Key Insights

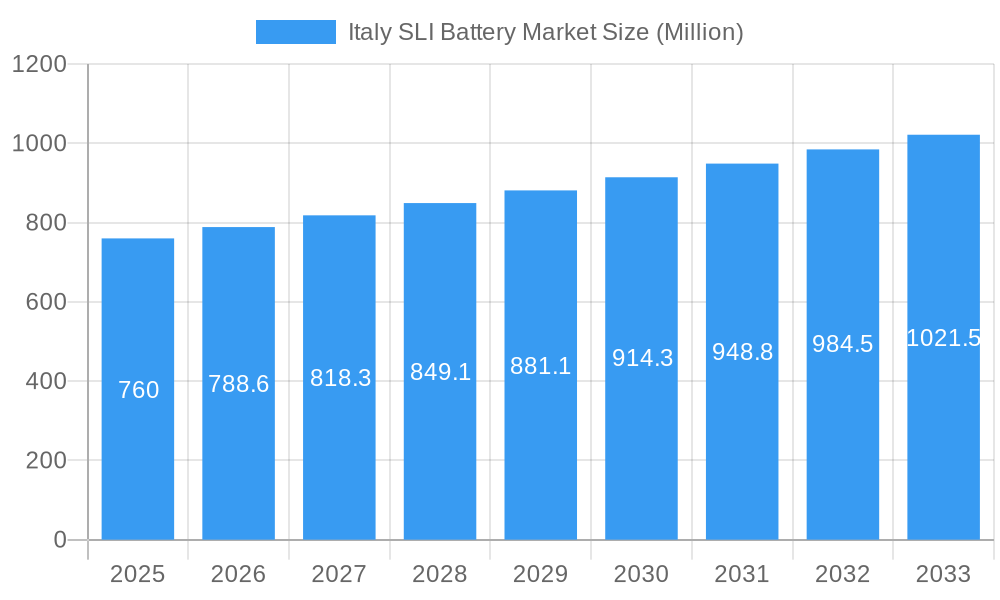

The Italy SLI (Starting, Lighting, and Ignition) battery market, valued at €760 million in 2025, is projected to experience steady growth, driven by the increasing demand for vehicles and replacement batteries. A Compound Annual Growth Rate (CAGR) of 3.67% from 2025 to 2033 indicates a consistent expansion, reaching an estimated €1.04 billion by 2033. This growth is fueled by several factors, including the rising number of vehicle registrations, the increasing adoption of advanced automotive technologies requiring higher battery performance, and government initiatives promoting sustainable transportation. Key players like Sunlight Group, FAAM, and Exide Technologies are driving innovation and market competition, focusing on enhanced battery life, improved performance, and environmentally friendly solutions. While economic fluctuations could pose a restraint, the continuous replacement needs of the existing vehicle fleet and the growing demand for electric vehicles are likely to offset this factor to a large extent. The market is segmented by battery type (e.g., flooded, VRLA), vehicle type (cars, motorcycles, commercial vehicles), and distribution channel, offering diverse opportunities for market participants. Regional variations in demand exist, influenced by factors like economic conditions and infrastructure development within specific Italian regions. Further expansion is expected through technological advancements and the increased integration of smart grid technologies.

Italy SLI Battery Market Market Size (In Million)

The market's sustained growth trajectory is expected to be bolstered by ongoing advancements in SLI battery technology. The focus on improving energy density, extending lifespan, and developing more environmentally sustainable battery chemistries is likely to contribute significantly. Increased investment in R&D, coupled with collaboration between battery manufacturers and automotive companies, will further enhance the sophistication and capabilities of SLI batteries offered in the Italian market. The adoption of stricter emission regulations is also anticipated to indirectly drive demand for high-performance SLI batteries compatible with advanced engine management systems and start-stop functionalities. While potential supply chain disruptions remain a potential challenge, the overall outlook for the Italy SLI battery market remains optimistic, driven by robust automotive demand, technological advancements, and increasing focus on sustainable mobility solutions.

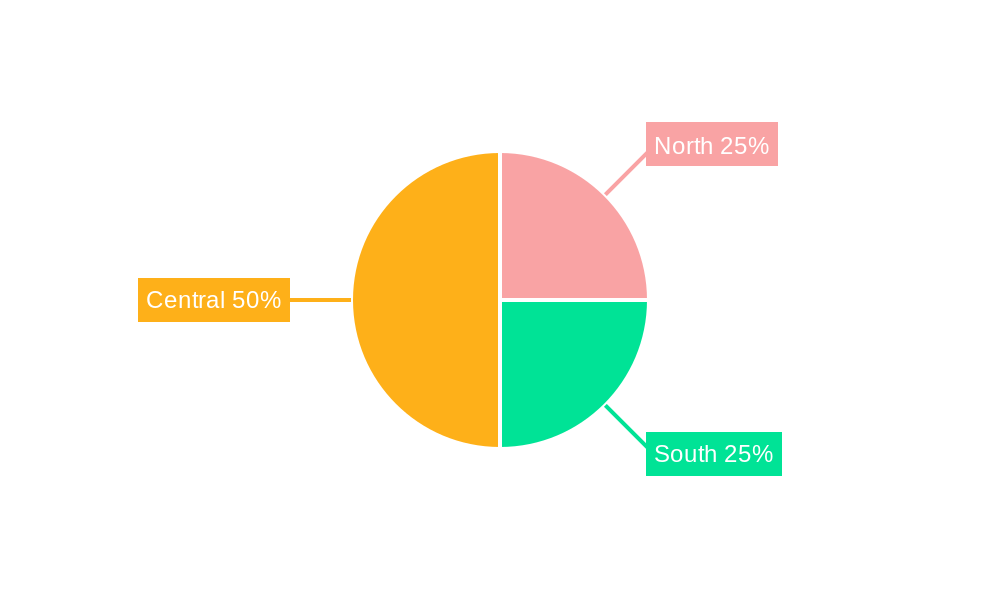

Italy SLI Battery Market Company Market Share

Italy SLI Battery Market: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the Italy SLI (Starting, Lighting, and Ignition) battery market, offering invaluable insights for stakeholders across the automotive, industrial, and energy sectors. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. The estimated market value in 2025 is xx Million, projected to reach xx Million by 2033, exhibiting a CAGR of xx%. This report includes a detailed competitive landscape analysis, highlighting key players and their market share, emerging trends, and future growth opportunities.

Italy SLI Battery Market Market Dynamics & Concentration

The Italian SLI battery market is characterized by a moderately concentrated landscape, with key players such as Sunlight Group, FAAM, Midac SpA, Accumulatori Ariete S R L, Exide Technologies, Johnson Controls, EnerSys, Leoch International Technology Limited Inc, C&D Technologies Inc, and Trojan Battery Company holding significant market share. However, several smaller players also contribute to the market's vibrancy. The market concentration ratio (CRx) is estimated at xx% in 2025.

- Innovation Drivers: Technological advancements in battery chemistry (e.g., lead-acid improvements, lithium-ion adoption) and enhanced energy density are driving market growth.

- Regulatory Framework: Stringent environmental regulations regarding lead-acid battery recycling and disposal are shaping industry practices. EU directives on battery waste management significantly influence the market.

- Product Substitutes: The emergence of advanced battery technologies like lithium-ion presents a challenge to traditional lead-acid SLI batteries, albeit with differing cost and application suitability.

- End-User Trends: The increasing demand for automobiles and industrial machinery fuels the market's growth. The shift toward electric and hybrid vehicles (though primarily impacting different battery segments) indirectly impacts SLI demand.

- M&A Activities: The past five years witnessed approximately xx M&A deals in the Italian SLI battery sector, primarily focused on consolidation and expansion into new markets. Market share acquisitions through M&A activities are influencing the market dynamics.

Italy SLI Battery Market Industry Trends & Analysis

The Italian SLI battery market exhibits a steady growth trajectory driven by several factors. The automotive sector, particularly the replacement market for traditional internal combustion engine vehicles, continues to be a major driver. The industrial sector, encompassing applications such as backup power systems and material handling equipment, contributes significantly. Technological advancements in lead-acid battery technology are leading to increased energy density and lifespan, enhancing market appeal. Furthermore, consumer preference for reliable and long-lasting batteries positively impacts market demand. The competitive dynamics are characterized by both price competition and innovation-led differentiation, with companies focusing on enhancing product features and service offerings.

Leading Markets & Segments in Italy SLI Battery Market

The Northern region of Italy dominates the SLI battery market, driven by factors such as:

- Strong Automotive Industry: The concentration of automotive manufacturers and suppliers in Northern Italy boosts demand for SLI batteries.

- Developed Industrial Base: A robust industrial infrastructure supports high demand across various sectors.

- Favorable Economic Conditions: Relatively stronger economic conditions in the region contribute to higher purchasing power.

The automotive segment holds the largest market share, followed by the industrial and motorcycle segments. The dominance of the automotive segment is directly linked to the large fleet of vehicles in Italy requiring periodic SLI battery replacements. The industrial segment's growth is attributed to the increasing adoption of material handling equipment and backup power systems across various industries.

Italy SLI Battery Market Product Developments

Recent product developments focus on improving energy density, extending battery lifespan, and enhancing performance under extreme temperature conditions. Manufacturers are focusing on advanced lead-acid technologies and improved manufacturing processes to create more efficient and durable batteries. These advancements enhance the competitiveness of SLI batteries against emerging alternatives while addressing environmental concerns.

Key Drivers of Italy SLI Battery Market Growth

Several key factors contribute to the growth of the Italy SLI battery market:

- Growing Vehicle Population: The expanding vehicle parc requires consistent battery replacements.

- Industrialization and Infrastructure Development: These factors fuel demand across various industrial applications.

- Government Incentives (if any): Government support for sustainable battery technologies, if available, can further drive growth.

Challenges in the Italy SLI Battery Market Market

The Italian SLI battery market faces certain challenges:

- Raw Material Prices: Fluctuations in lead prices impact production costs.

- Stringent Environmental Regulations: Compliance with stricter emission and recycling standards adds complexity.

- Competition from Alternative Technologies: The emergence of alternative battery technologies poses a long-term threat.

Emerging Opportunities in Italy SLI Battery Market

The Italian SLI battery market presents opportunities for growth through:

- Technological Advancements: Innovation in battery chemistry and design can lead to superior products.

- Strategic Partnerships: Collaborations between battery manufacturers and automotive/industrial companies can unlock new market segments.

- Expansion into Specialized Niches: Developing batteries for specific applications can create new revenue streams.

Leading Players in the Italy SLI Battery Market Sector

- Sunlight Group

- FAAM

- Midac SpA

- Accumulatori Ariete S R L

- Exide Technologies

- Johnson Controls

- EnerSys

- Leoch International Technology Limited Inc

- C&D Technologies Inc

- Trojan Battery Company

- List Not Exhaustive

Key Milestones in Italy SLI Battery Market Industry

- September 2023: Stellantis opened its USD 43 Million Battery Technology Center in Turin, significantly enhancing Italy's battery production capabilities.

- July 2024: Ferrari launched extended warranty programs for high-voltage SLI battery packs in its hybrid vehicles, impacting the demand for high-performance SLI batteries.

Strategic Outlook for Italy SLI Battery Market Market

The future of the Italian SLI battery market looks promising, with continued growth driven by the replacement market for existing vehicles and industrial applications. Technological advancements, strategic partnerships, and a focus on sustainable practices will be crucial for companies to thrive in this evolving market. Further research into next-generation battery technologies may also create new opportunities for growth and diversification.

Italy SLI Battery Market Segmentation

-

1. Type

- 1.1. Flooded Battery

- 1.2. VRLA Battery

- 1.3. EBF Battery

-

2. End-User

- 2.1. Automotive

- 2.2. Others

Italy SLI Battery Market Segmentation By Geography

- 1. Italy

Italy SLI Battery Market Regional Market Share

Geographic Coverage of Italy SLI Battery Market

Italy SLI Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Automotive Industry4.; Growing Adoption of Batteries in the Industrial Applications

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Automotive Industry4.; Growing Adoption of Batteries in the Industrial Applications

- 3.4. Market Trends

- 3.4.1. The Automotive Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy SLI Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flooded Battery

- 5.1.2. VRLA Battery

- 5.1.3. EBF Battery

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Automotive

- 5.2.2. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sunlight Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FAAM

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Midac SpA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Accumulatori Ariete S R L

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Exide Technologies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Johnson Controls

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 EnerSys

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Leoch International Technology Limited Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 C&D Technologies Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Trojan Battery Company*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sunlight Group

List of Figures

- Figure 1: Italy SLI Battery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Italy SLI Battery Market Share (%) by Company 2025

List of Tables

- Table 1: Italy SLI Battery Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Italy SLI Battery Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Italy SLI Battery Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Italy SLI Battery Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 5: Italy SLI Battery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Italy SLI Battery Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Italy SLI Battery Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Italy SLI Battery Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Italy SLI Battery Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: Italy SLI Battery Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 11: Italy SLI Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Italy SLI Battery Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy SLI Battery Market?

The projected CAGR is approximately 3.67%.

2. Which companies are prominent players in the Italy SLI Battery Market?

Key companies in the market include Sunlight Group, FAAM, Midac SpA, Accumulatori Ariete S R L, Exide Technologies, Johnson Controls, EnerSys, Leoch International Technology Limited Inc, C&D Technologies Inc, Trojan Battery Company*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi.

3. What are the main segments of the Italy SLI Battery Market?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.76 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Automotive Industry4.; Growing Adoption of Batteries in the Industrial Applications.

6. What are the notable trends driving market growth?

The Automotive Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Growing Automotive Industry4.; Growing Adoption of Batteries in the Industrial Applications.

8. Can you provide examples of recent developments in the market?

July 2024: Ferrari, renowned for its luxury sports cars, introduced two novel warranty extension programs. Under the 'Warranty Extension Hybrid' and 'Power Hybrid' initiatives, Ferrari offers owners the opportunity to replace the high-voltage SLI battery packs (HVB) in the eighth and 16th year of their vehicle's lifespan. These SLI batteries are crucial for the vehicle's electrical system, ensuring reliable starting, lighting, and ignition functions.September 2023: Stellantis marked a significant milestone with the inauguration of its inaugural Battery Technology Center, situated at the Mirafiori complex in Turin, Italy. This cutting-edge facility, backed by a USD 43 million investment, bolstered Stellantis' prowess in crafting and testing battery packs, modules, high-voltage cells, and software tailored for their upcoming vehicle lineup. It stands as Italy's largest and ranks among Europe's premier facilities of its kind.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy SLI Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy SLI Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy SLI Battery Market?

To stay informed about further developments, trends, and reports in the Italy SLI Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence