Key Insights

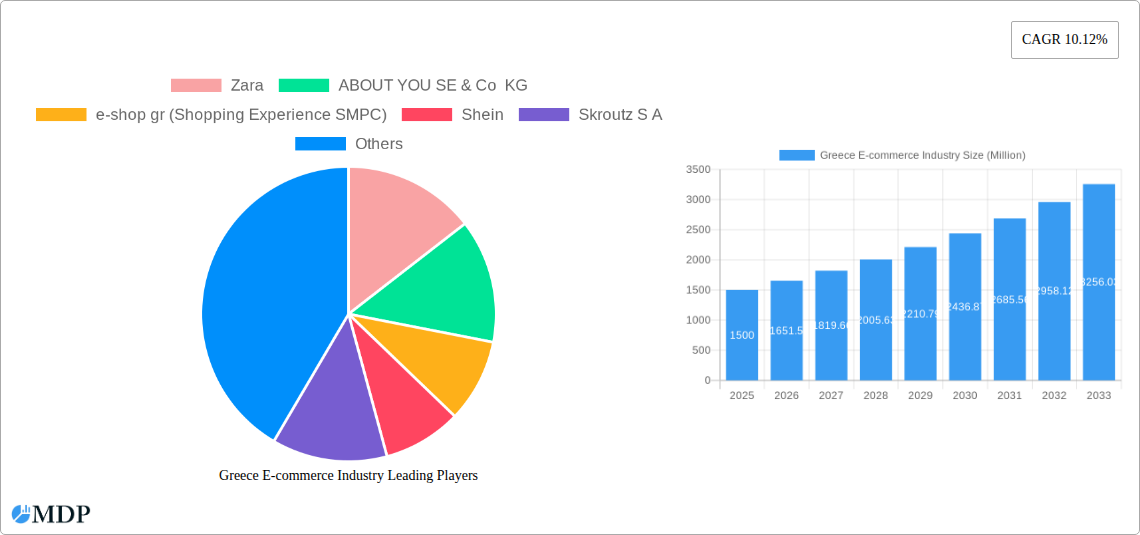

The Greek e-commerce market, valued at 34.63 billion in 2025, is poised for substantial growth. Projected to achieve a Compound Annual Growth Rate (CAGR) of 9.97% from 2025 to 2033, this expansion is attributed to several pivotal drivers. Enhanced internet and smartphone penetration is increasing digital literacy and online shopping adoption across Greece. The pandemic served as a catalyst, solidifying e-commerce as a primary retail channel for a diverse consumer base. Advancements in mobile commerce, alongside improvements in logistics and delivery networks, are significantly elevating the customer experience and accelerating market growth. Intense competition from global brands like Zara and Shein, as well as domestic leaders such as Skroutz S.A., fosters innovation and competitive pricing, benefiting consumers. Key challenges include the imperative for further digital infrastructure development in underserved areas and the need to address data security and online fraud concerns.

Greece E-commerce Industry Market Size (In Billion)

Market segmentation highlights significant opportunities across key applications. Fashion and apparel remain dominant sectors, driven by the appeal of international brands like Zara and Shein, and strong local contenders. Electronics and consumer durables constitute another major segment, with prominent participation from companies such as Plaisio Computers and Kotsovolos. Future growth will be propelled by rising consumer disposable income, data-driven marketing strategies, and the increasing demand for convenience and accessibility inherent in online retail. The forecast period (2025-2033) indicates a bright future for the Greek e-commerce sector, fueled by continuous expansion from both established and emerging businesses adapting to the evolving digital ecosystem.

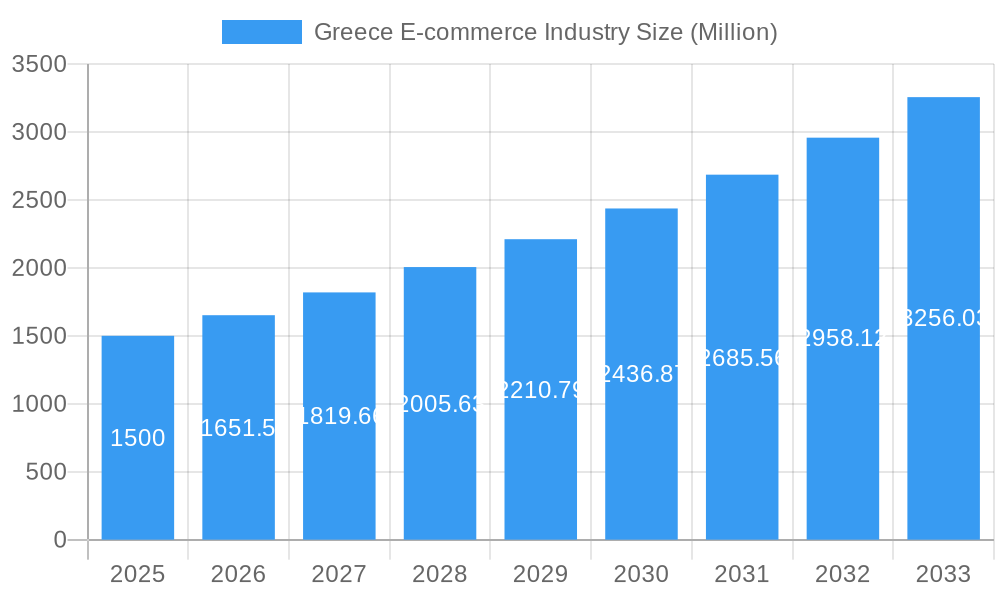

Greece E-commerce Industry Company Market Share

Greece E-commerce Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Greece e-commerce industry, offering invaluable insights for stakeholders, investors, and businesses operating within or considering entry into this dynamic market. The report covers the period 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. We analyze key market trends, leading players, growth drivers, and challenges, providing actionable data to inform strategic decision-making. The market size is estimated to be xx Million in 2025.

Greece E-commerce Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of the Greek e-commerce market, examining market concentration, innovation, regulations, substitutes, consumer trends, and mergers & acquisitions (M&A) activity. The market is characterized by a mix of large multinational players and smaller, specialized businesses.

Market Concentration: The top five players (Zara, ABOUT YOU SE & Co KG, e-shop gr, Shein, Skroutz S.A.) hold an estimated xx% of the market share in 2025, indicating a moderately concentrated market. Smaller players compete through niche offerings and specialized services.

Innovation Drivers: Technological advancements such as mobile commerce, improved logistics, and personalized shopping experiences are driving innovation. The adoption of AI and data analytics for targeted marketing and customer service is also significant.

Regulatory Framework: The Greek government's policies regarding data privacy, consumer protection, and online taxation significantly influence market dynamics. Compliance costs and regulations influence operational efficiency and profitability.

Product Substitutes: Traditional brick-and-mortar retail remains a significant competitor, although the growth of e-commerce is steadily reducing this rivalry. The emergence of social commerce platforms and direct-to-consumer (DTC) brands also presents competitive challenges.

End-User Trends: Growing smartphone penetration, increased internet access, and a shift towards online shopping are major consumer trends. Convenience, competitive pricing, and diverse product selections drive online purchasing.

M&A Activity: The Greek e-commerce sector has witnessed a moderate level of M&A activity in recent years. The number of deals in the period 2019-2024 is estimated at xx, with larger companies acquiring smaller firms to expand their market share or gain access to new technologies.

Greece E-commerce Industry Industry Trends & Analysis

The Greek e-commerce market exhibits robust growth potential driven by factors such as increasing internet and smartphone penetration, rising disposable incomes, and a shift towards online shopping behaviors. The compound annual growth rate (CAGR) is projected at xx% during the forecast period (2025-2033), reaching an estimated market value of xx Million by 2033. Market penetration is currently at approximately xx% and expected to increase to xx% by 2033. This expansion is fueled by several key trends:

Growth Drivers: The increasing adoption of mobile commerce, the growth of social media platforms as shopping channels, and the increasing preference for online delivery options are key growth drivers.

Technological Disruptions: The adoption of Artificial Intelligence (AI) for personalized recommendations, improved search functionality, and chatbot-powered customer service is transforming the customer experience. Blockchain technologies offer potential solutions for enhancing trust and security in online transactions.

Consumer Preferences: Greek consumers increasingly value convenience, competitive pricing, and a wide selection of products. The rise of omnichannel retailing is improving the shopping experience.

Competitive Dynamics: Competition is intensifying, both from established players and new entrants. The market sees players focusing on building customer loyalty through personalized experiences and superior delivery options.

Leading Markets & Segments in Greece E-commerce Industry

The Greek e-commerce market demonstrates substantial regional diversity. While Athens and Thessaloniki are currently the dominant regions, growth is observed in smaller cities and towns due to better infrastructure and expanding internet accessibility.

Key Drivers:

- Economic Policies: Government initiatives promoting digitalization and e-commerce adoption.

- Infrastructure: Improvements in logistics and delivery networks, expanding internet coverage.

- Consumer Behavior: Growing preference for online shopping among diverse demographics.

Dominance Analysis: Athens and Thessaloniki benefit from higher population density, established logistics networks, and greater digital literacy. However, growth in other regions shows the expanding reach of e-commerce across Greece.

Greece E-commerce Industry Product Developments

Recent product innovations in the Greek e-commerce market focus on personalized shopping experiences, improved mobile commerce capabilities, and seamless integration across different devices. Companies are investing in advanced technologies such as AI-powered recommendation systems, augmented reality (AR) features, and improved payment gateways to enhance the customer journey. This creates a more competitive market, fostering better customer engagement.

Key Drivers of Greece E-commerce Industry Growth

Several factors are driving the growth of the Greek e-commerce industry. These include:

Technological Advancements: Increased smartphone penetration, faster internet speeds, and the development of user-friendly e-commerce platforms.

Economic Factors: Rising disposable incomes and a growing middle class increase consumer spending power, leading to higher online purchases.

Regulatory Support: Government initiatives promoting digitalization and e-commerce adoption facilitate market growth.

Challenges in the Greece E-commerce Industry Market

The Greek e-commerce industry faces several challenges:

Regulatory Hurdles: Complex regulations related to data privacy, consumer protection, and taxation can hinder business growth.

Supply Chain Issues: Inefficient logistics infrastructure and high delivery costs remain a constraint.

Competitive Pressures: Intense competition from established players and new entrants increases pressure on pricing and profitability.

Emerging Opportunities in Greece E-commerce Industry

The Greek e-commerce sector presents significant opportunities for long-term growth. Technological breakthroughs in areas such as AI, blockchain, and AR/VR will create new market opportunities and improve customer experiences. Strategic partnerships between e-commerce platforms and traditional retailers are expected to gain momentum, creating omnichannel opportunities. Expanding into underserved regions of Greece will unlock further market potential.

Leading Players in the Greece E-commerce Industry Sector

- Zara

- ABOUT YOU SE & Co KG

- e-shop gr (Shopping Experience SMPC)

- Shein

- Skroutz S A

- Marks and Spencer plc

- Plaisio Computers

- RetailWorld S A (public gr)

- Kotsovolos

- Apple Inc *List Not Exhaustive

Key Milestones in Greece E-commerce Industry Industry

April 2022: TaskUs acquires Heloo, expanding its customer care services in the European e-commerce and gaming sectors. This acquisition benefits TaskUs' global operations and provides cross-selling opportunities across its European client base.

April 2022: Swipbox partners with Skroutz S.A. to launch a network of SwipBox parcel lockers in Athens, enhancing last-mile delivery efficiency for Skroutz's nationwide shipments. This improves the customer experience and logistics for online orders.

Strategic Outlook for Greece E-commerce Industry Market

The Greek e-commerce market holds significant potential for continued growth. Focusing on enhancing customer experience, improving logistics, and leveraging technological advancements will be key to success. Strategic partnerships, expansion into new regions, and adapting to evolving consumer preferences will be critical for players aiming to thrive in this dynamic and competitive market.

Greece E-commerce Industry Segmentation

-

1. B2C E-commerce

- 1.1. Market size (GMV) for the Period of 2017-2027

-

1.2. Market Segmentation - by Application

- 1.2.1. Beauty & Personal Care

- 1.2.2. Consumer Electronics

- 1.2.3. Fashion & Apparel

- 1.2.4. Food & Beverage

- 1.2.5. Furniture & Home

- 1.2.6. Others (Toys, DIY, Media, etc.)

- 2. Market size (GMV) for the Period of 2017-2027

-

3. Application

- 3.1. Beauty & Personal Care

- 3.2. Consumer Electronics

- 3.3. Fashion & Apparel

- 3.4. Food & Beverage

- 3.5. Furniture & Home

- 3.6. Others (Toys, DIY, Media, etc.)

- 4. Beauty & Personal Care

- 5. Consumer Electronics

- 6. Fashion & Apparel

- 7. Food & Beverage

- 8. Furniture & Home

- 9. Others (Toys, DIY, Media, etc.)

-

10. B2B E-commerce

- 10.1. Market Size for the period of 2017-2027

Greece E-commerce Industry Segmentation By Geography

- 1. Greece

Greece E-commerce Industry Regional Market Share

Geographic Coverage of Greece E-commerce Industry

Greece E-commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Apparel and Footwear Industry.; Penetration of Internet and Smartphone Usage

- 3.3. Market Restrains

- 3.3.1. lack of awareness of mobile accessibility features and mobile internet are key barriers

- 3.4. Market Trends

- 3.4.1. Significant Market Growth is Expected Post the COVID-19 Outbreak

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Greece E-commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 5.1.1. Market size (GMV) for the Period of 2017-2027

- 5.1.2. Market Segmentation - by Application

- 5.1.2.1. Beauty & Personal Care

- 5.1.2.2. Consumer Electronics

- 5.1.2.3. Fashion & Apparel

- 5.1.2.4. Food & Beverage

- 5.1.2.5. Furniture & Home

- 5.1.2.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Market size (GMV) for the Period of 2017-2027

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Beauty & Personal Care

- 5.3.2. Consumer Electronics

- 5.3.3. Fashion & Apparel

- 5.3.4. Food & Beverage

- 5.3.5. Furniture & Home

- 5.3.6. Others (Toys, DIY, Media, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Beauty & Personal Care

- 5.5. Market Analysis, Insights and Forecast - by Consumer Electronics

- 5.6. Market Analysis, Insights and Forecast - by Fashion & Apparel

- 5.7. Market Analysis, Insights and Forecast - by Food & Beverage

- 5.8. Market Analysis, Insights and Forecast - by Furniture & Home

- 5.9. Market Analysis, Insights and Forecast - by Others (Toys, DIY, Media, etc.)

- 5.10. Market Analysis, Insights and Forecast - by B2B E-commerce

- 5.10.1. Market Size for the period of 2017-2027

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. Greece

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zara

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABOUT YOU SE & Co KG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 e-shop gr (Shopping Experience SMPC)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shein

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Skroutz S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Marks and Spencer plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Plaisio Computers

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 RetailWorld S A (public gr)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kotsovolos

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Apple Inc *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Zara

List of Figures

- Figure 1: Greece E-commerce Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Greece E-commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: Greece E-commerce Industry Revenue billion Forecast, by B2C E-commerce 2020 & 2033

- Table 2: Greece E-commerce Industry Revenue billion Forecast, by Market size (GMV) for the Period of 2017-2027 2020 & 2033

- Table 3: Greece E-commerce Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Greece E-commerce Industry Revenue billion Forecast, by Beauty & Personal Care 2020 & 2033

- Table 5: Greece E-commerce Industry Revenue billion Forecast, by Consumer Electronics 2020 & 2033

- Table 6: Greece E-commerce Industry Revenue billion Forecast, by Fashion & Apparel 2020 & 2033

- Table 7: Greece E-commerce Industry Revenue billion Forecast, by Food & Beverage 2020 & 2033

- Table 8: Greece E-commerce Industry Revenue billion Forecast, by Furniture & Home 2020 & 2033

- Table 9: Greece E-commerce Industry Revenue billion Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 10: Greece E-commerce Industry Revenue billion Forecast, by B2B E-commerce 2020 & 2033

- Table 11: Greece E-commerce Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 12: Greece E-commerce Industry Revenue billion Forecast, by B2C E-commerce 2020 & 2033

- Table 13: Greece E-commerce Industry Revenue billion Forecast, by Market size (GMV) for the Period of 2017-2027 2020 & 2033

- Table 14: Greece E-commerce Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Greece E-commerce Industry Revenue billion Forecast, by Beauty & Personal Care 2020 & 2033

- Table 16: Greece E-commerce Industry Revenue billion Forecast, by Consumer Electronics 2020 & 2033

- Table 17: Greece E-commerce Industry Revenue billion Forecast, by Fashion & Apparel 2020 & 2033

- Table 18: Greece E-commerce Industry Revenue billion Forecast, by Food & Beverage 2020 & 2033

- Table 19: Greece E-commerce Industry Revenue billion Forecast, by Furniture & Home 2020 & 2033

- Table 20: Greece E-commerce Industry Revenue billion Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 21: Greece E-commerce Industry Revenue billion Forecast, by B2B E-commerce 2020 & 2033

- Table 22: Greece E-commerce Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Greece E-commerce Industry?

The projected CAGR is approximately 9.97%.

2. Which companies are prominent players in the Greece E-commerce Industry?

Key companies in the market include Zara, ABOUT YOU SE & Co KG, e-shop gr (Shopping Experience SMPC), Shein, Skroutz S A, Marks and Spencer plc, Plaisio Computers, RetailWorld S A (public gr), Kotsovolos, Apple Inc *List Not Exhaustive.

3. What are the main segments of the Greece E-commerce Industry?

The market segments include B2C E-commerce, Market size (GMV) for the Period of 2017-2027, Application, Beauty & Personal Care, Consumer Electronics, Fashion & Apparel, Food & Beverage, Furniture & Home, Others (Toys, DIY, Media, etc.), B2B E-commerce.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.63 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Apparel and Footwear Industry.; Penetration of Internet and Smartphone Usage.

6. What are the notable trends driving market growth?

Significant Market Growth is Expected Post the COVID-19 Outbreak.

7. Are there any restraints impacting market growth?

lack of awareness of mobile accessibility features and mobile internet are key barriers.

8. Can you provide examples of recent developments in the market?

April 2022 - Heloo, a Croatian provider of outsourced specialized services, was bought by TaskUs. Heloo is a customer care provider for European technology companies, focusing on the E-commerce and gaming industries. TASK expands its European language capabilities, diversifies its client base, and helps scale its global operations by expanding into Eastern Europe. Cross-selling prospects with Heloo's clientele in Greece, Germany, Austria, Switzerland, Finland, and other countries will benefit TASK.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Greece E-commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Greece E-commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Greece E-commerce Industry?

To stay informed about further developments, trends, and reports in the Greece E-commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence