Key Insights

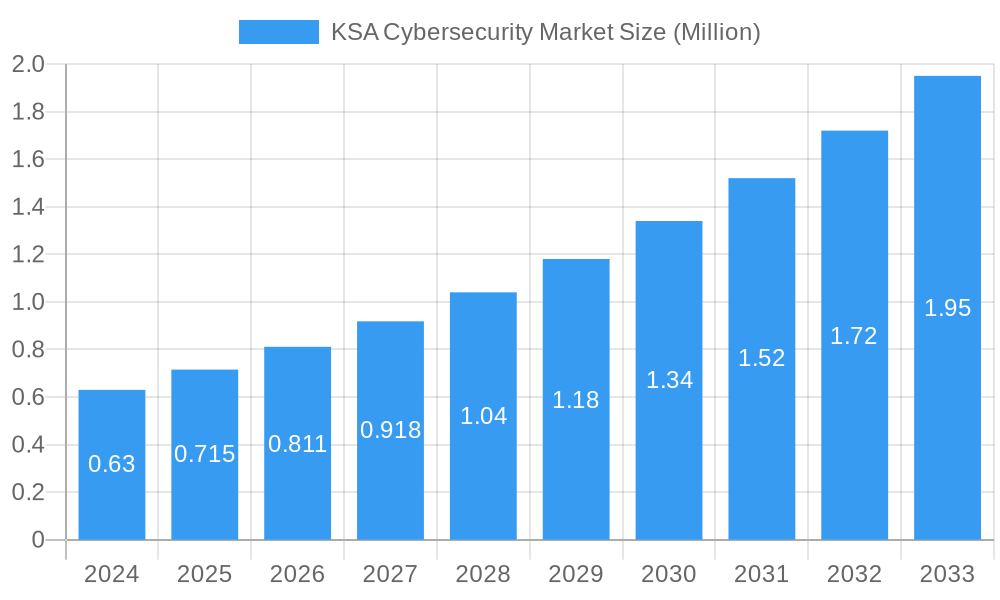

The KSA cybersecurity market is experiencing robust growth, projected to expand from a current valuation of $0.63 billion to an impressive $2.1 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 13.78%. This significant upward trajectory is propelled by an escalating threat landscape, driven by increasing digitalization and the adoption of advanced technologies across various sectors. Key drivers include the growing sophistication of cyberattacks, stringent government regulations mandating robust data protection, and a rising awareness among organizations about the critical need for cybersecurity investments. The demand for comprehensive security solutions is further fueled by the expansion of cloud adoption and the increasing reliance on sophisticated IT infrastructure.

KSA Cybersecurity Market Market Size (In Million)

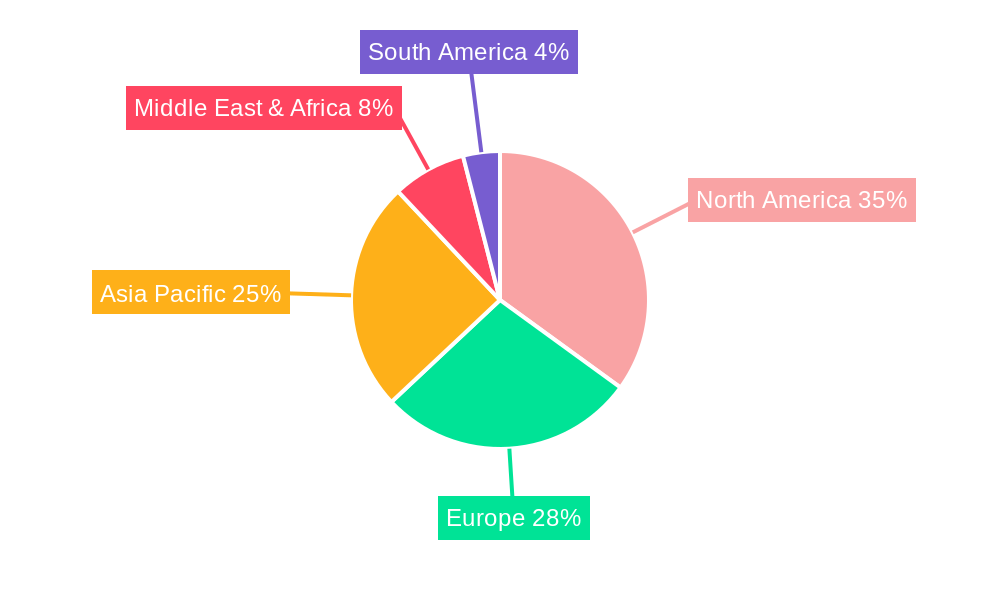

The market segmentation reveals a strong demand across diverse offerings, with solutions like cloud security, data security, and identity and access management leading the charge. Professional and managed services are also seeing substantial uptake as organizations seek expert guidance and continuous support in navigating complex security challenges. The widespread adoption of cloud-based solutions, coupled with the increasing presence of SMEs and large enterprises across crucial end-user industries such as BFSI, healthcare, and IT, underpins this market expansion. Geographically, North America currently holds a dominant share, but the Asia Pacific region, particularly countries like China and India, is emerging as a high-growth area, driven by rapid digital transformation and increasing cybersecurity investments. This dynamic market is characterized by intense competition among major players, fostering innovation and the development of advanced security technologies to address evolving cyber threats.

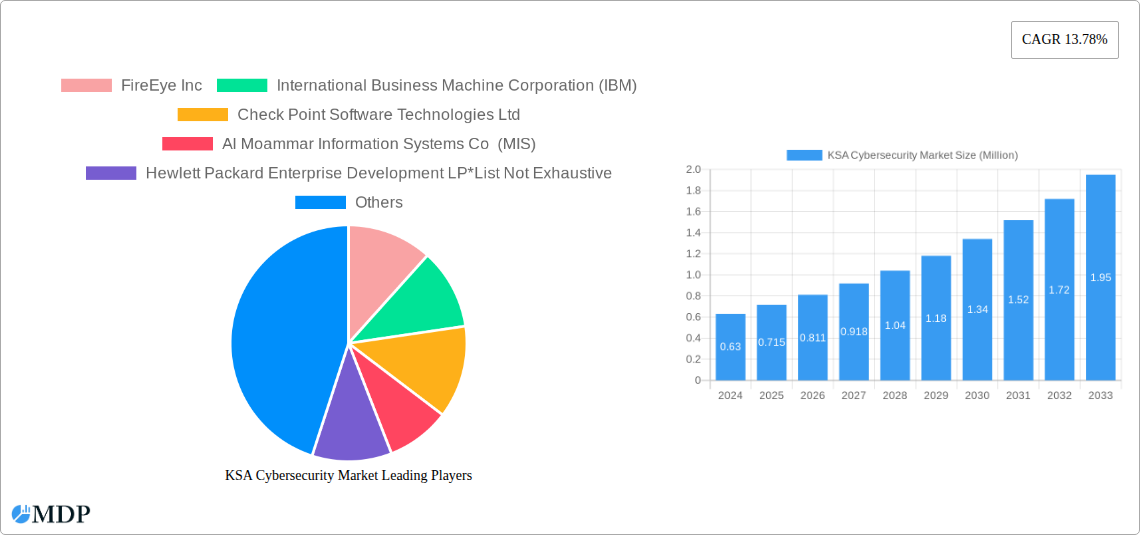

KSA Cybersecurity Market Company Market Share

Unveiling the Future: KSA Cybersecurity Market Report 2025-2033

Dive into the dynamic KSA Cybersecurity Market with our comprehensive report, meticulously crafted for industry stakeholders seeking actionable insights and strategic advantage. This in-depth analysis spans the Historical Period (2019–2024), the Base Year (2025), and projects growth through the Forecast Period (2025–2033), offering a robust understanding of market evolution. We explore the critical Segments including Offering (Solutions like Application Security, Cloud Security, Data Security, Identity and Access Management, Infrastructure Protection, Integrated Risk Management, Network Security Equipment, Consumer Security, and Other Solutions; and Services like Professional Services and Managed Services), Deployment (Cloud, On-premise), Organization Size (SMEs, Large Enterprises), and End User (BFSI, Healthcare, Construction, Government & Defense, IT and Telecommunication, Retail, Energy and Utilities, Manufacturing, and Other End Users). Discover the strategic moves of leading players such as FireEye Inc, International Business Machine Corporation (IBM), Check Point Software Technologies Ltd, Al Moammar Information Systems Co (MIS), Hewlett Packard Enterprise Development LP, Tenable Inc, Cisco Systems Inc, Salesforce com Inc, FORTINET INC, NortonLifeLock Inc, Dell Technologies Inc, McAfee Corporation, and Palo Alto Networks Inc. This report is your definitive guide to the Saudi Arabia cybersecurity landscape, identifying key drivers, challenges, and emerging opportunities.

KSA Cybersecurity Market Market Dynamics & Concentration

The KSA Cybersecurity Market is characterized by increasing concentration among leading technology providers, driven by significant government investments and the imperative to protect national digital infrastructure. Innovation is a primary driver, with companies continuously developing advanced solutions for evolving threats. Regulatory frameworks, such as those overseen by the National Cybersecurity Authority (NCA), are becoming more stringent, compelling businesses to adopt robust cybersecurity measures. Product substitutes exist, but the sophistication and integration of dedicated cybersecurity solutions offer superior protection. End-user trends indicate a growing demand for cloud-based security services and integrated risk management platforms. Merger and acquisition (M&A) activities, though not extensively detailed in public records for every transaction, are expected to increase as larger players consolidate market share and acquire innovative technologies. The market share distribution reflects a competitive yet consolidating landscape, with a few key players holding substantial portions. The number of M&A deals is projected to rise, indicative of strategic consolidation and expansion within the sector.

KSA Cybersecurity Market Industry Trends & Analysis

The KSA Cybersecurity Market is poised for significant growth, fueled by the Kingdom's ambitious Vision 2030, which emphasizes digital transformation across all sectors. This digital expansion inherently increases the attack surface, thereby amplifying the demand for comprehensive cybersecurity solutions and services. A projected Compound Annual Growth Rate (CAGR) of xx% over the forecast period underscores the robust expansion trajectory. Technological disruptions are rapidly reshaping the market, with the integration of Artificial Intelligence (AI) and Machine Learning (ML) becoming standard in threat detection and response systems. The increasing adoption of cloud computing and the Internet of Things (IoT) necessitates advanced cloud security and network security equipment. Consumer preferences are shifting towards proactive security measures and managed services that offer continuous monitoring and rapid incident response. Competitive dynamics are intensifying, with both global cybersecurity giants and local players vying for market dominance. Market penetration is steadily increasing as awareness of cyber threats and regulatory compliance requirements grows among businesses of all sizes. The ongoing digital transformation initiatives in Saudi Arabia, coupled with heightened geopolitical cybersecurity concerns, are creating a fertile ground for sustained market expansion and innovation.

Leading Markets & Segments in KSA Cybersecurity Market

The KSA Cybersecurity Market is predominantly driven by the Government & Defense and IT and Telecommunication end-user segments, reflecting the nation's strategic focus on national security and its rapidly expanding digital infrastructure. The BFSI sector also represents a significant market due to the high value of the data handled and the stringent regulatory environment.

Offering - Solutions:

- Cloud Security: Experiencing rapid adoption due to the increasing migration of data and applications to cloud environments. Economic policies promoting cloud adoption are a key driver.

- Identity and Access Management (IAM): Crucial for securing access to sensitive data and systems, with a growing emphasis on multi-factor authentication and zero-trust architectures.

- Data Security: Essential for protecting sensitive customer and corporate data, driven by data privacy regulations and the threat of data breaches.

- Network Security Equipment: Continues to be a foundational element, with ongoing demand for advanced firewalls, intrusion detection/prevention systems, and secure network access solutions.

- Application Security: Gaining prominence as applications become more complex and are increasingly targeted by attackers.

Offering - Services:

- Managed Services: A rapidly growing segment as organizations seek to outsource their cybersecurity operations to specialized providers for 24/7 monitoring and incident response.

- Professional Services: Including consulting, risk assessment, and implementation services, remain vital for organizations needing expert guidance to build and maintain their security posture.

Deployment:

- Cloud: The dominant deployment model for new solutions due to its scalability, flexibility, and cost-effectiveness.

- On-premise: Still relevant for organizations with specific regulatory or legacy system requirements, though its market share is gradually decreasing.

Organization Size:

- Large Enterprises: Represent the largest market share due to their extensive IT infrastructure and higher susceptibility to sophisticated cyberattacks.

- SMEs: Exhibiting strong growth as awareness of cybersecurity risks increases and more affordable managed security solutions become available.

KSA Cybersecurity Market Product Developments

The KSA Cybersecurity Market is witnessing a surge in product innovations focused on proactive threat detection and automated response. Companies are heavily investing in AI and ML capabilities to identify and neutralize sophisticated cyber threats in real-time. Cloud-native security solutions are becoming increasingly prevalent, offering seamless integration and scalability for organizations leveraging cloud infrastructure. Furthermore, there is a growing emphasis on unified security platforms that consolidate various security functionalities, simplifying management and enhancing overall visibility. These developments aim to provide enhanced protection against emerging threats like ransomware and advanced persistent threats (APTs), thereby bolstering market competitiveness.

Key Drivers of KSA Cybersecurity Market Growth

The KSA Cybersecurity Market's growth is propelled by several critical factors. Firstly, the Kingdom's unwavering commitment to its Vision 2030 digital transformation agenda significantly expands the digital footprint, necessitating robust security measures. Secondly, increasing government regulations and compliance mandates, particularly from the National Cybersecurity Authority (NCA), are compelling organizations to invest in advanced cybersecurity solutions. Thirdly, the escalating frequency and sophistication of cyber threats, including nation-state attacks and financially motivated cybercrime, are driving demand for proactive and comprehensive defense mechanisms. Finally, the burgeoning IT and Telecommunication, BFSI, and Government & Defense sectors are major adopters of cybersecurity technologies.

Challenges in the KSA Cybersecurity Market Market

Despite its robust growth, the KSA Cybersecurity Market faces several challenges. A significant hurdle is the persistent shortage of skilled cybersecurity professionals, which can hinder the effective implementation and management of complex security solutions. Additionally, the high cost of advanced cybersecurity technologies and services can be a barrier for Small and Medium-sized Enterprises (SMEs), limiting their adoption. Furthermore, the rapidly evolving threat landscape requires continuous investment in updating security infrastructure, posing a challenge for budget-constrained organizations. Ensuring seamless integration of new security solutions with existing legacy systems also presents a complex technical challenge.

Emerging Opportunities in KSA Cybersecurity Market

The KSA Cybersecurity Market presents compelling opportunities for growth and innovation. The increasing adoption of 5G technology and the expansion of the IoT ecosystem are creating new attack vectors, demanding specialized security solutions. The growing demand for cloud security services, driven by digital transformation initiatives, offers substantial expansion potential. Furthermore, the increasing focus on data privacy regulations is creating a strong market for data security and governance solutions. Strategic partnerships between international cybersecurity firms and local Saudi companies can foster knowledge transfer and market penetration, capitalizing on the growing awareness and need for advanced cybersecurity.

Leading Players in the KSA Cybersecurity Market Sector

- FireEye Inc

- International Business Machine Corporation (IBM)

- Check Point Software Technologies Ltd

- Al Moammar Information Systems Co (MIS)

- Hewlett Packard Enterprise Development LP

- Tenable Inc

- Cisco Systems Inc

- Salesforce com Inc

- FORTINET INC

- NortonLifeLock Inc

- Dell Technologies Inc

- McAfee Corporation

- Palo Alto Networks Inc

Key Milestones in KSA Cybersecurity Market Industry

- July 2022: Cisco launched a secure cloud utilizing an open shared signals and events framework for swift data sharing between vendors, simplifying the work of security analysts. Alongside, Talos Intel On-Demand was introduced, offering customized research based on an organization's unique threat landscape. The Secure Firewall 3100 series was also updated to incorporate AI and machine learning for enhanced threat detection.

- August 2022: Palo Alto Networks introduced Unit 42 Managed Detection and Response (Unit 42 MDR), a new service providing continuous 24/7 threat detection, investigation, and response. Built on Cortex XDR, Unit 42 MDR is optimized to prioritize alerts, significantly reducing the number of alerts customers receive and aiding in the detection of more suspicious activity.

Strategic Outlook for KSA Cybersecurity Market Market

The strategic outlook for the KSA Cybersecurity Market is highly promising, driven by continuous digital transformation and a proactive stance on national security. Key growth accelerators include the increasing adoption of advanced technologies like AI and ML for predictive threat intelligence, and the expansion of cloud-native security solutions. Strategic partnerships and localizing cybersecurity expertise will be crucial for market penetration. The government's ongoing commitment to fostering a secure digital environment, coupled with the private sector's increasing awareness of cyber risks, will undoubtedly fuel sustained growth and innovation, positioning Saudi Arabia as a leading player in regional cybersecurity.

KSA Cybersecurity Market Segmentation

-

1. Offering

-

1.1. Solutions

- 1.1.1. Application Security

- 1.1.2. Cloud Security

- 1.1.3. Data Security

- 1.1.4. Identity and Access Management

- 1.1.5. Infrastructure Protection

- 1.1.6. Integrated Risk Management

- 1.1.7. Network Security Equipment

- 1.1.8. Consumer Security

- 1.1.9. Other Solutions

-

1.2. Services

- 1.2.1. Professional Services

- 1.2.2. Managed Services

-

1.1. Solutions

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. Organization Size

- 3.1. SMEs

- 3.2. Large Enterprises

-

4. End User

- 4.1. BFSI

- 4.2. Healthcare

- 4.3. Construction

- 4.4. Government & Defense

- 4.5. IT and Telecommunication

- 4.6. Retail

- 4.7. Energy and Utilities

- 4.8. Manufacturing

- 4.9. Other End Users

KSA Cybersecurity Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

KSA Cybersecurity Market Regional Market Share

Geographic Coverage of KSA Cybersecurity Market

KSA Cybersecurity Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand for Digitalization and Scalable IT Infrastructure; Need to tackle risks from various trends such as third-party vendor risks

- 3.2.2 the evolution of MSSPs

- 3.2.3 and adoption of cloud-first strategy

- 3.3. Market Restrains

- 3.3.1. Lack of Cybersecurity Professionals; High Reliance on Traditional Authentication Methods and Low Preparedness

- 3.4. Market Trends

- 3.4.1. Growing usage of the Cloud Services across the region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global KSA Cybersecurity Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Solutions

- 5.1.1.1. Application Security

- 5.1.1.2. Cloud Security

- 5.1.1.3. Data Security

- 5.1.1.4. Identity and Access Management

- 5.1.1.5. Infrastructure Protection

- 5.1.1.6. Integrated Risk Management

- 5.1.1.7. Network Security Equipment

- 5.1.1.8. Consumer Security

- 5.1.1.9. Other Solutions

- 5.1.2. Services

- 5.1.2.1. Professional Services

- 5.1.2.2. Managed Services

- 5.1.1. Solutions

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by Organization Size

- 5.3.1. SMEs

- 5.3.2. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. BFSI

- 5.4.2. Healthcare

- 5.4.3. Construction

- 5.4.4. Government & Defense

- 5.4.5. IT and Telecommunication

- 5.4.6. Retail

- 5.4.7. Energy and Utilities

- 5.4.8. Manufacturing

- 5.4.9. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North America KSA Cybersecurity Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Solutions

- 6.1.1.1. Application Security

- 6.1.1.2. Cloud Security

- 6.1.1.3. Data Security

- 6.1.1.4. Identity and Access Management

- 6.1.1.5. Infrastructure Protection

- 6.1.1.6. Integrated Risk Management

- 6.1.1.7. Network Security Equipment

- 6.1.1.8. Consumer Security

- 6.1.1.9. Other Solutions

- 6.1.2. Services

- 6.1.2.1. Professional Services

- 6.1.2.2. Managed Services

- 6.1.1. Solutions

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Cloud

- 6.2.2. On-premise

- 6.3. Market Analysis, Insights and Forecast - by Organization Size

- 6.3.1. SMEs

- 6.3.2. Large Enterprises

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. BFSI

- 6.4.2. Healthcare

- 6.4.3. Construction

- 6.4.4. Government & Defense

- 6.4.5. IT and Telecommunication

- 6.4.6. Retail

- 6.4.7. Energy and Utilities

- 6.4.8. Manufacturing

- 6.4.9. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. South America KSA Cybersecurity Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Solutions

- 7.1.1.1. Application Security

- 7.1.1.2. Cloud Security

- 7.1.1.3. Data Security

- 7.1.1.4. Identity and Access Management

- 7.1.1.5. Infrastructure Protection

- 7.1.1.6. Integrated Risk Management

- 7.1.1.7. Network Security Equipment

- 7.1.1.8. Consumer Security

- 7.1.1.9. Other Solutions

- 7.1.2. Services

- 7.1.2.1. Professional Services

- 7.1.2.2. Managed Services

- 7.1.1. Solutions

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Cloud

- 7.2.2. On-premise

- 7.3. Market Analysis, Insights and Forecast - by Organization Size

- 7.3.1. SMEs

- 7.3.2. Large Enterprises

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. BFSI

- 7.4.2. Healthcare

- 7.4.3. Construction

- 7.4.4. Government & Defense

- 7.4.5. IT and Telecommunication

- 7.4.6. Retail

- 7.4.7. Energy and Utilities

- 7.4.8. Manufacturing

- 7.4.9. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Europe KSA Cybersecurity Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Solutions

- 8.1.1.1. Application Security

- 8.1.1.2. Cloud Security

- 8.1.1.3. Data Security

- 8.1.1.4. Identity and Access Management

- 8.1.1.5. Infrastructure Protection

- 8.1.1.6. Integrated Risk Management

- 8.1.1.7. Network Security Equipment

- 8.1.1.8. Consumer Security

- 8.1.1.9. Other Solutions

- 8.1.2. Services

- 8.1.2.1. Professional Services

- 8.1.2.2. Managed Services

- 8.1.1. Solutions

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Cloud

- 8.2.2. On-premise

- 8.3. Market Analysis, Insights and Forecast - by Organization Size

- 8.3.1. SMEs

- 8.3.2. Large Enterprises

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. BFSI

- 8.4.2. Healthcare

- 8.4.3. Construction

- 8.4.4. Government & Defense

- 8.4.5. IT and Telecommunication

- 8.4.6. Retail

- 8.4.7. Energy and Utilities

- 8.4.8. Manufacturing

- 8.4.9. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Middle East & Africa KSA Cybersecurity Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Solutions

- 9.1.1.1. Application Security

- 9.1.1.2. Cloud Security

- 9.1.1.3. Data Security

- 9.1.1.4. Identity and Access Management

- 9.1.1.5. Infrastructure Protection

- 9.1.1.6. Integrated Risk Management

- 9.1.1.7. Network Security Equipment

- 9.1.1.8. Consumer Security

- 9.1.1.9. Other Solutions

- 9.1.2. Services

- 9.1.2.1. Professional Services

- 9.1.2.2. Managed Services

- 9.1.1. Solutions

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. Cloud

- 9.2.2. On-premise

- 9.3. Market Analysis, Insights and Forecast - by Organization Size

- 9.3.1. SMEs

- 9.3.2. Large Enterprises

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. BFSI

- 9.4.2. Healthcare

- 9.4.3. Construction

- 9.4.4. Government & Defense

- 9.4.5. IT and Telecommunication

- 9.4.6. Retail

- 9.4.7. Energy and Utilities

- 9.4.8. Manufacturing

- 9.4.9. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Asia Pacific KSA Cybersecurity Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 10.1.1. Solutions

- 10.1.1.1. Application Security

- 10.1.1.2. Cloud Security

- 10.1.1.3. Data Security

- 10.1.1.4. Identity and Access Management

- 10.1.1.5. Infrastructure Protection

- 10.1.1.6. Integrated Risk Management

- 10.1.1.7. Network Security Equipment

- 10.1.1.8. Consumer Security

- 10.1.1.9. Other Solutions

- 10.1.2. Services

- 10.1.2.1. Professional Services

- 10.1.2.2. Managed Services

- 10.1.1. Solutions

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. Cloud

- 10.2.2. On-premise

- 10.3. Market Analysis, Insights and Forecast - by Organization Size

- 10.3.1. SMEs

- 10.3.2. Large Enterprises

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. BFSI

- 10.4.2. Healthcare

- 10.4.3. Construction

- 10.4.4. Government & Defense

- 10.4.5. IT and Telecommunication

- 10.4.6. Retail

- 10.4.7. Energy and Utilities

- 10.4.8. Manufacturing

- 10.4.9. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 FireEye Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 International Business Machine Corporation (IBM)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Check Point Software Technologies Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Al Moammar Information Systems Co (MIS)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hewlett Packard Enterprise Development LP*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tenable Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cisco Systems Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Salesforce com Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 FORTINET INC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 NortonLifeLock Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dell Technologies Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 McAfee Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Palo Alto Networks Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 FireEye Inc

List of Figures

- Figure 1: Global KSA Cybersecurity Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America KSA Cybersecurity Market Revenue (Million), by Offering 2025 & 2033

- Figure 3: North America KSA Cybersecurity Market Revenue Share (%), by Offering 2025 & 2033

- Figure 4: North America KSA Cybersecurity Market Revenue (Million), by Deployment 2025 & 2033

- Figure 5: North America KSA Cybersecurity Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 6: North America KSA Cybersecurity Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 7: North America KSA Cybersecurity Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 8: North America KSA Cybersecurity Market Revenue (Million), by End User 2025 & 2033

- Figure 9: North America KSA Cybersecurity Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America KSA Cybersecurity Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America KSA Cybersecurity Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America KSA Cybersecurity Market Revenue (Million), by Offering 2025 & 2033

- Figure 13: South America KSA Cybersecurity Market Revenue Share (%), by Offering 2025 & 2033

- Figure 14: South America KSA Cybersecurity Market Revenue (Million), by Deployment 2025 & 2033

- Figure 15: South America KSA Cybersecurity Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 16: South America KSA Cybersecurity Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 17: South America KSA Cybersecurity Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 18: South America KSA Cybersecurity Market Revenue (Million), by End User 2025 & 2033

- Figure 19: South America KSA Cybersecurity Market Revenue Share (%), by End User 2025 & 2033

- Figure 20: South America KSA Cybersecurity Market Revenue (Million), by Country 2025 & 2033

- Figure 21: South America KSA Cybersecurity Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe KSA Cybersecurity Market Revenue (Million), by Offering 2025 & 2033

- Figure 23: Europe KSA Cybersecurity Market Revenue Share (%), by Offering 2025 & 2033

- Figure 24: Europe KSA Cybersecurity Market Revenue (Million), by Deployment 2025 & 2033

- Figure 25: Europe KSA Cybersecurity Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 26: Europe KSA Cybersecurity Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 27: Europe KSA Cybersecurity Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 28: Europe KSA Cybersecurity Market Revenue (Million), by End User 2025 & 2033

- Figure 29: Europe KSA Cybersecurity Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe KSA Cybersecurity Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe KSA Cybersecurity Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa KSA Cybersecurity Market Revenue (Million), by Offering 2025 & 2033

- Figure 33: Middle East & Africa KSA Cybersecurity Market Revenue Share (%), by Offering 2025 & 2033

- Figure 34: Middle East & Africa KSA Cybersecurity Market Revenue (Million), by Deployment 2025 & 2033

- Figure 35: Middle East & Africa KSA Cybersecurity Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Middle East & Africa KSA Cybersecurity Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 37: Middle East & Africa KSA Cybersecurity Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 38: Middle East & Africa KSA Cybersecurity Market Revenue (Million), by End User 2025 & 2033

- Figure 39: Middle East & Africa KSA Cybersecurity Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: Middle East & Africa KSA Cybersecurity Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa KSA Cybersecurity Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific KSA Cybersecurity Market Revenue (Million), by Offering 2025 & 2033

- Figure 43: Asia Pacific KSA Cybersecurity Market Revenue Share (%), by Offering 2025 & 2033

- Figure 44: Asia Pacific KSA Cybersecurity Market Revenue (Million), by Deployment 2025 & 2033

- Figure 45: Asia Pacific KSA Cybersecurity Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 46: Asia Pacific KSA Cybersecurity Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 47: Asia Pacific KSA Cybersecurity Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 48: Asia Pacific KSA Cybersecurity Market Revenue (Million), by End User 2025 & 2033

- Figure 49: Asia Pacific KSA Cybersecurity Market Revenue Share (%), by End User 2025 & 2033

- Figure 50: Asia Pacific KSA Cybersecurity Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific KSA Cybersecurity Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global KSA Cybersecurity Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 2: Global KSA Cybersecurity Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 3: Global KSA Cybersecurity Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 4: Global KSA Cybersecurity Market Revenue Million Forecast, by End User 2020 & 2033

- Table 5: Global KSA Cybersecurity Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global KSA Cybersecurity Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 7: Global KSA Cybersecurity Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 8: Global KSA Cybersecurity Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 9: Global KSA Cybersecurity Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Global KSA Cybersecurity Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global KSA Cybersecurity Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 15: Global KSA Cybersecurity Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 16: Global KSA Cybersecurity Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 17: Global KSA Cybersecurity Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Global KSA Cybersecurity Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global KSA Cybersecurity Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 23: Global KSA Cybersecurity Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 24: Global KSA Cybersecurity Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 25: Global KSA Cybersecurity Market Revenue Million Forecast, by End User 2020 & 2033

- Table 26: Global KSA Cybersecurity Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global KSA Cybersecurity Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 37: Global KSA Cybersecurity Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 38: Global KSA Cybersecurity Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 39: Global KSA Cybersecurity Market Revenue Million Forecast, by End User 2020 & 2033

- Table 40: Global KSA Cybersecurity Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global KSA Cybersecurity Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 48: Global KSA Cybersecurity Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 49: Global KSA Cybersecurity Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 50: Global KSA Cybersecurity Market Revenue Million Forecast, by End User 2020 & 2033

- Table 51: Global KSA Cybersecurity Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific KSA Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the KSA Cybersecurity Market?

The projected CAGR is approximately 13.78%.

2. Which companies are prominent players in the KSA Cybersecurity Market?

Key companies in the market include FireEye Inc, International Business Machine Corporation (IBM), Check Point Software Technologies Ltd, Al Moammar Information Systems Co (MIS), Hewlett Packard Enterprise Development LP*List Not Exhaustive, Tenable Inc, Cisco Systems Inc, Salesforce com Inc, FORTINET INC, NortonLifeLock Inc, Dell Technologies Inc, McAfee Corporation, Palo Alto Networks Inc.

3. What are the main segments of the KSA Cybersecurity Market?

The market segments include Offering, Deployment, Organization Size, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Digitalization and Scalable IT Infrastructure; Need to tackle risks from various trends such as third-party vendor risks. the evolution of MSSPs. and adoption of cloud-first strategy.

6. What are the notable trends driving market growth?

Growing usage of the Cloud Services across the region.

7. Are there any restraints impacting market growth?

Lack of Cybersecurity Professionals; High Reliance on Traditional Authentication Methods and Low Preparedness.

8. Can you provide examples of recent developments in the market?

July 2022 - Cisco has launched a secure cloud that uses an open shared signals and events framework for swift sharing of data between vendors, making the work of security analysts simpler, along with Talos Intel On-Demand, which customizes research according to every organization's unique threat landscape. Its Secure Firewall 3100 series introduces AI and machine learning to the mix for detecting threats.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "KSA Cybersecurity Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the KSA Cybersecurity Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the KSA Cybersecurity Market?

To stay informed about further developments, trends, and reports in the KSA Cybersecurity Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence