Key Insights

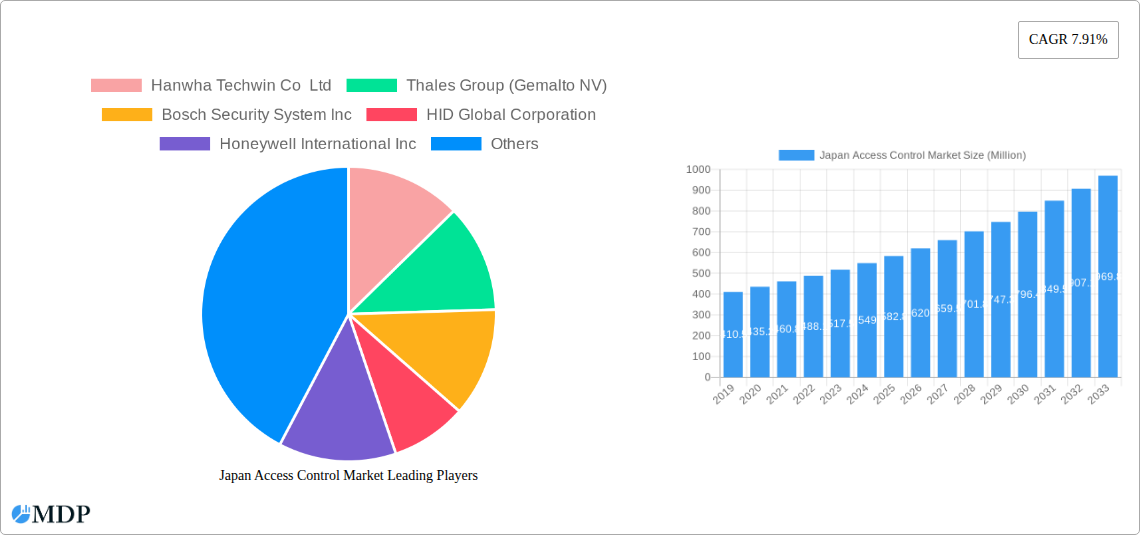

The Japan Access Control Market is poised for significant expansion, projected to reach a substantial market size of approximately USD 640 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.91% anticipated throughout the forecast period of 2025-2033. This growth is primarily fueled by escalating concerns for enhanced security across both commercial and residential sectors, driven by increasing threats and the need for sophisticated protection against unauthorized access. The burgeoning adoption of advanced technologies such as smartcards (contact and contactless) and biometric readers, alongside the integration of electronic locks and comprehensive software solutions, are key enablers of this market momentum. Furthermore, government mandates for stringent security protocols in critical infrastructure and public spaces, coupled with the increasing pervasiveness of smart home and building automation systems, are actively contributing to the upward trajectory of the access control market in Japan.

Japan Access Control Market Market Size (In Million)

The market's segmentation reveals a dynamic landscape, with Card Readers and Access Control Devices, particularly smartcard and biometric solutions, capturing a significant share. The growing emphasis on convenience and contactless access in the wake of public health concerns is further bolstering the demand for these advanced reader types. The Commercial and Residential end-user verticals are expected to lead the adoption, influenced by rising disposable incomes, urbanization, and a heightened awareness of personal and property security. While challenges such as the initial investment cost of sophisticated systems and the need for user training exist, the long-term benefits of enhanced security, operational efficiency, and regulatory compliance are expected to outweigh these restraints. Key players are actively investing in research and development to innovate and offer integrated, user-friendly, and cost-effective access control solutions tailored to the specific needs of the Japanese market, ensuring sustained growth and market penetration.

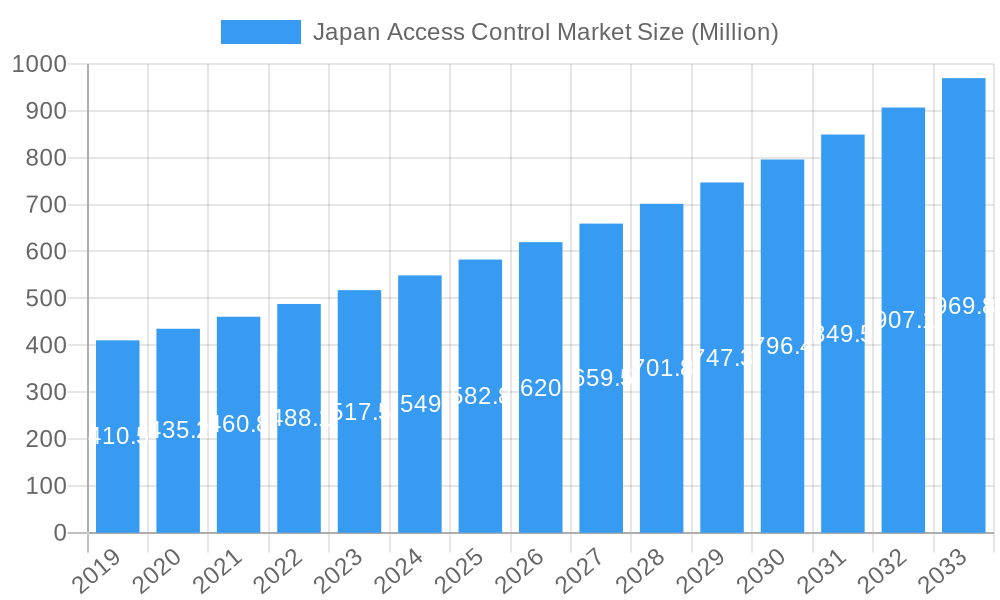

Japan Access Control Market Company Market Share

Unlock the future of secure access in Japan with our in-depth report on the Japan Access Control Market. This comprehensive analysis provides critical insights into market dynamics, growth drivers, technological advancements, and competitive landscapes from 2019 through 2033, with a base and estimated year of 2025 and a forecast period of 2025-2033. Delve into the burgeoning access control systems Japan, biometric access control Japan, and smart card access control Japan sectors, vital for enhancing security across commercial, residential, government, industrial, transport, healthcare, and military applications.

Our report offers unparalleled strategic intelligence for stakeholders seeking to navigate and capitalize on the evolving Japan security market. We dissect the impact of key industry developments, including ASSA ABLOY's innovative Centrios launch in April 2024 and Johnson Controls' cyber-hardened solutions showcased during ISC West, highlighting their influence on access control solutions Japan. Understand the trajectory of access control devices Japan and electronic locks Japan as they integrate with advanced access control software Japan.

This report is meticulously structured to provide actionable insights, from detailed market segmentation and competitive analysis to emerging opportunities and strategic outlooks, ensuring you have the knowledge to make informed decisions in this dynamic market.

Japan Access Control Market Dynamics & Concentration

The Japan Access Control Market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share, while a host of smaller and specialized companies vie for niche segments. Innovation drivers are primarily fueled by the increasing demand for advanced security solutions driven by rising crime rates, sophisticated threat landscapes, and the growing adoption of IoT and smart building technologies. Regulatory frameworks, while stringent in terms of data privacy and security standards, are also evolving to accommodate the integration of newer technologies like cloud-based access control and mobile credentials. Product substitutes, such as traditional key-based systems, are rapidly diminishing in relevance as businesses and individuals prioritize enhanced security, convenience, and auditability offered by electronic access control. End-user trends are leaning towards integrated security systems, seamless user experiences through mobile access, and robust data analytics for security management. Mergers and acquisition (M&A) activities are expected to play a crucial role in market consolidation, allowing larger players to expand their portfolios, technological capabilities, and market reach. Key M&A drivers include the acquisition of innovative technologies, access to new customer segments, and the pursuit of economies of scale.

- Market Concentration: Moderate to high in key segments.

- Innovation Drivers: Smart buildings, IoT integration, enhanced cybersecurity, demand for convenience.

- Regulatory Frameworks: Stringent data privacy (e.g., APPI), evolving security standards for critical infrastructure.

- Product Substitutes: Traditional key systems, basic alarm systems.

- End-User Trends: Integrated security platforms, mobile credentials, cloud-based solutions, remote management.

- M&A Activities: Anticipated to increase for technology acquisition and market expansion.

Japan Access Control Market Industry Trends & Analysis

The Japan Access Control Market is poised for significant expansion, driven by a confluence of technological advancements, evolving consumer preferences, and a robust economic environment. The projected Compound Annual Growth Rate (CAGR) is estimated to be substantial, reflecting the escalating need for sophisticated security measures across all sectors. Technological disruptions, particularly the integration of Artificial Intelligence (AI) into access control systems for enhanced threat detection and predictive analysis, are transforming the market. The proliferation of smart devices and the Internet of Things (IoT) is further accelerating the adoption of connected access control solutions, enabling remote management and real-time monitoring. Consumer preferences are increasingly shifting towards user-friendly interfaces, mobile-based access credentials, and systems that offer seamless integration with other smart building functionalities, such as lighting, HVAC, and surveillance. The competitive dynamics are characterized by a blend of established global players and innovative local providers, all competing on product features, reliability, cybersecurity, and customer support. Market penetration for advanced access control systems is still growing, particularly within the small and medium-sized enterprise (SME) sector, presenting a significant untapped opportunity. The increasing awareness of data security and the need to protect sensitive information are also compelling factors driving demand for robust access control solutions. Furthermore, the ongoing development of smart cities and critical infrastructure projects in Japan necessitates highly secure and efficient access management systems. The trend towards hybrid cloud solutions, offering scalability and flexibility, is also gaining traction, allowing organizations to balance on-premise security with cloud-based convenience. The market is also witnessing a growing demand for granular access control, enabling administrators to define and manage access permissions at a very detailed level, thereby enhancing security and compliance. The integration of biometric technologies, such as facial recognition and fingerprint scanning, continues to be a key differentiator, offering a high level of security and convenience. The emphasis on cybersecurity in access control systems is paramount, with manufacturers investing heavily in developing solutions that are resistant to cyber threats and data breaches.

Leading Markets & Segments in Japan Access Control Market

The Japan Access Control Market is segmented into several key areas, each exhibiting unique growth trajectories and demand drivers.

Type Segmentation:

- Card Reader and Access Control Devices: This segment is expected to maintain a dominant position, driven by the continued widespread adoption of various card technologies.

- Card-based (Proximity, Smartcard - Contact and Contactless): Proximity cards remain prevalent due to their cost-effectiveness and ease of use. Smartcards, both contact and contactless, are witnessing increased adoption due to their enhanced security features and the ability to store multiple applications, such as identification and payment. The trend towards contactless smartcards is particularly strong, offering faster transaction times and improved hygiene.

- Biometric Readers: This segment is experiencing rapid growth, fueled by the demand for higher security and enhanced user convenience. Fingerprint scanners, facial recognition systems, and iris scanners are becoming increasingly common in high-security environments. The accuracy and reliability of biometric technologies are continuously improving, driving their market penetration.

- Electronic Locks: These are integral to access control systems, offering sophisticated locking mechanisms controlled electronically. The integration of smart locks with mobile connectivity and remote control capabilities is a significant growth driver.

- Software: The market for access control software is critical, enabling system management, user authentication, audit trails, and integration with other security platforms. Cloud-based access control software is gaining significant traction due to its scalability, flexibility, and remote management capabilities.

- Other Types: This category may include emerging technologies like behavioral biometrics, QR code-based access, and wearable device integration, which are in their nascent stages but show promise for future growth.

End-user Vertical Segmentation:

- Commercial: This is a major segment, encompassing office buildings, retail spaces, and corporate campuses. The demand for robust security, employee credential management, and visitor tracking is high.

- Key Drivers: Need for enhanced corporate security, compliance with regulations, visitor management, operational efficiency.

- Residential: The adoption of smart home technologies is driving the demand for residential access control systems, including smart locks and app-controlled entry systems.

- Key Drivers: Increasing consumer interest in smart home automation, desire for enhanced home security, convenience of remote access.

- Government: This sector requires highly secure and reliable access control systems for public buildings, sensitive facilities, and critical infrastructure.

- Key Drivers: National security concerns, stringent regulatory requirements, protection of sensitive data and assets.

- Industrial: Manufacturing plants, warehouses, and industrial facilities demand robust access control to manage employee access to restricted areas, ensure operational safety, and prevent theft.

- Key Drivers: Workplace safety regulations, inventory management, prevention of unauthorized access to production areas.

- Transport and Logistics: Airports, seaports, train stations, and logistics hubs require sophisticated access control for passenger screening, cargo security, and operational efficiency.

- Key Drivers: Passenger safety and security, efficient cargo handling, operational continuity, border control.

- Healthcare: Hospitals, clinics, and research facilities need secure access control to protect patient data, sensitive equipment, and restrict access to specific areas.

- Key Drivers: Patient data privacy (HIPAA compliance), protection of medical equipment, controlled access to laboratories and pharmacies.

- Military and Defense: This sector demands the highest levels of security for sensitive installations, personnel, and classified information.

- Key Drivers: National security, threat prevention, protection of critical infrastructure, classified information control.

- Other End-user Verticals: This can include educational institutions, entertainment venues, and hospitality sectors, all of which have specific access control needs.

Japan Access Control Market Product Developments

The Japan Access Control Market is continuously shaped by a stream of innovative product developments aimed at enhancing security, user experience, and integration capabilities. Key trends include the miniaturization of devices, increased wireless connectivity, and the embedding of AI for smarter access decisions. Manufacturers are focusing on developing solutions that offer frictionless access, such as advanced facial recognition and behavioral biometrics, while simultaneously bolstering cybersecurity features to combat evolving threats. The integration of mobile credentials, allowing users to access facilities via their smartphones, is becoming a standard offering, providing unparalleled convenience. Furthermore, product developments are increasingly emphasizing interoperability and open standards, enabling seamless integration with existing security infrastructure and building management systems. This focus on open architectures and APIs allows for greater customization and scalability, catering to the diverse needs of various end-user verticals. The lifecycle management of access credentials and the ability to remotely manage access permissions are also key areas of innovation, driven by the need for greater operational efficiency and security oversight.

Key Drivers of Japan Access Control Market Growth

The growth of the Japan Access Control Market is propelled by several interconnected factors. The escalating global and domestic security concerns, coupled with increasing sophistication of threats, are compelling organizations and individuals to invest in advanced security solutions. The rapid adoption of IoT and smart building technologies is a significant driver, as access control systems are becoming integral components of these interconnected environments, offering centralized management and enhanced functionality. Government initiatives promoting smart city development and the modernization of critical infrastructure further fuel demand for sophisticated access control systems. Economic growth and increased disposable income in Japan are also contributing to the adoption of premium access control solutions, particularly in the residential and commercial sectors. Moreover, stringent data privacy regulations necessitate robust access control to protect sensitive information. The demand for seamless user experiences, such as mobile access and biometric authentication, is also a key growth accelerator, catering to evolving consumer expectations.

Challenges in the Japan Access Control Market Market

Despite robust growth, the Japan Access Control Market faces several challenges. The high initial investment cost associated with advanced access control systems can be a deterrent for small and medium-sized enterprises (SMEs), limiting wider market penetration. Ensuring robust cybersecurity against increasingly sophisticated cyber threats remains a continuous challenge, requiring ongoing investment in software updates and threat mitigation strategies. Integration complexities with legacy systems can also pose a barrier, necessitating careful planning and implementation to ensure seamless operation. Furthermore, the stringent regulatory landscape, while promoting security, can sometimes lead to lengthy approval processes and compliance hurdles for new technologies. Intense competition among domestic and international players can also exert downward pressure on pricing, impacting profit margins. Finally, a shortage of skilled professionals for installation, maintenance, and system management can hinder deployment and support.

Emerging Opportunities in Japan Access Control Market

The Japan Access Control Market presents numerous emerging opportunities for growth and innovation. The burgeoning smart city initiatives across Japan are creating significant demand for integrated access control solutions that can manage urban infrastructure, public transport, and residential areas seamlessly. The increasing focus on workplace safety and employee well-being is driving demand for advanced access control that can monitor occupancy, manage social distancing, and enhance overall security within office environments. The healthcare sector's growing need to protect sensitive patient data and secure medical equipment offers a substantial opportunity for specialized access control solutions. Furthermore, the expansion of cloud-based access control services is creating a recurring revenue model for providers, catering to the growing demand for flexible and scalable solutions. Strategic partnerships between access control providers, IoT platform developers, and cybersecurity firms are poised to unlock new integrated solutions and expand market reach. The adoption of AI and machine learning for predictive security and intelligent access management represents a significant technological frontier with vast potential.

Leading Players in the Japan Access Control Market Sector

- Hanwha Techwin Co Ltd

- Thales Group (Gemalto NV)

- Bosch Security System Inc

- HID Global Corporation

- Honeywell International Inc

- Tyco International PLC (Johnson Controls)

- Allegion PLC

- ASSA ABLOY AB Group

- Schneider Electric SE

- Panasonic Corporation

- Brivo Systems LLC

- Identiv Inc

- Dormakaba Holding AG

- NEC Corporation

- Idemia Group

- Axis Communications AB

- Dahua Technology

- Genetec Inc

- BioConnect Inc

Key Milestones in Japan Access Control Market Industry

- April 2024: ASSA ABLOY launched Centrios, a mobile-first access control business designed to offer advanced mobile-first access control solutions for small businesses. This initiative aims to empower distributors, integrators, locksmiths, and security professionals to expand their businesses through a strategic partnership program.

- April 2024: Johnson Controls showcased its comprehensive portfolio of in-house developed and cyber-hardened access control and video surveillance solutions for enterprise applications at ISC West. The introduction of the OSDP G2-RM-4E Door Control Module, offering flexible OSDP and legacy "RM" mode compatibility for cost-effective security system updates, highlights their commitment to backward compatibility and system modernization.

Strategic Outlook for Japan Access Control Market Market

The strategic outlook for the Japan Access Control Market is exceptionally positive, characterized by sustained growth and increasing technological integration. The market will likely witness a surge in demand for AI-powered and IoT-enabled access control systems that offer enhanced security, predictive analytics, and seamless integration with smart building ecosystems. Cloud-based solutions will continue to gain traction due to their scalability, flexibility, and remote management capabilities. Strategic partnerships and collaborations among key players will be crucial for developing comprehensive security offerings and expanding market reach. The ongoing digital transformation across various industries in Japan, coupled with a heightened awareness of security imperatives, will continue to drive innovation and investment in advanced access control technologies. The focus will shift towards creating user-centric solutions that balance robust security with convenience and operational efficiency, further solidifying the market's growth trajectory.

Japan Access Control Market Segmentation

-

1. Type

-

1.1. Card Reader and Access Control Devices

- 1.1.1. Card-based

- 1.1.2. Proximity

- 1.1.3. Smartcard (Contact and Contactless)

- 1.2. Biometric Readers

- 1.3. Electronic Locks

- 1.4. Software

- 1.5. Other Types

-

1.1. Card Reader and Access Control Devices

-

2. End-user Vertical

- 2.1. Commercial

- 2.2. Residential

- 2.3. Government

- 2.4. Industrial

- 2.5. Transport and Logistics

- 2.6. Healthcare

- 2.7. Military and Defense

- 2.8. Other End-user Verticals

Japan Access Control Market Segmentation By Geography

- 1. Japan

Japan Access Control Market Regional Market Share

Geographic Coverage of Japan Access Control Market

Japan Access Control Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Access Control Systems owing to Rising Crime Rates and Threats; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Growing Adoption of Access Control Systems owing to Rising Crime Rates and Threats; Technological Advancements

- 3.4. Market Trends

- 3.4.1. The Smart Card Segment is Expected to Register Significant Growth in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Access Control Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Card Reader and Access Control Devices

- 5.1.1.1. Card-based

- 5.1.1.2. Proximity

- 5.1.1.3. Smartcard (Contact and Contactless)

- 5.1.2. Biometric Readers

- 5.1.3. Electronic Locks

- 5.1.4. Software

- 5.1.5. Other Types

- 5.1.1. Card Reader and Access Control Devices

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Commercial

- 5.2.2. Residential

- 5.2.3. Government

- 5.2.4. Industrial

- 5.2.5. Transport and Logistics

- 5.2.6. Healthcare

- 5.2.7. Military and Defense

- 5.2.8. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hanwha Techwin Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Thales Group (Gemalto NV)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bosch Security System Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 HID Global Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Honeywell International Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tyco International PLC (Johnson Controls)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Allegion PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ASSA ABLOY AB Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Schneider Electric SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Brivo Systems LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Identiv Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Dormakaba Holding AG

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 NEC Corporation

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Idemia Group

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Axis Communications AB

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Dahua Technology

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Genetec Inc

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 BioConnect Inc

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.1 Hanwha Techwin Co Ltd

List of Figures

- Figure 1: Japan Access Control Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Access Control Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Access Control Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Japan Access Control Market Volume Million Forecast, by Type 2020 & 2033

- Table 3: Japan Access Control Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Japan Access Control Market Volume Million Forecast, by End-user Vertical 2020 & 2033

- Table 5: Japan Access Control Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Japan Access Control Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Japan Access Control Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Japan Access Control Market Volume Million Forecast, by Type 2020 & 2033

- Table 9: Japan Access Control Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 10: Japan Access Control Market Volume Million Forecast, by End-user Vertical 2020 & 2033

- Table 11: Japan Access Control Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Japan Access Control Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Access Control Market?

The projected CAGR is approximately 7.91%.

2. Which companies are prominent players in the Japan Access Control Market?

Key companies in the market include Hanwha Techwin Co Ltd, Thales Group (Gemalto NV), Bosch Security System Inc, HID Global Corporation, Honeywell International Inc, Tyco International PLC (Johnson Controls), Allegion PLC, ASSA ABLOY AB Group, Schneider Electric SE, Panasonic Corporation, Brivo Systems LLC, Identiv Inc, Dormakaba Holding AG, NEC Corporation, Idemia Group, Axis Communications AB, Dahua Technology, Genetec Inc, BioConnect Inc.

3. What are the main segments of the Japan Access Control Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 640 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Access Control Systems owing to Rising Crime Rates and Threats; Technological Advancements.

6. What are the notable trends driving market growth?

The Smart Card Segment is Expected to Register Significant Growth in the Market.

7. Are there any restraints impacting market growth?

Growing Adoption of Access Control Systems owing to Rising Crime Rates and Threats; Technological Advancements.

8. Can you provide examples of recent developments in the market?

April 2024: ASSA ABLOY launched Centrios, a mobile-first access control business within the company, to provide small businesses with advanced mobile-first access control solutions. Centrios offers distributors, integrators, locksmiths, and security professionals the opportunity to grow their businesses through a thoughtful partnership program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Access Control Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Access Control Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Access Control Market?

To stay informed about further developments, trends, and reports in the Japan Access Control Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence