Key Insights

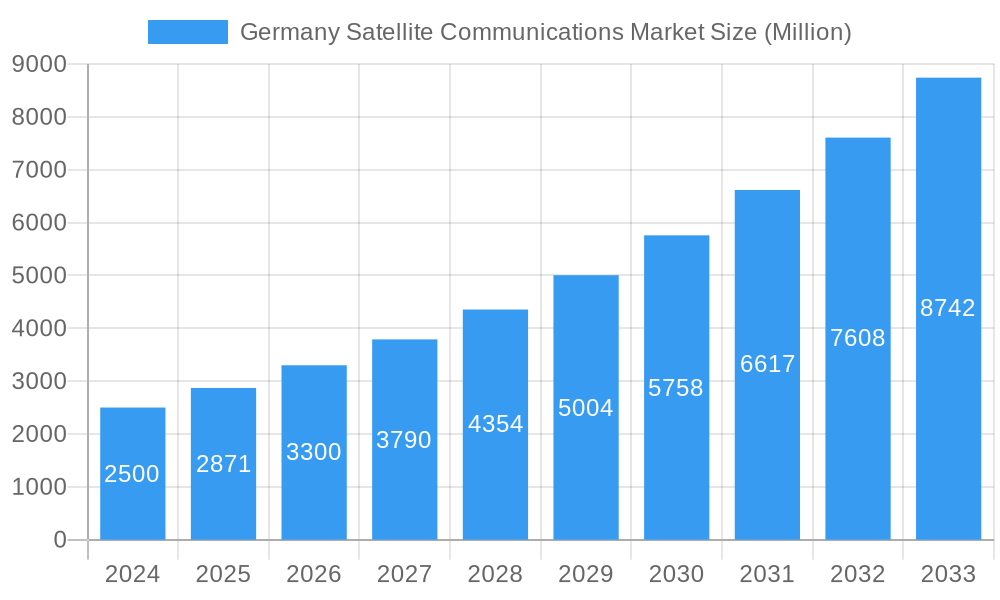

The German satellite communications market is projected for substantial growth, fueled by escalating demand across diverse sectors and continuous technological innovation. With an anticipated CAGR of 11.7%, the market is set to reach approximately 66.75 billion by 2025, underscoring a robust expansion trajectory. Key growth catalysts include the increasing adoption of satellite technology for enterprise mobility, the provision of enhanced connectivity solutions for remote regions, and the critical need for resilient communication networks within defense and government operations. The maritime sector is a significant contributor, utilizing satellite communications to improve navigation, operational efficiency, and crew welfare. Concurrently, the media and entertainment industry's dependence on satellite for broadcasting and content delivery is expected to sustain its upward trend. Advancements in satellite technology, such as high-throughput satellites (HTS) and the proliferation of Low Earth Orbit (LEO) constellations, are enhancing service capabilities, reducing latency, and broadening the market's scope.

Germany Satellite Communications Market Market Size (In Billion)

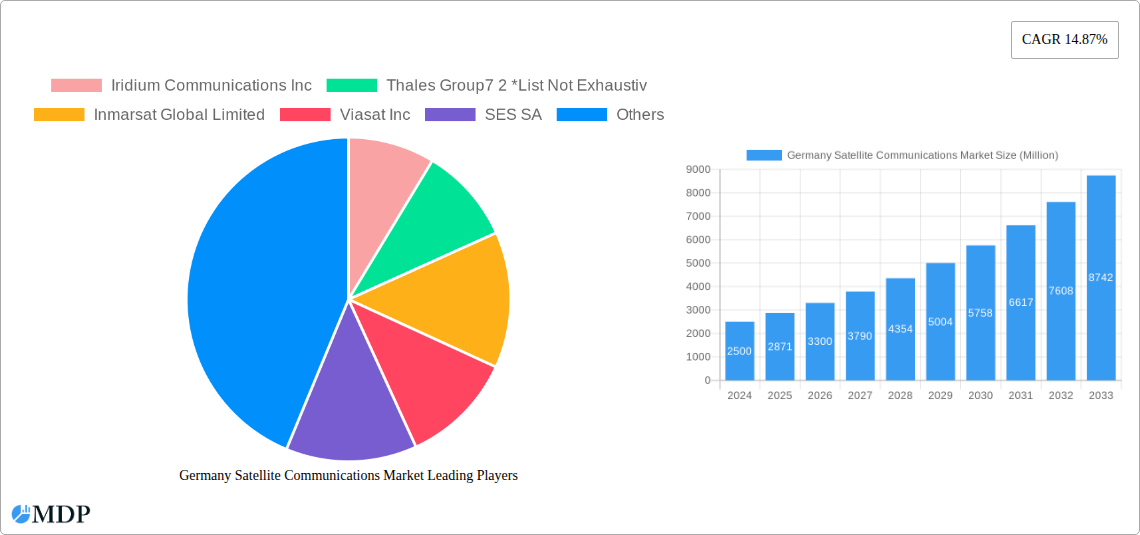

Segmentation of the German satellite communications market reveals "Services" as the leading growth segment, driven by the increasing demand for sophisticated managed solutions and value-added applications. "Ground Equipment" is also poised for steady expansion as users invest in advanced terminals and infrastructure to leverage new satellite capabilities. "Portable" and "Land" platforms are expected to experience the most rapid adoption, addressing the growing requirement for mobile and resilient connectivity across applications like IoT deployments and critical infrastructure management. While "Maritime" and "Defense and Government" remain pivotal end-user verticals, "Enterprises" and "Media and Entertainment" are emerging as significant growth areas, indicating a diversification in satellite communication applications. The competitive landscape features major global players such as Iridium Communications Inc. and Viasat Inc., alongside established European entities like Thales Group and Airbus Defence and Space GmbH, highlighting the market's potential for innovation and service expansion.

Germany Satellite Communications Market Company Market Share

This comprehensive report analyzes the German satellite communications market, covering ground equipment, services, and platforms including portable, land, maritime, and airborne solutions. It examines the market's critical role across defense and government, maritime, enterprises, media and entertainment, and other end-user verticals. The study spans the historical period from 2019 to 2024, with a base year of 2025, and forecasts market evolution through 2033. Gain strategic insights into market dynamics, key industry trends, product developments, growth drivers, challenges, and emerging opportunities, featuring leading players such as Iridium Communications Inc, Thales Group, Inmarsat Global Limited, Viasat Inc, SES SA, Airbus Defence and Space GmbH, Spaceopal GmbH, Gilat Satellite Networks Ltd, and Deutsche Telekom.

Germany Satellite Communications Market Market Dynamics & Concentration

The Germany satellite communications market is characterized by a moderate to high concentration, with key players like Iridium Communications Inc, Thales Group, Inmarsat Global Limited, and SES SA holding significant market shares. Innovation is a primary driver, fueled by increasing demand for reliable and high-bandwidth connectivity across various sectors. Regulatory frameworks, largely influenced by the European Union's space strategy and national telecommunications policies, play a vital role in shaping market access and service deployment. While terrestrial networks continue to advance, satellite communications offer unique advantages for remote areas, emergency services, and specialized applications, limiting the impact of direct product substitutes. End-user trends showcase a growing adoption of satellite services for IoT, remote sensing, and enhanced data transfer, particularly within the defense and government sectors. Mergers and acquisitions (M&A) activities, though not as frequent as in other tech sectors, are strategic moves to consolidate capabilities and expand service portfolios. For instance, a hypothetical M&A deal aimed at integrating advanced antenna technology could significantly alter market dynamics. The estimated total market value is expected to reach approximately $X.XX Billion by 2025.

Germany Satellite Communications Market Industry Trends & Analysis

The Germany satellite communications market is experiencing robust growth, driven by an increasing reliance on resilient and ubiquitous connectivity solutions. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX.XX% during the forecast period. Technological disruptions, including the advent of Low Earth Orbit (LEO) satellites and advancements in phased-array antennas, are significantly enhancing service capabilities and reducing latency, thereby expanding the addressable market. Consumer preferences are shifting towards seamless, high-speed data transmission for both professional and personal use, with a particular emphasis on mobility and remote access. This has led to a surge in demand for satellite broadband, in-flight connectivity, and specialized solutions for the maritime and defense sectors. Competitive dynamics are intensifying as established players invest heavily in next-generation satellite constellations and ground infrastructure, while new entrants with innovative business models vie for market share. The market penetration of satellite services is expected to rise considerably, moving beyond traditional niche applications to broader enterprise and consumer markets. The total market size is forecast to reach approximately $XX.XX Billion by 2033.

Leading Markets & Segments in Germany Satellite Communications Market

Within the Germany satellite communications market, several segments are poised for significant growth and dominance.

Ground Equipment: This segment is a foundational element, encompassing everything from user terminals and antennas to modems and gateways. The demand for advanced, portable, and ruggedized ground equipment is particularly strong, driven by the needs of the defense, government, and emergency services sectors. Innovations in miniaturization and increased bandwidth capabilities are key growth drivers.

Services: This is a rapidly expanding segment, covering managed services, connectivity solutions, data transmission, and value-added applications. The shift towards Software-Defined Networking (SDN) and Network Functions Virtualization (NFV) is transforming satellite service delivery, offering greater flexibility and scalability. The increasing adoption of satellite-based IoT solutions also contributes significantly to service revenue.

Platform:

- Portable: This platform is critical for mobile operations, disaster response, and field work, offering immediate connectivity where terrestrial infrastructure is unavailable. The development of man-packable and highly mobile terminals is a key trend.

- Land: This includes fixed and mobile solutions for terrestrial applications, such as remote asset monitoring, rural broadband, and enterprise connectivity in underserved areas.

- Maritime: The maritime sector is a major consumer of satellite communications for navigation, communication, fleet management, and crew welfare. The increasing digitalization of shipping operations fuels demand for higher bandwidth and more reliable services.

- Airborne: In-flight connectivity is a rapidly growing area, driven by passenger demand for internet access and airlines' need for operational efficiency through real-time data.

End-user Vertical:

- Defense and Government: This remains a cornerstone of the German satellite communications market. The need for secure, resilient, and global Beyond-Line-of-Sight (BLOS) communication capabilities for military operations, border security, and critical infrastructure protection drives substantial investment. The development of integrated satcom solutions for tactical operations is paramount.

- Maritime: As mentioned, this sector is a significant user, benefiting from improved fleet management, safety at sea, and enhanced communication for seafarers.

- Enterprises: Businesses are increasingly leveraging satellite communications for disaster recovery, remote site connectivity, and to augment terrestrial networks, especially in regions with limited infrastructure. The growth of IoT applications across various industries further boosts this segment.

- Media and Entertainment: Satellite remains crucial for broadcasting, live event coverage, and distribution of content, especially in remote or challenging locations.

- Other End-user Verticals: This includes sectors like agriculture, energy, and telecommunications, all of which are exploring satellite solutions for enhanced connectivity and data acquisition.

Germany Satellite Communications Market Product Developments

The Germany satellite communications market is witnessing continuous innovation in product development. Key advancements include the creation of novel on-the-go (OTM) man-packable satellite communications (satcom) terminals designed for global beyond-line-of-sight (BLOS) voice and data communications. These terminals offer a viable alternative to traditional manpack solutions and are crucial for tactical operations. Furthermore, the development of Europe's tallest communication satellite, featuring advanced antenna deployment and pointing mechanisms, alongside next-generation batteries and structural panels, signifies a leap in satellite technology. These innovations enhance broadband delivery and in-flight connectivity, showcasing a strong market fit for high-performance, reliable, and integrated satcom solutions. The competitive advantage lies in offering solutions that are more robust, faster, and easier to deploy.

Key Drivers of Germany Satellite Communications Market Growth

Several key factors are driving the growth of the Germany satellite communications market:

- Increasing demand for reliable connectivity: The imperative for uninterrupted communication, especially in defense, government, and emergency services, fuels the adoption of satellite solutions.

- Technological advancements: Innovations such as LEO constellations, advanced antenna technology, and miniaturization of terminals are enhancing service capabilities and reducing costs.

- Digitalization and IoT adoption: The growing implementation of IoT devices and the broader digitalization trend across industries necessitate robust connectivity for data transmission and remote operations.

- Government initiatives and investments: Support for space exploration and critical infrastructure development, including secure communication networks, by the German government and the EU is a significant growth catalyst.

- Expansion of in-flight connectivity: The rising passenger expectation for internet access during flights is driving demand for airborne satellite communication solutions.

Challenges in the Germany Satellite Communications Market Market

Despite strong growth, the Germany satellite communications market faces several challenges:

- High upfront costs: The initial investment for satellite infrastructure, ground stations, and terminals can be substantial, posing a barrier for some smaller enterprises.

- Regulatory complexities: Navigating international and national regulations for spectrum allocation and satellite operations can be complex and time-consuming.

- Competition from terrestrial networks: The continued expansion and improvement of fiber optic and 5G networks present a competitive challenge for satellite services in areas with good terrestrial coverage.

- Supply chain disruptions: Global events can impact the availability of specialized components and manufacturing processes, potentially leading to delays and increased costs.

- Cybersecurity threats: Ensuring the security and integrity of satellite communication networks against cyberattacks is a critical ongoing concern.

Emerging Opportunities in Germany Satellite Communications Market

The Germany satellite communications market is ripe with emerging opportunities:

- Growth of the LEO market: The deployment of LEO satellite constellations is opening up new possibilities for high-speed, low-latency broadband services, particularly for underserved regions and mobile platforms.

- Expansion of IoT and M2M communications: The increasing demand for connecting vast numbers of devices for monitoring, control, and data collection presents a significant opportunity for satellite IoT solutions.

- Development of integrated multi-orbit solutions: Combining GEO, MEO, and LEO satellites to offer seamless and optimized connectivity based on application needs is a promising area.

- Increased focus on secure and resilient communications: The ongoing geopolitical landscape emphasizes the need for highly secure and resilient communication networks, driving demand for advanced satcom solutions for defense and government.

- Commercialization of space data and services: Leveraging satellite platforms for Earth observation, navigation, and other data-driven services will create new revenue streams.

Leading Players in the Germany Satellite Communications Market Sector

- Iridium Communications Inc

- Thales Group

- Inmarsat Global Limited

- Viasat Inc

- SES SA

- Airbus Defence and Space GmbH

- Spaceopal GmbH

- Gilat Satellite Networks Ltd

- Deutsche Telekom

Key Milestones in Germany Satellite Communications Market Industry

- February 2023: Inmarsat and Hughes develop a novel on-the-go (OTM) man-packable satellite communications (satcom) terminal for use with the L-Band Tactical Satellite (L-TAC) service. This offers global beyond-line-of-sight (BLOS) voice and data communications as a manpack alternative to UHF TACSAT.

- September 2022: Ariane 5 launches Europe's tallest communication satellite. This 6.525-tonne satellite, weighing 99% of the launch mass, will provide high-speed broadband and in-flight connectivity throughout Europe. It features new antenna deployment and pointing mechanisms, structural panels, and next-generation batteries developed under an ESA Partnership Project.

Strategic Outlook for Germany Satellite Communications Market Market

The strategic outlook for the Germany satellite communications market is exceptionally positive, driven by a convergence of technological innovation, increasing demand for resilient connectivity, and growing governmental support for space-based infrastructure. Future growth will be significantly propelled by the expansion of LEO constellations, offering enhanced broadband capabilities and enabling a wider array of applications, particularly in the Internet of Things (IoT) and Machine-to-Machine (M2M) communication domains. Strategic partnerships between satellite operators, ground segment providers, and application developers will be crucial for creating integrated solutions that address specific end-user needs. The increasing emphasis on secure and sovereign communication capabilities for defense and government sectors presents a substantial opportunity for growth. Furthermore, the continuous evolution of satellite technology, focusing on higher bandwidth, lower latency, and greater energy efficiency, will unlock new market segments and solidify satellite communications' role as an indispensable component of Germany's digital future.

Germany Satellite Communications Market Segmentation

-

1. Type

- 1.1. Ground Equipment

- 1.2. Services

-

2. Platform

- 2.1. Portable

- 2.2. Land

- 2.3. Maritime

- 2.4. Airborne

-

3. End-user Vertical

- 3.1. Maritime

- 3.2. Defense and Government

- 3.3. Enterprises

- 3.4. Media and Entertainment

- 3.5. Other End-user Verticals

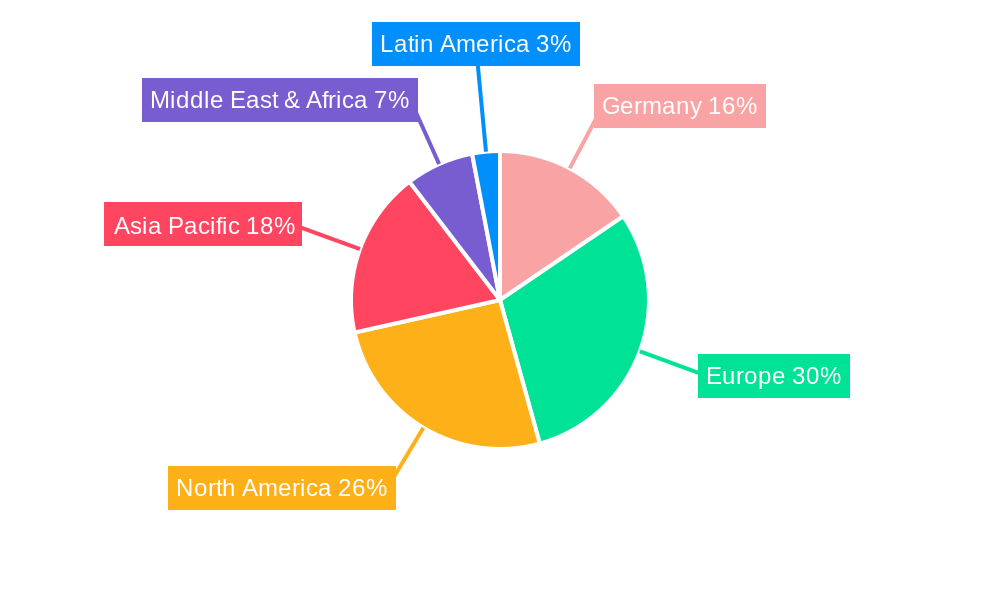

Germany Satellite Communications Market Segmentation By Geography

- 1. Germany

Germany Satellite Communications Market Regional Market Share

Geographic Coverage of Germany Satellite Communications Market

Germany Satellite Communications Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Armed forces will hold the significant share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Satellite Communications Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ground Equipment

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Portable

- 5.2.2. Land

- 5.2.3. Maritime

- 5.2.4. Airborne

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Maritime

- 5.3.2. Defense and Government

- 5.3.3. Enterprises

- 5.3.4. Media and Entertainment

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Iridium Communications Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Thales Group7 2 *List Not Exhaustiv

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Inmarsat Global Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Viasat Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SES SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Airbus Defence and Space GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Spaceopal GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gilat Satellite Networks Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Deutsche Telekom

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Iridium Communications Inc

List of Figures

- Figure 1: Germany Satellite Communications Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Satellite Communications Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Satellite Communications Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Germany Satellite Communications Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 3: Germany Satellite Communications Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 4: Germany Satellite Communications Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Germany Satellite Communications Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Germany Satellite Communications Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 7: Germany Satellite Communications Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 8: Germany Satellite Communications Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Satellite Communications Market?

The projected CAGR is approximately 11.7%.

2. Which companies are prominent players in the Germany Satellite Communications Market?

Key companies in the market include Iridium Communications Inc, Thales Group7 2 *List Not Exhaustiv, Inmarsat Global Limited, Viasat Inc, SES SA, Airbus Defence and Space GmbH, Spaceopal GmbH, Gilat Satellite Networks Ltd, Deutsche Telekom.

3. What are the main segments of the Germany Satellite Communications Market?

The market segments include Type, Platform, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 66.75 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Armed forces will hold the significant share.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

February 2023 - A novel on-the-go (OTM) man-packable satellite communications (satcom) terminal has been created by Inmarsat and Hughes for use with the L-Band Tactical Satellite (L-TAC) service. The current L-TAC system offers global beyond-line-of-sight (BLOS) voice and data communications in the L-band frequency range using existing tactical radios and Spectra SlingShot radio frequency (RF) converters. It is an alternative manpack solution to the ultra-high frequency tactical communications satellite (UHF TACSAT).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Satellite Communications Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Satellite Communications Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Satellite Communications Market?

To stay informed about further developments, trends, and reports in the Germany Satellite Communications Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence