Key Insights

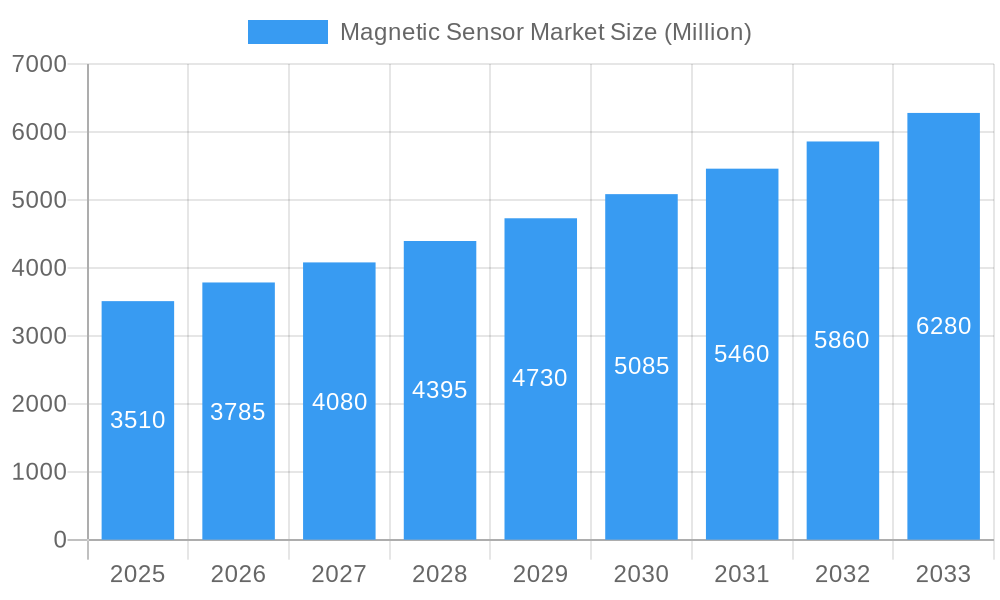

The global Magnetic Sensor Market is poised for significant expansion, projected to reach USD 3.51 billion by 2025 and exhibiting a robust Compound Annual Growth Rate (CAGR) of 7.91% through 2033. This dynamic growth is primarily fueled by the escalating demand for advanced sensing solutions across burgeoning sectors like automotive and consumer electronics, coupled with critical industrial automation needs. The automotive industry, in particular, is a major driver, integrating magnetic sensors for an array of functions including advanced driver-assistance systems (ADAS), electric vehicle (EV) powertrain management, and enhanced safety features like anti-lock braking systems (ABS) and electronic stability control (ESC). The increasing sophistication of connected vehicles and the drive towards autonomous driving further amplify this demand.

Magnetic Sensor Market Market Size (In Billion)

Technological advancements are continuously shaping the magnetic sensor landscape, with Hall Effect sensors leading in widespread adoption due to their cost-effectiveness and reliability. However, emerging technologies like Giant Magneto Resistance (GMR) and Tunneling Magneto Resistance (TMR) are gaining traction, offering superior sensitivity, accuracy, and miniaturization capabilities, which are crucial for the next generation of consumer electronics, including wearables, smart home devices, and advanced mobile devices. While the market enjoys strong growth momentum, challenges such as the high initial investment for cutting-edge R&D and the need for standardized integration protocols in some applications could pose minor restraints. Nonetheless, the pervasive integration of magnetic sensors in everyday technology and critical industrial processes ensures a sustained and upward trajectory for the market.

Magnetic Sensor Market Company Market Share

Magnetic Sensor Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides an unparalleled analysis of the global magnetic sensor market, encompassing market dynamics, key trends, leading segments, product developments, growth drivers, challenges, opportunities, and strategic insights. Leveraging high-traffic keywords such as "magnetic sensor market," "Hall effect sensors," "automotive sensors," "consumer electronics," "industrial automation," and "IoT sensors," this report is meticulously crafted for industry stakeholders seeking actionable intelligence and strategic advantage. The study covers the historical period from 2019 to 2024, the base and estimated year of 2025, and a comprehensive forecast period from 2025 to 2033.

Magnetic Sensor Market Market Dynamics & Concentration

The magnetic sensor market exhibits a moderate to high concentration, with a significant portion of the market share held by established players. Key innovation drivers include miniaturization, increased sensitivity, lower power consumption, and enhanced integration capabilities, particularly for Internet of Things (IoT) applications. Regulatory frameworks, while not overtly restrictive for magnetic sensors themselves, are indirectly influenced by broader automotive safety standards and industrial automation directives. Product substitutes, such as optical sensors and mechanical switches, pose a competitive threat in certain niche applications, but magnetic sensors often offer superior performance in harsh environments and for contactless sensing. End-user trends are heavily skewed towards the automotive sector for advanced driver-assistance systems (ADAS) and electric vehicles (EVs), followed by the burgeoning consumer electronics market, especially in wearables and smart home devices. Industrial automation continues to be a robust segment, driven by Industry 4.0 initiatives. Merger and acquisition (M&A) activities are present, with companies seeking to expand their technological portfolios and market reach. For instance, there have been approximately 5-8 significant M&A deals in the past three years, aimed at acquiring innovative sensor technologies or consolidating market positions. The market share of the top 5 players is estimated to be around 50-60%.

Magnetic Sensor Market Industry Trends & Analysis

The magnetic sensor market is projected to witness robust growth, driven by a confluence of technological advancements and expanding application footprints. The Compound Annual Growth Rate (CAGR) is estimated to be between 7% and 9% over the forecast period. A primary growth driver is the relentless demand for sophisticated sensing solutions in the automotive industry, propelled by the increasing adoption of autonomous driving features, advanced safety systems like ADAS, and the rapid expansion of the EV market, which relies heavily on magnetic sensors for motor control and battery management. The consumer electronics sector is another significant contributor, fueled by the proliferation of smartphones, smartwatches, gaming consoles, and smart home devices, all of which increasingly integrate magnetic sensors for functionality such as proximity detection, orientation sensing, and contactless user interfaces. Furthermore, the industrial sector, encompassing automation, robotics, and smart manufacturing, is witnessing a surge in demand for reliable and precise magnetic sensors to enhance operational efficiency, predictive maintenance, and process control, aligning with the principles of Industry 4.0. The market penetration of magnetic sensors is steadily increasing across these diverse sectors, moving from specialized applications to mainstream integration. Technological disruptions, such as advancements in magnetic materials and signal processing, are enabling the development of smaller, more sensitive, and cost-effective sensors, further accelerating market adoption. Consumer preferences are shifting towards seamless integration and intuitive user experiences, which magnetic sensors facilitate through their contactless and non-intrusive nature. Competitive dynamics are characterized by ongoing innovation, strategic partnerships, and a focus on offering integrated solutions that cater to specific application needs. The market is also benefiting from the increasing adoption of IoT devices, where magnetic sensors play a crucial role in data acquisition and device communication. The projected market size is expected to reach USD 10,000 Million by 2028.

Leading Markets & Segments in Magnetic Sensor Market

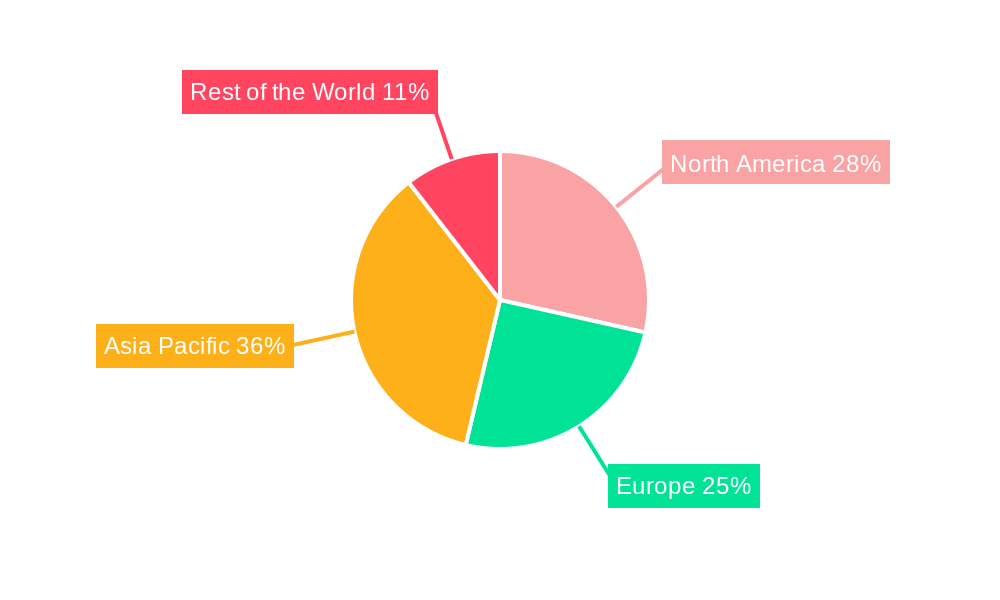

The Automotive segment is a dominant force within the magnetic sensor market, driven by stringent safety regulations, the electrification of vehicles, and the increasing complexity of vehicle electronics. Within automotive, key drivers include the widespread adoption of Electronic Stability Control (ESC), Anti-lock Braking Systems (ABS), and the burgeoning demand for ADAS features like adaptive cruise control, lane keeping assist, and automatic parking. The shift towards electric vehicles (EVs) further amplifies the need for precise magnetic sensors in electric motor control, battery position sensing, and charging systems. Geographically, Asia Pacific stands out as the leading market, propelled by its robust automotive manufacturing base, significant investments in R&D, and a rapidly growing consumer electronics industry. Countries like China, Japan, and South Korea are major contributors to this dominance.

Technology Dominance:

- Hall Effect: This technology continues to lead due to its cost-effectiveness, reliability, and versatility. It finds widespread application in automotive (position sensing, speed sensing), industrial (proximity switches, motor control), and consumer electronics (joysticks, contactless switches).

- Giant Magneto Resistance (GMR): GMR sensors are gaining traction due to their high sensitivity and low power consumption, making them ideal for applications requiring precise magnetic field detection, such as hard disk drives, automotive ignition systems, and advanced industrial sensors.

- Anisotropic Magneto Resistance (AMR): While less prevalent than Hall effect, AMR sensors offer a good balance of sensitivity and cost for applications like compass modules and some industrial position sensing.

- Tunneling Magneto Resistance (TMR): TMR technology is emerging as a high-performance option, offering superior sensitivity and linearity, making it suitable for demanding applications like medical imaging, advanced automotive systems, and high-precision industrial automation.

Application Dominance:

- Automotive: As detailed above, this segment is the largest and fastest-growing, driven by electrification and ADAS.

- Industrial (Excluding Automotive): This segment is crucial, encompassing automation, robotics, process control, and smart manufacturing. Key drivers include the need for enhanced efficiency, safety, and predictive maintenance in factories and industrial facilities.

- Consumer Electronics: The proliferation of smart devices, wearables, and gaming peripherals fuels demand for magnetic sensors in applications like gesture recognition, proximity sensing, and orientation tracking.

- Other Applications: This category includes medical devices, aerospace, defense, and scientific instrumentation, where specialized magnetic sensors are vital for critical functions.

Magnetic Sensor Market Product Developments

Recent product developments in the magnetic sensor market are characterized by enhanced miniaturization, improved sensitivity, and greater integration capabilities. Companies are focusing on developing Hall effect sensors with integrated signal conditioning and digital interfaces, enabling seamless integration into complex electronic systems. The advancement of GMR and TMR technologies is leading to the introduction of highly sensitive sensors capable of detecting minute magnetic field variations, crucial for applications in autonomous driving and advanced industrial automation. Furthermore, there is a growing trend towards the development of multi-axis magnetic sensors that can provide more comprehensive positional and directional information, offering greater functionality and competitive advantage in emerging markets.

Key Drivers of Magnetic Sensor Market Growth

The magnetic sensor market's growth is propelled by several key factors. The accelerating adoption of electric vehicles (EVs) necessitates sophisticated magnetic sensors for efficient motor control, battery management, and charging systems. The proliferation of autonomous driving features and ADAS in conventional vehicles is a major catalyst, requiring highly accurate sensors for object detection, navigation, and control. The expansion of the Internet of Things (IoT) ecosystem demands compact, low-power magnetic sensors for smart home devices, wearables, and industrial monitoring applications. Advancements in semiconductor technology are enabling the creation of smaller, more powerful, and cost-effective magnetic sensors. Finally, increasing automation in industries across the globe, driven by Industry 4.0 initiatives, is creating significant demand for reliable and precise sensing solutions.

Challenges in the Magnetic Sensor Market Market

Despite robust growth, the magnetic sensor market faces several challenges. Intense price competition among manufacturers can impact profit margins, particularly for high-volume, commoditized applications. Evolving regulatory landscapes, especially concerning automotive safety and data privacy, can introduce compliance complexities. Supply chain disruptions, as witnessed in recent years, can affect the availability of raw materials and components, impacting production timelines and costs. Furthermore, the emergence of alternative sensing technologies, while often complementary, can present competitive threats in specific niche applications. The increasing complexity of system integration for advanced applications requires specialized expertise, which can be a bottleneck for some market participants.

Emerging Opportunities in Magnetic Sensor Market

The magnetic sensor market is brimming with emerging opportunities. The continuous expansion of the EV market globally presents a substantial avenue for growth, particularly for sensors used in power electronics and battery management systems. The increasing demand for smart wearables and connected consumer electronics offers significant potential for miniaturized and low-power magnetic sensors. The ongoing digital transformation of industries, including smart manufacturing and predictive maintenance, will drive demand for robust and intelligent magnetic sensors. The advancements in medical device technology, such as non-invasive diagnostic equipment, also present a growing opportunity. Strategic partnerships between sensor manufacturers and system integrators can unlock new application areas and accelerate market penetration.

Leading Players in the Magnetic Sensor Market Sector

- Analog Devices

- ST Microelectronics NV

- Infineon Technologies AG

- Honeywell International Inc

- Allegro Microsystems (Sanken Electric Company)

- NXP Semiconductors NV

- NVE Corporation

- TE Connectivity

- Omron Corporation

- TDK Corporation

- Murata Manufacturing Co Ltd

- Texas Instruments Inc

- Crocus Technology

(List Not Exhaustive)

Key Milestones in Magnetic Sensor Market Industry

- 2019: Increased focus on Hall Effect sensors for automotive ADAS integration.

- 2020: Rise in demand for magnetic sensors in consumer electronics due to the pandemic-driven surge in smart home devices and wearables.

- 2021: Significant advancements in TMR sensor technology leading to higher sensitivity for niche applications.

- 2022: Growing investment in GMR sensor technology for improved performance in industrial automation.

- 2023: Strategic partnerships formed to accelerate the development of magnetic sensors for next-generation EVs.

- 2024: Introduction of highly integrated multi-axis magnetic sensor modules for simplified design in consumer devices.

Strategic Outlook for Magnetic Sensor Market Market

The strategic outlook for the magnetic sensor market remains exceptionally positive, driven by sustained innovation and expanding application horizons. The market will continue to be shaped by the automotive sector's transition to electrification and autonomy, alongside the burgeoning IoT landscape. Companies that focus on developing highly integrated, intelligent, and energy-efficient magnetic sensors will be best positioned for future success. Strategic investments in R&D for advanced materials and sensing technologies, coupled with strong partnerships across the value chain, will be crucial for capturing emerging market opportunities and maintaining a competitive edge in this dynamic and growth-oriented sector. The projected market size is expected to reach USD 15,000 Million by 2030.

Magnetic Sensor Market Segmentation

-

1. Technology

- 1.1. Hall Effect

- 1.2. Anisotropic Magneto Resistance (AMR)

- 1.3. Giant Magneto Resistance (GMR)

- 1.4. Tunneling Magneto Resistance (TMR)

- 1.5. Other Technologies

-

2. Application

- 2.1. Automotive

- 2.2. Consumer Electronics

- 2.3. Industrial (Excluding Automotive)

- 2.4. Other Applications

Magnetic Sensor Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East

Magnetic Sensor Market Regional Market Share

Geographic Coverage of Magnetic Sensor Market

Magnetic Sensor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Regulations Around Energy-efficient Systems and Automobiles; Emerging Applications in Consumer Electronics and Data Centers

- 3.3. Market Restrains

- 3.3.1. ; Falling Average Selling Prices (ASPS) of Semiconductors and Sensors; Coronavirus Outbreak Influencing the Electronics Industry 4.; Assessment of COVID-19 Impact on the Industry

- 3.4. Market Trends

- 3.4.1. Automotive Industry to Hold Largest Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Magnetic Sensor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Hall Effect

- 5.1.2. Anisotropic Magneto Resistance (AMR)

- 5.1.3. Giant Magneto Resistance (GMR)

- 5.1.4. Tunneling Magneto Resistance (TMR)

- 5.1.5. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive

- 5.2.2. Consumer Electronics

- 5.2.3. Industrial (Excluding Automotive)

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Magnetic Sensor Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Hall Effect

- 6.1.2. Anisotropic Magneto Resistance (AMR)

- 6.1.3. Giant Magneto Resistance (GMR)

- 6.1.4. Tunneling Magneto Resistance (TMR)

- 6.1.5. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Automotive

- 6.2.2. Consumer Electronics

- 6.2.3. Industrial (Excluding Automotive)

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Magnetic Sensor Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Hall Effect

- 7.1.2. Anisotropic Magneto Resistance (AMR)

- 7.1.3. Giant Magneto Resistance (GMR)

- 7.1.4. Tunneling Magneto Resistance (TMR)

- 7.1.5. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Automotive

- 7.2.2. Consumer Electronics

- 7.2.3. Industrial (Excluding Automotive)

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Magnetic Sensor Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Hall Effect

- 8.1.2. Anisotropic Magneto Resistance (AMR)

- 8.1.3. Giant Magneto Resistance (GMR)

- 8.1.4. Tunneling Magneto Resistance (TMR)

- 8.1.5. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Automotive

- 8.2.2. Consumer Electronics

- 8.2.3. Industrial (Excluding Automotive)

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest of the World Magnetic Sensor Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Hall Effect

- 9.1.2. Anisotropic Magneto Resistance (AMR)

- 9.1.3. Giant Magneto Resistance (GMR)

- 9.1.4. Tunneling Magneto Resistance (TMR)

- 9.1.5. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Automotive

- 9.2.2. Consumer Electronics

- 9.2.3. Industrial (Excluding Automotive)

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Analog Devices

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ST Microelectronics NV

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Infineon Technologies AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Honeywell International Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Allegro Microsystems (Sanken Electric Company)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 NXP Semiconductors NV

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 NVE Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 TE Connectivity

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Omron Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 TDK Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Murata Manufacturing Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Texas Instruments Inc *List Not Exhaustive 6 2 Investment Analysi

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Crocus Technology

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Analog Devices

List of Figures

- Figure 1: Global Magnetic Sensor Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Magnetic Sensor Market Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Magnetic Sensor Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Magnetic Sensor Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Magnetic Sensor Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Magnetic Sensor Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Magnetic Sensor Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Magnetic Sensor Market Revenue (Million), by Technology 2025 & 2033

- Figure 9: Europe Magnetic Sensor Market Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Magnetic Sensor Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Magnetic Sensor Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Magnetic Sensor Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Magnetic Sensor Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Magnetic Sensor Market Revenue (Million), by Technology 2025 & 2033

- Figure 15: Asia Pacific Magnetic Sensor Market Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Magnetic Sensor Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Magnetic Sensor Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Magnetic Sensor Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Magnetic Sensor Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Magnetic Sensor Market Revenue (Million), by Technology 2025 & 2033

- Figure 21: Rest of the World Magnetic Sensor Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Rest of the World Magnetic Sensor Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Rest of the World Magnetic Sensor Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Magnetic Sensor Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Magnetic Sensor Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Magnetic Sensor Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Magnetic Sensor Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Magnetic Sensor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Magnetic Sensor Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 5: Global Magnetic Sensor Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Magnetic Sensor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Magnetic Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Magnetic Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Magnetic Sensor Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 10: Global Magnetic Sensor Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Magnetic Sensor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Magnetic Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Magnetic Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Magnetic Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Magnetic Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Magnetic Sensor Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 17: Global Magnetic Sensor Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Magnetic Sensor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Magnetic Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Magnetic Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Magnetic Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Magnetic Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Magnetic Sensor Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 24: Global Magnetic Sensor Market Revenue Million Forecast, by Application 2020 & 2033

- Table 25: Global Magnetic Sensor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Latin America Magnetic Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Middle East Magnetic Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Magnetic Sensor Market?

The projected CAGR is approximately 7.91%.

2. Which companies are prominent players in the Magnetic Sensor Market?

Key companies in the market include Analog Devices, ST Microelectronics NV, Infineon Technologies AG, Honeywell International Inc, Allegro Microsystems (Sanken Electric Company), NXP Semiconductors NV, NVE Corporation, TE Connectivity, Omron Corporation, TDK Corporation, Murata Manufacturing Co Ltd, Texas Instruments Inc *List Not Exhaustive 6 2 Investment Analysi, Crocus Technology.

3. What are the main segments of the Magnetic Sensor Market?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.51 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Regulations Around Energy-efficient Systems and Automobiles; Emerging Applications in Consumer Electronics and Data Centers.

6. What are the notable trends driving market growth?

Automotive Industry to Hold Largest Share of the Market.

7. Are there any restraints impacting market growth?

; Falling Average Selling Prices (ASPS) of Semiconductors and Sensors; Coronavirus Outbreak Influencing the Electronics Industry 4.; Assessment of COVID-19 Impact on the Industry.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Magnetic Sensor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Magnetic Sensor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Magnetic Sensor Market?

To stay informed about further developments, trends, and reports in the Magnetic Sensor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence