Key Insights

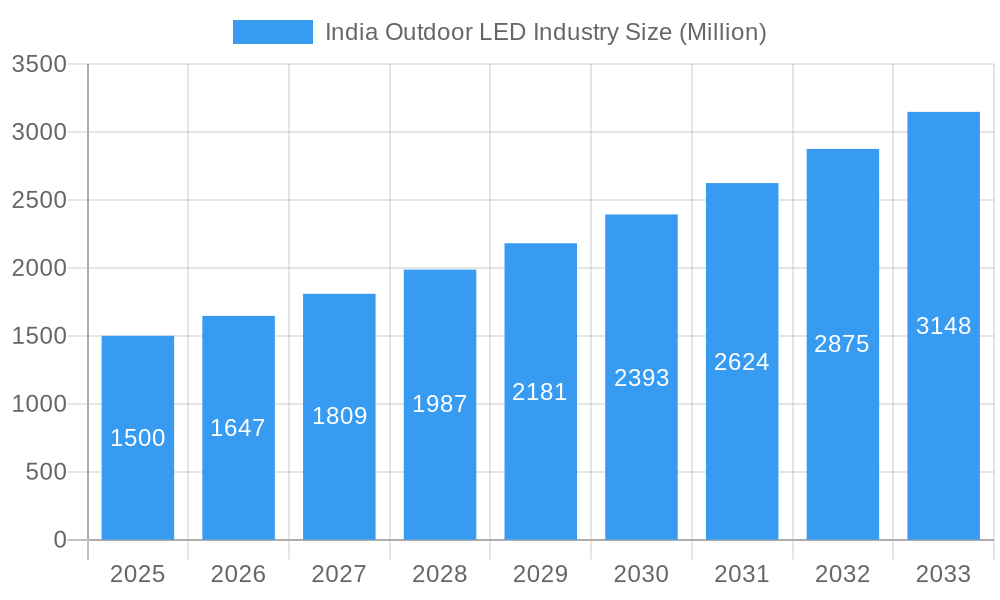

The Indian outdoor LED lighting market is poised for substantial growth, propelled by government emphasis on energy efficiency and smart city development. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of 8.56% from 2025, with an estimated market size of 11.56 billion. Key growth drivers include the transition from conventional lighting to energy-efficient LEDs, escalating urbanization, and a heightened focus on public safety and security through advanced illumination. Supportive government regulations and declining LED technology costs further bolster this expansion. The public spaces, streets, and roadways segment leads the market, reflecting ongoing infrastructure development. Major industry players are actively engaged in innovation and product diversification. While regional variations and challenges like inconsistent power supply exist, the long-term outlook remains highly positive, driven by sustained economic growth and infrastructure investment.

India Outdoor LED Industry Market Size (In Billion)

Future expansion of the Indian outdoor LED lighting market will be significantly influenced by smart city initiatives and the integration of intelligent control systems. Despite ongoing cost and maintenance considerations, the compelling long-term advantages of energy efficiency and operational cost reduction are driving adoption. The competitive environment, featuring both domestic and international companies, fosters innovation and price competitiveness, enhancing LED lighting accessibility. Opportunities for targeted growth strategies exist in regions with varying market penetration. Future market dynamics will be shaped by government policies, technological advancements, and evolving urban and rural community needs. The continued investment in smart lighting solutions and their integration with other smart city technologies is expected to accelerate market growth.

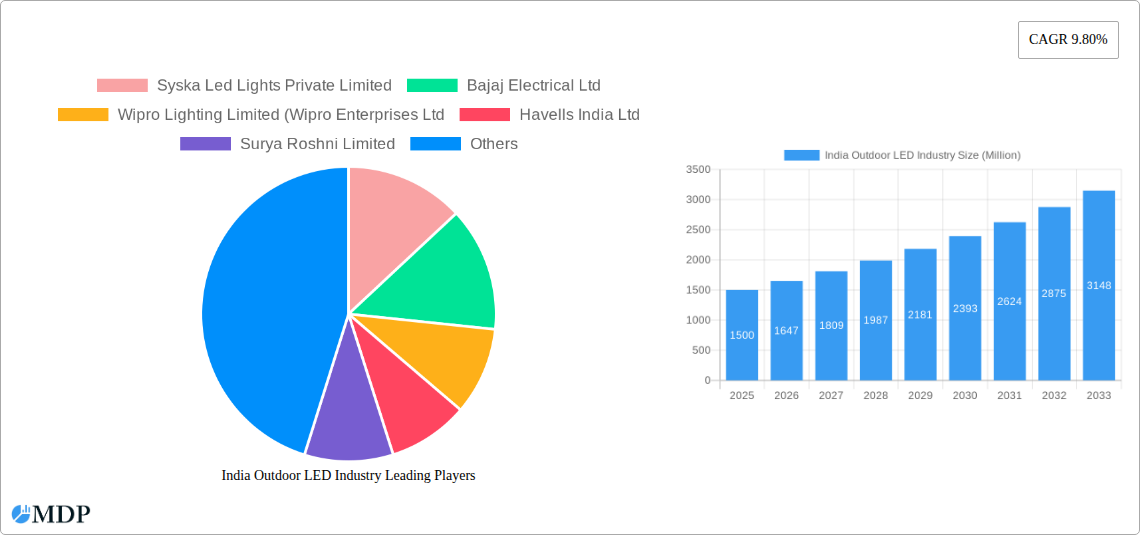

India Outdoor LED Industry Company Market Share

India Outdoor LED Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the India Outdoor LED industry, covering market dynamics, trends, leading players, and future opportunities. With a focus on the period 2019-2033, and a base year of 2025, this report is an invaluable resource for industry stakeholders, investors, and market researchers. The report includes an in-depth analysis of market size and forecasts, with projections reaching xx Million by 2033.

India Outdoor LED Industry Market Dynamics & Concentration

The Indian outdoor LED lighting market is experiencing robust growth, driven by government initiatives promoting energy efficiency and smart city development. Market concentration is moderate, with several major players holding significant market share, but also allowing room for smaller players to thrive. The market is characterized by intense competition, leading to innovation in product design, features, and pricing strategies. Regulatory frameworks, particularly those focused on energy conservation, are significant drivers influencing technological advancements. The increasing adoption of smart lighting solutions and the rising demand for energy-efficient alternatives are key factors pushing the market forward. Mergers and acquisitions (M&A) activity has been moderate in recent years, with a reported xx M&A deals between 2019 and 2024. The leading players, including Syska Led Lights Private Limited, Bajaj Electrical Ltd, Wipro Lighting Limited, Havells India Ltd, Surya Roshni Limited, OPPLE Lighting Co Ltd, Eveready Industries India Limited, Crompton Greaves Consumer Electricals Limited, Orient Electric Limited, and Signify Holding (Philips), are actively engaged in expanding their product portfolios and market reach.

- Market Share (2024): Syska: xx%; Bajaj: xx%; Wipro: xx%; Others: xx%.

- M&A Deal Count (2019-2024): xx

India Outdoor LED Industry Industry Trends & Analysis

The Indian outdoor LED industry is witnessing a significant transformation driven by rapid urbanization, government initiatives, and technological advancements. The market is experiencing substantial growth, with a projected CAGR of xx% during the forecast period (2025-2033). Increased government spending on infrastructure projects, especially smart city initiatives, is a primary driver. The shift towards energy-efficient lighting solutions is accelerating market penetration, with LED lighting rapidly replacing traditional technologies. Consumer preference for aesthetically pleasing, long-lasting, and cost-effective lighting options further fuels this growth. Competitive dynamics are intense, with companies focusing on innovation, product differentiation, and strategic partnerships to gain a competitive edge. Market penetration of LED outdoor lighting is expected to reach xx% by 2033.

Leading Markets & Segments in India Outdoor LED Industry

The Indian outdoor LED market is witnessing strong growth across all segments, with "Streets and Roadways" and "Public Places" leading the charge. This is due to substantial government investment in infrastructure projects, smart city initiatives, and a strong focus on improving public safety and aesthetics.

- Key Drivers for Streets and Roadways:

- Government initiatives promoting energy-efficient infrastructure.

- Increasing demand for smart city solutions.

- Focus on improving road safety and visibility.

- Key Drivers for Public Places:

- Enhanced safety and security through better lighting.

- Improved aesthetics and beautification of public spaces.

- Growing tourism and the need for attractive public areas.

The dominance of these two segments is underpinned by the significant funding allocated to upgrading urban and rural infrastructure. The "Others" segment, including industrial and commercial applications, also shows promising growth, though at a slower pace compared to the public infrastructure segments. Regional disparities exist, with metropolitan areas exhibiting higher adoption rates due to higher spending capacity and greater awareness of energy-efficient technologies.

India Outdoor LED Industry Product Developments

Recent product innovations have focused on smart lighting solutions, improved energy efficiency, and enhanced durability. Technological advancements in LED chip technology, control systems, and smart sensors have led to the development of more energy-efficient and feature-rich products. Companies are leveraging these advancements to create lighting solutions that offer better light quality, longer lifespan, and remote monitoring capabilities. The market is seeing a growing adoption of intelligent lighting systems that enable dynamic control and optimization of lighting based on real-time conditions, creating considerable competitive advantages.

Key Drivers of India Outdoor LED Industry Growth

Several factors are driving the growth of the Indian outdoor LED industry. Technological advancements, leading to greater energy efficiency and longer lifespans, are key. Government initiatives promoting energy conservation and smart city development are equally crucial, offering incentives and funding for LED adoption. The increasing urbanization and infrastructure development across the country further contribute to heightened demand.

Challenges in the India Outdoor LED Industry Market

Despite significant growth potential, the Indian outdoor LED industry faces challenges. High initial investment costs can hinder wider adoption, particularly in rural areas. Supply chain disruptions and fluctuating raw material prices affect profitability. Intense competition necessitates continuous innovation to maintain market share. Furthermore, regulatory compliance and standardization issues add complexity. These factors collectively impact market growth, though to a manageable extent compared to the overwhelming positive market drivers.

Emerging Opportunities in India Outdoor LED Industry

The long-term outlook for the Indian outdoor LED industry is positive. Technological breakthroughs in areas like smart lighting and IoT integration will unlock new market opportunities. Strategic partnerships between manufacturers, technology providers, and infrastructure developers will further fuel growth. Expanding into rural markets and tapping into the growing demand for energy-efficient solutions in emerging sectors present significant potential.

Leading Players in the India Outdoor LED Industry Sector

- Syska Led Lights Private Limited

- Bajaj Electrical Ltd

- Wipro Lighting Limited (Wipro Enterprises Ltd)

- Havells India Ltd

- Surya Roshni Limited

- OPPLE Lighting Co Ltd

- Eveready Industries India Limited

- Crompton Greaves Consumer Electricals Limited

- Orient Electric Limited

- Signify Holding (Philips)

Key Milestones in India Outdoor LED Industry Industry

- January 2023: Orient Electric launched the #OrientLightsUpIndia campaign, illuminating iconic buildings across India in tricolor for Republic Day.

- March 2023: An unnamed company launched LED track lights designed for ambient illumination.

- April 2023: Signify launched Philips Skyline e-Way, high-performance lighting solutions for safer highways. These launches showcase the continuous innovation and focus on enhanced functionalities and safety within the industry.

Strategic Outlook for India Outdoor LED Industry Market

The future of the Indian outdoor LED market is bright, with substantial growth potential driven by sustained government investment in infrastructure, increasing urbanization, and a strong focus on energy efficiency. Strategic partnerships, technological innovation, and market expansion into untapped segments present significant opportunities for growth and profitability. The market is poised for continued expansion, with smart lighting solutions leading the way.

India Outdoor LED Industry Segmentation

-

1. Outdoor Lighting

- 1.1. Public Places

- 1.2. Streets and Roadways

- 1.3. Others

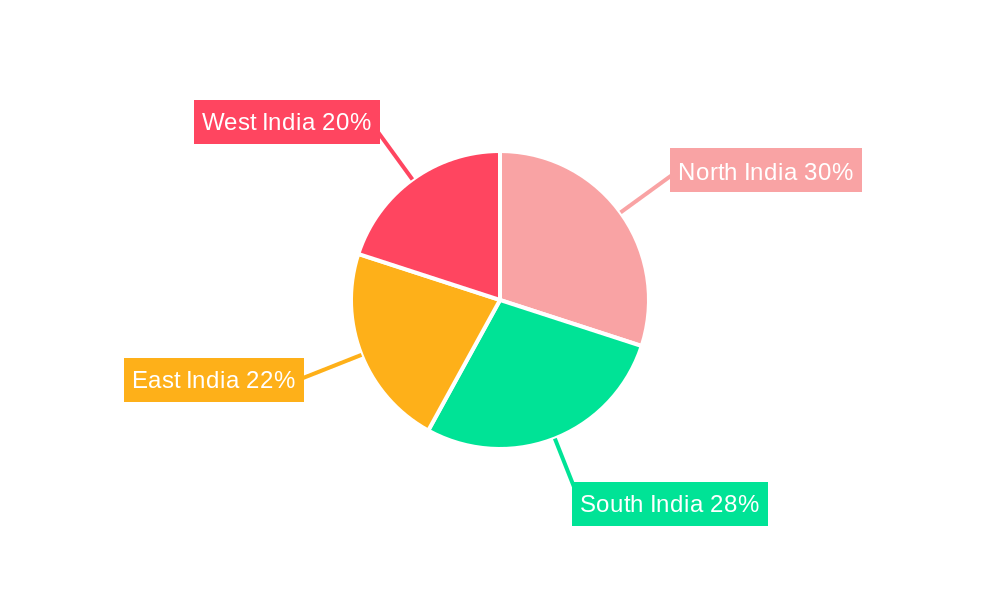

India Outdoor LED Industry Segmentation By Geography

- 1. India

India Outdoor LED Industry Regional Market Share

Geographic Coverage of India Outdoor LED Industry

India Outdoor LED Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Consumer Awareness and Government Regulations Mandating the Installation of Smart Meters; Increased Investments in Smart Grid Projects; Investments in Smart City Developments

- 3.3. Market Restrains

- 3.3.1. High Installation Cost and Longer ROI Period; Longer Replacement Cycle of Water Meters

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Outdoor LED Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 5.1.1. Public Places

- 5.1.2. Streets and Roadways

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Syska Led Lights Private Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bajaj Electrical Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wipro Lighting Limited (Wipro Enterprises Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Havells India Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Surya Roshni Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 OPPLE Lighting Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Eveready Industries India Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Crompton Greaves Consumer Electricals Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Orient Electric Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Signify Holding (Philips)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Syska Led Lights Private Limited

List of Figures

- Figure 1: India Outdoor LED Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Outdoor LED Industry Share (%) by Company 2025

List of Tables

- Table 1: India Outdoor LED Industry Revenue billion Forecast, by Outdoor Lighting 2020 & 2033

- Table 2: India Outdoor LED Industry Volume K Unit Forecast, by Outdoor Lighting 2020 & 2033

- Table 3: India Outdoor LED Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Outdoor LED Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: India Outdoor LED Industry Revenue billion Forecast, by Outdoor Lighting 2020 & 2033

- Table 6: India Outdoor LED Industry Volume K Unit Forecast, by Outdoor Lighting 2020 & 2033

- Table 7: India Outdoor LED Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 8: India Outdoor LED Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Outdoor LED Industry?

The projected CAGR is approximately 8.56%.

2. Which companies are prominent players in the India Outdoor LED Industry?

Key companies in the market include Syska Led Lights Private Limited, Bajaj Electrical Ltd, Wipro Lighting Limited (Wipro Enterprises Ltd, Havells India Ltd, Surya Roshni Limited, OPPLE Lighting Co Ltd, Eveready Industries India Limited, Crompton Greaves Consumer Electricals Limited, Orient Electric Limited, Signify Holding (Philips).

3. What are the main segments of the India Outdoor LED Industry?

The market segments include Outdoor Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.56 billion as of 2022.

5. What are some drivers contributing to market growth?

Higher Consumer Awareness and Government Regulations Mandating the Installation of Smart Meters; Increased Investments in Smart Grid Projects; Investments in Smart City Developments.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Installation Cost and Longer ROI Period; Longer Replacement Cycle of Water Meters.

8. Can you provide examples of recent developments in the market?

April 2023: Signify launched High Performance Lighting Solutions "Philips Skyline e-Way" For Safer Highways.March 2023: In 2023, the company launched LED track lights. The design of these track lights is aimed at producing a luminous and ambient illumination, which renders them ideal for generating a radiant ambiance in any area.January 2023: In 2023, the company Lights up Iconic Buildings Across India in Tricolour for Republic Day as a part of #OrientLightsUpIndia campaign.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Outdoor LED Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Outdoor LED Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Outdoor LED Industry?

To stay informed about further developments, trends, and reports in the India Outdoor LED Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence