Key Insights

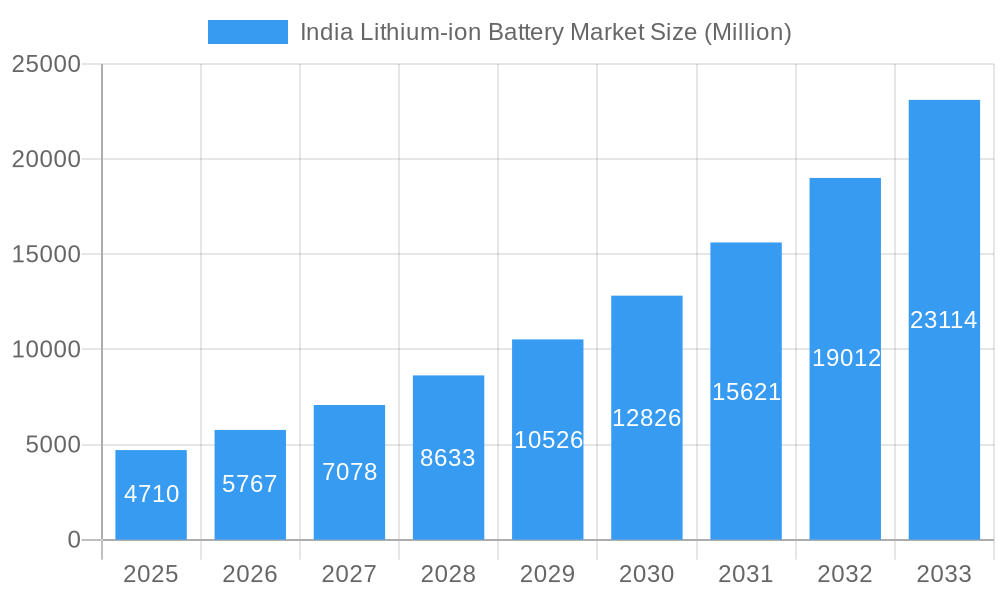

The India lithium-ion battery market is experiencing robust growth, projected to reach \$4.71 billion in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 22.72% from 2025 to 2033. This surge is driven by several key factors. The increasing adoption of electric vehicles (EVs) across India is a major catalyst, fueling demand for high-performance lithium-ion batteries. Furthermore, the government's strong push for renewable energy sources and energy storage solutions, coupled with declining battery costs and advancements in battery technology, are creating a favorable environment for market expansion. The portable electronics segment is a significant contributor, with smartphones, laptops, and other devices driving substantial demand. However, the market faces challenges including the dependence on imported raw materials, concerns about battery safety and recycling infrastructure, and potential supply chain disruptions. Despite these hurdles, the long-term outlook remains optimistic, with substantial growth opportunities expected across various application segments, particularly in automotive and energy storage. The competitive landscape is dynamic, with both domestic and international players vying for market share. Key players include Okaya Power Group, Nexcharge, and Telemax India Industries, among others, constantly innovating to improve battery performance and reduce costs. Regional variations in growth are anticipated, driven by infrastructure development and government initiatives in different parts of the country. The market is poised for continued expansion as India accelerates its transition towards a cleaner and more sustainable energy future.

India Lithium-ion Battery Market Market Size (In Billion)

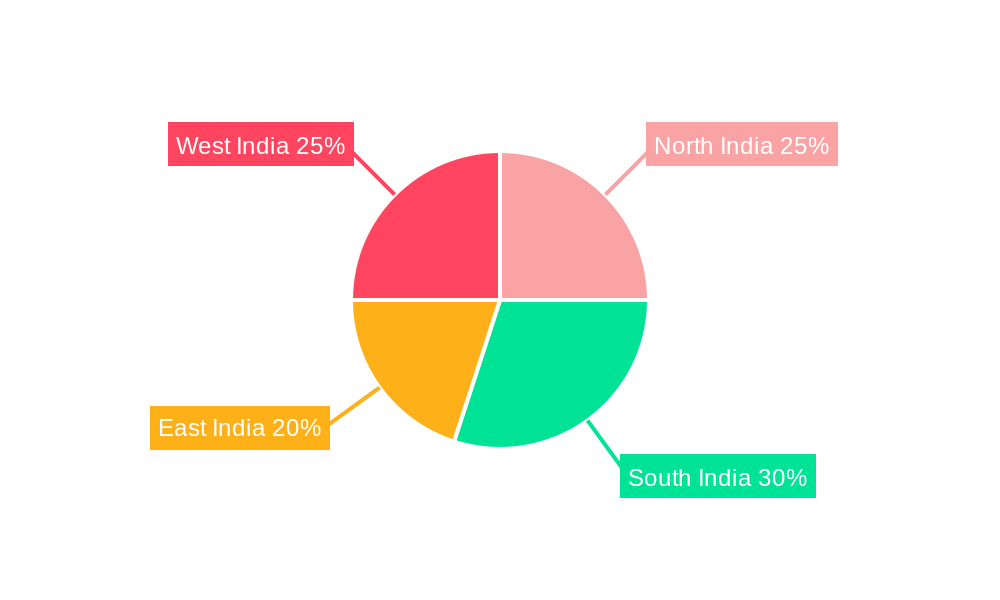

The market segmentation reveals significant opportunities within the portable, automotive, and other applications categories. The automotive segment, fueled by the growth of the EV industry, is expected to show particularly strong growth. The "other applications" category encompasses diverse sectors like stationary energy storage, industrial equipment, and medical devices, presenting a broad range of potential avenues for market expansion. Geographic segmentation highlights the differing growth trajectories across North, South, East, and West India, with potential variations in infrastructure development and market penetration rates. Continuous monitoring of government policies, technological innovations, and competitive dynamics will be crucial for success in this rapidly evolving market.

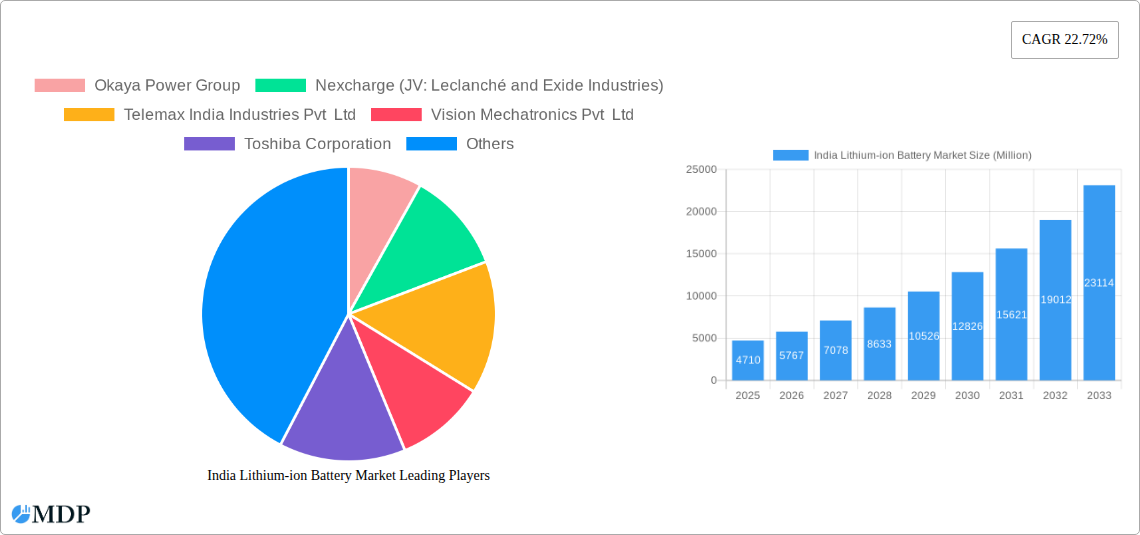

India Lithium-ion Battery Market Company Market Share

India Lithium-ion Battery Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning India Lithium-ion Battery market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a meticulous study period spanning 2019-2033, including a base year of 2025 and a forecast period from 2025-2033, this report delivers a 360° view of market dynamics, trends, and future prospects. High-growth keywords like "India lithium-ion battery market size," "electric vehicle battery market India," "lithium-ion battery manufacturing India," and "energy storage solutions India" are strategically incorporated to maximize search engine visibility.

India Lithium-ion Battery Market Market Dynamics & Concentration

The Indian lithium-ion battery market is experiencing rapid growth, driven by increasing demand from the burgeoning electric vehicle (EV) sector, portable electronics, and other applications. Market concentration is moderate, with a few dominant players and numerous smaller companies competing for market share. Innovation in battery technology, particularly in areas like energy density, charging time, and safety, is a key driver. The Indian government's supportive regulatory framework, including incentives and policies promoting EV adoption, is further fueling market expansion. Product substitutes, such as lead-acid batteries, are facing declining market share due to the superior performance and environmental benefits of lithium-ion batteries. The market has seen several mergers and acquisitions (M&A) in recent years, reflecting the strategic importance of securing market share and technological advancements.

- Market Share: The top 5 players account for approximately XX% of the market share in 2025. (Market share data needs to be collected).

- M&A Activity: There were approximately xx M&A deals in the Indian lithium-ion battery market during the historical period (2019-2024).

- End-User Trends: A shift towards higher-capacity, longer-lasting batteries is observed, driven by increasing consumer demand for improved performance and extended usage.

India Lithium-ion Battery Market Industry Trends & Analysis

The India lithium-ion battery market is characterized by strong growth drivers, including the government's push towards electric mobility, rising demand for portable electronic devices, and the increasing adoption of energy storage solutions for renewable energy integration. The market is experiencing significant technological disruptions, with advancements in battery chemistries (like LFP and NMC) and cell designs improving performance and reducing costs. Consumer preferences are leaning towards longer lifespan, faster charging, and improved safety features. Competitive dynamics are intense, with both domestic and international players vying for market share through innovation, strategic partnerships, and aggressive pricing strategies. The CAGR for the market during the forecast period (2025-2033) is estimated at XX%. Market penetration is expected to reach XX% by 2033.

Leading Markets & Segments in India Lithium-ion Battery Market

The automotive segment is projected to be the dominant application area for lithium-ion batteries in India, driven primarily by the rapid growth of the electric vehicle industry. Government initiatives, such as the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME) scheme, are significantly boosting EV adoption. The portable segment is another significant application, fuelled by the increasing demand for smartphones, laptops, and other portable electronic devices. The "other applications" segment includes energy storage for renewable energy systems and grid-scale applications, which are expected to gain traction in the coming years.

- Key Drivers for Automotive Segment:

- Government incentives for EV adoption.

- Growing consumer preference for electric vehicles.

- Expanding charging infrastructure.

- Key Drivers for Portable Segment:

- Rising demand for smartphones and other portable devices.

- Increasing disposable incomes.

- Technological advancements leading to smaller, lighter batteries.

The dominance of the automotive segment is primarily attributable to the scale of the EV revolution in India and the significant government support. The expanding charging infrastructure across urban centers is further reinforcing the growth of this sector.

India Lithium-ion Battery Market Product Developments

Recent product innovations focus on enhancing energy density, extending battery life, improving safety features, and reducing costs. Advancements in battery chemistries, like Lithium Iron Phosphate (LFP) and Nickel Manganese Cobalt (NMC), are leading to improved performance and wider applications. Innovations in battery management systems (BMS) are optimizing battery performance and extending lifespan. These advancements are enabling better market fit, addressing consumer demands for superior performance and reliability, while simultaneously increasing the competitiveness of domestic players in the global arena.

Key Drivers of India Lithium-ion Battery Market Growth

Several factors contribute to the robust growth of the India lithium-ion battery market. Government initiatives promoting electric vehicle adoption, coupled with increasing environmental awareness among consumers, are driving substantial demand. Furthermore, technological advancements resulting in higher energy density, faster charging, and improved safety features are creating a favorable market environment. The increasing penetration of renewable energy sources, which necessitate efficient energy storage solutions, is further bolstering market expansion. Finally, the availability of raw materials, along with strategic investments in manufacturing capabilities, is contributing to the market's positive growth trajectory.

Challenges in the India Lithium-ion Battery Market Market

Despite the considerable growth potential, several challenges impede the Indian lithium-ion battery market's expansion. High raw material costs, particularly for lithium and cobalt, can impact profitability. Supply chain disruptions, both domestically and globally, can negatively affect production and availability. Stringent regulatory compliance requirements and the need for robust quality control mechanisms pose additional challenges. Lastly, intense competition from established international players necessitates continuous innovation and cost optimization to remain competitive.

Emerging Opportunities in India Lithium-ion Battery Market

The Indian lithium-ion battery market presents numerous long-term growth opportunities. Technological breakthroughs in battery chemistry and manufacturing processes will unlock higher energy density and faster charging capabilities, leading to increased market penetration. Strategic partnerships between domestic and international players can facilitate technology transfer and enhance manufacturing capabilities. Furthermore, expanding into emerging applications, such as grid-scale energy storage and industrial automation, will unlock new market segments and contribute to sustained growth.

Leading Players in the India Lithium-ion Battery Market Sector

- Okaya Power Group

- Nexcharge (JV: Leclanché and Exide Industries)

- Telemax India Industries Pvt Ltd

- Vision Mechatronics Pvt Ltd

- Toshiba Corporation

- Amperex Technology Limited

- Future Hi-Tech Batteries

- Exicom Tele-Systems Limited

- iPower Batteries Pvt Ltd

- Trontek Group

- TDS Lithium-Ion Battery Gujarat Private Limited (TDSG)

- Inverted Energy Private Limited

- Bharat Electronics Limited (BEL)

Key Milestones in India Lithium-ion Battery Market Industry

- December 2023: Himadri Speciality Chemical Ltd announced a USD 576 Million investment in a lithium iron phosphate production plant, crucial for lithium-ion battery manufacturing.

- January 2024: Amara Raja Batteries Ltd announced plans for a gigafactory with a capacity of up to 16 GWh for lithium cells and 5 GWh for battery packs by the end of 2025.

- March 2024: Panasonic Energy Co Ltd and Indian Oil Corporation Ltd formed a joint venture to manufacture cylindrical lithium-ion batteries, signifying a significant foreign investment in the sector.

Strategic Outlook for India Lithium-ion Battery Market Market

The future of the India lithium-ion battery market appears exceptionally bright. The confluence of government support, technological advancements, and rising consumer demand creates a powerful growth impetus. Strategic investments in research and development, coupled with strategic partnerships and robust supply chains, will be key to capitalizing on the vast growth potential. The market is poised to become a global leader in lithium-ion battery manufacturing and adoption, contributing significantly to India's energy transition goals.

India Lithium-ion Battery Market Segmentation

-

1. Application

- 1.1. Portable

- 1.2. Automotive

- 1.3. Other Applications

India Lithium-ion Battery Market Segmentation By Geography

- 1. India

India Lithium-ion Battery Market Regional Market Share

Geographic Coverage of India Lithium-ion Battery Market

India Lithium-ion Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost Of Lithium-ion Batteries4.; Increasing Adoption of Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. 4.; Demand and Supply of Raw Materials for Battery Manufacturing

- 3.4. Market Trends

- 3.4.1. The Automotive Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Lithium-ion Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Portable

- 5.1.2. Automotive

- 5.1.3. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Okaya Power Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nexcharge (JV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.1 Okaya Power Group

List of Figures

- Figure 1: India Lithium-ion Battery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Lithium-ion Battery Market Share (%) by Company 2025

List of Tables

- Table 1: India Lithium-ion Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: India Lithium-ion Battery Market Volume K Units Forecast, by Application 2020 & 2033

- Table 3: India Lithium-ion Battery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Lithium-ion Battery Market Volume K Units Forecast, by Region 2020 & 2033

- Table 5: India Lithium-ion Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: India Lithium-ion Battery Market Volume K Units Forecast, by Application 2020 & 2033

- Table 7: India Lithium-ion Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: India Lithium-ion Battery Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Lithium-ion Battery Market?

The projected CAGR is approximately 22.72%.

2. Which companies are prominent players in the India Lithium-ion Battery Market?

Key companies in the market include Okaya Power Group, Nexcharge (JV: Leclanché and Exide Industries), Telemax India Industries Pvt Ltd, Vision Mechatronics Pvt Ltd, Toshiba Corporation, Amperex Technology Limited, Future Hi-Tech Batteries, Exicom Tele-Systems Limited, iPower Batteries Pvt Ltd *List Not Exhaustive 6 4 Market Ranking Analysi, Trontek Group, TDS Lithium-Ion Battery Gujarat Private Limited (TDSG), Inverted Energy Private Limited, Bharat Electronics Limited (BEL).

3. What are the main segments of the India Lithium-ion Battery Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.71 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost Of Lithium-ion Batteries4.; Increasing Adoption of Electric Vehicles.

6. What are the notable trends driving market growth?

The Automotive Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Demand and Supply of Raw Materials for Battery Manufacturing.

8. Can you provide examples of recent developments in the market?

March 2024: Panasonic Energy Co Ltd, a subsidiary of Panasonic Group, a Japan-based multinational electronics company, will form a joint venture with Maharatna PSU Indian Oil Corporation Ltd, the nation's biggest oil firm, to manufacture cylindrical lithium-ion batteries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Lithium-ion Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Lithium-ion Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Lithium-ion Battery Market?

To stay informed about further developments, trends, and reports in the India Lithium-ion Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence