experiencing robust growth driven by escalating demand for high-speed, reliable internet connectivity at sea. This surge is fueled by several converging trends: the increasing digitalization of maritime operations, necessitating real-time data transfer for logistics, fleet management, and predictive maintenance; the growing emphasis on crew welfare, with seafarers expecting connectivity comparable to land-based services for communication and entertainment; and the expanding adoption of smart ship technologies, including IoT devices and autonomous systems requiring constant communication links. Technological disruptions are at the forefront, with the advent of LEO satellite constellations promising to revolutionize latency and bandwidth offerings, making services more competitive with terrestrial options. The development of hybrid networks, seamlessly integrating satellite, cellular, and Wi-Fi, is also a significant trend, ensuring optimal connectivity across various environments. Consumer preferences are shifting towards flexible, data-rich service packages that can be tailored to specific operational needs and bandwidth requirements. Competitive dynamics are intensifying, leading to price pressures and a greater focus on value-added services, such as cybersecurity and cloud-based solutions. The market penetration of satellite communication systems continues to deepen across all end-user verticals, driven by the undeniable operational and crew satisfaction benefits. The Compound Annual Growth Rate (CAGR) for the industry is projected to be substantial over the forecast period, underscoring the sector's expansion.

Leading Markets & Segments in Maritime Satellite Communications Systems Industry

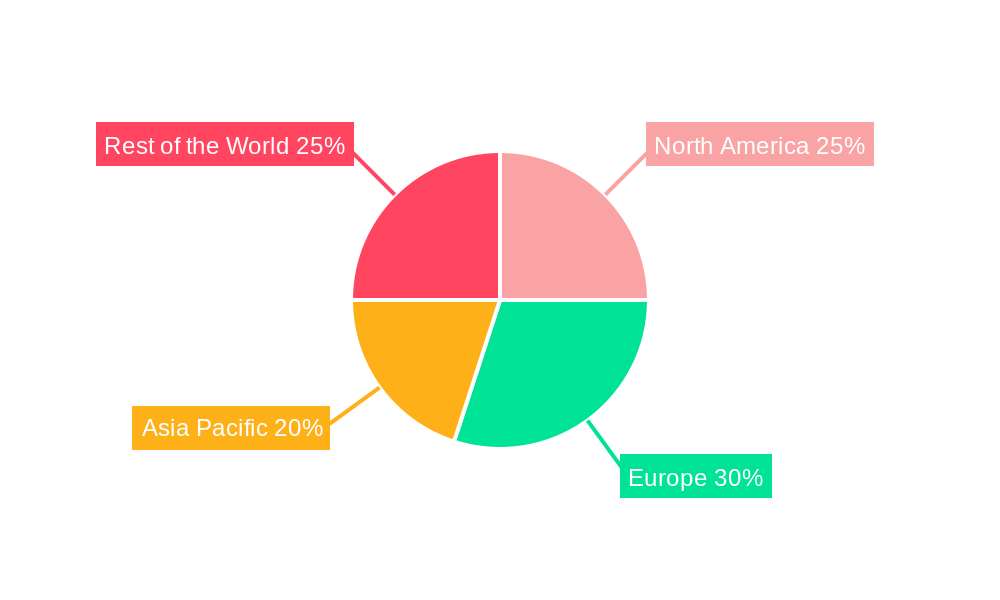

The maritime satellite communications systems industry sees significant dominance from the Merchant and Offshore Rigs and Support Vessels end-user verticals, driven by the critical need for operational efficiency, safety, and compliance in these sectors. The Passenger Fleet (Cruise and Ferry) segment is also a major growth area, with passengers increasingly expecting seamless internet access, pushing operators to invest in high-capacity solutions. The VSAT segment, offering broadband connectivity, continues to be the leading technology choice due to its ability to provide high bandwidth and reliable performance for data-intensive applications. In terms of offerings, Service plays a crucial role, with providers focusing on delivering integrated connectivity solutions, network management, and customer support. The Solution offering, encompassing hardware, software, and services bundled together, is also gaining traction. Geographically, key markets include Europe, particularly Northern Europe with its extensive shipping and offshore activities, and Asia-Pacific, driven by its large maritime trade volume and growing offshore exploration. Economic policies supporting maritime trade and infrastructure development in these regions act as significant drivers. The increasing adoption of advanced navigation and vessel management systems, requiring constant data flow, further solidifies the dominance of these segments.

Maritime Satellite Communications Systems Industry Product Developments

Recent product developments in the maritime satellite communications systems industry are focused on enhancing connectivity speed, reliability, and flexibility. Innovations include the introduction of hybrid networks that intelligently combine satellite, cellular, and Wi-Fi technologies to ensure optimal connection regardless of location. Companies are also launching customized connectivity packages that offer on-demand bandwidth streaming, allowing operators to reserve committed bandwidth by the hour and gain greater control over their data usage. These advancements are driven by the need to support a growing array of onboard applications, from real-time operational data analytics to enhanced crew welfare services, ultimately boosting operational efficiency and crew satisfaction.

Key Drivers of Maritime Satellite Communications Systems Industry Growth

Several key factors are propelling the growth of the maritime satellite communications systems industry. Technologically, the ongoing evolution of LEO satellite constellations offers the promise of significantly lower latency and higher bandwidth, making satellite communication a more viable alternative to terrestrial networks for a wider range of applications. Economically, the increasing volume of global maritime trade and the expansion of offshore energy exploration are directly translating into a greater demand for reliable connectivity. Regulatory drivers, such as the IMO's push for increased maritime digitalization and enhanced safety standards, mandate the adoption of advanced communication systems. Furthermore, the growing awareness of the importance of crew welfare and retention, with connectivity being a key factor for seafarers, is a significant social driver pushing the market forward.

Challenges in the Maritime Satellite Communications Systems Industry Market

Despite its robust growth, the maritime satellite communications systems industry faces several challenges. Regulatory hurdles, while often promoting safety, can sometimes lead to complex compliance requirements that vary by region. The high cost of satellite hardware and service plans remains a significant barrier for smaller operators. Supply chain issues, particularly concerning the availability of specialized components for terminals and equipment, can lead to delays and increased costs. Intense competitive pressures from established players and emerging technologies also necessitate continuous innovation and cost management. Furthermore, ensuring cybersecurity in a connected maritime environment presents an ongoing and evolving challenge.

Emerging Opportunities in Maritime Satellite Communications Systems Industry

Emerging opportunities in the maritime satellite communications systems industry are abundant, driven by technological breakthroughs and strategic market expansion. The widespread deployment of LEO satellite networks is creating opportunities for new service models, offering high-speed, low-latency connectivity that was previously unavailable at sea. Strategic partnerships between satellite operators, terminal manufacturers, and application developers are fostering the creation of integrated, end-to-end solutions tailored to specific maritime needs. Market expansion into less developed maritime regions and niche verticals, such as inland waterways and specialized research vessels, presents significant untapped potential. The increasing demand for data analytics and remote monitoring of vessels also opens doors for value-added services.

Leading Players in the Maritime Satellite Communications Systems Industry Sector

- Iridium Communications Inc

- Cobham Satcom

- Viasat Inc

- Speedcast International

- Hughes Network Systems LLC

- KVH Industries Inc

- NSSL Global Limited

- Thuraya Telecommunications Company

- Marlink SAS (Providence Equity Partners)

- Inmarsat Group Limited

Key Milestones in Maritime Satellite Communications Systems Industry Industry

- September 2022 - NSSLGlobal launched its latest VSAT IP@SEA on-demand customized connectivity packages. Customers can use its brand-new customized connectivity packages, which offer two excellent options to fulfill users' data needs. Operators can reserve committed bandwidth by the hour using the On-Demand Bandwidth Streaming service. With its range of customizable containers that can reach speeds of up to 150 Mbps, these services may give customers further control and independence over their service and bandwidth.

- July 2022 - KVH introduces KVH ONE Hybrid Network and groundbreaking TracNet Terminals. Innovative terminals feature integrated satellite, cellular, and Wi-Fi technology with intelligent, automatic switching to connect boats to the best-known communication option for fast, reliable connectivity at the ocean and the dock.

Strategic Outlook for Maritime Satellite Communications Systems Industry Market

The strategic outlook for the maritime satellite communications systems industry is exceptionally positive, driven by the inexorable trend towards a fully connected maritime ecosystem. Growth will be accelerated by the continued expansion of LEO satellite constellations, enabling more affordable and higher-performance connectivity. Strategic opportunities lie in the development of sophisticated integrated solutions that leverage this enhanced connectivity for advanced vessel operations, including remote diagnostics, autonomous navigation, and AI-driven fleet management. The focus will increasingly shift towards providing a seamless, user-friendly experience for both operators and crew, with an emphasis on cybersecurity and value-added services. Continued M&A activity is expected as companies seek to expand their capabilities and market reach, solidifying the industry’s trajectory of robust and sustained growth.

Maritime Satellite Communications Systems Industry Segmentation

-

1. Type

- 1.1. Mobile S

- 1.2. Very Small Aperture Terminal (VSAT)

-

2. Offering

- 2.1. Solution

- 2.2. Service

-

3. End-User Vertical

- 3.1. Merchant

- 3.2. Offshore Rigs and Support Vessels

- 3.3. Passenger Fleet (Cruise and Ferry)

- 3.4. Leisure (Yachts)

- 3.5. Finishing Vessels

Maritime Satellite Communications Systems Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Maritime Satellite Communications Systems Industry Regional Market Share

Geographic Coverage of Maritime Satellite Communications Systems Industry

Maritime Satellite Communications Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Connectivity for Crew Welfare and Operations; Launch of High-Throughput Satellite (HTS) satellites

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness About the Advanced Satellite Service Market; Reliance on High-cost Satellite Equipment

- 3.4. Market Trends

- 3.4.1. Maritime Satellite Communication Service Offering to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Maritime Satellite Communications Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mobile S

- 5.1.2. Very Small Aperture Terminal (VSAT)

- 5.2. Market Analysis, Insights and Forecast - by Offering

- 5.2.1. Solution

- 5.2.2. Service

- 5.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.3.1. Merchant

- 5.3.2. Offshore Rigs and Support Vessels

- 5.3.3. Passenger Fleet (Cruise and Ferry)

- 5.3.4. Leisure (Yachts)

- 5.3.5. Finishing Vessels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Maritime Satellite Communications Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Mobile S

- 6.1.2. Very Small Aperture Terminal (VSAT)

- 6.2. Market Analysis, Insights and Forecast - by Offering

- 6.2.1. Solution

- 6.2.2. Service

- 6.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 6.3.1. Merchant

- 6.3.2. Offshore Rigs and Support Vessels

- 6.3.3. Passenger Fleet (Cruise and Ferry)

- 6.3.4. Leisure (Yachts)

- 6.3.5. Finishing Vessels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Maritime Satellite Communications Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Mobile S

- 7.1.2. Very Small Aperture Terminal (VSAT)

- 7.2. Market Analysis, Insights and Forecast - by Offering

- 7.2.1. Solution

- 7.2.2. Service

- 7.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 7.3.1. Merchant

- 7.3.2. Offshore Rigs and Support Vessels

- 7.3.3. Passenger Fleet (Cruise and Ferry)

- 7.3.4. Leisure (Yachts)

- 7.3.5. Finishing Vessels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Maritime Satellite Communications Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Mobile S

- 8.1.2. Very Small Aperture Terminal (VSAT)

- 8.2. Market Analysis, Insights and Forecast - by Offering

- 8.2.1. Solution

- 8.2.2. Service

- 8.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 8.3.1. Merchant

- 8.3.2. Offshore Rigs and Support Vessels

- 8.3.3. Passenger Fleet (Cruise and Ferry)

- 8.3.4. Leisure (Yachts)

- 8.3.5. Finishing Vessels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Maritime Satellite Communications Systems Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Mobile S

- 9.1.2. Very Small Aperture Terminal (VSAT)

- 9.2. Market Analysis, Insights and Forecast - by Offering

- 9.2.1. Solution

- 9.2.2. Service

- 9.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 9.3.1. Merchant

- 9.3.2. Offshore Rigs and Support Vessels

- 9.3.3. Passenger Fleet (Cruise and Ferry)

- 9.3.4. Leisure (Yachts)

- 9.3.5. Finishing Vessels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Iridium Communications Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Cobham Satcom

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Viasat Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Speedcast International

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hughes Network Systems LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 KVH Industries Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 NSSL Global Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Thuraya Telecommunications Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Marlink SAS (Providence Equity Partners)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Inmarsat Group Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Iridium Communications Inc

List of Figures

- Figure 1: Global Maritime Satellite Communications Systems Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Maritime Satellite Communications Systems Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Maritime Satellite Communications Systems Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Maritime Satellite Communications Systems Industry Revenue (Million), by Offering 2025 & 2033

- Figure 5: North America Maritime Satellite Communications Systems Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 6: North America Maritime Satellite Communications Systems Industry Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 7: North America Maritime Satellite Communications Systems Industry Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 8: North America Maritime Satellite Communications Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Maritime Satellite Communications Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Maritime Satellite Communications Systems Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Maritime Satellite Communications Systems Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Maritime Satellite Communications Systems Industry Revenue (Million), by Offering 2025 & 2033

- Figure 13: Europe Maritime Satellite Communications Systems Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 14: Europe Maritime Satellite Communications Systems Industry Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 15: Europe Maritime Satellite Communications Systems Industry Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 16: Europe Maritime Satellite Communications Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Maritime Satellite Communications Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Maritime Satellite Communications Systems Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Maritime Satellite Communications Systems Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Maritime Satellite Communications Systems Industry Revenue (Million), by Offering 2025 & 2033

- Figure 21: Asia Pacific Maritime Satellite Communications Systems Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 22: Asia Pacific Maritime Satellite Communications Systems Industry Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 23: Asia Pacific Maritime Satellite Communications Systems Industry Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 24: Asia Pacific Maritime Satellite Communications Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Maritime Satellite Communications Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Maritime Satellite Communications Systems Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Rest of the World Maritime Satellite Communications Systems Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest of the World Maritime Satellite Communications Systems Industry Revenue (Million), by Offering 2025 & 2033

- Figure 29: Rest of the World Maritime Satellite Communications Systems Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 30: Rest of the World Maritime Satellite Communications Systems Industry Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 31: Rest of the World Maritime Satellite Communications Systems Industry Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 32: Rest of the World Maritime Satellite Communications Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Maritime Satellite Communications Systems Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 3: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 4: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 7: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 8: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 11: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 12: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 15: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 16: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 19: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 20: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Maritime Satellite Communications Systems Industry?

The projected CAGR is approximately 11.00%.

2. Which companies are prominent players in the Maritime Satellite Communications Systems Industry?

Key companies in the market include Iridium Communications Inc, Cobham Satcom, Viasat Inc, Speedcast International, Hughes Network Systems LLC, KVH Industries Inc, NSSL Global Limited, Thuraya Telecommunications Company, Marlink SAS (Providence Equity Partners), Inmarsat Group Limited.

3. What are the main segments of the Maritime Satellite Communications Systems Industry?

The market segments include Type, Offering, End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Connectivity for Crew Welfare and Operations; Launch of High-Throughput Satellite (HTS) satellites.

6. What are the notable trends driving market growth?

Maritime Satellite Communication Service Offering to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Awareness About the Advanced Satellite Service Market; Reliance on High-cost Satellite Equipment.

8. Can you provide examples of recent developments in the market?

September 2022 - NSSLGlobal launched its latest VSAT IP@SEA on-demand customized connectivity packages. Customers can use its brand-new customized connectivity packages, which offer two excellent options to fulfill users' data needs. Operators can reserve committed bandwidth by the hour using the On-Demand Bandwidth Streaming service. With its range of customizable containers that can reach speeds of up to 150 Mbps, these services may give customers further control and independence over their service and bandwidth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Maritime Satellite Communications Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Maritime Satellite Communications Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Maritime Satellite Communications Systems Industry?

To stay informed about further developments, trends, and reports in the Maritime Satellite Communications Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence