Key Insights

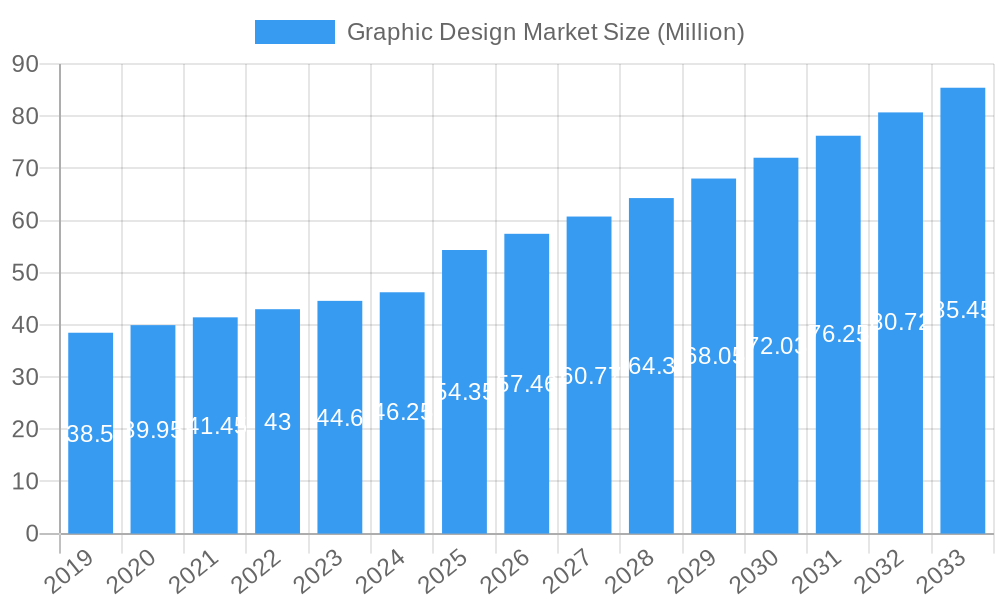

The global Graphic Design Market is poised for robust growth, projected to reach a substantial USD 54.35 billion in 2025. This expansion is fueled by a strong Compound Annual Growth Rate (CAGR) of 5.89%, indicating a dynamic and evolving industry landscape throughout the forecast period of 2025-2033. Key drivers propelling this market include the escalating demand for visually compelling brand identities across all sectors, the continuous need for engaging digital content in an increasingly online world, and the proliferation of e-commerce platforms necessitating sophisticated packaging and labeling solutions. Furthermore, the rise of content marketing strategies and the growing importance of user experience (UX) in app and digital design are significant contributors to this upward trajectory. The market is witnessing a notable shift towards online design platforms, offering greater accessibility and cost-effectiveness for businesses of all sizes, particularly SMEs seeking professional design services without the overhead of in-house teams.

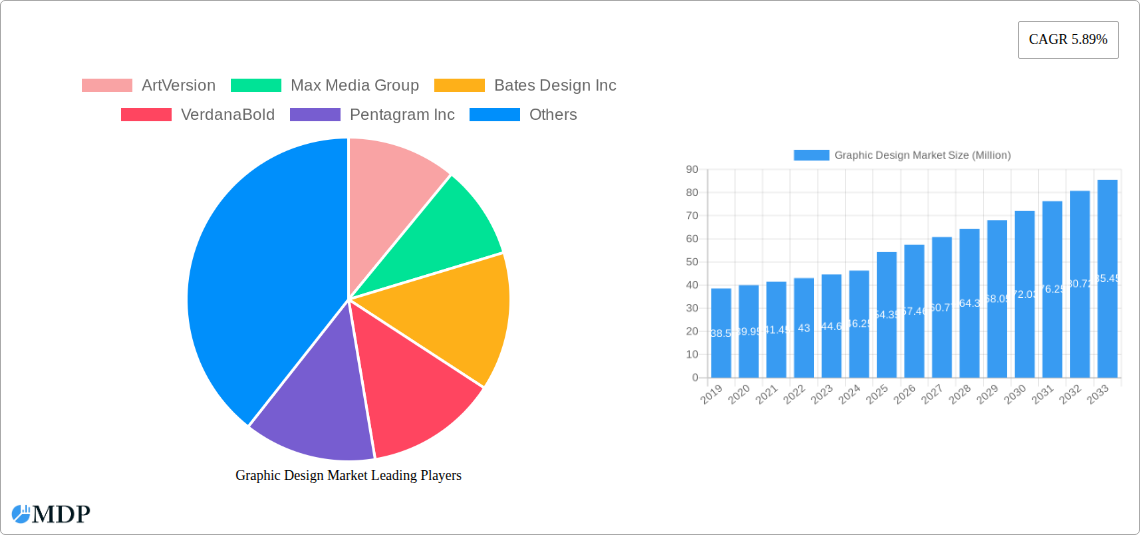

Graphic Design Market Market Size (In Million)

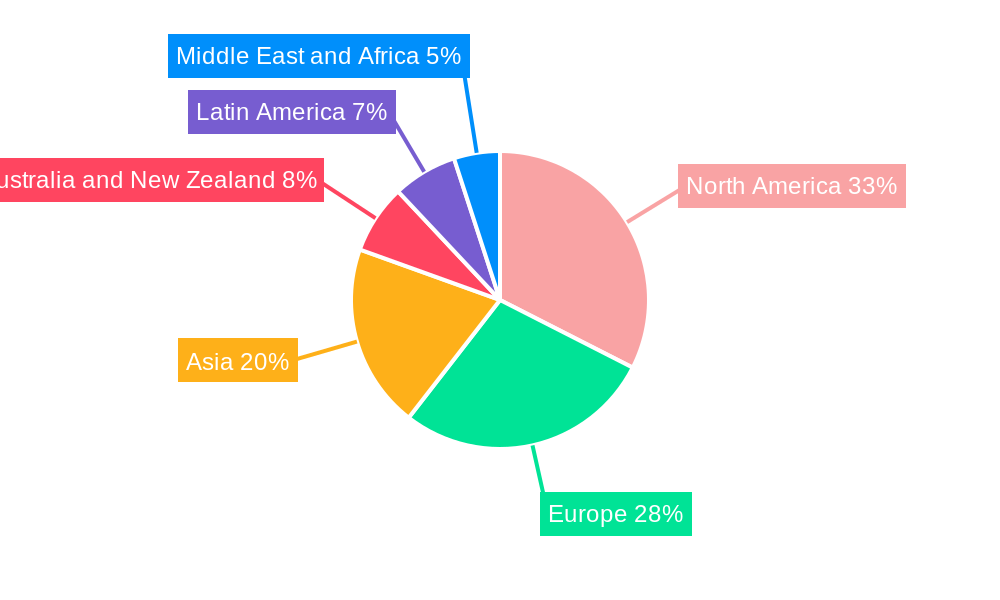

The market segmentation reveals diverse opportunities. Logo & Brand Identity and App & Digital Design are expected to dominate, reflecting the critical role of visual communication in establishing brand presence and user engagement in the digital age. Advertising and Clothing & Merchandise also present significant growth avenues. While offline design services maintain relevance, the rapid digital transformation is strongly favoring online design platforms, enabling faster turnaround times and wider reach. SMEs are identified as a major end-user segment, leveraging these services for competitive advantage. Geographically, North America and Europe are anticipated to hold substantial market shares, driven by mature economies with high adoption rates of design services and established creative industries. However, Asia is expected to witness the fastest growth, fueled by burgeoning economies, rapid digitalization, and a growing entrepreneurial ecosystem. Restraints such as budget limitations for smaller enterprises and the challenge of maintaining creative quality and consistency across diverse projects will need to be navigated by market players.

Graphic Design Market Company Market Share

This comprehensive report offers an in-depth analysis of the global Graphic Design Market, exploring its dynamics, key trends, leading segments, and future outlook. Covering the study period of 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this report provides actionable insights for industry stakeholders, including graphic design firms, brand strategists, marketing professionals, and investors.

Graphic Design Market Market Dynamics & Concentration

The Graphic Design Market is characterized by a dynamic landscape with evolving innovation drivers. Key among these are the increasing demand for digital and visual content across all platforms, the rapid advancement of design software and AI-powered tools, and the growing emphasis on brand consistency and unique visual identities. Regulatory frameworks, while generally supportive of creative industries, can introduce complexities regarding intellectual property and digital rights. Product substitutes, such as user-generated content platforms and template-based design services, present a competitive challenge, pushing established players towards greater specialization and value-added services.

End-user trends are strongly influenced by the digital transformation of businesses, leading to a surge in demand for app and digital design, online advertising visuals, and sophisticated brand identity systems. Small and Medium-sized Enterprises (SMEs) are increasingly leveraging accessible graphic design services to compete with larger corporations. Mergers & Acquisitions (M&A) activities, though not heavily concentrated, have been observed as companies seek to expand their service offerings, acquire specialized talent, and gain market share. M&A deal counts are projected to remain moderate, focusing on strategic acquisitions that enhance technological capabilities or market reach.

Graphic Design Market Industry Trends & Analysis

The Graphic Design Market is poised for significant growth, driven by the pervasive need for compelling visual communication in an increasingly digital world. The Compound Annual Growth Rate (CAGR) is anticipated to be robust, fueled by the expanding digital advertising sector, the rise of e-commerce, and the constant evolution of branding strategies. Market penetration is deepening as businesses of all sizes recognize the indispensable role of professional graphic design in building brand recognition, engaging target audiences, and driving sales.

Technological disruptions are at the forefront of market evolution. The integration of Artificial Intelligence (AI) in design processes, from ideation to automated asset creation, is revolutionizing workflows, increasing efficiency, and empowering designers with advanced tools. This includes AI-powered image generation, content optimization, and personalized design experiences. Consumer preferences are leaning towards minimalist aesthetics, authentic brand storytelling, and visually engaging content optimized for mobile consumption and social media platforms. The demand for dynamic and interactive design elements, such as motion graphics and AR/VR-integrated visuals, is also on the rise.

Competitive dynamics are intensifying, with a blend of large, established design agencies, specialized boutique firms, and a growing number of freelance and online design platforms. Companies are differentiating themselves through niche expertise, innovative service models, and a strong focus on client collaboration and understanding of specific industry needs. The ongoing need for visually appealing content across diverse channels, from social media campaigns to corporate branding, ensures a sustained demand for skilled graphic designers and innovative design solutions.

Leading Markets & Segments in Graphic Design Market

The Logo & Brand Identity segment is a dominant force within the Graphic Design Market, consistently driving demand across all end-user categories. This is due to the fundamental importance of a strong, memorable brand identity in establishing market presence and fostering customer loyalty.

Dominant Segments by Type:

- Logo & Brand Identity: Essential for brand recognition, this segment sees continuous demand as new businesses emerge and existing ones refresh their image.

- App & Digital Design: With the exponential growth of mobile applications and online platforms, this segment is a high-growth area, encompassing UI/UX design, web design, and digital marketing assets.

- Advertising: Both online and offline advertising campaigns rely heavily on impactful graphic design to capture consumer attention and convey marketing messages effectively.

- Packaging & Label: The retail sector's continuous product innovation and the need for attractive, informative packaging ensure a steady demand for design services.

Dominant Segments by Platform:

- Online Design: This segment is a clear leader, reflecting the shift towards digital-first marketing and communication strategies. It includes web design, social media graphics, digital ads, and more.

- Offline Design: While digital dominates, offline design, encompassing print collateral, event branding, and traditional advertising, remains crucial for many industries.

Dominant Segments by End-users:

- SMEs (Small and Medium-sized Enterprises): This segment represents a significant and growing market. As SMEs increasingly embrace digital transformation and recognize the value of professional branding, their demand for accessible and effective graphic design solutions is escalating.

- Large Enterprises: These organizations require sophisticated and consistent brand experiences across numerous touchpoints, driving demand for comprehensive branding, marketing collateral, and digital asset management.

Key drivers for dominance in these segments include the increasing digitization of economies, the need for effective visual storytelling to cut through market noise, and the growing recognition of design as a strategic business asset rather than just an aesthetic choice. Economic policies supporting small businesses and the digital infrastructure enabling online collaboration further bolster the growth of these leading segments.

Graphic Design Market Product Developments

Product developments in the Graphic Design Market are increasingly focused on leveraging artificial intelligence and automation to enhance creative workflows and deliver personalized experiences. Innovations in AI-powered design tools are enabling faster ideation, content generation, and style adaptation. For example, advancements in generative AI can assist in creating variations of logos, illustrations, and marketing collateral, offering competitive advantages through rapid prototyping and iteration. The integration of AR/VR capabilities is also opening new avenues for interactive packaging and immersive brand experiences. Market fit is achieved by aligning these technological advancements with the evolving needs of clients seeking efficiency, scalability, and cutting-edge visual solutions.

Key Drivers of Graphic Design Market Growth

The graphic design market's growth is propelled by several key drivers. The digital transformation across all industries necessitates constant visual content creation for websites, social media, and digital advertising. E-commerce expansion fuels the demand for compelling product packaging and online storefront designs. Technological advancements, particularly in AI and automation, are enhancing design capabilities and efficiency. Furthermore, the growing emphasis on brand differentiation in a competitive marketplace pushes businesses to invest in unique and impactful visual identities. Regulatory support for creative industries and the increasing disposable income of consumers in developing economies also contribute to market expansion.

Challenges in the Graphic Design Market Market

Despite robust growth, the Graphic Design Market faces several challenges. Intense competition from a wide array of service providers, including large agencies, boutique firms, and freelance platforms, can lead to pricing pressures and commoditization of services. Rapid technological changes require continuous investment in new software and skills, posing a barrier for smaller firms. Intellectual property protection and the ethical use of AI-generated content present evolving regulatory and ethical hurdles. Furthermore, economic downturns can lead to reduced marketing budgets, impacting the demand for design services. Quantifiable impacts include potential revenue stagnation during economic slowdowns and increased operational costs due to technology adoption.

Emerging Opportunities in Graphic Design Market

Emerging opportunities in the Graphic Design Market are abundant, driven by transformative trends. The metaverse and web3 present a new frontier for immersive 3D graphic design and virtual asset creation. Personalization and hyper-targeting in marketing demand dynamic and adaptable design solutions tailored to individual consumer preferences. Sustainability and ethical design are gaining traction, creating opportunities for environmentally conscious branding and packaging. AI integration continues to evolve, offering new avenues for intelligent design assistance and automated creative processes. Strategic partnerships between design firms and technology providers can unlock synergistic growth and innovative service offerings.

Leading Players in the Graphic Design Market Sector

- ArtVersion

- Max Media Group

- Bates Design Inc

- VerdanaBold

- Pentagram Inc

- ManyPixels Inc

- Huge LLC

- Duck Design Inc

- DesignCrowd Inc

- Design Pickle Inc

Key Milestones in Graphic Design Market Industry

- July 2024: Adobe announced breakthrough innovations in its industry-leading professional design apps Adobe Illustrator and Adobe Photoshop, accelerating everyday creative workflows and giving creators more control. From ideation to production, the new release of Illustrator unlocks new ways for pro designers and illustrators to more easily and quickly bring their vision to life across brand graphics, logos and icons, product packaging, marketing deliverables, pattern creation and beyond.

- September 2024: PepsiCo introduced a new visual design for 7UP as part of its global refresh, featuring bright colors and minimalistic aesthetics. The restaged 7UP VIS represents a frame of mind and style that encompasses all that is refreshing, distinctive, and modern.

Strategic Outlook for Graphic Design Market Market

The strategic outlook for the Graphic Design Market is overwhelmingly positive, driven by continuous digital evolution and the ever-increasing importance of visual communication. Growth accelerators include the adoption of AI-powered design tools that enhance efficiency and creativity, and the expansion into emerging markets such as the metaverse. Companies that focus on specialization, offer end-to-end design solutions encompassing branding, digital, and experiential design, and embrace sustainable design practices are well-positioned for success. Strategic partnerships and a commitment to continuous learning and adaptation will be crucial for navigating the dynamic landscape and capitalizing on future market potential.

Graphic Design Market Segmentation

-

1. Type

- 1.1. Logo & Brand Identity

- 1.2. App & Digital Design

- 1.3. Advertising

- 1.4. Clothing & Merchandise

- 1.5. Packaging & Label

- 1.6. Book& Magazine

- 1.7. Other Types

-

2. Platform

- 2.1. Online Design

- 2.2. Offline Design

-

3. End-users

- 3.1. SMEs

- 3.2. Large Enterprises

- 3.3. Government

Graphic Design Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Graphic Design Market Regional Market Share

Geographic Coverage of Graphic Design Market

Graphic Design Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Digital Content; Expansion of Branding and Advertising Initiatives

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Digital Content; Expansion of Branding and Advertising Initiatives

- 3.4. Market Trends

- 3.4.1. SMEs to Hold Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Graphic Design Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Logo & Brand Identity

- 5.1.2. App & Digital Design

- 5.1.3. Advertising

- 5.1.4. Clothing & Merchandise

- 5.1.5. Packaging & Label

- 5.1.6. Book& Magazine

- 5.1.7. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Online Design

- 5.2.2. Offline Design

- 5.3. Market Analysis, Insights and Forecast - by End-users

- 5.3.1. SMEs

- 5.3.2. Large Enterprises

- 5.3.3. Government

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Graphic Design Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Logo & Brand Identity

- 6.1.2. App & Digital Design

- 6.1.3. Advertising

- 6.1.4. Clothing & Merchandise

- 6.1.5. Packaging & Label

- 6.1.6. Book& Magazine

- 6.1.7. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Platform

- 6.2.1. Online Design

- 6.2.2. Offline Design

- 6.3. Market Analysis, Insights and Forecast - by End-users

- 6.3.1. SMEs

- 6.3.2. Large Enterprises

- 6.3.3. Government

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Graphic Design Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Logo & Brand Identity

- 7.1.2. App & Digital Design

- 7.1.3. Advertising

- 7.1.4. Clothing & Merchandise

- 7.1.5. Packaging & Label

- 7.1.6. Book& Magazine

- 7.1.7. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Platform

- 7.2.1. Online Design

- 7.2.2. Offline Design

- 7.3. Market Analysis, Insights and Forecast - by End-users

- 7.3.1. SMEs

- 7.3.2. Large Enterprises

- 7.3.3. Government

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Graphic Design Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Logo & Brand Identity

- 8.1.2. App & Digital Design

- 8.1.3. Advertising

- 8.1.4. Clothing & Merchandise

- 8.1.5. Packaging & Label

- 8.1.6. Book& Magazine

- 8.1.7. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Platform

- 8.2.1. Online Design

- 8.2.2. Offline Design

- 8.3. Market Analysis, Insights and Forecast - by End-users

- 8.3.1. SMEs

- 8.3.2. Large Enterprises

- 8.3.3. Government

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Graphic Design Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Logo & Brand Identity

- 9.1.2. App & Digital Design

- 9.1.3. Advertising

- 9.1.4. Clothing & Merchandise

- 9.1.5. Packaging & Label

- 9.1.6. Book& Magazine

- 9.1.7. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Platform

- 9.2.1. Online Design

- 9.2.2. Offline Design

- 9.3. Market Analysis, Insights and Forecast - by End-users

- 9.3.1. SMEs

- 9.3.2. Large Enterprises

- 9.3.3. Government

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Graphic Design Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Logo & Brand Identity

- 10.1.2. App & Digital Design

- 10.1.3. Advertising

- 10.1.4. Clothing & Merchandise

- 10.1.5. Packaging & Label

- 10.1.6. Book& Magazine

- 10.1.7. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Platform

- 10.2.1. Online Design

- 10.2.2. Offline Design

- 10.3. Market Analysis, Insights and Forecast - by End-users

- 10.3.1. SMEs

- 10.3.2. Large Enterprises

- 10.3.3. Government

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Graphic Design Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Logo & Brand Identity

- 11.1.2. App & Digital Design

- 11.1.3. Advertising

- 11.1.4. Clothing & Merchandise

- 11.1.5. Packaging & Label

- 11.1.6. Book& Magazine

- 11.1.7. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Platform

- 11.2.1. Online Design

- 11.2.2. Offline Design

- 11.3. Market Analysis, Insights and Forecast - by End-users

- 11.3.1. SMEs

- 11.3.2. Large Enterprises

- 11.3.3. Government

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 ArtVersion

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Max Media Group

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Bates Design Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 VerdanaBold

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Pentagram Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 ManyPixels Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Huge LLC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Duck Design Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 DesignCrowd Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Design Pickle Inc *List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 ArtVersion

List of Figures

- Figure 1: Global Graphic Design Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Graphic Design Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Graphic Design Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Graphic Design Market Volume (Billion), by Type 2025 & 2033

- Figure 5: North America Graphic Design Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Graphic Design Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Graphic Design Market Revenue (Million), by Platform 2025 & 2033

- Figure 8: North America Graphic Design Market Volume (Billion), by Platform 2025 & 2033

- Figure 9: North America Graphic Design Market Revenue Share (%), by Platform 2025 & 2033

- Figure 10: North America Graphic Design Market Volume Share (%), by Platform 2025 & 2033

- Figure 11: North America Graphic Design Market Revenue (Million), by End-users 2025 & 2033

- Figure 12: North America Graphic Design Market Volume (Billion), by End-users 2025 & 2033

- Figure 13: North America Graphic Design Market Revenue Share (%), by End-users 2025 & 2033

- Figure 14: North America Graphic Design Market Volume Share (%), by End-users 2025 & 2033

- Figure 15: North America Graphic Design Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Graphic Design Market Volume (Billion), by Country 2025 & 2033

- Figure 17: North America Graphic Design Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Graphic Design Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Graphic Design Market Revenue (Million), by Type 2025 & 2033

- Figure 20: Europe Graphic Design Market Volume (Billion), by Type 2025 & 2033

- Figure 21: Europe Graphic Design Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Graphic Design Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Graphic Design Market Revenue (Million), by Platform 2025 & 2033

- Figure 24: Europe Graphic Design Market Volume (Billion), by Platform 2025 & 2033

- Figure 25: Europe Graphic Design Market Revenue Share (%), by Platform 2025 & 2033

- Figure 26: Europe Graphic Design Market Volume Share (%), by Platform 2025 & 2033

- Figure 27: Europe Graphic Design Market Revenue (Million), by End-users 2025 & 2033

- Figure 28: Europe Graphic Design Market Volume (Billion), by End-users 2025 & 2033

- Figure 29: Europe Graphic Design Market Revenue Share (%), by End-users 2025 & 2033

- Figure 30: Europe Graphic Design Market Volume Share (%), by End-users 2025 & 2033

- Figure 31: Europe Graphic Design Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Graphic Design Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Europe Graphic Design Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Graphic Design Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Graphic Design Market Revenue (Million), by Type 2025 & 2033

- Figure 36: Asia Graphic Design Market Volume (Billion), by Type 2025 & 2033

- Figure 37: Asia Graphic Design Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Asia Graphic Design Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Asia Graphic Design Market Revenue (Million), by Platform 2025 & 2033

- Figure 40: Asia Graphic Design Market Volume (Billion), by Platform 2025 & 2033

- Figure 41: Asia Graphic Design Market Revenue Share (%), by Platform 2025 & 2033

- Figure 42: Asia Graphic Design Market Volume Share (%), by Platform 2025 & 2033

- Figure 43: Asia Graphic Design Market Revenue (Million), by End-users 2025 & 2033

- Figure 44: Asia Graphic Design Market Volume (Billion), by End-users 2025 & 2033

- Figure 45: Asia Graphic Design Market Revenue Share (%), by End-users 2025 & 2033

- Figure 46: Asia Graphic Design Market Volume Share (%), by End-users 2025 & 2033

- Figure 47: Asia Graphic Design Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Graphic Design Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Asia Graphic Design Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Graphic Design Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Australia and New Zealand Graphic Design Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Australia and New Zealand Graphic Design Market Volume (Billion), by Type 2025 & 2033

- Figure 53: Australia and New Zealand Graphic Design Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Australia and New Zealand Graphic Design Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Australia and New Zealand Graphic Design Market Revenue (Million), by Platform 2025 & 2033

- Figure 56: Australia and New Zealand Graphic Design Market Volume (Billion), by Platform 2025 & 2033

- Figure 57: Australia and New Zealand Graphic Design Market Revenue Share (%), by Platform 2025 & 2033

- Figure 58: Australia and New Zealand Graphic Design Market Volume Share (%), by Platform 2025 & 2033

- Figure 59: Australia and New Zealand Graphic Design Market Revenue (Million), by End-users 2025 & 2033

- Figure 60: Australia and New Zealand Graphic Design Market Volume (Billion), by End-users 2025 & 2033

- Figure 61: Australia and New Zealand Graphic Design Market Revenue Share (%), by End-users 2025 & 2033

- Figure 62: Australia and New Zealand Graphic Design Market Volume Share (%), by End-users 2025 & 2033

- Figure 63: Australia and New Zealand Graphic Design Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Australia and New Zealand Graphic Design Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Australia and New Zealand Graphic Design Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Australia and New Zealand Graphic Design Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Latin America Graphic Design Market Revenue (Million), by Type 2025 & 2033

- Figure 68: Latin America Graphic Design Market Volume (Billion), by Type 2025 & 2033

- Figure 69: Latin America Graphic Design Market Revenue Share (%), by Type 2025 & 2033

- Figure 70: Latin America Graphic Design Market Volume Share (%), by Type 2025 & 2033

- Figure 71: Latin America Graphic Design Market Revenue (Million), by Platform 2025 & 2033

- Figure 72: Latin America Graphic Design Market Volume (Billion), by Platform 2025 & 2033

- Figure 73: Latin America Graphic Design Market Revenue Share (%), by Platform 2025 & 2033

- Figure 74: Latin America Graphic Design Market Volume Share (%), by Platform 2025 & 2033

- Figure 75: Latin America Graphic Design Market Revenue (Million), by End-users 2025 & 2033

- Figure 76: Latin America Graphic Design Market Volume (Billion), by End-users 2025 & 2033

- Figure 77: Latin America Graphic Design Market Revenue Share (%), by End-users 2025 & 2033

- Figure 78: Latin America Graphic Design Market Volume Share (%), by End-users 2025 & 2033

- Figure 79: Latin America Graphic Design Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Latin America Graphic Design Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Latin America Graphic Design Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Latin America Graphic Design Market Volume Share (%), by Country 2025 & 2033

- Figure 83: Middle East and Africa Graphic Design Market Revenue (Million), by Type 2025 & 2033

- Figure 84: Middle East and Africa Graphic Design Market Volume (Billion), by Type 2025 & 2033

- Figure 85: Middle East and Africa Graphic Design Market Revenue Share (%), by Type 2025 & 2033

- Figure 86: Middle East and Africa Graphic Design Market Volume Share (%), by Type 2025 & 2033

- Figure 87: Middle East and Africa Graphic Design Market Revenue (Million), by Platform 2025 & 2033

- Figure 88: Middle East and Africa Graphic Design Market Volume (Billion), by Platform 2025 & 2033

- Figure 89: Middle East and Africa Graphic Design Market Revenue Share (%), by Platform 2025 & 2033

- Figure 90: Middle East and Africa Graphic Design Market Volume Share (%), by Platform 2025 & 2033

- Figure 91: Middle East and Africa Graphic Design Market Revenue (Million), by End-users 2025 & 2033

- Figure 92: Middle East and Africa Graphic Design Market Volume (Billion), by End-users 2025 & 2033

- Figure 93: Middle East and Africa Graphic Design Market Revenue Share (%), by End-users 2025 & 2033

- Figure 94: Middle East and Africa Graphic Design Market Volume Share (%), by End-users 2025 & 2033

- Figure 95: Middle East and Africa Graphic Design Market Revenue (Million), by Country 2025 & 2033

- Figure 96: Middle East and Africa Graphic Design Market Volume (Billion), by Country 2025 & 2033

- Figure 97: Middle East and Africa Graphic Design Market Revenue Share (%), by Country 2025 & 2033

- Figure 98: Middle East and Africa Graphic Design Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Graphic Design Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Graphic Design Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global Graphic Design Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Global Graphic Design Market Volume Billion Forecast, by Platform 2020 & 2033

- Table 5: Global Graphic Design Market Revenue Million Forecast, by End-users 2020 & 2033

- Table 6: Global Graphic Design Market Volume Billion Forecast, by End-users 2020 & 2033

- Table 7: Global Graphic Design Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Graphic Design Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Graphic Design Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Graphic Design Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Global Graphic Design Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 12: Global Graphic Design Market Volume Billion Forecast, by Platform 2020 & 2033

- Table 13: Global Graphic Design Market Revenue Million Forecast, by End-users 2020 & 2033

- Table 14: Global Graphic Design Market Volume Billion Forecast, by End-users 2020 & 2033

- Table 15: Global Graphic Design Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Graphic Design Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global Graphic Design Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Graphic Design Market Volume Billion Forecast, by Type 2020 & 2033

- Table 19: Global Graphic Design Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 20: Global Graphic Design Market Volume Billion Forecast, by Platform 2020 & 2033

- Table 21: Global Graphic Design Market Revenue Million Forecast, by End-users 2020 & 2033

- Table 22: Global Graphic Design Market Volume Billion Forecast, by End-users 2020 & 2033

- Table 23: Global Graphic Design Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Graphic Design Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Graphic Design Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Graphic Design Market Volume Billion Forecast, by Type 2020 & 2033

- Table 27: Global Graphic Design Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 28: Global Graphic Design Market Volume Billion Forecast, by Platform 2020 & 2033

- Table 29: Global Graphic Design Market Revenue Million Forecast, by End-users 2020 & 2033

- Table 30: Global Graphic Design Market Volume Billion Forecast, by End-users 2020 & 2033

- Table 31: Global Graphic Design Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Graphic Design Market Volume Billion Forecast, by Country 2020 & 2033

- Table 33: Global Graphic Design Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Global Graphic Design Market Volume Billion Forecast, by Type 2020 & 2033

- Table 35: Global Graphic Design Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 36: Global Graphic Design Market Volume Billion Forecast, by Platform 2020 & 2033

- Table 37: Global Graphic Design Market Revenue Million Forecast, by End-users 2020 & 2033

- Table 38: Global Graphic Design Market Volume Billion Forecast, by End-users 2020 & 2033

- Table 39: Global Graphic Design Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Graphic Design Market Volume Billion Forecast, by Country 2020 & 2033

- Table 41: Global Graphic Design Market Revenue Million Forecast, by Type 2020 & 2033

- Table 42: Global Graphic Design Market Volume Billion Forecast, by Type 2020 & 2033

- Table 43: Global Graphic Design Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 44: Global Graphic Design Market Volume Billion Forecast, by Platform 2020 & 2033

- Table 45: Global Graphic Design Market Revenue Million Forecast, by End-users 2020 & 2033

- Table 46: Global Graphic Design Market Volume Billion Forecast, by End-users 2020 & 2033

- Table 47: Global Graphic Design Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Graphic Design Market Volume Billion Forecast, by Country 2020 & 2033

- Table 49: Global Graphic Design Market Revenue Million Forecast, by Type 2020 & 2033

- Table 50: Global Graphic Design Market Volume Billion Forecast, by Type 2020 & 2033

- Table 51: Global Graphic Design Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 52: Global Graphic Design Market Volume Billion Forecast, by Platform 2020 & 2033

- Table 53: Global Graphic Design Market Revenue Million Forecast, by End-users 2020 & 2033

- Table 54: Global Graphic Design Market Volume Billion Forecast, by End-users 2020 & 2033

- Table 55: Global Graphic Design Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Graphic Design Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Graphic Design Market?

The projected CAGR is approximately 5.89%.

2. Which companies are prominent players in the Graphic Design Market?

Key companies in the market include ArtVersion, Max Media Group, Bates Design Inc, VerdanaBold, Pentagram Inc, ManyPixels Inc, Huge LLC, Duck Design Inc, DesignCrowd Inc, Design Pickle Inc *List Not Exhaustive.

3. What are the main segments of the Graphic Design Market?

The market segments include Type, Platform, End-users.

4. Can you provide details about the market size?

The market size is estimated to be USD 54.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Digital Content; Expansion of Branding and Advertising Initiatives.

6. What are the notable trends driving market growth?

SMEs to Hold Significant Growth.

7. Are there any restraints impacting market growth?

Rising Demand for Digital Content; Expansion of Branding and Advertising Initiatives.

8. Can you provide examples of recent developments in the market?

July 2024: Adobe announced breakthrough innovations in its industry leading professional design apps Adobe Illustrator and Adobe Photoshop that accelerate everyday creative workflows and give creators more control. From ideation to production, the new release of Illustrator unlocks new ways for pro designers and illustrators to more easily and quickly bring their vision to life across brand graphics, logos and icons, product packaging, marketing deliverables, pattern creation and beyond.September 2024: PepsiCo introduced a new visual design for 7UP as part of this global refresh with bright colors and minimalistic aesthetics. The restaged 7UP VIS represents a frame of mind and style that encompasses all that is refreshing, distinctive, and modern.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Graphic Design Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Graphic Design Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Graphic Design Market?

To stay informed about further developments, trends, and reports in the Graphic Design Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence