Key Insights

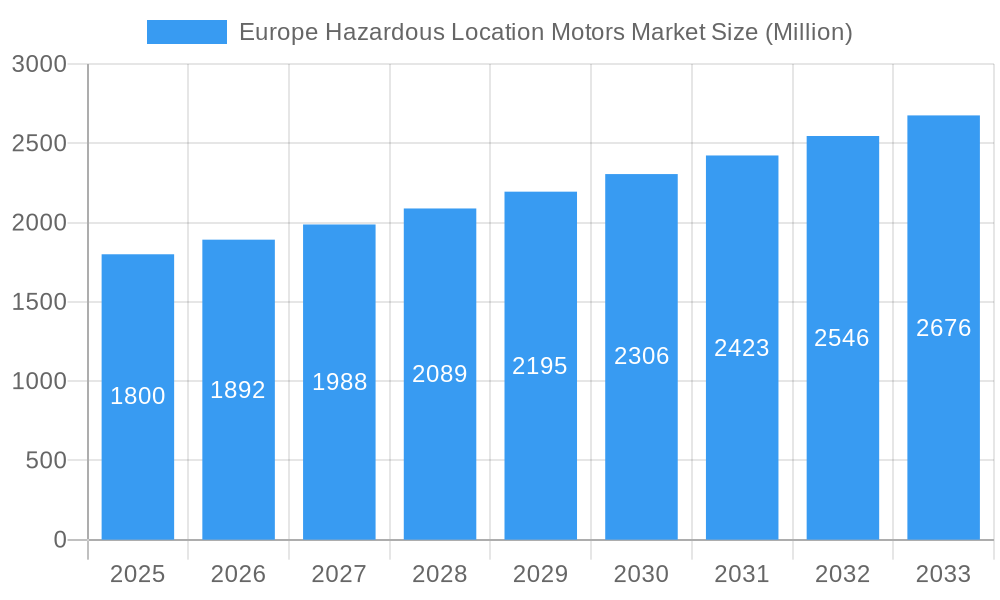

The Europe Hazardous Location Motors Market is projected for substantial growth, with an estimated market size of USD 4.71 billion in 2024 and a Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This expansion is driven by stringent safety regulations and consistent demand for explosion-proof solutions across European industrial sectors, including petroleum refining, chemical processing, and grain handling. Increased adoption of advanced technologies and a growing emphasis on reliable electrical equipment in hazardous environments further fuel market penetration. Key growth catalysts include significant infrastructure investments, particularly in oil and gas, and industrial facility modernization to meet evolving safety standards.

Europe Hazardous Location Motors Market Market Size (In Billion)

The market segmentation highlights Explosion-Proof General Purpose Motors as a dominant segment due to their widespread application. However, specialized motors, such as Drill Rig Duty Motors and Explosion-Proof Pump Motors, are experiencing significant growth, catering to specific industry needs. Europe, with its robust industrial base and stringent safety mandates, leads the market. Germany, the United Kingdom, and France are at the forefront of adoption, supported by extensive manufacturing operations and proactive regulatory frameworks. While initial equipment costs and installation complexity present challenges, the paramount focus on worker safety, environmental protection, and operational continuity will largely overcome these restraints, ensuring sustained market expansion.

Europe Hazardous Location Motors Market Company Market Share

This comprehensive report offers an in-depth analysis of the Europe Hazardous Location Motors Market, providing critical insights for industry stakeholders. The study covers the period from 2019 to 2033, with 2024 as the base year, detailing market dynamics, segmentation, trends, and competitive landscapes. Discover the estimated market size, projected to reach USD 4.71 billion in 2024, and forecast to grow at a CAGR of 6.5% from 2025 to 2033. This report is an essential resource for manufacturers, suppliers, investors, and end-users aiming to navigate and capitalize on the evolving European hazardous area motor market.

Europe Hazardous Location Motors Market Market Dynamics & Concentration

The Europe Hazardous Location Motors Market is characterized by a moderately concentrated landscape, with major players such as ABB Ltd, WEG Industries, and Emerson Electric Co holding significant market share. Innovation is primarily driven by the stringent safety regulations across the EU, pushing manufacturers to develop advanced explosion-proof and intrinsically safe motor technologies. Regulatory frameworks like ATEX and IECEx are paramount, dictating product design, certification, and deployment. Product substitutes are limited due to the critical safety requirements, though advancements in variable frequency drives (VFDs) integrated with explosion-proof motor designs offer enhanced efficiency and control. End-user trends point towards increased demand for energy-efficient motors and solutions for increasingly complex hazardous environments. Mergers and acquisitions (M&A) activity, while not hyperactive, has seen strategic consolidation, with an estimated XX M&A deal counts in the historical period, aimed at expanding product portfolios and geographical reach. The market share of the top 3 players is estimated to be XX%.

Europe Hazardous Location Motors Market Industry Trends & Analysis

The Europe Hazardous Location Motors Market is poised for substantial growth, fueled by a confluence of technological advancements, stringent safety mandates, and the expansion of industries operating in hazardous environments. The CAGR of XX% projected for the forecast period (2025–2033) underscores the market's robust trajectory. Key growth drivers include the increasing adoption of explosion-proof motors in the petrochemical sector, driven by escalating safety standards and the need to prevent ignition sources in volatile atmospheres. Furthermore, the burgeoning renewable energy sector, particularly in offshore wind farms and biofuel production, requires specialized explosion-proof motors designed to withstand harsh marine environments and potentially explosive gas mixtures.

Technological disruptions are playing a pivotal role, with manufacturers investing heavily in the development of motors with enhanced ingress protection (IP ratings), improved thermal management, and integrated smart features for predictive maintenance and remote monitoring. The integration of advanced materials, such as corrosion-resistant stainless steel and high-performance insulation, is also a significant trend, enhancing motor durability and reliability in corrosive or chemically aggressive settings.

Consumer preferences are increasingly shifting towards motors that not only meet stringent safety certifications but also offer superior energy efficiency and lower total cost of ownership. This is leading to greater demand for explosion-proof inverter duty motors that can optimize power consumption and reduce operational expenses. The competitive dynamics are characterized by a mix of established global players and specialized regional manufacturers, all vying for market share through product innovation, strategic partnerships, and adherence to evolving regulatory landscapes. Market penetration for advanced hazardous location motor solutions is steadily increasing across various industrial verticals, reflecting a growing awareness and prioritization of safety compliance. The market penetration is estimated to reach XX% by 2033.

Leading Markets & Segments in Europe Hazardous Location Motors Market

Dominant Region & Country: Germany is expected to emerge as the leading market within Europe, driven by its robust industrial base, stringent safety regulations, and significant presence in the chemical, pharmaceutical, and manufacturing sectors. The country's commitment to technological advancement and safety compliance positions it at the forefront of hazardous location motor adoption.

Dominant Segments:

- Type:

- Explosion-Proof General Purpose Motors: These remain a cornerstone of the market due to their widespread application across various industries requiring protection against flammable atmospheres.

- Explosion-Proof Pump Motors: Critical for fluid handling in hazardous areas, particularly in the oil and gas and chemical processing industries, these will continue to see sustained demand.

- Explosion-Proof Inverter Duty Motors: With the increasing focus on energy efficiency and precise speed control, these motors are gaining significant traction, especially in applications requiring variable operation.

- Class:

- Class I: Motors designed for areas where flammable gases or vapors may be present will continue to dominate, especially in the oil and gas sector.

- Class II: Demand for motors suitable for atmospheres containing combustible dust, prevalent in grain handling and aluminum manufacturing, will also be robust.

- Division:

- Division 1: Applications requiring high levels of protection in potentially ignitable atmospheres will drive demand for Division 1 rated motors.

- Division 2: As industries optimize their safety protocols and operational procedures, Division 2 motors, suitable for atmospheres where ignitable concentrations are unlikely during normal operation, will also see significant uptake.

- Zone:

- Zone 1: These motors are crucial for areas with a high probability of an explosive atmosphere being present, common in refineries and chemical plants.

- Zone 22: Applications in areas where combustible dust is present but unlikely to form an explosive mixture under normal conditions will drive demand for Zone 22 rated motors.

- Applications:

- Petroleum Refining Plants: This sector remains a primary driver due to the inherent risks associated with handling flammable hydrocarbons.

- Spray Painting and Finishing Areas: Increasing automation and stricter VOC emission controls necessitate robust explosion-proof motor solutions.

- Grain Elevators and Grain Handling Facilities / Flour Mills: Combustible dust explosion risks make these sectors significant consumers of Class II hazardous location motors.

- Aluminum Manufacturing and Storage Areas: The presence of flammable metal dust demands specialized explosion-proof motor technologies.

Key Drivers for Segment Dominance:

- Economic Policies: Government incentives for industrial modernization and safety upgrades in key European nations.

- Infrastructure Development: Expansion and upgrade of critical infrastructure in sectors like energy, chemicals, and manufacturing.

- Technological Advancements: Development of more efficient, reliable, and intelligent hazardous location motors.

- Regulatory Enforcement: Strict enforcement of ATEX and other regional safety standards.

Europe Hazardous Location Motors Market Product Developments

Recent product developments in the Europe Hazardous Location Motors Market are characterized by a strong emphasis on enhanced safety features, energy efficiency, and smart capabilities. Manufacturers are innovating with advanced sealing technologies to prevent ingress of dust and moisture, crucial for longevity in harsh environments. The integration of variable frequency drives (VFDs) directly into explosion-proof motor designs is a notable trend, offering precise speed control and significant energy savings for applications in sectors like chemical processing and oil and gas. Furthermore, the incorporation of IoT sensors and predictive maintenance algorithms allows for real-time monitoring of motor performance, enabling proactive maintenance and reducing downtime. The competitive advantage for companies lies in offering customized solutions that meet specific hazardous location classifications (e.g., ATEX, IECEx) and application requirements, thereby ensuring compliance and operational reliability.

Key Drivers of Europe Hazardous Location Motors Market Growth

The growth of the Europe Hazardous Location Motors Market is propelled by several key factors. Stringent safety regulations, such as the ATEX directive, mandated across EU member states, are the primary catalyst, compelling industries to invest in certified explosion-proof equipment. Technological advancements, including the development of more energy-efficient motor designs and integrated smart features for remote monitoring and diagnostics, are enhancing the appeal of these motors. The expansion of key end-user industries, including petrochemicals, pharmaceuticals, food and beverage processing, and renewable energy, which inherently involve hazardous substances or environments, directly fuels demand. Furthermore, government initiatives aimed at improving industrial safety standards and promoting energy efficiency contribute to market expansion.

Challenges in the Europe Hazardous Location Motors Market Market

Despite the robust growth trajectory, the Europe Hazardous Location Motors Market faces several challenges. The high cost of certified explosion-proof motors, compared to standard industrial motors, can be a barrier for some small and medium-sized enterprises. Navigating the complex and evolving regulatory landscape across different European countries can be challenging for manufacturers and end-users alike. Supply chain disruptions, particularly for specialized components and raw materials, can impact production timelines and costs. Additionally, the market faces intense competition from established players and new entrants, putting pressure on pricing and profit margins. The need for specialized installation and maintenance expertise also presents a hurdle for widespread adoption.

Emerging Opportunities in Europe Hazardous Location Motors Market

Emerging opportunities in the Europe Hazardous Location Motors Market are largely driven by technological innovation and the increasing demand for sustainable and intelligent industrial operations. The growing adoption of Industry 4.0 principles is creating opportunities for smart hazardous location motors equipped with advanced sensors and connectivity, enabling predictive maintenance and optimized operational efficiency. The expansion of the renewable energy sector, particularly in offshore wind and biofuel production, presents a significant opportunity for specialized explosion-proof motors designed for extreme environmental conditions. Strategic partnerships between motor manufacturers and automation solution providers can unlock new market segments and enhance product offerings. Furthermore, the increasing focus on retrofitting older industrial facilities with modern safety equipment presents a substantial market for upgrade solutions.

Leading Players in the Europe Hazardous Location Motors Market Sector

- ABB Ltd

- WEG Industries

- Emerson Electric Co

- Nidec Motor Corporation

- Brook Crompton

- Rockwell Automation Inc

- Kollmorgen Corporation

- Stainless Motors Inc

- Heatrex Inc

- Dietz Electric Co Inc

Key Milestones in Europe Hazardous Location Motors Market Industry

- 2019: Increased adoption of ATEX-compliant motors in the chemical processing industry.

- 2020: Launch of enhanced explosion-proof inverter duty motors offering superior energy efficiency.

- 2021: Growing demand for explosion-proof pump motors in wastewater treatment plants.

- 2022: Introduction of smart hazardous location motors with integrated IoT capabilities for predictive maintenance.

- 2023: Significant investments in explosion-proof motor R&D for renewable energy applications, particularly offshore wind.

- 2024 (Q1-Q3): Focus on developing motors with improved ingress protection (IP) ratings for harsh industrial environments.

Strategic Outlook for Europe Hazardous Location Motors Market Market

The strategic outlook for the Europe Hazardous Location Motors Market is highly positive, characterized by sustained growth and continuous innovation. Key growth accelerators will include the ongoing strict enforcement of safety regulations, driving the adoption of certified explosion-proof solutions across all hazardous sectors. The relentless pursuit of energy efficiency by industries will further boost demand for advanced inverter duty and smart motor technologies. Companies that can successfully integrate IoT capabilities and offer comprehensive lifecycle services, including installation, maintenance, and upgrade solutions, will be well-positioned to capture significant market share. Strategic collaborations with automation providers and end-users to develop bespoke solutions for emerging applications in sectors like green hydrogen production and advanced manufacturing will be crucial for long-term success. The market is expected to witness continued investment in research and development, focusing on lighter, more robust, and intelligent motor designs.

Europe Hazardous Location Motors Market Segmentation

-

1. Type

- 1.1. Explosion-Proof General Purpose Motors

- 1.2. Drill Rig Duty Motors

- 1.3. Explosion-Proof Pump Motors

- 1.4. Explosion-Proof Inverter Duty Motors

- 1.5. Explosion-Proof Severe Duty Motors

-

2. Class

- 2.1. Class I

- 2.2. Class II

- 2.3. Class III

-

3. Division

- 3.1. Division 1

- 3.2. Division 2

-

4. Zone

- 4.1. Zone 0

- 4.2. Zone 1

- 4.3. Zone 21

- 4.4. Zone 22

-

5. Applications

- 5.1. Spray Painting and Finishing Areas

- 5.2. Petroleum Refining Plants

- 5.3. Dry Cleaning Facilities

- 5.4. Utility Gas Plants

- 5.5. Grain Elevators and Grain Handling Facilities

- 5.6. Flour Mills

- 5.7. Aluminum Manufacturing and Storage Areas

- 5.8. Fire Work Plants and Storage Areas

- 5.9. Confectionary Plants

- 5.10. Other Applications

Europe Hazardous Location Motors Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Hazardous Location Motors Market Regional Market Share

Geographic Coverage of Europe Hazardous Location Motors Market

Europe Hazardous Location Motors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Safety Measures; Increasing Demand for Energy Efficient Motors

- 3.3. Market Restrains

- 3.3.1. ; Regulations and Compliance; High Installation Cost for Material and Labor in Comparison to Non-Explosion Proof Motors

- 3.4. Market Trends

- 3.4.1. Explosion Proof Motor in Coal Production is Expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Hazardous Location Motors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Explosion-Proof General Purpose Motors

- 5.1.2. Drill Rig Duty Motors

- 5.1.3. Explosion-Proof Pump Motors

- 5.1.4. Explosion-Proof Inverter Duty Motors

- 5.1.5. Explosion-Proof Severe Duty Motors

- 5.2. Market Analysis, Insights and Forecast - by Class

- 5.2.1. Class I

- 5.2.2. Class II

- 5.2.3. Class III

- 5.3. Market Analysis, Insights and Forecast - by Division

- 5.3.1. Division 1

- 5.3.2. Division 2

- 5.4. Market Analysis, Insights and Forecast - by Zone

- 5.4.1. Zone 0

- 5.4.2. Zone 1

- 5.4.3. Zone 21

- 5.4.4. Zone 22

- 5.5. Market Analysis, Insights and Forecast - by Applications

- 5.5.1. Spray Painting and Finishing Areas

- 5.5.2. Petroleum Refining Plants

- 5.5.3. Dry Cleaning Facilities

- 5.5.4. Utility Gas Plants

- 5.5.5. Grain Elevators and Grain Handling Facilities

- 5.5.6. Flour Mills

- 5.5.7. Aluminum Manufacturing and Storage Areas

- 5.5.8. Fire Work Plants and Storage Areas

- 5.5.9. Confectionary Plants

- 5.5.10. Other Applications

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 WEG Industries

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Emerson Electric Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nidec Motor Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Brook Crompton

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rockwell Automation Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kollmorgen Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Stainless Motors Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Heatrex Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dietz Electric Co Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: Europe Hazardous Location Motors Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Hazardous Location Motors Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Hazardous Location Motors Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Hazardous Location Motors Market Revenue billion Forecast, by Class 2020 & 2033

- Table 3: Europe Hazardous Location Motors Market Revenue billion Forecast, by Division 2020 & 2033

- Table 4: Europe Hazardous Location Motors Market Revenue billion Forecast, by Zone 2020 & 2033

- Table 5: Europe Hazardous Location Motors Market Revenue billion Forecast, by Applications 2020 & 2033

- Table 6: Europe Hazardous Location Motors Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Europe Hazardous Location Motors Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Europe Hazardous Location Motors Market Revenue billion Forecast, by Class 2020 & 2033

- Table 9: Europe Hazardous Location Motors Market Revenue billion Forecast, by Division 2020 & 2033

- Table 10: Europe Hazardous Location Motors Market Revenue billion Forecast, by Zone 2020 & 2033

- Table 11: Europe Hazardous Location Motors Market Revenue billion Forecast, by Applications 2020 & 2033

- Table 12: Europe Hazardous Location Motors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Hazardous Location Motors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Hazardous Location Motors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Europe Hazardous Location Motors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Hazardous Location Motors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Hazardous Location Motors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Hazardous Location Motors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Hazardous Location Motors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Hazardous Location Motors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Hazardous Location Motors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Hazardous Location Motors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Hazardous Location Motors Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Hazardous Location Motors Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Europe Hazardous Location Motors Market?

Key companies in the market include ABB Ltd, WEG Industries, Emerson Electric Co, Nidec Motor Corporation, Brook Crompton, Rockwell Automation Inc, Kollmorgen Corporation, Stainless Motors Inc, Heatrex Inc, Dietz Electric Co Inc.

3. What are the main segments of the Europe Hazardous Location Motors Market?

The market segments include Type, Class, Division, Zone, Applications.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.71 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Safety Measures; Increasing Demand for Energy Efficient Motors.

6. What are the notable trends driving market growth?

Explosion Proof Motor in Coal Production is Expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

; Regulations and Compliance; High Installation Cost for Material and Labor in Comparison to Non-Explosion Proof Motors.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Hazardous Location Motors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Hazardous Location Motors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Hazardous Location Motors Market?

To stay informed about further developments, trends, and reports in the Europe Hazardous Location Motors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence