Key Insights

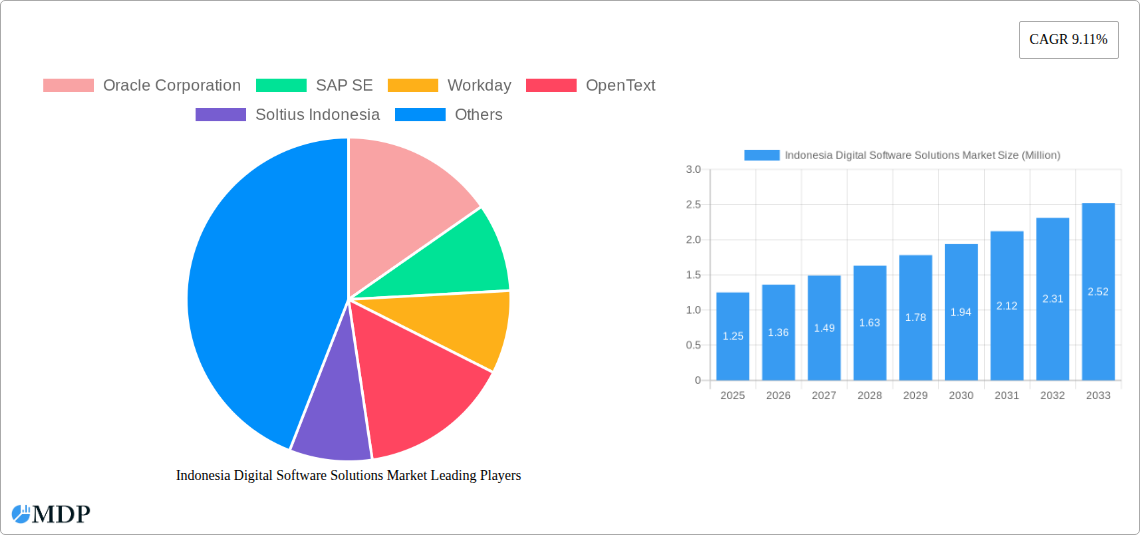

The Indonesian digital software solutions market is poised for significant expansion, with a projected market size of USD 1.25 million. This growth is driven by a robust Compound Annual Growth Rate (CAGR) of 9.11%, indicating a dynamic and evolving landscape for software adoption across various business functions. Key growth drivers within this market include the increasing demand for enhanced customer engagement through Customer Communication Management (CCM) and Customer Relationship Management (CRM) software, coupled with the necessity for streamlined operations via Workflow Management and Enterprise Resource Planning (ERP) solutions. Furthermore, the growing reliance on data-driven decision-making is fueling the adoption of Business Intelligence (BI) software. The market is segmented across diverse software types, with CCM, Workflow Management, ERP, and CRM likely to command substantial shares due to their direct impact on operational efficiency and customer satisfaction.

Indonesia Digital Software Solutions Market Market Size (In Million)

The competitive landscape is characterized by a mix of global software giants like Oracle, SAP, Workday, OpenText, and Salesforce, alongside local players such as Soltius Indonesia and Nintex, who are catering to the specific needs of the Indonesian market. Cloud deployment models are expected to dominate, offering scalability and cost-effectiveness, particularly for Small and Medium-sized Enterprises (SMEs) who are increasingly embracing digital transformation. Large enterprises also represent a significant segment, focusing on comprehensive solutions. The adoption of digital software solutions is widespread across critical industries in Indonesia, including Banking, Financial Services, and Insurance (BFSI), Information Technology (IT) and Telecom, Manufacturing, Healthcare, and Retail & E-commerce. This broad industry penetration underscores the foundational role of digital software in modernizing Indonesian businesses and driving economic progress, with robust growth anticipated throughout the forecast period of 2025-2033.

Indonesia Digital Software Solutions Market Company Market Share

This in-depth report provides a definitive analysis of the Indonesia digital software solutions market, offering critical insights into its current landscape and future trajectory. Spanning from 2019 to 2033, with a base and estimated year of 2025, this study is an indispensable resource for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate the competitive environment of Indonesian enterprise software, cloud solutions Indonesia, and digital transformation solutions Indonesia. Our analysis delves into key segments including Customer Communication Management (CCM), Workflow Management, Enterprise Resource Planning (ERP) Software, Customer Relationship Management (CRM) Software, Business Intelligence (BI) Software, and other vital types. We also examine deployment modes (On-premise, Cloud), organization sizes (SMEs, Large Enterprises), and a wide array of industries such as BFSI, IT and Telecom, Manufacturing, Healthcare, Retail & E-commerce, and Energy & Utilities. With a robust forecast period from 2025 to 2033, this report equips you with the intelligence needed to make informed strategic decisions in this rapidly evolving market.

Indonesia Digital Software Solutions Market Market Dynamics & Concentration

The Indonesia digital software solutions market is characterized by a moderate to high concentration, driven by the presence of both global technology giants and emerging local players. Innovation is a key driver, fueled by the increasing adoption of cloud computing and the demand for data-driven decision-making. Regulatory frameworks, while evolving, are becoming more conducive to digital adoption, with government initiatives supporting digital transformation. Product substitutes are abundant, ranging from off-the-shelf solutions to custom-built applications, intensifying competition. End-user trends point towards a growing preference for integrated solutions, AI-powered functionalities, and enhanced cybersecurity measures. Mergers and acquisitions (M&A) activities are on the rise as larger companies seek to expand their portfolios and market reach. For instance, strategic partnerships and acquisitions aimed at integrating new technologies like AI and advanced analytics are becoming commonplace, contributing to market consolidation. The market share of leading players is significant, with global vendors often holding a substantial portion, while local providers are carving out niches with specialized offerings and localized support.

- Innovation Drivers: AI integration, big data analytics, cloud-native architectures, low-code/no-code platforms, IoT integration.

- Regulatory Frameworks: Government support for digital economy, data privacy regulations, cybersecurity mandates.

- End-User Trends: Demand for seamless integration, personalized customer experiences, mobile accessibility, automation of business processes.

- M&A Activities: Focus on acquiring companies with advanced AI capabilities, niche software solutions, and strong local market presence.

- Market Concentration: Dominated by a few large global vendors, with a growing number of agile local players.

Indonesia Digital Software Solutions Market Industry Trends & Analysis

The Indonesia digital software solutions market is experiencing robust growth, propelled by a confluence of factors that are fundamentally reshaping how businesses operate. The increasing digital maturity across various industries, coupled with the pervasive influence of the internet and mobile penetration, has created fertile ground for the adoption of advanced software solutions. Small and Medium Enterprises (SMEs), in particular, are increasingly recognizing the imperative to leverage digital tools to enhance efficiency, competitiveness, and customer engagement. This shift is evident in the burgeoning demand for cloud-based ERP and CRM systems, which offer scalability, cost-effectiveness, and accessibility, thereby democratizing access to sophisticated business management capabilities. The COVID-19 pandemic further accelerated this trend, highlighting the critical need for resilient and agile digital infrastructures.

Technological disruptions are continuously reshaping the market landscape. The widespread adoption of Artificial Intelligence (AI) and Machine Learning (ML) is transforming traditional software applications into intelligent platforms capable of predictive analytics, personalized customer interactions, and automated decision-making. Business Intelligence (BI) software, for example, is evolving to provide deeper insights into complex datasets, enabling businesses to make more informed strategic choices. Furthermore, the rise of the Internet of Things (IoT) is creating new avenues for software solutions that can manage and analyze data from connected devices, opening up opportunities in sectors like manufacturing and utilities.

Consumer preferences are also playing a pivotal role. Businesses are demanding software solutions that offer intuitive user interfaces, seamless integration with existing systems, and robust cybersecurity features. The emphasis is shifting from mere functionality to holistic user experience and data security. This has led to an increased focus on developing user-friendly and adaptable software that can cater to the diverse needs of a dynamic workforce. The competitive dynamics within the Indonesian market are intensifying, with both established global players and nimble local startups vying for market share. Strategic partnerships, alliances, and even acquisitions are becoming prevalent as companies seek to expand their technological capabilities, geographical reach, and customer base. The overall market penetration of digital software solutions is still on an upward trajectory, indicating substantial room for continued growth and innovation. The projected Compound Annual Growth Rate (CAGR) for the Indonesia digital software solutions market signals a healthy and expanding economic opportunity for all stakeholders involved.

Leading Markets & Segments in Indonesia Digital Software Solutions Market

The Indonesia digital software solutions market presents a diverse landscape of dominant segments and industries, each contributing significantly to the overall growth. Within the Type segmentation, Customer Relationship Management (CRM) Software and Enterprise Resource Planning (ERP) Software stand out as key growth drivers. The increasing need for businesses to manage customer interactions effectively, streamline sales processes, and integrate core business functions like finance, human resources, and supply chain management has propelled these segments to the forefront. Business Intelligence (BI) Software is also gaining substantial traction as organizations prioritize data-driven decision-making and advanced analytics to gain a competitive edge.

The Deployment Mode is witnessing a clear dominance of Cloud solutions over On-premise deployments. This shift is attributed to the inherent benefits of cloud computing, including lower upfront costs, greater scalability, enhanced accessibility, and reduced IT infrastructure burdens. Cloud-based solutions empower businesses of all sizes to access sophisticated software without significant capital investment, aligning perfectly with the growth aspirations of Indonesian enterprises.

In terms of Organization Size, both Small and Medium Enterprises (SMEs) and Large Enterprises are significant contributors, though SMEs represent a rapidly expanding segment. Government initiatives and the increasing awareness of digital benefits are enabling SMEs to adopt advanced software solutions, thereby leveling the playing field. Large enterprises, on the other hand, continue to invest in comprehensive digital transformation strategies, often opting for integrated suites and customized solutions.

Across Industries, the BFSI (Banking, Financial Services, and Insurance) sector is a leading adopter of digital software solutions, driven by the need for enhanced security, regulatory compliance, customer service, and operational efficiency. The IT and Telecom industry is also a major consumer, intrinsically linked to the development and deployment of these technologies. The Manufacturing sector is increasingly embracing digital solutions for automation, supply chain optimization, and smart factory initiatives. The Retail & E-commerce industry benefits immensely from CRM, BI, and supply chain management software to improve customer experience and streamline operations.

- Dominant Software Types:

- Customer Relationship Management (CRM) Software: Driving customer engagement and sales optimization.

- Enterprise Resource Planning (ERP) Software: Streamlining core business processes and improving operational efficiency.

- Business Intelligence (BI) Software: Enabling data-driven decision-making and strategic insights.

- Dominant Deployment Mode:

- Cloud: Offering scalability, cost-effectiveness, and accessibility.

- Dominant Organization Sizes:

- SMEs: Rapidly adopting digital solutions to enhance competitiveness.

- Large Enterprises: Investing in comprehensive digital transformation for strategic advantage.

- Leading Industries:

- BFSI: Prioritizing security, compliance, and customer experience.

- IT and Telecom: Core consumers and enablers of digital technologies.

- Manufacturing: Embracing automation and supply chain optimization.

- Retail & E-commerce: Leveraging software for customer engagement and operational efficiency.

Indonesia Digital Software Solutions Market Product Developments

The Indonesia digital software solutions market is characterized by a dynamic pace of product development, with a strong emphasis on innovation that addresses evolving business needs. Companies are focusing on enhancing their existing offerings with advanced features such as artificial intelligence (AI) integration, machine learning capabilities, and improved data analytics. The development of low-code/no-code platforms is democratizing software creation, allowing businesses to build custom applications more rapidly and with less technical expertise. Furthermore, there is a significant push towards developing solutions that offer seamless integration across different modules and third-party applications, fostering a connected and efficient digital ecosystem. Cybersecurity remains a paramount concern, leading to the incorporation of robust security protocols and compliance features within new product releases. The competitive advantage for vendors lies in their ability to deliver scalable, user-friendly, and secure solutions that provide tangible business value, such as increased productivity, enhanced customer satisfaction, and optimized resource allocation.

Key Drivers of Indonesia Digital Software Solutions Market Growth

The Indonesia digital software solutions market is experiencing accelerated growth driven by several key factors. The Indonesian government's strong commitment to fostering a digital economy through initiatives like "Making Indonesia 4.0" is creating a supportive ecosystem for software adoption. Increasing internet penetration and the widespread availability of affordable mobile devices are expanding the reach of digital solutions to a broader audience, including SMEs. Furthermore, the rising awareness among businesses about the benefits of digital transformation, such as improved operational efficiency, enhanced customer engagement, and data-driven decision-making, is a significant catalyst. The competitive pressure to stay relevant in a globalized market also compels local businesses to invest in advanced software solutions.

- Government Initiatives: Pro-digitalization policies and incentives.

- Internet & Mobile Penetration: Wider access to digital tools and services.

- Business Awareness: Recognition of digital benefits for efficiency and competitiveness.

- Competitive Landscape: Necessity to adopt digital solutions to remain relevant.

Challenges in the Indonesia Digital Software Solutions Market Market

Despite the promising growth, the Indonesia digital software solutions market faces several challenges. A primary hurdle is the digital skills gap, where a shortage of adequately trained IT professionals can impede the effective implementation and utilization of complex software. High implementation costs, especially for custom solutions or advanced enterprise-level software, can also be a barrier for some businesses, particularly SMEs with limited budgets. Concerns regarding data security and privacy persist, with businesses often hesitant to fully embrace cloud solutions due to potential risks. Moreover, legacy systems and resistance to change within established organizations can slow down the adoption of new digital technologies.

- Digital Skills Gap: Shortage of qualified IT professionals.

- Implementation Costs: Significant upfront investment for some solutions.

- Data Security Concerns: Hesitation to adopt cloud due to potential risks.

- Resistance to Change: Inertia associated with adopting new technologies.

Emerging Opportunities in Indonesia Digital Software Solutions Market

Emerging opportunities in the Indonesia digital software solutions market are abundant, driven by ongoing technological advancements and evolving market demands. The growing adoption of Artificial Intelligence (AI) and Machine Learning (ML) presents significant opportunities for intelligent automation, predictive analytics, and personalized customer experiences across all software categories. The expansion of IoT technology is creating a demand for software solutions that can manage and analyze data from connected devices, particularly in sectors like manufacturing, smart cities, and utilities. The increasing focus on sustainability and ESG (Environmental, Social, and Governance) is also spurring demand for software that can help organizations track, manage, and report on their environmental impact and social responsibility initiatives. Strategic partnerships between global technology providers and local Indonesian companies are crucial for expanding market reach, tailoring solutions to local needs, and fostering innovation.

Leading Players in the Indonesia Digital Software Solutions Market Sector

- Oracle Corporation

- SAP SE

- Workday

- OpenText

- Soltius Indonesia

- Nintex

- Salesforce

Key Milestones in Indonesia Digital Software Solutions Market Industry

- May 2024: SugarCRM, a provider of an award-winning AI-driven sales automation platform, was awarded a 2024 CRM Excellence Award for the fourth consecutive year by TMC, a global integrated media company. This highlights the continuous innovation and recognition of CRM solutions in enhancing customer relationships.

- November 2023: Trilliant, a significant global player in software solutions for advanced metering infrastructure (AMI), smart cities, smart grids, and IIoT, forged a strategic partnership with IntelliSmart Infrastructure Private Limited. IntelliSmart, an advanced metering infrastructure service (AMISP) and digital solutions provider in India, became a software partner for Trilliant's Head-end System (HES) cellular applications through this partnership. This signifies growing collaboration in critical infrastructure and smart technology sectors.

Strategic Outlook for Indonesia Digital Software Solutions Market Market

The strategic outlook for the Indonesia digital software solutions market is exceptionally positive, driven by a sustained commitment to digital transformation across all sectors. The continued expansion of cloud infrastructure and the increasing affordability of software solutions will empower a wider range of businesses, especially SMEs, to leverage advanced technologies. Key growth accelerators include the integration of AI and machine learning to deliver more intelligent and personalized user experiences, as well as the development of specialized solutions for emerging industries and niche applications. Strategic partnerships, mergers, and acquisitions will continue to shape the market, fostering consolidation and the development of comprehensive, end-to-end digital offerings. The focus will increasingly be on providing solutions that enhance operational efficiency, drive innovation, and ensure robust cybersecurity, positioning Indonesia as a significant player in the regional digital economy.

Indonesia Digital Software Solutions Market Segmentation

-

1. Type

- 1.1. Customer Communication Management (CCM)

- 1.2. Workflow Management

- 1.3. Enterprise Resource Planning (ERP) Software

- 1.4. Customer Relationship Management (CRM) Software

- 1.5. Business Intelligence (BI) Software

- 1.6. Other Types (SCM, HRM, etc.)

-

2. Deployment Mode

- 2.1. On-premise

- 2.2. Cloud

-

3. Organization Size

- 3.1. Small and Medium Enterprises (SMEs)

- 3.2. Large Enterprises

-

4. Industry

- 4.1. BFSI

- 4.2. IT and Telecom

- 4.3. Manufacturing

- 4.4. Healthcare

- 4.5. Retail & E-commerce

- 4.6. Energy & Utilities

- 4.7. Other Industries

Indonesia Digital Software Solutions Market Segmentation By Geography

- 1. Indonesia

Indonesia Digital Software Solutions Market Regional Market Share

Geographic Coverage of Indonesia Digital Software Solutions Market

Indonesia Digital Software Solutions Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Implementation of Technologies such as Cloud Computing

- 3.2.2 AI

- 3.2.3 ML

- 3.2.4 IoT

- 3.2.5 and Big Data; Presence of International Companies and Increased Spending on Technology in the Country

- 3.3. Market Restrains

- 3.3.1 Implementation of Technologies such as Cloud Computing

- 3.3.2 AI

- 3.3.3 ML

- 3.3.4 IoT

- 3.3.5 and Big Data; Presence of International Companies and Increased Spending on Technology in the Country

- 3.4. Market Trends

- 3.4.1. Retail Industry Significantly Driving Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Digital Software Solutions Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Customer Communication Management (CCM)

- 5.1.2. Workflow Management

- 5.1.3. Enterprise Resource Planning (ERP) Software

- 5.1.4. Customer Relationship Management (CRM) Software

- 5.1.5. Business Intelligence (BI) Software

- 5.1.6. Other Types (SCM, HRM, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Organization Size

- 5.3.1. Small and Medium Enterprises (SMEs)

- 5.3.2. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by Industry

- 5.4.1. BFSI

- 5.4.2. IT and Telecom

- 5.4.3. Manufacturing

- 5.4.4. Healthcare

- 5.4.5. Retail & E-commerce

- 5.4.6. Energy & Utilities

- 5.4.7. Other Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Oracle Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SAP SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Workday

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 OpenText

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Soltius Indonesia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nintex

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Salesforc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Oracle Corporation

List of Figures

- Figure 1: Indonesia Digital Software Solutions Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Digital Software Solutions Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Digital Software Solutions Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Indonesia Digital Software Solutions Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Indonesia Digital Software Solutions Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 4: Indonesia Digital Software Solutions Market Volume Billion Forecast, by Deployment Mode 2020 & 2033

- Table 5: Indonesia Digital Software Solutions Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 6: Indonesia Digital Software Solutions Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 7: Indonesia Digital Software Solutions Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 8: Indonesia Digital Software Solutions Market Volume Billion Forecast, by Industry 2020 & 2033

- Table 9: Indonesia Digital Software Solutions Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Indonesia Digital Software Solutions Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Indonesia Digital Software Solutions Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Indonesia Digital Software Solutions Market Volume Billion Forecast, by Type 2020 & 2033

- Table 13: Indonesia Digital Software Solutions Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 14: Indonesia Digital Software Solutions Market Volume Billion Forecast, by Deployment Mode 2020 & 2033

- Table 15: Indonesia Digital Software Solutions Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 16: Indonesia Digital Software Solutions Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 17: Indonesia Digital Software Solutions Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 18: Indonesia Digital Software Solutions Market Volume Billion Forecast, by Industry 2020 & 2033

- Table 19: Indonesia Digital Software Solutions Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Indonesia Digital Software Solutions Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Digital Software Solutions Market?

The projected CAGR is approximately 9.11%.

2. Which companies are prominent players in the Indonesia Digital Software Solutions Market?

Key companies in the market include Oracle Corporation, SAP SE, Workday, OpenText, Soltius Indonesia, Nintex, Salesforc.

3. What are the main segments of the Indonesia Digital Software Solutions Market?

The market segments include Type, Deployment Mode, Organization Size, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Implementation of Technologies such as Cloud Computing. AI. ML. IoT. and Big Data; Presence of International Companies and Increased Spending on Technology in the Country.

6. What are the notable trends driving market growth?

Retail Industry Significantly Driving Market Growth.

7. Are there any restraints impacting market growth?

Implementation of Technologies such as Cloud Computing. AI. ML. IoT. and Big Data; Presence of International Companies and Increased Spending on Technology in the Country.

8. Can you provide examples of recent developments in the market?

May 2024 – SugarCRM, provider of an award-winning AI-driven sales automation platform, announced that it had been awarded a 2024 CRM Excellence Award for the fourth consecutive year. TMC, a global integrated media company, presented the 25th annual awards program. Winners were selected for their product or service’s ability to extend and expand the customer relationship to become all-encompassing, covering the entire enterprise and customer lifetime.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Digital Software Solutions Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Digital Software Solutions Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Digital Software Solutions Market?

To stay informed about further developments, trends, and reports in the Indonesia Digital Software Solutions Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence