Key Insights

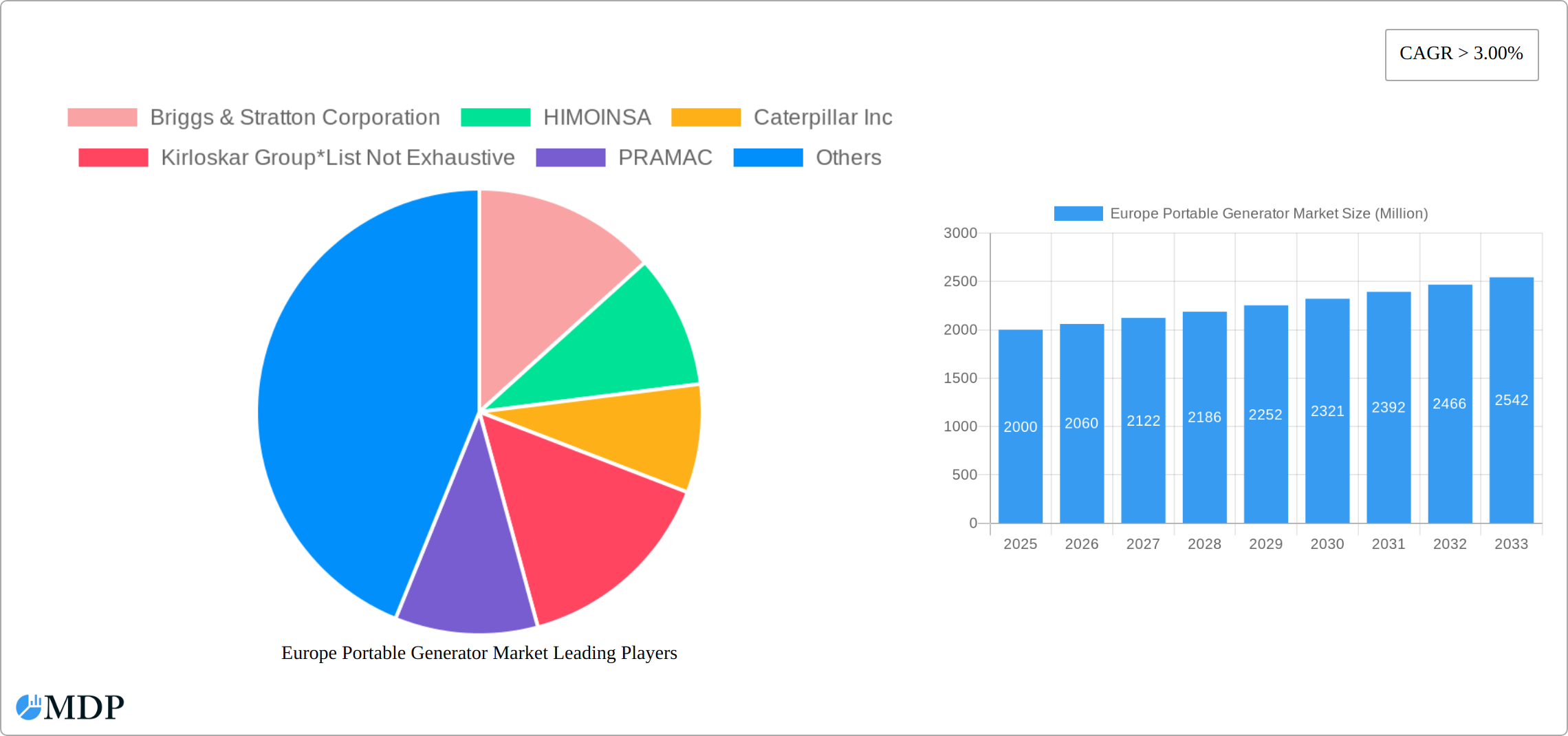

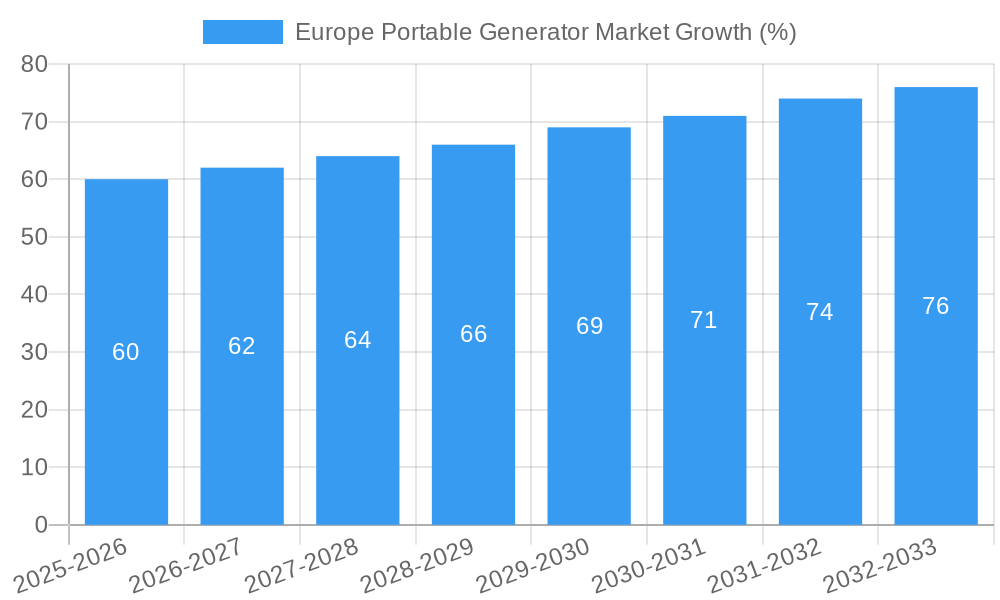

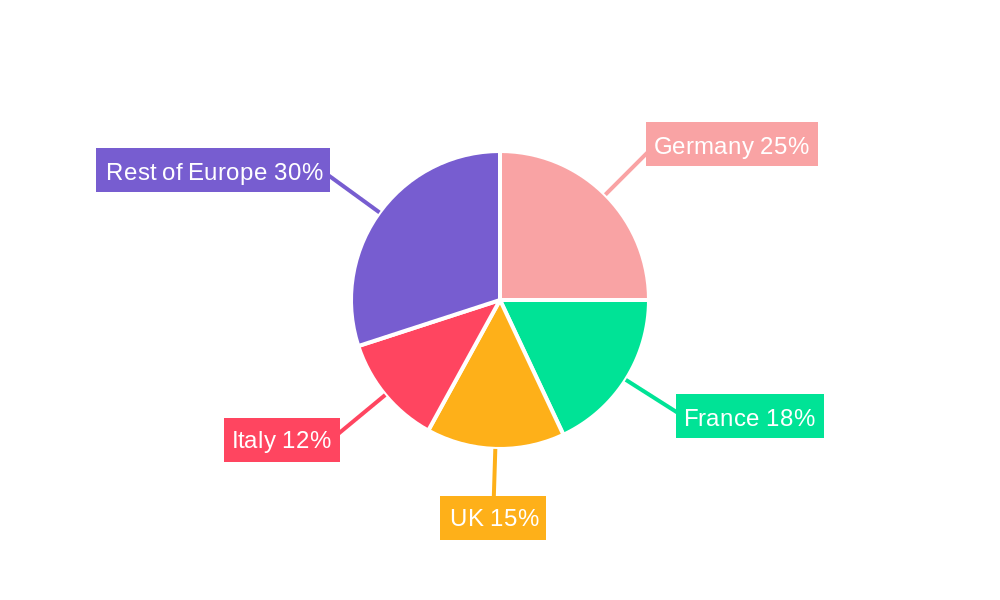

The European portable generator market, valued at approximately €[Estimate based on market size XX and value unit Million. A reasonable estimate considering similar markets might be €2 Billion in 2025] in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) exceeding 3.00% from 2025 to 2033. This expansion is fueled by several key factors. Increasing demand from the industrial and commercial sectors, driven by rising power outages and the need for backup power solutions in critical infrastructure, is a primary driver. The growth of renewable energy sources, while seemingly contradictory, also contributes; portable generators are increasingly used to supplement intermittent renewable energy generation. Furthermore, advancements in generator technology, leading to lighter, more fuel-efficient, and quieter models, are enhancing market appeal among residential and commercial consumers. The market segmentation reveals a significant portion of demand concentrated in the 5-10 kW power rating category, reflecting the widespread utility of this range for diverse applications. Diesel generators currently dominate the fuel type segment, although growth in alternative fuels like LPG and natural gas may challenge this position in the coming years. Germany, France, and the UK represent significant regional markets within Europe, driven by their strong industrial bases and established infrastructure.

However, market growth faces certain restraints. Stringent emission regulations in several European countries are pushing manufacturers to develop cleaner generator technologies, which can inflate costs. Fluctuations in fuel prices, especially diesel, create price volatility and affect consumer purchasing decisions. The increasing adoption of grid-connected renewable energy systems could marginally curb the demand for portable generators in the long term, although the need for backup power remains significant, particularly in remote locations or situations involving grid instability. Major players like Briggs & Stratton, Himoinsa, Caterpillar, and Kirloskar are actively shaping the market through technological innovation and strategic partnerships, contributing to ongoing market dynamism and competitive landscape. The expanding market for portable generators offers lucrative opportunities for manufacturers who can effectively address the evolving consumer needs and regulatory requirements.

Europe Portable Generator Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Portable Generator Market, offering invaluable insights for industry stakeholders, investors, and strategists. Covering the period 2019-2033, with a focus on 2025, this report dissects market dynamics, trends, and future potential, providing actionable intelligence for informed decision-making. The market size is predicted to reach xx Million by 2033.

Europe Portable Generator Market Dynamics & Concentration

The European portable generator market exhibits a moderately consolidated structure, with key players like Briggs & Stratton Corporation, HIMOINSA, Caterpillar Inc, Kirloskar Group, PRAMAC, Inmesol SLA, Honda Motor Co Ltd, Wacker Neuson SE, Atlas Copco, and FG Wilson holding significant market share. The market share of the top 5 players is estimated at xx%. Innovation is a key driver, with companies focusing on developing quieter, more fuel-efficient, and technologically advanced generators. Stringent emission regulations are shaping product development, pushing the adoption of cleaner fuel types. Product substitution is limited, with portable generators primarily competing with other power backup solutions like UPS systems. Residential users are increasingly adopting smaller, more portable generators, while industrial users seek high-power options. M&A activity within the sector has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024. This activity is expected to increase as companies seek to expand their market presence and product portfolios.

- Market Concentration: Moderately consolidated, with top 5 players holding xx% market share.

- Innovation Drivers: Fuel efficiency, noise reduction, technological advancements.

- Regulatory Frameworks: Stringent emission regulations driving cleaner fuel adoption.

- Product Substitutes: UPS systems, other backup power solutions.

- End-User Trends: Growing residential demand for smaller units, industrial demand for high-power options.

- M&A Activity: Approximately xx deals between 2019 and 2024.

Europe Portable Generator Market Industry Trends & Analysis

The European portable generator market is experiencing steady growth, driven by increasing demand from various sectors. The market registered a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Rising electricity prices and concerns about power outages are fueling market expansion, particularly in residential and commercial sectors. Technological advancements, such as the incorporation of inverter technology and digital controls, are enhancing the efficiency and user-friendliness of portable generators. Consumer preferences are shifting towards quieter, more environmentally friendly options, influencing manufacturers to prioritize these features in their product development. Competitive dynamics are characterized by intense rivalry, with companies focusing on product differentiation, pricing strategies, and expansion into new markets. Market penetration is estimated at xx% in 2025.

Leading Markets & Segments in Europe Portable Generator Market

Germany, France, and the United Kingdom remain the dominant markets within the European portable generator landscape. This strong performance is fueled by robust infrastructure development, consistent economic growth, and a high rate of homeownership. A deeper segment analysis reveals key trends:

Power Rating: The 5-10 kW power range continues to hold the largest market share, owing to its versatility across both residential and commercial applications. This segment caters to a broad spectrum of power needs, making it a popular choice for diverse user groups.

Fuel Type: Diesel generators maintain a significant market presence, prized for their extended runtimes and reliable performance in demanding industrial settings. However, gasoline generators are experiencing increased adoption driven by their lower upfront costs and suitability for less intensive applications. The market is witnessing a gradual shift towards cleaner-burning fuel options, reflecting growing environmental concerns.

End User: The commercial sector remains a key driver of market growth, followed by the industrial and residential sectors. Specific growth drivers within each sector include:

- Industrial: Robust demand stems from the critical need for backup power during essential operations, construction projects, and emergency response efforts. The increasing reliance on uninterrupted power supply in manufacturing and other industrial processes is a major factor.

- Commercial: Business continuity requirements, especially in retail, hospitality, and small to medium-sized enterprises (SMEs), are pushing the adoption of portable generators. The need to mitigate the impact of power outages on revenue and operations is driving growth.

- Residential: The rising frequency of power outages, coupled with a growing awareness of the importance of emergency power backup, is fueling residential demand. Increased awareness of climate change and the potential for extreme weather events further enhances this trend.

Europe Portable Generator Market Product Developments

Recent product innovations focus on enhancing efficiency, portability, and user-friendliness. Inverter technology has significantly improved fuel efficiency and reduced noise levels. Lightweight, compact designs cater to portability needs. Manufacturers are also incorporating advanced features such as digital controls, remote monitoring capabilities, and parallel operation to improve usability and expand application options. These developments contribute to a stronger market fit and enhance competitive advantages for manufacturers.

Key Drivers of Europe Portable Generator Market Growth

Several factors contribute to the growth of the European portable generator market:

- Increasing frequency of power outages: Leading to greater demand for reliable backup power solutions.

- Rising electricity costs: Making portable generators a cost-effective alternative for certain applications.

- Growth in construction and infrastructure projects: Requiring portable power for various operations.

- Advancements in technology: Leading to more fuel-efficient, quieter, and user-friendly generators.

- Favorable government policies: Supporting the adoption of backup power solutions in certain sectors.

Challenges in the Europe Portable Generator Market

The European portable generator market faces several persistent challenges that impact growth and profitability:

- Stringent Emission Regulations: The increasingly stringent emission standards across Europe necessitate significant investment in research and development to meet compliance requirements, leading to higher manufacturing costs and potentially limiting the availability of certain generator types.

- Fluctuations in Raw Material Prices: Volatility in the prices of key raw materials, such as metals and plastics, directly impacts production costs and profitability, making it crucial for manufacturers to effectively manage their supply chains and mitigate price risks.

- Intense Competition: A highly competitive market landscape puts pressure on pricing, demanding continuous innovation and differentiation to maintain a competitive edge. This necessitates the development of value-added features and services.

- Supply Chain Disruptions: The ongoing impact of global supply chain disruptions continues to affect product availability and delivery times. These disruptions, estimated to have reduced market growth by approximately xx% in 2022, highlight the vulnerability of the sector to external factors and the need for robust supply chain resilience.

Emerging Opportunities in Europe Portable Generator Market

Despite the challenges, the long-term growth prospects for the European portable generator market remain positive, driven by several key opportunities:

- Technological Advancements: The development and adoption of eco-friendly generators, including fuel-cell technology and generators with enhanced energy efficiency, present significant opportunities for market expansion and improved environmental performance. This trend aligns with the growing demand for sustainable energy solutions.

- Strategic Partnerships: Collaborative efforts between manufacturers and distributors are crucial for expanding market reach, optimizing distribution efficiency, and enhancing customer service. Strategic alliances can leverage complementary expertise and resources to drive growth.

- Market Expansion: Exploring new geographic markets and applications, such as integration with renewable energy systems and microgrids, opens up new revenue streams and diversifies the market. The potential for portable generators in supporting renewable energy infrastructure is significant.

Leading Players in the Europe Portable Generator Market Sector

- Briggs & Stratton Corporation

- HIMOINSA

- Caterpillar Inc

- Kirloskar Group

- PRAMAC

- Inmesol SLA

- Honda Motor Co Ltd

- Wacker Neuson SE

- Atlas Copco

- FG Wilson

Key Milestones in Europe Portable Generator Market Industry

- January 2022: Honda announced plans to begin sales of its new EU32i portable generator with a newly developed dedicated engine (3.2kVA maximum output). Sales commenced in March 2022 in Europe, with plans for global rollout. This launch signifies a significant step towards enhanced portable power solutions.

Strategic Outlook for Europe Portable Generator Market Market

The European portable generator market presents significant growth opportunities in the coming years. Strategic focus should center on technological innovation, particularly in developing greener and more efficient generators, exploring strategic partnerships to expand distribution networks, and capitalizing on the rising demand for backup power in both residential and commercial sectors. The market's future potential hinges on adapting to evolving environmental regulations and consumer preferences for sustainable energy solutions.

Europe Portable Generator Market Segmentation

-

1. Power Rating

- 1.1. Below 5 kW

- 1.2. 5-10 kW

- 1.3. Above 10 kW

-

2. Fuel Type

- 2.1. Gas

- 2.2. Diesel

- 2.3. Other Fuel Types

-

3. End User

- 3.1. Industrial

- 3.2. Commercial

- 3.3. Residential

Europe Portable Generator Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

- 5. Rest of Europe

Europe Portable Generator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Soaring Demand From Natural Gas Sector4.; Increasing Demand From The Refinery And Petrochemical Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Higher Capital Cost Compared To Traditional Internal Combustion Engines

- 3.4. Market Trends

- 3.4.1. Residential Sector to be a Significant Market Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Rating

- 5.1.1. Below 5 kW

- 5.1.2. 5-10 kW

- 5.1.3. Above 10 kW

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Gas

- 5.2.2. Diesel

- 5.2.3. Other Fuel Types

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Industrial

- 5.3.2. Commercial

- 5.3.3. Residential

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Germany

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Power Rating

- 6. United Kingdom Europe Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Power Rating

- 6.1.1. Below 5 kW

- 6.1.2. 5-10 kW

- 6.1.3. Above 10 kW

- 6.2. Market Analysis, Insights and Forecast - by Fuel Type

- 6.2.1. Gas

- 6.2.2. Diesel

- 6.2.3. Other Fuel Types

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Industrial

- 6.3.2. Commercial

- 6.3.3. Residential

- 6.1. Market Analysis, Insights and Forecast - by Power Rating

- 7. Germany Europe Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Power Rating

- 7.1.1. Below 5 kW

- 7.1.2. 5-10 kW

- 7.1.3. Above 10 kW

- 7.2. Market Analysis, Insights and Forecast - by Fuel Type

- 7.2.1. Gas

- 7.2.2. Diesel

- 7.2.3. Other Fuel Types

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Industrial

- 7.3.2. Commercial

- 7.3.3. Residential

- 7.1. Market Analysis, Insights and Forecast - by Power Rating

- 8. France Europe Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Power Rating

- 8.1.1. Below 5 kW

- 8.1.2. 5-10 kW

- 8.1.3. Above 10 kW

- 8.2. Market Analysis, Insights and Forecast - by Fuel Type

- 8.2.1. Gas

- 8.2.2. Diesel

- 8.2.3. Other Fuel Types

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Industrial

- 8.3.2. Commercial

- 8.3.3. Residential

- 8.1. Market Analysis, Insights and Forecast - by Power Rating

- 9. Italy Europe Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Power Rating

- 9.1.1. Below 5 kW

- 9.1.2. 5-10 kW

- 9.1.3. Above 10 kW

- 9.2. Market Analysis, Insights and Forecast - by Fuel Type

- 9.2.1. Gas

- 9.2.2. Diesel

- 9.2.3. Other Fuel Types

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Industrial

- 9.3.2. Commercial

- 9.3.3. Residential

- 9.1. Market Analysis, Insights and Forecast - by Power Rating

- 10. Rest of Europe Europe Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Power Rating

- 10.1.1. Below 5 kW

- 10.1.2. 5-10 kW

- 10.1.3. Above 10 kW

- 10.2. Market Analysis, Insights and Forecast - by Fuel Type

- 10.2.1. Gas

- 10.2.2. Diesel

- 10.2.3. Other Fuel Types

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Industrial

- 10.3.2. Commercial

- 10.3.3. Residential

- 10.1. Market Analysis, Insights and Forecast - by Power Rating

- 11. Germany Europe Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 12. France Europe Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 13. Italy Europe Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Europe Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Europe Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 16. Sweden Europe Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Europe Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Briggs & Stratton Corporation

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 HIMOINSA

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Caterpillar Inc

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Kirloskar Group*List Not Exhaustive

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 PRAMAC

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Inmesol SLA

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Honda Motor Co Ltd

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Wacker Neuson SE

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Atlas Copco

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 FG Wilson

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Briggs & Stratton Corporation

List of Figures

- Figure 1: Europe Portable Generator Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Portable Generator Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Portable Generator Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Portable Generator Market Revenue Million Forecast, by Power Rating 2019 & 2032

- Table 3: Europe Portable Generator Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: Europe Portable Generator Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Europe Portable Generator Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Portable Generator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Portable Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Portable Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Portable Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Portable Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Portable Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Portable Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Portable Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Portable Generator Market Revenue Million Forecast, by Power Rating 2019 & 2032

- Table 15: Europe Portable Generator Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 16: Europe Portable Generator Market Revenue Million Forecast, by End User 2019 & 2032

- Table 17: Europe Portable Generator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Portable Generator Market Revenue Million Forecast, by Power Rating 2019 & 2032

- Table 19: Europe Portable Generator Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 20: Europe Portable Generator Market Revenue Million Forecast, by End User 2019 & 2032

- Table 21: Europe Portable Generator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Portable Generator Market Revenue Million Forecast, by Power Rating 2019 & 2032

- Table 23: Europe Portable Generator Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 24: Europe Portable Generator Market Revenue Million Forecast, by End User 2019 & 2032

- Table 25: Europe Portable Generator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Europe Portable Generator Market Revenue Million Forecast, by Power Rating 2019 & 2032

- Table 27: Europe Portable Generator Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 28: Europe Portable Generator Market Revenue Million Forecast, by End User 2019 & 2032

- Table 29: Europe Portable Generator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Portable Generator Market Revenue Million Forecast, by Power Rating 2019 & 2032

- Table 31: Europe Portable Generator Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 32: Europe Portable Generator Market Revenue Million Forecast, by End User 2019 & 2032

- Table 33: Europe Portable Generator Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Portable Generator Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Europe Portable Generator Market?

Key companies in the market include Briggs & Stratton Corporation, HIMOINSA, Caterpillar Inc, Kirloskar Group*List Not Exhaustive, PRAMAC, Inmesol SLA, Honda Motor Co Ltd, Wacker Neuson SE, Atlas Copco, FG Wilson.

3. What are the main segments of the Europe Portable Generator Market?

The market segments include Power Rating, Fuel Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Soaring Demand From Natural Gas Sector4.; Increasing Demand From The Refinery And Petrochemical Sector.

6. What are the notable trends driving market growth?

Residential Sector to be a Significant Market Segment.

7. Are there any restraints impacting market growth?

4.; Higher Capital Cost Compared To Traditional Internal Combustion Engines.

8. Can you provide examples of recent developments in the market?

January 2022: Honda announced plans to begin sales of its new EU32i portable generator with a newly developed dedicated engine (with a maximum output of 3.2kVA). Additionally, the company announced that it would begin sales in March 2022 in the European region, followed by additional sales in other regions around the world.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Portable Generator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Portable Generator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Portable Generator Market?

To stay informed about further developments, trends, and reports in the Europe Portable Generator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence