Key Insights

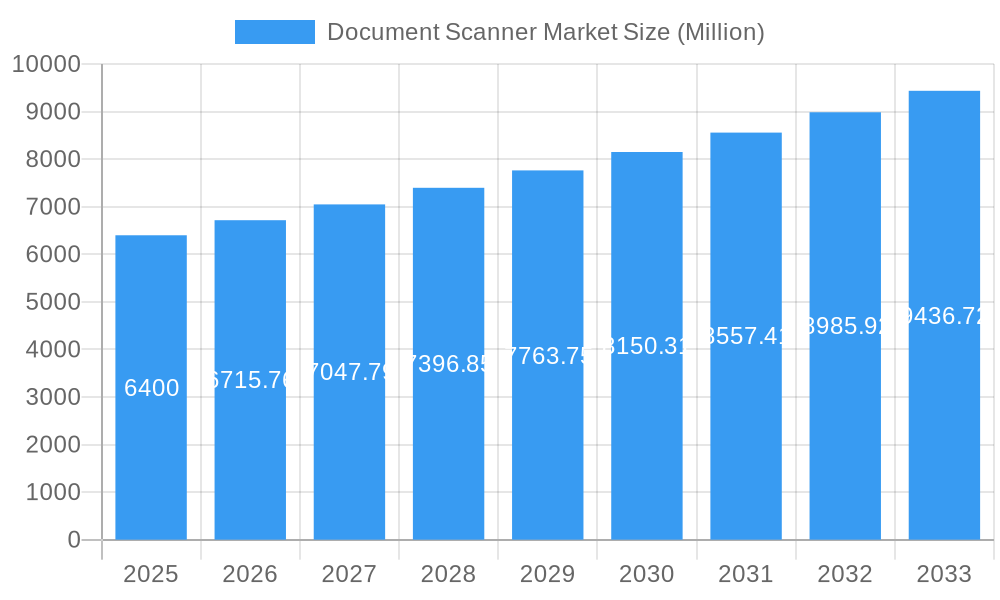

The global Document Scanner Market is projected for robust growth, with an estimated market size of $6.40 billion in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 5.09% through 2033. This upward trajectory is fueled by the escalating need for digital transformation across various sectors, driving demand for efficient document management solutions. Key market drivers include the increasing volume of paper-based records requiring digitization, stringent regulatory compliance mandates that necessitate secure document archiving, and the burgeoning adoption of cloud-based document management systems. Businesses across industries are recognizing the benefits of streamlined workflows, enhanced data accessibility, and improved operational efficiency offered by advanced scanning technologies. The market's expansion is further supported by ongoing technological advancements, leading to the development of faster, more accurate, and user-friendly document scanners.

Document Scanner Market Market Size (In Billion)

The Document Scanner Market encompasses a diverse range of applications, with significant contributions from the Government, BFSI (Banking, Financial Services, and Insurance), and IT & Telecom sectors. Educational institutions are also increasingly embracing digitization to manage academic records and research materials. While the market is characterized by significant growth, certain restraints such as the initial investment cost for high-end scanning equipment and concerns regarding data security and privacy can pose challenges. However, the pervasive trend towards paperless offices and the continuous evolution of scanner technologies, including AI-powered features for enhanced data extraction and intelligent document processing, are expected to outweigh these limitations. Major industry players like Canon Inc., Xerox Corporation, and HP Inc. are at the forefront of innovation, introducing sophisticated scanners that cater to the evolving demands of businesses and institutions worldwide.

Document Scanner Market Company Market Share

This in-depth report provides a detailed analysis of the global Document Scanner Market, offering insights into market dynamics, industry trends, key segments, leading players, and future growth opportunities. Covering the period from 2019 to 2033, with a Base Year of 2025 and a Forecast Period of 2025-2033, this study is an essential resource for stakeholders seeking to understand and capitalize on the evolving landscape of digital document management. The market is projected to witness robust growth, driven by increasing digitization initiatives across various industries and the demand for efficient document processing solutions. The global document scanner market size is expected to reach a significant value, propelled by technological advancements and growing adoption of cloud-based document management systems.

Document Scanner Market Market Dynamics & Concentration

The Document Scanner Market exhibits a moderate to high level of concentration, with several prominent players dominating the landscape. Key companies like Canon Inc, Xerox Corporation, HP Inc, Fujitsu Limited, Seiko Epson Corporation, and Brother Industries Ltd collectively hold a substantial market share. Innovation is a primary driver, with manufacturers continuously introducing advanced features such as faster scanning speeds, improved image quality, AI-powered data extraction, and enhanced connectivity options. Regulatory frameworks, particularly those related to data privacy and compliance (e.g., GDPR, HIPAA), indirectly influence the demand for secure and efficient document scanning solutions. Product substitutes, while present in the form of mobile scanning apps, are largely complemented by dedicated document scanners for professional and high-volume environments. End-user trends highlight a growing preference for integrated document management systems that combine scanning, indexing, and workflow automation. Mergers and acquisitions (M&A) activities, though not always frequent, play a crucial role in market consolidation and expansion of product portfolios. The M&A deal count in the document scanner market, while variable, often signifies strategic moves to acquire new technologies or expand market reach. Market share analysis reveals a competitive environment where product differentiation and customer service are key to sustained success.

Document Scanner Market Industry Trends & Analysis

The Document Scanner Market is experiencing sustained growth, fueled by an escalating digital transformation across industries. The Compound Annual Growth Rate (CAGR) is projected to remain robust throughout the forecast period, driven by the imperative for businesses to streamline operations and enhance data accessibility. A significant trend is the increasing adoption of high-speed document scanners and intelligent document processing (IDP) solutions, which leverage AI and machine learning to automate data extraction and classification. This technological disruption is revolutionizing how organizations manage their paper-based information, moving beyond simple digitization to intelligent information capture. Consumer preferences are shifting towards compact, user-friendly, and mobile-compatible scanning devices that can seamlessly integrate into existing workflows. The market penetration of advanced document scanners is steadily increasing, particularly in sectors with high volumes of transactional documents. Competitive dynamics are characterized by intense innovation, with companies focusing on developing feature-rich, cost-effective, and energy-efficient scanners. The rise of cloud-based document management systems also influences hardware choices, with an emphasis on scanners that offer direct integration with these platforms. The demand for secure and compliant document handling is paramount, driving the development of scanners with advanced security features.

Leading Markets & Segments in Document Scanner Market

The Government segment represents a dominant force in the Document Scanner Market, driven by substantial investments in digitization initiatives and the critical need for secure and efficient record management. Government agencies across federal, state, and local levels are actively digitizing vast archives of historical documents, legal records, and citizen-related information to improve accessibility, reduce physical storage costs, and enhance operational efficiency. This commitment to digital transformation is supported by significant economic policies and budgetary allocations towards e-governance projects.

- Key Drivers in Government Segment:

- Digital India Initiative and similar global e-governance programs: These government-led programs are a primary catalyst for widespread adoption of document scanning technologies to create digital archives and facilitate online service delivery.

- Legal and regulatory compliance: The necessity to adhere to stringent record retention policies and ensure data integrity mandates the use of reliable and high-volume document scanning solutions.

- National archives and historical preservation: Governments are increasingly investing in digitizing national archives to preserve cultural heritage and make historical documents accessible to researchers and the public.

- Disaster recovery and business continuity: Digital document repositories offer a crucial layer of disaster preparedness, ensuring data availability even in the event of physical damage to original records.

The BFSI (Banking, Financial Services, and Insurance) sector is another major segment experiencing significant growth in document scanner adoption. The industry handles a massive volume of sensitive financial documents, loan applications, insurance policies, and customer records, necessitating efficient and secure digitization for compliance and operational streamlining. The increasing adoption of digital banking and online services further accelerates the need for robust back-end document management systems, where document scanners play a pivotal role.

- Key Drivers in BFSI Segment:

- Regulatory compliance (e.g., KYC, AML): Stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations require meticulous document verification and record-keeping.

- Digital transformation of financial services: The shift towards online account opening, loan processing, and claims management relies heavily on digitized documents.

- Fraud detection and prevention: High-quality scanned images and efficient data extraction aid in identifying anomalies and preventing fraudulent activities.

- Customer experience enhancement: Faster processing of applications and claims through digitized workflows leads to improved customer satisfaction.

The IT & Telecom sector, characterized by its rapid pace of innovation and vast data requirements, also presents a substantial market for document scanners. The industry deals with contracts, technical documentation, service records, and customer support information, all of which benefit from digitization.

- Key Drivers in IT & Telecom Segment:

- Project documentation and lifecycle management: Efficient management of project-related documents is crucial for successful IT and telecom deployments.

- Customer onboarding and support: Streamlining customer onboarding processes and managing support documentation enhances operational efficiency.

- Intellectual property management: Secure digitization and management of intellectual property documents are vital for competitive advantage.

Educational Institutions are increasingly investing in document scanning solutions to digitize academic records, research papers, administrative documents, and library resources. This facilitates better access for students and faculty, improves research capabilities, and streamlines administrative processes.

- Key Drivers in Educational Institutions Segment:

- Digital library initiatives: Creating digital archives of books, journals, and research papers to enhance accessibility.

- Student record management: Digitizing student applications, transcripts, and academic history for efficient management.

- Research and collaboration: Facilitating access to research materials and promoting collaborative work through digital platforms.

The Other Applications segment encompasses a diverse range of industries, including healthcare, legal services, manufacturing, and retail, all of which are experiencing a growing need for efficient document management solutions to improve workflow, reduce costs, and ensure compliance.

Document Scanner Market Product Developments

Recent product developments in the Document Scanner Market focus on enhancing speed, portability, and intelligent features. Manufacturers are integrating advanced technologies like AI-powered OCR (Optical Character Recognition) for accurate data extraction and classification, as well as improved image processing for superior scan quality. Compact and mobile-friendly designs are gaining traction, catering to the needs of remote workforces and space-constrained offices. Examples include scanners with vertical paper feed systems, saving desk space while maintaining high throughput. These innovations aim to provide businesses with solutions that not only digitize documents but also automate workflows, reduce manual data entry errors, and improve overall operational efficiency, thereby offering significant competitive advantages.

Key Drivers of Document Scanner Market Growth

The Document Scanner Market is propelled by several key drivers. Firstly, the pervasive digital transformation initiatives across various industries, including government, BFSI, and IT, are creating a substantial demand for efficient document digitization. Secondly, increasing regulatory compliance requirements worldwide mandate secure and organized record-keeping, thereby boosting the adoption of advanced scanning solutions. Technological advancements, such as the integration of AI for intelligent data extraction and the development of faster, more compact scanners, are further stimulating market growth. Economic factors, including the drive for operational efficiency and cost reduction in businesses, also contribute significantly to the sustained demand for document scanning technology.

Challenges in the Document Scanner Market Market

Despite the promising growth trajectory, the Document Scanner Market faces several challenges. Intense competition among established players and the emergence of low-cost alternatives can put pressure on profit margins. The reliance on complex supply chains for components can lead to disruptions and increased costs. Furthermore, while mobile scanning apps offer convenience, they often lack the speed, accuracy, and volume capabilities required by enterprises, creating a gap that dedicated scanners must address. Security concerns surrounding sensitive data digitization and the cost of implementing and maintaining advanced document management systems can also act as barriers to adoption for some organizations.

Emerging Opportunities in Document Scanner Market

Emerging opportunities in the Document Scanner Market lie in the continued advancements in AI and machine learning, enabling more sophisticated intelligent document processing. The growing demand for cloud-based document management solutions presents a significant avenue for growth, with opportunities for scanners that offer seamless integration and enhanced data security. The increasing adoption of remote and hybrid work models is driving the need for compact, portable, and connected scanning devices. Furthermore, strategic partnerships between hardware manufacturers and software providers can unlock new value propositions, offering end-to-end document management solutions that cater to specific industry needs. Market expansion into developing economies with growing digitization efforts also represents a significant long-term growth catalyst.

Leading Players in the Document Scanner Market Sector

- Canon Inc

- Xerox Corporation

- HP Inc

- Fujitsu Limited

- Seiko Epson Corporation

- Brother Industries Ltd

- Mustek Systems Inc

- Plustek Corp

Key Milestones in Document Scanner Market Industry

- August 2023: Konica Minolta Business Solutions U.S.A., Inc. reported a strategic alliance with Epson America, Inc. Konica Minolta will offer Epson’s retail scanning solutions to its nationwide network of channel partners and office equipment dealers. The collaboration will enable Konica Minolta to provide a broad range of scanning solutions to meet the growing needs of its consumers and partners. In advanced document management technologies, IT Services, and application solutions, Konica Minolta concentrates on comprehensive solutions, including business systems, digital services, production print methods and printers, vertical application solutions, and related services.

- August 2023: To ensure success, business tools must deliver fast speeds and the right functionality and fit seamlessly into any environment. Epson America, a global imaging technology leader, introduced the DS-C330, DS-C480W, and DS-C490 compact desktop document scanners for efficient workspaces. Featuring a vertical paper feed system, the small and lightweight scanners save up to 60 percent of desk space, enabling businesses from a wide range of industries to stay productive and keep workflow moving even when space is limited.

Strategic Outlook for Document Scanner Market Market

The strategic outlook for the Document Scanner Market is characterized by a strong emphasis on innovation and integration. Future growth will be accelerated by the development of scanners with advanced AI capabilities for automated data capture and analysis, further bridging the gap between physical and digital information. The increasing demand for cloud-native scanning solutions and secure remote access will drive the development of connected devices. Strategic partnerships between hardware manufacturers, software providers, and IT service companies will be crucial for offering comprehensive, end-to-end document management solutions. Expanding market reach into emerging economies and tailoring solutions to specific industry verticals will unlock significant future potential.

Report Scope:

- Study Period: 2019–2033

- Base Year: 2025

- Estimated Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

Key Segments Analyzed:

- Application: Government, BFSI, IT & Telecom, Educational Institutions, Other Applications

Leading Companies Covered:

- Canon Inc

- Xerox Corporation

- HP Inc

- Fujitsu Limited

- Seiko Epson Corporation

- Brother Industries Ltd

- Mustek Systems Inc

- Plustek Corp (List Not Exhaustive)

Document Scanner Market Segmentation

-

1. Application

- 1.1. Government

- 1.2. BFSI

- 1.3. IT & Telecom

- 1.4. Educational Institutions

- 1.5. Other Applications

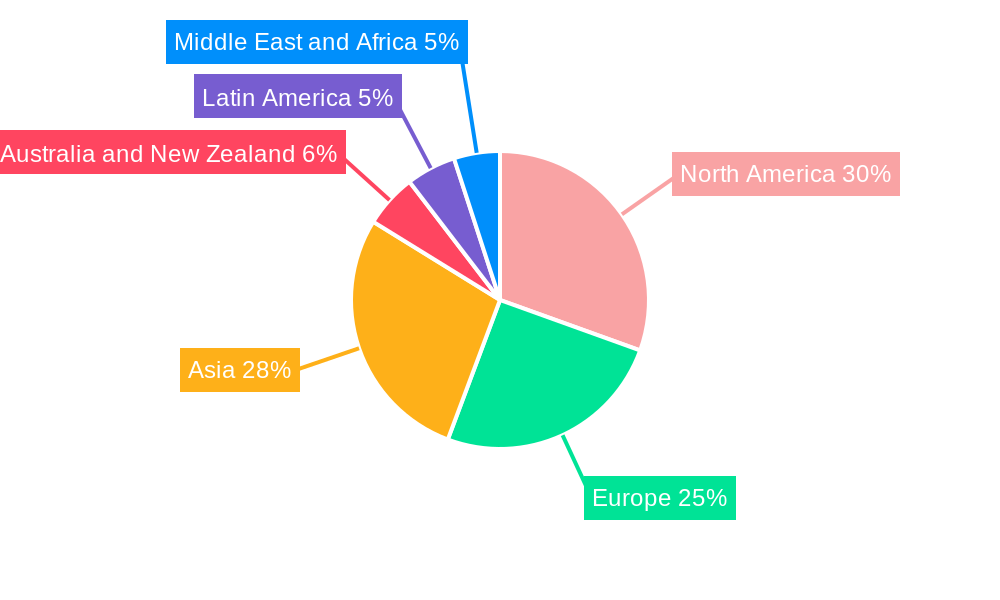

Document Scanner Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Document Scanner Market Regional Market Share

Geographic Coverage of Document Scanner Market

Document Scanner Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Use of High-speed Document Scanners

- 3.3. Market Restrains

- 3.3.1. Digital Transformation Solutions (Mobile Printing) Being Integrated into the Workplace

- 3.4. Market Trends

- 3.4.1. Increasing Use of High-speed Document Scanners to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Document Scanner Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Government

- 5.1.2. BFSI

- 5.1.3. IT & Telecom

- 5.1.4. Educational Institutions

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Document Scanner Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Government

- 6.1.2. BFSI

- 6.1.3. IT & Telecom

- 6.1.4. Educational Institutions

- 6.1.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Document Scanner Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Government

- 7.1.2. BFSI

- 7.1.3. IT & Telecom

- 7.1.4. Educational Institutions

- 7.1.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Document Scanner Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Government

- 8.1.2. BFSI

- 8.1.3. IT & Telecom

- 8.1.4. Educational Institutions

- 8.1.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Australia and New Zealand Document Scanner Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Government

- 9.1.2. BFSI

- 9.1.3. IT & Telecom

- 9.1.4. Educational Institutions

- 9.1.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Latin America Document Scanner Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Government

- 10.1.2. BFSI

- 10.1.3. IT & Telecom

- 10.1.4. Educational Institutions

- 10.1.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Middle East and Africa Document Scanner Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Government

- 11.1.2. BFSI

- 11.1.3. IT & Telecom

- 11.1.4. Educational Institutions

- 11.1.5. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Canon Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Xerox Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 HP Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Fujitsu Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Seiko Epson Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Brother Industries Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Mustek Systems Inc *List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Plustek Corp

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Canon Inc

List of Figures

- Figure 1: Global Document Scanner Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Document Scanner Market Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Document Scanner Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Document Scanner Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Document Scanner Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Document Scanner Market Revenue (Million), by Application 2025 & 2033

- Figure 7: Europe Document Scanner Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Document Scanner Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Document Scanner Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Document Scanner Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Document Scanner Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Document Scanner Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Document Scanner Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Australia and New Zealand Document Scanner Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Australia and New Zealand Document Scanner Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Australia and New Zealand Document Scanner Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Australia and New Zealand Document Scanner Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Latin America Document Scanner Market Revenue (Million), by Application 2025 & 2033

- Figure 19: Latin America Document Scanner Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Latin America Document Scanner Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Latin America Document Scanner Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Middle East and Africa Document Scanner Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Middle East and Africa Document Scanner Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East and Africa Document Scanner Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Document Scanner Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Document Scanner Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Document Scanner Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Document Scanner Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Document Scanner Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Document Scanner Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Document Scanner Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Document Scanner Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Document Scanner Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Document Scanner Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Document Scanner Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Document Scanner Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Document Scanner Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Document Scanner Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Document Scanner Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Document Scanner Market?

The projected CAGR is approximately 5.09%.

2. Which companies are prominent players in the Document Scanner Market?

Key companies in the market include Canon Inc, Xerox Corporation, HP Inc, Fujitsu Limited, Seiko Epson Corporation, Brother Industries Ltd, Mustek Systems Inc *List Not Exhaustive, Plustek Corp.

3. What are the main segments of the Document Scanner Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Use of High-speed Document Scanners.

6. What are the notable trends driving market growth?

Increasing Use of High-speed Document Scanners to Drive the Market.

7. Are there any restraints impacting market growth?

Digital Transformation Solutions (Mobile Printing) Being Integrated into the Workplace.

8. Can you provide examples of recent developments in the market?

August 2023: Konica Minolta Business Solutions U.S.A., Inc. reported a strategic alliance with Epson America, Inc. Konica Minolta will offer Epson’s retail scanning solutions to its nationwide network of channel partners and office equipment dealers. The collaboration will enable Konica Minolta to provide a broad range of scanning solutions to meet the growing needs of its consumers and partners. In advanced document management technologies, IT Services, and application solutions, Konica Minolta concentrates on comprehensive solutions, including business systems, digital services, production print methods and printers, vertical application solutions, and related services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Document Scanner Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Document Scanner Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Document Scanner Market?

To stay informed about further developments, trends, and reports in the Document Scanner Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence