Key Insights

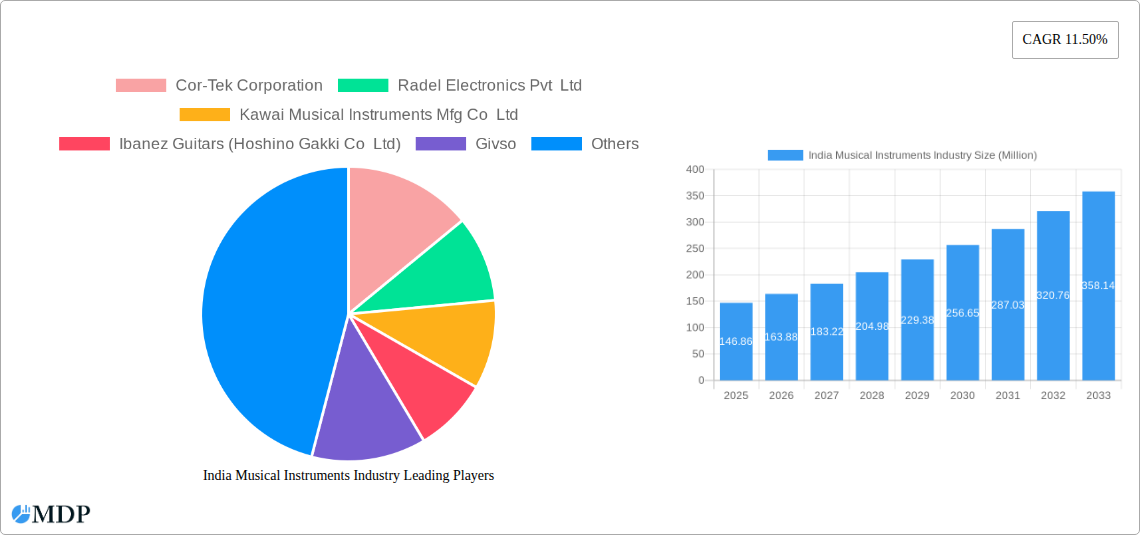

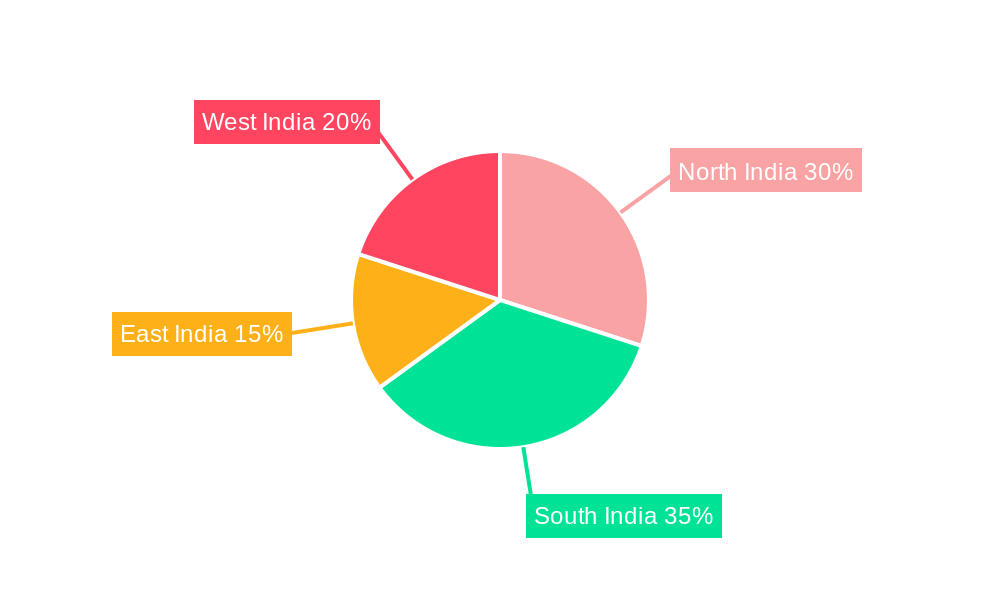

The India musical instruments market, valued at $146.86 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 11.50% from 2025 to 2033. This expansion is fueled by several key drivers. The rising disposable incomes among the Indian middle class are leading to increased spending on leisure activities, including music education and instrument purchases. A burgeoning youth population passionate about music, coupled with the expanding popularity of various musical genres, further contributes to market growth. The growing accessibility of online music education platforms and the rise of social media influencers showcasing musical talent are also creating significant demand. Furthermore, a thriving live music scene and increasing participation in musical events and competitions fuel the demand for high-quality instruments. The market is segmented by instrument type (electronic, stringed, wind, keyboard, percussion, and accessories) and distribution channel (online and offline), providing diversified opportunities for growth. The offline channel, encompassing music stores and retail outlets, currently dominates, but the online segment is witnessing rapid expansion due to e-commerce penetration and convenience. Geographical segmentation reveals varying levels of market maturity across North, South, East, and West India, with potential for accelerated growth in certain regions based on evolving musical preferences and infrastructure development. While challenges such as fluctuating raw material prices and competition from cheaper imported instruments exist, the overall market outlook remains positive, indicating significant potential for investment and expansion in the coming years.

India Musical Instruments Industry Market Size (In Million)

The segmentation by instrument type reveals dynamic trends. Electronic musical instruments, driven by technological advancements and affordability, are experiencing strong growth. The traditional segments like stringed and wind instruments also maintain steady demand, fueled by established music education systems and cultural traditions. The increasing popularity of Western genres and fusion styles is boosting demand for instruments like guitars, keyboards, and drums. The growth of music schools and academies, along with increased government initiatives promoting music education, acts as a catalyst for sustained market expansion. The presence of both established international brands and emerging domestic players contributes to a competitive yet dynamic market landscape. The competitive landscape includes global giants like Yamaha and Fender, alongside rapidly growing domestic players catering to price-sensitive segments. This mixture of established players and new entrants presents both challenges and opportunities for businesses looking to navigate and capitalize on the burgeoning Indian music market.

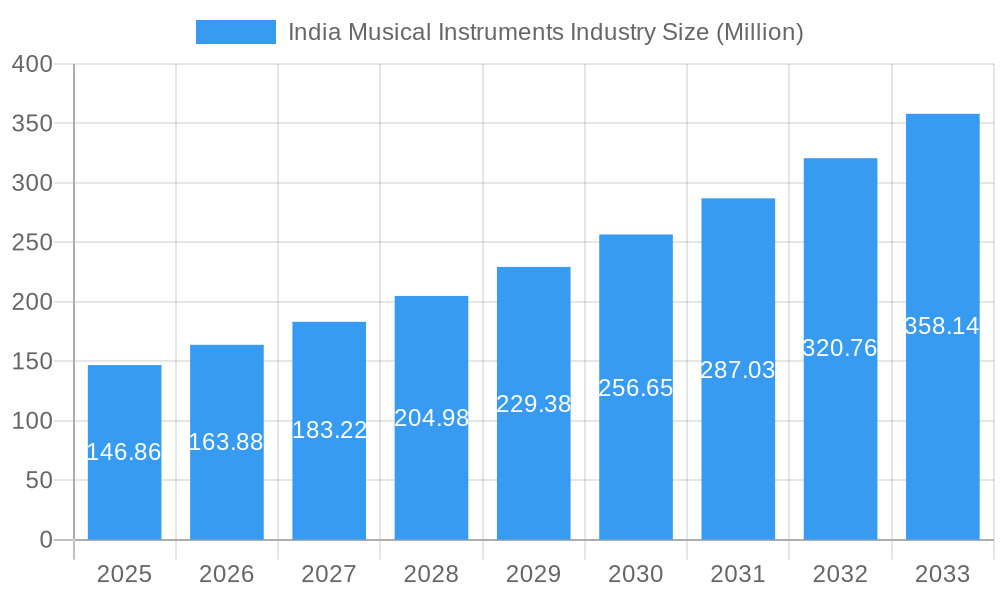

India Musical Instruments Industry Company Market Share

India Musical Instruments Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report offers an in-depth analysis of the India musical instruments industry, providing invaluable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, leading players, and future growth potential. The report leverages extensive data analysis to provide actionable insights and strategic recommendations, covering a market currently valued at xx Million and projected to reach xx Million by 2033.

India Musical Instruments Industry Market Dynamics & Concentration

The Indian musical instruments market is experiencing dynamic growth, fueled by rising disposable incomes, increasing youth population, and growing popularity of music education. Market concentration is moderate, with a mix of established global players and emerging domestic brands. Innovation is a key driver, with continuous development of new instruments and technologies. The regulatory framework, while largely supportive, presents some challenges related to import/export regulations and taxation. Product substitutes, such as digital music creation software, pose a competitive threat, though the tactile and emotional experience of physical instruments remains highly valued. End-user trends show a preference for digital instruments amongst younger demographics, while traditional instruments maintain strong appeal among older generations. M&A activities have been relatively limited in recent years, with only xx deals recorded between 2019 and 2024, indicating a relatively stable market structure. The market share is distributed as follows (estimated):

- Yamaha Corporation: xx%

- Roland Corporation: xx%

- Fender Musical Instruments Corporation: xx%

- Other Players: xx%

India Musical Instruments Industry Industry Trends & Analysis

The Indian musical instruments market exhibits a strong growth trajectory, driven by a multitude of factors. The increasing popularity of Indian classical and Western music, coupled with a rise in music education initiatives, significantly boosts demand. Technological advancements, such as the incorporation of digital features into traditional instruments and the emergence of innovative electronic instruments, are reshaping the market landscape. Consumer preferences are shifting towards versatility and affordability, favoring instruments that combine traditional aesthetics with modern functionalities. Competitive dynamics are intense, with both established international brands and emerging domestic players vying for market share. The market is experiencing a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), and this growth is expected to continue at a CAGR of xx% during the forecast period (2025-2033). Market penetration of digital instruments is steadily increasing, particularly amongst younger demographics, reaching an estimated xx% in 2024.

Leading Markets & Segments in India Musical Instruments Industry

The Indian musical instruments market is geographically diverse, with significant variations in demand across regions. However, metropolitan areas and regions with strong cultural traditions in music demonstrate higher market penetration.

By Type:

- Electronic Musical Instruments: This segment dominates the market, driven by technological advancements, affordability, and the growing popularity of electronic music. Key drivers include the rising adoption of digital audio workstations (DAWs) and the increasing demand for electronic instruments in music production studios.

- Stringed Musical Instruments: This segment holds a significant share, reflecting the enduring appeal of traditional instruments like guitars, violins, and sitar. Drivers include the growing interest in classical music and the development of hybrid instruments combining traditional designs with modern technologies.

- Wind Instruments: This segment shows steady growth, fueled by increasing participation in band and orchestral music. Drivers include government initiatives to promote music education and the increasing availability of quality wind instruments at competitive prices.

- Acoustic Pianos and Stringed Keyboard Instruments: This segment experiences moderate growth, driven by increasing affordability and the continued appeal of acoustic instruments. Drivers include the growing popularity of piano and keyboard lessons and the availability of diverse instrument options for different skill levels.

- Percussion Instruments: This segment exhibits consistent demand, particularly for traditional Indian percussion instruments. Drivers include the rise of fusion music and the ongoing demand for these instruments in religious and cultural ceremonies.

- Other Musical Instruments (Parts and Accessories): This segment complements the other segments, experiencing growth in line with overall market expansion. This growth is supported by the increasing availability of spare parts and accessories from online retailers and instrument shops.

By Distribution Channel:

- Online: The online segment is experiencing rapid growth, driven by the expansion of e-commerce platforms and the increasing accessibility of online music retailers.

- Offline: The offline segment continues to be significant, with a substantial presence of physical music stores and instrument retailers across the country.

India Musical Instruments Industry Product Developments

Recent innovations include hybrid instruments that blend acoustic and digital features, smart instruments with integrated technology, and personalized instrument customization options. These developments cater to evolving consumer preferences and market demand for versatility and enhanced musical experience. The market is witnessing a trend towards compact, portable instruments, appealing to both professionals and amateurs.

Key Drivers of India Musical Instruments Industry Growth

Key growth drivers include the burgeoning music education sector, the rising popularity of music festivals and concerts, and increased government initiatives to support the arts. Technological advancements, including the creation of more affordable and accessible digital instruments, play a significant role. The growth of the middle class and increased disposable incomes also contribute to higher spending on musical instruments.

Challenges in the India Musical Instruments Industry Market

Challenges include the impact of counterfeit instruments, fluctuating raw material prices, and intense competition, especially from cheaper imports. Supply chain disruptions can lead to price volatility and delays. Regulatory hurdles and taxation policies can also affect market growth. These factors collectively impact overall profitability and market stability.

Emerging Opportunities in India Musical Instruments Industry

Emerging opportunities lie in tapping into the growing demand for online music education platforms, developing innovative hybrid instruments, and expanding into rural markets. Strategic partnerships with music schools and educational institutions represent a promising avenue for growth. The continued growth of the digital music sector also presents opportunities for manufacturers to integrate their products with digital platforms and software.

Leading Players in the India Musical Instruments Industry Sector

- Cor-Tek Corporation

- Radel Electronics Pvt Ltd

- Kawai Musical Instruments Mfg Co Ltd

- Ibanez Guitars (Hoshino Gakki Co Ltd)

- Givso

- Kadence

- Steinway & Sons

- Yamaha Corporation

- Roland Corporation

- Fender Musical Instruments Corporation

Key Milestones in India Musical Instruments Industry Industry

- February 2024: Kawai's CA901 digital piano receives the "Editor's Choice" award at the 2024 NAMM Show. This recognition boosts brand credibility and market visibility.

- March 2024: Roland launches the RD-08 stage piano, showcasing advancements in digital piano technology and increasing competition in the market.

Strategic Outlook for India Musical Instruments Industry Market

The future of the Indian musical instruments market appears bright, with continued growth driven by a confluence of factors. Strategic opportunities exist in focusing on innovation, expanding distribution networks, particularly in digital channels, and fostering strategic partnerships. By addressing challenges proactively and leveraging emerging opportunities, industry players can secure significant market share and achieve substantial growth in the coming years.

India Musical Instruments Industry Segmentation

-

1. Type

- 1.1. Electronic Musical Instruments

- 1.2. Stringed Musical Instruments

- 1.3. Wind Instruments

- 1.4. Acoustic Pianos and Stringed Keyboard Instruments

- 1.5. Percussion Instruments

- 1.6. Other Musical Instruments (Parts and Accessories)

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

India Musical Instruments Industry Segmentation By Geography

- 1. India

India Musical Instruments Industry Regional Market Share

Geographic Coverage of India Musical Instruments Industry

India Musical Instruments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Popularity of Live Concerts and Performances; Increasing Technological Advancements in Musical Instruments

- 3.3. Market Restrains

- 3.3.1. High Cost of Instruments

- 3.4. Market Trends

- 3.4.1. Growing Popularity of Live Concerts and Performances to Witness the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Musical Instruments Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Electronic Musical Instruments

- 5.1.2. Stringed Musical Instruments

- 5.1.3. Wind Instruments

- 5.1.4. Acoustic Pianos and Stringed Keyboard Instruments

- 5.1.5. Percussion Instruments

- 5.1.6. Other Musical Instruments (Parts and Accessories)

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cor-Tek Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Radel Electronics Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kawai Musical Instruments Mfg Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ibanez Guitars (Hoshino Gakki Co Ltd)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Givso

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kadence

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Steinway & Sons

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yamaha Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Roland Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fender Musical Instruments Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cor-Tek Corporation

List of Figures

- Figure 1: India Musical Instruments Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Musical Instruments Industry Share (%) by Company 2025

List of Tables

- Table 1: India Musical Instruments Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Musical Instruments Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: India Musical Instruments Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Musical Instruments Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: India Musical Instruments Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: India Musical Instruments Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Musical Instruments Industry?

The projected CAGR is approximately 11.50%.

2. Which companies are prominent players in the India Musical Instruments Industry?

Key companies in the market include Cor-Tek Corporation, Radel Electronics Pvt Ltd, Kawai Musical Instruments Mfg Co Ltd, Ibanez Guitars (Hoshino Gakki Co Ltd), Givso, Kadence, Steinway & Sons, Yamaha Corporation, Roland Corporation, Fender Musical Instruments Corporation.

3. What are the main segments of the India Musical Instruments Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 146.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Live Concerts and Performances; Increasing Technological Advancements in Musical Instruments.

6. What are the notable trends driving market growth?

Growing Popularity of Live Concerts and Performances to Witness the Growth.

7. Are there any restraints impacting market growth?

High Cost of Instruments.

8. Can you provide examples of recent developments in the market?

March 2024 - Roland recently unveiled its newest addition to the RD stage piano lineup, the RD-08. Boasting an impressive array of features, the RD-08 stands out with its 100 scenes, over 3,000 tones, and an extensive selection of effects. The piano offers hands-on control through assignable pitch bend and modulation wheels, along with four control knobs. Additionally, it provides inputs for a damper pedal and two other assignable pedals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Musical Instruments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Musical Instruments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Musical Instruments Industry?

To stay informed about further developments, trends, and reports in the India Musical Instruments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence