Key Insights

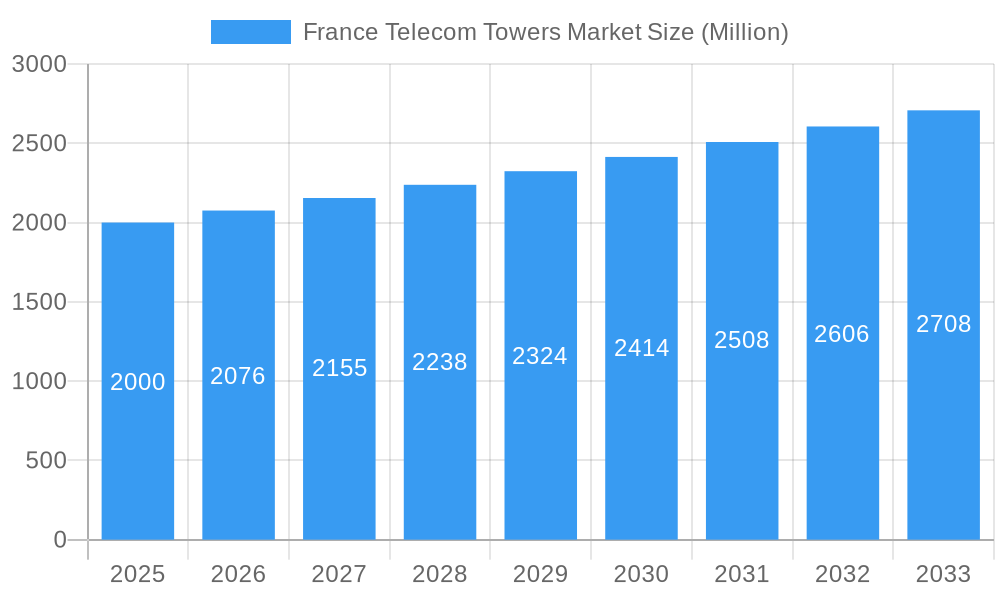

The France Telecom Towers market is poised for robust expansion, projected to reach €1.79 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.93% from 2025 to 2033. This growth trajectory is fueled by escalating demand for mobile broadband, the imperative for denser infrastructure to support 5G deployment, and the expanding Internet of Things (IoT) ecosystem. A significant trend shaping the market is the rise of tower colocation, enabling cost efficiencies and enhanced operational performance for multiple mobile network operators. The proliferation of small cells and distributed antenna systems (DAS) further contributes to this evolving landscape. Prominent market participants, including Phoenix Tower International, Bouygues Telecom, Cellnex France, Vodafone, and Orange S.A., are strategically investing in infrastructure modernization and expansion to harness emerging opportunities. Nevertheless, regulatory complexities, site acquisition challenges, and escalating land costs present key market growth impediments.

France Telecom Towers Market Market Size (In Billion)

Analysis reveals a dominant segment comprising macrocell towers, while the emerging market for small cells and DAS demonstrates accelerated growth, driven by the demand for superior network coverage and capacity in urban environments. Market concentration is anticipated in metropolitan areas and high-density regions throughout France, reflecting high mobile service adoption rates. Future growth will be significantly influenced by government initiatives supporting digital infrastructure, investments in rural broadband, and the pace of national 5G network rollout. The competitive arena is characterized by a blend of global operators and dedicated tower companies, fostering intense competition and a strong emphasis on innovative solutions.

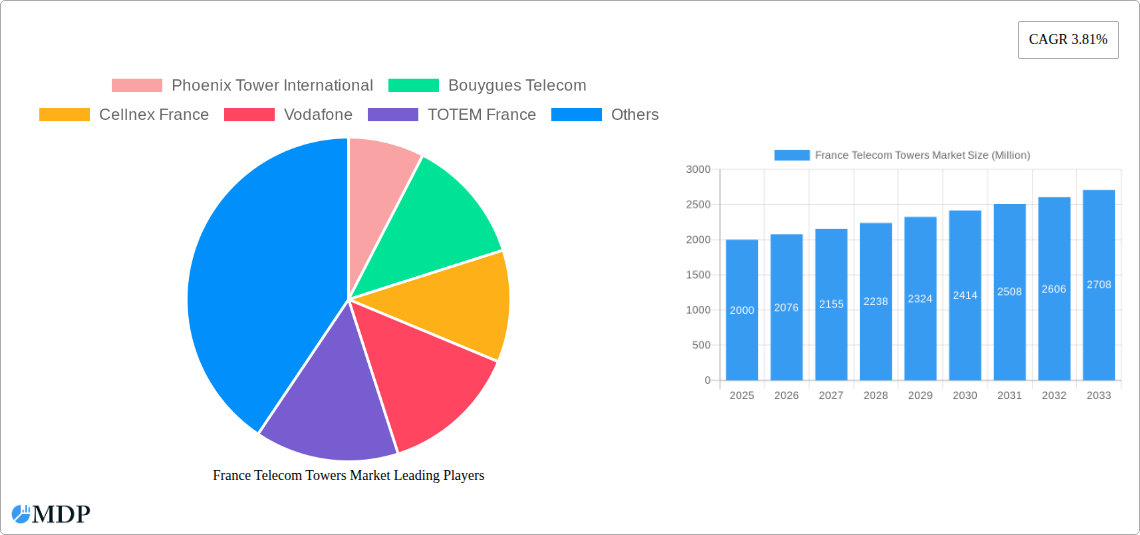

France Telecom Towers Market Company Market Share

France Telecom Towers Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the France Telecom Towers Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's dynamics, trends, and future potential. The report is meticulously researched and presents actionable data points, forecasts, and strategic recommendations. Key players like Phoenix Tower International, Bouygues Telecom, and Orange S.A. are analyzed, along with a detailed examination of market segments and technological advancements.

France Telecom Towers Market Market Dynamics & Concentration

This section analyzes the competitive landscape of the French Telecom Towers market, examining market concentration, innovation, regulatory frameworks, and M&A activities. The market is characterized by a relatively high level of concentration, with a few major players holding significant market share.

- Market Concentration: While precise market share figures for each player are proprietary, preliminary estimates suggest that the top three operators account for approximately xx% of the total market share in 2025. This concentration is influenced by factors like substantial capital expenditure requirements for infrastructure development and regulatory hurdles.

- Innovation Drivers: The push for 5G deployment, the increasing demand for private networks, and the growing IoT sector are driving innovation within the market. Tower companies are investing heavily in upgrading existing infrastructure and constructing new towers to accommodate these advanced technologies.

- Regulatory Framework: French regulatory policies significantly impact the market, influencing licensing, spectrum allocation, and infrastructure deployment. The current regulatory framework promotes competition and infrastructure sharing, but navigating these regulations presents its complexities.

- Product Substitutes: While there are limited direct substitutes for telecom towers, alternative technologies such as distributed antenna systems (DAS) and small cells are gaining traction in specific use cases. This competitive pressure necessitates continuous innovation and adaptation.

- End-User Trends: The increasing penetration of smartphones and other connected devices, coupled with the rising demand for high-speed data, fuels the growth of the telecom tower market. Growing urban populations further contribute to the demand for greater network capacity.

- M&A Activities: The market has witnessed a significant number of mergers and acquisitions in recent years (xx deals in the period 2019-2024). These activities are driven by companies looking to expand their footprint, access new technologies, and consolidate their market positions. For instance, Phoenix Tower International's acquisition of nearly 2,000 sites in 2023 exemplifies this trend.

France Telecom Towers Market Industry Trends & Analysis

This section provides a detailed analysis of industry trends shaping the French Telecom Towers market. The market is exhibiting strong growth, fueled by several factors detailed below:

The French Telecom Towers market is experiencing robust growth, projected to reach a value of xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Market penetration is steadily increasing, driven by various trends, such as:

- 5G rollout: The ongoing deployment of 5G networks requires a substantial increase in the number of towers, providing a significant growth driver.

- Increased mobile data consumption: The exponential rise in mobile data usage necessitates more efficient and advanced network infrastructure to manage the increased traffic.

- IoT expansion: The growth of the Internet of Things (IoT) demands denser network coverage, creating further demand for telecom towers.

- Private Network Growth: The adoption of private 5G networks by large and medium-sized enterprises (SMEs) is boosting the demand for tailored tower solutions and infrastructure. This trend is evidenced by recent collaborations such as the three-year partnership between Bouygues Telecom, Siemens France, and Alten announced in March 2024.

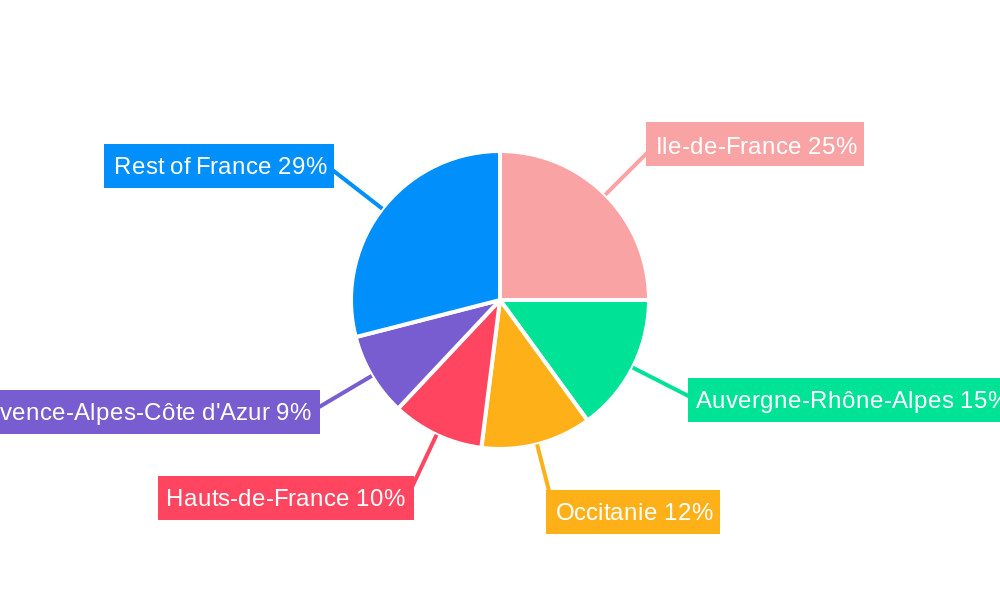

Leading Markets & Segments in France Telecom Towers Market

The demand for telecom towers is geographically widespread across France. However, the urban areas and major metropolitan regions are experiencing significantly higher demand compared to more rural areas. This is due to several factors:

- High population density: Urban areas naturally have higher population densities, leading to greater demand for network capacity and higher tower deployment.

- Increased mobile device usage: Urban populations typically exhibit higher mobile device usage than rural areas, resulting in increased data consumption and network strain.

- Business and commercial activities: High concentrations of businesses and commercial activities in urban centers further intensify the need for reliable network connectivity.

Specific drivers of dominance in major urban centers include:

- Government initiatives: Government funding and support for infrastructure development have facilitated the expansion of network infrastructure in key regions.

- Favorable regulatory environment: The regulatory environment encourages the development and deployment of telecom infrastructure in strategic locations.

France Telecom Towers Market Product Developments

Recent product developments focus on the improvement of tower design, the incorporation of advanced technologies like 5G and IoT capabilities, and the optimization of energy efficiency. Innovation in antenna technology and the integration of smart sensors and monitoring systems are enhancing performance and operational efficiency. This results in improved network capacity, resilience, and energy savings.

Key Drivers of France Telecom Towers Market Growth

Several factors are driving the expansion of the French Telecom Towers market:

- Government initiatives: The French government's investments in digital infrastructure and its support for 5G deployment are key catalysts for growth.

- Technological advancements: The introduction of 5G technology and the growing adoption of IoT are creating a significant demand for additional tower capacity.

- Increased data consumption: The rising consumption of mobile data requires a robust and expanded network infrastructure to support user demand.

Challenges in the France Telecom Towers Market

The market faces various challenges, including:

- High capital expenditure: Building and maintaining telecom towers requires significant upfront investment, potentially hindering smaller players.

- Siting regulations: Obtaining necessary permits and approvals for new tower construction can be a time-consuming and complex process.

- Competition: Intense competition among existing and emerging players puts pressure on pricing and profitability.

Emerging Opportunities in France Telecom Towers Market

The future of the France Telecom Towers market appears bright. Opportunities for long-term growth exist through:

- Strategic partnerships: Collaborations between tower companies, network operators, and technology providers offer opportunities for innovation and market expansion. The recent partnership between Bouygues Telecom, Siemens France, and Alten serves as an example.

- Expansion into rural areas: Significant opportunities exist in expanding network coverage to underserved rural areas.

- Tower infrastructure sharing: Efficient tower infrastructure sharing among multiple operators maximizes resource utilization and reduces overall costs.

Leading Players in the France Telecom Towers Market Sector

- Phoenix Tower International

- Bouygues Telecom

- Cellnex France

- Vodafone

- TOTEM France

- ATC France

- Orange S.A.

Key Milestones in France Telecom Towers Market Industry

- September 2023: Phoenix Tower International (PTI) acquired nearly 2,000 urban sites in France, significantly expanding its market share.

- March 2024: Bouygues Telecom, Siemens France, and Alten partnered to boost industrial 5G deployment in France, stimulating demand for specialized tower solutions.

Strategic Outlook for France Telecom Towers Market Market

The France Telecom Towers market is poised for sustained growth, driven by ongoing technological advancements, increasing data demand, and government support for infrastructure development. Strategic partnerships and innovative solutions are vital for companies to capture market share and thrive in this dynamic landscape. The market's potential is considerable, offering significant returns for companies that successfully navigate the challenges and capitalize on the opportunities presented.

France Telecom Towers Market Segmentation

-

1. Ownership

- 1.1. Operator-owned

- 1.2. Private-owned

- 1.3. MNO Captive Sites

-

2. Installation

- 2.1. Rooftop

- 2.2. Ground-based

-

3. Fuel Type

- 3.1. Renewable

- 3.2. Non-renewable

France Telecom Towers Market Segmentation By Geography

- 1. France

France Telecom Towers Market Regional Market Share

Geographic Coverage of France Telecom Towers Market

France Telecom Towers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.93% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Improving Connectivity to Rural Areas5.1.2 5G deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment; Improving and Catering to Increasing Data Needs

- 3.3. Market Restrains

- 3.3.1. Improving Connectivity to Rural Areas5.1.2 5G deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment; Improving and Catering to Increasing Data Needs

- 3.4. Market Trends

- 3.4.1. 5G Deployments are Expected to be a major catalyst for Growth in the Cell Tower Leasing Environment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Telecom Towers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Operator-owned

- 5.1.2. Private-owned

- 5.1.3. MNO Captive Sites

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Rooftop

- 5.2.2. Ground-based

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Renewable

- 5.3.2. Non-renewable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. France

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Phoenix Tower International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bouygues Telecom

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cellnex France

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vodafone

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TOTEM France

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ATC France

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Orange S A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Phoenix Tower International

List of Figures

- Figure 1: France Telecom Towers Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Telecom Towers Market Share (%) by Company 2025

List of Tables

- Table 1: France Telecom Towers Market Revenue billion Forecast, by Ownership 2020 & 2033

- Table 2: France Telecom Towers Market Revenue billion Forecast, by Installation 2020 & 2033

- Table 3: France Telecom Towers Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 4: France Telecom Towers Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: France Telecom Towers Market Revenue billion Forecast, by Ownership 2020 & 2033

- Table 6: France Telecom Towers Market Revenue billion Forecast, by Installation 2020 & 2033

- Table 7: France Telecom Towers Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 8: France Telecom Towers Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Telecom Towers Market?

The projected CAGR is approximately 4.93%.

2. Which companies are prominent players in the France Telecom Towers Market?

Key companies in the market include Phoenix Tower International, Bouygues Telecom, Cellnex France, Vodafone, TOTEM France, ATC France, Orange S A.

3. What are the main segments of the France Telecom Towers Market?

The market segments include Ownership, Installation, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.79 billion as of 2022.

5. What are some drivers contributing to market growth?

Improving Connectivity to Rural Areas5.1.2 5G deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment; Improving and Catering to Increasing Data Needs.

6. What are the notable trends driving market growth?

5G Deployments are Expected to be a major catalyst for Growth in the Cell Tower Leasing Environment.

7. Are there any restraints impacting market growth?

Improving Connectivity to Rural Areas5.1.2 5G deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment; Improving and Catering to Increasing Data Needs.

8. Can you provide examples of recent developments in the market?

March 2024: Bouygues Telecom, Siemens France, and Alten joined forces in a three-year collaboration to bolster industrial 5G in France. The partnership focuses on both large and medium-sized enterprises in the country. The collaboration agreement details the integration of Bouygues Telecom's 5G and private network solutions with Siemens France's IoT offerings, complemented by Alten's expertise in implementation and integration.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Telecom Towers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Telecom Towers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Telecom Towers Market?

To stay informed about further developments, trends, and reports in the France Telecom Towers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence