Key Insights

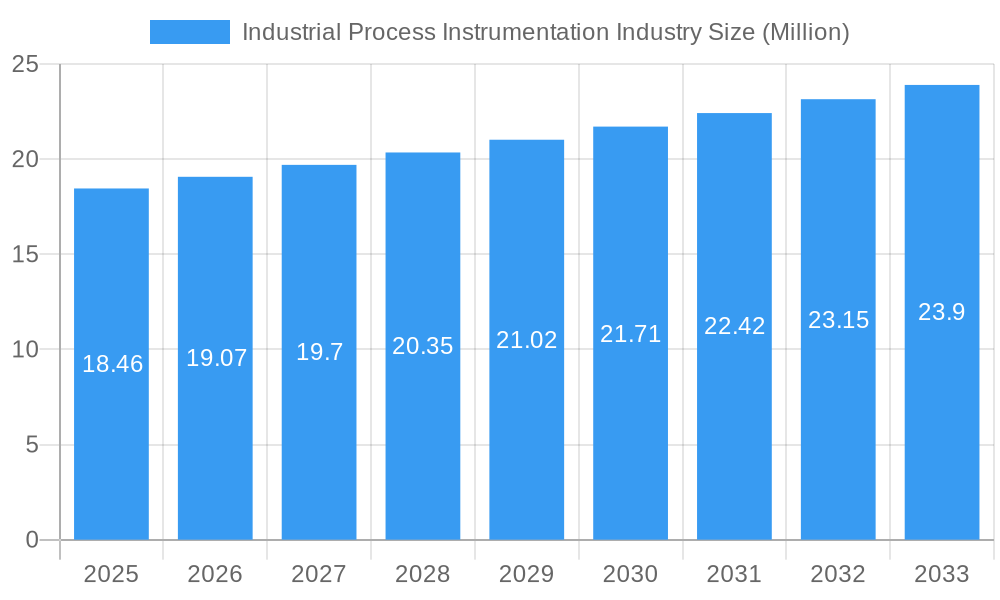

The Industrial Process Instrumentation market is projected to reach a substantial USD 18.46 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 3.35% through 2033. This sustained expansion is primarily driven by the increasing demand for automation and digital transformation across various process industries. Key growth catalysts include the imperative for enhanced operational efficiency, stringent regulatory compliance, and the growing need for real-time data analytics to optimize production processes. The integration of advanced technologies like Programmable Logic Controllers (PLCs), Distributed Control Systems (DCS), Supervisory Control and Data Acquisition (SCADA) systems, and Manufacturing Execution Systems (MES) is pivotal in meeting these demands. Furthermore, the continuous upgrade of existing infrastructure and the development of new industrial facilities worldwide are significant contributors to market momentum. The sector is witnessing a strong trend towards smart instrumentation, the Industrial Internet of Things (IIoT), and predictive maintenance solutions, all aimed at minimizing downtime and maximizing output.

Industrial Process Instrumentation Industry Market Size (In Million)

The market is segmented into key instruments such as Transmitters and Control Valves, with significant adoption of technologies including PLCs, DCS, SCADA, and MES. Leading end-user industries like Water and Wastewater Treatment, Chemical Manufacturing, Energy & Utilities, and Oil and Gas Extraction are at the forefront of adopting these advanced instrumentation solutions. The Oil and Gas sector, in particular, continues to be a major consumer, driven by the need for precise monitoring and control in exploration, production, and refining processes. Emerging economies in the Asia Pacific region are anticipated to experience the highest growth rates due to rapid industrialization and increasing investments in infrastructure development. While the market presents immense opportunities, challenges such as the high initial investment cost for sophisticated instrumentation, cybersecurity concerns with connected systems, and the need for skilled personnel to operate and maintain these technologies, are factors that require strategic consideration by market players. However, the overarching benefits of improved safety, enhanced product quality, and reduced environmental impact are propelling widespread adoption, ensuring a positive growth trajectory for the Industrial Process Instrumentation industry.

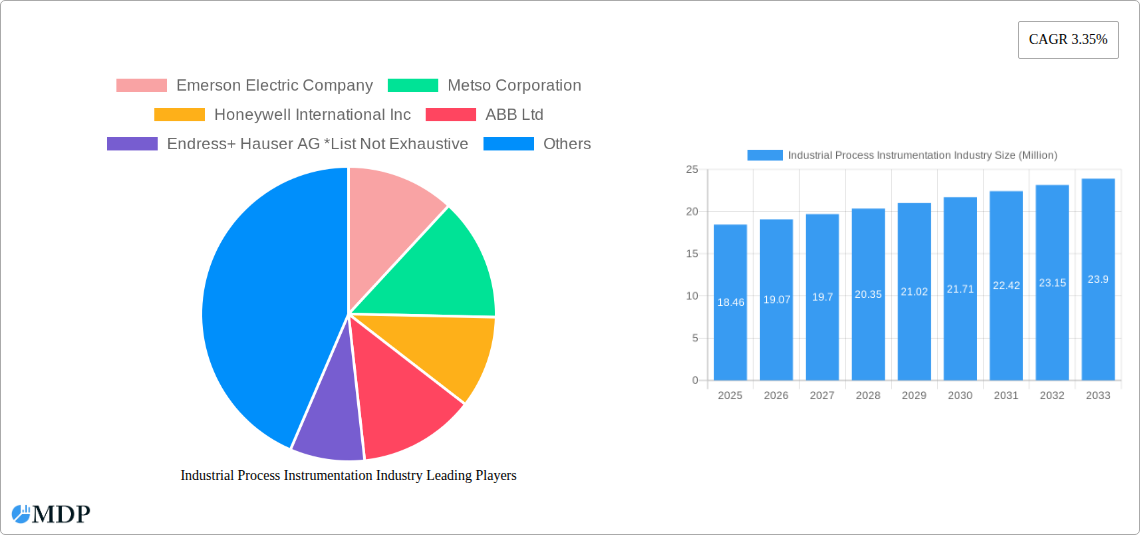

Industrial Process Instrumentation Industry Company Market Share

Industrial Process Instrumentation Industry: Comprehensive Market Analysis and Growth Forecast (2019-2033)

Gain unparalleled insights into the Industrial Process Instrumentation Industry, a critical sector driving efficiency and safety across global manufacturing and resource extraction. This comprehensive report, covering the Study Period: 2019–2033, with a Base Year: 2025, Estimated Year: 2025, and Forecast Period: 2025–2033, delves deep into market dynamics, technological advancements, and future growth trajectories. Discover the intricate interplay of Transmitters, Control Valves, PLCs, DCS, SCADA, and MES systems, and understand their impact on key end-user industries like Water and Wastewater Treatment, Chemical Manufacturing, Energy & Utilities, Oil and Gas Extraction, and Metals and Mining. Uncover the strategies of leading players and identify the lucrative opportunities shaping the future of process control. This report is essential for industry leaders, investors, and stakeholders seeking to navigate and capitalize on the evolving landscape of industrial automation.

Industrial Process Instrumentation Industry Market Dynamics & Concentration

The Industrial Process Instrumentation Industry exhibits a moderate to high concentration, with key players like Emerson Electric Company, Honeywell International Inc, Siemens AG, and ABB Ltd holding significant market shares. The industry is propelled by continuous innovation, driven by the demand for enhanced efficiency, safety, and sustainability in industrial operations. Regulatory frameworks, particularly concerning environmental protection and operational safety, play a crucial role in shaping market trends and product development. Product substitutes, while present in some basic instrumentation, are largely overcome by the specialized nature and integrated solutions offered by advanced process instrumentation. End-user trends are increasingly focused on digitalization, predictive maintenance, and data analytics, leading to a higher adoption of smart and connected devices. Mergers and acquisitions (M&A) activity, with approximately 5-10 significant deals annually during the historical period, are strategic moves by major corporations to expand their product portfolios, technological capabilities, and geographical reach. The market share of the top 5 players is estimated to be around 60-70%.

Industrial Process Instrumentation Industry Industry Trends & Analysis

The Industrial Process Instrumentation Industry is poised for robust growth, driven by several key factors. The escalating adoption of Industry 4.0 and the Industrial Internet of Things (IIoT) is a primary catalyst, fostering the demand for intelligent sensors, smart transmitters, and integrated control systems that enable real-time data acquisition and analysis. The continuous drive for operational efficiency and cost reduction across various end-user sectors, including Chemical Manufacturing and Energy & Utilities, further fuels the market. Technological disruptions, such as advancements in artificial intelligence (AI) for predictive maintenance and process optimization, wireless sensor technologies, and advanced analytics platforms, are transforming the capabilities of process instrumentation. Consumer preferences are shifting towards solutions that offer greater accuracy, reliability, remote monitoring, and ease of integration. The competitive dynamics are characterized by intense innovation, strategic partnerships, and a focus on providing end-to-end solutions. The global market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 6-8% during the forecast period. Market penetration of advanced instrumentation, particularly in developing economies, is projected to rise significantly, reaching an estimated 75-85% by 2033 for critical applications.

Leading Markets & Segments in Industrial Process Instrumentation Industry

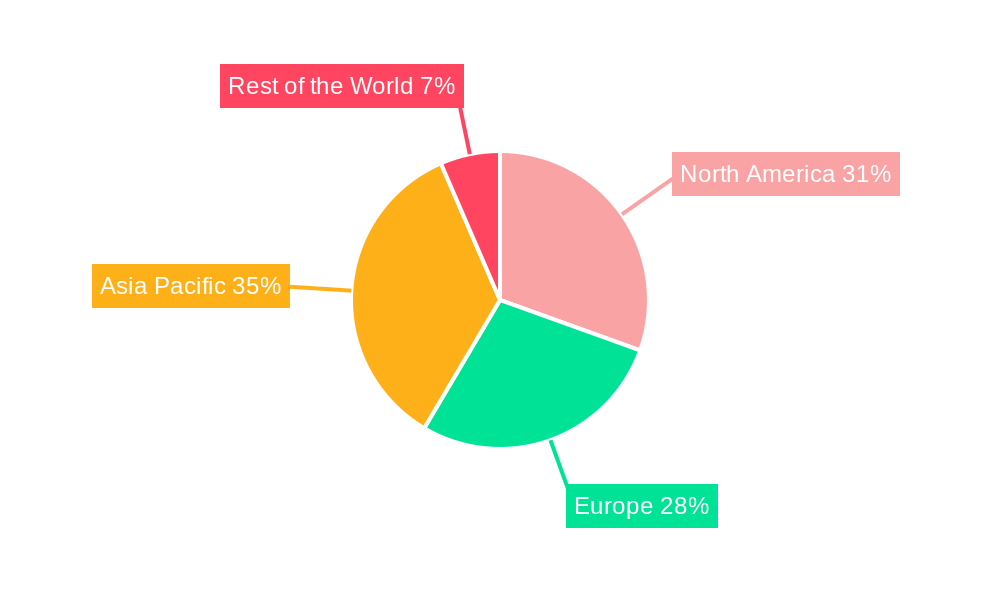

North America, particularly the United States, currently dominates the Industrial Process Instrumentation Industry, owing to its advanced manufacturing infrastructure and high adoption rates of automation technologies. However, the Asia-Pacific region, driven by rapid industrialization and significant investments in Energy & Utilities and Chemical Manufacturing, is emerging as the fastest-growing market.

Instrument: Transmitter

- Key Drivers: Increased demand for precise measurement of process variables such as pressure, temperature, flow, and level is crucial. The proliferation of smart sensors with enhanced communication protocols like HART and Foundation Fieldbus is a significant growth driver.

- Dominance Analysis: Transmitters form the foundational layer of any process control system. Their widespread application across all end-user industries ensures a consistently high demand. Technological advancements in wireless transmitters and those incorporating AI for self-diagnostics are expanding their market reach.

Instrument: Control Valve

- Key Drivers: The need for precise regulation of fluid and gas flow in complex industrial processes is paramount. Advancements in digital valve positioners and smart control valves offer improved accuracy, faster response times, and enhanced diagnostic capabilities.

- Dominance Analysis: Control valves are integral to maintaining process stability and efficiency. Their critical role in sectors like Oil and Gas Extraction and Chemical Manufacturing ensures sustained market demand. The development of modular and easily maintainable control valves is a key trend.

Technology: Programmable Logic Controller (PLC)

- Key Drivers: PLCs are the backbone of discrete and batch automation, enabling flexible and efficient control of machinery and processes. The increasing complexity of manufacturing operations and the need for faster production cycles drive PLC adoption.

- Dominance Analysis: PLCs are indispensable in various industrial settings, from assembly lines to complex chemical processes. Their scalability and ability to integrate with other control systems contribute to their widespread use.

Technology: Distributed Control System (DCS)

- Key Drivers: DCS provides centralized control and monitoring for large-scale and complex industrial plants, offering enhanced system integration and reliability. The growing emphasis on process optimization and safety in continuous process industries fuels DCS demand.

- Dominance Analysis: DCS is critical for maintaining operational integrity in sectors such as Energy & Utilities and Chemical Manufacturing. Its ability to manage intricate processes and ensure system-wide coordination makes it a preferred choice for large facilities.

Technology: Supervisory Control and Data Acquisition (SCADA)

- Key Drivers: SCADA systems enable remote monitoring and control of geographically dispersed assets, making them vital for industries like Energy & Utilities and Water and Wastewater Treatment. The increasing need for real-time data for decision-making drives SCADA adoption.

- Dominance Analysis: SCADA's capability to oversee widespread operations and gather critical performance data is essential for industries with distributed infrastructure. Its role in enhancing operational efficiency and preventing downtime is a key growth factor.

Technology: Manufacturing Execution System (MES)

- Key Drivers: MES bridges the gap between enterprise resource planning (ERP) and shop floor control, optimizing production processes, managing resources, and ensuring quality control. The drive towards smart manufacturing and digital transformation makes MES increasingly important.

- Dominance Analysis: MES is crucial for improving manufacturing agility and responsiveness. Its ability to track production in real-time, manage work-in-progress, and ensure compliance makes it vital for the Chemical Manufacturing and Metals and Mining sectors.

End-User: Water and Wastewater Treatment

- Key Drivers: Stringent environmental regulations and the growing global demand for clean water are significant drivers. Process instrumentation ensures efficient operation of treatment plants, accurate monitoring of water quality, and compliance with discharge standards.

- Dominance Analysis: This sector presents a stable and growing demand for process instrumentation due to its essential nature and increasing focus on sustainability and resource management.

End-User: Chemical Manufacturing

- Key Drivers: The chemical industry relies heavily on precise control of complex reactions and hazardous materials. Process instrumentation is vital for ensuring product quality, operational safety, and environmental compliance.

- Dominance Analysis: This is a major end-user segment due to the inherent complexity and stringent safety requirements of chemical processes. Automation and advanced instrumentation are key to maintaining efficiency and mitigating risks.

End-User: Energy & Utilities

- Key Drivers: The demand for reliable and efficient energy generation and distribution drives the adoption of process instrumentation. Monitoring and control of power plants, grid management, and renewable energy integration require sophisticated instrumentation.

- Dominance Analysis: This sector is a substantial market for process instrumentation, with a continuous need for reliable and accurate measurement and control to ensure power supply and operational safety.

End-User: Oil and Gas Extraction

- Key Drivers: The exploration, extraction, and refining of oil and gas involve highly demanding environments and critical safety considerations. Process instrumentation is essential for monitoring wellhead pressure, flow rates, and ensuring safe operations.

- Dominance Analysis: This sector represents a significant market, driven by the need for robust and reliable instrumentation in harsh conditions and for optimizing production and safety.

End-User: Metals and Mining

- Key Drivers: Process instrumentation plays a crucial role in optimizing mineral processing, ensuring accurate material flow, and monitoring environmental parameters in mining operations.

- Dominance Analysis: While sometimes overlooked, this sector presents a steady demand for instrumentation, particularly in areas like bulk material handling, flotation processes, and environmental monitoring.

Other Process Industries

- Key Drivers: This broad category includes sectors like pharmaceuticals, food and beverage, pulp and paper, and automotive manufacturing, all of which utilize process instrumentation to enhance efficiency and quality.

- Dominance Analysis: The diversity of this segment offers continuous opportunities for customized instrumentation solutions, contributing to the overall market growth.

Industrial Process Instrumentation Industry Product Developments

Recent product innovations in the Industrial Process Instrumentation Industry focus on enhanced connectivity, intelligence, and ease of use. The development of Guided Wave Radar Position Transmitters with Power over Ethernet (PoE) by Hawk Measurement Systems signifies a trend towards integrated power and data transmission, simplifying installation and reducing costs. SymphonyAI Industrial's AI-powered MOM 360 solution exemplifies the integration of Manufacturing Execution Systems (MES) with artificial intelligence for advanced workflow optimization and data-driven decision-making, aligning with Industry 4.0 objectives. AMETEK Process Instruments' launch of a novel e-commerce platform demonstrates a commitment to customer accessibility and streamlined purchasing processes. Parker Hannifin's EP Series Pro-Bloc instrument valves, complying with EEMUA 182 standards and featuring dual block and bleed functionality, highlight advancements in safety and reliability for valve applications. These developments underscore a market shift towards smart, interconnected, and user-friendly instrumentation solutions.

Key Drivers of Industrial Process Instrumentation Industry Growth

Several key factors are propelling the growth of the Industrial Process Instrumentation Industry. The pervasive adoption of Industry 4.0 and IIoT technologies necessitates sophisticated sensors and control systems for data acquisition and analytics. Increasing global demand for efficient and sustainable industrial processes across sectors like Energy & Utilities and Chemical Manufacturing fuels investment in automation. Stringent regulatory mandates for safety and environmental compliance compel industries to deploy advanced instrumentation for accurate monitoring and control. Furthermore, the continuous pursuit of operational efficiency and cost optimization by businesses worldwide drives the adoption of intelligent and integrated instrumentation solutions, leading to enhanced productivity and reduced waste.

Challenges in the Industrial Process Instrumentation Industry Market

The Industrial Process Instrumentation Industry faces several challenges that can restrain growth. Evolving and complex regulatory landscapes across different regions can create compliance hurdles and increase development costs. Supply chain disruptions, exacerbated by geopolitical factors and material shortages, can impact production timelines and product availability. Intense competition among established players and emerging technology providers can lead to price pressures and reduced profit margins. Furthermore, the need for specialized skills for installation, maintenance, and integration of advanced instrumentation can create workforce development challenges for end-users, potentially slowing adoption.

Emerging Opportunities in Industrial Process Instrumentation Industry

The Industrial Process Instrumentation Industry is ripe with emerging opportunities. The accelerating digital transformation across all industrial sectors, particularly the embrace of AI and machine learning for predictive maintenance and process optimization, presents a significant growth avenue. The increasing focus on sustainability and circular economy principles drives demand for instrumentation that enables precise resource management and emissions monitoring. Strategic partnerships between instrumentation manufacturers and software providers are creating integrated solutions that offer enhanced data analytics and cloud-based services. Furthermore, the expansion of industrial automation in emerging economies, coupled with government initiatives promoting smart manufacturing, opens new markets and application areas.

Leading Players in the Industrial Process Instrumentation Industry Sector

- Emerson Electric Company

- Metso Corporation

- Honeywell International Inc

- ABB Ltd

- Endress+Hauser AG

- Mitsubishi Electric Corporation

- Siemens AG

- Danaher Corporation

- Omron Corporation

- Rockwell Automation Inc

- Yokogawa Electric Corporation

Key Milestones in Industrial Process Instrumentation Industry Industry

- July 2022 - Hawk Measurement Systems (HAWK) introduced the industry's first Guided Wave Radar Position Transmitter with Power through Ethernet communications.

- May 2022 - SymphonyAI Industrial launched its AI-incorporated MOM 360 manufacturing operations management solution, featuring integrated MES capabilities and AI-based workflow optimization for Industry 4.0 objectives.

- March 2022 - AMETEK Process Instruments launched a novel e-commerce platform for its US market, allowing online purchasing of its equipment.

- January 2022 - Parker Hannifin introduced its EP Series Pro-Bloc instrument valves, fully compliant with EEMUA 182, featuring dual block and bleed functionality.

Strategic Outlook for Industrial Process Instrumentation Industry Market

The strategic outlook for the Industrial Process Instrumentation Industry is exceptionally positive, driven by ongoing technological advancements and increasing industrial automation. The integration of AI, machine learning, and IIoT will continue to be a primary growth accelerator, enabling predictive analytics and smart process control. The growing emphasis on sustainability and regulatory compliance will further drive demand for precision instrumentation in Water and Wastewater Treatment and Energy & Utilities. Strategic partnerships focused on developing integrated hardware and software solutions, alongside market expansion into emerging economies, will be critical for sustained growth and capturing new opportunities. The industry is well-positioned to capitalize on the global drive towards more efficient, safe, and intelligent industrial operations.

Industrial Process Instrumentation Industry Segmentation

-

1. Instrument

- 1.1. Transmitter

- 1.2. Control Valve

-

2. Technology

- 2.1. Programmable Logic Controller (PLC)

- 2.2. Distributed Control System (DCS)

- 2.3. Supervisory Control and Data Acquisition (SCADA)

- 2.4. Manufacturing Execution System (MES)

-

3. End-User

- 3.1. Water and Wastewater Treatment

- 3.2. Chemical Manufacturing

- 3.3. Energy & Utilities

- 3.4. Oil and Gas Extraction

- 3.5. Metals and Mining

- 3.6. Other Process Industries

Industrial Process Instrumentation Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Industrial Process Instrumentation Industry Regional Market Share

Geographic Coverage of Industrial Process Instrumentation Industry

Industrial Process Instrumentation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for energy-efficient production processes; High level of efficiency with minimum cost

- 3.3. Market Restrains

- 3.3.1. Higher cost of research and development; Higher cost of implementation and maintenance of solutions and devices

- 3.4. Market Trends

- 3.4.1. Water and Wastewater Treatment is Expected to Witness the Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Process Instrumentation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Instrument

- 5.1.1. Transmitter

- 5.1.2. Control Valve

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Programmable Logic Controller (PLC)

- 5.2.2. Distributed Control System (DCS)

- 5.2.3. Supervisory Control and Data Acquisition (SCADA)

- 5.2.4. Manufacturing Execution System (MES)

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Water and Wastewater Treatment

- 5.3.2. Chemical Manufacturing

- 5.3.3. Energy & Utilities

- 5.3.4. Oil and Gas Extraction

- 5.3.5. Metals and Mining

- 5.3.6. Other Process Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Instrument

- 6. North America Industrial Process Instrumentation Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Instrument

- 6.1.1. Transmitter

- 6.1.2. Control Valve

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Programmable Logic Controller (PLC)

- 6.2.2. Distributed Control System (DCS)

- 6.2.3. Supervisory Control and Data Acquisition (SCADA)

- 6.2.4. Manufacturing Execution System (MES)

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Water and Wastewater Treatment

- 6.3.2. Chemical Manufacturing

- 6.3.3. Energy & Utilities

- 6.3.4. Oil and Gas Extraction

- 6.3.5. Metals and Mining

- 6.3.6. Other Process Industries

- 6.1. Market Analysis, Insights and Forecast - by Instrument

- 7. Europe Industrial Process Instrumentation Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Instrument

- 7.1.1. Transmitter

- 7.1.2. Control Valve

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Programmable Logic Controller (PLC)

- 7.2.2. Distributed Control System (DCS)

- 7.2.3. Supervisory Control and Data Acquisition (SCADA)

- 7.2.4. Manufacturing Execution System (MES)

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Water and Wastewater Treatment

- 7.3.2. Chemical Manufacturing

- 7.3.3. Energy & Utilities

- 7.3.4. Oil and Gas Extraction

- 7.3.5. Metals and Mining

- 7.3.6. Other Process Industries

- 7.1. Market Analysis, Insights and Forecast - by Instrument

- 8. Asia Pacific Industrial Process Instrumentation Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Instrument

- 8.1.1. Transmitter

- 8.1.2. Control Valve

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Programmable Logic Controller (PLC)

- 8.2.2. Distributed Control System (DCS)

- 8.2.3. Supervisory Control and Data Acquisition (SCADA)

- 8.2.4. Manufacturing Execution System (MES)

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Water and Wastewater Treatment

- 8.3.2. Chemical Manufacturing

- 8.3.3. Energy & Utilities

- 8.3.4. Oil and Gas Extraction

- 8.3.5. Metals and Mining

- 8.3.6. Other Process Industries

- 8.1. Market Analysis, Insights and Forecast - by Instrument

- 9. Rest of the World Industrial Process Instrumentation Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Instrument

- 9.1.1. Transmitter

- 9.1.2. Control Valve

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Programmable Logic Controller (PLC)

- 9.2.2. Distributed Control System (DCS)

- 9.2.3. Supervisory Control and Data Acquisition (SCADA)

- 9.2.4. Manufacturing Execution System (MES)

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Water and Wastewater Treatment

- 9.3.2. Chemical Manufacturing

- 9.3.3. Energy & Utilities

- 9.3.4. Oil and Gas Extraction

- 9.3.5. Metals and Mining

- 9.3.6. Other Process Industries

- 9.1. Market Analysis, Insights and Forecast - by Instrument

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Emerson Electric Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Metso Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Honeywell International Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 ABB Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Endress+ Hauser AG *List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mitsubishi Electric Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Siemens AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Danaher Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Omron Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Rockwell Automation Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Yokogawa Electric Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Emerson Electric Company

List of Figures

- Figure 1: Global Industrial Process Instrumentation Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Industrial Process Instrumentation Industry Revenue (Million), by Instrument 2025 & 2033

- Figure 3: North America Industrial Process Instrumentation Industry Revenue Share (%), by Instrument 2025 & 2033

- Figure 4: North America Industrial Process Instrumentation Industry Revenue (Million), by Technology 2025 & 2033

- Figure 5: North America Industrial Process Instrumentation Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Industrial Process Instrumentation Industry Revenue (Million), by End-User 2025 & 2033

- Figure 7: North America Industrial Process Instrumentation Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America Industrial Process Instrumentation Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Industrial Process Instrumentation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Industrial Process Instrumentation Industry Revenue (Million), by Instrument 2025 & 2033

- Figure 11: Europe Industrial Process Instrumentation Industry Revenue Share (%), by Instrument 2025 & 2033

- Figure 12: Europe Industrial Process Instrumentation Industry Revenue (Million), by Technology 2025 & 2033

- Figure 13: Europe Industrial Process Instrumentation Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Europe Industrial Process Instrumentation Industry Revenue (Million), by End-User 2025 & 2033

- Figure 15: Europe Industrial Process Instrumentation Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 16: Europe Industrial Process Instrumentation Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Industrial Process Instrumentation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Industrial Process Instrumentation Industry Revenue (Million), by Instrument 2025 & 2033

- Figure 19: Asia Pacific Industrial Process Instrumentation Industry Revenue Share (%), by Instrument 2025 & 2033

- Figure 20: Asia Pacific Industrial Process Instrumentation Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Asia Pacific Industrial Process Instrumentation Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Asia Pacific Industrial Process Instrumentation Industry Revenue (Million), by End-User 2025 & 2033

- Figure 23: Asia Pacific Industrial Process Instrumentation Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Asia Pacific Industrial Process Instrumentation Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Industrial Process Instrumentation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Industrial Process Instrumentation Industry Revenue (Million), by Instrument 2025 & 2033

- Figure 27: Rest of the World Industrial Process Instrumentation Industry Revenue Share (%), by Instrument 2025 & 2033

- Figure 28: Rest of the World Industrial Process Instrumentation Industry Revenue (Million), by Technology 2025 & 2033

- Figure 29: Rest of the World Industrial Process Instrumentation Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Rest of the World Industrial Process Instrumentation Industry Revenue (Million), by End-User 2025 & 2033

- Figure 31: Rest of the World Industrial Process Instrumentation Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Rest of the World Industrial Process Instrumentation Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Industrial Process Instrumentation Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Instrument 2020 & 2033

- Table 2: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Instrument 2020 & 2033

- Table 6: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 7: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Instrument 2020 & 2033

- Table 10: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 11: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Instrument 2020 & 2033

- Table 14: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 15: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 16: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Instrument 2020 & 2033

- Table 18: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 19: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 20: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Process Instrumentation Industry?

The projected CAGR is approximately 3.35%.

2. Which companies are prominent players in the Industrial Process Instrumentation Industry?

Key companies in the market include Emerson Electric Company, Metso Corporation, Honeywell International Inc, ABB Ltd, Endress+ Hauser AG *List Not Exhaustive, Mitsubishi Electric Corporation, Siemens AG, Danaher Corporation, Omron Corporation, Rockwell Automation Inc, Yokogawa Electric Corporation.

3. What are the main segments of the Industrial Process Instrumentation Industry?

The market segments include Instrument, Technology , End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for energy-efficient production processes; High level of efficiency with minimum cost.

6. What are the notable trends driving market growth?

Water and Wastewater Treatment is Expected to Witness the Highest Growth.

7. Are there any restraints impacting market growth?

Higher cost of research and development; Higher cost of implementation and maintenance of solutions and devices.

8. Can you provide examples of recent developments in the market?

July 2022 - Hawk Measurement Systems (HAWK), a pioneer in positioning, level, asset monitoring, and fiber optical monitoring systems, created the industry's first Guided Wave Radar Position Transmitter with Power through Ethernet communications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Process Instrumentation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Process Instrumentation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Process Instrumentation Industry?

To stay informed about further developments, trends, and reports in the Industrial Process Instrumentation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence