Key Insights

The Indonesian data center construction market is experiencing robust expansion, projected to reach a significant valuation by 2033. Driven by the accelerating digital transformation across various sectors, including BFSI, IT & Telecommunications, and Government, the demand for advanced and reliable data center infrastructure is on a steep upward trajectory. This growth is further fueled by increasing internet penetration, the proliferation of cloud computing services, and the burgeoning adoption of IoT devices, all of which necessitate substantial data processing and storage capabilities. The market's expansion is also supported by government initiatives aimed at fostering digital infrastructure development and attracting foreign investment.

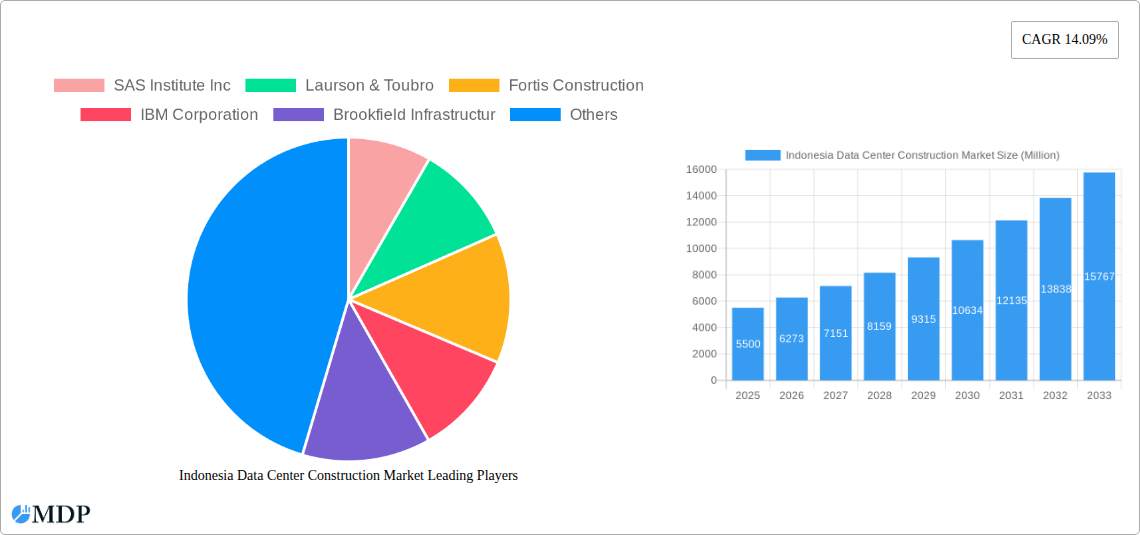

Indonesia Data Center Construction Market Market Size (In Billion)

The market is characterized by a strong emphasis on sophisticated electrical and mechanical infrastructure. Within electrical components, power distribution solutions like PDUs, transfer switches (ATS), and switchgear are paramount, alongside robust power backup systems such as UPS and generators. Cooling systems, including immersion cooling and direct-to-chip solutions, are gaining prominence to manage the thermal challenges of high-density computing environments. The tiered structure of data centers, with a significant focus on Tier-III and Tier-IV facilities, underscores the increasing need for high availability and reliability. Key players like Schneider Electric SE, IBM Corporation, and AECOM are actively involved in shaping this dynamic market, contributing through their expertise in construction, technology, and infrastructure solutions, thereby driving innovation and capacity expansion within Indonesia.

Indonesia Data Center Construction Market Company Market Share

Dive deep into the dynamic Indonesia data center construction market, a rapidly expanding sector driven by the nation's escalating digital transformation and the burgeoning demand for robust IT infrastructure. This comprehensive report provides an unparalleled analysis of market trends, growth drivers, competitive landscapes, and emerging opportunities, equipping industry stakeholders with actionable insights for strategic decision-making. With a study period spanning 2019–2033, a base year of 2025, and a forecast period from 2025–2033, this report offers a granular view of market evolution. Explore key segments including Electrical Infrastructure (Power Distribution Solutions like PDUs, Transfer Switches, Switchgear, Power Panels, and Power Backup Solutions like UPS and Generators), Mechanical Infrastructure (Cooling Systems, Racks), and General Construction, alongside an in-depth analysis of Tier Types (Tier-I & II, Tier-III, Tier-IV) and End User segments (BFSI, IT & Telecommunications, Government & Defense, Healthcare). Uncover the impact of industry developments such as a 23 MW data center construction in Jakarta and significant business transfers within the telecommunications sector.

Indonesia Data Center Construction Market Market Dynamics & Concentration

The Indonesia data center construction market is characterized by a moderate to high concentration, with key players actively investing in expanding capacity and modernizing infrastructure. Innovation drivers are predominantly centered around energy efficiency, high-density computing, and sustainable construction practices. The regulatory framework, while evolving, plays a crucial role in shaping development through permits, environmental standards, and data localization policies. Product substitutes for traditional data center construction are limited, but the rise of edge computing and specialized cloud solutions influences design requirements. End-user trends indicate a strong preference for hyperscale facilities driven by cloud providers and a growing need for secure, compliant infrastructure from the BFSI and Government sectors. Merger and acquisition (M&A) activities are on the rise as established players consolidate their market position and new entrants seek strategic market entry. We estimate approximately 8-12 significant M&A deals within the past five years, indicating a healthy consolidation phase.

- Market Concentration: Moderate to High, driven by significant foreign and domestic investments.

- Innovation Drivers: Energy efficiency, hyperscale deployments, sustainable practices, advanced cooling technologies.

- Regulatory Frameworks: Evolving, focusing on data security, environmental compliance, and digital infrastructure incentives.

- Product Substitutes: Limited for core data center facilities, but edge and cloud solutions influence demand.

- End-User Trends: Dominance of hyperscale demand, increasing enterprise adoption for colocation and hybrid cloud.

- M&A Activities: Increasing trend for market consolidation and strategic expansion.

Indonesia Data Center Construction Market Industry Trends & Analysis

The Indonesia data center construction market is poised for robust growth, fueled by a confluence of technological advancements, a rapidly digitizing economy, and increasing data consumption. The market is experiencing a significant CAGR of approximately 15-18% during the forecast period. This expansion is largely driven by the surge in cloud computing adoption, the proliferation of smart devices, and the government's push towards a digital economy. Technological disruptions, particularly in cooling systems like immersion cooling and direct-to-chip solutions, are enabling higher power densities and improved energy efficiency, catering to the needs of hyperscale operators and AI workloads. Consumer preferences are shifting towards hyperscale and colocation facilities that offer scalability, reliability, and cost-effectiveness. The competitive dynamics are intensifying, with both global giants and local players vying for market share through strategic partnerships, capacity expansions, and service diversification. Market penetration for hyperscale facilities is expected to increase from 30% in the base year to over 50% by 2033.

Leading Markets & Segments in Indonesia Data Center Construction Market

Jakarta stands as the dominant region within the Indonesia data center construction market, driven by its strategic location, established infrastructure, and a high concentration of businesses, particularly in the IT & Telecommunications and Banking, Financial Services, and Insurance (BFSI) sectors. The Electrical Infrastructure segment, specifically Power Distribution Solutions, is witnessing substantial investment, driven by the fundamental need for reliable and efficient power management.

- Dominant Region: Jakarta, accounting for over 70% of current and projected construction projects due to its economic hub status and connectivity.

- Key Infrastructure Segments:

- Electrical Infrastructure: Critical for operational uptime and energy efficiency.

- Power Distribution Solutions: High demand for Transfer Switches (ATS) and advanced Switchgear (Low-voltage and Medium-voltage) to ensure uninterrupted power flow and load balancing. Power Panels and Components are also seeing consistent demand.

- Power Backup Solutions: UPS systems and Generators remain essential, with increasing interest in hybrid solutions for enhanced resilience.

- Mechanical Infrastructure: Growing focus on advanced Cooling Systems like In-row and In-rack Cooling, and increasingly, Rear Door Heat Exchangers, to manage the thermal challenges of high-density computing.

- Electrical Infrastructure: Critical for operational uptime and energy efficiency.

- Tier Type Dominance: Tier-III facilities are currently the most sought-after, balancing redundancy with cost-effectiveness, although Tier-IV facilities are gaining traction for critical applications. Tier-I and-II facilities are primarily for less critical enterprise needs.

- End User Dominance:

- IT and Telecommunications: The largest consumer, driving demand for hyperscale and colocation facilities.

- Banking, Financial Services, and Insurance (BFSI): A significant segment requiring highly secure, compliant, and low-latency infrastructure.

- Government and Defense: Growing demand for secure and sovereign data localization solutions.

Indonesia Data Center Construction Market Product Developments

Product developments in the Indonesia data center construction market are increasingly focused on enhancing energy efficiency, scalability, and sustainability. Innovations in cooling systems, such as advanced immersion cooling and direct-to-chip cooling technologies, are gaining traction, allowing for higher power densities and reduced environmental impact. The integration of AI-powered management systems for power and cooling optimization is another key trend. Companies are also developing modular and pre-fabricated data center solutions to accelerate deployment times and reduce on-site construction complexities. These advancements provide a competitive advantage by enabling data center operators to meet the growing demands for performance and sustainability from their clients.

Key Drivers of Indonesia Data Center Construction Market Growth

The Indonesia data center construction market's growth is propelled by several key factors:

- Digital Transformation: The accelerating adoption of digital technologies across all sectors, including e-commerce, fintech, and cloud services, is creating an insatiable demand for data storage and processing power.

- Growing Internet Penetration and Smartphone Usage: An expanding digital native population fuels content creation and consumption, requiring robust data center infrastructure.

- Government Initiatives: The Indonesian government's focus on developing its digital economy and attracting foreign investment in technology infrastructure provides a supportive environment.

- Rise of Hyperscale Cloud Providers: Major global cloud providers are increasing their presence in Indonesia to serve the growing regional demand, leading to significant construction projects.

- Increasing Data Sovereignty Requirements: As businesses and governments prioritize data localization, the demand for domestic data centers is on the rise.

Challenges in the Indonesia Data Center Construction Market Market

Despite robust growth, the Indonesia data center construction market faces several challenges:

- Land Acquisition and Permitting: Navigating complex land acquisition processes and obtaining necessary permits can lead to delays and increased project costs.

- Skilled Workforce Shortage: A lack of adequately trained personnel for specialized data center construction and operations can impact project timelines and quality.

- Power Supply Reliability and Cost: Ensuring a stable and cost-effective power supply, particularly in emerging locations, remains a significant concern.

- Supply Chain Disruptions: Global and local supply chain issues can affect the availability of critical components and equipment, leading to project delays.

- Environmental Regulations and Sustainability Pressures: Increasingly stringent environmental regulations and the demand for sustainable practices require significant investment in green technologies.

Emerging Opportunities in Indonesia Data Center Construction Market

The Indonesia data center construction market is ripe with emerging opportunities:

- Expansion into Tier 2 and Tier 3 Cities: As hyperscale demand matures in Jakarta, there is a significant opportunity to develop data centers in other major cities to serve regional markets and reduce latency.

- Edge Data Centers: The growing need for low-latency processing for IoT, AI, and real-time applications presents a strong opportunity for the development of smaller, distributed edge data centers.

- Green Data Center Solutions: Increasing environmental consciousness and government incentives are creating a market for sustainable data centers utilizing renewable energy sources and advanced energy-efficient technologies.

- Managed Services and Colocation: Beyond construction, there is a growing demand for integrated managed services and colocation offerings, presenting opportunities for value-added services.

- Partnerships with Local Telecoms and Utilities: Collaborating with local telecommunication companies and utility providers can streamline deployment and enhance connectivity.

Leading Players in the Indonesia Data Center Construction Market Sector

- SAS Institute Inc

- Laurson & Toubro

- Fortis Construction

- IBM Corporation

- Brookfield Infrastructur

- Schneider Electric SE

- Turner Construction Co

- Delta Power Solutions

- Legrand

- NTT Facillities

- AECOM

- Iris Global

Key Milestones in Indonesia Data Center Construction Market Industry

- September 2022: A major company commenced construction on a 23 MW data center in Jakarta, Indonesia. This project, marking the company's third site in Southeast Asia, is designed for high-power density applications and is expected to complete by Q4 2023.

- August 2022: PT Sigma Cipta Caraka (SCA), also known as Telkomsigma, transferred its data center business to PT Telkom Data Ekosistem (TDE) for IDR 2.01 trillion. This move signifies a strategic restructuring within the Telkom Group aimed at optimizing its data center operations.

Strategic Outlook for Indonesia Data Center Construction Market Market

The strategic outlook for the Indonesia data center construction market remains exceptionally positive. Continued investment in digital infrastructure, coupled with favorable government policies, will drive sustained growth. Key growth accelerators include the increasing adoption of AI and big data analytics, the expansion of 5G networks, and the ongoing digital transformation across various industries. Stakeholders should focus on developing facilities that can accommodate higher power densities, incorporate advanced cooling technologies, and adhere to stringent sustainability standards. Strategic partnerships with local entities, proactive engagement with regulatory bodies, and a focus on talent development will be crucial for navigating the market's complexities and capitalizing on its significant long-term potential.

Indonesia Data Center Construction Market Segmentation

-

1. Infrastructure

-

1.1. Market Segmentation - By Electrical Infrastructure

-

1.1.1. Power Distribution Solution

- 1.1.1.1. PDUs - B

-

1.1.1.2. Transfer Switches

- 1.1.1.2.1. Static

- 1.1.1.2.2. Automatic (ATS)

-

1.1.1.3. Switchgear

- 1.1.1.3.1. Low-voltage

- 1.1.1.3.2. Medium-voltage

- 1.1.1.4. Power Panels and Components

- 1.1.1.5. Others

-

1.1.2. Power Backup Solutions

- 1.1.2.1. UPS

- 1.1.2.2. Generators

- 1.1.3. Service

-

1.1.1. Power Distribution Solution

-

1.2. Market Segmentation - By Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.2.1.1. Immersion Cooling

- 1.2.1.2. Direct-to-chip Cooling

- 1.2.1.3. Rear Door Heat Exchanger

- 1.2.1.4. In-row and In-rack Cooling

- 1.2.2. Racks

- 1.2.3. Other Mechanical Infrastructures

-

1.2.1. Cooling Systems

- 1.3. General Construction

-

1.1. Market Segmentation - By Electrical Infrastructure

-

2. Electrical Infrastructure

-

2.1. Power Distribution Solution

- 2.1.1. PDUs - B

-

2.1.2. Transfer Switches

- 2.1.2.1. Static

- 2.1.2.2. Automatic (ATS)

-

2.1.3. Switchgear

- 2.1.3.1. Low-voltage

- 2.1.3.2. Medium-voltage

- 2.1.4. Power Panels and Components

- 2.1.5. Others

-

2.2. Power Backup Solutions

- 2.2.1. UPS

- 2.2.2. Generators

- 2.3. Service

-

2.1. Power Distribution Solution

-

3. Power Distribution Solution

- 3.1. PDUs - B

-

3.2. Transfer Switches

- 3.2.1. Static

- 3.2.2. Automatic (ATS)

-

3.3. Switchgear

- 3.3.1. Low-voltage

- 3.3.2. Medium-voltage

- 3.4. Power Panels and Components

- 3.5. Others

-

4. Power Backup Solutions

- 4.1. UPS

- 4.2. Generators

- 5. Service

-

6. Mechanical Infrastructure

-

6.1. Cooling Systems

- 6.1.1. Immersion Cooling

- 6.1.2. Direct-to-chip Cooling

- 6.1.3. Rear Door Heat Exchanger

- 6.1.4. In-row and In-rack Cooling

- 6.2. Racks

- 6.3. Other Mechanical Infrastructures

-

6.1. Cooling Systems

-

7. Cooling Systems

- 7.1. Immersion Cooling

- 7.2. Direct-to-chip Cooling

- 7.3. Rear Door Heat Exchanger

- 7.4. In-row and In-rack Cooling

- 8. Racks

- 9. Other Mechanical Infrastructures

- 10. General Construction

-

11. Tier Type

- 11.1. Tier-I and-II

- 11.2. Tier-III

- 11.3. Tier-IV

- 12. Tier-I and-II

- 13. Tier-III

- 14. Tier-IV

-

15. End User

- 15.1. Banking, Financial Services, and Insurance

- 15.2. IT and Telecommunications

- 15.3. Government and Defense

- 15.4. Healthcare

- 15.5. Other End Users

- 16. Banking, Financial Services, and Insurance

- 17. IT and Telecommunications

- 18. Government and Defense

- 19. Healthcare

- 20. Other End Users

Indonesia Data Center Construction Market Segmentation By Geography

- 1. Indonesia

Indonesia Data Center Construction Market Regional Market Share

Geographic Coverage of Indonesia Data Center Construction Market

Indonesia Data Center Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Major ICT Indicators Contributing to the Growth of Data Centre in Indonesia; Rise of Green Data Centers; Government Support in the Form of Tax Incentives for Development of Data Centers

- 3.3. Market Restrains

- 3.3.1. Higher Initial Investments and Low Availability of Resources

- 3.4. Market Trends

- 3.4.1. Major ICT Indicators Contributing to the Growth of Data Centre in Indonesia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Data Center Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.1.1.1. Power Distribution Solution

- 5.1.1.1.1. PDUs - B

- 5.1.1.1.2. Transfer Switches

- 5.1.1.1.2.1. Static

- 5.1.1.1.2.2. Automatic (ATS)

- 5.1.1.1.3. Switchgear

- 5.1.1.1.3.1. Low-voltage

- 5.1.1.1.3.2. Medium-voltage

- 5.1.1.1.4. Power Panels and Components

- 5.1.1.1.5. Others

- 5.1.1.2. Power Backup Solutions

- 5.1.1.2.1. UPS

- 5.1.1.2.2. Generators

- 5.1.1.3. Service

- 5.1.1.1. Power Distribution Solution

- 5.1.2. Market Segmentation - By Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.2.1.1. Immersion Cooling

- 5.1.2.1.2. Direct-to-chip Cooling

- 5.1.2.1.3. Rear Door Heat Exchanger

- 5.1.2.1.4. In-row and In-rack Cooling

- 5.1.2.2. Racks

- 5.1.2.3. Other Mechanical Infrastructures

- 5.1.2.1. Cooling Systems

- 5.1.3. General Construction

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Electrical Infrastructure

- 5.2.1. Power Distribution Solution

- 5.2.1.1. PDUs - B

- 5.2.1.2. Transfer Switches

- 5.2.1.2.1. Static

- 5.2.1.2.2. Automatic (ATS)

- 5.2.1.3. Switchgear

- 5.2.1.3.1. Low-voltage

- 5.2.1.3.2. Medium-voltage

- 5.2.1.4. Power Panels and Components

- 5.2.1.5. Others

- 5.2.2. Power Backup Solutions

- 5.2.2.1. UPS

- 5.2.2.2. Generators

- 5.2.3. Service

- 5.2.1. Power Distribution Solution

- 5.3. Market Analysis, Insights and Forecast - by Power Distribution Solution

- 5.3.1. PDUs - B

- 5.3.2. Transfer Switches

- 5.3.2.1. Static

- 5.3.2.2. Automatic (ATS)

- 5.3.3. Switchgear

- 5.3.3.1. Low-voltage

- 5.3.3.2. Medium-voltage

- 5.3.4. Power Panels and Components

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Power Backup Solutions

- 5.4.1. UPS

- 5.4.2. Generators

- 5.5. Market Analysis, Insights and Forecast - by Service

- 5.6. Market Analysis, Insights and Forecast - by Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.6.1.1. Immersion Cooling

- 5.6.1.2. Direct-to-chip Cooling

- 5.6.1.3. Rear Door Heat Exchanger

- 5.6.1.4. In-row and In-rack Cooling

- 5.6.2. Racks

- 5.6.3. Other Mechanical Infrastructures

- 5.6.1. Cooling Systems

- 5.7. Market Analysis, Insights and Forecast - by Cooling Systems

- 5.7.1. Immersion Cooling

- 5.7.2. Direct-to-chip Cooling

- 5.7.3. Rear Door Heat Exchanger

- 5.7.4. In-row and In-rack Cooling

- 5.8. Market Analysis, Insights and Forecast - by Racks

- 5.9. Market Analysis, Insights and Forecast - by Other Mechanical Infrastructures

- 5.10. Market Analysis, Insights and Forecast - by General Construction

- 5.11. Market Analysis, Insights and Forecast - by Tier Type

- 5.11.1. Tier-I and-II

- 5.11.2. Tier-III

- 5.11.3. Tier-IV

- 5.12. Market Analysis, Insights and Forecast - by Tier-I and-II

- 5.13. Market Analysis, Insights and Forecast - by Tier-III

- 5.14. Market Analysis, Insights and Forecast - by Tier-IV

- 5.15. Market Analysis, Insights and Forecast - by End User

- 5.15.1. Banking, Financial Services, and Insurance

- 5.15.2. IT and Telecommunications

- 5.15.3. Government and Defense

- 5.15.4. Healthcare

- 5.15.5. Other End Users

- 5.16. Market Analysis, Insights and Forecast - by Banking, Financial Services, and Insurance

- 5.17. Market Analysis, Insights and Forecast - by IT and Telecommunications

- 5.18. Market Analysis, Insights and Forecast - by Government and Defense

- 5.19. Market Analysis, Insights and Forecast - by Healthcare

- 5.20. Market Analysis, Insights and Forecast - by Other End Users

- 5.21. Market Analysis, Insights and Forecast - by Region

- 5.21.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SAS Institute Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Laurson & Toubro

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fortis Construction

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 IBM Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Brookfield Infrastructur

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Schneider Electric SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Turner Construction Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Delta Power Solutions

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Legrand

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 NTT Facillities

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 AECOM

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Iris Global

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 SAS Institute Inc

List of Figures

- Figure 1: Indonesia Data Center Construction Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Indonesia Data Center Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Data Center Construction Market Revenue undefined Forecast, by Infrastructure 2020 & 2033

- Table 2: Indonesia Data Center Construction Market Revenue undefined Forecast, by Electrical Infrastructure 2020 & 2033

- Table 3: Indonesia Data Center Construction Market Revenue undefined Forecast, by Power Distribution Solution 2020 & 2033

- Table 4: Indonesia Data Center Construction Market Revenue undefined Forecast, by Power Backup Solutions 2020 & 2033

- Table 5: Indonesia Data Center Construction Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 6: Indonesia Data Center Construction Market Revenue undefined Forecast, by Mechanical Infrastructure 2020 & 2033

- Table 7: Indonesia Data Center Construction Market Revenue undefined Forecast, by Cooling Systems 2020 & 2033

- Table 8: Indonesia Data Center Construction Market Revenue undefined Forecast, by Racks 2020 & 2033

- Table 9: Indonesia Data Center Construction Market Revenue undefined Forecast, by Other Mechanical Infrastructures 2020 & 2033

- Table 10: Indonesia Data Center Construction Market Revenue undefined Forecast, by General Construction 2020 & 2033

- Table 11: Indonesia Data Center Construction Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 12: Indonesia Data Center Construction Market Revenue undefined Forecast, by Tier-I and-II 2020 & 2033

- Table 13: Indonesia Data Center Construction Market Revenue undefined Forecast, by Tier-III 2020 & 2033

- Table 14: Indonesia Data Center Construction Market Revenue undefined Forecast, by Tier-IV 2020 & 2033

- Table 15: Indonesia Data Center Construction Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 16: Indonesia Data Center Construction Market Revenue undefined Forecast, by Banking, Financial Services, and Insurance 2020 & 2033

- Table 17: Indonesia Data Center Construction Market Revenue undefined Forecast, by IT and Telecommunications 2020 & 2033

- Table 18: Indonesia Data Center Construction Market Revenue undefined Forecast, by Government and Defense 2020 & 2033

- Table 19: Indonesia Data Center Construction Market Revenue undefined Forecast, by Healthcare 2020 & 2033

- Table 20: Indonesia Data Center Construction Market Revenue undefined Forecast, by Other End Users 2020 & 2033

- Table 21: Indonesia Data Center Construction Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 22: Indonesia Data Center Construction Market Revenue undefined Forecast, by Infrastructure 2020 & 2033

- Table 23: Indonesia Data Center Construction Market Revenue undefined Forecast, by Electrical Infrastructure 2020 & 2033

- Table 24: Indonesia Data Center Construction Market Revenue undefined Forecast, by Power Distribution Solution 2020 & 2033

- Table 25: Indonesia Data Center Construction Market Revenue undefined Forecast, by Power Backup Solutions 2020 & 2033

- Table 26: Indonesia Data Center Construction Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 27: Indonesia Data Center Construction Market Revenue undefined Forecast, by Mechanical Infrastructure 2020 & 2033

- Table 28: Indonesia Data Center Construction Market Revenue undefined Forecast, by Cooling Systems 2020 & 2033

- Table 29: Indonesia Data Center Construction Market Revenue undefined Forecast, by Racks 2020 & 2033

- Table 30: Indonesia Data Center Construction Market Revenue undefined Forecast, by Other Mechanical Infrastructures 2020 & 2033

- Table 31: Indonesia Data Center Construction Market Revenue undefined Forecast, by General Construction 2020 & 2033

- Table 32: Indonesia Data Center Construction Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 33: Indonesia Data Center Construction Market Revenue undefined Forecast, by Tier-I and-II 2020 & 2033

- Table 34: Indonesia Data Center Construction Market Revenue undefined Forecast, by Tier-III 2020 & 2033

- Table 35: Indonesia Data Center Construction Market Revenue undefined Forecast, by Tier-IV 2020 & 2033

- Table 36: Indonesia Data Center Construction Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 37: Indonesia Data Center Construction Market Revenue undefined Forecast, by Banking, Financial Services, and Insurance 2020 & 2033

- Table 38: Indonesia Data Center Construction Market Revenue undefined Forecast, by IT and Telecommunications 2020 & 2033

- Table 39: Indonesia Data Center Construction Market Revenue undefined Forecast, by Government and Defense 2020 & 2033

- Table 40: Indonesia Data Center Construction Market Revenue undefined Forecast, by Healthcare 2020 & 2033

- Table 41: Indonesia Data Center Construction Market Revenue undefined Forecast, by Other End Users 2020 & 2033

- Table 42: Indonesia Data Center Construction Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Data Center Construction Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the Indonesia Data Center Construction Market?

Key companies in the market include SAS Institute Inc, Laurson & Toubro, Fortis Construction, IBM Corporation, Brookfield Infrastructur, Schneider Electric SE, Turner Construction Co, Delta Power Solutions, Legrand, NTT Facillities, AECOM, Iris Global.

3. What are the main segments of the Indonesia Data Center Construction Market?

The market segments include Infrastructure, Electrical Infrastructure, Power Distribution Solution, Power Backup Solutions, Service , Mechanical Infrastructure, Cooling Systems, Racks, Other Mechanical Infrastructures, General Construction, Tier Type, Tier-I and-II, Tier-III, Tier-IV, End User, Banking, Financial Services, and Insurance, IT and Telecommunications, Government and Defense, Healthcare, Other End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Major ICT Indicators Contributing to the Growth of Data Centre in Indonesia; Rise of Green Data Centers; Government Support in the Form of Tax Incentives for Development of Data Centers.

6. What are the notable trends driving market growth?

Major ICT Indicators Contributing to the Growth of Data Centre in Indonesia.

7. Are there any restraints impacting market growth?

Higher Initial Investments and Low Availability of Resources.

8. Can you provide examples of recent developments in the market?

September 2022: The company commenced construction on a 23 MW data center in Jakarta, Indonesia, marking the company's third site in South East Asia as it capitalizes on the region's rapid digital transformation in the wake of the global pandemic. The new facility will offer 3,430 cabinets and an IT load of 23 MW and is designed to cater to the growing demand for high-power density applications from cloud-driven hyperscale deployments, local and international networks, and financial service providers. It is expected to complete by Q4 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Data Center Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Data Center Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Data Center Construction Market?

To stay informed about further developments, trends, and reports in the Indonesia Data Center Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence