Key Insights

The European Testing, Inspection, and Certification (TIC) market is poised for significant expansion, driven by escalating regulatory compliance demands and a heightened emphasis on product quality and safety across key industries. The market, valued at approximately 119057.8 million in the base year of 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 3% through 2033. Key growth catalysts include stringent environmental regulations, increased demand for quality assurance in manufacturing and supply chains, and the rapid expansion of e-commerce, all of which necessitate comprehensive TIC services. The market is segmented by sourcing type (outsourced vs. in-house), service type (testing, inspection, certification), and end-user vertical (automotive, food and agriculture, etc.). The outsourced segment leads due to its specialized expertise and cost-efficiency. Germany, France, the UK, and Italy represent the largest national markets, benefiting from advanced industrial bases and robust regulatory frameworks. Growth opportunities also exist in emerging European markets as they enhance their infrastructure and adopt stricter quality standards.

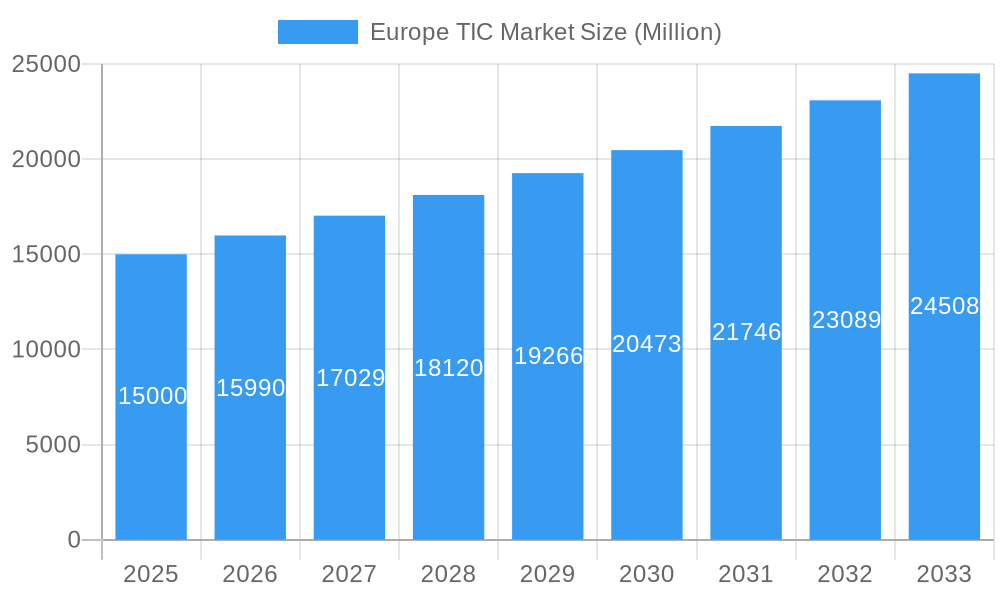

Europe TIC Market Market Size (In Billion)

Market expansion is further accelerated by technological advancements, particularly in automation and data analytics, which enhance the efficiency and accuracy of TIC processes. Despite potential challenges such as economic volatility and cybersecurity concerns, the long-term outlook for the European TIC market remains highly positive. The competitive landscape features a blend of large multinational corporations and specialized regional players, fostering innovation and continuous service improvement to meet evolving industry demands. Key trends shaping sustained growth include the increasing adoption of digital technologies, a greater focus on sustainability and circular economy principles, and an elevated emphasis on supply chain resilience and risk mitigation.

Europe TIC Market Company Market Share

Europe TIC Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe TIC (Testing, Inspection, and Certification) market, offering invaluable insights for stakeholders across the industry. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and future prospects, enabling informed strategic decision-making. The study encompasses detailed segmentation by sourcing type, service type, end-user vertical, and key European countries. Market size projections are provided in Millions.

Europe TIC Market Market Dynamics & Concentration

The European TIC market is characterized by a moderately concentrated competitive landscape, where prominent multinational corporations command a substantial market share. Leading entities such as Quality Analysis GmbH, Intertek Group, Vinçotte International SA, and SGS SA are key players, collectively accounting for approximately **[Insert Percentage]**% of the total market revenue in 2025. Alongside these giants, a dynamic ecosystem of smaller, specialized firms thrives within niche segments, fostering a competitive and innovative environment. Market concentration is anticipated to remain relatively stable in the short to medium term, though strategic mergers and acquisitions (M&A) are expected to continue reshaping the competitive contours of the industry.

Key Market Drivers:

- Evolving Regulatory Imperatives: Increasingly stringent and complex regulatory frameworks across diverse industries are a primary catalyst for TIC services. This is particularly evident in critical sectors like food safety, automotive manufacturing, pharmaceuticals, and environmental compliance, where adherence to standards is non-negotiable.

- Globalized Supply Chains and Risk Management: The intricate and interconnected nature of global supply chains necessitates robust TIC solutions. These services are crucial for ensuring product quality, verifying compliance with international standards, and effectively mitigating a wide spectrum of risks, from counterfeit products to ethical sourcing concerns.

- Digital Transformation and Technological Advancements: The integration of cutting-edge technologies such as Artificial Intelligence (AI), automation, the Internet of Things (IoT), and digitalization is revolutionizing TIC processes. These advancements are driving significant improvements in efficiency, accuracy, data analysis, and the expansion of innovative service offerings, enabling more proactive and predictive testing and inspection.

- Growing Demand for Sustainability and ESG: With a heightened global focus on environmental, social, and governance (ESG) factors, there is a burgeoning demand for TIC services related to sustainability certifications, carbon footprint analysis, ethical labor practices, and circular economy initiatives.

- Consumer Expectations for Safety and Quality: Rising consumer awareness and demand for safe, high-quality, and ethically produced goods across all sectors are compelling businesses to invest more heavily in TIC services to build trust and meet stringent quality benchmarks.

Merger and Acquisition (M&A) Activity: The TIC sector has experienced a notable surge in M&A activity. Larger, established players are actively pursuing strategic acquisitions to broaden their geographic footprint, diversify their service portfolios, enhance their technological capabilities, and gain access to specialized expertise. In the Europe TIC market, the number of M&A deals reached **[Insert Number]** in 2024, marking a **[Insert Percentage]**% increase compared to the preceding year. This consolidation trend is projected to persist, further influencing the market structure.

Product Substitutes: While direct substitutes for comprehensive TIC services are scarce, potential alternatives include the development of in-house testing and quality control capabilities. However, such approaches can often entail higher capital expenditure, ongoing operational costs, and may present challenges in maintaining the same level of impartiality, specialized expertise, and adherence to international accreditation standards that independent TIC providers offer.

Europe TIC Market Industry Trends & Analysis

The Europe TIC market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: increasing regulatory scrutiny, rising consumer demand for high-quality products, and the growing adoption of advanced technologies within the TIC industry. Market penetration of digital technologies in TIC services is estimated at xx% in 2025, and is poised to increase significantly over the next decade. The market is also witnessing increased demand for specialized TIC services tailored to specific industry needs, such as sustainability certifications and cybersecurity assessments. Consumer preferences for ethically sourced products and increased focus on sustainability are also shaping demand in the TIC sector.

Technological advancements, such as AI-powered inspection systems and blockchain-based traceability solutions are streamlining operations and boosting the efficiency of TIC providers. However, maintaining data security and addressing potential biases in AI-driven systems remain key challenges for companies operating in this rapidly evolving market. The competitive landscape remains robust, with both established players and innovative start-ups vying for market share.

Leading Markets & Segments in Europe TIC Market

By Country: Germany, the United Kingdom, and France represent the largest national markets within the European TIC sector in 2025, driven by robust industrial bases and stringent regulatory frameworks. The "Rest of Europe" segment also contributes significantly.

- Germany: Strong manufacturing sector, advanced technological capabilities, and strict regulations create high demand.

- United Kingdom: Significant industrial activity across various sectors necessitates comprehensive TIC solutions.

- France: Developed economy, diverse industrial base, and robust regulatory environment support market growth.

By Sourcing Type: Outsourced TIC services dominate the market, reflecting the preference of many businesses to leverage the expertise and capacity of specialized providers.

By Type of Service: Testing and Inspection are the largest segments, driven by the pervasive need for product quality assurance and regulatory compliance across numerous industries. Certification is a rapidly growing segment fueled by increasing demand for third-party validation. In-house/Government segments contribute, but outsource remains dominant.

By End User Vertical: The Manufacturing and Industrial Goods, Food and Agriculture, Automotive, and Consumer Goods and Retail sectors represent the largest end-user segments, reflecting the high volume of products requiring testing, inspection, and certification.

Europe TIC Market Product Developments

Recent product developments in the Europe TIC market have focused on integrating advanced technologies, such as AI and machine learning, into testing and inspection processes. This enables increased automation, higher accuracy, and faster turnaround times. New software platforms for data management and analysis are improving efficiency and transparency. Furthermore, there's a growing focus on developing sustainable and environmentally friendly testing methods. These developments are enhancing the value proposition of TIC providers and meeting the evolving needs of various industries.

Key Drivers of Europe TIC Market Growth

The Europe TIC market is propelled by a confluence of powerful forces. Paramount among these are the increasingly stringent regulatory mandates imposed across a multitude of industries, demanding rigorous adherence to safety, quality, and environmental standards. The globalization of supply chains, with their inherent complexities, further amplifies the need for dependable TIC solutions to guarantee product integrity, ensure compliance, and effectively manage risks. Concurrently, the accelerating adoption of advanced technologies, including AI and automation, is significantly enhancing the efficiency, accuracy, and scope of TIC processes. Beyond these, a growing consumer consciousness and demand for demonstrably safe and high-quality products are directly fueling market expansion. Additionally, proactive government initiatives aimed at promoting sustainable development and ethical business practices are creating new avenues for specialized TIC services.

Challenges in the Europe TIC Market

Navigating the Europe TIC market presents several significant challenges. Maintaining the highest standards of data security and robust protection for sensitive client information is paramount, especially with the increasing reliance on digital platforms. Harmonizing service delivery and compliance with the diverse national regulatory frameworks within Europe remains a complex undertaking. The potential for bias in AI-driven testing systems requires careful development and oversight to ensure objectivity. Fierce competition necessitates continuous innovation and competitive pricing strategies, putting pressure on profit margins. Furthermore, supply chain disruptions can lead to unpredictable delays and operational uncertainties. The ongoing challenge of attracting, training, and retaining a highly skilled and specialized workforce is also a critical factor influencing market growth and service quality.

Emerging Opportunities in Europe TIC Market

The expansion of e-commerce necessitates reliable TIC services for online retailers, the integration of blockchain technology for enhanced traceability and transparency, increased demand for sustainability-related certification services, and the development of innovative digital solutions to enhance service delivery and customer experience are all opportunities. Strategic partnerships between TIC providers and technology companies will enable the development and deployment of advanced solutions.

Leading Players in the Europe TIC Market Sector

- Quality Analysis Gmb

- Intertek Group

- Vinçotte International SA

- DNV GL

- Société Générale de Surveillance SA (SGS SA)

- Applus Services SA

- TÜV NORD Group

- A/S Baltic Control Ltd Aarhus

- RTM BREDA SRL

- TÜV SÜD Limited

- LabAnalysis SRL

- CIS Commodity Inspection Services BV

- TÜV Rheinland Group

- VIC Inspection Services Holding Ltd

- DEKRA SA

- UL LLC

- Kiwa NV

- ALS Limited

- AQM SRL

- Bureau Veritas SA

- Element Materials Technology

- Eurofins Scientific SE

- ATG Technology Group

Key Milestones in Europe TIC Market Industry

- June 2023: NMi and CCIC Europe forged a strategic partnership to collaboratively offer comprehensive testing, inspection, and certification (TIC) services to manufacturers in the People's Republic of China (PRC). This collaboration significantly broadens their service reach and strengthens their global presence in key manufacturing hubs.

- October 2022: TÜV NORD made a strategic investment in Global Surface Intelligence, a move that integrates AI-based image analysis capabilities into their certification services. This integration promises more efficient, data-driven, and precise assessment of surface properties and performance.

- January 2022: SGS entered into a significant collaboration with Microsoft to co-develop innovative TIC solutions. This partnership leverages Microsoft's extensive data analytics and cloud computing expertise to accelerate technological advancements and enhance the digital offerings within the TIC industry.

Strategic Outlook for Europe TIC Market Market

The Europe TIC market is poised for robust and sustained growth, underpinned by continuous technological innovation, the ever-evolving regulatory landscape, and a pronounced societal and corporate focus on sustainability and ethical practices. Strategic alliances, joint ventures, and ongoing M&A activities are expected to be pivotal in shaping the future market structure, driving consolidation and specialization. Companies that effectively embrace digital transformation, proactively adapt to emerging industry demands, and invest in advanced analytical capabilities will undoubtedly secure a significant competitive advantage. Furthermore, a strategic focus on developing and delivering specialized services and catering to niche market segments presents substantial growth opportunities. The long-term outlook for the Europe TIC market remains highly positive, with projections indicating considerable expansion throughout the forecast period, driven by an increasing demand for assurance and compliance in an increasingly complex world.

Europe TIC Market Segmentation

-

1. Sourcing Type

-

1.1. Outsourced

-

1.1.1. Type of Service

- 1.1.1.1. Testing and Inspection

- 1.1.1.2. Certification

-

1.1.1. Type of Service

- 1.2. In-house/Government

-

1.1. Outsourced

-

2. End User Vertical

- 2.1. Consumer Good and Retail

- 2.2. Automotive

- 2.3. Food and Agriculture

- 2.4. Manufacturing and Industrial Goods

- 2.5. Energy and Utilities

- 2.6. Oil & Gas and Chemicals

- 2.7. Construction

- 2.8. Transport, Aerospace, and Rail

- 2.9. Life Sciences

- 2.10. Marine & Mining

- 2.11. Other End User Verticals

Europe TIC Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe TIC Market Regional Market Share

Geographic Coverage of Europe TIC Market

Europe TIC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trading Across Borders and Stringent Regulations; Technological Evolution; Mass Customization and Shorter Product Life Cycles

- 3.3. Market Restrains

- 3.3.1. Increase in Lead Times For Assessment Programs Due to the Growing Complexity of the Supply Chain

- 3.4. Market Trends

- 3.4.1. Consumer Goods and Retail Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe TIC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 5.1.1. Outsourced

- 5.1.1.1. Type of Service

- 5.1.1.1.1. Testing and Inspection

- 5.1.1.1.2. Certification

- 5.1.1.1. Type of Service

- 5.1.2. In-house/Government

- 5.1.1. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End User Vertical

- 5.2.1. Consumer Good and Retail

- 5.2.2. Automotive

- 5.2.3. Food and Agriculture

- 5.2.4. Manufacturing and Industrial Goods

- 5.2.5. Energy and Utilities

- 5.2.6. Oil & Gas and Chemicals

- 5.2.7. Construction

- 5.2.8. Transport, Aerospace, and Rail

- 5.2.9. Life Sciences

- 5.2.10. Marine & Mining

- 5.2.11. Other End User Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Quality Analysis Gmb

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Intertek Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vinçotte International SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DNV GL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Société Générale de Surveillance SA (SGS SA)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Applus Services SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TÜV NORD Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 A/S Baltic Control Ltd Aarhus

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 RTM BREDA SRL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TÜV SÜD Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 LabAnalysis SRL

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 CIS Commodity Inspection Services BV

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 TÜV Rheinland Group

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 VIC Inspection Services Holding Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 DEKRA SA

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 UL LLC

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Kiwa NV

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 ALS Limited

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 AQM SRL

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Bureau Veritas SA

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Element Materials Technology

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 Eurofins Scientific SE

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 ATG Technology Group

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.1 Quality Analysis Gmb

List of Figures

- Figure 1: Europe TIC Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe TIC Market Share (%) by Company 2025

List of Tables

- Table 1: Europe TIC Market Revenue million Forecast, by Sourcing Type 2020 & 2033

- Table 2: Europe TIC Market Revenue million Forecast, by End User Vertical 2020 & 2033

- Table 3: Europe TIC Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe TIC Market Revenue million Forecast, by Sourcing Type 2020 & 2033

- Table 5: Europe TIC Market Revenue million Forecast, by End User Vertical 2020 & 2033

- Table 6: Europe TIC Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: France Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe TIC Market?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the Europe TIC Market?

Key companies in the market include Quality Analysis Gmb, Intertek Group, Vinçotte International SA, DNV GL, Société Générale de Surveillance SA (SGS SA), Applus Services SA, TÜV NORD Group, A/S Baltic Control Ltd Aarhus, RTM BREDA SRL, TÜV SÜD Limited, LabAnalysis SRL, CIS Commodity Inspection Services BV, TÜV Rheinland Group, VIC Inspection Services Holding Ltd, DEKRA SA, UL LLC, Kiwa NV, ALS Limited, AQM SRL, Bureau Veritas SA, Element Materials Technology, Eurofins Scientific SE, ATG Technology Group.

3. What are the main segments of the Europe TIC Market?

The market segments include Sourcing Type, End User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 119057.8 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trading Across Borders and Stringent Regulations; Technological Evolution; Mass Customization and Shorter Product Life Cycles.

6. What are the notable trends driving market growth?

Consumer Goods and Retail Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Increase in Lead Times For Assessment Programs Due to the Growing Complexity of the Supply Chain.

8. Can you provide examples of recent developments in the market?

June 2023 - NMi, one of the market leaders in the certification of measuring and metering technologies, and CCIC Europe (CCIC EU), the regional company of the China Inspection & Certification Group, have announced a partnership to provide testing, inspection, and certification services to manufacturers in the People’s Republic of China (PRC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe TIC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe TIC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe TIC Market?

To stay informed about further developments, trends, and reports in the Europe TIC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence