Key Insights

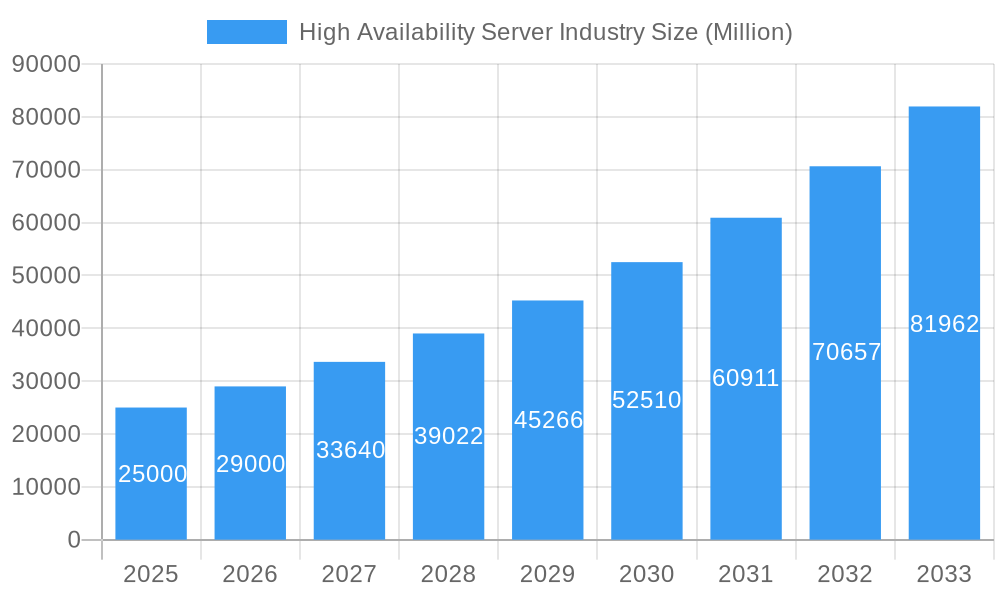

The High Availability Server Industry is poised for substantial growth, projected to reach a significant market size in millions, driven by a robust CAGR of 16.00%. This impressive expansion is fueled by the increasing demand for uninterrupted IT operations across various sectors. Key drivers include the escalating digital transformation initiatives, the growing reliance on cloud infrastructure, and the critical need to mitigate downtime, which incurs substantial financial losses and reputational damage. Businesses are increasingly investing in high availability solutions to ensure business continuity, enhance customer satisfaction, and maintain a competitive edge in an always-on digital landscape. The IT & Telecommunication and BFSI sectors are leading the charge in adopting these solutions, recognizing their paramount importance for data integrity and service reliability. Furthermore, the growing adoption of advanced technologies like artificial intelligence, machine learning, and the Internet of Things (IoT) necessitates resilient infrastructure capable of handling continuous data streams and complex processing without interruption.

High Availability Server Industry Market Size (In Billion)

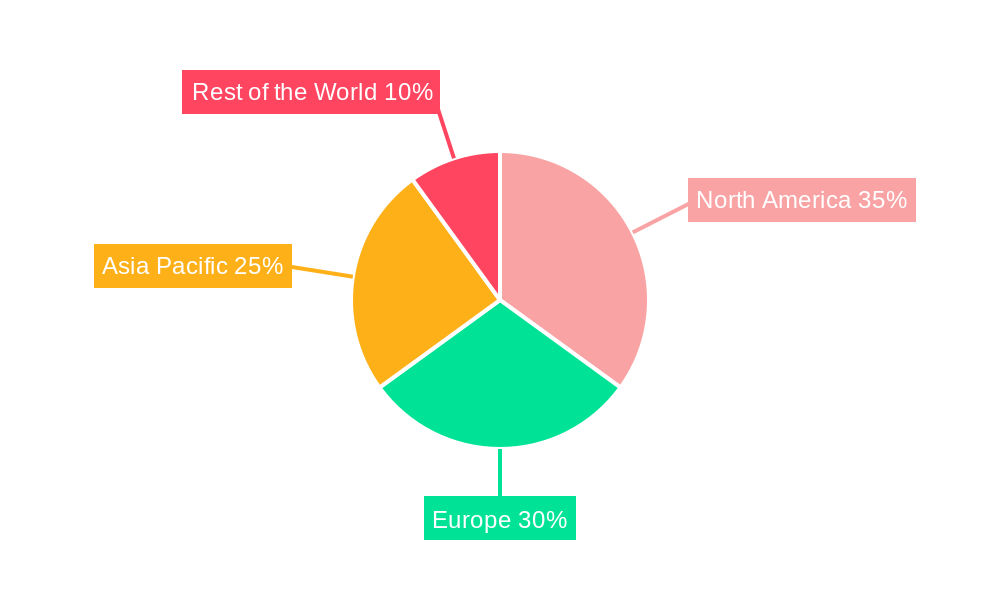

The market is witnessing a pronounced shift towards cloud-based deployment models, offering scalability, flexibility, and cost-effectiveness compared to traditional on-premise solutions. However, on-premise deployments continue to hold a significant share, particularly in industries with stringent data security and regulatory compliance requirements. The Windows operating system dominates, followed by Linux, reflecting their widespread enterprise adoption. Emerging operating systems like UNIX and BSD also contribute to the market, catering to specialized high-performance computing environments. Geographically, North America and Europe currently represent the largest markets due to their established technological infrastructure and early adoption of enterprise solutions. However, the Asia Pacific region is expected to experience the fastest growth, fueled by rapid digitalization, a burgeoning IT sector, and increasing investments in robust IT infrastructure by enterprises of all sizes. Key industry players are actively innovating, offering advanced clustering, failover, and disaster recovery solutions to meet the evolving demands of this dynamic market.

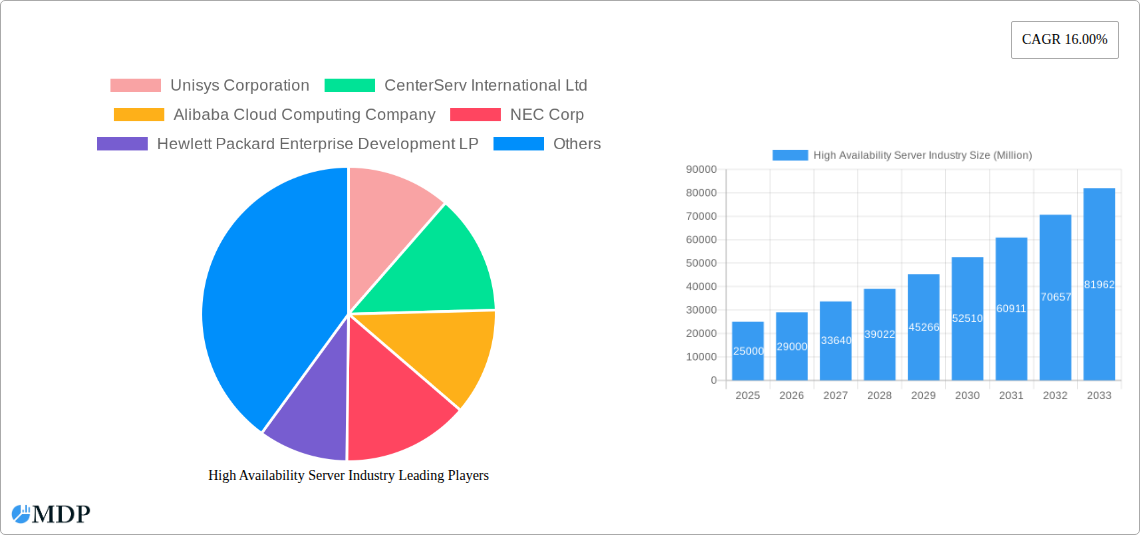

High Availability Server Industry Company Market Share

This in-depth report offers a definitive analysis of the global High Availability Server Industry, providing critical insights for stakeholders navigating this dynamic sector. With a study period spanning from 2019 to 2033, a base year of 2025, and a detailed forecast period of 2025–2033, this report leverages historical data from 2019–2024 to project future market trajectories. Discover key market drivers, technological innovations, emerging opportunities, and challenges that will shape the high availability server landscape, impacting critical industries like IT & Telecommunication, BFSI, Retail, Healthcare, and Industrial sectors.

High Availability Server Industry Market Dynamics & Concentration

The High Availability Server Industry is characterized by a moderate to high level of market concentration, with several key players dominating market share. Innovation drivers, such as the increasing demand for uninterrupted business operations, the proliferation of cloud computing, and the growing volume of data necessitating robust infrastructure, are propelling market expansion. Regulatory frameworks, while not overtly restrictive, often mandate stringent uptime requirements for critical sectors like BFSI and Healthcare, indirectly fueling demand for high availability solutions. Product substitutes, primarily comprising advanced disaster recovery solutions and virtualized environments with failover capabilities, offer competitive alternatives, though dedicated high availability server hardware often provides superior performance and reliability for mission-critical applications. End-user trends indicate a strong preference for solutions that minimize downtime and data loss, driving adoption across all major industries. Mergers and acquisitions (M&A) activities are a significant feature of the market, with an estimated xx M&A deals recorded during the historical period, aimed at consolidating market presence, acquiring innovative technologies, and expanding service offerings. Key companies like IBM Corp and Hewlett Packard Enterprise Development LP have historically been involved in strategic acquisitions to bolster their high availability server portfolios.

High Availability Server Industry Industry Trends & Analysis

The High Availability Server Industry is experiencing robust growth, driven by a confluence of technological advancements and evolving business imperatives. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. Key market growth drivers include the escalating digital transformation initiatives across various sectors, the pervasive adoption of cloud-native architectures, and the increasing complexity of IT infrastructures that demand resilient computing environments. Technological disruptions, such as advancements in virtualization, containerization, and edge computing, are reshaping the way high availability is implemented, offering more flexible and scalable solutions. Consumer preferences are increasingly leaning towards service-level agreements (SLAs) that guarantee near-zero downtime, pushing vendors to offer more sophisticated and reliable high availability server solutions. Competitive dynamics are intense, with established players continuously innovating and new entrants challenging the status quo with specialized offerings. The market penetration of high availability server solutions is expected to rise significantly, particularly within the BFSI and IT & Telecommunication sectors, where operational continuity is paramount. The demand for geographically distributed disaster recovery capabilities and active-active configurations is also a prominent trend, further enhancing the value proposition of high availability server systems.

Leading Markets & Segments in High Availability Server Industry

The global High Availability Server Industry demonstrates significant regional and segment-specific dominance.

Deployment:

- Cloud-based Deployment: This segment is experiencing rapid expansion, fueled by the cost-effectiveness, scalability, and flexibility offered by cloud providers. The convenience of managed services and the reduced burden of infrastructure maintenance are key drivers. Cloud-based high availability solutions are increasingly favored by small and medium-sized enterprises (SMEs) as well as large enterprises looking to optimize their IT operational expenditures.

- On-premise Deployment: While cloud-based solutions are gaining traction, on-premise deployments remain crucial for organizations with strict data sovereignty requirements, stringent security protocols, or existing substantial on-premise infrastructure investments. Sectors like BFSI and government often maintain significant on-premise footprints for their core operations.

Operating System:

- Linux: This segment leads the market due to its open-source nature, cost-effectiveness, flexibility, and robust performance, making it a preferred choice for mission-critical applications. Its extensive community support and widespread adoption in server environments contribute to its dominance.

- Windows: Windows-based high availability servers are prevalent in environments heavily invested in the Microsoft ecosystem, particularly within enterprises utilizing Windows Server and related applications.

- Other Operating System (UNIX, BSD): These operating systems maintain a strong presence in niche markets and legacy systems, particularly in financial services and telecommunications where their inherent stability and reliability are highly valued.

End-user Industry:

- IT & Telecommunication: This sector is the largest consumer of high availability server solutions, owing to the constant demand for uninterrupted connectivity and digital services. The growing reliance on data centers and cloud infrastructure further amplifies this demand.

- BFSI (Banking, Financial Services, and Insurance): The stringent regulatory environment and the critical need for transactional integrity and customer data protection make this industry a major driver for high availability servers. Downtime in this sector can result in substantial financial losses and reputational damage.

- Retail: With the rise of e-commerce and the need for seamless online and in-store operations, the retail sector is increasingly investing in high availability solutions to ensure uninterrupted customer experience and sales.

- Healthcare: The critical nature of patient care and the need for immediate access to medical records and systems drive significant demand for high availability servers within the healthcare industry.

- Industrial: The adoption of Industry 4.0 technologies and the increasing reliance on interconnected systems for manufacturing and operations are spurring the demand for resilient server infrastructure.

Economic policies supporting digital infrastructure development and technological advancements in server hardware and software are key factors driving the dominance of these markets and segments.

High Availability Server Industry Product Developments

Recent product developments in the High Availability Server Industry are focused on enhanced resilience, automation, and integration. Vendors are introducing next-generation servers with advanced hardware-level redundancy, faster failover times, and improved energy efficiency. Innovations in software-defined high availability and AI-driven predictive maintenance are enabling proactive issue detection and resolution, minimizing potential downtime. The integration of high availability solutions with cloud platforms and hybrid cloud environments is becoming increasingly sophisticated, offering seamless scalability and management. Competitive advantages are being derived from solutions that offer comprehensive data protection, robust disaster recovery capabilities, and simplified deployment and management for complex workloads.

Key Drivers of High Availability Server Industry Growth

Several key factors are propelling the growth of the High Availability Server Industry. The escalating digital transformation across all sectors necessitates continuous operational uptime to support critical business functions and customer interactions. The increasing volume and complexity of data, coupled with the growing adoption of big data analytics and AI, demand robust and uninterrupted processing capabilities. Furthermore, stringent regulatory compliance requirements, particularly in industries like BFSI and Healthcare, mandate high levels of server availability and data integrity. The ongoing shift towards cloud computing and hybrid cloud environments is also a significant driver, as organizations seek resilient infrastructure solutions to support their distributed applications and services.

Challenges in the High Availability Server Industry Market

Despite the strong growth trajectory, the High Availability Server Industry faces several challenges. The high initial cost of implementing advanced high availability solutions can be a barrier for some organizations, particularly SMEs. The complexity of configuring and managing sophisticated high availability systems requires specialized expertise, which may not be readily available. Furthermore, the rapidly evolving technological landscape demands continuous investment in upgrades and maintenance to stay competitive and secure. Supply chain disruptions for critical hardware components can also lead to implementation delays and increased costs, impacting market availability.

Emerging Opportunities in High Availability Server Industry

The High Availability Server Industry is poised for significant growth driven by emerging opportunities. The expansion of edge computing and the Internet of Things (IoT) will necessitate highly available server infrastructure at distributed locations to process data in real-time. Strategic partnerships between hardware manufacturers, software providers, and cloud service providers are creating integrated and comprehensive high availability solutions. Market expansion into developing economies, as they accelerate their digital transformation initiatives, presents a substantial untapped market for these critical server technologies. The increasing adoption of AI and machine learning for predictive analytics and automated system management within high availability frameworks offers further avenues for innovation and market differentiation.

Leading Players in the High Availability Server Industry Sector

- Unisys Corporation

- CenterServ International Ltd

- Alibaba Cloud Computing Company

- NEC Corp

- Hewlett Packard Enterprise Development LP

- IBM Corp

- Fujitsu Limited

- Juniper Networks Inc

- Amazon Web Services Inc

- Dell Inc

- Cisco System Inc

- Oracle Corp

Key Milestones in High Availability Server Industry Industry

- 2019: Increased adoption of hyperconverged infrastructure (HCI) solutions offering integrated high availability capabilities.

- 2020: Accelerated demand for cloud-based high availability services due to remote work trends and increased online activity.

- 2021: Introduction of AI-powered predictive analytics for proactive failure detection in server systems.

- 2022: Significant investments in geographically dispersed disaster recovery solutions to mitigate regional outages.

- 2023: Growth in specialized high availability offerings for edge computing and IoT deployments.

- 2024: Enhanced focus on software-defined high availability for greater flexibility and automation.

Strategic Outlook for High Availability Server Industry Market

The strategic outlook for the High Availability Server Industry is exceptionally promising, driven by the persistent and growing need for uninterrupted business operations in an increasingly digital world. Future growth will be accelerated by the continued expansion of cloud services, the proliferation of edge computing, and the integration of AI for enhanced resilience and automation. Organizations will increasingly adopt multi-cloud and hybrid cloud strategies, demanding robust and seamlessly integrated high availability solutions across these environments. Strategic opportunities lie in developing more cost-effective and easily deployable high availability solutions for SMEs, while larger enterprises will seek advanced, AI-driven platforms for mission-critical workloads. The market is set for continued innovation and strategic collaborations.

High Availability Server Industry Segmentation

-

1. Deployment

- 1.1. Cloud-based

- 1.2. On-premise

-

2. Operating System

- 2.1. Windows

- 2.2. Linux

- 2.3. Other Operating System ( (UNIX, BSD)

-

3. End-user Industry

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Retail

- 3.4. Healthcare

- 3.5. Industrial

- 3.6. Other End-user Industries

High Availability Server Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

High Availability Server Industry Regional Market Share

Geographic Coverage of High Availability Server Industry

High Availability Server Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; High Adoption Rate of High Availability Server Across BFSI Sector; Growing Demand for Modular & Micro Data Center with the Increasing Application of IoT Devices

- 3.3. Market Restrains

- 3.3.1. ; Lack of Awareness Among Professionals; High Cost for Initial Installation/Deployment

- 3.4. Market Trends

- 3.4.1. BFSI Sector is Expected to Have a Significant Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Availability Server Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Cloud-based

- 5.1.2. On-premise

- 5.2. Market Analysis, Insights and Forecast - by Operating System

- 5.2.1. Windows

- 5.2.2. Linux

- 5.2.3. Other Operating System ( (UNIX, BSD)

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Retail

- 5.3.4. Healthcare

- 5.3.5. Industrial

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America High Availability Server Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. Cloud-based

- 6.1.2. On-premise

- 6.2. Market Analysis, Insights and Forecast - by Operating System

- 6.2.1. Windows

- 6.2.2. Linux

- 6.2.3. Other Operating System ( (UNIX, BSD)

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. IT & Telecommunication

- 6.3.2. BFSI

- 6.3.3. Retail

- 6.3.4. Healthcare

- 6.3.5. Industrial

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe High Availability Server Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. Cloud-based

- 7.1.2. On-premise

- 7.2. Market Analysis, Insights and Forecast - by Operating System

- 7.2.1. Windows

- 7.2.2. Linux

- 7.2.3. Other Operating System ( (UNIX, BSD)

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. IT & Telecommunication

- 7.3.2. BFSI

- 7.3.3. Retail

- 7.3.4. Healthcare

- 7.3.5. Industrial

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific High Availability Server Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. Cloud-based

- 8.1.2. On-premise

- 8.2. Market Analysis, Insights and Forecast - by Operating System

- 8.2.1. Windows

- 8.2.2. Linux

- 8.2.3. Other Operating System ( (UNIX, BSD)

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. IT & Telecommunication

- 8.3.2. BFSI

- 8.3.3. Retail

- 8.3.4. Healthcare

- 8.3.5. Industrial

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Rest of the World High Availability Server Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. Cloud-based

- 9.1.2. On-premise

- 9.2. Market Analysis, Insights and Forecast - by Operating System

- 9.2.1. Windows

- 9.2.2. Linux

- 9.2.3. Other Operating System ( (UNIX, BSD)

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. IT & Telecommunication

- 9.3.2. BFSI

- 9.3.3. Retail

- 9.3.4. Healthcare

- 9.3.5. Industrial

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Unisys Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 CenterServ International Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Alibaba Cloud Computing Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 NEC Corp

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hewlett Packard Enterprise Development LP

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 IBM Corp

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Fujitsu Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Juniper Networks Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Amazon Web Services Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Dell Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Cisco System Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Oracle Corp

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Unisys Corporation

List of Figures

- Figure 1: Global High Availability Server Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America High Availability Server Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 3: North America High Availability Server Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America High Availability Server Industry Revenue (Million), by Operating System 2025 & 2033

- Figure 5: North America High Availability Server Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 6: North America High Availability Server Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America High Availability Server Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America High Availability Server Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America High Availability Server Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe High Availability Server Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 11: Europe High Availability Server Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 12: Europe High Availability Server Industry Revenue (Million), by Operating System 2025 & 2033

- Figure 13: Europe High Availability Server Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 14: Europe High Availability Server Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe High Availability Server Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe High Availability Server Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe High Availability Server Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific High Availability Server Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 19: Asia Pacific High Availability Server Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 20: Asia Pacific High Availability Server Industry Revenue (Million), by Operating System 2025 & 2033

- Figure 21: Asia Pacific High Availability Server Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 22: Asia Pacific High Availability Server Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific High Availability Server Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific High Availability Server Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific High Availability Server Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World High Availability Server Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 27: Rest of the World High Availability Server Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Rest of the World High Availability Server Industry Revenue (Million), by Operating System 2025 & 2033

- Figure 29: Rest of the World High Availability Server Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 30: Rest of the World High Availability Server Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Rest of the World High Availability Server Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Rest of the World High Availability Server Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World High Availability Server Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global High Availability Server Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Global High Availability Server Industry Revenue Million Forecast, by Operating System 2020 & 2033

- Table 3: Global High Availability Server Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global High Availability Server Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global High Availability Server Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 6: Global High Availability Server Industry Revenue Million Forecast, by Operating System 2020 & 2033

- Table 7: Global High Availability Server Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global High Availability Server Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global High Availability Server Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 10: Global High Availability Server Industry Revenue Million Forecast, by Operating System 2020 & 2033

- Table 11: Global High Availability Server Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global High Availability Server Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global High Availability Server Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 14: Global High Availability Server Industry Revenue Million Forecast, by Operating System 2020 & 2033

- Table 15: Global High Availability Server Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global High Availability Server Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global High Availability Server Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 18: Global High Availability Server Industry Revenue Million Forecast, by Operating System 2020 & 2033

- Table 19: Global High Availability Server Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global High Availability Server Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Availability Server Industry?

The projected CAGR is approximately 16.00%.

2. Which companies are prominent players in the High Availability Server Industry?

Key companies in the market include Unisys Corporation, CenterServ International Ltd, Alibaba Cloud Computing Company, NEC Corp, Hewlett Packard Enterprise Development LP, IBM Corp, Fujitsu Limited, Juniper Networks Inc, Amazon Web Services Inc, Dell Inc, Cisco System Inc, Oracle Corp.

3. What are the main segments of the High Availability Server Industry?

The market segments include Deployment, Operating System, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; High Adoption Rate of High Availability Server Across BFSI Sector; Growing Demand for Modular & Micro Data Center with the Increasing Application of IoT Devices.

6. What are the notable trends driving market growth?

BFSI Sector is Expected to Have a Significant Growth Rate.

7. Are there any restraints impacting market growth?

; Lack of Awareness Among Professionals; High Cost for Initial Installation/Deployment.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Availability Server Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Availability Server Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Availability Server Industry?

To stay informed about further developments, trends, and reports in the High Availability Server Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence