Key Insights

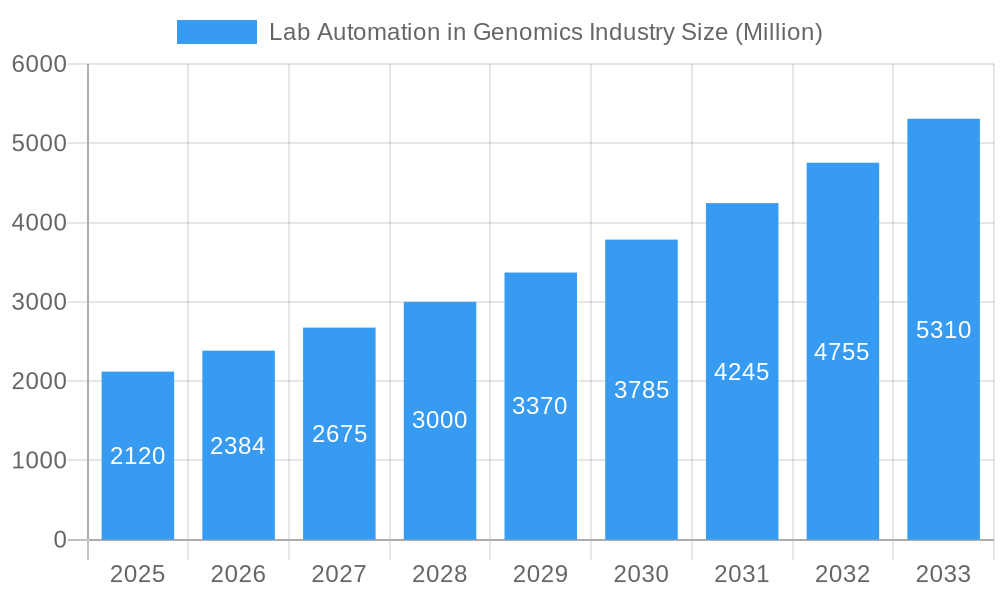

The global Lab Automation in Genomics market is poised for significant expansion, currently valued at approximately USD 2.12 billion in 2025 and projected to surge to an impressive USD 5.3 billion by 2033. This robust growth trajectory is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 12.43%, indicating a dynamic and rapidly evolving industry. The primary drivers fueling this surge include the escalating demand for high-throughput genomic analysis, crucial for advancements in personalized medicine, drug discovery, and diagnostics. The increasing complexity and volume of genomic data necessitate sophisticated automation solutions to enhance efficiency, accuracy, and reproducibility in research and clinical settings. Furthermore, the growing emphasis on research and development within the life sciences sector, coupled with significant investments in genomics research globally, are creating a fertile ground for the adoption of lab automation technologies.

Lab Automation in Genomics Industry Market Size (In Billion)

The market landscape is characterized by a diverse range of segments, with Automated Liquid Handlers and Automated Plate Handlers emerging as core components, facilitating precision and speed in sample preparation and assay execution. Robotic Arms and Automated Storage and Retrieval Systems (AS/RS) are also playing pivotal roles in streamlining workflows and optimizing laboratory space. Vision Systems are increasingly integrated to provide real-time monitoring and quality control. Key industry players such as Becton Dickinson and Company, Tecan Group Ltd, and Thermo Fisher Scientific Inc. are at the forefront, driving innovation through continuous product development and strategic collaborations. Emerging trends include the integration of artificial intelligence and machine learning into automation platforms, enabling predictive analytics and smarter experimental design. While the market is experiencing tremendous growth, potential restraints such as high initial investment costs and the need for specialized expertise to operate complex systems might present challenges, though these are likely to be mitigated by the demonstrable return on investment and increasing availability of skilled professionals.

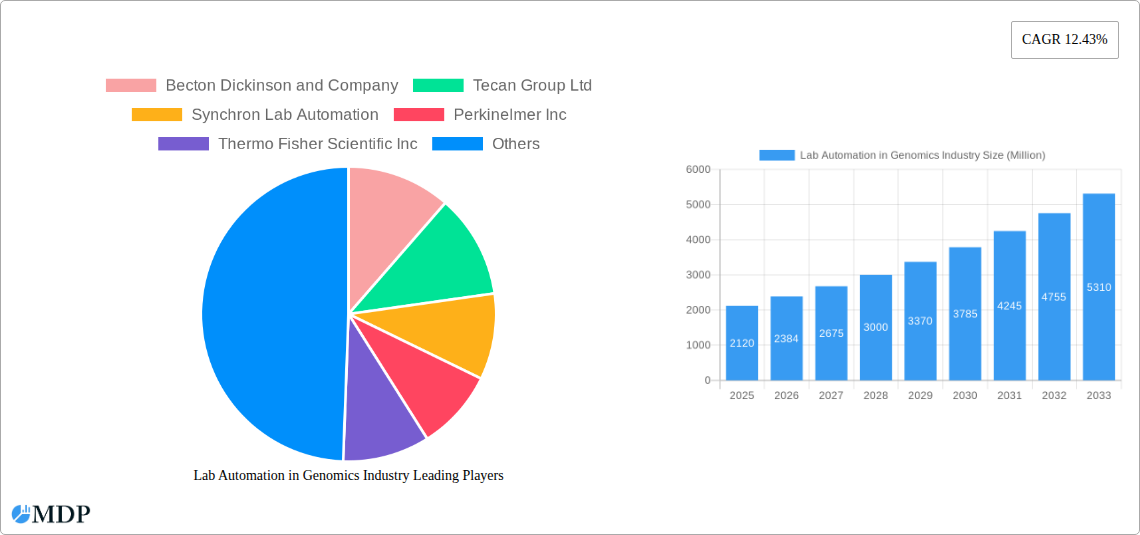

Lab Automation in Genomics Industry Company Market Share

This comprehensive report offers an in-depth analysis of the lab automation in genomics industry, a rapidly evolving sector poised for significant expansion. Explore market dynamics, cutting-edge trends, leading segments, and strategic opportunities shaping the future of genomic research and diagnostics. With a study period spanning from 2019 to 2033, this report provides invaluable insights for industry stakeholders seeking to navigate this dynamic landscape. The base year for analysis is 2025, with forecasts extending through 2033, leveraging historical data from 2019-2024.

Lab Automation in Genomics Industry Market Dynamics & Concentration

The lab automation in genomics industry is characterized by a moderate to high market concentration, with a few key players holding substantial market share, estimated to be over 60% collectively. Innovation drivers are primarily fueled by the increasing demand for high-throughput genomic analysis, precision medicine initiatives, and the growing complexity of biological research. Regulatory frameworks, while essential for ensuring data integrity and patient safety, can also present hurdles, requiring stringent adherence to standards. Product substitutes, such as manual laboratory processes, are rapidly diminishing in relevance as automation offers superior efficiency, accuracy, and scalability. End-user trends are overwhelmingly in favor of automated solutions, with research institutions, pharmaceutical companies, and diagnostic laboratories actively seeking to optimize workflows. Merger and acquisition (M&A) activities have been a significant factor in market consolidation, with an estimated xx M&A deals occurring annually during the historical period, further shaping the competitive landscape. Key players are actively acquiring smaller innovators to expand their technological portfolios and market reach. The market share of leading companies like Thermo Fisher Scientific Inc. and Danaher Corporation / Beckman Coulter is substantial, reflecting their extensive product offerings and established customer bases.

Lab Automation in Genomics Industry Industry Trends & Analysis

The lab automation in genomics industry is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of approximately 12.5% over the forecast period. This substantial market expansion is driven by a confluence of factors, including the escalating volume of genomic data being generated, the increasing adoption of next-generation sequencing (NGS) technologies, and the growing need for cost-effective and efficient laboratory operations. Technological disruptions are a constant theme, with advancements in artificial intelligence (AI) and machine learning (ML) being integrated into automation platforms to enhance data analysis, predictive capabilities, and workflow optimization. Consumer preferences are shifting towards integrated, end-to-end automation solutions that minimize manual intervention and reduce the potential for human error. This is leading to a demand for more sophisticated and interconnected systems. Competitive dynamics are intense, with established players investing heavily in research and development to maintain their market leadership and newer entrants striving to carve out niche markets. The market penetration of advanced lab automation solutions is steadily increasing across various research and clinical settings, transforming how genomic research is conducted and diagnostic tests are performed. The estimated market size in the base year of 2025 is projected to reach approximately $15 Billion.

Leading Markets & Segments in Lab Automation in Genomics Industry

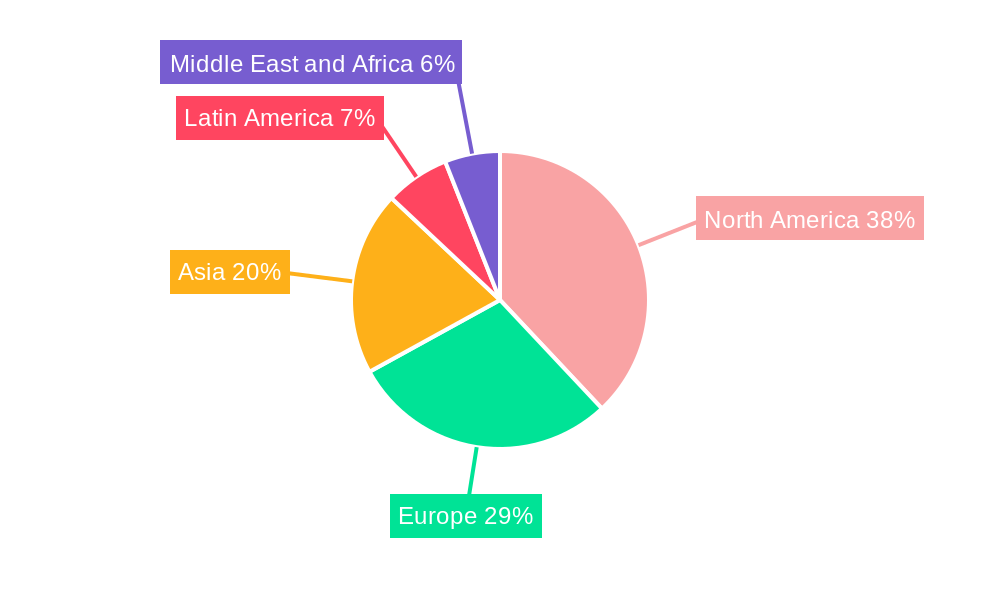

The North America region currently dominates the lab automation in genomics industry, driven by significant investments in life sciences research, a strong presence of leading pharmaceutical and biotechnology companies, and favorable government funding initiatives. The United States, in particular, stands out as a key market due to its advanced healthcare infrastructure and high adoption rate of cutting-edge technologies.

Within the Equipment segment, Automated Liquid Handlers represent the largest and fastest-growing sub-segment.

- Key Drivers for Dominance:

- High-throughput screening: Essential for drug discovery and development, enabling the processing of millions of samples.

- Precision and Accuracy: Automated liquid handling minimizes pipetting errors, crucial for reproducible genomic analyses.

- Scalability: Easily accommodates increasing sample volumes, a common requirement in genomic research.

- Cost-Effectiveness: Over the long term, automation reduces labor costs and improves operational efficiency.

Automated Plate Handlers are also crucial, facilitating the seamless movement of microplates between different automated instruments, thereby enhancing workflow efficiency. Robotic Arms play a vital role in complex workflows, performing intricate tasks such as sample preparation, cell culture, and assay setup. The Automated Storage and Retrieval Systems (AS/RS) are increasingly important for managing vast sample libraries and ensuring secure, long-term storage of precious genomic materials. Vision Systems, integrated with automation platforms, are gaining traction for quality control, identification, and tracking of samples and reagents, further ensuring data integrity. The economic policies promoting R&D in genomics and the robust academic and industrial infrastructure in North America are significant contributors to the region's leadership.

Lab Automation in Genomics Industry Product Developments

Product developments in lab automation for genomics are focused on enhancing speed, accuracy, and flexibility. Innovations include modular automation platforms that can be customized to specific research needs, advanced robotics with greater dexterity, and integrated software solutions leveraging AI for intelligent workflow management and data interpretation. These developments aim to reduce turnaround times for genomic analysis, improve the reproducibility of results, and enable researchers to tackle increasingly complex biological questions. The competitive advantage lies in offering intuitive, user-friendly systems that seamlessly integrate into existing laboratory infrastructure, thereby maximizing ROI for users.

Key Drivers of Lab Automation in Genomics Industry Growth

Several factors are propelling the growth of the lab automation in genomics industry.

- Technological Advancements: The continuous evolution of sequencing technologies (e.g., NGS) necessitates sophisticated automation for data processing and analysis.

- Increasing Research & Development Spending: Pharmaceutical and biotechnology companies are investing heavily in drug discovery and development, requiring high-throughput screening capabilities.

- Rising Prevalence of Chronic Diseases: The growing demand for personalized medicine and targeted therapies, often driven by genetic profiling, fuels the need for automated genomic analysis.

- Cost Reduction Initiatives: Laboratories are seeking to optimize operational costs by reducing manual labor and minimizing errors through automation.

- Government Initiatives and Funding: Supportive policies and grants for life sciences research and development encourage the adoption of advanced automation solutions.

Challenges in the Lab Automation in Genomics Industry Market

Despite the strong growth trajectory, the lab automation in genomics industry faces several challenges.

- High Initial Investment Costs: The upfront cost of advanced automation systems can be a barrier for smaller research labs and institutions.

- Integration Complexity: Integrating diverse automation components and software can be challenging and require specialized expertise.

- Skilled Workforce Shortage: A lack of adequately trained personnel to operate and maintain complex automation systems can hinder adoption.

- Regulatory Compliance: Adhering to stringent regulatory requirements for data security, sample integrity, and quality control adds complexity and cost.

- Supply Chain Disruptions: Global supply chain issues can impact the availability of critical components and lead to production delays. The estimated impact of supply chain disruptions on market growth is approximately 3-5%.

Emerging Opportunities in Lab Automation in Genomics Industry

The lab automation in genomics industry is ripe with emerging opportunities for long-term growth.

- Advancements in AI and Machine Learning: Integrating AI and ML into automation platforms will enable predictive analytics, intelligent decision-making, and automated data interpretation, creating significant value.

- Personalized Medicine Expansion: The growing demand for tailored treatments based on individual genetic makeup will drive the need for scalable and efficient automated genomic analysis.

- Point-of-Care Genomics: The development of portable and automated genomic analysis devices for point-of-care diagnostics presents a vast new market segment.

- Strategic Partnerships: Collaborations between automation providers, genomic service companies, and research institutions will foster innovation and market penetration.

- Emerging Markets: Expansion into developing economies with growing healthcare infrastructure and research capabilities offers significant growth potential.

Leading Players in the Lab Automation in Genomics Industry Sector

- Becton Dickinson and Company

- Tecan Group Ltd

- Synchron Lab Automation

- Perkinelmer Inc

- Thermo Fisher Scientific Inc

- Eli Lilly and Company

- Danaher Corporation / Beckman Coulter

- Siemens Healthineers AG

- Agilent Technologies Inc

- Hudson Robotics Inc

- F Hoffmann-La Roche Ltd

Key Milestones in Lab Automation in Genomics Industry Industry

- July 2022: MAKO Medical Laboratories announced the expansion of its molecular and COVID-19 test processing capacity by purchasing four additional high-tech liquid handling automation systems, significantly enhancing its ability to more than double COVID-19 testing capacity per lab technician.

- July 2022: University Hospital Southampton (UHS) NHS Foundation Trust signed a strategic collaboration agreement with robotic automation solution provider, Automata, to develop new applications for laboratory automation technology, aiming to improve laboratory efficiency and diagnostic capabilities.

Strategic Outlook for Lab Automation in Genomics Industry Market

The strategic outlook for the lab automation in genomics industry is exceptionally positive, driven by an unwavering demand for faster, more accurate, and scalable genomic analysis. Future growth will be fueled by the continued integration of AI and ML for enhanced data insights, the expansion of personalized medicine applications, and the development of user-friendly, modular automation systems. Strategic partnerships between technology providers and end-users will be crucial for co-developing solutions that address specific industry challenges. Furthermore, the increasing focus on disease prevention and early diagnosis will necessitate widespread adoption of automated genomic screening platforms. The market is expected to witness further consolidation and innovation, with companies that can offer comprehensive, end-to-end solutions poised for sustained success. The projected market size for 2033 is estimated to reach approximately $40 Billion.

Lab Automation in Genomics Industry Segmentation

-

1. Equipment

- 1.1. Automated Liquid Handlers

- 1.2. Automated Plate Handlers

- 1.3. Robotic Arms

- 1.4. Automated Storage and Retrieval Systems (AS/RS)

- 1.5. Vision Systems

Lab Automation in Genomics Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

Lab Automation in Genomics Industry Regional Market Share

Geographic Coverage of Lab Automation in Genomics Industry

Lab Automation in Genomics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Research and Development by Pharmaceutical and Biotech Companies; Growing Demand from Drug Discovery and Genomics

- 3.3. Market Restrains

- 3.3.1. Growing Trend of Digital Transformation for Laboratories with IoT; Effective Management of the Huge Amount of Data Generated

- 3.4. Market Trends

- 3.4.1. Automated Liquid Handlers to Witness High Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Automated Liquid Handlers

- 5.1.2. Automated Plate Handlers

- 5.1.3. Robotic Arms

- 5.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 5.1.5. Vision Systems

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. North America Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 6.1.1. Automated Liquid Handlers

- 6.1.2. Automated Plate Handlers

- 6.1.3. Robotic Arms

- 6.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 6.1.5. Vision Systems

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 7. Europe Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 7.1.1. Automated Liquid Handlers

- 7.1.2. Automated Plate Handlers

- 7.1.3. Robotic Arms

- 7.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 7.1.5. Vision Systems

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 8. Asia Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 8.1.1. Automated Liquid Handlers

- 8.1.2. Automated Plate Handlers

- 8.1.3. Robotic Arms

- 8.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 8.1.5. Vision Systems

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 9. Latin America Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 9.1.1. Automated Liquid Handlers

- 9.1.2. Automated Plate Handlers

- 9.1.3. Robotic Arms

- 9.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 9.1.5. Vision Systems

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 10. Middle East and Africa Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Equipment

- 10.1.1. Automated Liquid Handlers

- 10.1.2. Automated Plate Handlers

- 10.1.3. Robotic Arms

- 10.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 10.1.5. Vision Systems

- 10.1. Market Analysis, Insights and Forecast - by Equipment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tecan Group Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Synchron Lab Automation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Perkinelmer Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thermo Fisher Scientific Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Eli Lilly and Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Danaher Corporation / Beckman Coulter

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Siemens Healthineers AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Agilent Technologies Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hudson Robotics Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 F Hoffmann-La Roche Ltd *List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Lab Automation in Genomics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Lab Automation in Genomics Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 3: North America Lab Automation in Genomics Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 4: North America Lab Automation in Genomics Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Lab Automation in Genomics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Lab Automation in Genomics Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 7: Europe Lab Automation in Genomics Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 8: Europe Lab Automation in Genomics Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Lab Automation in Genomics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Lab Automation in Genomics Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 11: Asia Lab Automation in Genomics Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 12: Asia Lab Automation in Genomics Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Lab Automation in Genomics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Lab Automation in Genomics Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 15: Latin America Lab Automation in Genomics Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 16: Latin America Lab Automation in Genomics Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Lab Automation in Genomics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Lab Automation in Genomics Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 19: Middle East and Africa Lab Automation in Genomics Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 20: Middle East and Africa Lab Automation in Genomics Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Lab Automation in Genomics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 2: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 4: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 6: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 8: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 10: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 12: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lab Automation in Genomics Industry?

The projected CAGR is approximately 12.43%.

2. Which companies are prominent players in the Lab Automation in Genomics Industry?

Key companies in the market include Becton Dickinson and Company, Tecan Group Ltd, Synchron Lab Automation, Perkinelmer Inc, Thermo Fisher Scientific Inc, Eli Lilly and Company, Danaher Corporation / Beckman Coulter, Siemens Healthineers AG, Agilent Technologies Inc, Hudson Robotics Inc, F Hoffmann-La Roche Ltd *List Not Exhaustive.

3. What are the main segments of the Lab Automation in Genomics Industry?

The market segments include Equipment.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Research and Development by Pharmaceutical and Biotech Companies; Growing Demand from Drug Discovery and Genomics.

6. What are the notable trends driving market growth?

Automated Liquid Handlers to Witness High Growth.

7. Are there any restraints impacting market growth?

Growing Trend of Digital Transformation for Laboratories with IoT; Effective Management of the Huge Amount of Data Generated.

8. Can you provide examples of recent developments in the market?

July 2022: MAKO Medical Laboratories announced to expand molecular and COVID-19 test processing capacity by purchasing four additional high-tech liquid handling automation systems to allow the lab to more than double the COVID-19 testing capacity of a single lab technician in the future.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lab Automation in Genomics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lab Automation in Genomics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lab Automation in Genomics Industry?

To stay informed about further developments, trends, and reports in the Lab Automation in Genomics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence