Key Insights

The Industrial Direct Radiography (IDR) market is poised for substantial expansion, driven by the critical need for non-destructive testing (NDT) across diverse industries. With a projected Compound Annual Growth Rate (CAGR) of 7.9% from 2025 to 2033, the market is estimated to reach 0.8 billion by the end of the forecast period. Key growth catalysts include stringent quality control mandates in sectors such as aerospace, healthcare, and petrochemicals, alongside the increasing adoption of advanced IDR technologies for superior defect detection. Technological innovations, enhancing image quality, processing speed, and operational efficiency, further propel this growth. While initial investment and skilled personnel requirements present challenges, the inherent benefits of IDR in ensuring product safety and reliability mitigate these concerns. The healthcare and aerospace sectors are prominent end-users, highlighting their commitment to rigorous safety standards. Leading companies are actively investing in research and development to maintain a competitive advantage. Geographically, North America and Europe currently dominate, with Asia Pacific anticipated to exhibit significant growth due to escalating industrialization and infrastructure development.

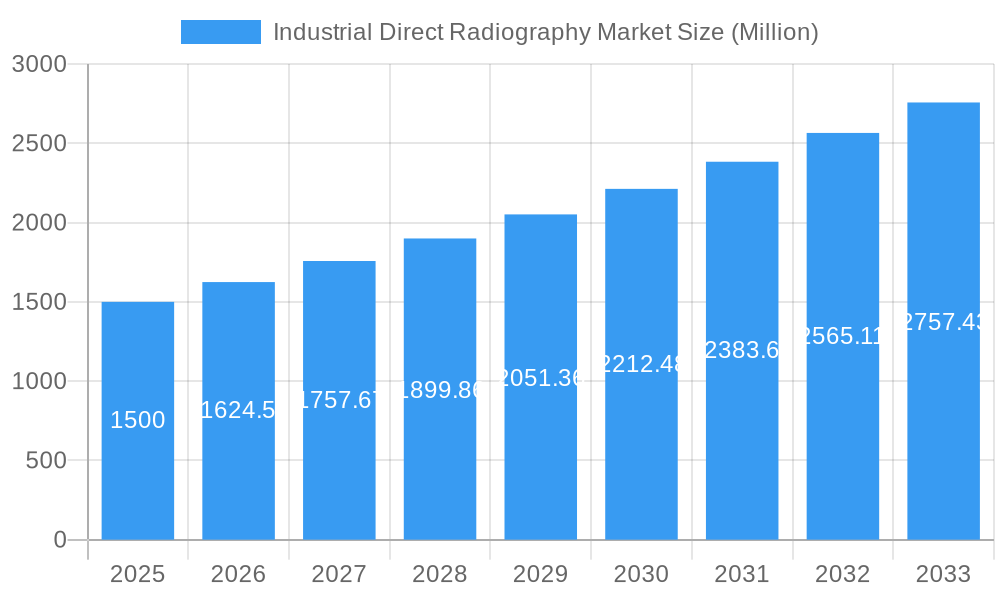

Industrial Direct Radiography Market Market Size (In Million)

The competitive arena features a mix of established and emerging companies. Industry leaders are pursuing strategic alliances and acquisitions, while new entrants are introducing innovative solutions to meet evolving market demands. The development of advanced digital radiography systems, sophisticated image analysis software, and comprehensive technician training programs will significantly shape the IDR market's future. Evolving government regulations and safety standards are driving compliance with stringent testing protocols and the utilization of certified equipment. The IDR market's outlook is highly positive, supported by sustained industrial expansion, continuous technological advancements, and an unwavering focus on product quality and safety across all sectors.

Industrial Direct Radiography Market Company Market Share

Industrial Direct Radiography Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Industrial Direct Radiography Market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report leverages rigorous research methodologies to provide actionable intelligence, projecting a market valued at xx Million by 2033. This report is essential for investors, industry professionals, and researchers seeking to understand current market dynamics and future growth potential.

Industrial Direct Radiography Market Market Dynamics & Concentration

The Industrial Direct Radiography market exhibits a moderately concentrated landscape, with key players such as NOVO DR Ltd, TWI Group Inc, Intertek Group Plc, Canon Inc, and Fujifilm Corporation holding significant market share. The market's dynamics are shaped by several factors:

- Innovation Drivers: Continuous advancements in detector technology, image processing software, and automation are driving market growth. The development of high-resolution, portable systems is increasing accessibility and applications.

- Regulatory Frameworks: Stringent safety regulations and quality control standards in various industries (aerospace, healthcare) are key drivers, mandating non-destructive testing (NDT) methods like direct radiography.

- Product Substitutes: While other NDT techniques exist (e.g., ultrasound), direct radiography maintains a strong position due to its high penetration capabilities and ability to detect internal flaws. However, competitive pressure from alternative methods remains a factor.

- End-User Trends: The growing demand for enhanced quality control and safety across industries, particularly in aerospace and healthcare, fuels market expansion. Increased infrastructure projects globally also contribute to higher demand.

- M&A Activities: The market has witnessed a moderate level of M&A activity in recent years, with xx mergers and acquisitions recorded between 2019 and 2024. This consolidation is expected to continue, shaping the competitive landscape. The market share of the top 5 players is estimated to be around xx%.

Industrial Direct Radiography Market Industry Trends & Analysis

The Industrial Direct Radiography market is experiencing robust growth, projected to achieve a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors:

The increasing adoption of advanced materials in various industries necessitates robust quality control measures, driving demand for direct radiography. Technological advancements, such as the introduction of digital radiography systems offering enhanced image quality and reduced processing time, are significantly impacting market penetration. Consumer preferences are shifting towards faster, more accurate, and efficient NDT techniques, further boosting the adoption of direct radiography. Intense competition among established players and emerging entrants is driving innovation and pushing prices down, making the technology more accessible across various sectors. The market penetration rate for direct radiography in the aerospace sector is estimated at xx%, while in the healthcare sector it stands at xx%.

Leading Markets & Segments in Industrial Direct Radiography Market

The Aerospace sector currently dominates the Industrial Direct Radiography market, followed closely by the Petrochemical and Healthcare sectors.

- Aerospace: Stringent safety regulations, the need for meticulous quality control in aircraft manufacturing, and the high cost of failure drive the high demand in this sector. Key drivers include:

- Robust government regulations and certifications.

- High capital expenditure in aerospace manufacturing.

- Technological advancements leading to sophisticated aircraft designs.

- Petrochemical: The need for regular inspections and maintenance of pipelines, storage tanks, and other critical infrastructure necessitates frequent use of direct radiography.

- Healthcare: Growing demand for advanced medical imaging techniques in orthopedics, dentistry and other specialized areas drives adoption, although the market share is smaller compared to aerospace and petrochemicals.

While North America and Europe currently hold the largest market share, the Asia-Pacific region is poised for significant growth due to rapid industrialization and infrastructure development.

Industrial Direct Radiography Market Product Developments

Recent product developments focus on enhancing image quality, portability, and automation. Digital direct radiography (DDR) systems are gaining significant traction, replacing traditional film-based methods. These systems offer superior image resolution, faster processing times, and reduced costs associated with film handling and development. Advances in detector technology, such as the use of flat-panel detectors, are further improving image quality and reducing exposure times. The integration of advanced image processing algorithms enhances the detection of subtle flaws, improving overall inspection accuracy.

Key Drivers of Industrial Direct Radiography Market Growth

Several factors drive the growth of the Industrial Direct Radiography market:

- Technological advancements: Improved image quality, faster processing times, and increased portability of digital systems.

- Stringent safety regulations: The need for reliable and accurate non-destructive testing (NDT) methods in various industries.

- Increasing demand for quality control: Growing awareness of the importance of quality control and safety across manufacturing and other sectors.

Challenges in the Industrial Direct Radiography Market Market

The market faces certain challenges:

- High initial investment costs: The purchase and implementation of advanced digital radiography systems can be expensive, particularly for smaller companies.

- Specialized expertise required: Operating and interpreting radiographic images requires skilled personnel, leading to potential labor shortages.

- Competition from alternative NDT methods: Ultrasonic testing and other NDT techniques present competition, particularly in certain applications.

Emerging Opportunities in Industrial Direct Radiography Market

Significant opportunities exist for market expansion:

The growing adoption of advanced materials and complex manufacturing processes will drive demand. Strategic partnerships between equipment manufacturers and service providers can create integrated solutions. Expansion into emerging markets in Asia and Africa presents significant potential for growth. Furthermore, the development of artificial intelligence (AI)-powered image analysis tools could automate inspection processes and improve efficiency.

Leading Players in the Industrial Direct Radiography Market Sector

Key Milestones in Industrial Direct Radiography Market Industry

- 2020: Introduction of a new portable digital radiography system by NOVO DR Ltd.

- 2022: Merger between two leading providers of radiographic equipment, resulting in increased market consolidation.

- 2023: Launch of AI-powered image analysis software by a major player, enhancing inspection efficiency.

- 2024: Adoption of new safety standards for direct radiography equipment in the aerospace industry.

Strategic Outlook for Industrial Direct Radiography Market Market

The future of the Industrial Direct Radiography market appears promising, driven by technological innovation, increasing regulatory stringency, and the expanding applications across various industries. Strategic partnerships, investments in R&D, and expansion into new geographical markets will be crucial for success. Companies that effectively leverage AI and automation in their products and services will gain a competitive edge. The market's long-term growth potential is significant, with opportunities for both established players and new entrants to capitalize on the rising demand for advanced non-destructive testing solutions.

Industrial Direct Radiography Market Segmentation

-

1. End-user Industry

- 1.1. Healthcare

- 1.2. Petrochemical

- 1.3. Aerospace

- 1.4. Chemical

- 1.5. Military

- 1.6. Construction

- 1.7. Other End-user Industries

Industrial Direct Radiography Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Industrial Direct Radiography Market Regional Market Share

Geographic Coverage of Industrial Direct Radiography Market

Industrial Direct Radiography Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Demand for Timelier

- 3.2.2 Safer and More Detailed Inspection is Helping in Market Expansion

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Equipment than Conventional Radiography is Discouraging the Market Growth

- 3.4. Market Trends

- 3.4.1. Healthcare to Witness the Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Direct Radiography Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Healthcare

- 5.1.2. Petrochemical

- 5.1.3. Aerospace

- 5.1.4. Chemical

- 5.1.5. Military

- 5.1.6. Construction

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America Industrial Direct Radiography Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Healthcare

- 6.1.2. Petrochemical

- 6.1.3. Aerospace

- 6.1.4. Chemical

- 6.1.5. Military

- 6.1.6. Construction

- 6.1.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. Europe Industrial Direct Radiography Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Healthcare

- 7.1.2. Petrochemical

- 7.1.3. Aerospace

- 7.1.4. Chemical

- 7.1.5. Military

- 7.1.6. Construction

- 7.1.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Asia Pacific Industrial Direct Radiography Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Healthcare

- 8.1.2. Petrochemical

- 8.1.3. Aerospace

- 8.1.4. Chemical

- 8.1.5. Military

- 8.1.6. Construction

- 8.1.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Latin America Industrial Direct Radiography Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Healthcare

- 9.1.2. Petrochemical

- 9.1.3. Aerospace

- 9.1.4. Chemical

- 9.1.5. Military

- 9.1.6. Construction

- 9.1.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East Industrial Direct Radiography Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Healthcare

- 10.1.2. Petrochemical

- 10.1.3. Aerospace

- 10.1.4. Chemical

- 10.1.5. Military

- 10.1.6. Construction

- 10.1.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 NOVO DR Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TWI Group Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intertek Group Plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Canon Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Applus Services SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Durr NDT GmbH & Co KG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Vidisco Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Koninklijke Philips N V

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fujifilm Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mistras Group Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 OR Technology

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Stanley Inspection

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 General Electric Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 NOVO DR Ltd

List of Figures

- Figure 1: Global Industrial Direct Radiography Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Industrial Direct Radiography Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 3: North America Industrial Direct Radiography Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: North America Industrial Direct Radiography Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Industrial Direct Radiography Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Industrial Direct Radiography Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 7: Europe Industrial Direct Radiography Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Europe Industrial Direct Radiography Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Industrial Direct Radiography Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Industrial Direct Radiography Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: Asia Pacific Industrial Direct Radiography Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific Industrial Direct Radiography Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Industrial Direct Radiography Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Industrial Direct Radiography Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: Latin America Industrial Direct Radiography Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Latin America Industrial Direct Radiography Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Industrial Direct Radiography Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Industrial Direct Radiography Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 19: Middle East Industrial Direct Radiography Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Middle East Industrial Direct Radiography Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East Industrial Direct Radiography Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Direct Radiography Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Industrial Direct Radiography Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Industrial Direct Radiography Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Industrial Direct Radiography Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Industrial Direct Radiography Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Industrial Direct Radiography Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Industrial Direct Radiography Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Industrial Direct Radiography Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Industrial Direct Radiography Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Industrial Direct Radiography Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Industrial Direct Radiography Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Industrial Direct Radiography Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Direct Radiography Market?

The projected CAGR is approximately 7.9%.

2. Which companies are prominent players in the Industrial Direct Radiography Market?

Key companies in the market include NOVO DR Ltd, TWI Group Inc, Intertek Group Plc, Canon Inc, Applus Services SA, Durr NDT GmbH & Co KG, Vidisco Ltd, Koninklijke Philips N V, Fujifilm Corporation, Mistras Group Inc, OR Technology, Stanley Inspection, General Electric Corporation.

3. What are the main segments of the Industrial Direct Radiography Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.8 billion as of 2022.

5. What are some drivers contributing to market growth?

; Demand for Timelier. Safer and More Detailed Inspection is Helping in Market Expansion.

6. What are the notable trends driving market growth?

Healthcare to Witness the Highest Growth.

7. Are there any restraints impacting market growth?

; High Cost of Equipment than Conventional Radiography is Discouraging the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Direct Radiography Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Direct Radiography Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Direct Radiography Market?

To stay informed about further developments, trends, and reports in the Industrial Direct Radiography Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence